Abstract

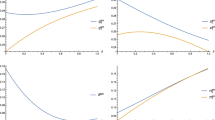

This paper considers a one-stage Cournot duopoly of R&D. We characterize the Nash equilibrium of the one-stage game and provide a comparison with the two-stage version of the same Cournot model of R&D/product market competition. We look at R&D expenditures, profits, output and welfare. Under perfect symmetry, the one-stage model always leads to higher profits when the spillover parameter is not equal to 1/2. Moreover, the one-stage model implies more R&D expenditure and higher welfare if and only if the spillover parameter is greater than 1/2. The insights are robust to an n -firm generalization, but the differences between the one-stage game and the two-stage game disappear as the market becomes perfectly competitive.

Similar content being viewed by others

Notes

This is a reflection of a general coincidence between one-stage and two-stage games with infinitely many players, see Wiszniewska-Matyszkiel (2014) for more on this point.

As noticed here, we use ∗ (e.g., y*) to denote one-stage game equilibrium variables and bar (e.g., \(\bar{y}\)) to denote the two-stage counterparts.

Specifically, in a Cournot competition with n firms, one can solve firm i ’s output to be \(q_i=\frac{a-nc_{i}+\Sigma _{j\ne i}c_{j}}{b(n+1)}\). Under extremely unequal R&D choices, \(c_i=c\) and \(c_j=0\) for all \(j\ne i\), so \(q_i=\frac{a-nc}{b(n+1)}\), which is guaranteed to be positive if \(a>nc\).

It is straightforward to verify that \(b \gamma>\frac{a n}{c (1+n)^2}>\frac{ a (n-(n-1) \beta )}{c (1+n)^2}\) and \(\frac{a n}{c (1+n)^2}>\frac{a}{2(n+1)c}\) for \(n\ge 2\).

The derivation of the limit expressions is a standard one. Since all that are involved in these formulas are fraction expressions regarding n, the limit of each fraction term is the quotient of the coefficients of the terms with the highest order of n in the denominator and the numerator, respectively. For instance, one checks the coefficients of \(n^{3}\) in \(W_{n}^{*}\) to get \(W_{n}^{*}\rightarrow \frac{\gamma (a-c)^{2}2b\gamma \beta }{(2b\gamma )^{2}\beta }=\frac{(a-c)^{2}}{2b}\).

It can be shown that for industry output and price, the convergence is monotone. Both the one-stage and the two-stage models satisfy the well-known property of quasi-competitiveness, a cornerstone property of classical static oligopoly models (Amir & Lambson, 2000).

References

Akcigit, U., Hanley, D., & Serrano-Velarde, N. (2021). Back to basics: Basic research spillovers, innovation policy and growth. Review of Economic Studies, 88, 1–43.

Amir, R. (2000). Modelling imperfectly appropriable R &D via spillovers. International Journal of Industrial Organization, 18, 1013–1032.

Amir, R., Chalioti, E., & Halmenschlager, C. (2021). University-firm competition in basic research: Simultaneous versus sequential moves. Journal of Public Economic Theory, 23, 1199–1219.

Amir, R., Evstigneev, I., & Wooders, J. (2003). Noncooperative versus cooperative R &D with endogenous spillover rates. Games and Economic Behavior, 42, 183–207.

Amir, R., Gama, A., Lahmandi-Ayed, R., & Werner, K. (2023). A one-stage model of abatement innovation in Cournot duopoly: emissions vs performance standards. Environmental Modeling & Assessment. https://doi.org/10.21203/rs.3.rs-2565461/v1.

Amir, R., & Lambson, V. (2000). On the effects of entry in Cournot markets. Review of Economic Studies, 67, 235–254.

Banerjee, S., Mukherjee, A., & Poddar, S. (2023). Optimal patent licensing—Two or three-part tariff. Journal of Public Economic Theory, 25(3), 624–648.

Bernstein, J., & Nadiri, I. (1988). Interindustry R &D spillovers, rates of return, and production in high-tech industries. American Economic Review, 78, 429–434.

Brander, J. A., & Spencer, B. J. (1983). Strategic commitment with R &D: The symmetric case. The Bell Journal of Economics, 14, 225–235.

Cabon-Dhersin, M.-L., & Gibert, R. (2020). R &D cooperation, proximity and distribution of public funding between public and private research sectors. The Manchester School, 88, 773–800.

Cosandier, C., Feo, G. D., & Knauff, M. (2017). Equal treatment and socially optimal R &D in duopoly with one-way spillovers. Journal of Public Economic Theory, 19, 1099–1117.

Dasgupta, P., & Stiglitz, J. (1980). Industrial structure and the nature of innovative activity. The Economic Journal, 90, 266–293.

d’Aspremont, C., & Jacquemin, A. (1988). Cooperative and noncooperative R &D in duopoly with spillovers. The American Economic Review, 78, 1133–1137.

d’Aspremont, C., & Jacquemin, A. (1990). Cooperative and noncooperative R &D in duopoly with spillovers: Erratum. American Economic Review, 80, 641.

Gama, A., Maret, I., & Masson, V. (2019). Endogenous heterogeneity in duopoly with deterministic one-way spillovers. Annals of Finance, 15, 103–123.

Griliches, Z. (1995). R &D and productivity: Econometric results and measurement issues. In P. Stonemand (Ed.), Handbook of the economics of innovation and technological change (pp. 52–89). Basil Blackwell.

Hu, M., Chen, P., Chu, H., & Lai, C. (2023b). Growth and optimal policies in an R&D-growth model with imperfect international capital mobility. Journal of Public Economic Theory, 25(4), 840–866.

Hu, R., Yang, Y., & Zheng, Z. (2023a). Effects of subsidies on growth and welfare in a quality-ladder model with elastic labor. Journal of Public Economic Theory. https://doi.org/10.1111/jpet.12645

Kamien, M. I., Muller, E., & Zang, I. (1992). Research joint ventures and R &D cartels. The American Economic Review, 82, 1293–1306.

Katz, M. L. (1986). An analysis of cooperative research and development. The Rand Journal of Economics, 17, 527–543.

Kline, J. J. (2000). Research joint ventures and the cost paradox. International Journal of Industrial Organization, 18, 1049–1065.

Kreps, D.M., & Scheinkman, J. (1983). Quantity precommitment and Bertrand competition yield Cournot outcomes, The Bell Journal of Economics, 326–337.

Lambertini, L., Poyago-Theotoky, J., & Tampieri, A. (2017). Cournot competition and “green’’ innovation: An inverted-U relationship. Energy Economics, 68, 116–123.

López, Á. L., & Vives, X. (2019). Overlapping ownership, R&D spillovers, and antitrust policy. Journal of Political Economy, 127(5), 2394–2437.

Martin, S. (1996). R &D joint ventures and tacit product market collusion. European Journal of Political Economy, 11, 733–741.

Martin, S. (2002). Spillovers, appropriability, and R &D. Journal of Economics, 75, 1–32.

Pal, R., Scrimitore, M., & Song, R. (2023). Externalities, entry bias, and optimal subsidy policy for cleaner environment. Journal of Public Economic Theory. https://doi.org/10.1111/jpet.12612

Poyago-Theotoky, J. (1999). A note on endogenous spillovers in a non-tournament R &D duopoly. Review of Industrial Organization, 15, 253–262.

Schumpeter, J. A. (1943). Capitalism, socialism and democracy. London: Unwin University Books.

Scotchmer, S. (2004). Innovation and incentives. MIT Press.

Spence, M. (1984). Cost reduction, competition, and industry performance. Econometrica, 52(1), 101–121.

Vives, X. (2008). Innovation and competitive pressure. The Journal of Industrial Economics, 56(3), 419–469.

Wan, J., & Zhang, J. (2023). R&D subsidies, income taxes, and growth through cycles. Economic Theory. https://doi.org/10.1007/s00199-022-01480-y

Wiszniewska-Matyszkiel, A. (2014). Open and closed loop nash equilibria in games with a continuum of players. Journal of Optimization Theory and Applications, 160, 280–301.

Funding

This article was funded by “the Fundamental Research Funds for the Central Universities” at Zhongnan University of Economics and Law (Grant no. 31512212202).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors declare that they have no conflicts of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I especially thank Dominika Machowska for her many helpful discussions and suggestions. This research was supported by “the Fundamental Research Funds for the Central Universities”, Zhongnan University of Economics and Law (Grant no. 31512212202).

Appendix

Appendix

Proof for Proposition 2

First, we need to replicate the four variable comparisons for R&D expenditure, consumer surplus, profit and welfare between the one-stage model and two-stage model.

The difference in R&D expenditure: \(\bar{Y}_n-Y^*_n\) can be simplified as

We claim that \((2 (n+\beta -n \beta )+b (1+n) (-1-3 n+2 (-1+n) \beta ) \gamma )<0\), so that \(\bar{Y}_n-Y^*_n\) has the same sign as \((1-2 \beta )\), which leads to the conclusion as in Proposition 1. The inequality can be simplified to be \(\frac{2 (n-(n-1)\beta )}{(1+n) (1+3 n-2 (n-1) \beta ) }<b \gamma\). By Assumptions (A2) (first inequality) and (A1) (second inequality), \(b \gamma>\frac{a n}{c (1+n)^2}>\frac{n^2}{ (1+n)^2}> \frac{2 (n-(n-1)\beta )}{(1+n)(1+3 n-2 (n-1) \beta ) }\), the last inequality can be verified to hold for all \(n\ge 2\) and \(0<\beta <1\).

Since consumer surplus \(\int _{0}^{2q^{*}}(a-bt)dt\) increases in the firm’s output, while the output increases in effective cost reduction, \(q^*= \frac{(a-c+ \text {effective cost reduction})}{b(n+1)}\), and effective cost reduction increases in R&D expenditure. So CS has the same sign comparison as the R&D expenditure. The same logic has been employed in the duopoly scenario.

Note that \({\bar{Y}}_n=\frac{(a-c)^2 \gamma }{\left( -1+\frac{b (1+n)^2 \gamma }{n (1-\beta )+\beta }\right) ^2}\rightarrow 0\) when \(n\rightarrow \infty\). Also \(Y^*_n=\frac{\gamma (a-c)^2}{(2b(n+1)\gamma -1)^2}\rightarrow 0\) when \(n\rightarrow \infty\). So \({\bar{Y}}_n-Y^*_n\rightarrow 0\). So the differences in R&D expenditure and CS disappear as \(n\rightarrow \infty\).

The difference in profit, \(\bar{\pi }_n-\pi ^*_n\) can be simplified as

Except for the negative sign in the front, all other terms are non-negative. Particularly, the term \(\left( -1-2 n-\beta +n \beta +3 b (1+n)^2 \gamma \right) >0\) requires \(3 b (1+n)^2 \gamma >1+2 n+\beta -n \beta\), which requires \(b \gamma >\frac{1+2n+\beta -n \beta }{3 (1+n)^2 }\). We have shown right before, in proving for the R&D expenditure, that \(b \gamma >\frac{n^2 }{ (1+n)^2}\), and one can verify that \(\frac{n^2}{ (1+n)^2}>\frac{1+2 n+\beta -n \beta }{3 (1+n)^2 }\) always holds for all \(n\ge 2\) and \(0<\beta <1\). So \(b \gamma >\frac{1+2n+\beta -n \beta }{3 (1+n)^2 }\) is proved. So \(\bar{\pi }_n-\pi ^*_n\le 0\), while the equality holds only when \(\beta =\frac{1}{2}\).

For the welfare, \({\bar{W}}_n-W^*_n\) can be simplified as

We claim that \({\bar{W}}_n-W^*_n\) has the same sign as \(1-2\beta\), which is stated in the Proposition. To validate that, we need \(-1-3 n-2 \beta +2 n \beta +4 b (1+n)^2 \gamma >0\), or \(b \gamma >\frac{1+3 n+2\beta -2n \beta }{4 \text { }(1+n)^2 }\), which can be verified to be true, since \(b \gamma >\frac{ n^2}{ (1+n)^2}\) and \(\frac{n^2}{ (1+n)^2}>\frac{1+3 n+2\beta -2n \beta }{4 (1+n)^2 }\) for all \(n\ge 2\) and \(0<\beta <1\).

Now, we want to show that all these differences will disappear, moreover, in a quite monotonic manner, as n approaches infinity. First, let us show this for the R&D expenditure. Differentiating \(\bar{Y}_n-Y^*_n\) with respect to n, it equals \(2 b (a-c)^2 \gamma ^2 A\), where A is the following term:

It can be verified that for the denominators, \(\frac{n+1}{2} (-1+2 b (1+n) \gamma )>-n-\beta +n \beta +b (1+n)^2 \gamma >0\), and for the numerators, \(\frac{(n+1)^2}{ 4}<(-1+n (1-\beta )+3 \beta ) (n (1-\beta )+\beta )\), two always hold for all \(n\ge 3\) and \(0<\beta <\frac{1}{2}\). So the sign of A should be negative. Thus \(\bar{Y}_n-Y^*_n\) decreases in n for \(0<\beta < \frac{1}{2}\), and since \(\bar{Y}_n-Y^*_n\ge 0\) for \(0<\beta <\frac{1}{2}\) and \(\bar{Y}_n-Y^*_n\rightarrow 0\) when \(n\rightarrow \infty\), we conclude that \(\bar{Y}_n-Y^*_n\) decreases in n and approaches 0 when \(n\rightarrow \infty\) . Similarly, one can verify that the two inequalities for the denominators and the numerators flip signs when \(1>\beta >\frac{1}{2}\), so that \(\bar{Y} _n-Y^*_n\) increases in n for all \(n\ge 3\) and \(1>\beta >\frac{1}{2}\). Combined with the fact that \(\bar{Y}_n-Y^*_n\le 0\) for \(1>\beta >\frac{1}{2}\) , it proves that \(\bar{Y}_n-Y^*_n\) increases in n to 0 as \(n\rightarrow \infty\).

Because of the relation between the R&D expenditure and the consumer surplus, as argued shortly above, the consumer surplus should follow the same pattern as the R&D expenditure when \(n\rightarrow \infty\).

The monotonic tendency of disappearing difference between the one-stage and two-stage models for the profit and welfare can also be proved, by playing with the differentiation terms, the inequalities and the assumptions, but they are too bulky to be presented here, so an interested reader can request from the authors a formal proof. Here, we want to give a last account on the profit and welfare as to simply prove what is stated in Proposition 2, which, the readers may notice, contains no account of monotonicity. We have shown that \(\bar{Y}_n-Y^*_n\rightarrow 0\), which implies \(\bar{q} _n-q^*_n\rightarrow 0\), one discussed already when we dealt with consumer surplus. Now that the profit is only affected by quantity q and the effective cost reduction achieved by Y, one immediately gets \(\bar{\pi } _n-\pi ^*_n\rightarrow 0\). Lastly, as the differences of both consumer surplus and profit disappear in perfect competition, it follows that \(\bar{W} _n-W^*_n\rightarrow 0\). And we have proved Proposition 2. \(\square\)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Liu, H., Tian, J. Spillovers and strategic commitment in R&D. Theory Decis 96, 477–501 (2024). https://doi.org/10.1007/s11238-023-09953-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-023-09953-9