Abstract

Using survey data from a representative sample of Irish Small and Medium Enterprises (SMEs), we study how firms are likely to perform under macroeconomic forecasts of the pandemic recovery. The rate of financial distress among firms is expected to fall under baseline forecasts from a peak of 12% in 2020 to 7% by 2024. We find that those firms that struggle to recover by the end of our scenario window were mostly unprofitable or distressed prior to the pandemic. Beyond our baseline case, we further model three alternative recovery scenarios to study the effect of fiscal support tapering, a partial recovery due to structural change in sectoral demand, and a financing gap driven by credit risk retrenchment by lenders. Our findings highlight the continued importance of “bridging” liquidity finance provision to ensure the long-term solvency of viable firms.

Plain English Summary

What proportion of SMEs are financially unviable in the post-pandemic economy? We study data from a representation sample of Irish SMEs and consider how they will perform under forecasts of the pandemic recovery. In our baseline scenario, we estimate that 7% of firms will remain distressed by 2024 and we find that most of these firms were unprofitable or already distressed prior to the pandemic. We look at a number of alternative macroeconomic scenarios, including where government supports are withdrawn, firms in some sectors do not fully recover, and where lenders lower the amount of money they are willing to extend to loan applicants. The impact of government support tapering alone is expected to be modest, and a partial recovery for some firms is not expected to raise aggregate distress by a sizeable amount. However, a sharp contraction in lending to otherwise viable firms leads to a significantly heightened distress rate. Policy measures that seek to support liquidity finance provision to viable firms will continue to have a role in the pandemic recovery.

Similar content being viewed by others

1 Introduction

As the global economy recovers from the COVID-19 pandemic, the longer-term viability of small firms remains an issue of major policy interest. The economic shock that hit firms has resulted in balance sheet damage and uncertainty about future profitability. While extraordinary policy measures from fiscal, monetary, and prudential authorities have lessened the impact of the pandemic on firms, they have potentially masked some of the impacts of the crisis on longer-term viability. Traditional indicators of firm distress, such as loan defaults (ECB, 2021; Federal Reserve, 2021) and corporate bankruptcies (Banerjee et al., 2020; Djankov & Zhang, 2021), have remained remarkably low. In the absence of emergent signs of risks via traditional indicators, there is a need for alternative approaches to understand how small firms will recover as trading conditions normalise and extraordinary supports are tapered.

In this paper, we use survey data from a representative sample of Irish Small and Medium Enterprises (SMEs) to study the impact of a forecasted macroeconomic recovery on firm financial distress and viability. We extend the micro-simulation model developed by McCann and Yao (2021) to estimate the scale of latent financial distress among Irish SMEs and to study the likely path for firms under different recovery scenarios. Our methodological contribution is two-fold. First, we make use of detailed data on the realised outcomes of firms during the pandemic itself and compare these with pre-pandemic financial characteristics. Second, we design a new scenario analysis which simulates firm outcomes out to 2024. This allows us to assess the balance sheet impact of the crisis, as well as expected post-pandemic performance under a range of scenarios.

In each year of our scenario window, we project the turnover of each firm in our sample based on headline macroeconomic forecasts and firm-specific characteristics. We allow costs to adjust with turnover using estimated elasticities, and we allocate fiscal support payments. This generates profit estimates, which we use to update each firm’s balance sheet. Firms with low levels of cash insufficient to cover operational losses trigger a liquidity distress flag, and firms struggling to service high debt levels trigger a solvency distress flag. We also demonstrate the crucial role of liquidity management and fiscal support in alleviating short-term SME distress. We further incorporate a cash-hoarding impulse into how firms respond to losses, whereby cash grants and subsidised borrowing through tax deferrals are sought before existing cash reserves are depleted.

The main results of our analysis are the following:

First, we show that financial distress among SMEs is expected to fall significantly under our baseline macroeconomic recovery scenario. The rate of financial distress is expected to fall from a peak of 12% in 2020 to 7% by 2024. This is driven by the easing of liquidity pressures on firms due to substantially recovered turnover levels. We further show that if firms were unable to claim supports and so had to use up all of their available cash, then our baseline financial distress rate of 12% in 2020 would have risen to 30%. Our baseline 12% estimate of financial distress can be considered a lower bound, while our 30% estimate can be considered an upper bound. Based on the extent of fiscal support utilisation, the growth of SME bank deposits, and the relatively low level of liquidity-driven insolvencies during the pandemic, we judge that a baseline assumption close to this 12% lower bound is appropriate.

Second, approximately 70% of the firms that remain distressed at the end of our scenario window were already distressed prior the pandemic. There is a distinction to be made between those firms which were temporarily liquidity distressed in 2020 and those that had pre-existing financial difficulties. In our simulation, even with a strong recovery trajectory, the latter group of firms overwhelmingly fails to escape distressed by 2024. Furthermore, we show that sustained loss-making by these firms would lead to solvency distress by the end of our scenario window.

Third, we present results under alternative recovery scenarios depending on policy variation and sector-specific partial recoveries. We find that, absent a return of significant public health restrictions, the tapering of government supports will in general plays a relatively minor role in determining the financial distress of SMEs. Due to the strength of the forecasted recovery and the design of support policies, we find that firms will lose eligibility for government supports naturally as their turnover levels recover. The forecast of buoyant economic activity into 2022, which is dependent on the lack of an emergence of further pandemic-related restrictions, suggests that the withdrawal or increased targeting of grant supports will not adversely impact most firms. We also consider a partial recovery in trade as we enter a “New Normal” environment, under which certain pandemic-induced changes in sectoral demand become structural in nature. We simulate the impact of a partial recovery in the accommodation and food and wholesale and retail sectors, where turnover of firms only recovers to 75% of the pre-pandemic level. We find that while liquidity distress remains low for such firms once they are facilitated by creditors, sustained loss-making would over time lead to over-indebtedness, and without continued availability of debt financing, such firms would be unable to meet outgoings.

Lastly, we demonstrate the continued importance of adequate liquidity finance for viable SMEs. We show that in a scenario where only 60% of the operating losses of SMEs can be bridged by external financing, the financial distress rate at 2024 would rise from 7 to 13%. This generates critical policy implications around the important role that liquidity finance will continue to play as SMEs trade their way to viability during the COVID-19 recovery. To mitigate these risks during the pandemic recovery phase, it will be important to ensure adequate liquidity finance provision for viable firms, potentially through policies that can encourage lending to this type of illiquid-yet-solvent borrower, such as loan guarantees. Such a policy would only be necessary in cases of a retrenching of risk appetite to borrowers that have a long-term viable future, but due to the unprecedented nature of the pandemic shock, may run operating losses over a 2- to 3-year horizon while recovering to a sustainable trading position.

Small business distress is the subject of analysis in a variety of social science literatures, with alternative perspectives and lenses applied. Our theoretical motivation and empirical strategy are rooted in financial economics, where theoretical contributions—most notably including Merton (1974)—and empirical work rest primarily on the assessment of income statement and balance sheet health. Contributions such as Altman (1968) and Campbell et al. (2008), for example, document key financial ratio thresholds beyond which firms are highly likely to encounter repayment difficulty and conflict with creditors. Our contribution fits neatly within this analytical framework. However, our paper will also be of interest to scholars in other fields such as strategic management and entrepreneurship. Strategic management theories not only focus mainly on the resource-based view (Penrose, 2009; Rangone, 1999) but also include alternatives such as environmental determinism (Moulton et al, 1996). Our work can be thought of as documenting environmental determinism in action, with the COVID-19 pandemic representing a massive external and unexpected shock to financial health for misfortunate firms. Entrepreneurship scholars have also looked in depth at business failure, often highlighting the role of individual-level entrepreneur characteristics and experience. Examples include the determinants of failure, attribution bias upon failure, learning from failure, and the personal impact of failure on the entrepreneur.Footnote 1 While we have little to say on the impact of business distress on the entrepreneurs themselves, our work is able to give great insight into the determinants and attribution of business distress during the extraordinary pandemic period.

This paper is also closely related to three strands of the literature on the impacts of the COVID-19 pandemic and associated policy measures.

Firstly, the international literature has thus far grappled with the impact of the pandemic and policy supports on firm turnover, profitability, and employment. Much less has been said about the future viability of firms. Bartik et al. (2020), Bańkowska et al. (2020), and Ferrando and Ganoulis (2020) provide early survey evidence on the effect of the pandemic on businesses in Europe and the USA. Chetty et al. (2020) find that Payroll Protection Program (PPP) loans in the USA had little impact on employment at small businesses because firms that apply for the loans did not intend to lay off workers. Altavilla et al. (2020) analyse the effect of a wider range of policy supports taken in the euro area, including monetary and prudential policies, and find that in absence of these policies, the pandemic would lead to a significantly larger decline in firms’ employment. Our simulation analysis provides estimates not only for the immediate effects but also for the longer-run effect.

Secondly, when studying SME viability, Cros et al. (2021) estimate factors predicting firm failures in the COVID crisis using French firm-level data. They find that public policies have so far largely offset the sectoral impacts of the COVID shock, and creative destruction has not been distorted during the COVID crisis. Our focus in this paper is not on the determinants of firm failures but on the conditions that determine financial distress of SMEs. Gourinchas et al. (2020, 2021) use a combination of a partial equilibrium model of firm cost minimization, macro projections, and firm-level financial data to estimate the impact of the COVID-19 crisis on business failures. They find that government supports were of central importance in holding down SME failure rates. While government supports were in many cases poorly targeted, they find little evidence that supports simply postponing mass failures. One important difference from our work is that, in the Gourinchas et al. (2020, 2021) framework, the only criterion for business viability relates to liquidity shortfalls. This approach has the advantage of simplicity, but it removes a role for problems relating to debt overhang from the modelling approach. Our approach allows for richer modelling of mechanisms that is relevant to the debate on SME finance during the pandemic. For example, a key component of the policy response in 2020 across Europe was the widespread issuance of government guarantees on SME borrowing, which can come with currently unknown debt overhang risks as economic conditions normalise. Our framework also allows firms with liquidity shortfalls to replace government support over time with borrowing from the financial sector and other related sources of funding such as owners’ equity. With this mechanism, we can also model the implications of a dry-up in access to this kind of outside funding through our scenario window.

Lastly, our findings also contribute to the international debate on zombie firms in the context of the COVID-19 pandemic (Laeven et al., 2020). Some participants in this debate express concern at the possibility that firms with pre-pandemic distress have been artificially kept alive by government support measures and creditor flexibility, and that some firms that have become long-term non-viable due to the pandemic are now in a similar situation. Our results suggest that, in Ireland at least, the vast majority of companies made distressed by the pandemic are likely to have a viable future, and that policy support has not created a large group of “zombie” enterprises. By contrast, our results confirm that those firms already distressed in 2019 are estimated to predominantly remain in distress by 2024, highlighting the importance of an insolvency system that can distinguish between those requiring restructuring, and those for whom liquidation would be more appropriate.Footnote 2

The remainder of the paper is organised as follows. Section 2 provides a review our data and the key metrics we make use of. Section 3 examines the pre-pandemic financial characteristics of our firms. Section 4 contains our main results. Section 5 concludes.

2 Data

We first provide an overview of the data we utilise and the key financial ratios we examine. We source our data from the 2020 wave of the SME Credit Demand Survey (CDS). This is a representative survey of SMEs commissioned regularly by the Irish Department of Finance. It provides detailed information on firm turnover, costs, and key balance sheet items. A major strength of the survey is its timeliness and its ability to measure realised firm outcomes during the pandemic.Footnote 3 The survey is delivered in pooled cross sections, with no capacity for panel data analysis. Our focus throughout this paper is on the March to October 2020 period, during which companies were asked a number of questions relating to pre-pandemic starting points and changes relative to 2019 in key financial and performance indicators.

Applying basic cleaning filters, including the removal of outliers, yields a starting sample of 1787 firms. We retain only non-financial firms that responded to all survey questions relevant for our purposes. In addition, we exclude 52 firms that ceased trading during the pandemic so that we retain our focus on firms that are staging a recovery. This reduces our sample size to 1003 firms.

We adjust reported firm profits in one important way. First, we assume that respondents do not include depreciation in their estimate of “expenditure”. Second, we assume that realised 2019 and expected 2020 investment levels are representative of the fixed asset composition within each sector. We apply straight-line depreciation charges that differentiate between different asset types.Footnote 4 This yields profit margins that are much closer aligned to aggregate figures published by Ireland’s statistical agency.Footnote 5

We measure net profit as turnover minus total expenditure minus depreciation. We measure profit margins as the ratio of net profit to turnover.

We measure firm leverage as debt liabilities plus accounts payable over total assets. These two liabilities are similar in scale and together provide good insight into firm indebtedness. This approach should be thought of as providing a lower bound estimate on leverage, as there may be additional unreported liabilities owed to tax authorities, company directors, or other counterparties.

Table 1 provides a summary of the dataset. We observe the NACE letter sectoral code of each firm. In cases where the number of firms in a particular sector is below 50, we group the sector with another. For example, we combine professional, scientific and technical firms with administrative and support services firms.

The median level of cash holdings prior to the pandemic was 10% of assets. This varied among sectors, with accommodation and food firms having a median of 5% and professional and administrative firms having 25%. The median leverage ratio was 0.32, with firms in the construction and wholesale and retail sectors showing relatively high levels of indebtedness. Profit margins ran at 15% overall and most sectors have median profit margins of approximately this level. The highest margins were in professional and administrative sectors, while the lowest margins were in Human Health and Manufacturing.

These summary statistics are informative about typical firms in each sector, but they do not tell us much about firms with relatively poor liquidity and leverage characteristics. Section 3 provides more detail on the distribution of these indicators.

3 Pre-pandemic financial performance

A key determinant of post-pandemic viability will be the existence of a strong underlying business model. Firms will need to generate enough turnover to service pre-existing liabilities and any additional liabilities they have built up over the course of the pandemic. With this in mind, we investigate the financial performance of the firms in our sample immediately prior to the pandemic.

A viable firm is one that is capable of generating a sustainable level of profitability. Firms that were unprofitable prior to the pandemic are thus a group of particular interest and so we devote a large share of this section to understanding their characteristics. We place less emphasis on those firms that have suffered balance sheet damage due to the pandemic. This is part due to the significant mitigating effects of government grants and partly due to the availability of legal remedies for distressed corporates. Examinership in Ireland (a scheme similar in nature to the Administration scheme in the UK or Chapter 11 Bankruptcy in the USA) requires that a company has a “reasonable prospect of survival” once a restructuring scheme is implemented (Courtney, 2016). A company with a solid business model can thus access the restructuring framework, even if they have very high leverage. This model is particularly relevant for firms that may have suffered significant balance sheet impairment during the pandemic, but have good future trading prospects.

3.1 Profitability and leverage

Figure 1 shows the profit margin distribution of firms in different sectors. The majority of firms in each sector were profitable, though there exists a left tail of unprofitable firms in each sector.

A possible explanation for the significant loss-making reported by some firms is that this is simply a part of the firm life cycle. Early-stage start-ups may be encountering losses as they establish their enterprise.Footnote 6 In Appendix A.2, we show that this is not the case. The firms experiencing heavy losses in our sample are not unusually young or unusually small. They appear to be well-established firms that are showing signs of financial vulnerability.

Figure 2 shows the leverage distribution by sector. There is more variation across sectors on this metric. Firms in the construction and wholesale and retail sectors report higher levels of leverage, while those in the human health sector report relatively low levels of leverage. While the median leverage of accommodation and food firms is relatively low, the distribution is rather skewed.

Table 2 shows the realised pandemic outcomes of firms by their 2019 profitability status. This is possible because the 2020 survey wave included questions on pre-pandemic turnover and costs. We make use of a break-even (BE) window of a ± 1% profit margin. Firms that were loss-making or breaking-even in 2019 were overwhelmingly loss-making in 2020. Twenty percent of firms were profitable in 2019, but unprofitable in 2020. Forty-nine percent were profitable in 2019 and remained profitable in 2020.

Our estimates are qualitatively similar to those reported by Kren et al. (2021) but differ for two main reasons. First, we have adjusted firm profit margins for depreciation. This pushes a cohort of firms with exactly zero profit to be mild loss-making. Second, we do not impose a scale adjustment to firm costs based on CSO aggregates. This results in higher profit margin estimates, particularly in the relatively large wholesale and retail sector.

4 Firm viability post-pandemic

In this section, we consider a recovery scenario period out to 2024. We adopt a macroeconomic scenario based on the Central Bank of Ireland Quarterly Bulletin 2021Q3 forecasts of modified domestic demand.Footnote 7 Under this scenario, domestic economic activity returns to pre-pandemic levels by 2022. We thus assume that firm turnover recovers to 2019 levels by 2022. We interpolate linearly between our realised 2020 figures and the return to pre-pandemic levels in 2022. We further assume a return to turnover growth of 3% per annum in 2023 and 2024.

Figure 3 illustrates our baseline recovery scenario. The 2020 figures represent the realised pandemic outcomes. The most severe decline was in the accommodation and food sector, which experienced a decline of nearly 70%. Manufacturing firms experienced a more modest decline of approximately 15%. All other sectors had declines of 25 to 40%.

The scenario is designed with a linear recovery path from 2020 to 2022. This has the effect of generating a relatively poor 2021 outcomes for sectors that were most affected by the pandemic. For example, the large rebound for the accommodation and food sector in 2021 only brings it to 65% of its pre-pandemic level.

We observe firm turnover in 2019 and 2020. Our baseline recovery scenario includes a recovery to at least 2019 turnover for all firms by 2022. For those firms that experienced losses in 2020, we linearly interpolate between the pandemic trough and the 2022 level. These firms then grow their turnover at a typical rate of 3% per annum out to 2024.Footnote 8 For firms that experienced increased turnover in 2020, we permit them to retain this gain and grow at 3% per annum from 2021 onwards.

4.1 Model

In this section, we describe our modelling framework and how we go about tracing firm profitability, liquidity, and leverage estimates out to 2024.

Equation (1) gives the profit of firm i in year T. Turnover in the recovery is generated by our recovery path as described above. We scale costs using sector-level cost elasticities estimated using firm-level changes in turnover and costs from 2019 to 2020 as outlined in Appendix A.4. Depreciation is a recurring straight-line charge based on each firm’s 2020 fixed asset stock.

Grant payments are calibrated to the terms of existing government schemes and our firm-level characteristics. The most consequential support is the Employment Wage Subsidy Scheme (EWSS).Footnote 9 In the years when this support is available and firm turnover is 30% below its 2019 level, we provide firms with a flat payment of €203 per week per employee. We then establish a further pool of fixed-cost grants amounting to 25% of the total wage subsidy cost. This is informed by the aggregate level of utilisation of government support schemes.Footnote 10 We allocate these additional grants to loss-making firms weighted by their fixed costs.

Equations (2) and (3) show how profit outcomes in each period impact firm balance sheets. Our approach in assigning firms with a cash-hoarding impulse is clearly apparent here. Where firms are loss-making, they finance this loss through further debt accumulation and maintain their cash at its current level. In this way, loss-making results in higher leverage and not an acute liquidity shortfall. If firms generate profits, then they add this surplus to their cash holdings. In years where the support is available, we allow loss-making firms to source debt finance in the form of low-interest tax deferrals. We apply a zero interest rate on these tax borrowings until 2022 when we apply a 3% interest rate in line with the Irish tax warehousing scheme.Footnote 11 All other debt attracts an interest rate of 5%.Footnote 12

Our cash hoarding assumption is informed by expectations of extreme precautionary behaviour by company directors, the unusually low ex-post level of liquidity-driven corporate insolvency notifications in Ireland up to summer 2021 (Central Bank of Ireland FSR 2021-II; McGeever et al., 2020), substantial growth in cash deposits for households and firms at Irish banks since March 2020, even among affected sectors, and the heavy utilisation of government grant and subsidised debt facilities.

We use these balance sheet indicators to inform a financial distress indicator based on the literature and recently applied to Irish SMEs by McCann and Yao (2021). Firms are distressed if one or more of the following criteria are met. First, the firm’s liquidity coverage ratio is below 3 months. This captures cases of liquidity distress where low liquid asset holdings are struggling to meet operational losses. Second, the book leverage of the firm is above 1.5 and the interest coverage ratio is below 3 months. This captures cases where firms are struggling to service high debt levels.

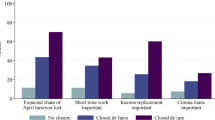

We later go further and consider three extensions to our framework. First, we consider support tapering whereby government grants are withdrawn at the end of 2021. This simplifies our profit estimate in (1) and has the potential to adversely impact balance sheet liquidity and leverage. Second, we consider a “New Normal” scenario in which turnover only recovers to 75% of its 2019 level for firms in the accommodation and food and wholesale and retail sectors. Similarly, this hits profitability for these firms. Lastly, we consider a scenario in which the financial sector only provides a proportion of demanded liquidity. This complicates the transmission of profits to firm balance sheets through Eqs. (2) and (3). Firms are forced to part finance losses through debt and cash, adversely impacting liquidity.

4.2 Results: Baseline recovery scenario

A key determinant of distress is how firms choose to make use of their ex ante cash holdings. A strategy of hoarding pre-pandemic cash holdings and borrowing to fund pandemic losses results in substantially lower distress estimates in 2020 and throughout our scenario window. If loss-making firms instead burn through all of their cash and borrow only the remaining deficit, then cash holdings remain at zero until such as time as profitability returns. Note also that we are assuming here that all non-cash assets are indispensable and cannot be used as a source of liquidity at fire-sale prices or otherwise.

Figure 4 illustrates the importance of ex ante cash holdings in determining distress rates. Exhausting cash assets to fund 2020 losses would have raised the aggregate SME distress rate to 30%. This rate halves if cash is hoarded and losses are funded with grants and debt.

Proportion of firms in financial distress. Notes: Financial distress rates under alternative firm tactics. First, firms use their cash holdings to finance losses and then borrow the remaining deficit. Second, firms borrow the full deficit. Third, firms claim grant support and then borrow any remaining deficit

As discussed in Sect. 5.1, we incorporate cash hoarding and support utilisation into our baseline scenario. All subsequent results assume this precautionary behaviour.

We report the relative importance of our liquidity and solvency triggers in Table 3. In all cases, liquidity is the predominant driver of financial distress, as would be expected given that over half of Irish SMEs have reported having no debt in recent years, and that high-debt firms have been falling as a share of the population since the financial crisis. The continuation of relatively low levels of solvency stress out into the scenario window is also likely helped by the nature of Irish government policy. Previous work from the Central Bank of Ireland (FSR 2021-I) has shown that Irish firms availed of a policy mix that was among the most skewed globally towards grants and subsidies rather than debt, a feature that is likely to benefit the Irish economy in mitigating debt overhang and solvency risks in the coming years.

Figure 5 shows financial distress rates by sector. The accommodation and food sector peaked at almost 20% at the height of the pandemic, while at the other end of the distribution Manufacturing hit approximately 8%. Distress rates fall in all sectors over our scenario window, though notably remain higher than 2019 levels for the accommodation and food and wholesale and retail sectors (Table 4).

Figure 6 shows a scatterplot of 2019 and 2024 profit margins for each firm in our sample. The main result is that most firms recover to a very similar level of profitability by the end of our sample period. A small minority of firms improve their profit margins, but only to a modest degree. Figure 7 similarly shows the distribution of profit margins in 2019 and 2024. There is only a modest difference in the two periods, with a small shift from profitability to loss-making.

We next look at the 2019 status of firms that are distressed through our scenario window. Figure 8 shows that half of firms that were distressed in 2020 were already distressed in 2019. The decline in the aggregate distress rate is almost completely explained by pandemic-related distress easing as turnover levels recover. This demonstrates that firms with pre-pandemic distress will be an important cohort in viability assessments. Despite a substantial projected turnover recovery, these firms are not able to escape distressed status under our baseline scenario.

The source of financial distress is also an important consideration. Figure 9 shows that liquidity constraints were the primary source of distress in both 2019 and 2020. As the recovery advances, sustained loss-making by distressed firms leads to further balance sheet impairment and triggering of solvency distress. We have shown in Fig. 8 that these 2024 distressed cases were mostly distressed in 2019 also. These firms display very serious signs of vulnerability and, in the absence of a dramatic improvement in profitability, they appear to be unviable.

We next look at the 2024 profit outcomes under our scenario for only those firms that were distressed in 2020. In this way, we consider how resilient the profitability of these firms is. A concern associated with the pandemic is that the balance sheet shock of the pandemic, the large gross losses experienced in 2020 in particular, might impact future profitability by raising interest costs on a large stock of liabilities. Figure 10 presents the 2024 profit margin distributions for these 2020 distressed firms and splits this cohort by whether they were distressed pre-pandemic or not. Those firms that were temporarily distressed in 2020 show substantially better outcomes than those firms that were distressed pre-pandemic. The scale of loss-making for the latter group can help explain the distress and solvency dynamics shown above in Figs. 8 and 9. These results further emphasise the poor expected outlook for this pre-pandemic distressed cohort.

Lastly, we look at the level of debt owed by firms in our data to the banking system. Our interest here is in understanding the transmission of the pandemic shock onto the balance sheets of Irish banks. Loan defaults among firms have the potential to generate financial stability effects. For example, banks encountering losses may reduce credit allocation to healthy firms and, in extremis, create a socially costly credit crunch and fire sale dynamic.

Table 4 shows the debt-weighted financial distress rate among our sample of firms under a variety of scenarios. The impact of the pandemic on this indicator is largely similar to that of the equal-weighted distress rates we have already examined. Again, a key determinant of distress is the ability of firms to hoard cash and to lower losses through support utilisation. The general trajectory of a decreasing distress rate coinciding with a strong turnover recovery is common across the main scenarios we consider. It is worth noting also that the debt-weighted distress rate is higher at 10% than the 7% equal-weighted rate for firms in general.

4.3 The impact of support tapering

We next consider the impact of government support tapering on firm outcomes. We assume that wage subsidies, grants, and tax warehousing will be withdrawn at the end of 2021. If firms continue to encounter losses in 2022 and beyond, then they must finance these losses solely through borrowing.

Figure 11 presents the results for this alternative scenario. Figure 11 a shows that the aggregate SME distress rate is largely unaffected by the withdrawal of supports at end-2021. This is due to the strong forecasted recovery and the swift return to pre-pandemic turnover levels. Figures 11 b,–d decompose the distress indicator and show that the liquidity position of firms is essentially unchanged with and without support tapering. There is some deviation for firm leverage, as some loss-making firms must borrow rather than continuing to claim grants. An implicit assumption in this analysis is that market-rate credit provision will continue to be available to firms that need refinancing or new credit. We relax this assumption in Sect. 4.5 and investigate the impact of credit risk retrenchment on the part of banks, potentially through a financial accelerator mechanism.

4.4 A new normal?

We next look at an alternative “new normal” scenario in which turnover recovers only to 75% of pre-pandemic levels for the wholesale and retail and accommodation and food sectors. We retain the withdrawal of supports from 2022 onwards as part of this analysis. While this might appear to be a severe turnover decline, our primary interest is in understanding distress among incumbent firms. If there is significant disruption in these sectors and turnover is lost to new entrants or indeed other sectors, we would still like to keep our focus on the fortunes of firms that made up the market pre-pandemic. It is their distress that has the potential to generate losses for creditors in the short term.

We find two key results. First, heightened loss-making for firms in these two sectors does not result in a major hit to firm liquidity once existing debt can be rolled over and new debt is forthcoming from credit institutions. Second, and more worrying, is that this level of partial turnover recovery is not enough for many firms to return to profitability. Without government supports, significant losses build up and must be financed somehow. In our framework, the only option is for firms to seek external finance through additional borrowing. This results in higher aggregate leverage ratios that do not fall over the course of our scenario window (Fig. 12).

4.5 Credit appetite retrenchment

Our analysis thus far makes an implicit assumption that liquidity finance remains in ample supply throughout the scenario window and that it must come from the financial sector once government supports are tapered during 2022. In our modelling up to now, firms that are loss-making are able to re-organise their balance sheet by raising their leverage in order to generate cash to meet their obligations. We now relax this assumption and examine the impact of risk retrenchment on the part of credit providers on firm distress. As part of this scenario, we also assume that government supports are tapered from 2022 onwards. Specifically, we consider what would happen if lenders provided only a proportion of required liquidity finance and firms were obligated to meet the remaining deficit using only internal liquid assets.

This analysis demonstrates the vulnerability of many firms to an abrupt regime shift in liquidity financing conditions. If they are denied sufficient liquidity finance from creditor providers, then loss-making firms will need to source funds from alternative sources. This might be in the form of equity or debt finance sourced from the proprietor’s own personal balance sheet or through fire sales of company assets.

The policy implication from our findings, combined with those on partial turnover recoveries, is that affected firms with liquidity challenges but robust business models will still require access to liquidity finance from the financial sector during the recovery phase of the pandemic. At the current juncture, the majority of firms with a need to finance short-term shortfalls through borrowing are likely to be able to do so, due to the current relatively low level of financing constraints facing SMEs. However our findings in Fig. 13 highlight how precarious the financial distress rate is and how important macro-financial feedback loops could become in the event of a retrenchment in risk appetite, by showing that there is still considerable scope for firm distress to remain elevated if liquidity finance were to be withdrawn from companies with a viable trading future.

A long research literature has highlighted the importance of banks’ credit supply appetite for firm financing and its vulnerability to unexpected shocks, such as capital erosion through loan losses (for example, Peek & Rosengren, 2000). The findings of this literature suggest that policy supports such as loan guarantees may continue to have an important role during the pandemic recovery, in ensuring that risk retrenchment does not lead to vulnerable-yet-viable firms falling over. Further, bank capital adequacy plays an important role in our framework, given that a credit supply reduction can act in a circular way to lead to financial distress for firms that were on a path to trading to long-term viability.

Kelly et al. (2021) find evidence of modest credit supply tightening in Ireland in 2021 using data from the ECB Bank Lending Survey. This is notably associated with the economic outlook and borrower-specific factors, rather than a deterioration in bank capital ratios. They also discuss the factors that could lead to further credit supply contraction and point to the type of scenario we have considered in this section—declining bank risk appetite allied with fiscal support tapering (including the withdrawal of tax deferrals).

Loan guarantees can play an important role in averting a major shock to credit supply. Honohan (2010) reviews the economic rationale for government loan guarantees, including the social benefits of offsetting a credit crunch for small businesses. Using euro area data during the COVID-19 pandemic, Altavilla et al. (2021) demonstrate that credit guarantees facilitated lending to small firms in heavily-affected sectors and that these firms did not show signs of distress prior to the pandemic. Given our results on the important role of credit supply, if evidence of a retrenchment of risk appetite was to become apparent, policy interventions to ensure the continued availability of “bridging” liquidity finance for viable firms could be warranted.

5 Conclusion

In this paper, we have examined the financial performance of SMEs pre- and post-pandemic. We do this by linking pre-pandemic profitability and indebtedness to survey responses on realised outcomes in 2020 and simulated firm outcomes under headline macroeconomic forecasts out to 2024.

One of our main findings is that 12% of Irish SMEs were financially distressed in 2020 and that this would have been 15% in the absence of government financial supports. If firms had been forced to use all available cash resources to meet losses immediately, distress rates of closer to 30% are estimated. This shows the central role of government supports and other forbearance in mitigating the effects of the pandemic for SMEs.

Our modelling framework allows us to examine the impact of a significant recovery in turnover on profitability, liquidity, and leverage. We find that the SME distress rate is expected to fall significantly under headline macroeconomic forecasts, in line with a substantial recovery in turnover. This is true also of firms with outstanding loans to credit institutions.

Half of firms that were financially distressed in 2020 were already distressed prior to the pandemic. Firms that remain distressed under our recovery scenario in 2024 were mainly distressed prior to the pandemic. The profitability outlook for these firms is much worse than that of firms that were temporarily distressed in 2020 and 2021. Sustained loss-making by these firms leads to growing solvency distress out to 2024.

Given the strength of the underlying recovery, the impact of government support tapering is expected to be more modest than might be first imagined. The strong rise in turnover for firms under our baseline scenario sees them roll off supports like wage subsidies naturally. A partial recovery in firm turnover for some sectors of the economy is a more acute concern. We consider a “new normal” scenario in which firms in the accommodation and food and wholesale and retail sectors struggle to adjust to post-pandemic trading. This results in a marginally more sluggish fall in distress rates, with continued loss-making for some firms.

We lastly consider the impact of a substantial retrenchment in external liquidity finance provision by the financial sector. Throughout our modelling horizon, we assume that losses can be met through external borrowing. We consider the implications of between 60 and 80% of required liquidity finance being made available from external sources (banks, non-banks, related parties such as directors). We show that this is enough to generate significant liquidity distress, as the cash buffers of firms are not sufficient to meet losses. In magnitude terms, the financial distress rate in 2024 would rise from 7 to 9 or 13%, when full provision is reduced to 80 and 60%, respectively. This points towards a significant vulnerability to the availability of “bridging” finance for recovering firms, which may warrant policy intervention if evidence of a retrenchment of risk appetite towards this group of illiquid yet long-run viable companies emerges.

Financial distress triggers under alternative firm tactics. First, firms use their cash holdings to finance losses and then borrow the remaining deficit. Second, firms borrow the full deficit. Third, firms claim grant support and then borrow any remaining deficit.

Notes

See Walsh and Cunningham (2016) for a tour de force survey of the entrepreneurship literature on business failure and how it relates to approaches in other fields, including financial economics.

Recent reforms to the Irish corporate insolvency system under the Companies (Small Company Administrative Rescue Process and Miscellaneous Provisions) Bill 2021, will allow for access to the Irish examinership system at lower cost, to a wider range of smaller companies. It is hoped in Ireland that this reform will allow for more ready restructuring of liabilities in cases where financially distressed SMEs can be shown to have a viable trading future.

The public disclosure of corporate financial accounts in Ireland comes at a significant lag and, furthermore, reporting deadlines were extended during the pandemic as a relief measure.

See Appendix A.1.

See the CSO Business in Ireland 2020 release.

The Small Business Administration published results showing that half of US start-ups fail by their fifth year. https://cdn.advocacy.sba.gov/wp-content/uploads/2021/11/03093005/Small-Business-FAQ-2021.pdf

See Appendix A.2.

Our choice of 3% is consistent with average changes in domestic demand in recent years. Assuming no growth in turnover in 2023 and 2024 does not impact our results meaningfully.

See Box G of the Central Bank of Ireland Financial Stability Review 2021-I.

We show in Appendix A.5 that lowering this market rate from 5 to 2%, reflecting a potential state guarantee discount, does not meaningfully lower distress estimates. Access matters much more than the rate.

References

Altavilla, C., Barbiero, F., Boucinha, M., & Burlon, L. (2020). The great lockdown: Pandemic response policies and bank lending conditions. ECB Working paper series, 2465. European Central Bank.

Altavilla, C., Ellul, A., Pagano, M., Polo, A., & Vlassopoulos, T. (2021) Loan guarantees, bank lending and credit risk reallocation. CSEF Working Papers 629. Centre for Studies in Economics and Finance (CSEF), University of Naples, Italy, revised 30 Jul 2022.

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. Journal of Finance, 23(4), 589–609.

Banerjee, R., Cornelli, G., & Zakrajšek, E. (2020). The outlook for business bankruptcies. BIS Bulletin No. 30. Bank of International Settlements.

Bańkowska, K., Ferrando, A., & García, J. A. (2020). The COVID-19 pandemic and access to finance for small and medium-sized enterprises: Evidence from survey data. ECB Economic Bulletin, 4/2020. European Central Bank.

Bartik, A. W., Bertrand, M., Cullen, Z. B., Glaeser, E. L., Luca, M., & Stanton, C. T. (2020). How are small businesses adjusting to COVID-19? Early evidence from a survey. Working Paper 26989. National Bureau of Economic Research.

Campbell, J. Y., Hilscher, J., & Szilagyi, J. (2008). In search of distress risk. Journal of Finance, 63(6), 2899–2939.

Chetty, R., Friedman, J. N., Hendren, N., & Stepner, M., The Opportunity Insights Team. (2020). How did COVID-19 and stabilization policies affect spending and employment? A new real-time economic tracker based on private sector data. Working Paper 27431. NBER.

Courtney, T. B. (2016). The law of companies. Bloomsbury.

Cros, E., Epaulard, A., & Martin, P. (2021). Will Schumpeter catch COVID-19? Evidence from France. Working Papers hal-03215379, HAL.

Djankov, S., & Zhang, E. (2021). Bankruptcy restructurings can help more firms survive. In: Realtime Economic Issues Watch. Peterson Institute for International Economics.

ECB. (2021). Financial stability review. European Central Bank.

Federal Reserve. (2021). Financial stability report. Board of Governors of the Federal Reserve System.

Ferrando, A., & Ganoulis, I. (2020). Firms’ expectations on access to finance at the early stages of the Covid-19 pandemic. ECB Working Paper Series, 2446. European Central Bank.

Gourinchas, P-O., Kalemli-Özcan, S., Penciakova, V., & Sander N. (2020). Covid-19 and SME failures. FRB Atlanta Working Paper 2020-21. Federal Reserve Bank of Atlanta.

Gourinchas, P-O., Kalemli-Özcan, S., Penciakova, V., & Sander, N. (2021). Fiscal policy in the age of COVID: Does it “get in all the cracks”? NBER Working Paper No. 29293. National Bureau of Economic Research.

Honohan, P. (2010). Partial credit guarantees: Principles and practice. Journal of Financial Stability, 6(1), 1–9.

Kelly, J., McElligott, R., Parle, C., & Sherman, M. (2021). Credit conditions for Irish Households and SMEs. Economic Letters 5/EL/21. Central Bank of Ireland.

Kren, J., Lawless, M., McCann, F., McQuinn, J., & O’Toole, C. (2021). New survey evidence on COVID-19 and Irish SMEs: Measuring the impact and policy response. Research Technical Papers 3/RT/21. Central Bank of Ireland.

Laeven, L., Schepens, G., & Schnabel, I. (2020). Zombification in Europe in times of pandemic. Voxeu.

McCann, F., & Yao, F. (2021). Simulating business failures through the liquidity and solvency channels: A framework with applications to COVID-19. Research Technical Papers 2/RT/21. Central Bank of Ireland.

McGeever, N., Sarchi, C., & Woods, M. (2020). Irish company births and insolvent liquidations during the COVID-19 shock. Economic Letters 13/EL/20. Central Bank of Ireland.

Merton, R. C. (1974). On the pricing of corporate debt. Journal of Finance, 29(2), 449–470.

Moulton, W. N., Thomas, H., & Pruett, M. (1996). Business failure pathways: Environmental stress and organizational response. Journal of Management, 22(4), 571–595.

Peek, J., & Rosengren, E. S. (2020). Collateral damage: Effects of the Japanese bank crisis on real activity in the United States. American Economic Review, 90(1), 30–45.

Penrose, E. T. (2009). The theory of the growth of the firm. Oxford University Press.

Rangone, A. (1999). A resource-based approach to strategy analysis in small-medium sized enterprises. Small Business Economics, 12(3), 233–248.

Walsh, G. S., & Cunningham, J. A. (2016). Business failure and entrepreneurship: Emergence, evolution and future research. Foundations and Trends in Entrepreneurship, 12(3), 163–285.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

A 1 Depreciation

Table 5

A 2 Profit margins by firm characteristics.

Fig. 14

Shows that firms with high levels of leverage did not report unusually weak profitability. Those firms with the weakest levels of profitability generally had low to moderate levels of leverage. Leverage versus profit margins in 2019. We next consider the age profile of low profitability and low leverage firms. It may be that young start-ups are loss-making and reliant on financing from equity investors or related parties. In this way, heavy loss-making may be a natural part of establishing an enterprise rather than an overt sign of distress

Fig. 15

Fig. 16

A 3 Macroeconomic scenario.

Please see Table 6

A 4 Cost elasticities.

Table 7

A 5 State guarantee interest rate discount.

Fig. 17

A 6 Financial distress rate robustness checks.

Table 8

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

McCann, F., McGeever, N. & Yao, F. SME viability in the COVID-19 recovery. Small Bus Econ 61, 1053–1074 (2023). https://doi.org/10.1007/s11187-022-00723-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-022-00723-5