Abstract

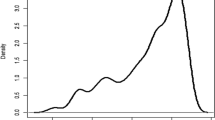

This study applies a stochastic frontier model to examine the relationship between firm size and efficiency using a novel approach. The first novelty is that this study examines large and small firms separately to allow for heterogeneity between firm group sizes in terms of measuring the size-efficiency relationship. The second is that we use a modified frontier model which explicitly includes a family firm variable when measuring firm efficiency. Empirical results reveal that firms are in fact heterogeneous, with small- and medium-sized enterprises (SMEs) exhibiting a U-shaped scale efficiency curve, while large enterprises (LE) exhibit an efficiency curve which is positive and linear. Robust results also confirm that family firms are relatively more efficient than non-family firms. In addition, while controlling for family firms does not appear to change the firm’s size-efficiency dynamics, failure to control for family firms leads to a bias in characterizing the nature of the firm’s production returns to scale.

Plain English Summary

This study reveals that with scale expansion, firm efficiency dynamics vary depending on firm size. Empirical results show that SMEs go through an initial stage of efficiency loss and then rebound, exhibiting a U-shaped efficiency curve, while for LEs, the effect is linear with a slightly positive slope as firm efficiency increases slowly and steadily. Findings suggest that there are implications for entrepreneurship policy, as the important role of family firms in increasing firm production efficiency is revealed. There are also important implications for small business research, as results show that failure to control for family effects in the efficiency model can cause misjudgement in characterizing production as increasing in returns to scale rather than decreasing returns to scale.

Similar content being viewed by others

Data Availability

The data for this study were accessed under license from the Directorate-General of Budget, Accounting, and Statistics (DGBAS) Executive Yuan of Taiwan. As such, restrictions may apply to the availability of these data and are not considered publicly available.

Notes

For a review of earlier efficiency studies see Yang & Chen, (2009). Due to the size of this literature, this review excludes studies using an alternative approach such as productive or profit efficiency (Arbelo et al., (2021a, 2021b), Cowling & Tanewski, (2019), Hasan et al., (2020), Bartoloni et al., (2021) and others).

In a related study, Miralles-Marcelo et al., (2014) found that for Portugal and Spain, family firms have a positive impact on accounting performance, especially for small-scale and long-established firms.

An excellent discussion on how to define family firms can be found in Chua et al., (1999).

References

Abbas, M., & Siddiqui, D. A. (2020). Profit efficiency and its determinants: A comparative analysis of energy and non-energy sectors of Pakistan using stochastic frontier approach. Available at SSRN 36813f24.

Aigner, D., Lovell, C. K., & Schmidt, P. (1977). Formulation and estimation of stochastic frontier production function models. Journal of Econometrics, 6(1), 21–37. https://doi.org/10.1016/0304-4076(77)90052-5

Alvarez, R., & Crespi, G. (2003). Determinants of technical efficiency in small firms. Small Business Economics, 20(3), 233–244. https://doi.org/10.1023/A:1022804419183

Anderson, R. C., & Reeb, D. M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. The Journal of Finance, 58(3), 1301–1328. https://doi.org/10.1111/1540-6261.00567

Arbelo, A., Arbelo-Pérez, M., & Pérez-Gómez, P. (2021). Are SMEs less efficient? A Bayesian approach to addressing heterogeneity across firms. Small Business Economics, 58, 1915–1929. https://doi.org/10.1007/s11187-021-00489-2

Arbelo, A., Arbelo-Pérez, M., & Pérez-Gómez, P. (2021). Profit efficiency as a measure of performance and frontier models: A resource-based view. BRQ Business Research Quarterly, 24(2), 143–159. https://doi.org/10.1177/2340944420924336

Assaf, A. G., Deery, M., & Jago, L. (2011). Evaluating the performance and scale characteristics of the Australian restaurant industry. Journal of Hospitality & Tourism Research, 35(4), 419–436. https://doi.org/10.1177/1096348010380598

Astrachan, J. H., Zahra, S. A., & Sharma, P. (2003). Family-sponsored ventures. Kansas, MO: Kauffman Foundation.

Bartoloni, E., Arrighetti, A., & Landini, F. (2021). Recession and firm survival: Is selection based on cleansing or skill accumulation? Small Business Economics, 57(4), 1893–1914. https://doi.org/10.1007/s11187-020-00378-0

Batra, G., & Tan, H. (2003). SME technical efficiency and its correlates: cross-national evidence and policy implications. World Bank Institute Working Paper, 9.

Bhandari, A. K., & Maiti, P. (2007). Efficiency of Indian manufacturing firms: Textile industry as a case study. International Journal of Business, 6(1), 71–88.

Biggs, T., Shah, M., & Srivastava, P. (1996). Technological capabilities and learning in African enterprises (Case studies series). Washington: Regional Program of Enterprise Development (RPEP), World Bank.

Bunch, D. S., & Smiley, R. (1992). Who deters entry? Evidence on the use of strategic entry deterrents. Review of Economics and Statistics, 74(3), 509–521. The MIT Press https://doi.org/10.2307/2109496

Burkart, M., Panunzi, F., & Shleifer, A. (2003). Family firms. The Journal of Finance, 58(5), 2167–2201. https://doi.org/10.1111/1540-6261.00601

Carney, M. (1998). A management capacity constraint? Obstacles to the development of the overseas Chinese family business. Asia Pacific Journal of Management, 15(2), 137–162. https://doi.org/10.1023/A:1015433429765

Chen, K.-H., & Ghosh, S. N. (2014). Threshold effects of technological regimes for the stochastic frontier model. The Journal of Developing Areas, 48(2), 223–253. https://doi.org/10.1353/jda.2014.0040

Chrisman, J. J., Chua, J. H., & Litz, R. A. (2004). Comparing the agency costs of family and non–family firms: Conceptual issues and exploratory evidence. Entrepreneurship Theory and Practice, 28(4), 335–354. https://doi.org/10.1111/j.1540-6520.2004.00049.x

Christensen, L. R., Jorgenson, D. W., & Lau, L. J. (1973). Transcendental logarithmic production frontiers. The Review of Economics and Statistics, 55(1), 28–45. https://doi.org/10.2307/1927992

Chu, W. (2009). The influence of family ownership on SME performance: Evidence from public firms in Taiwan. Small Business Economics, 33(3), 353–373. https://doi.org/10.1007/s11187-009-9178-6

Chu, W. (2011). Family ownership and firm performance: Influence of family management, family control, and firm size. Asia Pacific Journal of Management, 28(4), 833–851. https://doi.org/10.1007/s10490-009-9180-1

Chua, J. H., Chrisman, J. J., & Sharma, P. (1999). Defining the family business by behavior. Entrepreneurship Theory and Practice, 23(4), 19–39. https://doi.org/10.1177/104225879902300402

Chuang, H.H.-C., Oliva, R., & Heim, G. R. (2019). Examining the link between retailer inventory leanness and operational efficiency: Moderating roles of firm size and demand uncertainty. Production and Operations Management, 28(9), 2338–2364. https://doi.org/10.1111/poms.13055

Coto-Millán, P., Casares-Hontañón, P., Inglada, V., Agüeros, M., Pesquera, M. Á., & Badiola, A. (2014). Small is beautiful? The impact of economic crisis, low cost carriers, and size on efficiency in Spanish airports (2009–2011). Journal of Air Transport Management, 40, 34–41. https://doi.org/10.1016/j.jairtraman.2014.05.006

Cowling, M., & Tanewski, G. (2019). On the productive efficiency of Australian businesses: Firm size and age class effects. Small Business Economics, 53, 739–752. https://doi.org/10.1007/s11187-018-0070-0

Daily, C. M., & Dollinger, M. J. (1992). An empirical examination of ownership structure in family and professionally managed firms. Family Business Review, 5(2), 117–136. https://doi.org/10.1111/j.1741-6248.1992.00117.x

DeAngelo, H., & DeAngelo, L. (2000). Controlling stockholders and the disciplinary role of corporate payout policy: A study of the Times Mirror Company. Journal of Financial Economics, 56(2), 153–207. https://doi.org/10.1016/S0304-405X(00)00039-8

Demsetz, H. (1983). The structure of ownership and the theory of the firm. The Journal of Law and Economics, 26(2), 375–390. https://doi.org/10.1086/467041

Demsetz, H., & Lehn, K. (1985). The structure of corporate ownership: Causes and consequences. Journal of Political Economy, 93(6), 1155–1177. https://doi.org/10.1086/261354

Díaz, M., & Sánchez, R. (2008). Firm size and productivity in Spain: A stochastic frontier analysis. Small Business Economics, 30(3), 315–323. https://doi.org/10.1007/s11187-007-9058-x

Eisenhardt, K. M. (1989). Agency theory: An assessment and review. Academy of Management Review, 14(1), 57–74. https://doi.org/10.5465/amr.1989.4279003

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301–325. https://doi.org/10.1086/467037

Fang, H., Chrisman, J. J., Daspit, J. J., & Madison, K. (2022). Do nonfamily managers enhance family firm performance? Small Business Economics, 58(3), 1459–1474. https://doi.org/10.1007/s11187-021-00469-6

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society: Series A (general), 120(3), 253–281. https://doi.org/10.2307/2343100

Ferreira, M. D. P., & Féres, J. G. (2020). Farm size and land use efficiency in the Brazilian Amazon. Land Use Policy, 99, 104901. https://doi.org/10.1016/j.landusepol.2020.104901

Giancotti, M., Guglielmo, A., & Mauro, M. (2017). Efficiency and optimal size of hospitals: Results of a systematic search. PLoS One, 12(3), e0174533. https://doi.org/10.1371/journal.pone.0174533

Gomez-Mejia, L. R., Nuñez-Nickel, M., & Gutierrez, I. (2001). The role of family ties in agency contracts. Academy of Management Journal, 44(1), 81–95. https://doi.org/10.5465/3069338

Hamelin, A. (2013). Influence of family ownership on small business growth. Evidence from French SMEs. Small Business Economics, 41(3), 563–579. https://doi.org/10.1007/s11187-012-9452-x

Hansen, J. A. (1992). Innovation, firm size, and firm age. Small Business Economics, 4(1), 37–44. https://doi.org/10.1007/BF00402214

Hart, P. E., & Oulton, N. (1996). Job creation and variations in corporate growth (No. 95). National Institute of Economic and Social Research.

Hasan, S., Klaiber, H. A., & Sheldon, I. (2020). The impact of science parks on small-and medium-sized enterprises’ productivity distributions: The case of Taiwan and South Korea. Small Business Economics, 54(1), 135–153.

Hill, H., & Kalirajan, K. P. (1993). Small enterprise and firm-level technical efficiency in the Indonesian garment industry. Applied Economics, 25(9), 1137–1144. https://doi.org/10.1080/00036849300000174

Human, S. E., & Provan, K. G. (1997). An emergent theory of structure and outcomes in small-firm strategic manufacturing networks. Academy of Management Journal, 40(2), 368–403. https://doi.org/10.5465/256887

James, H. S. (1999). Owner as manager, extended horizons and the family firm. International Journal of the Economics of Business, 6(1), 41–55. https://doi.org/10.1080/13571519984304

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Jovanovic, B. (1982). Selection and the evolution of industries. Econometrica, 50(3), 649–670. https://doi.org/10.2307/1912606

Kagin, J., Taylor, J. E., & Yúnez-Naude, A. (2016). Inverse productivity or inverse efficiency? Evidence from Mexico. The Journal of Development Studies, 52(3), 396–411. https://doi.org/10.1080/00220388.2015.1041515

Kepner, E. (1983). The family and the firm: A coevolutionary perspective. Organizational Dynamics, 12(1), 57–70. https://doi.org/10.1016/0090-2616(83)90027-X

Kets de Vries, M. F. R. (1993). The dynamics of family controlled firms: The good and the bad news. Organizational Dynamics, 21(3), 59–71. https://doi.org/10.1016/0090-2616(93)90071-8

Kimberly, J. R. (1976). Organizational size and the structuralist perspective: A review, critique, and proposal. Administrative science quarterly, 12(4), 571–597. https://doi.org/10.2307/2391717

Kumbhakar, S. C., Ghosh, S., & McGuckin, J. T. (1991). A generalized production frontier approach for estimating determinants of inefficiency in US dairy farms. Journal of Business & Economic Statistics, 9(3), 279–286. https://doi.org/10.1080/07350015.1991.10509853

Lam, H. K., Yeung, A. C., & Cheng, T. E. (2016). The impact of firms’ social media initiatives on operational efficiency and innovativeness. Journal of Operations Management, 47, 28–43. https://doi.org/10.1016/j.jom.2016.06.001

Lansberg, I. S. (1983). Managing human resources in family firms: The problem of institutional overlap. Organizational Dynamics, 12(1), 39–46. https://doi.org/10.1016/0090-2616(83)90025-6

Lauterbach, B., & Vaninsky, A. (1999). Ownership structure and firm performance: Evidence from Israel. Journal of Management and Governance, 3(2), 189–201. https://doi.org/10.1023/A:1009990008724

Laverty, K. J. (2004). Managerial myopia or systemic short-termism? The importance of managerial systems in valuing the long term. Management Decision. https://doi.org/10.1108/00251740410555443

Le, V., & Harvie, C. (2010). Firm Performance in Vietnam: Evidence from Manufacturing Small and Medium Enterprises (No. wp10-04).

Liaquat, H., Irfan, A., & Sami, A. (2017). Technical efficiency and its determinants: A case study of Faisalabad textile industry (pp. 183–194). City University Research Journal.

Lundvall, K., & Battese, G. E. (2000). Firm size, age and efficiency: Evidence from Kenyan manufacturing firms. The Journal of Development Studies, 36(3), 146–163. https://doi.org/10.1080/00220380008422632

Mansfield, E. (1962). Entry, Gibrat's law, innovation, and the growth of firms. The American Economic Review, 52(5), 1023–1051. http://www.jstor.org/stable/1812180

Marsili, O. (2002). Technological regimes and sources of entrepreneurship. Small Business Economics, 19(3), 217–231. https://doi.org/10.1023/A:1019670009693

Martínez, J. I., Stöhr, B. S., & Quiroga, B. F. (2007). Family ownership and firm performance: Evidence from public companies in Chile. Family Business Review, 20(2), 83–94. https://doi.org/10.1111/j.1741-6248.2007.00087.x

McConnell, J. J., & Servaes, H. (1990). Additional evidence on equity ownership and corporate value. Journal of Financial Economics, 27(2), 595–612. https://doi.org/10.1016/0304-405X(90)90069-C

Meeusen, W., & van Den Broeck, J. (1977). Efficiency estimation from Cobb-Douglas production functions with composed error. International Economic Review, 18(2), 435–444. https://doi.org/10.2307/2525757

Ministry of Economic Affairs (2022). White paper: Small and medium enterprises in Taiwan, 2022. https://book.moeasmea.gov.tw/book/doc_detail.jsp?pub_SerialNo=2020 (in Chinese).

Miralles-Marcelo, J. L., del Mar Miralles-Quirós, M., & Lisboa, I. (2014). The impact of family control on firm performance: Evidence from Portugal and Spain. Journal of Family Business Strategy, 5(2), 156–168. https://doi.org/10.1016/j.jfbs.2014.03.002

Morck, R., Shleifer, A., & Vishny, R. W. (1988). Management ownership and market valuation: An empirical analysis. Journal of Financial Economics, 20, 293–315. https://doi.org/10.1016/0304-405X(88)90048-7

Owalla, B., Gherhes, C., Vorley, T., & Brooks, C. (2022). Mapping SME productivity research: A systematic review of empirical evidence and future research agenda. Small Business Economics, 58(3), 1285–1307.

Pieper, T. M., Klein, S. B., & Jaskiewicz, P. (2008). The impact of goal alignment on board existence and top management team composition: Evidence from family-influenced businesses. Journal of Small Business Management, 46(3), 372–394. https://doi.org/10.1111/j.1540-627X.2008.00249.x

Poza, E. J. (2013). Family business. Cengage Learning.

PricewaterhouseCoopers Business Consulting Services Taiwan Ltd., (2018). 2018 Global and Taiwanese family firms survey report, date of availability: 16 Oct, 2022; website: https://www.pwc.tw/zh/publications/topic-family-business/ assets/pwctw-family-business-survey-2018.pdf. (in Chinese)

Sathe, V. (2007). Corporate entrepreneurship: Top managers and new business creation. Cambridge University Press.

Schiersch, A. (2013). Firm size and efficiency in the German mechanical engineering industry. Small Business Economics, 40(2), 335–350. https://doi.org/10.1007/s11187-012-9438-8

Schulze, W. S., Lubatkin, M. H., & Dino, R. N. (2003). Toward a theory of agency and altruism in family firms. Journal of Business Venturing, 18(4), 473–490. https://doi.org/10.1016/S0883-9026(03)00054-5

Serrasqueiro, Z. S., & Maçãs Nunes, P. (2008). Performance and size: Empirical evidence from Portuguese SMEs. Small Business Economics, 31(2), 195–217. https://doi.org/10.1007/s11187-007-9092-8

Shleifer, A., & Vishny, R. W. (1986). Large shareholders and corporate control. Journal of Political Economy, 94(3 Part 1), 461–488.

Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. The Journal of Finance, 52(2), 737–783. https://doi.org/10.1111/j.1540-6261.1997.tb04820.x

Silva, F., Majluf, N., & Paredes, R. D. (2006). Family ties, interlocking directors and performance of business groups in emerging countries: The case of Chile. Journal of Business Research, 59(3), 315–321. https://doi.org/10.1016/j.jbusres.2005.09.004

Singh, A., & Whittington, G. (1975). The size and growth of firms. The Review of Economic Studies, 42(1), 15–26. https://doi.org/10.2307/2296816

Smith, B. F., & Amoako-Adu, B. (1999). Management succession and financial performance of family controlled firms. Journal of Corporate Finance, 5(4), 341–368. https://doi.org/10.1016/S0929-1199(99)00010-3

Stein, J. C. (1989). Efficient capital markets, inefficient firms: A model of myopic corporate behavior*. The Quarterly Journal of Economics, 104(4), 655–669. https://doi.org/10.2307/2937861

Tanewski G.A., Prajogo D., & Sohal A. (2003). Strategic orientation and innovation performance between family and non–family firms. World Conference of the International Council of Small Business, Monash University, Caulfield East, Australia.

Taymaz, E. (2005). Are small firms really less productive? Small Business Economics, 25(5), 429–445. https://doi.org/10.1007/s11187-004-6492-x

Taymaz, E., & Saatci, G. (1997). Technical change and efficiency in Turkish manufacturing industries. Journal of Productivity Analysis, 8(4), 461–475.

Thomsen, S., & Pedersen, T. (2000). Ownership structure and economic performance in the largest European companies. Strategic Management Journal, 21(6), 689–705. https://doi.org/10.1002/(SICI)1097-0266(200006)21:63.0.CO;2-Y

Toma, P. (2020). Size and productivity: A conditional approach for Italian pharmaceutical sector. Journal of Productivity Analysis, 54(1), 1–12. https://doi.org/10.1007/s11123-020-00580-y

Villalonga, B., & Amit, R. (2006). How do family ownership, control and management affect firm value? Journal of Financial Economics, 80(2), 385–417. https://doi.org/10.1016/j.jfineco.2004.12.005

Westhead, P., Cowling, M., & Howorth, C. (2001). The development of family companies: Management and ownership imperatives. Family Business Review, 14(4), 369–385. https://doi.org/10.1111/j.1741-6248.2001.00369.x

Xu, X., & Chi, C. G. (2017). Examining operating efficiency of US hotels: A window data envelopment analysis approach. Journal of Hospitality Marketing & Management, 26(7), 770–784. https://doi.org/10.1080/19368623.2017.1314205

Yang, C.-H., & Chen, K.-H. (2009). Are small firms less efficient? Small Business Economics, 32(4), 375–395. https://doi.org/10.1007/s11187-007-9082-x

Zahra, S. A. (2005). Entrepreneurial risk taking in family firms. Family Business Review, 18(1), 23–40. https://doi.org/10.1111/j.1741-6248.2005.00028.x

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interest

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1

Appendix 1

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Chen, KH., Chen, PH., Elston, J.A. et al. Are family firms more efficient? Revisiting the U-shaped curve of scale and efficiency. Small Bus Econ 61, 983–1008 (2023). https://doi.org/10.1007/s11187-022-00720-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-022-00720-8