Abstract

We investigate the role of community-level social capital in individuals’ investment decisions in equity crowdfunding. We exploit a hand-collected dataset of individual investments pledged to successful campaigns in Italy between 2014 and 2018. Individuals born in provinces with high social capital invest more substantially in riskier campaigns. Contrary to inborn social capital, social capital in the province where investors live has no impact. This evidence survives several robustness checks and highlights the crucial role of an individual's cultural traits in fostering investment in equity crowdfunding.

Plain English Summary

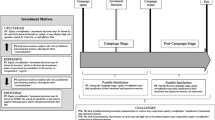

Do characteristics of investors’ birthplace shape behavior? We study community-level social capital and investments in equity crowdfunding and show that cultural factors, rather than the environment, are correlated with investment choices. People born or living in high social capital areas are more likely to trust others, either because of higher cooperative values and beliefs stowed in their cultural makeup, or because of the influence of the surrounding environment. We find that higher inborn social capital of investors results in higher amounts pledged to riskier campaigns, while conditions in their living place have no impact. By unveiling such relationship, we find interesting implications for entrepreneurs and managers of crowdfunding platforms. Founders of risky ventures should target pledgers born in districts where local social capital is more prominent. Platforms’ managers should support entrepreneurs in following this strategy and consider existing clients' place of birth in marketing efforts to maximize the probability of success.

Similar content being viewed by others

Data Availability

Raw data were collected on platforms' web sites, from Registro delle Imprese and Aida-Bvd. Derived data supporting the findings of this study are available from the corresponding author on request.

Notes

Unsuccessful campaigns attract a significantly smaller number of investors. There were 92 unsuccessful equity crowdfunding campaigns in Italy initiated between 2014 and 2018. We do not know who the pledgers were (or whether they were individual investors or firms), but these campaigns were supported by 11 pledges, on average, against 65 (= 12,161/188) for successful campaigns. Moreover, pledges to unsuccessful campaigns can be placed only to attract other investors and might be withdrawn strategically before the end of the campaign (Meoli and Vismara, 2021). Therefore, using pledges to unsuccessful campaigns leads to the risk of considering pledges that would never become real.

Table 14 in the appendix provides a detailed description of the proxies and how they are constructed, along with the data source.

We weight 2003 waste recycling by the share of the population in each province that was actually covered by sorted waste collection services, as in Galardo et al. (2019).

In the robustness section later in the paper, we also use each of these five variables in isolation. In spite of an expected lower statistical significance, this exercise shows that the main results of the paper continue to hold.

Figure 2 in the Appendix shows the provincial distribution for each of the five proxies.

We recognize that for some firms (e.g., newly established ventures), information on profitability might not be accessible when the campaign is launched. We discuss this matter later in the paper, and we check the robustness of our results to a more restrictive definition of Unprofitable.

The number of observations is not exactly the same in each of the two subsamples, as CSC is defined at the provincial level, and all investments made by investors born in the same province share the same level of CSC.

All results hold unchanged excluding follow-on campaigns.

We repeat our regressions in the subsample of first pledgers. All results continue to hold.

In untabulated results, we repeat the analysis in Table 7 only for a subsample of 2246 investments made by movers. The results continue to hold and are available upon request.

References

Aggarwal, R., Faccio, M., Guedhami, O., & Kwok, C. C. Y. (2016). Culture and finance: An introduction. Journal of Corporate Finance, 41, 466–474. https://doi.org/10.1016/j.jcorpfin.2016.09.011

Ahlers, G. K. C., Cumming, D., Günther, C., & Schweizer, D. (2015). Signaling in equity crowdfunding. Entrepreneurship Theory and Practice, 39(4), 955–980. https://doi.org/10.1111/etap.12157

Blaseg, D., Cumming, D., & Koetter, M. (2021). Equity crowdfunding: High-quality or low-quality entrepreneurs? Entrepreneurship: Theory and Practice, 45(3), 505–530. https://doi.org/10.1177/1042258719899427

Block, J. H., Colombo, M. G., Cumming, D. J., & Vismara, S. (2018). New players in entrepreneurial finance and why they are there. Small Business Economics, 50, 239–250. https://doi.org/10.1007/s11187-016-9826-6

Block, J. H., Groh, A., Hornuf, L., Vanacker, T., & Vismara, S. (2021). The entrepreneurial finance markets of the future: A comparison of crowdfunding and initial coin offerings. Small Business Economics, 57, 865–882. https://doi.org/10.1007/s11187-020-00330-2

Bottazzi, L., Da Rin, M., & Hellmann, T. (2016). The importance of trust for investment: Evidence from venture capital. Review of Financial Studies, 29(9), 2283–2318. https://doi.org/10.1093/rfs/hhw023

Butticè, V., Di Pietro, F., & Tenca, F. (2020). Is equity crowdfunding always good? Deal structure and the attraction of venture capital investors. Journal of Corporate Finance, 65, 1–15. https://doi.org/10.1016/j.jcorpfin.2020.101773

Butticè, V., & Vismara, S. (2022). Inclusive digital finance: The industry of equity crowdfunding. Journal of Technology Transfer, 47, 1224–1241. https://doi.org/10.1007/s10961-021-09875-0

Cai, W., Polzin, F., & Stam, E. (2021). Crowdfunding and social capital: A systematic review using a dynamic perspective. Technological Forecasting and Social Change, 162(2021), 1–22. https://doi.org/10.1016/j.techfore.2020.120412

Cholakova, M., & Clarysse, B. (2015). Does the possibility to make equity investments in crowdfunding projects crowd out reward-based investments? Entrepreneurship Theory and Practice, 39(1), 145–172. https://doi.org/10.1111/etap.12139

Colombo, M.G., Fisch, C., Momtaz, P.P., and Vismara, S. (2022). The CEO beauty premium: Founder CEO attractiveness and firm valuation in initial coin offerings, Strategic Entrepreneurship Journal. https://doi.org/10.1002/sej.1417

Colquitt, J. A., Scott, B. A., & LePine, J. A. (2007). Trust, trustworthiness, and trust propensity: a meta-analytic test of their unique relationships with risk taking and job performance. Journal of Applied Psychology, 92(4), 909. https://doi.org/10.1037/0021-9010.92.4.909

Cumming, D., Hervé, F., Manthé, E., and Schwienbacher, A. (2020). Testing-the-waters policy with hypothetical investment: Evidence from equity crowdfunding, Entrepreneurship Theory and Practice, 1-26. https://doi.org/10.1177/1042258720932522

Cumming, D., Johan, S., & Zhang, Y. (2019a). The role of due diligence in crowdfunding platforms. Journal of Banking & Finance, 108, 105661. https://doi.org/10.1016/j.jbankfin.2019.105661

Cumming, D., Meoli, M., & Vismara, S. (2019b). Investors’ choices between cash and voting rights: Evidence from dual-class equity crowdfunding. Research Policy, 48(8), 1–19. https://doi.org/10.1016/j.respol.2019.01.014

Cumming, D., Meoli, M., & Vismara, S. (2021). Does equity crowdfunding democratize entrepreneurial finance? Small Business Economics, 56(2), 533–552. https://doi.org/10.1007/s11187-019-00188-z

Degeorge, F., Patel, J., & Zeckhauser, R. (1999). Earnings management to exceed thresholds. Journal of Business, 72(1), 1–33. https://doi.org/10.1086/209601

El-Attar, M., & Poschke, M. (2011). Trust and the choice between housing and financial assets: Evidence from Spanish households. Review of Finance, 15(4), 727–756. https://doi.org/10.1093/rof/rfq030

Fernández, R. (2011). Does culture matter? In Handbook of Social Economics (Vol. 1, pp. 481–510). Elsevier. https://doi.org/10.1016/B978-0-444-53187-2.00011-5

Fernández, R., & Fogli, A. (2009). Culture: An Empirical Investigation of Beliefs Work, and Fertility. American Economic Journal: Macroeconomics, 1(1), 146–177. https://doi.org/10.1257/mac.1.1.146

Galardo, M., Lozzi, M., and Mistrulli, P.E. (2019). Credit supply, uncertainty and trust: The role of social capital, Working Paper. https://doi.org/10.32057/0.TD.2019.1245

Giraudo, E., Giudici, G., & Grilli, L. (2019). Entrepreneurship policy and the financing of young innovative companies: Evidence from the Italian Startup Act. Research Policy, 48(9), 1–18. https://doi.org/10.1016/j.respol.2019.05.010

Giudici, G. (2015). Equity crowdfunding of an entreprenurial activity, in University Evolution, Entrepreneurial Activity and Regional Competitiveness, Springer. https://doi.org/10.1007/978-3-319-17713-7_20

Giudici, G., Guerini, M., & Rossi-Lamastra, C. (2013). Crowdfunding in Italy: State of the art and future prospects. Economia e Politica Industriale, 40(4), 173–188. https://doi.org/10.3280/POLI2013-004008

Giudici, G., Guerini, M., & Rossi-Lamastra, C. (2018). Reward-based crowdfunding of entrepreneurial projects: The effect of local altruism and localized social capital on proponents’ success. Small Business Economics, 50(2), 307–324. https://doi.org/10.1007/s11187-016-9830-x

Giudici, G., Guerini, M., & Rossi-Lamastra, C. (2020). Elective affinities: Exploring the matching between entrepreneurs and investors in equity crowdfunding. Baltic Journal of Management, 15(2), 183–198. https://doi.org/10.1108/BJM-08-2019-0287

Guiso, L., Sapienza, P., & Zingales, L. (2004). The role of social capital in financial development. American Economic Review, 94(3), 526–556. https://doi.org/10.1257/0002828041464498

Guiso, L., Sapienza, P., & Zingales, L. (2006). Does culture affect economic outcomes? Journal of Economic Perspectives, 20(2), 23–48. https://doi.org/10.1257/jep.20.2.23

Guiso, L., Sapienza, P., & Zingales, L. (2008a). Trusting the stock market. Journal of Finance, 63(6), 2557–2600. https://doi.org/10.1111/j.1540-6261.2008.01408.x

Guiso, L., Sapienza, P., & Zingales, L. (2008b). Social capital as good culture. Journal of the European Economic Association, 6(2–3), 295–320. https://doi.org/10.1162/JEEA.2008.6.2-3.295

Guiso, L., Sapienza, P., and Zingales, L. (2012). Civic capital as the missing link, in Handbook of Social Economics, Elsevier. https://doi.org/10.1016/B978-0-444-53187-2.00010-3

Guiso, L., Sapienza, P., & Zingales, L. (2015). Corporate culture, societal culture, and institutions. American Economic Review, 105(5), 336–339. https://doi.org/10.1257/aer.p20151074

Gupta, A., Raman, K., & Shang, C. (2018). Social capital and the cost of equity. Journal of Banking and Finance, 87, 102–117. https://doi.org/10.1016/j.jbankfin.2017.10.002

Hasan, I., He, Q., & Lu, H. (2020). The impact of social capital on economic attitudes and outcomes. Journal of International Money and Finance, 108, 102162. https://doi.org/10.1016/j.jimonfin.2020.102162

Hasan, I., He, Q. and Lu, H. (2021). Social capital, trusting, and trustworthiness: Evidence from peer-to-peer lending, Journal of Financial and Quantitative Analysis, 1-67. https://doi.org/10.1017/S0022109021000259

Hervé, F., Manthé, E., Sannajust, A., & Schwienbacher, A. (2019). Determinants of individual investment decisions in investment-based crowdfunding. Journal of Business Finance and Accounting, 46(5–6), 762–783. https://doi.org/10.1111/jbfa.12372

Hervé, F., & Schwienbacher, A. (2018). Round-number bias in investment: Evidence from equity crowdfunding. Finance, 39(1), 71–105. https://doi.org/10.3917/fina.391.0071

Hoi, C. K., Wu, Q., & Zhang, H. (2019). Does social capital mitigate agency problems? Evidence from Chief Executive Officer (CEO) compensation. Journal of Financial Economics, 133(2), 498–519. https://doi.org/10.1016/j.jfineco.2019.02.009

Hong, H., Kubik, J. D., & Stein, J. C. (2004). Social interaction and stock-market participation. Journal of Finance, 59(1), 137–163. https://doi.org/10.1111/j.1540-6261.2004.00629.x

Hornuf, L., & Schwienbacher, A. (2017). Should securities regulation promote equity crowdfunding? Small Business Economics, 49(3), 579–593. https://doi.org/10.1007/s11187-017-9839-9

Ichino, A., & Maggi, G. (2000). Work environment and individual background: Explaining regional shirking differentials in a large Italian firm. Quarterly Journal of Economics, 115(3), 1057–1090. https://doi.org/10.1162/003355300554890

Johan, S., & Zhang, Y. (2020). Quality revealing versus overstating in equity crowdfunding. Journal of Corporate Finance, 65(2020), 1–16. https://doi.org/10.1016/j.jcorpfin.2020.101741

Javakhadze, D., Ferris, S. P., & French, D. W. (2016). Managerial social capital and financial development: A cross-country analysis. Financial Review, 51(1), 37–68. https://doi.org/10.1111/fire.12097

Jha, A. (2019). Financial reports and social capital. Journal of Business Ethics, 155(2), 567–596. https://doi.org/10.1007/s10551-017-3495-5

Laursen, K., Masciarelli, F., & Prencipe, A. (2012a). Regions matter: How localized social capital affects innovation and external knowledge acquisition. Organization Science, 23(1), 177–193. https://doi.org/10.1287/orsc.1110.0650

Laursen, K., Masciarelli, F., & Prencipe, A. (2012). Trapped or spurred by the home region? The effects of potential social capital on involvement in foreign markets for goods and technology. Journal of International Business Studies, 43(9), 783–807. https://doi.org/10.1057/jibs.2012.27

Lin, T. C. and Pursiainen, V. (2022). Regional Social Capital and Moral Hazard in Crowdfunding, SSRN Working paper. https://ssrn.com/abstract=3088905. Accessed 8 Dec 2022

Lins, K. V., Servaes, H., & Tamayo, A. (2017). Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. Journal of Finance, 72(4), 1785–1824. https://doi.org/10.1111/jofi.12505

Lukkarinen, A., Teich, J. E., Wallenius, H., & Wallenius, J. (2016). Success drivers of online equity crowdfunding campaigns. Decision Support Systems, 8, 26–38. https://doi.org/10.1016/j.dss.2016.04.006

Meoli, M., & Vismara, S. (2021). Information manipulation in equity crowdfunding markets. Journal of Corporate Finance, 67(1), 101866. https://doi.org/10.1016/j.jcorpfin.2020.101866

Mistrulli, P.E. and Vacca V. (2015). Social capital and the cost of credit: Evidence from a crisis, SSRN Working Paper. https://doi.org/10.2139/ssrn.2600887

Mochkabadi, K. and Volkmann, C.K. (2020). Equity crowdfunding: A systematic review of the literature, Small Business Economics, 75-118. https://doi.org/10.1007/s11187-018-0081-x

Mohammadi, A., & Shafi, K. (2018). Gender differences in the contribution patterns of equity-crowdfunding investors. Small Business Economics, 50(2), 275–287. https://doi.org/10.1007/s11187-016-9825-7

Polzin, F., Toxopeus, H., & E., Stam,. (2018). The wisdom of the crowd in funding: Information heterogeneity and social networks of crowdfunders. Small Business Economics, 50(2), 251–273. https://doi.org/10.1007/s11187-016-9829-3

Putnam, R. D. (1993). Making democracy work: Civic traditions in modern Italy. Princeton University Press.

Rau, P.R. (2020). Law, trust, and the development of crowdfunding, SSRN Working Paper. https://ssrn.com/abstract=2989056. Accessed 8 Dec 2022

Rupasingha, A., Goetz, S. J., & Freshwater, D. (2006). The production of social capital in US counties. Journal of Socio-Economics, 35(1), 83–101. https://doi.org/10.1016/j.socec.2005.11.001

Scrivens, K. and Smith C. (2013). Four interpretations of social capital: An agenda for measurement, OECD Statistics Working Paper. https://doi.org/10.1787/5jzbcx010wmt-en

Servaes, H., & Tamayo, A. (2017). The role of social capital in corporations: A review. Oxford Review of Economic Policy, 33(2), 201–220. https://doi.org/10.1093/oxrep/grx026

Shafi, K., & Mohammadi, A. (2020). Too gloomy to invest: Weather-induced mood and crowdfunding. Journal of Corporate Finance, 65, 1–20. https://doi.org/10.1016/j.jcorpfin.2020.101761

Signori, A., & Vismara, S. (2018). Does success bring success? The Post-Offering Lives of Equity-Crowdfunded Firms. Journal of Corporate Finance, 50, 575–591. https://doi.org/10.1016/j.jcorpfin.2017.10.018

Tabellini, G. (2008). The scope of cooperation: Values and incentives. Quarterly Journal of Economics, 123(3), 905–950. https://doi.org/10.1162/qjec.2008.123.3.905

Uslaner, E. M. (2008). Where you stand depends upon where your grandparents sat: The inheritability of generalized trust. Public Opinion Quarterly, 72(4), 725–740. https://doi.org/10.1093/poq/nfn058

Vismara, S. (2016). Equity retention and social network theory in equity crowdfunding. Small Business Economics, 46(4), 579–590. https://doi.org/10.1007/s11187-016-9710-4

Vismara, S. (2018). Information cascades among investors in equity crowdfunding. Entrepreneurship: Theory and Practice, 42(3), 467–497. https://doi.org/10.1111/etap.12261

Vismara, S. (2022). Expanding corporate finance perspectives to equity crowdfunding. Journal of Technology Transfer, 47, 1629–1639. https://doi.org/10.1007/s10961-021-09903-z

Wilson, K.E. and Testoni M. (2014). Improving the role of equity crowdfunding in Europe's capital markets, SSRN Working Paper. https://ssrn.com/abstract=2502280. Accessed 8 Dec 2022

Ziegler, T., Shneor, R., Wenzlaff, K., Odorovic, A., Johanson, D., Hao, R., and Ryll L. (2019). Shifting paradigms. The 4th European alternative finance benchmarking report. Cambridge. https://doi.org/10.2139/ssrn.3772260

Acknowledgements

We would like to thank the Editor (Silvio Vismara) and two anonymous reviewers for their constructive comments, which greatly improved the paper. We also thank Emanuele Bajo, Mascia Bedendo, Marco Bigelli, Sabri Boubaker, Vincenzo Butticè, Douglas Cumming, Riccardo Fini, Ivo Jansen, Louis Murray, Raghavendra Rau, Sandro Sandri, the participants at the 2021 EFMA conference in Leeds, 2021 FEBS conference in Lille, 2021 IAFDS Doctoral Symposium, and 2022 research seminar at IAE Lyon School of Management for their insightful comments and suggestions. We also thank Matteo De Piccoli and Stefano Frenati for their excellent research assistance. All remaining errors or omissions are our responsibility. The Department of Management at the University of Bologna contributed to funding this research project ("MIUR Progetto Dipartimenti di Eccellenza").

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1. Community-level social capital (CSC) proxies and index

Appendix 1. Community-level social capital (CSC) proxies and index

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Barbi, M., Febo, V. & Giudici, G. Community-level social capital and investment decisions in equity crowdfunding. Small Bus Econ 61, 1075–1110 (2023). https://doi.org/10.1007/s11187-022-00724-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-022-00724-4