Abstract

The drivers of the valuations of entrepreneurial ventures are an important issue in entrepreneurial finance, but related research is fragmented. The theoretical perspectives and the drivers highlighted by previous studies differ based on the financial milestones during a venture’s lifecycle in which the valuation is performed (e.g., venture capital investments, initial public offerings, acquisitions). The introduction of new digital financing channels (e.g., crowdfunding, initial coin offerings) that allow retail investors to directly invest in entrepreneurial ventures challenge our understanding of the drivers of valuation. This change has also increased the diversity in the sequence of financial milestones that ventures go through, with important implications for valuation. We conduct a systematic literature review and develop a map highlighting how and why the drivers of venture valuations and their underlying theoretical lenses vary across the different milestones that ventures go through. The map allows us to outline new promising avenues for future research.

Plain English Summary

In this paper, we conduct a systematic literature review on entrepreneurial ventures’ valuation drivers and their underlying theoretical lenses, highlighting how and why they vary along firms’ life cycle. The valuation of entrepreneurial ventures is a challenging task for practitioners and a relevant issue that attracts the attention of scholars in entrepreneurship, finance, management, and economics. The literature on the topic is highly fragmented. Indeed, the context in which venture valuations are observed (e.g., in private deals or public offerings) differs across different financial milestones. The introduction of new digital financing channels (e.g., crowdfunding, initial coin offerings) and the increased diversity in the sequence of financial milestones that ventures go through further challenge our understanding of valuation drivers. This study is primarily aimed at scholars, offering them a map to create order in what we know about the drivers of entrepreneurial venture valuations and indicating promising avenues for future research.

Similar content being viewed by others

1 Introduction

The factors that determine the valuation of entrepreneurial ventures are a relevant issue that increasingly attracts the attention of scholars in entrepreneurship, finance, management, and economics. In principle, the resource-based view (e.g., Barney, 1991) postulates that ventures that possess a larger set of unique resources are more valuable. However, scholars agree that the often large information asymmetries between venture insiders and external investors generate a lemon premium (Akerlof, 1970). Entrepreneurial ventures often have limited track records, their assets are predominantly intangible, and their operations are surrounded by high uncertainty. Moreover, insiders are often reluctant to divulge proprietary information on their firms’ operations to third parties because of the risk of knowledge misappropriation (Alvarez & Barney, 2001). Thus, factors that alleviate this information asymmetry by signaling venture quality (Spence, 1973) increase venture valuation. For example, scholars found that entrepreneurial teams’ skills and competencies, developed through their education and work experiences, and venture affiliation with prestigious third parties (e.g., reputable underwriters or prestigious universities), led to higher valuations of initial public offerings (IPOs) (e.g., Bruton et al., 2009; Cohen & Dean, 2005; Colombo et al., 2019; Lee et al., 2011; Sanders & Boivie, 2004).

However, our understanding of the drivers of venture valuation is limited.Footnote 1 First, venture valuation is observed at different financial milestones over a venture’s life cycle, from seed stage financing events to exits through IPOs or acquisitions. Most previous studies focused on venture capital (VC) rounds and IPOs and the valuation of acquisitions or business angel financing events received less attention. In addition, scholars considering different financial milestones adopted different theoretical lenses, sometimes based on different behavioral assumptions relating to the transacting parties, and emphasized different drivers of valuation. The extent of information asymmetries between insiders and external investors, the factors that allegedly reduce these information asymmetries, and more generally, the context in which venture valuations are observed (e.g., in private deals or public offerings) differ across different financial milestones. Accordingly, the drivers of venture valuations and the underlying theoretical mechanisms, explaining their effects, differ.

Second, the recent digitalization of financial markets and the rise of alternative digital financial channels such as equity crowdfunding and initial coin offerings (ICOs) further challenged our limited understanding of the drivers of the valuation of entrepreneurial ventures. While equity financing was traditionally provided to entrepreneurial ventures by sophisticated professional investors such as business angels and VCs, the development of these alternative channels makes it possible for retail (i.e., small, non-professional) investors to directly invest in entrepreneurial ventures (Block et al., 2020; Kher et al., 2021). The “crowd” of retail investors typically lacks both the expertise and the incentives to perform the in-depth due diligence required for valuing ventures (Block et al., 2018). Scholars questioned the ability of professional and crowd investors to effectively process the abundant and sometimes contradictory information provided by different sources (Butticè et al., 2021; Meoli et al., 2020). If investors, suffering from information overload, select investment targets based on cognitive shortcuts (as reported in a highly cited paper by Busenitz et al. (2005)) and gut feelings (Narayanan & Lévesque, 2019), it can impact the drivers of venture valuations.

Lastly, today, different entrepreneurial ventures follow different financing sequences as a consequence of the rise of alternative financial channels. Some ventures raise VC after raising equity crowdfunding (Signori & Vismara, 2018), while others do the opposite (Kleinert et al., 2020). Following unsuccessful offerings, some companies approach a different platform, others give up (Rossi et al., 2022). These sequences make venture valuations path-dependent and introduce a new source of heterogeneity for its drivers. A venture’s decision to go through a particular financial milestone, and the responses of investors, as reflected in its valuation at that milestone, changes the information set of prospective investors at subsequent milestones. Again, this is likely to impact valuations.

To summarize, the literature on the drivers of entrepreneurial venture valuations is highly fragmented. It offers a partial view greatly influenced by studies focusing on specific financial milestones (i.e., VC rounds and IPOs), and thus incurs the risk of faulty generalizations. We lack a unified framework explaining how and why these drivers vary across different financial milestones, differentiating between the early (i.e., seed and start-up) and late (i.e., scale-up and exit) stages, the type of deal (i.e., private deals or public offerings), and the type of actors involved in the transaction (i.e., professional or crowd investors, financial investors or corporations). This is an essential step to highlight gaps in the extant literature on venture valuations and promising avenues for future research. This work aims to contribute to the literature on the drivers of entrepreneurial venture valuations by creating order and conducting a systematic literature review encompassing studies in entrepreneurship, finance, management, and economics (Cumming & Vismara, 2017). In doing so, our goal is to generate discussion among scholars around three broad-reaching questions: How do the drivers of the valuation of entrepreneurial ventures change throughout the financial milestones in which valuations are observed and depending on their sequence? What are the underlying theoretical mechanisms explaining the effects of these drivers on venture valuations? What are the open issues and promising avenues for future research on the drivers of venture valuations?

While addressing the above questions, the main contribution of this study is to build a novel map that highlights (1) the drivers of venture valuations in correspondence with the different financial milestones through a venture’s life cycle (Table 1, 2), (2) the different theoretical lenses used in the literature (Table 2), and (3) challenges in the extant literature that suggest promising avenues for future research (Table 3). This is an important step forward in the literature on the drivers of entrepreneurial venture valuations, which currently lacks such a comprehensive framework. The few literature reviews published on this topic adopt a specific theoretical perspective or focus on a specific financial milestone. For example, DeTienne (2010) as well as Wennberg and DeTienne (2014) focused on the exit stage. Wu et al. (2013) reviewed the applications of signaling theory in acquisitions. Drover et al. (2017) consider all the financial milestones and actors involved in the entrepreneurial equity financing process but they do not place venture valuations at the core of their analyses. Vismara (2022) expands the corporate finance perspectives to equity crowdfunding, considering also the drivers of valuation. Finally, from a different perspective, Cummings et al. (2020) review and qualitatively analyze a large corpus of 540 public comments submitted by stakeholders in response to new US equity crowdfunding regulations, from which they derive and present unanswered questions and fruitful research directions in this emerging domain.

The remainder of this paper is organized as follows. Section 2 presents the methodology used to review extant studies. In Sect. 3, we classify the drivers of the valuation of entrepreneurial ventures considered in previous studies according to the different financial milestones and different types of deals. In Sect. 4, we present related theoretical approaches. In Sect. 5 we switch from “what we know” to “what we do not know,” outlining challenges in the extant literature and promising directions for future research. Finally, Sect. 6 concludes the study and provides practical implications.

2 Methodology

To conduct a systematic literature review, we defined a rigorous protocol setting the criteria for paper selection, information extraction, and synthesis (Tranfield et al., 2003). The selection process is described in Fig. 1 and is composed of the following steps:

First, we concentrated our search on peer-reviewed journals included in the SciVerse Scopus online database. Excluding gray literature allows us to make the search process replicable. Second, since the topic under consideration is positioned at the intersection of different disciplines, we selected articles belonging to the “Business, Management and Accounting,” “Economics, Econometrics and Finance,” and “Social Sciences” Scopus subject areas. We chose to focus on articles and reviews as document types.

Third, we limited our search to journals ranked three or above according to the Academic Journal Guide 2021 by the Chartered Association of Business Schools (ABS). No filters were used for the publication year to allow the inclusion of early contributions. We selected articles dealing with entrepreneurial ventures in any of the financial milestones in which valuations were performed. Considering entrepreneurship is characterized by many subfields and by authors with different backgrounds, who use different terminologies for the same objects, we included several synonyms for entrepreneurial ventures. Deep-diving into overlapping terminology used to refer to new and typically small firms, Brown and Mason (2017) stress the recent allurement of entrepreneurship scholars to use terms such as “high growth firms” (HGFs) (Brown et al. 2017), “young innovative companies” (YICs) (Schneider & Veugelers, 2010) and “new technology-based firms” (NTBFs) (Colombo & Grilli, 2005). These periphrases pivot on the concepts of newness, innovation, and growth potential. As a consequence, we selected articles that mention in the title, abstract, or keywords any of these terms, in addition to “entrepreneurial venture,” “new venture,” and “startup.” We then drew on organizational life cycle theory (e.g., Miller & Friesen, 1984) to identify the financial milestones during the entrepreneurial ventures’ life cycles in which their valuations are observed. The financial milestones that we considered included all the events in which an agreement was reached between a focal venture’s existing shareholders and external investors to exchange the venture’s equity at a given price. Accordingly, we included articles that mention the following terms: business angels (BA), venture capital (VC), private equity (PE), equity crowdfunding, crowd-investing, initial coin offerings (ICO), initial public offerings (IPO), and acquisitions (M&A) in the title, abstract or keywords. Using these criteria, we selected 551 documents.

Finally, we excluded articles that did not address the drivers of venture valuation by only retaining articles that mention “valuation” or its synonyms, “valuing,” “market value,” “enterprise value,” and “business value” in their texts. We cross-checked the selection by reviewing the abstracts of the selected papers to ensure that they dealt with the topic under discussion. Moreover, to assess the possible presence of false negatives, we randomly selected 50 papers among those excluded by our procedure. None of them dealt with the drivers of venture valuations. This process resulted in a sample of 115 documents (i.e., articles or reviews, for the sake of simplicity, hereafter, “articles”) published between January 1991 and June 2022.

The articles collected were then classified according to the year of publication, authors’ affiliation, journal, and financial milestones on which the articles focused. Figure 2 provides a summary of the final sample. The number of published articles increased systematically during the past ten years, peaking at seventeen articles published in 2018. The majority related to VC investments (sixty-three out of which ten were on corporate venture capital investments). Forty-six articles considered the exit stage, of which thirty-four dealt with IPOs. While articles on VC investments and IPOs were distributed quite homogeneously, articles on equity crowdfunding, BAs, ICOs, and acquisitions were mainly concentrated in the last few years. Ten articles investigated more than one financial milestone, either financial milestones typical of the seed stage (BAs, equity crowdfunding, early VC investments) or the exit phase (IPOs and M&As). The selected articles were published in top journals in different disciplinary sub-fields, including entrepreneurship and small business management (e.g., Journal of Business Venturing: nineteen articles; Small Business Economics: thirteen articles), strategy (Strategic Management Journal: ten articles), innovation (Research Policy: eight articles), and finance (Journal of Financial Economics: eight articles). The four journals with the largest number of articles accounted for 42% of the selected articles, and nine journals accounted for more than two-thirds of the articles.

We analyzed all the collected articles to identify both the factors influencing entrepreneurial venture valuations and the theoretical lenses they use. In the following section, we first illustrate the classification of the drivers of entrepreneurial venture valuations in the different stages in which the valuations are observed and then discuss their underlying theoretical mechanisms.

3 Mapping the existing literature: the drivers of the valuation of entrepreneurial firms

In Table 1, we propose a taxonomy of the drivers of the valuation of entrepreneurial ventures highlighted by the previous empirical studies included in our review.Footnote 2 We classified these drivers into two dimensions. First, we differentiate the financial milestones according to the stages of the ventures’ life cycles, distinguishing between the seed or start-up (panel A) and the scale-up or exit stages (panel B). Second, we distinguish between public offerings, including equity crowdfunding, ICOs, and IPOs, and private deals, including investments by BAs, VCs, private equity (PE) investors, and acquisitions. Some of the drivers of venture valuations have been studied across several financial milestones, while others are contingent on the specific type of deal or stage involved or both.

We assigned the drivers to seven categories, namely: (i) the characteristics of the entrepreneurial and management teams, that is a venture’s human and social capital; (ii) intellectual property (i.e., patents and trademarks); (iii) financial information disclosure, which influences the set of information on which investors can base their offers; (iv) growth opportunities characterizing the ventures or their industries; (v) the characteristics of the investors, with a focus on the fit between the target ventures and the investors; (vi) market conditions; and (vii) the sequences of previous financing rounds ventures have gone through. The first four categories all refer to a broader classification, which we call “company characteristics.”

3.1 Characteristics of the entrepreneurial/management team

The first group of valuation drivers relates to the characteristics of the ventures’ entrepreneurial and/or management teams. Several studies, crossing most of the financial milestones, have determined that the human capital of entrepreneurs and managers figures prominently. Piva and Rossi-Lamastra (2018) found that the academic education of the members of the entrepreneurial teams, especially in economics, management, or fields related to the industries wherein the ventures operate, was positively correlated with the success of ventures’ equity crowdfunding campaigns. The education of entrepreneurs similarly had a positive impact on venture valuations in VC rounds (Franke et al., 2008; Hsu, 2007), and IPOs (Gounopoulos et al., 2021a, 2021b).

Leadership experiences in other startups (i.e., serial entrepreneurs) or small organizations and previous work experience in companies, operating in the same industry as the focal entrepreneurial venture, have a positive impact on valuations of VC investments (Franke et al., 2008; Hoenig & Henkel, 2015; Nahata, 2019). However, other scholars presented some contradictory results, showing that human capital sometimes has a dark side. For example, Pérez-Calero et al. (2019) find that firms obtain lower valuations at IPO when their CEOs have previous shared work experience with board members, especially if they are in the same industry as the focal firm, as prospective investors perceive a higher risk of overconfidence and myopic decisions. Building on agency and resource dependence theories, Bertoni et al. (2022) document an inverted U‐shape relationship between the value of initial public offerings and the extent of board independence. Consistent with agency theory, the inverted U‐shaped relationship is more pronounced when ownership and control rights are separated. Consistent with resource dependence theory, the inverted U‐shaped relationship is more pronounced in companies with higher industry diversification and less pronounced when the roles of the CEO and president of the board of directors are separated.

While the human capital of entrepreneurs and managers influences venture valuations across all financial milestones, their other characteristics play a key role in specific milestones. For example, Wang and Song (2016) considered the associations between IPO valuations and the ratio of founders to the total number of board members and argued for an inverse U-shaped relationship. Although being controlled by more founders signals group consensus, the predominance of founders may lead to a limited diversity in decision alternatives due to their common social origins. This negative effect is reduced if one or more VC investors sit on the board. In addition, a high percentage of inside directors are preferred by IPO investors when the venture’s CEO is one of the founders. Founder-CEOs are perceived to be less objective in their assessments of their firms than non-founder CEOs. A highly cited paper by Certo et al. (2001) suggests that this bias can be mitigated by inside directors, who have higher quality information on firms compared to outside directors.

Entrepreneurs’ social capital, and notably their ability to recruit executives through their personal network rather than exploiting the network of VC investors, have a positive effect on venture valuations in VC rounds, as shown by a highly cited paper by Hsu (2007). Moreover, VC investors set higher valuations when investing in companies led by founders who are socially similar to them in terms of the regions from which they originate, but dissimilar in terms of social status. In particular, high-status VCs invest higher amounts in companies led by low-status founders, especially if the founders signal their qualities through prestigious academic achievements (Claes & Vissa, 2020). Entrepreneurs’ and board members’ social capital plays a role also in the IPO domain. For example, Gounopoulos et al., (2021a, 2021b) show that having politically active CEOs and founders, e.g., in terms of individuals’ political donations and ties with institutions, increases the IPO premium and the survivability of IPO firms, especially for non-venture-backed ventures.

The commitment of entrepreneurs, expressed through ownership retention, also influences venture valuations (Leland & Pyle, 1977; Mudambi & Treichel, 2005). In particular, the equity ownership share retained by entrepreneurs has an inverse U-shaped relationship with IPO valuation. On the one hand, the decision of existing shareholders to keep their “skin in the game” after the IPO shows that they anticipate a profitable future for the company because only high-quality assets are worth retaining (Busenitz et al., 2005; Vismara, 2016). This increases the valuation. On the other hand, after a certain level of ownership retention, insiders may become entrenched and gain private benefits by abusing external investors (Morck et al., 1988). This reduces valuation.

Interestingly, entrepreneurs’ characteristics influence their venture valuations differently depending on the milestone reached. The gender of entrepreneurs is a case in point. VC and IPO investors tend to assign lower valuations to ventures led by women (Guzman & Kacperczyk, 2019). Conversely, scholars do not detect any gender bias in equity crowdfunding (Cumming et al., 2021; Rossi et al., 2021) and ICOs (Fisch et al., 2020).

Finally, a few recent studies consider the emotional characteristics and personality traits of entrepreneurs. Entrepreneurs’ facial trustworthiness is positively associated with crowdfunding campaign successes. Huang et al. (2021) find that a higher level of confidence in CEOs led to increased capital in ICOs. Momtaz (2021) considers CEOs’ emotions and sensations from facial expressions displayed in public photos during an ICO and shows that ICO investors discount venture valuations if they perceive negative traits. This effect is stronger if a firm is characterized by higher information asymmetry. At the same time, physical appearance has also a value per se, as founder CEOs' facial attractiveness positively influences firm valuation at ICOs (Colombo et al., 2021). Last, in a study on IPOs and acquisitions, DeTienne et al. (2015) find that entrepreneurs with strong emotional attachments to their firms make decisions that maximize their socio-emotional wealth rather than their financial wealth, obtaining lower proceeds.

3.2 Intellectual property

The second group of drivers includes ventures’ technological resources. Several studies have considered the influence of patents on venture valuations. In VC rounds, ventures command a higher valuation if they have more patents (Mann & Sager, 2007; Haeussler et al., 2014; Zhang et al., 2019; Tumasjan et al., 2021). Patent disclosure in a strong IP protection regime positively influences startup valuation in CVC deals (Mohammadi & Khashabi, 2021). The positive effect of patents was also detected in acquisitions (Cotei & Farhat, 2018) and IPOs (Vismara, 2014).

Conversely, patents are not associated with greater amounts of funding in ICOs (Fisch, 2019) and, with some exceptions, in equity crowdfunding (Rossi et al., 2021). Zhou et al. (2016) show that in initial VC rounds, the effect of patents on VC financing is complementary to the effect of trademarks. Ventures that file for both patents and trademarks have higher valuations than those that apply for only one; however, this complementarity effect vanishes in later VC rounds. Block et al. (2014) focus on trademarks only and find that the number and breadth of trademark applications have an inverted U-shaped relationship with VC investor valuations of start-ups. On the one hand, trademarks signal market orientations and growth ambitions, and protect the firms’ brands and marketing assets through the right to exclude others from their use. On the other hand, beyond a certain number of trademarks, VC investors do not gain any additional information on a firm’s ambition. Moreover, the additional protection granted becomes lower than the additional costs to file the trademark, making the marginal value of a new trademark negative. Last, Fisch et al. (2022) draw on real options theory and document that greater trademark breadth constitutes a valuable real option that is associated with higher firm valuation at the IPO and performance after the IPO.

Previous studies have considered other factors that reflect ventures’ technological resources and innovation capabilities. For example, research alliances make ventures more valuable to VC investors (Hoenig & Henkel, 2015), the number of technical white papers and high-quality source codes of the ventures increase the amount raised in ICOs (Fisch, 2019), and the early adoption of management accounting systems increases IPO valuations (Davila & Foster, 2005).

3.3 Growth opportunities

The role played by growth opportunities with respect to firms’ performances has been extensively documented by previous literature. Nevertheless, few works specifically investigated the impact of growth potential and industry characteristics on venture valuation. In addition, Twitter sentiment on the development of novel technologies or positive trends in a given industry is positively correlated with the valuations in VC rounds of the ventures operating in that industry (Tumasjan et al., 2021).

3.4 Market conditions

Equity market conditions in the venture industry, the market cycle, and information on the valuations obtained by firms in similar deals affect valuations in equity crowdfunding campaigns (Hornuf & Neuenkirch, 2017), IPOs, and acquisitions (Ozmel et al., 2017). Firms benefit from a market cycle by timing their IPOs in periods in which investors are optimistic about the future of an industry thereby obtaining higher valuations (Loughran & Ritter, 1995). Masiak et al. (2020) show that market timing linked to Bitcoin and Ethereum can positively influence the valuations of ICOs as well.

Moreover, in markets where laws protect the shareholders from the misuse of corporate assets and from low corporate transparency, or where there is the perception of good legal shareholders protection, investors are more willing to provide capital to firms in IPOs (Bernstein et al., 2020; Schnyder et al., 2022). Regulations play a crucial role in ICOs as well. Gan et al. (2021) show that in unregulated environments, ICOs can lead to lower valuations. Furthermore, when multiple bidders compete for a given target company, valuations increase (Wu et al., 2013).

Regulations and institutional factors in certain markets can also have spillover effects in other domains. For example, the Jumpstart Our Business Startups (JOBS) Act, aimed at simplifying the IPO process for emerging growth companies and associated with an increase in IPO activity, also has effects on the M&A market. Indeed, while making IPO easier, the JOBS Act increases private firms’ bargaining power in the M&A market, thus increasing the valuation of private target firms (Chu et al., 2022).

3.5 Financial information

Entrepreneurs may rely on direct information disclosures to reduce investors’ level of information asymmetry and increase their venture valuations. For example, in equity crowdfunding, posting information on the campaign page showing the aggregate amount of collected investment intentions (Cumming et al., 2020) and campaign dynamics (Vismara, 2018) increase the success of crowdfunding campaigns and backers’ offers. This is so relevant that managers of equity crowdfunding platforms manipulate the information displayed online to increase the appeal of the offerings, positively impacting funding successes (Meoli & Vismara, 2021). Similarly, providing explicit information on the mission of the company running the campaign can increase backers’ willingness to pay, which is driven by their personal values and motivations (Short et al., 2016). In particular, using promotional linguistic expressions to deliver this information positively influences retail investors’ offerings in equity crowdfunding, while the same mechanism does not affect sophisticated investors (Johan & Zhang, 2020).

Having more information on the company is also valuable for IPO investors. Liu et al. (2020) show that a greater number of positive (negative) affective language used in a firm’s press coverage newspaper articles is negatively (positively) related to underpricing. However, in IPOs, the effects of direct information disclosures also depend on how entrepreneurs communicate. For example, while filing for an IPO and preparing the necessary corporate governance documents, entrepreneurs tend to enhance good news with positive and easier-to-read writing (Howard et al., 2021), and camouflage bad news with more complex expressions, especially in periods of low scrutiny and low analyst coverage, with a consequent increase in IPO proceeds (Benson et al., 2015). On the contrary, going-concern disclosures in the financial reports of firms pursuing IPOs are associated with lower initial returns (Bochkay et al., 2018).

3.6 Characteristics of investors

In equity crowdfunding, more sophisticated investors, that is, backers with better knowledge of how the crowdfunding mechanism works, are characterized by a higher willingness to pay (Hornuf & Neuenkirch, 2017), which results in more successful campaigns. Meoli et al. (2020) document higher crowdfunding platforms’ survival profiles where the level of financial literacy is high. Financial literacy, however, needs to combine with specific platform characteristics to take full effect, as it matters more to those platforms that deliver voting rights and that provide poorer value-added services to crowdfunding investors. In early-stage VC deals, a highly cited paper by Hsu (2004) finds that offers made by VC investors with high reputations are three times more likely to be accepted, and they acquire start-up equity at a 10 to 14% discount.

Regarding investors’ conduct, there is evidence of herding behavior in both IPOs and equity crowdfunding. Investors tend to mimic the investment decisions of other investors and neglect substantive private information (Nanda & Rhodes-Kropf, 2013; Vismara, 2018). Herding behavior has also been detected in VC deals (Wilson et al., 2018), with a consequent increase in the supply of VC in certain markets or industries, which results in greater competition between investors and higher valuations (Inderst & Müller, 2004). Other deal-specific factors can influence investors’ behavior and decision-making processes. For instance, investors set higher valuations at IPOs if highly reputable underwriters are involved in the deals (Shi & Xu, 2018).

Finally, in private deals involving corporations, the fit between the target and the investors influences valuations. As for corporate VC investors, fit resulting from the complementarity of assets between the target venture and the investor has a positive impact on valuation (Dushnitsky & Lenox, 2005; Hellmann, 2002; Ivanov & Xie, 2010; Park & Steensma, 2012). The opportunity to combine a target venture’s specific intangible assets with those of the acquirer and to create synergistic gains also positively influence valuations during acquisitions (Cotei & Farhat, 2018).

3.7 Sequence of previous financing rounds

This final group of drivers refers to the effects of the characteristics of previous financial milestones on the valuations obtained by firms at subsequent milestones. These drivers stress the path dependencies of the venture valuations.

In equity crowdfunding, research shows that previous campaigns and being backed by multiple types of investors, especially in the seed stage, are positively related to campaign success (Butticè et al., 2017; Kleinert et al., 2020). Having past experiences with successful crowdfunding campaigns and being VC-backed positively affect the ability to collect more capital also in subsequent BA or VC rounds (Hornuf et al., 2018; Hsu, 2007). The effect is stronger if ventures are backed by numerous VC investors (Hornuf et al., 2018), who have industry-specific experience (Vanacker & Forbes, 2016), are prominent (Davila Foster and Gupta 2003), and have broadened the venture’s network (Braune et al., 2021; Davila et al., 2003; Ter Wal et al., 2016; Wang, 2020). In addition, ventures command higher valuations in VC deals if they are backed by experienced BAs (Hellmann & Thiele, 2015).

The characteristics of previous VC or private equity rounds also impact entrepreneurial venture valuations. For example, being invested by more prominent private equity investors improved firms’ ability to attract subsequent funding (Janney & Folta, 2006). Moreover, we have evidence that IPO valuations are positively related to staged financing and syndication by VC investors, especially if VC investors have a high reputation (Shi & Xu, 2018) or, as shown in a highly cited paper by Stuart et al. (1999), high status. However, other scholars show contradicting findings, proving that there are situations in which being backed by young VC firms is advantageous. Butler and Goktan (2013) found that young VC firms manage to produce better information about opaque invested companies due to their organizational structures, compared to more established VC firms, and this advantage is reflected in higher IPO valuations. Backing by foreign VC investors does not significantly improve valuations at exit (Humphery-Jenner & Suchard, 2013). A greater geographic distance between ventures and their VC investors increases the monitoring cost incurred by investors, thus undermining the substantive benefits. In this case, if VC investors replace the venture’s CEO with a manager with a higher level of human capital to implement indirect monitoring, the IPO valuation of a firm increases (Chahine & Zhang, 2020).

Despite the numerous beneficial effects of VC backing on valuation at subsequent financial milestones, there are exceptions. Although VC investors are expected to help the companies in which they invest to receive the highest possible amount of capital from the IPO, the limited life of their funds, and their desires to maintain ties with underwriters reduce their willingness to limit IPO underpricing. This results in higher IPO underpricing for firms backed by VCs who have strong ties with the underwriter (Arthurs et al., 2008).

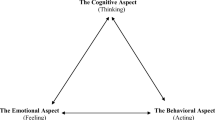

4 Theories used to study venture valuations across firm stages and deal types

In this section, we review the theoretical mechanisms underlying the drivers of the valuation of entrepreneurial ventures considered in the previous section. This is an important step in the process of creating order in the literature. Table 2 illustrates the different theoretical lenses used in the previous studies. For every theory, we reported in the table the related seminal paper. We classify theories, according to the same dimensions used in Table 1, that classify the drivers of a venture’s valuation (i.e., the stage in the venture’s life cycle and type of equity deal in correspondence with the valuation observed). The table shows that the literature, from a theoretical perspective, is highly fragmented. The different theories are insourced from different disciplinary domains (e.g., economics, management, social psychology) and schools of thought. While some theoretical lenses have been used only in specific stages or types of deals, other approaches, such as signaling theory (Spence, 1973) and the resource-based view (RBV) (Barney, 1991) are quite ubiquitous. The application of signaling theory in entrepreneurial finance is well-established (for a review, see Connelly et al., 2011), and venture valuations are no exception. There is evidence of large information asymmetries between insiders and outsiders in all milestones and types of deals (Bergh et al., 2019). When information disclosure is not pursued, insiders can use observable and costly resources to signal the high quality of their firms to prospective investors and distinguish themselves from lower-quality firms that cannot afford the signaling costs. Similarly, the RBV suggests that venture resources generate productive effects that positively influence venture valuations, beyond their pure signaling content. Patents are an example of resources that provide both signaling effects (Useche, 2014; Hoenig & Henkel, 2015; Vismara, 2014; Zhang et al., 2019) and substantive benefits brought by legal rights to exclude other firms from exploiting a certain invention, easing cooperation with other business partners (e.g., Hall & Ziedonis, 2001). The same applies to other drivers of venture valuations, such as entrepreneurs’ human capital (Cohen & Dean, 2005; Colombo & Grilli, 2005; Wright et al., 2007; Piva et al. 2018), and associations with prominent VC investors (Megginson & Weiss, 1991), reputable underwriters (Shi & Xu, 2018), established alliance partners (Vanacker & Forbes, 2016), and famous academic institutions (Colombo et al., 2019).

Agency theory (Jensen & Meckling, 1976) has also been used in several financial milestones, mainly to explain principal-principal conflicts between entrepreneurs and external equity investors (Fiet, 1995), and also to provide a better interpretation of the sometimes contradictory nature of external investors’ objectives and incentives. For example, VCs or private equity (PE) firms that invest in a certain company are interested in maximizing their value in subsequent milestones, but they are also keen on exiting as fast as possible, even with a slightly lower valuation, to satisfy the liquidity and timing requirements of their funds. This happens because VCs and PEs are not only principals of the invested company as shareholders but also agents of investors in the VC fund (Arthurs et al., 2008; Batt & Appelbaum, 2020).

An interesting distinction between the different theoretical approaches that emerge from our analysis is the behavioral assumptions on which the theories rely. Most approaches assume that the observed venture valuation is the result of an equilibrium between supply and demand, with both sellers and acquirers being fully rational. For example, on the investors’ side, Hellmann (2002) leverages property rights theory (Grossman & Hart, 1987; Hart & Moore, 1990) and the related contracting theory (Hellmann, 1998) to argue that the asset complementarity and the entrepreneurs’ bargaining power influence the valuations obtained by firms when invested by corporate VCs, especially if they compete in the same market or are willing to access the firms’ technologies (Masulis & Nahata, 2009). Similarly, in acquisitions, the target venture’s valuation is higher if the deal leads to a larger reduction in transaction costs (Williamson, 1973, 1975, 1979), the creation of more synergies, and the elimination of a potentially dangerous market competitor (Stigler, 1950). On the contrary, the real options theory suggests that prospective investors are ready to commit a lower number of financial resources in the presence of higher uncertainty regarding future benefits (Folta, 1998). On the entrepreneurs’ side, the expected utility framework and the social identity theory suggest that entrepreneurs decide on the financial conditions that would make them accept a certain investment to maximize their returns on their human capital (Douglas & Shepherd, 2000) or that preserves the private benefits and emotional willingness to maintain control of a firm (DeTienne et al., 2015).

Conversely, other theoretical approaches influenced by behavioral finance and social psychology assume that in contexts where there is limited and noisy information, agents suffer from cognitive constraints and cannot be considered fully rational. For instance, as suggested by prospect theory (Kahneman & Tversky, 1979; Wennberg et al., 2010) and aspiration theory (Greve, 1998), individuals may value a certain firm based on whether its characteristics are above or below a predetermined threshold. Similarly, institutional theory argues that a new venture is more likely to receive a higher valuation if it is seen as legitimate by prospective investors, that is if it reaches performance levels based on expectations derived from the performance of other companies in the field (Fisher et al., 2017). Investors’ decisions are also influenced by sentiment. For example, in late-stage deals, the windows-of-opportunities theory argues that firms can benefit from the market cycle by timing their IPO in periods in which investors are optimistic about the future of an industry, thereby obtaining higher valuations (Loughran & Ritter, 1995).

Legend: ECF, equity crowdfunding; BAs, business angels; IVCs, independent venture capitalists; CVCs, corporate venture capitalists; GVCs, government venture capital; IPOs, initial public offerings; M&As, mergers and acquisitions; PEs, private equity firms.

5 Avenues for future research

The fragmentation of the literature on entrepreneurial venture valuations poses several challenges that scholars need to address to improve our understanding of the valuation phenomenon. In particular, the varied range of theoretical frameworks employed by extant studies on valuations makes this field particularly suitable for pursuing theoretical advancement. In this section, summarized in Table 3, we identify and classify the abovementioned challenges and provide scholars with suggestions and examples on how to address them in future research.

5.1 New digital milestones

First, our work reveals the need for further investigation into new digital milestones. Although our analysis documents the granularity of venture valuations, Tables 1 and 2 show that previous studies have mostly concentrated on the traditional milestones and deal types.

Some new financial milestones related to digital alternative financial channels have not been extensively tackled by the academic community and were therefore only marginally covered by us; they certainly deserve more attention. For instance, the limited number of studies on ICOs does not allow us to fully explore the related drivers and underlying theoretical frameworks. Considering ICOs’ large funding amounts (e.g., EOS raised over $4 billion) and the importance of blockchain technology for innovation in financial markets, the drivers of the value of these new instruments are important open issues. Financing channels based on blockchain technology can reduce transaction costs and information asymmetry problems. Presently, ICOs are lively debated among researchers, practitioners, and policymakers, and scholars are called to investigate the impact of the disintermediated nature of this channel, on a firm’s valuation, which presents retail investors the opportunity but also the challenge of a direct assessment of entrepreneurial ventures. A better understanding of the drivers of venture valuations is crucial to the development of these markets and the exploitation of opportunities for financial inclusion that they might offer.

Moreover, some of the driver categories identified in this review have received limited attention from previous studies on new digital milestones. For instance, drivers related to growth opportunities have been studied mainly in the context of VC funding. However, these drivers specifically refer to the entrepreneurial development phase; they may impact venture valuations in other seed and early-stage milestones as well, such as equity crowdfunding campaigns and ICOs. Similarly, the effect on venture valuations of market characteristics, such as the number of prospective investors or their sentiment, has been explored mainly in late stages and exit deals. Whether they also play a crucial role in the earlier stages is an important open issue.

Another major challenge that scholars need to address, regarding new digital milestones, is the impact on the valuation of investors’ behavioral characteristics. First, investors in new digital milestones have access to a large amount of mostly noisy information. As Simon (1947) says, attention is a scarce resource and individuals have a bounded capacity to be rational in their distributed attention. This increases the complexity of assessing the investment. Therefore, scholars should investigate how bounded rationality prevents investors from processing the most relevant information (e.g., Butticè et al., 2021) and whether retail and professional investors are differently impacted by information abundance. In addition, there is evidence that in new digital milestones, investors’ decisions can be influenced by sentiment. Social psychology theories (such as cognitive theory, affective events theory, stereotype content theory, and framing theory) have been used in the crowdfunding literature to model the motivations and investment behaviors of crowd investors. Theories belonging to the same domain could also be applied to the ICO context as an additional tool to better investigate the behavior of investors (e.g., Momtaz, 2021), whose motivation to invest in blockchain finance are diversified (Fisch et al., 2021).

Finally, future research focusing on new digital financial milestones should help policymakers face the challenges of finding a balance in the trade-off between capital formation and investor protection. The recent higher engagement of retail investors in entrepreneurial finance, through crowdfunding platforms and other types of digital channels, increases and diversifies entrepreneurs’ opportunities to raise initial funding, particularly for individuals who encounter barriers in accessing traditional entrepreneurial finance channels. Digital financial channels are easily accessible to a wide variety of early-stage ventures and are substantially less costly for issuers than traditional financial channels. Although the possibility of investing online in securities may be welcomed as a way to increase the supply of financial capital for entrepreneurial ventures, it raises serious concerns related to the protection of retail investors and the allocative efficiency of the financial resources provided. Unlike traditional entrepreneurial finance settings, which are subject to a host of regulations designed to protect investors, digital finance markets expose retail investors to the possibility of being taken advantage of by entrepreneurs and sophisticated investors operating alongside them. The possible lack of financial literacy on the supply side (i.e., among retail investors seeking investment opportunities) might pair with adverse selection problems on the demand side (i.e., among entrepreneurs seeking finance) to undermine the functioning of these thin capital markets. Improving our understanding of the drivers of entrepreneurial venture valuations and their underlying theoretical mechanisms in new digital milestones will help policymakers set the disclosure and timely information requirements needed to balance the monetary and proprietary information costs borne by entrepreneurs with the informational efficiency that is instrumental to attract retail investors’ demands.

5.2 Boundary conditions of the drivers’ effects

Second, we lack a comprehensive picture of the boundary conditions that influence drivers’ effects on valuation. In this study, we show that several drivers have contradictory effects on valuation. For these drivers, we need to better explore the boundary conditions that cause one effect to prevail over another.

In some cases, a single theoretical lens predicts opposite effects for a specific driver. A case in point is offered by multiple agency contexts in which a single actor is both the principal in a particular relationship and the agent in another (Arthurs et al., 2008). This kind of multiple agency relationships is found more frequently in later-stage deals. For instance, in the IPOs of VC-backed ventures, VC investors are both principals as shareholders of a firm that is going public, and agents to investors in the VC fund. Due to this duality, the positive effects on IPO valuations, that being VC-backed brings, may be undermined by VC investors’ needs to satisfy the funds’ liquidity needs and to maintain good relationships with underwriters aimed at assuring future exit opportunities for other investments (Arthurs et al., 2008). Similar reasoning applies to ventures in which investors with conflicting objectives, such as family offices and sovereign funds, invest. These investors allegedly pursue both financial and socio-emotional or political objectives, which influence their valuation of a focal venture. Understanding when one objective prevails over another is a promising area for future research. Trademark applications are another driver with opposing effects, as explained by a single theory. Their inverted U-shaped relationship with the valuations of start-ups in VC deals (Block et al., 2014) is determined by the fact that their signaling power decreases when the number of trademarks generated by the same company increases. After a certain threshold, investors do not gain any additional information, so the marginal net value of a new trademark becomes negative.

In other cases, different theoretical lenses lead to opposing predictions of the effects of a specific driver on venture valuations. Some scholars have combined agency theory with resource dependence theory (Pfeffer & Salancik, 1978) and argued that, for prospective investors, entrepreneurs with firm-specific human capital are a double-edged sword, representing both a source of competitive advantage and a threat of appropriation of future cash flows. For this reason, valuation by prospective investors is higher if investors are assured that their interests are protected. For instance, the replacement of founder CEOs with professional CEOs guarantees better monitoring (Chahine & Zhang, 2020), simultaneously allowing key entrepreneurs to remain involved in the organizations if they are moved to other roles. Another example is retained ownership. On the one hand, signaling theory has been used to interpret the positive effect of ownership retention, driven by the decision of entrepreneurs to keep their skin in the game because of their beliefs that the firms have promising business opportunities (Ahlers et al., 2015; Ivanov & Xie, 2010; Vismara, 2016). On the other hand, principal-principal agency theory claims that a high level of ownership retained by entrepreneurs has a negative impact on venture valuations, because entrepreneurs’ entrenchment may generate conflicts and result in the expropriation of minority investors. Finally, signaling theory and agency theory explain the double-edged sword effect of being backed by a foreign VC. A foreign VC has a strong signaling effect but also incurs high monitoring costs. The former positive effect prevails if the foreign VC investor replaces the CEO with a manager with a higher level of human capital to implement indirect monitoring (Chahine & Zhang, 2020).

Another challenge arises when the effect of a focal driver on venture valuations is compatible with theoretical arguments that rely on different behavioral assumptions. In these situations, scholars need to explore the boundary conditions that allow disentangling the predictions of different theories. A telling example is offered by the mimicking behavior of investors who tend to inflate their valuations. The theory of herd behavior in investments (Nanda & Rhodes-Kropf, 2013; Scharfstein & Stein, 1990) and information cascade theory (Meoli & Vismara, 2021; Welch, 1992) suggest that investors tend to mimic the investment decisions of other investors because they base their funding decisions on gut feelings (Narayanan & Lévesque, 2019). Alternatively, by following their peers, investors may rationally want to maintain a certain level of reputation in the industry.

5.3 Path-dependency of valuation

Third, scholars should put more effort into examining the path-dependency nature of venture valuations and their implications. Valuations at different financial milestones are linked to each other, in that the valuation obtained at a given stage influences the valuation at later stages, which increases the risk that venture valuations will be inflated. In particular, there is evidence that VC investors tend to overvalue their holdings. Moreover, according to Gornall and Strebulaev (2020), who studied the valuation of 135 VC-backed unicorns based in the United States, VC investors, on average, overvalue post-money valuations by almost fifty percent. There is evidence that also PE fund managers may report inflated valuations of private companies that are not yet sold, to attract new investors into follow-up rounds (Cumming & Walz, 2010). Inflation generated in this manner may have negative consequences. For example, firms’ valuations may grow at every VC round leading up to the IPO and then deflate soon after going public, as in the cases of WeWork, Uber, and Lyft.Footnote 3 Furthermore, the more the valuations are biased, the higher the risk of misallocating funds, which denies resources to the most deserving firms (Hsieh & Klenow, 2009). Simultaneously, obtaining high valuations allows institutional investors such as VC investors to make their businesses sustainable. VC investors need to liquidate their initial investments after a few years to obtain sufficiently high returns (DeTienne, 2010). In this way, they can implement entrepreneurial re-cycling (Mason & Harrison, 2006) which involves reinvesting the exit proceeds of one venture in a new venture thereby triggering self-perpetuating cycles in the entrepreneurial ecosystem. The higher the valuation obtained at every milestone, the greater the financial resources that investors can re-inject into the ecosystem. This dilemma deserves further research and is part of a larger debate on whether the Silicon Valley model, based on high-tech VC-funded firms (Lerner 2012), is still valid in addressing the most urgent economic issues nowadays that involve economic and social disparities and inequality in the distribution of wealth and income (e.g., Audretsch, 2021). From this perspective, the path-dependency of a valuation becomes an essential aspect of the functioning of the entrepreneurial finance ecosystem.

5.4 Theory transmigration

Fourth, scholars can provide valuable insights into the less investigated facets of some financial milestones by pursuing theory transmigration. Theory transmigration involves transferring the theories that were used to interpret the effects of the drivers of venture valuations in certain financial milestones to other milestones. For example, as Table 2 shows, current research on venture valuations by business angels uses a limited number of theories (Tenca et al., 2018). Considering the disintermediated nature of business angels’ investments and their direct relationships with the entrepreneurs they finance; it would be helpful to understand whether theories that model entrepreneurs’ behavior could be applied to angel investors as well. In particular, it would be interesting to understand how angel investors’ bargaining power as individual shareholders influences their negotiations with other prospective investors, modeled through property rights theory and contracting theory. Scholars could also explore whether business angels, like entrepreneurs, face a trade-off between the desire for financial rewards and the emotional willingness to remain with the venture, and how this trade-off affects valuation. In a similar vein, family offices which have not been tackled explicitly in this work, pursue multiple objectives; they manage the wealth of business families seeking financial returns while also attempting to preserve the social identity of the families and avoid jeopardizing their members’ socio-emotional wealth (Gómez-Mejía et al., 2007). It is unclear how these conflicting objectives influence a family office’s valuation of a focal venture.

5.5 Theory integration

Lastly, scholars could improve our understanding of venture valuations at different financial milestones and provide theoretical advancement at the same time by combining different theoretical frameworks. A promising way, among the possible ways to combine theories (see Mayer & Sparrowe, 2013), is to take two compatible theoretical frameworks that were previously applied to the same milestone, independently of each other, and combine them to obtain a more complete understanding of the drivers of valuations. For instance, our understanding of venture valuations at acquisition can be improved by integrating signaling and auction theories. This can be done by building on studies that model acquisitions as auctions, wherein competition between multiple bidders for a target venture increases its price (Eckbo et al., 2020; Wu et al., 2013). The evidence suggests that this mechanism works only if all the bidders are equally well informed (Povel & Singh, 2006). However, in many situations, bidders are heterogeneous and have different information sets. For example, they may operate in industries or be located in countries that are different from those of the target venture and thus be less well-informed than the bidders who are closer to the target venture. This is especially the case of ICOs (Huang et al., 2020). Information asymmetries make bidders more cautious in their offerings, undermining competition, and negatively influencing valuations. Studying how signals work within the target–bidder relationships and examining whether these signals can create a high level of competition among bidders may provide insights that guide entrepreneurial ventures in extracting more value from acquisitions.

The literature on valuations can also be extended through the application of other theories to the domains typical of signaling theory. For example, in the context of multiple signals sent by the same company, applying a temporal lens to signaling theory, that is, considering the sequence in which the signals have been sent, allows signaling theory to be integrated with the literature on judgment and information processing (Colombo & Montanaro, 2021a). In a noisy information environment, where signal receivers are characterized by bounded rationality, signals coming from the same company can be more easily interpreted through a processing mechanism. According to this mechanism, when a strong signal follows a weak one, thus creating an increasing trend in signal strength, receivers assume that the trend will continue, which results in a positive effect on valuation. On the contrary, when a weak signal is generated after a strong one, receivers also assume that the trend will continue, and they reduce the firm’s valuation. We have limited knowledge of how the temporal sequencing of signals impacts their effectiveness and whether receivers’ perceptions of a signal later in a sequence are influenced by the strength of the previous signals.

Another challenge emerging from theory integration arises from drivers that have been investigated through two or more theoretical lenses. Scholars could disentangle the explanatory power of the different theories, casting light on alternative explanations of the theories’ effects on venture valuations. The human capital characteristics of venture entrepreneurs, including managers and board members, and patent activities are clear examples that have been investigated by studies adopting either or both signaling theory and RBV. On the one hand, patents have been used by firm insiders to communicate their firms’ quality to prospective external investors, overcoming information asymmetry issues and avoiding lemon premiums, which negatively influence venture valuations (Hoenig & Henkel, 2015). On the other hand, patents provide a legal right to exclude other firms from exploiting a certain invention. Hence, patents are assets that have trade values for entrepreneurs and investors because they can be sold to third parties (Hoenig & Henkel, 2015). They also ease cooperation with other business partners (e.g., Hall & Ziedonis, 2001). Other drivers of venture valuations are suitable for interpretations that use the lenses of signaling theory and RBV. For example, associations with prominent VC investors (Megginson & Weiss, 1991), reputable underwriters (Shi & Xu, 2018), established alliance partners (Vanacker & Forbes, 2016), and famous academic institutions (Colombo et al., 2019) are signals of venture quality and, at the same time, generate substantive benefits to ventures. Both mechanisms have positive implications for venture valuations. In addition, the positive effects on valuations caused by the association with prominent agents have also been investigated through the lens of network theory. Scholars have used network theory to model ties between invested and investing corporations (Knoke & Burt, 1983). Networks are used by firms as vehicles for transferring information, knowledge, and resources. Moreover, belonging to a high-status network also conveys a signal of the venture’s quality.

By integrating theories, scholars can achieve a two-fold goal. On the one hand, they can improve the academic understanding of venture valuations, adopting a more comprehensive vision than what the individual theories could provide in isolation. On the other hand, they can extend established theories by addressing the assumptions of other theories, as in the case described above regarding bounded rationality applied to signaling theory.

6 Conclusion

This study is primarily aimed at scholars interested in the valuation of entrepreneurial ventures in the fields of entrepreneurship, management, finance, and economics. It offers them a map to assist in making sense of what we know about the drivers of entrepreneurial venture valuations and indicates promising avenues for future research.

The practical implications of this work and the discussions that it may stimulate are also of interest to practitioners, particularly to both founders of entrepreneurial ventures and professional external equity investors such as VC investors and business angels. Moreover, thanks to the introduction of new digital financing channels that disintermediate and democratize access to external equity finance (Butticè & Vismara, 2022; Cumming et al., 2021), this topic is becoming increasingly relevant for platforms that offer ordinary citizens the opportunity to invest in young companies and the crowd of retail investors that populate these platforms. Finally, this study is also helpful to policymakers, as entrepreneurial venture valuations at different financial milestones are a key element for the development of effective and self-perpetuating entrepreneurial ecosystems (Brown & Mason, 2017; Link et al., 2021).

As with all studies, our work is not without limitations. First, the research method used to select and collect the reviewed papers may not totally avoid any loss of information, as we excluded works belonging to the so-called gray literature, i.e., working papers and other published material that has not been subjected to the traditional peer review process (Adams et al., 2016). We also focused on journals ranked “3” or above according to the Academic Journal Guide 2021 by the Chartered Association of Business Schools (ABS) to make our search manageable. Similarly, we did not include works from scientific journals still not accredited. Although we did that to ensure the replicability of the search process, this might entail omitting novel and possibly relevant findings and suffering from the lack of immediacy caused by the lag of academic knowledge (Adams et al., 2016). Second, for the abovementioned reason, when identifying valuation drivers our aim is not to be exhaustive, as there might be other studies (e.g., published in journals that are not considered in this review) that highlight positive or negative associations between specific drivers and entrepreneurial venture valuations at specific financial milestones or deal types. Rather, one of the purposes of this paper is to illustrate the empirical “stylized facts” about the drivers of venture valuations based on the empirical evidence provided by studies published in prominent journals. Third, we only marginally covered some new financial milestones related to digital alternative financial channels, that still need to be extensively tackled by the academic community. For example, only very few studies reviewed in this paper deal with ICOs. Moreover, we do not include in our analysis studies on listing via SPAC (e.g., Gahng et al., 2021; Jenkinson & Sousa, 2011; Kiesel et al., 2022), two rising phenomena and alternative channels for entrepreneurial ventures exit that are increasingly drawing the attention of academics and practitioners. In a similar vein, other financial investors like family offices and sovereign funds have not been tackled by this review. These milestones certainly deserve more attention. All in all, the context where entrepreneurial venture valuations are observed is dynamic and quickly developing, thus very promising for future research, given that many relevant domains still have to be properly addressed by scholars.

The above considerations, combined with the fact that the sequence of financial milestones in which a valuation is agreed upon, between a venture’s existing shareholders and external investors, is becoming increasingly diverse, create a compelling reason to place valuations at the center of the academic community’s attention. This study is an attempt to improve our understanding of this phenomenon in terms of both individual milestones and path-dependent processes. In doing so, this work investigates what drives firms’ value at the market equilibrium, i.e., at the intersection between capital demand, determined by the ventures’ entrepreneurs and shareholders, and capital supply, driven by external equity investors. Because of this, our paper has some overlaps with the large literature investigating the investment criteria of investors. Some studies use surveys to find how institutional venture capitalists (VCs) make decisions in sourcing, evaluating, and selecting investments (e.g., Gompers et al., 2009). Other works run experimental analyses to investigate the investment choices of different types of institutional (e.g., Block et al., 2019) and retail investors (e.g., Butticè et al., 2021). With this review, we move a step forward suggesting that the entrepreneurial ventures’ valuation topic should be approached by looking at the demand side as well. In particular, it would be interesting to disentangle the component of the drivers’ effect related to the demand side, from the one related to the supply side. Moreover, there is the need to better understand what role entrepreneurs play in negotiating valuations with investors, and what spurs entrepreneurs’ demand for some investors over others.

Notes

Firm or business valuation is the market value of a firm that is observed when a firm raises fresh capital or when its equity is exchanged between two parties, e.g., in venture capital (VC) rounds or when ventures go through an initial public offering (IPO). In this study, we focus on what determines the valuation of entrepreneurial ventures as observed in financing deals. We refer to drivers of valuations, defined as variables that previous studies have found to impact firms’ valuations. These drivers include variables such as patents, entrepreneurs’ human capital characteristics, or market conditions. Different streams of literature refer to these drivers in different ways, such as value-enhancing factors, determinants, or signals. The methodologies to perform business valuations (e.g., discounted cash flow or multiples) lie beyond the scope of this study. Suffice here to mention that ventures’ lack of track records, the difficulty of assessing their costs of capital, and the scarcity of comparable ventures all make valuations difficult tasks. Accordingly, there is evidence that even professional investors lack precision in their appraisal processes, with the consequent risk of inaccurate valuations.

The purpose of Table 1 is not to be exhaustive as there might be other studies (e.g., published in journals that are not considered in this review) that highlight positive or negative associations between specific drivers and entrepreneurial venture valuations at specific financial milestones or deal types. Rather, the purpose of Table 1 is to illustrate the empirical “stylized facts” about the drivers of venture valuations based on the empirical evidence provided by studies published in prominent journals.

References

Adams, R. J., Jeanrenaud, S., Bessant, J., Denyer, D., & Overy, P. (2016). Sustainability-oriented innovation: A systematic review. International Journal of Management Reviews, 18, 180–205.

Aghion, P., & Bolton, P. (1992). An incomplete contracts approach to financial contracting. Review of Economic Studies, 59, 473–494.

Ahlers, G. K. C., Cumming, D., Gunther, C., & Schweizer, D. (2015). Signaling in equity crowdfunding. Entrepreneurship Theory and Practice, 39, 955–980.

Akerlof, G. (1970). The market for “lemons”: Qualitative uncertainty and the market mechanism. Quarterly Journal of Economics, 84(3), 488–500.

Allison, T. H., Davis, B. C., Short, J. C., & Webb, J. W. (2015). Crowdfunding in a prosocial microlending environment: Examining the role of intrinsic versus extrinsic cues. Entrepreneurship Theory and Practice, 39, 53–73.

Alvarez, S. A., & Barney, J. B. (2001). How entrepreneurial firms can benefit from alliances with large partners. Academy of Management Executive, 15, 139–148.

Arthurs, J. D., Hoskisson, R. E., Busenitz, L. W., & Johnson, R. A. (2008). Managerial agents watching other agents: Multiple agency conflicts regarding underpricing in IPO firms. Academy of Management Journal, 51, 277–294.

Audretsch, D. B. (2021). Have we oversold the Silicon Valley model of entrepreneurship? Small Business Economics, 56, 849–856.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, 99–120.

Batt, R., and Appelbaum, E. (2020). The agency costs of private equity: Why do limited partners still invest? (in press) Academy of Management Perspectives. https://doi.org/10.5465/amp.2018.0060.

Becker, G. S. (1964). Human capital: A theoretical and empirical analysis, with special reference to education. National Bureau of Economic Research.

Becker, G. S. (1965). A theory of the allocation of time. Economic Journal, 75, 493–517.

Becker, G. S. (1975). Human capital: A theoretical and empirical analysis, with special reference to education (2nd ed.). National Bureau of Economic Research.

Benson, D. F., Brau, J. C., Cicon, J., & Ferris, S. P. (2015). Strategically camouflaged corporate governance in IPOs: Entrepreneurial masking and impression management. Journal of Business Venturing, 30, 839–864.

Bergh, D. D., Ketchen, D., Orlandi, I., Heugens, P. P. M. A. R., & Boyd, B. (2019). Information asymmetry in management research: Past accomplishments and future opportunities. Journal of Management, 45(1), 122–158.

Bernstein, S., Dev, A., & Lerner, J. (2020). The creation and evolution of entrepreneurial public markets. Journal of Financial Economics, 136, 307–329.

Bertoni, F., Meoli, M., Vismara S. (2022). Too much of a good thing? Board independence and the value of initial public offerings. British Journal of Management, forthcoming.

Block, J. H., De Vries, G., Schumann, J. H., & Sandner, P. (2014). Trademarks and venture capital valuation. Journal of Business Venturing, 29, 525–542.

Block, J. H., Colombo, M., Cumming, D., & Vismara, S. (2018). New players in entrepreneurial finance and why they are there. Small Business Economics, 50, 239–250.

Block, J. H., Fisch, C., Vismara, S., & Andres, R. (2019). Private equity investment criteria: An experimental conjoint analysis of venture capital, business angels, and family offices. Journal of Corporate Finance, 58, 329–352.

Block, J. H., Groh, A., Hornuf, L., Vanacker, T., and Vismara, S. (2020). The entrepreneurial finance markets of the future: A comparison of crowdfunding and initial coin offerings. Small Business Economics. Forthcoming. https://doi.org/10.1007/s11187-020-00330-2.

Bochkay, K., Chychyla, R., Sankaraguruswamy, S., & Willenborg, M. (2018). Management disclosures of going concern uncertainties: The case of initial public offerings. Accounting Review, 93, 29–59.

Braune, E., Lantz, J.-S., Sahut, J.-M., & Teulon, F. (2021). Corporate venture capital in the IT sector and relationships in VC syndication networks. Small Business Economics, 56, 1221–1233.

Brown, R., & Mason, C. (2017). Looking inside the spiky bits: A critical review and conceptualisation of entrepreneurial ecosystems. Small Business Economics, 49, 11–30.

Bruton, G. D., Chahine, S., & Filatotchev, I. (2009). Founders, private equity investors, and underpricing in entrepreneurial IPOs. Entrepreneurship Theory and Practice, 33, 909–923.

Busenitz, L. W., Fiet, J. O., & Moesel, D. D. (2005). Signaling in venture capitalist – New venture team funding decisions: Does it indicate long-term venture outcomes? Entrepreneurship Theory and Practice, 29, 1–12.

Butler, A. W., & Goktan, M. S. (2013). On the role of inexperienced venture capitalists in taking companies public. Journal of Corporate Finance, 22, 299–319.

Butticè, V., Colombo, M. G., & Wright, M. (2017). Serial crowdfunding, social capital, and project success. Entrepreneurship Theory and Practice, 41, 183–207.

Butticè, V., Collewaert, V., Stroe, S., Vanacker, T., Vismara, S., and Walthoff-Borm, X. (2021). Equity crowdfunders’ human capital and signal set formation: Evidence from eye tracking, Entrepreneurship Theory and Practice, 1–27.

Butticè, V., Vismara, S. (2022). Inclusive digital finance: The industry of equity crowdfunding. Journal of Technology Transfer, Forthcoming. https://doi.org/10.1007/s10961-021-09875-0

Certo, S. T., Covin, J. G., Daily, C. M., & Dalton, D. R. (2001). Wealth and the effects of founder management among IPO-stage new ventures. Strategic Management Journal, 22, 641–658.

Chahine, S., & Zhang, Y. A. (2020). Change gears before speeding up: The roles of chief executive officer human capital and venture capitalist monitoring in chief executive officer change before initial public offering. Strategic Management Journal, 41, 1653–1681.

Chong, D., & Druckman, J. N. (2007). Framing theory. Annual Review of Political Science, 10, 103–129.

Chu, Y., Liu, M., & Zhang, S. (2022). The JOBS Act and mergers and acquisitions. Journal of Corporate Finance, 72, 1–14.

Claes, K., & Vissa, B. (2020). Does social similarity pay off? Homophily and venture capitalists’ deal valuation, downside risk protection, and financial returns in India. Organization Science, 31(3), 576–603.

Cohen, B. D., & Dean, T. J. (2005). Information asymmetry and investor valuation of IPOs: Top management team legitimacy as a capital market signal. Strategic Management Journal, 26, 683–690.

Colombo, M. G., & Grilli, L. (2005). Founders’ human capital and the growth of new technology-based firms: A competence-based view. Research Policy, 34, 795–816.

Colombo, M. G., and Montanaro, B. (2021a). Signal sequences: Venture capital, IPO and startup valuation at acquisitions. Working paper.

Colombo, M. G., and Montanaro, B. (2021b). Signals’ effectiveness in an auction setting: the impact of bidders’ information on the valuation of entrepreneurial ventures at acquisition. Working paper.

Colombo, M. G., Meoli, M., & Vismara, S. (2019). Signaling in science-based IPOs: The combined effect of affiliation with prestigious universities, underwriters, and venture capitalists. Journal of Business Venturing, 34, 141–177.

Colombo, M. G., Fisch, C., Momtaz, P. P., and Vismara, S. (2021). The CEO beauty premium: Founder CEO attractiveness and firm valuation in initial coin offerings. Strategic Entrepreneurship Journal, 1–31.

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011). Signaling theory: A review and assessment. Journal of Management, 37, 39–67.

Cotei, C., & Farhat, J. (2018). The M&A exit outcomes of new, young firms. Small Business Economics, 50, 545–567.

Cumming, D. J., & Vismara, S. (2017). De-segmenting research in entrepreneurial finance. Venture Capital, 19(1–2), 17–27.

Cumming, D. J., & Walz, U. (2010). Private equity returns and disclosure around the world. Journal of International Business Studies, 41, 727–754.

Cumming D., Hervé F., Manthé E., and Schwienbacher A. (2020). Testing-the-waters policy with hypothetical investment: Evidence from equity crowdfunding. Entrepreneurship: Theory and Practice, forthcoming,

Cumming, D., Meoli, M., & Vismara, S. (2021). Does equity crowdfunding democratize entrepreneurial finance? Small Business Economics, 56, 533–552.

Cummings, M. E., Rawhouser, H., Vismara, S., & Hamilton, E. L. (2020). An equity crowdfunding research agenda: Evidence from stakeholder participation in the rulemaking process. Small Business Economics, 54, 907–932. https://doi.org/10.1007/s11187-018-00134-5

Davila, A., Foster, G., & Gupta, M. (2003). Venture capital financing and the growth of startup firms. Journal of Business Venturing, 18, 689–708.