Abstract

Economic determinants of economic integration agreements have received ample attention in the economic literature. Political motivations for such agreements have been mostly studied as functions of domestic politics or in the context of conflict. In this paper the author suggests a different narrative. Economic integration may be used as an instrument of foreign policy, where political considerations influence the choice of contracting partners. He sketches a simple model that exhibits the proposed mechanism in which a big country chooses between alternatives for integration in terms of economic and political welfare gains, while a small country is indifferent between possible partners for integration. In the empirical part the author uses a novel dataset on political events to test the predictions of the model and finds evidence for the hypothesis that there is more to economic integration than “just trade”. Geopolitical considerations play a determining role in the choice of the contracting partner country and the depth of economic integration.

Similar content being viewed by others

1 Introduction

This connection between economic power and global influence explains why the United States is placing economics at the heart of our own foreign policy. I call it economic statecraft.

— former Secretary of State Hillary Clinton, Nov. 2012

Since the end of the Cold War the geography of economic integration agreements (EIA) is rapidly evolving. Bilateral and multilateral EIAsFootnote 1 have seen a massive boost in numbers since the early 1990’s, before the Brexit vote signaled a possible momentum towards disintegration. While part of the reason for regional and supra-regional trade agreements is grounded in obvious economic benefits, often there appears to be more than “just trade” as incentive. The connection between bilateral political relations and economic integration between partnering countries can be profound, as probably best exemplified by the arguably deepest and most advanced agreement, the European Union. For some country pairs, political motivations may even dominate trade gains altogether, defying the usual logic for how deep a trade agreement should be: Why e.g. has the US deeper agreements in the Middle East than with East Asian countries? Figure 1 underlines the intuition by showing the number of bilateral relations a country has with an underlying EIA. Aside from the highly integrated European continent, the Middle East in particular appears to be not only a politically volatile region, but also a hotbed of EIAs. Figures 2a and b display the changing nature of country pairs that form EIAs. Since the early 1960’s the average distance and ratio of GDPs between countries in active EIAs is growing and accelerating since the 1990’s.

This paper aims to address the question of how trade policy, in the form of signing a new or deepening of an existing EIA, is influenced by political considerations, and more specifically, why countries negotiate and sign agreements with little economic benefits. Aside from traditional trade gains, bilateral trade policy in the form of EIAs appears to follow a pattern in which larger countries form such agreements with smaller, but potentially geopolitically important countries.Footnote 2

As such, the paper is related to an extensive literature on the determinants and effects of economic integration. Limão (2016) provides comprehensive overviews of the literature on economic and non-economic determinants of preferential trade agreements—as well as their impact on trade. In Limão (2007) he provides the benchmark model on non-traditional determinants of economic integration that incorporates a generic non-trade issue into bilateral trade negotiations and identifies the implications on multilateral trade liberalization. I will build on this model to provide a theoretical intuition for the proposed mechanisms at play.

Baier and Bergstrand (2004) and Baier et al. (2014) provide analyses of economic determinants of free trade agreements. In Baier and Bergstrand (2007) they quantify the effect of free trade agreements on trade flows, taking into account potential endogeneity issues of selection into EIAs. Vicard (2009) shows that countries tend to follow different paths of economic integration that he finds, somewhat surprisingly, to exhibit similar trade impacts. Aichele et al. (2014) contribute to the debate on the economic and political effects of the Transatlantic Trade and Investment Partnership (TTIP) between the European Union and the United States. They estimate the impact of economic integration across the North Atlantic on gross trade, trade in value-added and welfare in a structural gravity framework similar in spirit to Caliendo and Parro (2015). This current paper deviates from these prior works by analyzing the impact of the depth of integration, hence moving away from the traditional binary coding of bilateral agreements. Maggi (2014) and Freund and Ornelas (2010) provide comprehensive overviews of the more recent developments since Baldwin and Venables (1995) and draw the frontiers in this field: According to Freund and Ornelas “participation in any [trade agreement] is a political decision,” warranting future research.

Previous work has established links between EIAs and conflict, capturing one facet of political motivations. Martin et al. (2008), in their aptly named paper “Make Trade Not War”, show that the onset of war greatly diminishes the value of traded goods, therefore implying that strong trading relations create higher opportunity costs for war, in turn minimizing the probability of conflict. In Martin et al. (2012) they then go on to show that this effect can be institutionalized by forming a trade agreement within a certain time window after a conflict. Vicard (2012) finds that deep economic integration between countries significantly reduces their probability of conflict, while shallow agreements do not. Other papers study the link between trade and politics in a broader sense. Glick and Taylor (2010) estimate the impact of the two world wars on trade and other economic indicators, using a gravity model approach similar to mine. Umana Dajud (2013) studies the impact of political proximity on trade flows, finding that countries ruled by governments that are similar in terms of their position on the left/right spectrum and degree of authoritarianism/libertarianism, have a greater exchange of goods. Lederman and Ozden (2007) show how US geopolitical interests, as expressed through political alliances, are played out against preferential access to the US market. Berger et al. (2013) reveal another aspect of the mixing of political and commercial interests by showing how CIA interventions lead to an increase in US imports by the affected country.

Naturally, the interaction between trade policy and foreign policy has also been studied from the perspective of political science. Waltz (1999) and Nye (1988, 2011) portray the thinking in the two most prominent schools of thought in this respect: the school of realism and that of (neo)liberalism. Others have established the link between domestic politics and trade agreements: Mansfield et al. (2002) show that trade agreements generate information that help leaders “show their constituents their achievements” during their time in power. Liu and Ornelas (2014) find further evidence for this hypothesis, showing that trade agreements can serve as a commitment device for the purpose of stabilizing a democratic regime (Maggi 2014). This resonates also with results from Mansfield et al. (2000), who demonstrate common characteristics of signatories of trade agreements: Democracies set trade barriers reciprocally at lower levels than autocracies.

This paper contributes to the literature by seeking to demonstrate the impact of political motivations for EIAs. Building on a modified version of the model introduced by Limão (2007), I show how in a stylized framework a big country may weigh alternative motivations for integration—of economic or political nature—while a smaller country may be indifferent between possible partner countries at the same time. I test these predictions with proxies for economic and political motivations for integration. The economic motivation is proxied by non-realized trade gains from bilateral economic integration computed using general equilibrium counterfactuals from a gravity framework. In the gravity setup I introduce an index of depth of integration that improves upon the customary estimation with a dummy variable, allowing for heterogeneity of effects. The political motivation is proxied by two new indices to describe the state of political relations between two countries—bilateral political importance and mood—harnessing the powers of the GDELT dataset on political events. I find evidence for the hypothesis that there is more to economic integration than “just trade”. Specifically, geopolitical considerations play a determining role in the choice of the contracting partner country and the depth of economic integration. Traditional trade gains and political considerations are substitutes for the choice of the partner country and depth of integration. This can explain, e.g., why the United States has formed deeper economic integration agreements with some geopolitically relevant countries in the Middle East, than with some economically relevant countries in East Asia.

The paper is structured as follows. In Sect. 2 I sketch a model that displays the mechanism through which countries choose their contracting partner for an EIA—allowing for economic and political motivations. In Sect. 3 I introduce an index of depth of economic integration, estimate the elasticity of trade to this depth and subsequently calculate the trade gains of existing and hypothetical EIAs between countries. In Sect. 4 I construct two new indices that quantify bilateral political relations: the mood and importance. Finally in Sect. 5 I bring both empirical components together and estimate the effect of political motivations as a determinant of trade policy. Section 6 concludes.

2 Theoretical model

The stylized model broadly follows Limão (2007). Aside from the initial setup and notation, it is particularly similar in the way the non-trade motivation for economic integration is modeled: A small country produces a public good with a positive externality for a big country, which may lead the latter to grant preferential access to its market to the former. The present model diverges from Limão (2007) in two important aspects, however. It is a one shot game that ignores enforcement constraints and its purpose is to demonstrate different outcomes contingent on initial parameters through comparative statics. The game takes place in a situation in which each country is potentially signing an economic integration agreement with one other country, weighing the alternatives. Hence, in the present model, there exists no multilateral trade policy.

Furthermore, the basic setting consists of three traded goods, indexed i, and as many countries, indexed j, with two big countries, E and P, and one small country, S. The two big countries—defined by their larger endowment with private goods—differ in that one, E, has an economically-focused population, while the other, P, a politically-aware population. Next to a public good G there exist different kinds of private goods: A non-traded good n, and three traded goods, lowercase e, p, and s.

For simplicity, each of the countries has a population of the size L and the two big countries are symmetric in economic size.Footnote 3 Each individual in the two big countries is endowed with one unit of each traded good \(i \in \{e, p\}\), while in the small country each individual is endowed with only one traded good \(i \in \{s\}\). The non-traded good is produced with labor and constant returns, with the marginal product normalized to 1.

2.1 The consumer

Each consumer in \(j \in \{ E, P, S \}\) has preferences over the consumption of the non-traded good \(c_{n}^{j}\), the traded goods \(c_{i}^{j}\) and a public good G. Each individual’s utility is written as

whereas the subutility function for the public good is

\(\lambda ^{j}\) is the weight placed on the public good G and global spillovers occur if \(\alpha ^{j}\) is non-zero, both of which are country specific. A high \(\alpha ^{j}\) signals a high sensitivity towards the public good produced abroad. \(\Psi\) and u are assumed to meet the Inada conditions. G can be interpreted as public expenditures to address policy issues with global spillovers, such as the fight against terrorism, for security against piracy, but also, like in Limão (2007) for environmental or labor standards.

The individual’s income y consists of a wage w, net taxes equal to a per capita lump-sum transfer of the government’s tariff revenue r minus a tax used to finance public good g, and her value of endowments with goods \(i \in \{ e, p, s \}\), so that

For given prices, taxes, income and level of G, the individual chooses the quantities of the private goods \(i \in \{ e, p, s \}\) she consumes to maximize her utility subject to the budget constraint

Given the assumptions on the utility, the budget constraint is satisfied with equality, thus individual demand is

for each of the traded goods. The individual’s indirect utility is then

where the last term represents consumer surplus.

As in Limão (2007), I am interested in the case in which there is an underprovision of the public good G in the small country from the point of view of the politically-aware country. I follow Limão’s assumptions on consumers in the small country and take the extreme case where the population in S places no weight (\(\lambda ^{S} = 0\)) on the provision of the public good and receives no utility from traded goods. As Limão (2007) shows, this “trick” circumvents any possible trade diversion effects and puts the focus on the non-economic motivation. Consumers in S only value the non-traded good. The indirect utility for individuals in the small country is therefore equal to income y. Furthermore, I assume that while consumers in E and P place the same weight on the provision of the domestic public good so that \(\lambda ^{E} = \lambda ^{P}\), while consumers in E do not care about the provision of the public good in other countries, so that \(\alpha ^{E} = 0\).Footnote 4 Hence, the indirect utility for individuals in E is equal to the value of the traded and non-traded goods, and the provision of G by the domestic government. This is the distinctive difference between the two big countries, which are otherwise indistinguishable.

2.2 The government

The government sets the trade policy and chooses G to maximize domestic aggregate welfare. The public good is produced using \(l_{g}^{j}\) units of labor in a linear production function

The population L is assumed to be sufficiently large so that the non-traded good is always produced in equilibrium, fixing the wage at unity. Then the cost of producing a given level \(G^{j}\) is simply \(l_{g}^{j}\). The tariff revenue is distributed to consumers as a lump-sum transfer and hence government revenue comes exclusively from taxes \(g^{j}\), so that the government budget constraint is

The government therefore chooses \(g^{j}\) to fund the production of \(G^{j}\). The government also decides on the tariffs on imported traded goods, \(\tau _{i}^{j}\).Footnote 5

2.3 Trade pattern and objective functions

As the two big countries E and P have the same endowments of each traded good, differences in the \(u_{i}^{j}\) and therefore in the respective demand determine the trade pattern of \(i \in \{e, p\}\). Similar to Limão (2007), for simplicity and without loss of generality, I assume that country E has a stronger preference for good e, and country P for good p. Hence, country E imports good e from P and vice versa. The small country derives no utility from these goods and therefore exports its endowment of good \(i \in \{s\}\) in its entirety, without importing any of the other two goods. This implies that the small country does not set any tariff, so that in case of economic integration it cannot offer any reduction of tariffs.Footnote 6 Thus, all the small country can offer to a big country is the provision of the public good. In return, lower tariffs from a big country increase the price that the small country receives for its exports of \(i \in \{s\}\). Figure 3 illustrates the trade pattern.

Prices \(p_{i}^{j}\) are therefore determined through net imports \(M_{i}^{j}\) summing to zero, so that

Net imports are given by \(M_{i}^{j} = \left( d_{i}^{j} \left( p_{i}^{j} \right) - 1\right) L\) for \(j \in \{E, P\}\) and \(M_{s}^{S} = -L\). The objective functions in terms of the policy variables for the three governments are then

for the small country, while for the economically-minded being

and finally for the politically-aware country

\(\gamma\) is the share of exports from S to E (and hence \(1 - \gamma\) the share to P) and \(\eta _{i}^{j} = v_{i}^{j} \left( p_{i}^{j} \left( \tau _{i}^{j} \right) \right)\) the consumer surplus from good i in country j. Similar to Limão (2007), for the small country the objective function, Eq. (1), consists of aggregate wages Lw, the production cost for the provision of the public good \(Lg^{S}\) as well as the export revenue by destination E and P. For the economically-focused country the objective function, Eq. (2), consists of aggregate wages, productions costs for the public good, and the utility from the domestic public good \(\lambda ^{E} \Psi \left( b^{E} L g^{E} \right)\), as well as tariff revenue on net imports (second row) and the aggregate surplus from goods \(i \in \{e, p, s\}\) (third row). The objective function in the politically-aware country, Eq. (3), is analogous to the one in the economically-focused one, with the addition of the terms \(\alpha ^{P} \lambda ^{P} \Psi \left( b^{j} L g^{j}\right) \, \forall \, j \in \{E, S\}\) that represent the sensitivity to public goods produced abroad.

2.4 Comparative statics: integrating for economic or political reasons

The situation is the following. Each country can enter an EIA with one of the other countries. Hence there are three possible scenarios of integration: P with E, P with S and E with S. Assume that the differences in demand are sufficiently large such that lower trade barriers are always Pareto improving. Given the asymmetries of the countries and following Limão (2007), the two big countries possess all the bargaining power in negotiations with the small country, while they have equal bargaining power in bilateral negotiations.

The non-cooperative Nash outcome is given by a solution \(\{\tau _{i}^{j}, g^{S}\}\), i.e. all import tariffs by good and country and the level of provision of the public good in S.Footnote 7 The solution is found by maximizing Eqs. (1), (2) and (3) taking the other countries’ policies as given. Analogous to the maximization problem in Limão (2007) this yields

The respective \(\overline{\tau }_{i}^{j}\) depend on the utility functions \(u_{i}^{j}\) and represent the upper bound tariff. The import tariffs on good s are both equal to the price of s in both countries: As S does not value the good, both big countries increase their tariff until it equals the price, thereby fully extracting and sharing the surplus. At the same time, S does not value the public good and hence provides none of it.

In this situation, multiple scenarios would yield welfare improvements for at least one of the countries. E would benefit from lower tariffs in P, i.e. for \(\tau _{p}^{P \prime } < \overline{\tau }_{p}^{P}\); P would benefit from lower tariffs in E, i.e. for \(\tau _{e}^{E \prime } < \overline{\tau }_{e}^{E}\); S would benefit from lower tariffs in P and E, i.e. for \(\tau _{s}^{j \prime } < \overline{\tau }_{s}^{j}\) and P would benefit from higher production of the public good in S, i.e. \(g^{S \prime } > g^{S} = 0\). Setting enforcement issues aside, all three countries now consider which other country to integrate with. An agreement only comes to fruition when both parties agree.

I first consider the options for the economically-focused country: As described above, an integration with S offers no welfare improvement to E, as S does not import anything from E and E only values the domestically produced public good \(g^{E}\). The country hence offers the exact same deal as before, such that \(\tau _{s}^{E \prime } = \overline{\tau }_{s}^{E}\). On the other hand, integrating with P through reciprocally lower bilateral import tariffs yields improvements in welfare for E. The government of E will hence only form an agreement with P, as it is the only option that is welfare improving under the assumptions given. Tariffs in this situation are defined by

The politically-aware country considers two options: Integration with S offers welfare improvements through the production of the public good in S, whereas integration with E yields welfare improvements through reciprocally lower tariffs. Tariffs in the latter situation are—analogously to above—given by:

The former situation, integration of P with S is similar to the solution described by Limão (2007) in detail:

Here, P benefits from an increase in \(g^{S}\) up until the constraint binds, which is at the point where S is indifferent to the previous situation of \(\overline{\tau }_{s}^{P}\) and \(g^{S} = 0\). By way of Eq. (1) the solution is therefore at \(g^{S \prime } ( \overline{\tau }_{s}^{P} ) = ( \overline{\tau }_{s}^{P} - \tau _{s}^{P} ) / L\), where the per capita revenue of S’s exports to P is equal to the tax required to fund the provision of \(g^{S}\).

The alternatives for the small country are simple: As both big countries have all bargaining power, they both offer a “take it or leave it” contract to the small country. From the point of view of a consumer in S, then, the welfare implications of the two alternatives are exactly the same, as both offer no welfare improvement. Hence the government of S is indifferent between both potential partners.

In the end, it all comes down to the politically-aware country: P can improve its welfare by either integrating with E and reaping further utility through the consumption of imported traded goods, i.e. an economic motivation. Alternatively, P can integrate with S and improve its aggregate welfare by deriving utility from the provision of \(g^{S}\), i.e. a political motivation, produced by the smaller country although S itself does not gain any utility from it. Which of the two options prevails can be deduced from comparing the new welfare achieved by either integrating with P or S. Let a tilde describe the difference of a variable after P integrating with either S or E, so e.g. \(\widetilde{W}^{P} = W^{P \prime S} - W^{P \prime E}\) being the difference in the welfare outcome for P after integrating with either S or E, or the difference of a function evaluated for the two situations, i.e. \(\widetilde{\Psi } \left( \widetilde{x}\right) = \Psi (x^{P \prime S}) - \Psi \left( x^{P \prime E}\right)\).

In case \(\widetilde{W}^{P} > 0\), integrating with S leads to higher welfare for P than integrating with E, and vice-versa. Using Eqs. (3) and (7) and rearranging yields

where the first terms, \(\alpha ^{P} \lambda ^{P} \left( \widetilde{\Psi }\left( b^{S} L \widetilde{g}^{S}\right) + \widetilde{\Psi }\left( b^{E} L \widetilde{g}^{E} \right) \right)\) describe the difference in the changes in the production of the public good produced abroad, i.e. in S and E after integration. \(\Gamma ^{P} = \lambda ^{P} \widetilde{\Psi }( b^{P} L \widetilde{g}^{P} ) - \widetilde{g}^{P}\) denote the difference in the changes in the domestic production of the public good in P itself, and \(\Upsilon ^{P} = \left( \widetilde{M}_{s}^{P} \overline{\tau }_{s}^{P} - M_{s}^{P \prime S} \tau _{s}^{P} + \widetilde{M}_{p}^{P} \tau _{p}^{P} \right) / L + \widetilde{p}_{e}^{P} + \widetilde{p}_{p}^{P} + \widetilde{\eta }_{s}^{P} + \widetilde{\eta }_{e}^{P} + \widetilde{\eta }_{p}^{P}\) the differences in the changes of the usual economic terms, i.e. tariff revenue and aggregate surplus.Footnote 8 As P indirectly funds S’s provision of its public good in case of integration, a large parameter \(\alpha ^{P}\)—a high sensitivity towards the public good produced abroad—ceteris paribus may dominate the welfare comparison. To put it in other words, a sufficiently large \(\alpha ^{P}\) can potentially lead to a larger change in welfare from economically integrating with the small country than the change in welfare from reciprocally lower trade barriers by integrating with the other big country.

2.5 Reduced form predictions of the model

The reduced form predictions of this stylized model are therefore twofold:

Prediction 1

Countries may pursue economic integration with the aim of the provision of a public good by the partner country, weighing economic against non-economic benefits. Either this geopolitical or economic motivation is a necessary, but neither is a sufficient condition for integration.

Prediction 2

The degree to which countries pursue economic integration with a geopolitical motivation is constraint by their bargaining power. A “big” country may do so, while a “small” country—due to its limited bargaining power—is indifferent between integrating with a selection of comparably big countries. This does not mean the small country is passive in the negotiations, it is merely indifferent between alternatives.

I test these predictions in Sect. 5, using proxies for economic and political motivations that I describe in more detail in the following.

3 Depth and trade gains of economic integration

In order to analyze the effect of political motivations for economic integration, I first estimate the trade gains brought about by the agreement, which are unquestionably a primary determinant. More specifically, I compute non-realized trade gains as a proxy for the economic motivation to integrate with a partner country. I do this with the help of a structural gravity framework.

The existence of a trade agreement, whether in a form of a full-fledged FTA or a mere bilateral agreement on minor tariff reductions, has traditionally appeared as a dummy variable in most gravity equations. However, this might leave out important information about the depth of an agreement and therefore the effect on trade flows between two countries. I account for this heterogeneity by constructing an index of depth for 306 unique agreements.Footnote 9

3.1 Depth of economic integration agreements

The main characteristics of the design of an EIA are its depth, scope and flexibility (Baccini et al., 2015). Deep EIAs, as understood in the economic literature, exhibit far-reaching regulatory provisions that go beyond a mere decrease or abolition of tariffs. The inclusion of further rules, e.g. on government procurement, services and intellectual property describe a wider scope. Flexibility describes the mechanisms and circumstances under which countries may break these provisions without voiding the entire agreement.

Breaking down these features of EIAs into one index is obviously a difficult task. The multidimensionality of the information on each agreement will be lost to a certain degree. Kohl et al. (2016) propose an aggregate “index of trade agreement heterogeneity” by counting the number of areas covered by the agreement and dividing by all areas that are available in the data. In order to account for the distinction between depth and scope, I refine this index by weighting by legal enforceability of the provisions. Horn et al. (2010) and Orefice and Rocha (2014), upon whose data the index is primarily built, code agreements by area with 2 for legally enforceable provision, 1 for non-enforceable provision and 0 for no provision at all.Footnote 10 I follow this notion and give legally enforceable provisions twice the weight as non-enforceable ones, implicitly forming the assumption that legal enforceability is increasing the depth of an EIA.Footnote 11 The index of depth of integration then reads

where \(I_{p,odt}\) is an indicator for whether a provision p is in force between two countries o and d at time t.Footnote 12 The indicator variable is set to 1 if the agreement includes provisions in the respective area, to 2 if these provisions are also legally enforceable, and to 0 otherwise.

EIAs can be bilateral or multilateral and additionally often allow for accessions of further countries. I treat agreements between multiple countries as a “web of bilateral” treaties. Agreements between the EU and a third country are therefore treated exactly the same as individual agreements of each EU member state with this third country. Accessions are also treated as bilateral treaties, however only between existing countries and the newly acceding country. Additionally, new member states “inherit” old agreements between the trading bloc and non-member trade agreement partners.Footnote 13 As some country pairs have signed more than one agreement over time which all remain in effect while covering different issues, the overall depth of integration \(\mathbf {d}\) between countries is therefore at least as big as any one depth of the separate agreements. The index is based on an updated and extended version of the accompanying database included in the Word Trade Report 2011Footnote 14 and the dataset provided alongside Kohl et al. (2016). I further extend the data to account for entries to and exits from agreements allowing the introduction of a proper time dimension.Footnote 15 The index is constructed for all years between 1950 and 2010.

According to the index, the three deepest agreements are the European Union (1), NAFTA (0.77) and the EU-Turkey customs union and association agreement (0.76). Figure 4a shows the distribution of depths of EIAs in 2000, capturing a total of 5236 unique bilateral relations with EIA, out of approximately 40.000 bilateral country pair relations. The mean depth is 0.534.Footnote 16 Figure 4b shows the evolution of depth between Germany and France from 1950 to 2006. After the initial step of economic integration through the European Coal and Steel Community, successive waves of integration are reflected in the increase of the index of depth of integration. This variation from the time dimension will be used below to estimate the elasticity of trade to the depth of integration between two countries.

3.2 Estimating trade gains with gravity

In order to compute the trade gains of an EIA, I turn to a standard structural gravity framework, similar to the one used by Crozet and Hinz (2016) and Anderson et al. (2018). The framework allows for a straightforward quantification of trade flows in the presence (and absence) of trade barriers, reflecting general equilibrium effects of changes in trade costs. I describe the technical details of the approach in Appendix B and provide a short intuition in the following paragraphs.

The central idea is to proxy the trade gains from a change in depth of bilateral integration for the origin country o with destination country d at time t from a depth of \(d_{odt}\) to \(d_{odt}'\) by the relative change in country o’s total exports, i.e. its production and hence income, such that

where \(X_{odt}\) is the trade flow between the two countries o and d at time t.Footnote 17 Let this flow be described by a structural gravity structure as in Head and Mayer (2014), so that

where \(Y_{ot} = \sum _{d} X_{odt}\) is the exporter-specific value of production in o at time t, i.e. all exports, and \(E_{dt} = \sum _{o} X_{odt}\) is the importer-specific value of expenditure in d time t, i.e. all imports. \(\Omega _{ot}\) and \(\Phi _{dt}\) are the so-called outward and inward multilateral resistance terms, which are defined as

Trade costs \(\tau _{odt}\) are assumed to be dependent on the depth of integration and other natural or policy-induced trade barriers, such that

\(\rho\) is the elasticity of trade to the depth of integration \(\mathbf {d}_{odt}\) between countries o and d at time t, as defined above. The elasticity is assumed to be constant across country pairs and over time, which allows me to exploit the depth’s variation over time and country pairs to obtain an estimate for the parameter. \(\nu _{odt}\) is a vector of additional standard trade barriers, such as distance, common language, etc., and \(\eta\) the vector of respective elasticities.

The structure of this simple yet powerful model allows me to quantify general equilibrium counterfactual trade flows between all countries conditional on any \(\mathbf {d}_{odt}'\), and hence compute trade gains with respect to any particular depth of any hypothetical agreement between any two countries. All necessary components can be estimated by relying only on bilateral trade flows as well as the specified trade cost components.

Specifically, I estimate Eq. (10) with a Pseudo-Poisson Maximum Likelihood procedure by regressing bilateral flows between country o and d at time t on the index of depth of integration, and origin \(\times\) time, destination \(\times\) time, as well as an origin \(\times\) destination fixed effects to capture all time-invariant bilateral trade barriers, such that:Footnote 18

The estimated coefficient \(\rho\), i.e. the elasticity of trade with respect to the depth of integration, in combination with the estimated fixed effects allow me to back out all components of Eq. (10).Footnote 19 Trade data and a number of time-varying standard gravity controls, in this case the incidence of conflict, a hegemony-colony relationship and common membership in a monetary union, are sourced from the CEPII gravity dataset (Head et al., 2010).

Table 1 reports the estimated coefficients for the PPML estimator in columns (1) and (2), and an OLS estimator—without zero flows—in columns (3) and (4). The models in columns (1) and (3) estimate the elasticity of trade with respect to the depth index described above, columns (2) and (4) report the elasticity with respect to the more customary binary indicator for an EIA for the purpose of comparison with prior works. The preferred specification in column (1) yields a \(\widehat{\rho } = 0.321\), implying an increase in bilateral trade between origin and destination country of about \(\exp (0.321) * 1 - 1 = 37 \%\) for a full-depth EIA.Footnote 20 The comparable OLS estimate in column (3) yields 0.77—significantly higher, as often the case with OLS versus PPML (Head and Mayer, 2014). The results using a binary indicator yield 0.173 and 0.502, respectively. This translates into average effects of EIAs on trade of between 19 and 65 %, similar to those found in the related literature.Footnote 21

Having estimated all necessary components of Eq. (10), I can now compute the non-realized trade gains for the hypothetical bilateral integration of any country pair, i.e. the foregone increase in exports by not having signed a full-depth agreement yet. In line with the model in Sect. 2, where increased exports through lower trade costs improve welfare through higher income, I will use these non-realized trade gains to proxy the economic motivation for integration. Specifically, these non-realized trade gains are computed as

where all \(\overline{\mathbf {d}}_{odt}\) denotes the actual current depth of integration, and \(\widehat{X}_{jkt} \left( \mathbf {d}_{odt}^{\prime } = 1 \right)\) are elements of the counterfactual trade matrix resulting from a depth of integration between countries o and d being \(\mathbf {d}_{odt}^{\prime } = 1\).

Table 2a, b and c display the top 10 of bilateral trade relations for the United States in 2006 in terms of currently realized trade gains, i.e. \(\text {Trade gains}_{odt} \left( \mathbf {d}_{odt} = 0, \mathbf {d'}_{odt} = \overline{\mathbf {d}}_{odt} \right)\), hypothetical trade gains for a full-depth integration, or \(\text {Trade gains}_{odt} \left( \mathbf {d}_{odt} = 0, \mathbf {d'}_{odt} = 1\right)\), and non-realized trade gains, i.e. \(\text {Trade gains}_{odt} \left( \mathbf {d}_{odt} = \overline{\mathbf {d}}_{odt}, \mathbf {d'}_{odt} = 1\right)\). The ranking and magnitude of realized, full-depth and non-realized trade gains is very sensible. At the same time, the rankings display the curious choices of US trade policy. Canada and Mexico rank high in both rankings of realized and full-depth trade gains (ranked 1st and 2nd in Table 2a as well as in Table 2b) and can be considered natural partners for EIAs, with clear economic justification. Other top rankings of realized trade gains are more unusual: Australia, Singapore, Chile and Israel are comparatively small economies and far away. Neither of them shows up in the top 10 of full-depth trade gains (Singapore is ranked 11th, Australia 13th, Israel 27th and Chile 32nd). In fact, in 2006 the United States had EIAs with only two countries ranked in the top 10 of full-depth trade gains (Mexico and Canada), while top-ranked economies like Japan, China and Germany did not enjoy trade at preferential terms.Footnote 22

In the following I use these non-realized trade gains as a proxy for economic motivations to form EIAs with the respective partner country. As described above, were only these economic motivations at play when policymakers decide to pursue economic integration, the ranking of non-realized trade gains would amount to a list of “low-hanging fruit”. One after another, countries would sign new or deepen existing agreements based on the highest expected trade gains. As this appears not to be the case in the real world, I now explore ways to quantify political motivations.

4 Quantification of political motivation

Having obtained estimates for trade gains as the economic motivation behind forming an EIA, I now proceed to constructing the hypothesized second motivation for such agreement: a political motivation. Quantifying political motivations behind the formation of EIAs is a daunting task. Although often an acknowledged aspect in economic transactions of various kinds, finding a proper proxy is marred by the qualitative nature of political exchanges.

In the recent literature a popular way to describe bilateral political relations has been to equate it to an aligned foreign policy, proxied by the similarity of voting patterns in the UN General Assembly with data from Voeten and Merdzanovic (2009). The idea implicitly invokes the “my enemy’s enemy is my friend” rationale. Rose (2007) equates political interest to the geopolitical importance of the bilateral partner for a domestic country and finds the number of embassy staff as an interesting proxy. Umana Dajud (2013) measures political proximity of countries along two axis, the political left/right and authoritarianism/libertarianism, using data from the Manifesto Project (Volkens et al., 2013) on the agenda of political parties in elections and from the Polity IV project (Marshall and Jaggers, 2002), respectively.

I proceed differently in this paper and follow Pollins (1989) and Desbordes and Vicard (2009) in constructing quantitative measures of bilateral political relations with event data. For this I rely on data from the “Global Database of Events, Language, and Tone” ((Leetaru and Schrodt, 2013), GDELT). Almost all of the proxies for political relations described above are not directional,Footnote 23 i.e. the measures yield the same value for a country pair from o to d and d to o. This may not be an issue when interested in how similar certain policies or points of view from two countries are, it does matter however when interested in how important the countries are for one another. The GDELT dataset allows me to compute such a directional measure. The vast dataset of more than 300 million events since 1979 offers an unsurprisingly very noisy, but incredibly rich view on political events in virtually all countries. The data, which is open source and freely available, is collected via software-read and coded news reports from a variety of international news agencies. Its wealth of data has excited much of the empirical political science for enabling a true testing of political theories,Footnote 24 but to the best of my knowledge has not yet been used in the economic literature.

Next to the date and link to source articles from major news agencies, each event is geo-, actor-, and verb-coded following the CAMEO taxonomy (Gerner et al., 2002).Footnote 25 Verb- and actor-coding yields categorical descriptions of actions and participants by nationality and broad profession/affiliation. As an example, the event “Sudanese students and police fought in the Egyptian capital" is identified as “SUDEDU fought COP” and geo-tagged to Cairo, Egypt. This allows the extraction of information about people (of potentially different countries) involved. Additionally the geolocation can be exploited to verify the “directionality”. Based on the respective verb, each event is classified by the GDELT database into one of the four categories of “material cooperation”, “verbal cooperation”, “verbal conflict” or “material conflict”. Using the information on the date, location, nationalities of actors involved and these four categories, I construct two indices describing the status of the political relationship between two countries: the “mood” and the “importance”.

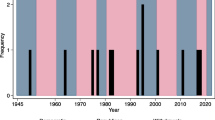

While the dataset offers daily (and daily updated) information, I aggregate by year, as to reflect to the rather long-term nature of political relationships. While an aggregation to monthly, weekly or even daily data would be possible, it were to exhibit a much higher variance and deteriorate in its purpose of portraying general trends.Footnote 26 I also restrict the data to international events, where the two actor variables reflect people or entities from two different countries.Footnote 27 Furthermore, I exclude events that fall below a certain threshold of the number of newspaper articles they are mentioned in.Footnote 28 In order to ensure the indicators to be representative to a certain degree, I further exclude all country-pair-year observations that fall below a threshold of 10 events. The final dataset comprises 7107095 events. See Tables 6 and 7 in Appendix Sect. D for more detail on the aggregation technique and descriptive statistics.

The mood of the political relations between countries o and d (and vice versa) is defined as

where \(M^{cp}_{odt}\) is the count of events in a year t initiated in country o towards country d that fall into the category “material cooperation”. \(V^{cp}_{odt}\), \(V^{cf}_{odt}\) and \(M^{cf}_{odt}\) hence are those counts of “verbal cooperation”, “verbal conflict” or “material conflict” respectively, with the analogous definition for events in d towards o.Footnote 29 The latter two terms are given negative weights, while the former two are given positive weights, and assuming verbal exchanges to be of less consequence with a weight of one third, the index then describes the mood of political relations on the \([-1, 1]\) interval.Footnote 30 The choice of using \(\frac{1}{3}\) as the weight for “verbal” events is chosen for the equal length of intervals between categories.Footnote 31

Figure 5 shows the evolution of the mood index for the country pairs Israel and Palestine, as well as Israel and USA, with the global median as a benchmark. The grey-shaded area denotes the interval between the 10th and 90th percentiles. The level and variation of the bilateral moods appears sensible. For the pair of Israel and Palestine, vividly shows historical episodes of improving and deteriorating relations: the first Intifada (1987–1993), the Oslo Peace Process up to Camp David (1993–2000), and the second Intifada (2000–2005). Almost throughout the entire observed time period the bilateral mood ranks the country pair in the least friendly 10 percentile of global relations.

However, the mood of political relations is not all that counts: Relations between countries can be generally positive or negative, but practically irrelevant for one another anyway. I therefore construct a directional index of importance of country d to country o

The index reflects the share of events, regardless of the four categories, that took place in country o in year t that involved country d. Figure 6 reports the evolution of the importance index again for the country pairs Israel-Palestine and Israel-USA, as well as the global median and the 10th and 90th percentiles as a benchmark. As expected, except for USA - Israel relations, all levels of bilateral importance of these “special” country pairs are in the top 10 percentile of global bilateral relationships throughout the observed time period. The respective bilateral importances, however, do not necessarily closely follow one another, yet again the data series exhibits a variation and different levels that reflect historical episodes of political relations: Israel appears to be more important to Palestine than vice versa, particularly since the end of the second Intifada, while the indices peak in unison in times of strained political relations.

The two indices offer greater detail into the nature of the bilateral relation between countries than previous measures. In fact, “mood” and “importance” explain about 94 % of the variation of aforementioned Voeten and Merdzanovic (2009)’s UNGA similarity index, while being (in part) directional and differentiating between two aspects of relations.Footnote 32

In the context of this present study the two indices reveal interesting patterns with respect to the formation of EIAs. Figure 7a shows the evolution of the mean mood of a country pair that is about to sign an EIA with one another at time \(t = 0\) (solid line) compared to other countries (dashed line). The mean mood is significantly better towards the partner country than towards other countries in the time prior to the agreement, but insignificantly different in the time afterwards. When differentiating between a bigger country and a smaller country—in terms of GDP—at the time the respective country forms an EIA, the importance figure however shows a particularly interesting pattern. Here the picture is heterogeneous for the evolution of the mean of the importance indices for the big towards the small country in Fig. 7b and the small towards the big country in Fig. 7c. Apart from the different levels of importance of a small country for a big country and vice versa, the evolution is different. It appears as though small countries with which a big country is about to form an EIA at a time \(t = 0\) are much more important than other small countries. This is different for the inverse case: For small countries there is very little difference between different bigger countries in their respective importance, whether they will be a partner in a future EIA or not. Overall, the data suggests a story in which a larger country could be interested to form an agreement with those smaller countries that are politically more important, while for smaller countries this is not the case. This also gives further plausibility for the assumptions of the model in Sect. 2, which gave a big country political interests in small countries, yet not the vice versa.

5 Political and economic motivations for economic integration

With quantitative proxies for both economic and political motivations at hand, I can proceed to address the main question of this paper: How is trade policy influenced by foreign policy objectives and why do countries form agreements with little trade gains? Who do countries sign economic integration agreements with?

I first look at the determinants of the choice of the contracting partner when countries form a new or deepen an existing EIA. As suggested by Prediction 1 in the stylized model in Sect. 2, political motivations may be a key driver of economic integration. I then explore possible heterogeneities between smaller and bigger countries—as suggested by Prediction 2.

5.1 Benchmark regression

As developed above, were policymakers only motivated by economic incentives, trade gains alone should be able to explain the choice of the partner country when forming EIAs. Armed with proxies for economic motivations and hypothesized political motivations, I estimate the probability of forming an EIA with any given country at time \(t + 1\) by regressing the following equation:

The dependent variable is the probability that at a time \(t + 1\) when o does form an EIA, it does so with country d, i.e. that in time \(t+1\) the depth of integration between o and d, \(\mathbf {d}_{odt}\), is greater than 0, given that it was 0 before. The independent variables are the importance of d for country o at time t, the mood between o and d at time t and the non-realized trade gains o has by not having full-depth integration with d at time t. The interaction terms capture whether the two possible motivations are alternatives or complements. Next to Eq. (13), I also estimate a similar equation with the change in depths of integration, such that

The equation is equivalent to the previous one with the exception that also changes in depth are taken into account, i.e. the deepening of existing integration agreements. In both regressions, \(\beta _{1}\) and \(\beta _{2}\) capture the effect of bilateral political importance and mood, which are expected to be positive. \(\beta _{3}\) is also expected to be positive, while the signs of the coefficients on the interactions of political motivations and economic motivations, \(\beta _{4}\) and \(\beta _{5}\), could go either way. I estimate Eq. (13) in a linear probability model with an OLS estimator following Wooldridge (2012) and a fixed effects Probit estimator following Hinz et al. (2020). I include country \(\times\) year fixed effects in all specifications. Standard errors are clustered at the country-year level.

Table 3 columns (1) and (2) report the coefficients for the estimation of Eq. (13). With both estimators, OLS and Probit, the importance and mood variables, as well as trade gains have the expected positive sign and are highly significant. The interaction of the importance index with the trade gains measure has a significant negative coefficient, pointing to the two motivations as substitutes. The coefficient for the interaction of the mood variable with trade gains is insignificant in both specifications.Footnote 33

Table 3 column (4) reports the coefficients for the estimation of Eq. (14) where the change in depth is the dependent variable. The overall picture is confirmed. A concern could be that the results are driven by the initial formations of EIAs and less so by the deepening of existing ones. In column (5) I report the results for only these cases of deepened EIAs. While the coefficients for importance drops by an order of magnitude, it remains positive and significant. All other estimated coefficients are similar to those in the other specifications and remain statistically significant.

The previous specifications, however, do not address the potential endogeneity of political relations to (negotiations for) economic integration—the importance measure in particular comes to mind. I address this concern by following an instrumental variable strategy that is inspired by the literature on the identification of peer effects on individuals’ economic outcomes. Bramoullé et al. (2009) show that certain network structures of social networks of individuals can be used for the identification. As countries’ bilateral political relations can easily be thought of as a social network among countries, I adapt to the current setting one of these proposed network structures: Friends of friends, that are not friends themselves, i.e. a network with intransitive triads (Bramoullé et al., 2009). At the same time, it is highly unlikely that negotiations between two countries systematically affect bilateral political relations of the two affected countries with all other countries. I therefore instrument country d’s importance to a country o by aggregating all other countries’ \(k \backslash \{o, d\}\) importances towards d, weighted by country o’s importance towards \(k \backslash \{o, d\}\), such that \(\sum _{k \backslash \{o,d\}} \left( \text {Importance}_{okt} \cdot \text {Importance}_{kdt} \right)\). Given a matrix of importances between all countries \(\mathbf {A}\) and a zero diagonal, the bilateral \(Importance_{odt}\) is instrumented with the respective odt element in the matrix product \(\mathbf {A}\mathbf {A}\). Figure 8 shows a strong correlation between the importance measure and the instrument. The results for the first stage are displayed in Table 8 in Appendix E. The F-statistic on the instruments are well above the customary threshold of 10 for strong instruments. Columns (3) and (6) of Table 3 report the coefficients for the IV estimation, confirming the previous results.

Overall, the results provide evidence for Prediction 1 from the model presented in Sect. 2. Next to anticipated trade gains, bilateral importance and mood appear to play a significant role in the choice of the contracting partner country.

5.2 Heterogeneity in motivations

As laid out by Prediction 2, the model predicts a heterogeneity in the motivations for economic integration, depending on whether a country is a “senior” or “junior” partner in the agreement. Figure 7 gave a first hint that these “average” results may shield important heterogeneity in the motivations. As suggested, bigger countries might sign EIAs with smaller countries for political purposes. To test this proposition, I dichotomize the sample by size of GDP at the time of the formation of the agreement, so as to have a big and small country as the two countries pursuing economic integration. I then re-estimate slight modifications of Eqs. 13 and 14 and include proxies for political and economic motivations from both countries. The regression for the probability to form a new agreement then yields

where the variables and coefficients have the equivalent interpretations as above. The difference here is that o is a bigger country, d a smaller country, so that now all variables subscripted dot denote those for the smaller partner country. Again I also estimate a corresponding equation for a change in depths of integration, so that Eq. (14) here becomes

The interpretation of the variables and coefficients is equivalent to those of Eq. (15) above. In the current context, when dichotomizing the sample, the importance of the small country for the bigger country, i.e. Importance\(_{odt}\), is expected to have a positive effect, while that of the big country for the smaller country, i.e. Importance\(_{dot}\), less so. As before, all regressions include fixed effects for origin and destination country by year to account for unobservables. Standard errors are clustered at the country year level.

Table 4 shows the results for a number of different samples and specifications of Eqs. (15) and (16). The coefficients for the benchmark estimation in column (1) show the expected signs: The more important a small country is for the big country and the greater the trade gains, the greater the probability to form an EIA in the following year. The importance of the big country for the small country is positive and significant as well, while much less so in magnitude compared to the inverse relationship. Bilateral mood is insignificant. In column (2) I re-implement the IV strategy from the previous section. The results are largely confirmed.Footnote 34 In order to test whether anticipation effects of an impending agreement could drive the results, column (3) reports the coefficient when re-estimating Eq. (15) with 10-year lagged variables.Footnote 35 While the coefficients for importance and its interaction with trade gains are markedly smaller, the overall story remains.

Columns (4)–(6) of show Table 4 the analogous results for the estimation of Eq. (16), i.e. the change in depth as the dependent variable. Overall, while in some cases different in magnitude, the point estimates are similar to the ones of estimating the probability of forming a new agreement, so that the overall narrative is confirmed. The results support the notion put forward by Prediction 2: “Big” countries may have alternative motivations for economic integration, weighing trade gains and political motivations. Small countries, on the other hand, appear to be largely indifferent between choices of potential contracting partners.

5.3 Robustness checks

In order to ensure that these results are not spuriously driven by some countries with “special” relationships, the specificities of the new political indicators of importance and mood, or that results actually reflect the impact of other geographic and political variables, I now conduct a number of robustness checks.

It could be that both trade gains and political relations—importance in particular—are merely reflecting deeper geographic, cultural or historic connections between countries. In Table 10 in Appendix E I therefore add standard gravity control variables—contiguity, common language, colonial history, past conflict and the log of bilateral distances—as additional control variables. Columns (1) and (3) correspond to the specifications of Table 3 columns (1) and (4), i.e. the benchmark specifications for the determinants of the formation and deepening of bilateral integration. Columns (2) and (4) correspond to the extension that explores the heterogeneity between small and big countries, i.e. those reported in Table 4 columns (1) and (4). All variables of interest retain the expected signs and magnitudes vary only slightly. The coefficients on the included gravity covariates themselves are in line with previous results from Martin et al. (2012), who also find that a common colonial history and recent previous conflict tend to decrease the probability for countries to enter a new agreement.

Of concern could also be that the results are singularly driven by the European Union, whose declared political goal is an “ever closer union” (EU European Council 1983). In Table 11 in Appendix E I conduct a number of experiments with relevant subsamples. Columns (1) and (4) report the benchmark specifications when removing all connections to and from current EU countries. The coefficients on all variables of interest keep their expected sign, and remain at similar levels and statistically significant. In columns (2) and (5) I replicate the exercise with a sample restricted to only intra EU relationships. While overall the results appear to hold, one possibly interesting point to raise is that instead of a highly significant importance measure, the bilateral mood appears to be of particular relevance for EU integration.

A last concern could be that above results are spuriously driven by the new indicators for political relations introduced in this paper. I therefore perform the same regression with Voeten and Merdzanovic (2009)’s often-used indicator on the similarity of UN General Assembly votes by the two countries. Columns (3) and (6) of Table 11 report the results. I again find a positive and significant impact of political relations and a significant negative coefficient on its interaction with trade gains.

The outcomes of these robustness checks underline the overall validity of the results: As postulated by Prediction 1, political considerations appear to be a major determinant of economic integration. Complementary to Martin et al. (2012)’s results, previous conflict is only one of several potential avenues for politics to shape economic integration. General political considerations, captured by the bilateral importance of countries, is another. On top of that, Prediction 2 asserts that there may be substantial heterogeneity between countries in terms of their ability to pursue economic integration for political purposes. The empirical results support this notion: Bigger countries, as measured by GDP, appear to weigh the alternatives of political and economic motivations, while for smaller countries political importance and mood with regard to the bigger country is less determining.

6 Conclusion

Economic determinants of economic integration agreements have received ample attention in the economic literature, while political motivations for such agreements have not received as much focus. However, observing the evolution of the geography of EIAs over the past decades, it becomes apparent that there is more to trade policy than “just trade”. While recent research establishes a connection between trade policy and a reduction of conflict, this paper suggests a different narrative: trade policy, in the form of EIAs, is used as an instrument of foreign policy. Smaller, but politically important countries are likelier to integrate economically with a bigger country than their economic attractiveness warrants.

Building on previous work by Limão (2007) on non-traditional determinants for preferential trade agreements, I sketch a model that exhibits the mechanism in which political considerations are alternatives to economic benefits from economic integration. The model puts forward two testable reduced form predictions: (1) political motivations may matter in the choice of the contracting partner country; and (2), under the given assumptions, “big” countries may weigh economic gains against political motivations from integration, while smaller countries remain indifferent to the partner country’s motivations.

I test these propositions on the choices of partners in EIAs by estimating trade gains of hypothetical EIAs as a function of their depth and introducing two new indicators for political relations between countries. I construct an index of depth of integration that allows for heterogeneity of different stages of economic integration and estimate the elasticity of trade to this depth of integration in a gravity framework. I then compute non-realized trade gains of hypothetical deeper integration between any given country pair as a proxy for the economic motivations to integrate further.

Aside from the theoretical and empirical results, the developed proxies for bilateral political relations, “importance” and “mood”, are the main contributions of this paper. As the qualitative nature of political relations is notoriously difficult to quantify, I turn to the vast political event dataset provided by GDELT (Leetaru and Schrodt, 2013) that has so far not been used in the literature in empirical economics. From the dataset I extract political events with participants of different countries and derive directional indicators for the “importance” of and “mood” between countries. These two indices are then used to proxy political motivations for economic integration.

Finally I estimate the impact of the two hypothesized determinants on the probability of forming a new agreement and on changes to the depth of integration. As suggested by the model, political considerations are an important predictor for the choice of partnering countries for economic integration. This effect is not homogeneous though: The political importance of a smaller country—as measured in terms of GDP—for a bigger country is more decisive than vice versa. Furthermore, economic and political motivations for economic integration are shown to be alternatives rather than complements.

Notes

Here defined as including any customs union, partial or full free trade agreement.

Incidentally, the motivation behind Brexit also appears to be grounded in a political rationale, despite yielding large economic costs (Sampson, 2017).

This assumption is not necessary for the results below. As long as E is sufficiently larger than S (in the sense that it retains most bargaining power), while being sufficiently similar in size compared to P (in the sense of having similar bargaining power in negotiations) the derived predictions remain the same.

This is obviously an extreme case, but it nicely demonstrates the underlying mechanism. The results hold for any \(\alpha ^{E} < \alpha ^{P}\).

Under the above assumptions these are specific to the trade partner, as S is only endowed with \(i \in \{s\}\), so that each country imports a respective good from only one partner country.

As consumers in both big countries value the domestic production of the public good it is always provided in these countries.

Depending on the specification of \(\Psi\) and u an integration with either country may lead to changes in all prices, and hence net imports, tariff revenue, domestic public good provision and aggregate surplus.

Not counting an additional 44 accessions to existing agreements.

Although the choice of the weight for legal enforceability is of course somewhat arbitrary, the econometric results of the estimation of the gravity equation do not vary significantly with different weighting.

Note that deviating from the model in Sect. 2, in the following the origin country of a trade flow or bilateral agreement is denoted o, while the destination country is d.

An example illustrates the differences: The initial EU treaty, the treaty of Rome (1958), is considered as a multitude of agreements between Belgium, France, (West) Germany, Italy, Luxembourg, and the Netherlands. The enlargement of 1973 with the accession of the UK and Denmark is considered as bilateral treaties between each of the then EU-members and each of the new member states. A FTA between the EU and Switzerland also went in effect on 01/01/1973, and this treaty was immediately “inherited” by the UK and Denmark, and is considered as bilateral agreements between them, although they never took part in the negotiations beforehand.

See the appendix for further information. The full dataset is available on https://julianhinz.com/research/eia_dataset/.

Note that trade flows between two countries o and k are also affected by a change in depth of integration between o and d due to general equilibrium effects.

Country-pair fixed effects also capture unobserved factors following Baier and Bergstrand (2007), accounting for possible omitted variables and simultaneity biases.

For the purpose of comparability to previous studies, I also estimate a log-linearized version, namely \(\log X_{odt} = \Xi _{ot} + \Theta _{dt} + \phi _{od} + \rho \mathbf {d}_{odt} + \epsilon _{odt}\) for the identification of \(\rho\). The fixed effects estimated with this linear estimator cannot directly be used for the quantification exercise, however, as Fally (2015) shows PPML fixed effects to be unique in their interpretation as indices of inward and outward multilateral resistances.

The partial equilibrium impact of a shallower agreement can be computed as \(\exp (\widehat{\rho } \cdot \mathbf {d}_{odt}^{\prime }) - 1\).

For some time, before the onset of the Presidency of Donald Trump, this appeared to have the potential to change: the United States was in negotiations to form the so-called “Trans-Pacific Partnership” and “Transatlantic Trade and Investment Partnership” that would have seen six further countries in the top 10 of full-depth trade gains with EIAs with the United States. These countries are Japan, Germany, United Kingdom, South Korea, the Netherlands, and France.

The exception is the embassy staff count used by Rose (2007).

See Gleditsch et al. (2014) for a discussion.

Note that each event is only listed once, irrespective the number of articles about the event. The number of publications reporting on the event, however, is an indicator about the veracity of the information.

Other uses of this data greatly benefit from this detail, such as e.g. Yonamine (2013), who forecasts violence in Afghani districts using GDELT.

A similar index and aggregation could also be used to measure internal mood and importance of countries.

Only those events that are mentioned at least as much as the median of any event that took place in the country in a respective month.

An earlier version of the index was directional, in the sense that only events taking place in country o with respect to country d where counted for \(\text {Mood}_{odt}\) and only those in country d with respect to o in \(\text {Mood}_{dot}\), so that \(\text {Mood}_{odt} \ne \text {Mood}_{dot}\). I thank Vincent Vicard for the comment and discussion on this issue.

Different weighting, as long as the ranking is preserved, does not significantly alter the econometric results.

In terms of effect size, a one standard deviation increase in importance leads to a 1.9% higher likelihood of forming an economic integration agreement, for trade gains the equivalent increase leads to a 3.4% higher likelihood.

No economic integration agreement comes to mind, whose negotiations stretched over a decade. Shorter lags produce similar results.

Alternatively, Anderson et al. (2018) show that the PPML estimator yields correct multilateral resistance terms with observed trade flows and counterfactual trade costs.

References

Aichele, R., Felbermayr, G. J., & Heiland, I. (2014). Going deep: The trade and welfare effects of TTIP. CESifo working paper series 5150, CESifo Group Munich.

Anderson, J. (1979). A theoretical foundation for the gravity equation. American Economic Review, 69(1), 106–16.

Anderson, J. E., Larch, M., & Yotov, Y. V. (2018). GEPPML: General equilibrium analysis with PPML. The World Economy, 41(10), 2750–2782.

Baccini, L., Dür, A., & Elsig, M. (2015). The politics of trade agreement design: Revisiting the depth-flexibility nexus. International Studies Quarterly, 59(4), 765–775.

Baier, S. L., & Bergstrand, J. H. (2004). Economic determinants of free trade agreements. Journal of International Economics, 64(1), 29–63.

Baier, S. L., & Bergstrand, J. H. (2007). Do free trade agreements actually increase members’ international trade? Journal of International Economics, 71(1), 72–95.

Baier, S. L., Bergstrand, J. H., & Mariutto, R. (2014). Economic determinants of free trade agreements revisited: Distinguishing sources of interdependence. Review of International Economics, 22(1), 31–58.

Baldwin, R. E., & Venables, A. J. (1995). Regional economic integration. In G.M. Grossman, & K. Rogoff (Eds.), Handbook of international economics (Vol. 3, Chap. 31, pp. 1597–1644). Elsevier.

Berger, D., Easterly, W., Nunn, N., & Satyanath, S. (2013). Commercial imperialism? Political influence and trade during the cold war. American Economic Review, 103(2), 863–96.

Bramoullé, Y., Djebbari, H., & Fortin, B. (2009). Identification of peer effects through social networks. Journal of Econometrics, 150(1), 41–55.

Caliendo, L., & Parro, F. (2015). Estimates of the trade and welfare effects of NAFTA. Review of Economic Studies, 82(1), 1–44.

Crozet, M., & Hinz, J. (2016). Collateral damage: The impact of the Russia sanctions on sanctioning countries’ exports. Working Papers 2016-16, CEPII.

Desbordes, R., & Vicard, V. (2009). Foreign direct investment and bilateral investment treaties: An international political perspective. Journal of Comparative Economics, 37(3), 372–386.

Ethier, W. J. (1998). Regionalism in a multilateral world. Journal of Political Economy, 106(6), 1214–1245.

EU European Council. (1983). Solemn declaration on European Union (Stuttgart, 19 June 1983). Bulletin of the European Communities, 6, 24–29.

Fally, T. (2015). Structural gravity and fixed effects. Journal of International Economics, 97(1), 76–85.

Freund, C., & Ornelas, E. (2010). Regional trade agreements. Annual Review of Economics, 2(1), 139–166.

Gerner, D. J., & Schrodt, P. A. (1998). The effects of media coverage on crisis assessment and early warning in the Middle East. In Early Warning and Early Response. Columbia University Press-Columbia International Affairs Online.

Gerner, D. J., Schrodt, P. A., Yilmaz, O., & Abu-Jabr, R. (2002). The creation of cameo (conflict and mediation event observations): An event data framework for a post Cold War world. In Annual meetings of the American Political Science Association (Vol. 29).

Gleditsch, K. S., Metternich, N. W., & Ruggeri, A. (2014). Data and progress in peace and conflict research. Journal of Peace Research, 51(2), 301–314.

Glick, R., & Taylor, A. M. (2010). Collateral damage: Trade disruption and the economic impact of war. Review of Economics and Statistics, 92(1), 102–127.

Head, K., & Mayer, T. (2014). Gravity equations: Workhorse, toolkit, and cookbook. In K. R. Elhanan Helpman & G. Gopinath (Eds.), Handbook of international economics (Vol. 4, Chap. 3, pp. 131–195). Elsevier.

Head, K., Mayer, T., & Ries, J. (2010). The erosion of colonial trade linkages after independence. Journal of International Economics, 81(1), 1–14.

Hinz, J., Stammann, A., & Wanner, J. (2020). State dependence and unobserved heterogeneity in the extensive margin of trade. arXiv:2004.12655.

Horn, H., Mavroidis, P., & Sapir, A. (2010). Beyond the WTO? An anatomy of EU and US preferential trade agreements. The World Economy, 33(11), 1565–1588.

Kohl, T., Brakman, S., & Garretsen, H. (2016). Do trade agreements stimulate international trade differently? Evidence from 296 trade agreements. The World Economy, 39(1), 97–131.

Lederman, D., & Ozden, C. (2007). Geopolitical interests and preferential access to u.s. markets. Economics and Politics, 19(2), 235–258.

Leetaru, K., & Schrodt, P. A. (2013). Gdelt: Global data on events, location, and tone, 1979–2012. In Paper presented at the ISA Annual Convention, Volume 2 (pp. 4).

Limão, N. (2007). Are preferential trade agreements with non-trade objectives a stumbling block for multilateral liberalization? The Review of Economic Studies, 74(3), 821–855.

Limão, N. (2016). Preferential trade agreements. In Handbook of commercial policy (Vol. 1, pp. 279–367). North-Holland.

Liu, X., & Ornelas, E. (2014). Free trade agreements and the consolidation of democracy. American Economic Journal: Macroeconomics, 6(2), 29–70.

Lowe, W. (2012). Measurement models for event data. Technical report, MZES, University of Mannheim.

Maggi, G. (2014). International trade agreements (Vol. 4, pp. 317–390). Elsevier.

Mansfield, E. D., Milner, H., & Rosendorff, P. (2002). Why democracies cooperate more: Electoral control and international trade agreements. International Organization, 56(3), 477–513.

Mansfield, E. D., Milner, H. V., & Rosendorff, B. P. (2000). Free to trade: Democracies, autocracies, and international trade. The American Political Science Review, 94(2), 305–321.

Marshall, M. G., & Jaggers, K. (2002). Polity IV project: Political regime characteristics and transitions, 1800–2002. Technical report, Center for Systemic Peace.

Martin, P., Mayer, T., & Thoenig, M. (2008). Make trade not war? Review of Economic Studies, 75(3), 865–900.

Martin, P., Mayer, T., & Thoenig, M. (2012). The geography of conflicts and regional trade agreements. American Economic Journal: Macroeconomics, 4(4), 1–35.

Masad, D. (2013). How computers can help us track violent conflicts — including right now in syria. http://themonkeycage.org/2013/07/09/how-computers-can-help-us-track-violent-conflicts-including-right-now-in-syria/.

Nye, J. (2011). The future of power. PublicAffairs.

Nye, J. S. (1988). Neorealism and neoliberalism. World Politics, 40(2), 235–251.

Orefice, G., & Rocha, N. (2014). Deep integration and production networks: An empirical analysis. The World Economy, 37(1), 106–136.

Pollins, B. M. (1989). Conflict, cooperation, and commerce: The effect of international political interactions on bilateral trade flows. American Journal of Political Science, 33(3), 737–761.

Rose, A. K. (2007). The foreign service and foreign trade: Embassies as export promotion. The World Economy, 30(1), 22–38.

Sampson, T. (2017). Brexit: The economics of international disintegration. Journal of Economic Perspectives, 31(4), 163–84.

Ulfelder, J. (2013). Challenges in measuring violent conflict, syria edition. http://dartthrowingchimp.wordpress.com/2013/05/16/challenges-in-measuring-violent-conflict-syria-edition/.

Umana Dajud, C. (2013). Political proximity and international trade. Economics & Politics, 25(3), 283–312.

Vicard, V. (2009). On trade creation and regional trade agreements: Does depth matter? Review of World Economics/Weltwirtschaftliches Archiv, 145(2), 167–187.

Vicard, V. (2012). Trade, conflict, and political integration: Explaining the heterogeneity of regional trade agreements. European Economic Review, 56(1), 54–71.

Voeten, E., & Merdzanovic, A. (2009). United nations general assembly voting data. Accessed Online On, 2(25), 2010.

Volkens, A., Lehmann, P., Merz, N., Regel, S., & Werner, A. (2013). The Manifesto Data Collection. Manifesto Project (MRG/CMP/MARPOR). Version 2013a. Wissenschaftszentrum Berlin für Sozialforschung (WZB).

Waltz, K. N. (1999). Globalization and governance. PS: Political Science and Politics, 32(4), 693–700.

Wooldridge, J. (2012). Introductory econometrics: A modern approach. Cengage Learning.

World Trade Organization. (2011). World trade report 2011. WTO. Available online.

Yonamine, J. (2011). Working with event data: A guide to aggregation choices. Technical report, Unpublished manuscript.

Yonamine, J. E. (2013). Predicting future levels of violence in Afghanistan districs using GDELT. Technical report, UT Dallas.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I am grateful to the editor and two anonymous referees for their valuable comments. I thank Matthieu Crozet, Lionel Fontagné, Bernard Hoekman, Vincent Vicard, Gabriel Felbermayr, Axel Dreher and Gerald Willmann for helpful comments and suggestions. The paper greatly benefited from fruitful discussions with participants of the INFER workshop on “Trade Agreements”, ERF 2014 in Cairo, ETSG 2014 in Munich and the GLAD Conference in Göttingen.

Appendices

Appendix A

1.1 Data on economic integration agreements

See Table 5.

Appendix B

1.1 General equilibrium trade flow counterfactuals

General equilibrium counterfactual trade flows for any setting of \(\mathbf {d}_{odt}'\) can be computed as