Abstract

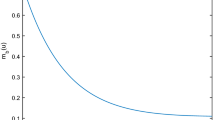

In this paper, we consider the risk model perturbed by a diffusion process. We assume an Erlang(n) risk process, (\(n=1,2,\ldots\)) to study the Gerber-Shiu discounted penalty function when ruin is due to claims or oscillations by including a dependence structure between claim sizes and their occurrence time. We derive the integro-differential equation of the expected discounted penalty function, its Laplace transform. Then, by analyzing the roots of the generalized Lundberg equation, we show that the expected penalty function satisfies a certain defective renewal equation and provide its representation solution. Finally, we give some explicit expressions for the Gerber-Shiu discounted penalty functions when the claim size distributions are Erlang(m), (\(m=1,2,\ldots\)) and provide numerical examples to illustrate the ruin probability.

Similar content being viewed by others

References

Adékambi F, Takouda E (2020) Gerber-Shiu Function in a Class of Delayed and Perturbed Risk Model with Dependence. Risks 8(1):30

Albrecher H, Boxma OJ (2004) A ruin model with dependence between claim sizes and claim intervals. Insurance Math Econom 35(2):245–254

Albrecher H, Teugels JL (2006) Exponential behavior in the presence of dependence in risk theory. J Appl Probab 43(1):257–273

Boudreault M, Cossette H, Landriault D (2006) Marceau E (2006) On a risk model with dependence between interclaim arrivals and claim sizes. Scand Actuar J 5:265–285

Cossette H, Marceau E, Marri F (2008) On the compound Poisson risk model with dependence based on a generalized Farlie–Gumbel–Morgenstern copula. Insurance Math Econom 43(3):444–455

Cai J (2007) On the time value of absolute ruin with debit interest. Adv Appl Probab 39:343–59

Cai J, Feng R, Willmot GW (2009) The compound poisson surplus model with interest and liquid reserves: analysis of the gerber-shiu discounted penalty function. Methodol Comput Appl Probab 11:401–23

Chadjiconstantinidis S, Spyridon V (2014) On a renewal risk process with dependence under a farlie-gumbel-morgenstern copula. Scand Actuar J 2014:125–58

Cheung ECK, Landriault D, Willmot GE, Jae-Kyung W (2010) Structural properties of gerber–shiu functions in dependent sparre andersen models. Insurance Math Econom 46:117–26

Cossette H, Marceau E, Fouad M (2010) Analysis of ruin measures for the classical compound poisson risk model with dependence. Scand Actuar J 2010:221–45

De Vylder FE, Goovaerts MJ (1998) On a Class of Renewal Risk Processes, David CM Dickson, July. North American Actuarial Journal 2(3):68–70. Taylor & Francis

Dufresne F, Gerber HU (1991) Risk theory for the compound poisson process that is perturbed by diffusion. Insurance Math Econom 10:51–59

Gao J, Wu L (2014) On the gerber-shiu discounted penalty function in a risk model with two types of delayed-claims and random income. J Comput Appl Math 269:42–52

Gerber HU, Bruno L (1998) On the discounted penalty at ruin in a jump-diffusion and the perpetual put option. Insurance Math Econom 22:263–76

Jeanblanc M, Yor M, Chesney M (2009) Mathematical methods for financial markets. Springer Science & Business Media

Li S, Garrido J (2004) On ruin for the Erlang (n) risk process. Insurance Math Econom 34(3):391–408. Elsevier

Li N, Wang W (2022) Optimal Dividend and Proportional Reinsurance Strategy Under Standard Deviation Premium Principle. Bulletin of the Malaysian Mathematical Sciences Society : 1–20

Li W, Tan KS, Wei P (2021) Demand for non-life insurance under habit formation. Insurance Math Econom 101:38–54

Lee WY, Willmot GE (2014) On the moments of the time to ruin in dependent sparre andersen models with emphasis on coxian interclaim times. Insurance Math Econom 59:1–10

Lin XS, Willmot GE (2000) The moments of the time of ruin, the surplus before ruin, and the deficit at ruin. Insurance Math Econom 27:19–44

Liu C (2015) Zhang Z (2015) On a generalized Gerber-Shiu function in a compound Poisson model perturbed by diffusion. Adv Difference Equ 1:1–20

McNeil AJ, Frey R, Embrechts P (2015) Quantitative risk management: concepts, techniques and tools-revise. Princeton University Press

Nadarajah S (2009) An alternative inverse Gaussian distribution. Math Comput Simul 79(5):1721–1729

Nelsen RB (2006) An introduction to Copulas. Springer Science & Business Media, Berlin

Palmowski Z, Vatamidou E (2020) Phase-type approximations perturbed by a heavy-tailed component for the Gerber-Shiu function of risk processes with two-sided jumps. Stoch Model 36(2):337–363

Ragulina O (2019) The risk model with stochastic premiums and a multi-layer dividend strategy. Modern Stochastics: Theory and Applications 6(3):285–309

Schmidli H (2014) A note on gerber-shiu functions with an application. Modern Problems in Insurance Mathematics. Springer, Cham, pp 21–36

Shija G, Jacob MJ et al (2016) Gerber Shiu Function of Markov Modulated Delayed By-Claim Type Risk Model with Random Incomes. J Mathematical Fin 36(2):337–363

Sun LJ (2005) The expected discounted penalty at ruin in the Erlang (2) risk process. Statistics & probability letters 78(3):205–217

Tan KS, Pengyu W, Wei W, Zhuang SC (2020) Optimal dynamic reinsurance policies under a generalized denneberg’s absolute deviation principle. Eur J Oper Res 282:345–62

Tijms HC (1986) Stochastic modelling and analysis: a computational approach. John Wiley & Sons, Incs

Tsai CCL, Willmot GE (2002) A generalized defective renewal equation for the surplus process perturbed by diffusion. Insurance Math Econom 30:51–66

Wang G (2001) A decomposition of the ruin probability for the risk process perturbed by diffusion. Insurance Math Econom 28:49–59

Willmot GE (2004) A note on a class of delayed renewal risk processes. Insurance Math Econom 34:251–57

Willmot GE, Dickson DCM (2003) The gerber–shiu discounted penalty function in the stationary renewal risk model. Insurance Math Econom 32:403–11

Willmot GE, Lin XS (2001) Lundberg Approximations for Compound Distributions with Insurance Applications. Springer Science & Business Media, vol, Berlin, p 156

Yang H, Zhang Z (2009) The perturbed compound Poisson risk model with multi-layer dividend strategy. Statistics & Probability Letters 79(1):70–78

Zhang Z, Yang Hu, Li S (2010) The perturbed compound Poisson risk model with two-sided jumps. J Comput Appl Math 233(8):1773–1784

Zhou M, Cai J (2009) A perturbed risk model with dependence between premium rates and claim sizes. Insurance Math Econom 45:382–92

Zhang Z, Hu Y (2011) Gerber-shiu analysis in a perturbed risk model with dependence between claim sizes and interclaim times. J Comput Appl Math 235:1189–204

Zhang Z, Wu X, Yang H (2014) On a perturbed Sparre Andersen risk model with dividend barrier and dependence. J Korean Stat Soc 43(4):585–598

Zhang Z, Yang H, Hu Y (2012) On a Sparre Andersen risk model with time-dependent claim sizes and jump-diffusion perturbation. Methodol Comput Appl Probab 14(4):973–995

Acknowledgements

This research paper was conducted by E. Takouda in the framework of a doctoral programme under the supervision of Prof. F. Adekambi. It was supported by the Global Excellence and Stature (GES) 4.0 scholarship of the University of Johannesburg (UJ) and the NRF incentive grant. The authors also thank the anonymous referees for constructive comments that improved the content and presentation of this paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Adékambi, F., Takouda, E. On the Discounted Penalty Function in a Perturbed Erlang Renewal Risk Model With Dependence. Methodol Comput Appl Probab 24, 481–513 (2022). https://doi.org/10.1007/s11009-022-09944-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-022-09944-3