Abstract

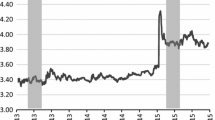

This study employed data on US mortgage rates from 2009 to 2017 to study the effect of gender on the mortgage rate. Preliminary examination revealed that women faced a comparatively high mortgage rate. This condition was most severe during 2012–2014, when female borrowers must pay an average of 0.1 percentage points higher rates than male peers. However, regression analysis indicated that income might exert diverse effects on the interest rates received by women. In terms of default risk assessment, lenders may distinguish between female borrowers with different incomes, causing income to become the key factor determining the interest rate received by female borrowers. This study adopted income as a threshold condition to estimate the effect of various default risk factors on mortgage rates. The obtained result indicated that during 2009–2017, women’s status shifted from disadvantageous to advantageous in the mortgage market. Female borrowers who belonged to the highest income group received their lowest interest rates in 2015–2017, which were 0.026 percentage points lower than those faced by male peers in the same financial position. Based on relevant behavioral differences between men and women proposed in literature, reasons for this phenomenon are proposed.

Similar content being viewed by others

Notes

Cheng et al. (2011) mentioned that compared to the extensive body of literature on racial disparity in nearly all aspects of mortgage lending, research on gender disparity is virtually nonexistent.

The hypothetical housing market in this study was efficient, meaning that the transaction price of real estate indicates the actual value.

Data source: FHFA. For more information, please see the website: https://www.fhfa.gov/DataTools/Downloads.

References

Adabre, M. A., Chan, A. P. C., & Darko, A. (2021). A scientometric analysis of the housing affordability literature. Journal of Housing and the Built Environment, In press. https://doi.org/10.1007/s10901−021−09825−0

Adzis, A. A., Lim, H. E., Yeok, S. G., & Saha, A. (2020). Malaysian residential mortgage loan default: A micro−level analysis. Review of Behavioral Finance, In press. https://doi.org/10.1108/RBF−03−2020−0047

Ahmed, A. M., & Hammarstedt, M. (2008). Discrimination in the rental housing market: A field experiment on the Internet. Journal of Urban Economics, 64(2), 362–372.

Al−Bahrani, A., Buser, W., & Patel, D. (2020). Early causes of financial disquiet and the gender gap in financial literacy: Evidence from college students in the southeastern United States. Journal of Family and Economic Issues, 41, 558−571

Altonji, J. G., & Blank, R. M. (1999). Race and gender in the labor market. In O. Ashenfelter & D. Card (Eds.), Handbook of Labor Economics (pp. 3143–3259). Elsevier.

Atkinson, S. M., Baird, S. B., & Frye, M. B. (2003). Do female mutual fund managers manage differently? Journal of Financial Research, 26(1), 1–18.

Ayres, I. (1991). Fair driving: Gender and race discrimination in retail car negotiations. Harvard Law Review, 104(4), 817–872.

Ayres, I., & Siegelman, P. (1995). Race and gender discrimination in bargaining for a new car. American Economic Review, 85(3), 304–321.

Bajtelsmit, V. L., & VanDerhei, J. L. (1997). Risk aversion and retirement income adequacy. In M. S. Gordon, O. S. Mitchell, & M. M. Twinney (Eds.), Positioning Pensions for the 21st Century (pp. 45–66). Pension Research Council and University of Pennsylvania Press.

Bao, H. X. H., Meng, C. C., & Wu, J. (2021). Reference dependence, loss aversion and residential property development decisions. Journal of Housing and the Built Environment, In press. https://doi.org/10.1007/s10901−020−09803−y

Barber, B. M., & Odean, T. (2001). Boys will be boys: Gender, overconfidence and common stock investment. Quarterly Journal of Economics, 116(1), 261–292.

Beckmann, D., & Menkhoff, L. (2008). Will women be women? Analyzing the gender difference among financial experts. Kyklos, 61(3), 364–384.

Bellucci, A., Borisov, A., & Zazzaro, A. (2010). Does gender matter in bank–firm relationships? Evidence from small business lending. Journal of Banking & Finance, 34(12), 2968–2984.

Buchan, N. R., Croson, R. T. A., & Solnick, S. (2008). Trust and gender: An examination of behavior and beliefs in the investment game. Journal of Economic Behavior & Organization, 68(3–4), 466–476.

Byrne, S., Devine, K., & McCarthy, Y. (2020). Room to improve: A review of switching activity in the Irish mortgage market. Economic Letter, No 12/EL/20.

Campbell, J. Y., & Cocco, J. F. (2015). A model of mortgage default. Journal of Finance, 70(4), 1495–1554.

Card, D., Cardoso, A. R., Heining, J., & Kline, P. (2018). Firms and labor market inequality: Evidence and some theory. Journal of Labor Economics, 36(S1), 13–70.

Charness, G., & Gneezy, U. (2012). Strong evidence for gender differences in risk taking. Journal of Economic Behavior & Organization, 83(1), 50–58.

Chen, X., Huang, B., & Ye, D. (2020). Gender gap in peer−to−peer lending: Evidence from China. Journal of Banking & Finance, 112, 105633.

Chen, X., Li, R., & Wu, X. (2021). Multi−home ownership and household portfolio choice in urban China. Journal of Housing and the Built Environment, 36, 131–151.

Chen, C., Pinar, M., & Stengos, T. (2020). Renewable energy consumption and economic growth nexus: Evidence from a threshold model. Energy Policy, 139, 111295.

Cheng, P., Lin, Z., & Liu, Y. (2011). Do women pay more for mortgages? Journal of Real Estate Finance and Economics, 43(4), 423–440.

Clark, W. A., Huang, Y., & Yi, D. (2021). Can millennials access homeownership in urban China? Journal of Housing and the Built Environment, 36, 69–87.

Cunningham, C., Gerardi, K., & Shen, L. (2021). The double trigger for mortgage default: Evidence from the fracking boom. Management Science, 67(6), 3943–3964.

Dai, N., Ivanov, V., & Cole, R. A. (2017). Entrepreneurial optimism, credit availability, and cost of financing: Evidence from U.S. small businesses. Journal of Corporate Finance, 44, 289–307.

Do, C., & Paley, I. (2013). Does gender affect mortgage choice? evidence from the US. Feminist Economics, 19(2), 33–68.

Dymski, G., Hernandez, J., & Mohanty, L. (2013). Race, gender, power, and the US subprime mortgage and foreclosure crisis: A meso analysis. Feminist Economics, 19(3), 124–151.

Edelberg, W. (2006). Risk−based pricing of interest rates for consumer loans. Journal of Monetary Economics, 53(8), 2283–2298.

Fang, L., & Munneke, H. J. (2020). Gender equality in mortgage lending. Real Estate Economics, 48(4), 957–1003.

Fehr-Duda, H., de Gennaro, M., & Schubert, R. (2006). Gender, financial risk and probability weights. Theory and Decision, 60(2–3), 283–313.

Felton, J., Gibson, B., & Sanbonmatsu, D. M. (2003). Preference for risk in investing as a function of trait optimism and gender. Journal of Behavioral Finance, 4(1), 33–40.

Goldin, C. (2014). A grand gender convergence: Its last chapter. American Economic Review, 104(4), 1091–1119.

Goldsmith-Pinkham, P., & Shue, K. (2020). The gender gap in housing returns. NBER Working Paper No. 26914. https://doi.org/10.3386/w26914

Guzman, J., & Kacperczyk, A. (2019). Gender gap in entrepreneurship. Research Policy, 48(7), 1666–1680.

Hinz, R. P., McCarthy, D. D., & Turner, J. A. (1997). Are women conservative investors? Gender differences in participant−directed pension investments. In M. S. Gordon, O. S. Mitchell, & M. M. Twinney (Eds.), Positioning Pensions for the 21st Century (pp (pp. 91–103). Pension Research Council and University of Pennsylvania Press.

Jacobsen, B., Lee, J. B., Marquering, W., & Zhang, C. Y. (2014). Gender differences in optimism and asset allocation. Journal of Economic Behavior & Organization, 107, 630–651.

Jianakoplos, N. A., & Bernasek, A. (1998). Are women more risk averse? Economic Inquiry, 36(4), 620–630.

Lin, B., & Li, Z. (2020). Is more use of electricity leading to less carbon emission growth? An analysis with a panel threshold model. Energy Policy, 137, 111121.

Lin, Y.-C., & Raghubir, P. (2005). Gender differences in unrealistic optimism about marriage and divorce: Are men more optimistic and women more realistic? Personality and Social Psychology Bulletin, 31(2), 198–207.

Morsy, H. (2020). Access to finance – Mind the gender gap. Quarterly Review of Economics and Finance, 78, 12–21.

Niu, G., & Zhao, G. (2021). State, market, and family: Housing inequality among the young generation in urban China. Journal of Housing and the Built Environment, 36, 89–111.

Olivetti, C., & Petrongolo, B. (2016). The evolution of gender gaps in industrialized countries. Annual Review of Economics, 8, 405–434.

Olsen, R. A., & Cox, C. M. (2001). The influence of gender on the perception and response to investment risk: The case of professional investors. Journal of Psychology and Financial Markets, 2(1), 29–36.

Owusu-Manu, D.-G., Asiedu, R. O., Edwards, D. J., Donkor-Hyiaman, K., Abuntori, P. A., & El-Gohary, H. (2019). An assessment of mortgage loan default propensity in Ghana. Journal of Engineering, Design and Technology, 17(5), 985–1017.

Schubert, R., Brown, M., Gysler, M., & Brachinger, H. W. (1999). Financial decision−making: Are women really more risk−averse? American Economic Review, 89(2), 381–385.

Tsai, I. C. (2018). Investigating gender differences in real estate trading sentiments. American Economist, 63(2), 187–214.

Watson, J., & McNaughton, M. (2007). Gender differences in risk aversion and expected retirement benefits. Financial Analysts Journal, 63(4), 52–62.

Yu, S., Hu, X., & Yang, J. (2021). Housing prices and carbon emissions: A dynamic panel threshold model of 60 Chinese cities. Applied Economics Letters, 28(3), 170–185.

Acknowledgements

I am immensely grateful to Professor Peter Boelhouwer (Editor−in−Chief) and the three anonymous referees for the constructive comments of this paper. Funding from the Ministry of Science and Technology of Taiwan under Project No. MOST−110−2410−H−390−008−MY3 has enabled the continuation of this research and the dissemination of these results.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflicts of interest to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Tsai, IC. Have men and women become equal in the housing market? effects of gender on mortgage rate. J Hous and the Built Environ 37, 2157–2177 (2022). https://doi.org/10.1007/s10901-022-09944-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10901-022-09944-2