Abstract

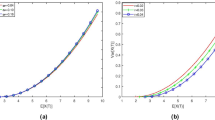

This paper is devoted to investigating a robust optimal excess-of-loss reinsurance and investment problem with defaultable risk, in which the insurer’s wealth process is described by a more general dependent risk model with two classes of insurance business. The insurer is allowed to purchase excess-of-loss reinsurance and invest in a risk-free asset, a defaultable bond and a risky asset whose price depends on a square-root stochastic factor process which makes the geometric Brownian motion, CEV model and Heston model as special cases. Our aim is to seek the optimal excess-of-loss reinsurance and investment strategy under the criterion of maximizing the expected exponential utility of the terminal wealth. Applying the stochastic control theory, the robust Hamilton-Jacobi-Bellman (HJB) equations for the post-default case and the pre-default case are first established, respectively. Then the explicit expressions of the optimal control strategy are obtained, moreover, we provide the verification theorem. Finally, some numerical examples are given to illustrate our results.

Similar content being viewed by others

References

Anderson EW, Hansen LP, Sargent TJ (1999) Robustness, detection and the price of risk, Working paper, University of Chicago. https://fles.nyu.edu/ts43/public/research/.svn/textbase/ahs3.pdf.snv-base.

Asmussen S, Højgaard B, Taksar M (2000) Optimal risk control and dividend distribution policies: example of excess-of-loss reinsurance for an insurance corporation. Finance Stochast 4:299–324

Bi J, Liang Z, Xu F (2016) Optimal mean-variance investment and reinsurance problems for the risk model with common shock dependence, Insurance Math Econom 70:245–258

Bielecki TR, Jang I (2006) Portfolio optimization with a defaultable security. Asia-Pac Financ Mark 13:113–127

Branger N, Larsen LS (2013) Robust portfolio choice with uncertainty about jump and diffusion risk. J Bank Financ 37(12):5036–5047

Browne S (1995) Optimal investment policies for a firm with a random risk process: exponential utility and minimizing the probability of ruin Math Oper Res 20:937–957

A Chunxiang, Li Z (2015) Optimal investment and excess-of-loss reinsurance problem with delay for an insurer under Heston’s SV model. Insurance Math Econom 61:181–196

Deng C, Zeng X, Zhu H (2018) Non-zero-sum stochastic differential reinsurance and investment games with default risk. Eur J Oper Res 264:1144–1158

Deng Y, Li M, Huang Y, Zhou J (2020) Robust optimal strategies for an insurer under generalized mean-variance premium principle with defaultable bond. Commun Stat Theor M. https://doi.org/10.1080/03610926.2020.1726391.

Gerber H (1979) An Introduction to Mathematical Risk Theory. In: S.S. Huebner Foundation Monograph, Series No. 8. Irwin, Homewood, III

Gong L, Badescu A, Cheung E (2012) Recursive methods for a multidimensional risk process with common shocks, Insurance Math. Econom 50:109–120

Grandell J (1991) Aspects of Risk Theory. Springer-Verlag, New York

Gu AL, Guo XP, Li ZF, Zeng Y (2012) Optimal control of excess-of-loss reinsurance and investment for insurers under a CEV model, Insurance Math. Econom 51:674–684

Huang Y, Ouyang Y, Tang L, Zhou J (2018) Robust optimal investment and reinsurance problem for the product of the insurer’s and the reinsurer’s utilities. J Comput Appl Math 344:532–552

Kraft H (2004) Optimal Portfolios with Stochastic Interest Rates and Defaultable Assets. Springer-Verlag, Berlin

Kraft H (2005) Optimal portfolios and Heston’s stochastic volatility model: an explicit solution for power utility. Quant Finance 5:303–313

Kwok YK (1998) Mathematical Models of Financial Derivatives. Springer, Berlin

Li D, Zeng Y, Yang H (2018) Robust optimal excess-of-loss reinsurance and investment strategy for an insurer in a model with jumps. Scand Actuar J 2:145–171

Li D, Li D, Young V (2017) Optimality of excess-loss reinsurance under a mean-variance criterion, Insurance Math. Econom 75:82–89

Li M, Deng Y, Huang Y, Ou H (2020) Optimal strategies for an ambiguity-averse insurer under a jump-diffusion model and defaultable risk. Math Probl Eng Article ID 6207805. https://doi.org/10.1155/2020/6207805

Li Q, Gu M (2013) Optimization problems of excess-of-loss and Investment under the CEV Model. Isrn Math Anal Article ID 383265. https://doi.org/10.1155/2013/383265.

Liang Z, Yuen KC (2016) Optimal dynamic reinsurance with dependent risks: variance premium principle. Scand Actuar J 1:18–36

Liang Z, Bi J, Yuen KC, Zhang C (2016) Optimal mean-variance reinsurance and investment in a jump-diffusion financial market with common shock dependence. Math Methods Oper Res 1:1–27

Liang X, Wang G (2012) On a reduced form credit risk model with common shock and regime switching, Insurance Math. Econom 51:567–575

Maenhout P (2004) Robust portfolio rules and asset pricing. Review of Financial Studies 17:951–983

Maenhout P (2006) Robust portfolio rules and detection-error probabilities for a mean-reverting risk premium. J Econ Teory 128:136–163

Mao X (1997) Stochastic Differential Equations and Applications. Horwood

Promislow DS, Young VR (2005) Minimizing the probability of ruin when claims follow Brownian motion with drift. N Am Actuar J 9:109–128

Schmidli H (2002) On minimizing the ruin probability by investment and reinsurance. Annals of Applied Probability 12:890–907

Shen Y, Zeng Y (2015) Optimal investment-reinsurance strategy for mean-variance insurers with square-root factor process. Insurance Math Econom 62:118–137

Sun J, Yao H, Kang Z (2019) Robust optimal investment-reinsurance strategies for an insurer with multiple dependent risks, Insurance Math. Econom 89:157–170

Sun Z, Zheng X, Zhang X (2017) Robust optimal investment and reinsurance of an insurer under variance premium principle and default risk. J Math Anal Appl 446:1666–1686

Wang GJ, Yuen KC (2005) On a correlated aggregate claims model with thinning-dependence structure. Insurance Math Econom 36:456–468

Wang S, Rong X, Zhao H (2019) Optimal time-consistent reinsurance-investment strategy with delay for an insurer under a defaultable market. J Math Anal Appl 474:205–218

Yi B, Li ZF, Viens FG, Zeng Y (2013) Robust optimal control for an insurer with reinsurance and investment under heston’s stochastic volatility model. Insurance Math Econom 53:601–614

Yuen KC, Guo J, Wu X (2002) On a correlated aggregate claim model with Poisson and Erlang risk process. Insurance Math Econom 31:205–214

Yuen KC, Guo J, Wu X (2006) On the first time of ruin in the bivariate compound Poisson model. Insurance Math Econom 38:298–308

Yuen KC, Liang Z, Zhou M (2015) Optimal proportional reinsurance with common shock dependence. Insurance Math Econom 64:1–13

Zeng Y, Li D, Gu A (2016) Robust equilibrium reinsurance-investment strategy for a mean-variance insurer in a model with jumps, Insurance Math. Econom 66:138–152

Zeng X, Taksar M (2013) A stochastic volatility model and optimal portfolio selection. Quant Finance 13:1547–1558

Zhang Q, Chen P (2019) Robust optimal proportional reinsurance and investment strategy for an insurer with defaultable risks and jumps. J Comput Appl Math 356:46–66

Zhang Y, Zhao P (2019) Robust optimal excess-of-loss reinsurance and investment problem with delay and dependent risks. Discrete Dyn Nat Soc 6805351, 21

Zhang Y, Zhao P (2020) Optimal Reinsurance and Investment problem with dependent risks Based on Legendre transform. J Ind Manga Optim 16:1457–1479

Zhao H, Rong X, Zhao Y (2013) Optimal excess-of-loss reinsurance and investment problem for an insurer with jump-diffusion risk process under the Heston model, Insurance Math. Econom 53:504–514

Zhao H, Shen Y, Zeng Y (2016) Time-consistent investment-reinsurance strategy for mean-variance insurers with a defaultable security. J Math Anal Appl 437:1036–1057

Zheng XX, Zhou JM, Sun ZY (2016) Robust optimal portfolio and proportional reinsurance for an insurer under a CEV model. Insurance Math Econom 67:77–87

Zhu H, Deng C, Yue S, Deng Y (2015) Optimal reinsurance and investment problem for an insurer with counterparty risk, Insurance Math. Econom 61:242–254

Zhu J, Guan G, Li S (2020) Time-consistent non-zero-sum stochastic differential reinsurance and investment game under default and volatility risks. J Comput Appl Math 374:112737

Acknowledgements

This work is supported by the National Natural Science Foundation of China (Grant No.11871275; No. 11371194).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of Interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Theorem 3.1

(i) If \({\xi }_{1}/(({\beta }_{0}+v){d}_{1})\ge 1\) or \({d}_{1}=0,\) then \({t}_{0}\le T\) holds.

For \({t}_{0}\le t\le T,\) we have \(0<{d}_{1}\le {d}_{2}.\) Since \({h}_{1}(x)\) and \({h}_{3}(x)\) are increasing functions on \([{d}_{1},+\infty ),\) it’s easy to verify that \(l(x)\) increases on \([{d}_{1},+\infty ).\) Moreover, based on the fact that \({h}_{1}({d}_{1})=0,\) we get \(l({d}_{1})={h}_{3}({d}_{1})\le {h}_{3}({d}_{2})=0.\)

If \(l({D}_{1})\ge 0,\) the equation \(l(x)=0\) has a unique solution \({d}_{0}(t)\in [{d}_{1},{D}_{1}],\) thus we have

Moreover, since \({a}_{2}(t)\le {D}_{2},\) we from (41) obtain that

If \(l({D}_{1})<0,\) it implies the equation \(l(x)=0\) has a unique solution on \(({D}_{1},+\infty ).\) Notice that \({a}_{1}(t)\le {D}_{1},\) so at this time, we choose \({a}_{1}^{*}(t)={D}_{1}.\) Then substituting \({a}_{1}^{*}(t)={D}_{1}\) back into \(g({a}_{1},{a}_{2})\) in (36), and taking the first derivative of \(g({a}_{1},{a}_{2})\) with respect to \({a}_{2}\), we can obtain the minimizer of \(g({a}_{1},{a}_{2})\) as follows

Based on (85), (86) and (87), consequently, \({a}_{1}^{*}(t)\) and \({a}_{2}^{*}(t)\) can be expressed as \({\widehat{a}}_{1}^{*}(t)\) and \({\widehat{a}}_{2}^{*}(t)\) given by (45).

For \(0\le t<{t}_{0},\) we have \({d}_{1}>{d}_{2},\) then \(l({a}_{l})={h}_{3}({d}_{1})>{h}_{3}({d}_{2})=0.\) Meanwhile, \(l(x)\) strictly increases on \([{d}_{1},+\infty )\) and \(l(x)>0,x\in [{d}_{1},+\infty ).\) As a result, the equation \(l(x)=0\) has no solution on \([{d}_{1},+\infty )\). In other words, there does not exist the solution \(({a}_{1}^{*},{a}_{2}^{*})\) satisfying (38) when \({a}_{1}\in ({d}_{1},+\infty )\) and \({a}_{2}\in [0,+\infty ).\) However, it doesn’t mean that (38) has no solution on \({a}_{1}\in [0,{d}_{1})\) and \({a}_{2}\in [0,+\infty ).\) It is not difficult to prove that \({h}_{1}(x)\) is a convex function on \([0,{d}_{1}).\) So for \(0\le t<{t}_{0},\) if the solution of \(l(x)=0\) exists, it will only be obtained on \(x\in [0,{d}_{1})\), hence, it is indeed \({a}_{1}^{*}(t)\) that we try to find.

Due to the fact that \({h}_{1}(0)={h}_{1}({d}_{1})=0,\) and \({h}_{1}(x)\) is a convex function on \([0,{d}_{1}),\) we have \({h}_{1}({a}_{1})\le 0\) on \({a}_{1}\in [0,{d}_{1}).\) Moreover, notice that \({h}_{2}^{-1}(x)\) is strictly increasing and \({h}_{2}^{-1}(0)=0,\) so we obtain from (41) that \({a}_{2}={h}_{2}^{-1}({h}_{1}({a}_{1}))\le 0.\)

Based on \({a}_{2}\ge 0,\) we get \({a}_{2}^{*}(t)=0.\) Substituting \({a}_{2}^{*}(t)=0\) into the function \(g({a}_{1},{a}_{2})\) given by (36) and taking the first derivative of the function \(g({a}_{1},0)\) with respect to \({a}_{1}\), we can obtain the minimizer of \(g({a}_{1},0)\) which is expressed as

To sum up, we derive (46) when \(0\le t<{t}_{0}\).

(iii)If \({\xi }_{1}/(({\beta }_{0}+v){d}_{1})<1\), then \({t}_{0}>T\) holds. Thus the inequality \({d}_{1}\ge {d}_{2}\) holds when \(0\le t\le T.\) In this case, the optimal control problem is similar to that of \(0\le t<{t}_{0}\) in case (i). Thus, the optimal reinsurance strategy with \(0\le t\le T\) is the same as that with \(0\le t<{t}_{0},\) which is given by (46).

Proof of Theorem 4.1

According to Kraft (2004, Corollary 1.2), Theorem 4.1 will hold if \(({\varepsilon }^{*},{\theta }^{*})\) and the corresponding candidate value function \(V(t,x,z,\alpha )\) satisfy the following three properties:

-

(1)

\({\varepsilon }^{*}\) is an admissible strategy and \({P}^{\theta ^{*}}\) is well-defined by \({\Lambda }^{\theta *}(t)\) with \({\theta }_{i}^{*},i=\mathrm{0,1},\mathrm{2,3};\)

-

(2)

\({E}^{{{P^\theta }^{*}}}\left[\underset{t\in [0,T]}{\mathrm{sup}}{\left|V(t,{X}^{{\varepsilon }^{*}}(t),H(t),\alpha (t))\right|}^{4}\right]<\infty\);

-

(3)

\({E}^{{{P^\theta }^{*}}}\left[\underset{t\in [0,T]}{\mathrm{sup}}{\left|\Psi (t,{X}^{{\varepsilon }^{*}}(t),{\varepsilon }^{*}(t,\alpha (t)),{\theta }^{*}(t,\alpha (t)))\right|}^{2}\right]<\infty .\)

Next, we shall verify the properties (1)-(3), respectively. To understand the proof process easily and logically, we first prove property (2) and then prove property (1).

Proof of (2)

Substituting \(({\varepsilon }^{*},{\theta }^{*})\) into (20), we get the following wealth process under \(({\varepsilon }^{*},{\theta }^{*})\)

Inserting (88) into (79), we obtain

Furthermore, we get the following estimate with appropriate constants \({M}_{1}<{M}_{2},\)

where \(\tilde{K }(t)\) is given in (75) and

Because \(\tilde{L }(t)=L(t)<0\) and \(\tilde{K }(t)\) are deterministic and bounded on \([0,T]\) and \(\alpha (t)>\text{0,}\) we obtain that the first estimate in (89) is valid. The second inequality holds due to that \({a}_{1}^{*}(t),{a}_{2}^{*}{(}t{),\ }{\theta }_{0}^{*}{(}t\text{),}\) and \({\pi }_{2}^{*}{(}t{)},H(t),{e}^{r(T-t)}\) are deterministic and bounded on \([0,T].\)

In what follows, we consider the four integrals about \(\mathrm{exp}\{{E}_{i}(t)\},i=\mathrm{1,2},\mathrm{3,4}.\) Firstly, note that \({a}_{1}^{*}\text{(}t\text{)}\) and \({a}_{2}^{*}\text{(}t\text{)}\) are bounded on \([0,T],\) it easy to check that

Secondly, by the Lemma 4.3 in Zeng and Taksar (2013), it is easily be seen that \(\mathrm{exp}\{4{E}_{1}(t)\}\) and \(\mathrm{exp}\{4{E}_{3}(t)\}\) are martingales under \({p}^{\theta }{}^{*},\) consequently,

Thirdly, according to Theorem 5.1 in Zeng and Taksar (2013), we obtain a sufficient condition for

is

for \(\forall s\in [0,T].\)

Note that \(\frac{{w}_{3}}{{w}_{1}+{w}_{2}}\le L(t)<0,\) based on (88), then (93) holds for \(\forall t\in [0,T]\) and \(T\in [0,\infty )\) due to the property of quadratic function. According to (91)-(93) and Cauchy–Schwarz inequality, we have

Similarly, \({E}^{{p}^{\theta ^{*}}}{|V(t,{X}^{{\varepsilon }^{*}}(t),0,\alpha (t))|}^{4}<\infty .\) Thus

Proof of (1)

From the process of solving HJB equation, we know \({\varepsilon }^{*}(t,\alpha (t))\) is progressively measurable. Moreover, \({a}_{1}^{*}(t)\) and \({a}_{2}^{*}(t)\) are deterministic and bounded on \([0,T]\) and \({\varepsilon }^{*}(t,\alpha (t))\) depends on the state process \(\alpha (t)\) which is a mean-reverting square root process. Notice that, for any fixed time, although \(\alpha (t)\) is generally unbounded, its first and second order moments are bounded (see Mao 1997 and Kwok 1998), thus condition (ii) in Definition 2.1 holds. Finally, according to Property (2), we can see that Condition (iii) in Definition 2.1 is met.

Proof of (3)

Since \({E}^{{P}^{\theta ^{*}}{}}[{\alpha }^{\kappa }(t)]<\infty\) for any \(\kappa >0,\) we obtain from (78) that

Moreover, let

then based on (78), we get \({E}^{{P}^{\theta ^{*}}{}}[{\Gamma }^{4}(t)]<\infty .\) From (27), we can see that \(V(T,x,z,\alpha )=-\frac{{\beta }_{i}}{v{\phi }_{i}},i=\mathrm{0,1},2.\) Inserting \({\theta }^{*}\) and \({\varepsilon }^{*}\) into (27) arrives at

where the first estimate follows from the Cauchy–Schwarz inequality and the last estimate from (95) and \({E}^{{{{P}^{\theta ^{*}}}}}({|\Gamma (t)|}^{4})<\infty .\) Thus, property (3) holds.

Now we have proved all the properties, the result of Kraft (2004, Corollary 1.2) guarantees that \(({\varepsilon }^{*},{\theta }^{*})\) is an optimal strategy and \(V(t,x,z,\alpha )\) is the corresponding optimal value function.

Rights and permissions

About this article

Cite this article

Zhang, Y., Zhao, P. & Ma, R. Robust Optimal Excess-of-Loss Reinsurance and Investment Problem with more General Dependent Claim Risks and Defaultable Risk. Methodol Comput Appl Probab 24, 2743–2777 (2022). https://doi.org/10.1007/s11009-022-09927-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-022-09927-4