Abstract

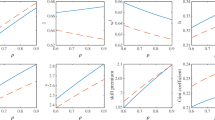

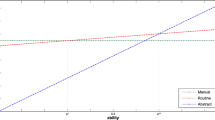

How does population aging affect economic growth and factor shares in times of increasingly automatable production processes? The present paper addresses this question in a new macroeconomic model of automation where competitive firms perform tasks to produce output. Tasks require labor and machines as inputs. New machines embody superior technological knowledge and substitute for labor in the performance of tasks. Automation is labor-augmenting in the reduced-form aggregate production function. If wages increase then the incentive to automate becomes stronger. Moreover, the labor share declines even though the aggregate production function is Cobb–Douglas. Population aging due to a higher longevity reduces automation in the short and promotes it in the long run. It boosts the growth rate of absolute and per-capita GDP in the short and the long run, lifts the labor share in the short and reduces it in the long run. Population aging due to a decline in fertility increases automation, reduces the growth rate of GDP, and lowers the labor share in the short and the long run. In the short run, it may or may not increase the growth rate of per-capita GDP, in the long run it unequivocally accelerates per-capita GDP growth.

Similar content being viewed by others

Notes

Section B.1 of the Online Appendix provides empirical evidence on the increase in longevity and the decline in fertility since the 1960ies for a sample of 27 selected OECD countries. The evolutions shown there in Figures B.1 and B.2 also support key assumptions regarding the household sector introduced below.

This mechanism mimics a key finding of the so-called induced innovations literature of the 1960s: higher expected wages induce faster labor-saving technical change (see Hicks 1932; von Weizsäcker 2010; Kennedy 1964; Samuelson 1965; Drandakis and Phelps 1966, or Funk 2002). It also plays an important role in models where automation is not labor-augmenting (see e.g., Acemoglu and Restrepo 2018d or Zeira 1998). The production sector developed in the present paper builds on and extends the one devised in Irmen (2017) and Irmen and Tabaković (2017) where the focus is on endogenous capital- and labor-saving technical change. Irmen (2020) studies the link between these models and the taxonomy developed in Acemoglu (2010).

Task-based models of automation tend to predict that automation reduces the labor share (see e.g., Acemoglu and Restrepo 2018d, and Acemoglu and Restrepo 2018c) for a discussion of the literature). In the present paper this feature occurs in spite of a Cobb–Douglas production function with constant coefficients.

The latter has two-period lived individuals with logarithmic utility, an exogenous labor supply growing at the same constant rate as the population, and a neoclassical production function of the Cobb–Douglas type (see e.g., Acemoglu 2009, Section 9.3).

This implication also contrasts with so-called semi-endogenous growth models (Jones 1995) where permanently lower population growth reduces the long-run growth rate of per-capita variables.

Allowing for each task n to be performed at a scale \(x_t(n)\ne 1\), means that (2.2) becomes \(x_t(n)= a_t(n) h_t(n)x_t(n)\). This generalization leaves the results derived below unchanged if the corresponding investment outlays of Eq. (2.4) are replaced by \(i_t(n)x_t(n)=\alpha q_{t}(n) x_t(n)\) reflecting the idea that a machine with a higher capacity requires proportionately larger investment outlays.

Imperfect substitution of labor with machines suggests that task n comprises subtasks. Following the substitution, more of these subtasks are performed by machines. This kind of substitution is in line with recent evidence, e.g., on the effect of computer-based technologies or of machine learning on occupations (Autor et al. 2003; Brynjolfsson et al. 2018).

If task n was performed in \(t-1\) then \(i_t(n)\) would also include the scrap costs of the old machine that is replaced. To avoid the asymmetry this would introduce for the investment outlays of tasks \(n\in [0,N_{t-1}]\) and \(n\in (N_{t-1},N_{t}]\) if \(N_{t}>N_{t-1}\) we neglect such expenses. This comes down to assuming that the firm can get rid of old machines without incurring a cost, i.e., its production set satisfies the property of free disposal. Observe that the qualitative results of this paper extend to more general functions i as long as these are increasing and convex.

This finding uses the minimization of costs per task and the definition of the firm’s demand for hours worked. Therefore, it generalizes beyond the Cobb–Douglas form to any production function \(F\left( K_t,N_t\right) \). For these functions one obtains \(Y_t= F\left( K_t, A_{t-1}\left( 1+q_t\right) H^d_t\right) \). Hence, the term labor-augmenting technical change is indeed meaningful here.

Hence, by assumption aging may affect the endogenous labor supply when young but not the timing of retirement. To a first approximation, this does not seem too far from reality. For instance, Bloom et al. (2010), pp. 5–6, report for a sample of 43 mostly developed countries that the average male life expectancy increased between 1965 and 2005 by 8.8 years whereas the average legal male retirement age increased by less than half a year. More strikingly, the correlation between the change in male life expectancy and the change in the retirement age over this time-span is small and negative. While recent years have seen political initiatives to increase the statutory retirement age, e.g., in the EU-27, there is often substantial political resistance (see e.g., New York Times 2011 or 2019) on France). Whether and how such changes impact on the effective retirement age that people choose is likely to depend on the future evolution of life expectancy and on institutional details of the retirement scheme (Gruber and Wise 2004). I shall get back to this issue in Sect. 6.

The function \(\bar{\nu }\left( \mu \beta \right) \) is strictly positive and declining in \(\mu \beta \) with \(\bar{\nu }(0)\approx 0.382\) and \(\bar{\nu }(1)\approx 0.293\). Hence, Assumption 1 imposes a tighter constraint on \(\nu \) than just \(\nu <1/2\) which is necessary for (2.19) to hold.

A higher \(\mu \) also reduces the gross rate of return to a surviving old, \(R_{t+1}/\mu \). However, for U of (2.18) the substitution and the income effect associated with such a reduction on \(h^s_t\), \(c^y_t\), and \(s_t\) cancel out.

A higher \(\mu \) means a higher \(w_c\). In Fig. 2 this shifts the aggregate supply of hours worked rightwards (not shown) so that \(\hat{\omega }_t\) falls.

In Fig. 2 a reduction of the labor supply at the extensive margin corresponds to a smaller \(L_t\). This shifts the aggregate supply of hours worked downwards (not shown). Hence, \(\hat{\omega }_t\) increases.

Consider a period length of 30 years and suppose that the annual productivity growth rate per hour worked is \(2\%\). Then, \(\hat{\omega }_{t+1}=(1.811)^2\alpha \) and \(\hat{q}_{t+1}=0.811\). Moreover, let \(\gamma =1/3\), \(\nu =1/4\), and \(g_L=0.35\), which corresponds to an annual fertility rate of \(1\%\). Then, condition (4.4) is satisfied for \(\mu <.75\). If instead \(g_L=0.56\), which corresponds to an annual fertility rate of \(1.5\%\), then condition (4.4) is satisfied for \(\mu <0.87\). For many industrialized countries the range of \(\mu \) interpreted, e.g., as the survival probability for males to age 65 between 1960-2017, is [0.5, 0.9] (see Section B.1 of the Online Appendix). Hence, condition (4.4) is sensitive to country-specific parameters.

The calibration exercise presented in Section B.3 of the Online Appendix reveals that the quantitative properties of the steady state are broadly consistent with the long-run evolution of industrialized economies over the last century.

Observe that a higher \(\nu \) increases the savings rate. Therefore, \(q^*\) also increases. The effect of a higher \(\nu \) on the growth factor of per-capita variables, \(\left( 1+q^*\right) ^{1-\nu }\), has to take the individual labor supply decision into account. Analytically, one can show that a higher \(\nu \) increases this growth factor if \(q^*\) is sufficiently small. This finding remains true for the parameter constellation considered in Footnote 16.

References

Acemoglu, D. (2009). Introduction to modern economic growth. Princeton University Press.

Acemoglu, D. (2010). When does labor scarcity encourage innovation? Journal of Political Economy, 118(6), 1037–1078.

Acemoglu, D., & Restrepo, P. (2018a). Artificial intelligence, automation, and work. In Economics of artificial intelligence. NBER Chapters: National Bureau of Economic Research Inc.

Acemoglu, D., & Restrepo, P. (2018b). Demographics and automation. NBER Working Papers 24421, National Bureau of Economic Research, Inc.

Acemoglu, D., & Restrepo, P. (2018c). Modeling automation. American Economic Review, Papers and Proceedings, 108, 48–53.

Acemoglu, D., & Restrepo, P. (2018d). The race between man and machine: Implications of technology for growth, factor shares, and employment. American Economic Review, 108(6), 1488–1542.

Allen, R. C. (2009). The British industrial revolution in global perspective. Cambridge University Press.

Autor, D. H., Levy, F., & Murnane, R. J. (2003). The skill content of recent technological change: An empirical exploration. The Quarterly Journal of Economics, 118(4), 1279–1333.

Aísa, R., Pueyo, F., & Sanso, M. (2012). Life expectancy and labor supply of the elderly. Journal of Population Economics, 25(2), 545–568.

Barro, R., & Lee, J.-W. (2018). Education attainment dataset. http://www.barrolee.com/.

Berg, A., Buffie, E. F., & Zanna, L.-F. (2018). Should we fear the robot revolution? (The correct answer is yes). Journal of Monetary Economics, 97(C), 117–148.

Blanchard, O. J. (1985). Debt, deficits, and finite horizons. Journal of Political Economy, 93, 223–247.

Bloom, D. E., Canning, D., & Fink, G. (2010). Implications of population ageing for economic growth. Oxford Review of Economic Policy, 26(4), 583–612.

Bloom, D. E., Canning, D., Mansfield, R. K., & Moore, M. (2007). Demographic change, social security systems, and savings. Journal of Monetary Economics, 54(1), 92–114.

Boppart, T., & Krusell, P. (2020). Labor supply in the past, present, and future: A balanced-growth perspective. Journal of Political Economy, 128(1), 118–157.

Brynjolfsson, E., & McAfee, A. (2014). The second machine age: Work, progress, and prosperity in a time of brilliant technologies. W. W. Norton & Company.

Brynjolfsson, E., Mitchell, T., & Rock, D. (2018). What can machines learn and what does it mean for occupations and the economy? American Economic Review, Papers and Proceedings, 108, 43–47.

Cutler, D. M., Poterba, J. M., Sheiner, L. M., & Summers, L. H. (1990). An aging society: Opportunity or challenge? Brookings Papers on Economic Activity, 21(1), 1–73.

de La Grandville, O. (1989). In quest of the slutsky diamond. American Economic Review, 79(3), 468–481.

Drandakis, E. M., & Phelps, E. S. (1966). A model of induced invention, growth, and distribution. The Economic Journal, 76, 823–840.

Ford, M. (2015). Rise of the robots: Technology and the threat of a jobless future. Basic Books.

Funk, P. (2002). Induced innovation revisited. Economica, 69, 155–171.

Galor, O. (2007). Discrete dynamical systems. Springer.

Goldfarb, A., & Tucker, C. (2019). Digital economics. Journal of Economic Literature, 57(1), 3–43.

Gruber, J., & Wise, D. A. (2004). Social security programs and retirement around the world: Micro-estimation, no. grub04-1 in NBER Books. National Bureau of Economic Research, Inc.

Hémous, D., & Olsen, M. (2021). The rise of the machines: Automation, horizontal innovation and income inequality. American Economic Journal: Macroeconomics (forthcoming).

Hicks, J. R. (1932). The theory of wages (1st ed.). London: Macmillan.

Huberman, M., & Minns, C. (2007). The times they are not Changi: Days and hours of work in old and new worlds, 1870–2000. Explorations in Economic History, 44(4), 538–567.

Irmen, A. (2017). Capital- and labor-saving technical change in an aging economy. International Economic Review, 58(1), 261–285.

Irmen, A. (2018a). A generalized steady-state growth theorem. Macroeconomic Dynamics, 22, 779–804.

Irmen, A. (2018b). Technological progress, the supply of hours worked, and the consumption-leisure complementarity. CESifo Working Paper Series 6843, CESifo Group Munich.

Irmen, A. (2020). Endogenous task-based technical change: Factor scarcity and factor prices. Economics and Business Review, 6(2), 81–118.

Irmen, A., & Tabaković, A. (2017). Endogenous capital- and labor-augmenting technical change in the neoclassical growth model. Journal of Economic Theory, 170, 346–384.

Jones, C. I. (1995). R&D-based models of economic growth. Journal of Political Economy, 103(4), 759–784.

Kaldor, N. (1961). Capital accumulation and economic growth. In F. A. Lutz & D. C. Hague (Eds.), The theory of capital (pp. 177–222). Macmillan & Co. Ltd., St. Martins Press.

Karabarbounis, L., & Neiman, B. (2014). The global decline of the labor share. The Quarterly Journal of Economics, 129(1), 61–103.

Kennedy, C. (1964). Induced bias in innovation and the theory of distribution. The Economic Journal, 74, 541–547.

Klump, R., & de La Grandville, O. (2000). Economic growth and the elasticity of substitution: Two theorems and some suggestions. American Economic Review, 90(1), 282–291.

Landes, D. S. (1969). The unbound Prometheus: Technological change and industrial development in Western Europe from 1750 to the present. Press Syndicate of the University of Cambridge.

Landes, D. S. (1998). The wealth and poverty of nations. W. W. Norton and Company.

Lutz, W., Sanderson, W., & Scherbov, S. (2008). The coming acceleration of global population ageing. Nature, Letters, 451, 716–719.

Mokyr, J. (1990). The lever of riches: Technological creativity and economic progress. Oxford University Press.

New York Times. (2011). France moves to raise minimum age of retirement. New York Times, September 15, 2011. Retrieved June 26, 2018, from, https://www.nytimes.com/2010/09/16/world/europe/16france.html.

New York Times. (2019). France pension protests: Why unions are up in arms against macron. New York Times, December 17, 2019. Retrieved December 17, 2019, from, https://www.nytimes.com/2019/12/17/world/europe/france-pension-protests.html.

Palivos, T., & Karagiannis, G. (2010). The elasticity of substitution as an engine of growth. Macroeconomic Dynamics, 14(05), 617–628.

Piketty, T. (2014). Capital in the twenty-first century. Harvard University Press.

Ross, A. (2016). The industries of the future. Simon & Schuster.

Samuelson, P. (1965). A theory of induced innovation along Kennedy–Weisäcker lines. Review of Economics and Statistics, 47(3), 343–356.

Steigum, E. (2011). Economic Growth and Development (Frontiers of Economics and Globalization). In G. de La Olivier (Ed.), Robotics and Growth (Vol.11, pp. 543–555). Bingley, UK: Emerald Group Publishing Limited.

United Nations. (2015). World Population Ageing 2015. United Nations, Department of Economic and Social Affairs, Population Division, New York, (ST/ESA/SER.A/390).

von Weizsäcker, C. C. (2010). (1962) A new technical progress function. Mimeo. MIT; published. In: German Economic Review, 11, 248–265.

Weil, D. (2008). Population aging. In S. N. Durlauf & L. E. Blume (Eds.), The new Palgrave dictionary of economics (2nd ed.). Palgrave Macmillan.

Yaari, M. (1965). Uncertain lifetime, life insurance and the theory of the consumer. The Review of Economic Studies, 32(2), 137–150.

Zeira, J. (1998). Workers, machines, and economic growth. Quarterly Journal of Economics, 113(4), 1091–1117.

Acknowledgements

The author gratefully acknowledges financial assistance under the Inter Mobility Program of the FNR Luxembourg (“Competitive Growth Theory—CGT”). A large fraction of this research was written during my visit to the Department of Economics at Brown University in the Spring 2018. I would like to thank Oded Galor and his colleagues for their kind hospitality. For valuable comments I am grateful to two anonymous referees, Gregory Casey, Oded Galor, Ka-Kit Iong, Jacqueline Otten, Klaus Prettner, Gautam Tripathi, audiences at Brown University, University of Hohenheim, University of Luxembourg, APET 2019 Strasbourg, EEA-ESEM 2019 Manchester, and at the Annual Conference of the Verein für Socialpolitik, Leipzig 2019.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendix: Proofs

Appendix: Proofs

The proofs of Proposition 2.2, 2.3, as well as of Corollary 2.2, 2.3, 4.6, and 5.3 are given in the main text.

1.1 Proof of Proposition 2.1

Given \(q\left( \omega _{t}\right) \) of (2.12), Eq. (2.8) delivers \(h_t=1/\left( A_{t-1}\left( 1+ q\left( \omega _{t}\right) \right) \right) \equiv h\left( \omega _{t}\right) /A_{t-1}\). From (2.4) \(i_t= i\left( \omega _{t}\right) \). Since the wage cost per task is \(w_t h_t=\omega _t h\left( \omega _{t}\right) \), we have \(c_t=\omega _t h\left( \omega _{t}\right) +i\left( \omega _{t}\right) \equiv c\left( \omega _{t}\right) \). Continuity of these functions follows since \(\lim _{\omega _t\downarrow \alpha } q\left( \omega _{t}\right) =0\). The remaining arguments that complete the proof are straightforward or given in the main text. \(\square \)

1.2 Proof of Corollary 2.1

If \(\omega _t>\alpha \) then \(q_t>0\) and the rationalization effect follows since \(\left( A_{t-1}\left( 1+q_t\right) \right) ^{-1}<A_{t-1}^{-1}\). The productivity effect follows since \(c_t\) is the solution to (2.10) and \(c\left( \omega _{t}\right) |_{\omega _t=\alpha }=\omega _t\). \(\square \)

1.3 Proof of Proposition 2.4

For ease of notation I shall most often suppress the time argument. Consider problem (2.21). Since preferences are increasing in \(c^o\) both periodic budget constraints will hold as equalities and can be merged. Accordingly, the Lagrangian of this problem is

Corner solutions involving \(c^y=c^o=0\) and \(l=1\) can be excluded since U satisfies the Inada conditions and \(l=1\) implies no income. Hence, with \(x\equiv \left( 1-l\right) \left( c^y\right) ^\frac{\nu }{1-\nu }\) the respective first-order Kuhn-Tucker conditions read as follows:

Suppose \(l>0\). Then, upon multiplication by \((1-l)\), condition (7.3) may be written as

Using the latter to replace \(\lambda \) in (7.2) and (7.4) delivers, respectively,

and

With (7.7) and (7.8) in the budget constraint (7.5) I obtain

Using (7.9) in (7.7), (7.8), and (2.20) delivers (2.22). Since the optimal plan satisfies Assumption 1 I have \(1>\nu (1+\mu \beta )\), hence, \(c^y>0\).

From the definition of x with \(h^s=1-l\) it holds that \(c^y= \left( x \left( h^s\right) ^{-1}\right) ^\frac{1-\nu }{\nu }\). Replacing \(c^y\) with this expression in (2.22) and solving for \(h^s\) delivers \(h^s_t\). Using the latter in (2.22) delivers \(c_t\) and \(s_t\). Then, \(c^o_{t+1}\) is obtained from the budget when old. Clearly, \(h^s_t\le 1\) as long as \(w_t\ge w_c\). In accordance with this, \(w< w_c\) implies a strict inequality in (7.3).

To see that the solution identified by the Lagrangian (7.1) is indeed a global maximum if \(\nu <\bar{\nu }\left( \mu \beta \right) \) consider first the leading principal minors of the Hessian matrix of \(U\left( c^y,l,c^o\right) \), i.e.,

First, we have \(-D_1\left( c^y,l,c^o\right) >0\). Second, observe that \(D_2\left( c^y,l,c^o\right) >0\) and \(-D_3\left( c^y,l,c^o\right) >0\) hold if and only if condition (2.19) holds. Hence, U is strictly concave for all \(\left( c^y,l,c^o\right) \in \mathcal {P}\).

What remains to be shown is that the solution identified by the Lagrangian satisfies condition (2.19). With \(\phi x\) of (7.9) this is the case if and only if

or

It is not difficult to show that the latter condition is satisfied if and only if \(\nu <\bar{\nu }\left( \mu \beta \right) \) as stated in Assumption 1.

Finally, observe that surviving members of cohort 0 satisfy their budget constraint when old as equality, i.e., we have \(c^o_1=R_1 s_0/\mu >0\). \(\square \)

1.4 Proof of Corollary 2.4

Some algebra reveals that

It follows that \(\partial h^s_t/\partial \mu >0\). From the definition of \(w_c\) and Proposition 2.4, \(c_t^y\) may be written as

Hence,

The sign of \(\partial s_t/\partial \mu >0\) follows since the marginal propensity to save in (2.22) increases in \(\mu \) and \(\partial h^s_t/\partial \mu >0\). Finally, using \(s_t\) in the budget constraint of a surviving old delivers

Hence, by Assumption 1

\(\square \)

1.5 Proof of Proposition 3.1

Under Assumption 2, \(H^{d}_t\) is given by (3.2) whereas \(H^s_t\) is given by (3.3). Hence, (3.4) delivers (3.5). Denote the right-hand side of (3.5) by \(RHS(\omega _t)\) where \(RHS:[\alpha ,\infty )\rightarrow [\underline{k}_c,\infty )\). Then, \(RHS(\alpha )=\underline{k}_c>0\). Moreover, since \(\nu <1/2\) we have \( RHS'(\omega _t)>0\) for \(\omega _t>\alpha \) and \(\lim _{\omega _t\rightarrow \infty }RHS(\omega _t)=\infty \). Hence, for Eq. (3.5) to be satisfied for any value \(\omega _t>\alpha \) it is necessary and sufficient to have \(RHS(\alpha )<k_t\) or \(k_t>\underline{k}_c\). Then, the above-mentioned properties of \(RHS(\omega _t)\) assure that there is indeed a unique \(\hat{\omega }_t>\alpha \) that satisfies (3.5). By the implicit function theorem, the function \(\omega \left( k_t\right) \) has the indicated properties. \(\square \)

1.6 Proof of Proposition 3.2

First, observe that \(k_t\) is a state variable of the inter-temporal general equilibrium. Indeed, given \(k_t>\underline{k}_c\), the labor market determines \(\hat{\omega }_t=A_{t-1}\hat{w}_t>\alpha \). Hence, Proposition 2.1 delivers \(q_t\), \(a_t\), \(i_t,\) and \(c_t\). Proposition 2.2 and (3.2) determine \(N_t\), \(Y_t\), \(I_t\), and \(H^d_t\). Hence, (2.13) delivers \(R_t\). On the household side, Proposition 2.4 gives \(h_t^s\), \(l_t\), \(c_t^y\), \(c_{t}^o\), \(s_t\). Finally, \(K_{t+1}\) follows from (3.6).

Second, consider (3.5) and replace \(\hat{\omega }_t\) by \(\omega _t=\left( k_{t+1}/\Omega \right) ^{1/(1-\nu )}\) from (3.7). Then, the equilibrium difference equation (3.8) is given by

Denote the right-hand side of (7.10) by RHS(k). The latter satisfies \(\lim _{k\downarrow \overline{k}_c}RHS(k)=\underline{k}_c\), is continuous, and, since \(\nu <1/2\), increasing with \(\lim _{k\rightarrow \infty }RHS(k)=\infty \). Hence, (7.10) assigns to each \(k_t>\underline{k}_c\) a unique \(k_{t+1}>\overline{k}_c\). To see that there is a unique fixed point \(k=RHS(k)\) write (7.10) for \(k_t=k_{t+1}=k\) as

or

where

Since \(0<\gamma <1\) and \(0<\nu <1/2\) it holds that \(0<\gamma /(2(1-\nu ))<1/(2(1-\nu ))<1\). Hence, the left and the right-hand side of (7.11) are concave with a unique intersection at some \(k>0\). Moreover, a straightforward graphical argument in \((k_{t+1},k_t)\) - space reveals that \(k>\overline{k}_c\) and that k is stable for all \(k_1>\underline{k}_c\) (see, e.g., Galor 2007). \(A_{0}>w_c/\alpha \) ensures Assumption 2. \(\square \)

1.7 Proof of Corollary 4.1

Since the right-hand side of (3.5) is increasing in \(\hat{\omega }_t\) and \(\partial w_c/\partial \mu >0\) there is by the implicit function theorem a function \(\hat{\omega }_t=\hat{\omega }(\mu )\) with \(d \hat{\omega }_t/d \mu <0\). Hence, \(d\hat{w}_t/d\mu =\left( \partial \hat{w}_t/\partial \omega _t\right) \left( d \hat{\omega }_t/d \mu \right) <0\). The sign of \(d\hat{q}_t/d\mu \) follows with Proposition 2.1. \(\square \)

1.8 Proof of Corollary 4.2

Let \(\hat{H}_t=H^d(\hat{\omega }_t)=H^d(\hat{\omega }(\mu ))\) where \(\hat{\omega }_t=\hat{\omega }(\mu )\) is defined in the Proof of Corollary 4.1. With \(\hat{N}_t=A_{t-1}\left( 1+q\left( \hat{\omega }(\mu )\right) \right) H^d(\hat{\omega }(\mu ))\) define \(\hat{GDP}_t=F\left( K_t,\hat{N}_t\right) -\hat{N}_t i\left( \hat{\omega }(\mu )\right) \equiv GDP\left( \hat{\omega }(\mu )\right) \). Then, it holds that \(d\hat{GDP}_t/d\mu =\left( \partial GDP\left( \hat{\omega }_t\right) /\partial \omega _t \right) \left( d\hat{\omega }_t/d\mu \right) \) where Corollary 4.1 delivers \(d\hat{\omega }_t/d\mu <0\). Some manipulations reveal that

where F is evaluated at \(\left( K_t,\hat{N}_t\right) \). In equilibrium, the bracketed expression in the first line vanishes. To see this, observe that the cost per task in a symmetric configuration is \(w_t h_t +i(q_t)=\omega _t/(1+q_t) +i(q_t)\). Minimizing this expression with respect to \(q_t\) gives the first-order condition \(\omega _t/(1+q_t)=(1+q_t)\partial i(q_t)/\partial q_t\). Hence, the minimized cost per task can be written as \(c_t=(1+q_t)\partial i(q_t)/\partial q_t+i(q_t)\). Profit maximization requires conditions (2.13) to hold. Hence, \(F_2=c_t=(1+q_t)\partial i(q_t)/\partial q_t+i(q_t)\) holds in equilibrium. As \(\partial H^d\left( \hat{\omega }_t\right) /\partial \omega _t<0\) and \(F_2-i\left( \hat{\omega }_t\right) >0\) it follows that \(\partial GDP\left( \hat{\omega }_t\right) /\partial \omega _t<0\), hence, \(d\hat{GDP}_t/d\mu >0\). \(\square \)

1.9 Proof of Corollary 4.3

Corollary 2.3 proves \(\partial LS_t/\partial \omega _t<0\). Hence, \(d\hat{LS}_t/d\mu =\left( \partial LS_t/\partial \omega _t\right) \left( d \hat{\omega }_t/d\mu \right) >0\). \(\square \)

1.10 Proof of Corollary 4.4

Consider (3.5) with \(k_{t+1}=K_{t+1}/\left( A_{t}^{1-\nu }L_t(1+g_L)\right) \). Since the right-hand side of (3.5) is increasing in \(\hat{\omega }_{t+1}\) there is by the implicit function theorem a function \(\hat{\omega }_{t+1}=\hat{\omega }(g_L)\) with \(d \hat{\omega }_{t+1}/d g_L<0\). Hence, \(d\hat{w}_{t+1}/dg_L=\left( \partial \hat{w}_{t+1}/\partial \omega _{t+1}\right) \left( d \hat{\omega }_{t+1}/d g_L\right) <0\). The sign of \(d\hat{q}_{t+1}/dg_L\) follows with Proposition 2.1. \(\square \)

1.11 Proof of Corollary 4.5

Let \(\hat{H}_{t+1}=H^d(\hat{\omega }_{t+1})=H^d(\hat{\omega }(g_L))\) where \(\hat{\omega }_{t+1}=\hat{\omega }(g_L)\) is defined in the proof of Corollary 4.4. With \(\hat{N}_{t+1}=A_{t}\left( 1+q\left( \hat{\omega }(g_L)\right) \right) H^d(\hat{\omega }(g_L))\) let \(\hat{GDP}_{t+1}=F\left( K_{t+1},\hat{N}_{t+1}\right) -\hat{N}_{t+1} i\left( \hat{\omega }(g_L)\right) \equiv GDP\left( \hat{\omega }(g_L)\right) \). Then, it holds that \(d\hat{GDP}_{t+1}/dg_L=\left( \partial GDP\left( \hat{\omega }_{t+1}\right) /\partial \omega _{t+1} \right) \left( d\hat{\omega }_{t+1}/d g_L\right) \). Some manipulations reveal that

where F is evaluated at \(\left( K_{t+1},\hat{N}_{t+1}\right) \). For the same reason as in the proof of Corollary 4.2, the bracketed expression in the first line vanishes. Hence, as \(\partial H^d\left( \hat{\omega }_{t+1}\right) /\partial \omega _{t+1}<0\) and \(F_2-i\left( \hat{\omega }_{t+1}\right) >0\) it follows that \(\partial GDP\left( \hat{\omega }_{t+1}\right) /\partial \omega _{t+1}<0\), hence, \(d\hat{GDP}_t/d g_L>0\).

Turning to the effect of \(g_L\) on \(\hat{gdp}_{t+1}\), observe that \(\hat{gdp}_{t+1}\equiv \hat{GDP}_{t+1}/\left( L_t\left( \mu +1+g_L\right) \right) \). Hence,

With (7.13) we have

where the second line uses the first-order condition (2.13) for \(N_{t+1}\), i.e., \(F_2(K_{t+1},N_{t+1})=c_{t+1}=w_{t+1}h_{t+1}+i_{t+1}\). The latter implies \(w_{t+1}=\left[ F_2(K_{t+1},N_{t+1})-i_{t+1}\right] /h_{t+1}=A_t\left( 1+q_{t+1}\right) \left[ F_2(K_{t+1},N_{t+1})-i_{t+1}\right] \).

With (3.5) and (4.2) one finds

where

With (7.15) and \(L_{t+1}=(1+g_L)L_t\) one obtains (4.4). \(\square \)

1.12 Proof of Proposition 5.1

From Proposition 3.2 the steady state has \(k_t=k^*>\overline{k}_c>\underline{k}_c\) so that Proposition 3.1 implies \(\omega _t=\hat{\omega }^*=\omega \left( k^*\right) >\alpha \). Then, from (2.12) I have \(q_t=q^*=q(\hat{\omega }^*)>0\), and the results listed under a) - d) follow from Proposition 2.1, Proposition 2.2, Proposition 2.4, Proposition 3.1, and Eqs. (2.13), (3.2) and (3.6). \(\square \)

1.13 Proof of Corollary 5.1

I show how a change in \(\mu \) and \(g_L\) affects \(\hat{\omega }^*\). Then, the corollary follows since \(\partial q(\hat{\omega }^*)/\partial \omega _t>0\) (see Proposition 2.1).

Consider the labor market equilibrium condition (3.5) and the capital market condition (3.7) in steady state. Solving both equations for \(k^*\) and substitution delivers

The right-hand side of Eq. (7.16) defines a continuous function \(RHS(\omega )\) with \(RHS'(\omega )>0\) for all \(\hat{\omega }^*>\alpha \). Then, total differentiation of (7.16) delivers \(d \hat{\omega }^*/d \mu >0\) and \(d \hat{\omega }^*/d g_L<0\). \(\square \)

1.14 Proof of Corollary 5.2

The sign of \(dg_{GDP}^*/d \mu \), \(d g_{gdp}^*/d \mu \), and \(d g_{gdp}^*/d g_L\) follow immediately from Corollary 5.1. To show that \(d g_{GDP}^*/d g_L>0\) observe that

where \(d q\left( \hat{\omega }^*\right) /d g_L=\left( \partial q\left( \hat{\omega }^*\right) /\partial \omega \right) \cdot \left( d \hat{\omega }^*/d g_L\right) <0\). Some algebraic manipulations using

obtained from (3.5) deliver the desired result. \(\square \)

Rights and permissions

About this article

Cite this article

Irmen, A. Automation, growth, and factor shares in the era of population aging. J Econ Growth 26, 415–453 (2021). https://doi.org/10.1007/s10887-021-09195-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10887-021-09195-w