Abstract

This paper documents the effect of the COVID-19 pandemic on the use of profession financial advisors across a broad sample of financial decision makers (N = 16,431). Findings show that financial literacy played a significant role in describing the use of financial advisors in the USA before and during the pandemic. Those who exhibited higher levels of financial literacy were more likely to use the services of professional financial advisors. Based on a series of regression tests, it was determined that the effect of COVID-19 on the use of financial advisors was, to some extent, moderated by financial literacy.

Similar content being viewed by others

Introduction

Complexities associated with making financial decisions have, over time, increased in relation to advancements in technology and innovations in the financial sector. Financial decision makers are increasingly being asked to navigate a market characterized by multifaceted interconnections, which requires both a proficient understanding of sophisticated financial instruments and the ability to judge the quality of advice received about products and services. Financial decision makers who rely on their own understanding, compared to those who depend on professional advice, often make poor financial choices because of a lack of knowledge, information costs, information asymmetry, and behavioral biases (Agnew & Szykman 2005; Fischer & Gerhardt, 2007; Hilgert et al., 2003; Lusardi & Mitchell, 2011). The extant literature shows that decision-making outcomes can be enhanced when a decision maker works with a professional financial advisor, primarily because advisors are trained to help their clients navigate the high degree of financial uncertainty associated with market complexities (Robb et al., 2012).

How financial literacy relates to the use of a financial advisor has recently received increasing attention among researchers. The relationship between the use of financial advisors and financial literacy—defined broadly as one’s knowledge and use of concepts, tools, and techniques needed to make effective financial decisions—is nuanced (Stolper & Walter, 2017). Much of the existing literature points to the notion that financial literacy and the use of financial advice are complements rather than substitutes (Collins, 2012). The literature also indicates that financial literacy increases the probability of seeking out and using financial advice (Calcagno & Monticone, 2015).

Households can obtain professional financial advice from a number of sources, including accountants, attorneys, stockbrokers, financial planners, and bankers. The type of financial advisor selected typically varies based on individual household needs and sociodemographic factors (Robb et al. 2012). Media reports from 2019 showed that roughly 17% of Americans use a financial advisor (CNBC, 2019), which is similar to usage rates in Europe, Australia, and Canada (Burke & Hung, 2015). Those who use financial advisors are more likely to state that they feel prepared for their financial future, especially when faced with economic uncertainty, compared to others who do not rely on professional advice when making financial decisions. Furthermore, the personal finance literature suggests that having a financial plan in place is associated with greater confidence during periods of economic ambiguity (Certified Financial Planner Board of Standards, 2019).

It is important to note, however, that much of the existing literature that discusses outcomes associated with the use of professional financial advice was collected prior to the spread of COVID-19. The world today looks much different than it did prior to the declaration of the worldwide COVID-19 pandemic. Every aspect of life has been altered by the pandemic, particularly in the USA (Cleveland Clinic, 2020). As of March 2021, there were approximately 30 million confirmed cases and over half a million deaths attributable to COVID-19 in the USA. The impact of COVID-19, and other societal health shocks, extends beyond morbidity (Gaunt & Benjamin, 2007; Turner et al., 1991). Millions of people are now experiencing unprecedented level of stress as they struggle to manage jobs, health, caregiving, and education amid great economic uncertainty (Fox & Bartholomae, 2020). During the deepest crisis moments of the COVID-19 pandemic, financial advisors reported increased client inquiries, with prospective clients contacting financial advisors with a range of concerns, such as managing investment volatility and protecting assets (Certified Financial Planner Board of Standards, 2020).

There are numerous reasons to believe the COVID-19 pandemic—and the ongoing response to the pandemic—altered the degree to which individuals seek and use professional financial advice. For example, Fox and Bartholomae (2020) reported that the majority of financial planners in the USA now practice virtual financial planning, which shifts services away from primarily technical advice giving to one that incorporates a focus on counseling.Footnote 1 Furthermore, it is known that approximately 74% of Americans adjusted their household and personal financial spending in reaction to COVID-19 (Reinicke, 2020). When providing counsel for coping with the pandemic, Reinicke (2020) emphasized the importance of utilizing professional advice, particularly in relation to financial decisions. A similar increase in demand for professional financial advice was observed following the Global Financial Crisis of 2008 (Haslem, 2010). It is not surprising, therefore, to read reports of an increased desire among a wide spectrum of households to seek financial advice.

Although there is some anecdotal evidence, primarily through media reports, that external and systemic shocks, like the Global Financial Crisis and the COVID-19 pandemic, increase the use of financial advisors, this possibility has not been fully explored in the literature. The goal of the present study is to address this gap in the literature by examining the degree to which the use of a professional financial advisorFootnote 2 changed in relation to the COVID-19 pandemic in the USA. This study focuses primarily on the USA because the US market for financial advice is large and relatively well developed. It is important to note, however, that responses to the pandemic continue to vary worldwide (International Monetary Fund, 2021) and that the US reaction to the pandemic in relation to professional finance advice help seeking may not be generalizable worldwide. Nonetheless, the pandemic is expected to influence financial services markets in ways that can informed by examining US financial decision-maker preferences and behaviors. What is learned in the USA may help other countries develop strategies and policies to improve the way individuals and households access professional financial advice.

Background

Literature review

The existing literature examining the use of financial advisors has consistently identified age, gender, marital status, wealth and income, education, financial knowledge, risk tolerance, and negative life events, as well as other factors, as being directly associated with the use of financial advisors (Fan, 2020, 2021; Ford et al., 2020). Use of professional financial advisors tends to be positively associated with income and wealth (Chang, 2005; Bluethgen et al., 2008; Elmerick et al., 2002; Hanna, 2011; Joo & Grable, 2001; Rengert & Rhine, 2016), education (Hanna, 2011; Elmerick et al., 2002), being female (Bluethgen et al., 2008; Joo & Grable, 2001; Hackethal et al., 2012), being married (Grable & Joo, 2001), and age (Bluethgen et al., 2008; Fan, 2021; Hanna, 2011; Hackethal et al., 2012; Joo & Grable, 2001).

Additionally, Hanna (2011) noted that individuals with greater degrees of risk tolerance (i.e., those who are less risk averse) are more likely to take advantage of financial advisory services when compared with individuals who exhibit lower risk tolerance (i.e., those who are more risk averse). In this regard, Cohn et al. (2015) reported that financial professionals exhibit less risk aversion (i.e., more risk tolerant) during financial booms compared to busts; however, König-Kersting and Trautmann (2018) did not find this countercyclical level of risk aversion among non-financial professionals. In relation to the COVID-19 pandemic, Huber et al. (2020) reported that market shocks resulting from the pandemic had different impacts on financial professionals and non-financial professionals. While financial professionals’ risk tolerance declined during the pandemic, the risk tolerance of non-financial professionals stayed relatively constant during the crisis. Outside of the USA, Shachat et al. (2020) reported an increase in risk tolerance in Wuhan China during the pandemic. Bu et al. (2020) argued that short-term changes in risk taking observed during the COVID-19 pandemic may stem more from changes in beliefs and optimism rather than from a fundamental shift in general risk preference.

A financial decision-maker’s degree of financial literacy has also been linked with the use of professional advice. Those who demonstrate greater financial knowledge are thought to be more likely to work with a financial advisor (Calcagno & Monticone, 2015). Some have also noted that seeking and using financial advice is related to experiencing major life events and stressors (e.g., economic and health shocks) (Leonard-Chambers & Bogdan, 2007).

Theory

One of the primary reasons individuals use the services of a financial advisor is to improve the accuracy of judgments and choices (Yaniv, 2004). Like any other form of economic decision-making, financial decisions require households to consider the relevant trade-offs between individual decision making (time intensive) and professional advice (resource intensive) (Fan, 2020). Making efficient and appropriate financial decisions requires significant knowledge of increasingly complex financial markets. Rather than investing scarce resources to acquire the financial knowledge needed to plan effectively, relying on the assistance of a professional may be more efficient (Anada et al., 2020; Chang, 2005).

Seeking advice is a form of information search where consumers will search until the marginal cost of the advice is equal to its marginal benefit (Stigler, 1961). In general, theorists have suggested that the demand for financial advisors should be related to the number and complexity of financial decisions that a particular household faces (Fan, 2021; Grable & Joo, 2001; Peterson, 2006). Milner and Rosenstreich (2013) pointed out that consumer decision making for financial services is an iterative process where the variables of interest combine in a nonlinear fashion to shape decisions related to help seeking. Financial literacy—the ability to use knowledge and skills to manage financial resources effectively (Yates & Ward, 2011)—is hypothesized to be, in this study, one of the key variables that describes help-seeking behavior. This hypothesis matches a proposition built into a widely modeled financial help-seeking framework first proposed by Suchman (1966) and modified by Grable and Joo (2001). In this framework, financial decision makers move through a series of behavioral and choice states to arrive at a point where the decision to seek and use help is ultimately made. The types of factors shaping the help-seeking choice tend to be broad, including demographic and socioeconomic characteristics of the household (Balasubramnian et al., 2014) as well as decision-maker preferences, experience, and knowledge/literacy (Lim et al., 2014; Robb et al., 2012).

Summary

While making financial decisions in the face of uncertainty has always been a challenge, the COVID-19 pandemic served to increase the complexities surrounding financial decision making and the practice of providing financial advice. Financial advisors and their clients have experienced, and continue to experience, significant stress resulting from the pandemic. In addition, external factors, such as job insecurity resulting from employer reactions to the pandemic, made the situation worse for many households. These issues continue to place new demands on financial advisors to provide advice that is both technically accurate and sensitive to the financial, social, and health realities faced by clients. In this regard, financial advisors have been tasked to incorporate more counseling skills into their work with clients. Layered into this are issues related to increased market volatility, the potential for household economic contraction, and general responses to calls for restructuring day-to-day activities. When viewed holistically, these factors combine to place increased burdens on household financial decision makers and financial advisors. Given the extant literature, one can reasonably hypothesize that the use of financial advisors likely increased during the COVID-19 pandemic compared to the pre-COVID-19 pandemic period. This seems like a reasonable proposition given the nature of financial advice—to serve as a source of reassurance and support during times of financial shock and economic turmoil. Whether this hypothesis is true, however, remains to be determined. The remainder of this paper presents the data and methods used to test this hypothesis.

Methods

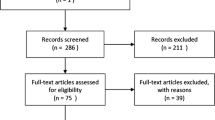

Data from a sample of investors and other financial decision makers (N = 16,431) were used to determine if the use of professional financial advisors increased as a result of the COVID-19 pandemic. Cross-sectional data were collected from individuals who visited a university-sponsored information and data-gathering website. The website was part of a larger multiyear proprietary data collection project sponsored by the University of Missouri (see Rabbani et al., 2018). While on the website, users were asked to respond to an internet survey. The survey was open to anyone with internet access (e.g., consumers, educators, financial counseling and planning practitioners, researchers, etc.). The website was publicized through Cooperative Extension Service publications, Land-Grant Extension specialists, references in trade publications, textbooks, and through word-of-mouth. Data from the survey have been widely used in previous research. Google™, Yahoo™, and Bing™ link to the website and survey as a primary search outcome associated with phrases like “financial risk tolerance assessment.” Information about the survey site has also been advertised as a no cost risk-assessment tool among financial literacy educators (e.g., Rabbani et al., 2018) and among those in the media (e.g., Robbins, 2014).

Data were collected over the period of January 2019 through early November 2020. This period represents the 22.5-month cycle in which no COVID-19 cases were known to a point when cases of COVID-19 were in the millions. In this study, the cutoff dividing the pre- and post-pandemic periods was the day the first COVID-19 case was confirmed in the USA, which was January 22, 2020 (Centers for Disease Control and Prevention, 2021; Heo et al., 2020). This date was used by Heo et al. (2020) when investigating the association between case trends and changes in financial behaviors among US financial decision makers resulting from the pandemic.

The survey, which took approximately 15 min to complete, was comprised of the following three sections: (a) a risk-tolerance assessment, (b) demographic and behavioral assessments, and (c) measures of financial literacy. The risk-tolerance questions were those developed by Grable and Lytton (1999). Demographic and behavioral questions included items designed to assess each respondent’s gender, age, education, income, and marital status. A separate question asked each respondent about their use of a financial advisor. The financial literacy questions were those proposed by Lusardi and Mitchell (2011).

Survey respondents were split into pre- and during-pandemic samples. The pre-pandemic sample included those who completed the survey between January 2, 2019, and January 21, 2020 (N = 8,106), whereas the during-pandemic sample included those who completed the same survey between January 22, 2020 and November 16, 2020 (N = 8,305). The sample was delimited to respondents over 25 years of age with investable assets. The sample was not designed to be representative of the larger US population; nonetheless, the sample was diverse and in many ways resembled the general characteristics of those who are tasked with making household financial decisions on a daily basis (McLachlan & Gardner, 2004). The sample was predominantly male (63%). The modal age category was 25 to 34 years, with the majority of respondents being married at the time of the survey (54%). The attained educational profile of those in the sample ranged from a high school diploma to a graduate or higher degree, with the majority reporting a Bachelor’s degree level of education or above. Household income was widely distributed, ranging from less than $25,000 to more than $100,000. The majority of respondents reported household income greater than $100,000.

The outcome variable of interest in this study was the use of a financial advisor. Respondents were asked to indicate if (a) they make their own investment decisions or (b) they rely on a professional when making investment decisions. Each response category was coded as a separate variable and coded dichotomously.

The independent variables used in the models were gender, age, education, marital status, income, risk tolerance, and financial literacy. Gender was coded as a binary variable, with males used as the reference group. Age was measured with the following seven categories: 1 = 25 to 34; 2 = 35 to 44; 3 = 45 to 54; 4 = 55 to 64; 5 = 65 to 74; and 6 = 75 and over. Six categories of marital status were used: 1 = married; 2 = never married; 3 = not married but living with significant other; 4 = separated/divorced; 5 = shared living arrangement; and 6 = widowed. Education level was measured on the following ordinal scale: 1 = Some high school or less; 2 = High school graduate; 3 = Some college/trade/vocational training; 4 = Associate degree; 5 = Bachelor's degree; and 6 = Graduate or professional degree. Household income was measured as an ordinal variable with 1 = Less than $25,000; 2 = $25,000 to $49,999; 3 = $50,000 to $74,999; 4 = $75,000 to $99,999; and 5 = $100,000 or greater. Financial risk tolerance (FRT) was measured using a 13-item scale developed by Grable and Lytton (1999). Scores on the 13 items were summed with higher scores indicating a greater willingness to take financial risk. Financial literacy was measured with three questions developed by Lusardi and Mitchell (2011). The questions were measured dichotomously as correct or incorrect and then summed to indicate four levels of financial literacy. The financial literacy variable was coded from 0 = extremely low financial literacy to 3 = high financial literacy.

A series of regression analyses were performed to assess whether the use of financial advisors was associated with the COVID-19 pandemic. For the purposes of this study, respondents were categorized by the date of survey completion and coded as follows: 1 if a response was recorded after January 22, 2020 (i.e., during the pandemic), otherwise 0. The first regression analyses were logistic regressions for each period (i.e., before-COVID-19 and during-COVID-19). These estimations used the following empirical models:

where Y represents whether a respondent used a financial advisor; bi denotes the coefficient of each level of financial literacy (i = 0, 1, and 2; reference i = 3); bj are coefficients of all other independent variables (i.e., financial risk tolerance, gender, age, marital status, education level, and income level); pre is the period before COVID-19; and post is the period during COVID-19. Seemingly Unrelated Estimation (SUE) (Weesie, 2000) was utilized to adjust standard errors simultaneously in order to compare the coefficients from Function 1 and Function 2. Specifically, gaps between any two coefficients (e.g., bipre—bipost) were tested to determine if gaps were equivalent to zero or otherwise. A Hausman test (Hausman, 1978) was used to test the significance of coefficient gaps. This assessment technique provided a robust way to evaluate the two models to determine if the models were comparable.

A second regression analysis was utilized to check the compound effect between periods (i.e., before- and during-COVID-19) and financial literacy. In this estimation, an interaction term between period and the level of financial literacy was used in the following empirical model:

where bc denotes the coefficient during COVID-19 and all includes all periods before and during the COVID-19 pandemic.

Results

As shown in Table 1, the use of a professional financial advisor across the broad sample of investors and other financial decision makers in this study remained very stable before and during the COVID-19 pandemic. Before the pandemic, 81% of the sample reporting making their own investment decisions, whereas 19% noted that they relied on a financial advisor when making investment decisions. The percentage of advisor usage was similar during the pandemic.

Data from Table 1 show that the average use of financial advisors did not change across the two COVID-19 periods. While it is true that an accelerated adoption of technology and virtual meetings when delivering financial advisory services increased during the pandemic (Fox & Bartholomae, 2020), the initial analysis conducted for this study did not indicate that financial decision makers changed their approach to financial and investment decision making in the context of the pandemic.

It is possible, however, that these averages may have disguised the true impact of the pandemic on financial advisor use. More specifically, advisor use was thought to have possibly changed based on the financial literacy status of respondents. A series of logistic regression models were used to test this possibility. The first set of regressions utilized the SUE method to provide a way to interpret coefficients more accurately through the estimation of standard errors (S.E.s) simultaneously across models. The results shown in Table 2 highlight the relationships between the independent variables and the use of financial advisors over the two periods.

As shown in Table 2, financial literacy was found to be positively associated with the use of financial advisors across the two periods, with a significant change detected between the two periods. Compared to the highest level of financial literacy (= 3) (i.e., the respondent answered all questions correctly), the intermediate level of financial literacy (= 2) (i.e., the respondent answered two of three questions correctly) showed a significant decreasing effect across the two periods (difference = 0.23; χ2 = 4.62, p < 0.05). In other words, the strength of association between financial literacy and advisor use decreased significantly for those who exhibited an intermediate level of financial literacy. Respondents, who were female, older than the reference group (i.e., age 25 to 34), and widows were found to be more likely to use a financial advisor before and during the pandemic. Before the pandemic, those with incomes greater than $100,000, compared to the reference group (i.e., incomes below $25,000), were less likely to use a financial advisor, whereas during the pandemic, those with incomes greater than $100,000 were more likely to report using a financial advisor. Additionally, a negative effect was noted between financial advisor use and education during the pandemic.

The last column of Table 2 shows the negative effect of gender during the COVID-19 pandemic. Whereas females were more likely than males, across periods, to use a financial advisor, the usage rate dropped significantly for women during the pandemic compared to the period before the pandemic. This finding differs from what has previously been reported in the literature related to shifts in help seeking resulting from economic shocks (e.g., Bluethgen et al., 2008; Joo & Grable, 2001; Hackethal et al., 2012). The decline in the use of financial advisors by females during the pandemic may be a result of the unbalanced impact the pandemic has had on women. Kochhar (2020) reported that COVID-19 related job losses disproportionately impacted female workers, which reduced incomes for female-headed households. When coupled with the finding showing that those earning $100,000 or more were more likely to report using a financial advisor during the pandemic, it is not surprising that women with constrained incomes would opt out of the financial advisor marketplace.

The relationship between financial literacy and use of a financial advisor was noteworthy. The finding showing that financial literacy was associated with a decrease in the use of financial advisors among those with an intermediate level of financial literacy prompted an additional analysis. Another logistic model was estimated that included interaction terms between financial literacy and the COVID-19 period. The results from the test are shown in Table 3.

As shown in Table 3, the pandemic did not have a direct meaningful effect on the use of financial advisors. However, when interacted with financial literacy, a significant effect was noted. During the pandemic, those who answered two out of three financial literacy questions correctly were found to be less likely to report using a financial advisor compared to those who answered all three questions correctly. This suggests that during the pandemic, financial decision makers who exhibited higher levels of financial literacy were more likely to seek and use financial advice. This finding indicates that seeking and using financial advice is a complement to financial literacy. The finding supports what has generally been reported in the literature (e.g., Collins, 2012). Other significant variables in Table 3 include being female, being older, widowed, and having income greater than $100,000. Education was found to be negatively associated with the use of a financial advisor.

Summary

When evaluating these results, it is worth considering the uniqueness of the sample. It is possible that a response bias was present in the data. The type of person who completes an online investment and financial decision-making survey may differ from other types of investors and financial decision makers. Also, it is possible that the demographic characteristics of respondents differed across periods.Footnote 3 Another possibility is that the sample may have been comprised of do-it-yourself investors and other financial decision makers who were seeking information from the survey website to help guide their own investment and financial choices. This could explain the negative education effect shown in Table 3. Those with more attained education may be more likely to manage their own household financial situation regardless of a health or financial shock, whereas those with less education may be more prone to seek out and rely on the advice of professionals. This possibility is worthy of additional study. Nonetheless, findings from Tables 2 and 3 do indicate that the effect of the COVID-19 pandemic, while not directly associated with financial advisor use, was moderated by financial literacy. During the pandemic, those with an intermediate level of financial literacy were significantly less likely to report using the services of a financial advisor. Males and those with high income, however, were more likely to report using a financial advisor during the pandemic compared to the before-COVID-19 period.

Discussion

This study was designed to evaluate the use of financial advisors before and during the COVID-19 pandemic by household financial decision makers. No meaningful changes in the proportions of use of financial advisors were noted when data from the pandemic were evaluated separately. Findings did show, however, that financial literacy played a significant role in describing the use of financial advisors. When the COVID-19 period was interacted with financial literacy scores it was determined that those who correctly answered two of three financial literacy questions were less likely to report using a financial advisor during the COVID-19 period compared to those who correctly answered all three questions. This suggests that the effect of COVID-19 on advisor use was moderated by financial literacy to some extent. It may be that those with some, but not perfect, financial literacy scores concluded that they could do just as well on their own compared to working with a financial advisor. Among other factors, gender, age, education, marital status, and income level were also found to be important in describing the use of financial advisors. Another significant finding from this study was that before the pandemic, higher household income, controlling for other household characteristics, was negatively associated with using a professional financial advisor; however, this association reversed during the pandemic.

While there is evidence that the use of financial advisors reduces panic selling during an environmental or financial crisis (e.g., Haslem, 2010), the results from this study suggest that events like the COVID-19 pandemic do not necessarily alter the seeking out and use of financial advisory services. Whereas one might expect a national or international health and/or financial crisis to drive consumers to increase the use of professional advisory services, this was not observed in this study. Instead, the findings showed that, if anything, a crisis may prompt some financial decision makers to eschew professional advice. Whether or not this is prudent is questionable. As noted in a 2013 TIAA-CREF survey, it is possible that some people may conclude that the costs, both in terms of time and money, coupled with the perception that financial advisors may not be trustworthy, are not worth the benefits associated with working with a professional financial advisor. In all likelihood, this conclusion is faulty. The literature does show that individuals who seek financial advice are more likely to follow the advice compared to individuals who receive unsolicited advice (Gibbons et al., 2003). While explicitly solicited advice is perceived as helpful, unsolicited advice or imposed support is generally perceived as intrusive and can even lead to negative feelings and actions (Deelstra, 2003; Goldsmith, 2000; Goldsmith & Fitch, 1997).

In a challenging social and economic environment, financial service firms are typically advised to maintain a highly integrative, customer-oriented sales culture based on building trust and relationship enhancement (Crittenden et al., 2014). This suggestion is particularly relevant during times of a health crisis. The COVID-19 pandemic fully tested the resiliency of financial advisors to adapt to the challenge of a global health shock. The findings from the present study suggest that financial advisors were able to maintain client engagement during the pandemic—no drop-off in the use of financial advisors was noted. This aligns with what Devlin et al. (2015) reported; namely, levels of trust in the financial services sector fluctuate only slightly during financial crises. While the hypothesis underlying this study was that the pandemic would have increased the use of financial advisors, what may have actually occurred is a shift in the way financial decision makers access information. Fox and Bartholomae (2020) described a “new normal” during the pandemic, which was characterized by a shorter, perhaps more efficient, web-based meeting with a shared screen showing portfolio or financial planning software illustrations. For financial decision makers with a preexisting financial advisory relationship, this approach to obtaining advice likely had a positive impact on the depth and breadth of the advisory relationship (Liang & Chen, 2009). For others, however, the “new normal” does not appear to have made a difference in shaping help-seeking behavior. The COVID-19 pandemic did not prompt a large segment of financial decision makers to seek the help of professional advisors. Whether the lingering effects of the pandemic will change this pattern of non-behavior remains to be determined.

While the findings from this study are noteworthy, three limitations should be considered when evaluating the results. First, the number of demographic variables used in the models was limited to those available in the dataset. Omitted variables may have affected results. For example, the dataset did not contain information about the race or ethnicity of respondents. Second, it is important to note that, given the limitations associated with the dataset’s cross-sectional design, the study did not address the potential issue of causality between the use of financial advisors and the independent variables. Future studies should further examine the issue of causality through the use of a panel dataset or an experimental study design. Finally, it is worth remembering that the sample was not representative of the USA as a whole. A nationally representative replication of this study would be valuable in adding to the existing literature.

Notes

Two profound household and personal financial side-effects of the COVID-19 pandemic have been observed. The first is increased financial asset price volatility. The second is a sharp reduction in close person-to-person interactions (Fox & Bartholomae, 2020; Lamdin, 2020). The pandemic forced (and in some cases continues to require) nearly all daily interactions onto online platforms. It is likely that the shift to virtual advice giving will remain in force long after the pandemic subsides, with COVID-19 likely influencing the way financial advice is conceptualized and presented in the future.

According to Cummings (2013), the terms “Financial Advisor” and “Financial Planner” are often used interchangeably. In practical terms, they likely represent slightly different groups of financial service providers. The term financial advisor is frequently used to describe an individual who is employed to provide advice on financial decisions, whereas the term financial planner is typically used to describe a specific subset of financial advisors who give particular attention to intertemporal consumption decisions in the presence of uncertainty (Cummings, 2013). In this regard, although most financial planners can also be considered financial advisors, some financial advisors may not be financial planners (Cummings, 2013). For consistency, financial advisor is used in this paper.

Given the potential adverse impact of different demographic characteristics across periods, a confirmatory factor analysis (CFA) was undertaken to provide clarity on this issue. It was thought that if the independent variables comprise one construct, across periods, then this minimizes the possibility of a response bias. Three CFA models were estimated (i.e., total sample model, before-COVID model, and during-COVID model). As shown in Appendix A, one factor, across periods, was identified using the set of independent variables. Each of the goodness-of-fit coefficients was in the acceptable range. This implies that changes in respondent characteristics across periods (i.e., a generalized response bias) were not a significant factor in the study.

References

Agnew, J.R., and L.R. Szykman. 2005. Asset allocation and information overload: The influence of information display, asset choice, and investor experience. The Journal of Behavioral Finance 6: 57–70.

Ananda, S., S. Devesh, and A.M. Lawati. 2020. What factors drive the adoption of digital banking? An empirical study from the perspective of Omani retail banking. Journal of Financial Services Marketing 25: 14–24.

Balasubramnian, B., E.R. Bricker, and S. Gradisher. 2014. Financial advisor background checks. Financial Services Review 23: 305–324.

Bluethgen, R., Gintschel, A., Hackethal, A., and Mueller, A. 2008. Financial advice and individual investors’ portfolios (available at SSRN: http://ssm.com/abstract=968197).

Bu, D., T. Hanspal, Y. Liao, and Y. Liu. 2020. Risk taking during a global crisis: Evidence from Wuhan. COVID Economics 5: 106–146.

Burke, J., and A.A. Hung. 2015. Financial advice markets. A cross-country comparison. Santa Monica: RAND Corporation.

Calcagno, R., and C. Monticone. 2015. Financial literacy and the demand for financial advice. Journal of Banking & Finance 50: 363–380.

Centers for Disease Control and Prevention, 2021. COVID Data Tracker: Trends in Number of COVID-19 Cases and Deaths in the US Reported to CDC, by State/Territory. Centers for Disease Control and Prevention. https://covid.cdc.gov/covid-data-tracker/#trends_totalandratecasessevendayrate.

Certified Financial Planner Board of Standards. 2019. CFP Board U.S. Economic Recession. https://www.cfp.net/-/media/files/cfp-board/knowledge/reports-and-research/consumer-surveys/cfpboard-morningconsult-us-recession-study-2019-10.pdf.

Certified Financial Planner Board of Standards. 2020. Pulse Survey: The Impact of Covid-19 on CFP® Professionals and Their Clients. https://www.cfp.net/-/media/files/cfp-board/knowledge/reports-and-research/certificant-surveys/2020-04-cfp-professionals-pulse-survey-report.pdf.

Chang, M. 2005. With a little help from my friends (and my financial planner). Social Forces 83: 1469–1497.

Cleveland Clinic, 2020. Here’s how the Coronovirus pandemic has changed our lives. https://health.clevelandclinic.org/heres-how-the-coronavirus-pandemic-has-changed-our-lives/.

CNBC, 2019. 75 percent of Americans are winging it when it comes to their financial future. https://www.cnbc.com/2019/04/01/when-it-comes-to-their-financial-future-most-americans-are-winging-it.html.

Cohn, A., J. Engelmann, E. Fehr, and M.A. Maréchal. 2015. Evidence for countercyclical risk aversion: An experiment with financial professionals. The American Economic Review 105: 860–885.

Collins, J.M. 2012. Financial advice: A substitute for financial literacy? Financial Services Review 21: 307–322.

Crittenden, V.L., W.F. Crittenden, and A.B. Crittenden. 2014. Relationship building in the financial services marketplace: The importance of personal selling. Journal of Financial Services Marketing 19: 74–84. https://doi.org/10.1057/fsm.2014.11.

Cummings, B. 2013. Three essays on the use and value of financial advice. [Unpublished doctoral dissertation]. Texas Tech University.

Deelstra, J.T., M.C.W. Peeters, W.B. Schaufeli, W. Stroebe, F.R.H. Zijlstra, and L.P. van Doornen. 2003. Receiving instrumental support at work: When help is not welcome. Journal of Applied Psychology 88: 324–331.

Devlin, J.F., C.T. Ennew, H.S. Sekhon, and S.K. Roy. 2015. Trust in financial services: Retrospect and prospect. Journal of Financial Services Marketing 20: 234–245. https://doi.org/10.1057/fsm.2015.21.

Elmerick, S.A., C.P. Montalto, and J.J. Fox. 2002. Use of financial planners by U.S. households. Financial Services Review 11: 217–231.

Fan, L. 2021. A conceptual framework of financial advice-seeking and short- and long-term financial behaviors: An age comparison. Journal of Family and Economic Issues 42 (3): 90–112.

Fan, L. 2020. Information search, financial advice use, and consumer financial behavior. Journal of Financial Counseling and Planning. https://doi.org/10.1891/JFCP-18-00086.

Fischer, R., & Gerhardt, R., 2007. Investment mistakes of individual investors and the impact of financial advice. Paper presented at the 20th Australasian Finance & Banking Conference, Sydney, Australia.

Ford, M.R., D.B. Ross, J. Grable, and A. DeGraff. 2020. Examining the role of financial therapy on relationship outcomes and help-seeking behavior. Contemporary Family Therapy 42 (3): 55–67.

Fox, J., and S. Bartholomae. 2020. Household finances, financial planning, and COVID-19. Financial Planning Review 3 (4): e1103. https://doi.org/10.1002/cfp2.1103.

Gaunt, R., and O. Benjamin. 2007. Job insecurity, stress, and gender: The moderating role of gender ideology. Community, Work and Family 10 (3): 339–353. https://doi.org/10.1080/13668800701456336.

Gibbons, A.M., Sniezek, J.A., and Dalal, R.S. 2003. Antecedents and consequences of unsolicited versus explicitly solicited advice. In D. Budescu (Chair), Symposium in Honor of Janet Sniezek. Symposium presented at the annual meeting of the Society for Judgment and Decision Making, Vancouver, BC.

Goldsmith, D.J. 2000. Soliciting advice: The role of sequential placement in mitigating face threat. Communications Monographs 67 (1): 1–19.

Goldsmith, D.J., and K. Fitch. 1997. The normative context of advice as social support. Human Communication Research 23: 454–476.

Grable, J.E., and S. Joo. 2001. A further examination of financial help-seeking behavior. Financial Counseling & Planning 12 (1): 55–65.

Grable, J., and R.H. Lytton. 1999. Financial risk tolerance revisited: The development of a risk assessment instrument☆. Financial Services Review 8: 163–181.

Hackethal, A., M. Haliassos, and T. Jappelli. 2012. Financial advisors: A case of babysitters? Journal of Banking & Finance 36: 509–524.

Hanna, S.D. 2011. The demand for financial planning services. Journal of Personal Finance 10 (1): 36–62.

Haslem, J.A. 2010. The new reality of financial advisors and investors. The Journal of Investing 19 (4): 23–30.

Hausman, J.A. 1978. Specification tests in econometrics. Econometrica 46: 1251–1271.

Heo, W., Rabbani, A.G., and Grable, J.E. 2020. An evaluation of the effect of the COVID-19 pandemic on the risk tolerance of financial decision makers. Finance Research Letters. Advanced online publication. https://doi.org/10.1016/j.frl.2020.101842.

Hilgert, M.A., J.M. Hogarth, and S.G. Beverly. 2003. Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin 89: 309.

Huber, C., Huber, J., and Kirchler, M. 2020. Market shocks and professionals’ investment behaviour—Evidence from the COVID-19 crash [Preprint]. Open Science Framework. https://doi.org/10.31219/osf.io/fgxpb.

International Monetary Fund. 2021. Policy Responses to COVID-19. International Monetary Fund. https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19.

Joo, S., and J. Grable. 2001. Factors associated with seeking and using professional retirement-planning help. Family & Consumer Sciences Research Journal 30 (1): 37–63.

Kochhar, R. 2020. Hispanic women, immigrants, young adults, those with less education hit hardest by COVID-19 job losses. Pew Research Center. Retrieved from https:// www.pewresearch.org/fact-tank/2020/06/09/hispanic-womenimmigrants- young-adults-those-with-less-education-hit-hardestby-covid-19-job-losses/.

König-Kersting, C., and S.T. Trautmann. 2018. Countercyclical risk aversion: Beyond financial professionals. Journal of Behavioral & Experimental Finance 18: 94–101. https://doi.org/10.1016/j.jbef.2018.03.001.

Lamdin, D.J. 2020. Lessons for and from COVID-19 for investors and their advisors. Financial Planning Review 3 (4): e1106. https://doi.org/10.1002/cfp2.1106.

Leonard-Chambers, V., and M. Bogdan. 2007. Why do mutual fund investors use professional financial advisers? Investment Company Institute Fundamentals 16 (16): 1–8.

Liang, C.-J., and H.-J. Chen. 2009. How to lengthen, deepen and broaden customer-firm relationships with online financial services? Journal of Financial Services Marketing 14 (3): 218–231. https://doi.org/10.1057/fsm.2009.20.

Lim, H., S.J. Heckman, C.P. Montalto, and J. Letkiewicz. 2014. Financial stress, self-efficacy, and financial help-seeking behavior of college students. Journal of Financial Counseling & Planning 25 (2): 148–160.

Lusardi, A., and Mitchell, O.S. 2011. Financial literacy and planning: Implications for retirement wellbeing (No. w17078). Washington, DC: National Bureau of Economic Research.

McLachlan, J., and J. Gardner. 2004. A comparison of socially responsible and conventional investors. Journal of Business Ethics 52 (1): 11–25.

Milner, T., and D. Rosenstreich. 2013. A review of consumer decision-making models and development of a new model for financial services. Journal of Financial Services Marketing 18: 106–120. https://doi.org/10.1057/fsm.2013.7.

Peterson, B. 2006. Are households with complex financial management issues more likely to use a financial planner? [Unpublished master’s thesis]. University of Wisconsin-Madison.

Rabbani, A., O’Neill, B., Lawrence, F., and Grable, J. 2018. The investment risk tolerance assessment: A resource for extension educators. Journal of Extension, 56(7), Article 3.

Reinicke, C. 2020. Covid-19 stress is driving the most vulnerable Americans to the brink. These 4 steps can help you cope. CNBC. Retrieved from https://www.cnbc.com/2020/10/14/these-4-steps-can-help-reduce-financial-stress-amid-covid-19.html.

Rengert, K.M., and Rhine, S.L. 2016. Bank efforts to serve unbanked and underbanked consumers: Qualitative research. Washington, DC: Federal Deposit Insurance Corporation. https://www.fdic.gov/consumers/community/research/qualitativeresearch_may2016.pdf.

Robb, C.A., P. Babiarz, and A. Woodyard. 2012. The demand for financial professionals’ advice: The role of financial knowledge, satisfaction, and confidence. Financial Services Review 21: 295–305.

Robbins, T. 2014. Money: Master the game—7 simple steps to financial freedom. New York: Simon & Schuster.

Shachat, J., Walker, M.J., and Wei, L. 2020. The Impact of the Covid-19 Pandemic on Economic Behaviours and Preferences: Experimental Evidence from Wuhan. P. 29.

Stigler, G.J. 1961. The economics of information. Journal of Political Economy 69: 213–225.

Stolper, O.A., and A. Walter. 2017. Financial literacy, financial advice, and financial behavior. Journal of Business Economics 87: 581–643.

Suchman, E.A. 1966. Health orientation and medical care. American Journal of Public Health 56: 97–105.

TIAA-CREF. 2013. Third annual financial advice survey. https://www.tiaa.org/public/pdf/TIAA-CREFAdviceSurveyExecutiveSummary2013.pdf.

Turner, J.B., R.C. Kessler, and J.S. House. 1991. Factors facilitating adjustment to unemployment: Implications for intervention. American Journal of Community Psychology 19: 521–542. https://doi.org/10.1007/BF00937990.

Weesie, J. 2000. Seemingly unrelated estimation and the cluster-adjusted sandwich estimator. Stata Technical Bulletin 52, 34–47. Reprinted in Stata Technical Bulletin Reprints, 9, 231–248. College Station, TX: Stata Press.

Yaniv, I. 2004. Receiving other people’s advice: Influence and benefit. Organizational Behavior & Human Decision Processes 93: 1–13.

Yates, D., and C. Ward. 2011. Financial literacy: Examining the knowledge transfer of personal finance from high school to college to adulthood. American Journal of Business Education 4 (1): 65–78.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Rabbani, A., Heo, W. & Grable, J.E. The role of financial literacy in describing the use of professional financial advisors before and during the COVID-19 pandemic. J Financ Serv Mark 26, 226–236 (2021). https://doi.org/10.1057/s41264-021-00109-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41264-021-00109-w