Abstract

In this study, we argue that racial discrimination exists in the credit markets in Latin American countries, particularly in Mexico, despite the subject of ethnicity being taboo. We have designed and conducted an experiment to verify the existence of racial discrimination in the access to the credit market in Mexico. In particular, because of the nature of the experiment, we have concentrated on the first step of the credit application process, namely, the inquiry process. We hired three professional pairs of Mexican actors that consisted of one white, Spanish member and one dark-skinned, mestizo member. These pairs impersonated small entrepreneurs with the same qualities and creditworthiness. The actors visited close to 300 randomly selected commercial banking branches in Mexico City to apply for credit. The results provide evidence of discriminatory behavior against dark-skinned Mexicans even after controlling for features such as their creditworthiness, annual sales, and industry as well as loan officers’ demographics and styles, among others.

Similar content being viewed by others

Notes

The government development bank provides these performance indicators.

In this sense, in contrast to advanced nations, the majority (i.e., the mestizo) not the minority (whites) is the one subject to discrimination.

The study was subject to different criticisms; see Browne and Tootell (1995).

Desai and Mollick (2014), while not addressing race, find that border cities in Mexico and the US are closely related even in credit markets. When the economies of border cities are not synchronized, bankruptcy rates are affected. The effect is favorable for the US border cities when the sister cities in Mexico are booming. The opposite holds.

Only recently did the National Institute for Statistics consider the race question in the novel Social Mobility Survey of 2016. Nonetheless, no question regarding credits was included.

We asked actors to provide the name of the loan officer they met in each branch. The information shows that in a minority of cases the loan officer interviewed was the same. To compensate for the impossibility to ensure both actors in each pair met the same loan officer, the questionnaire asked about the demographics of the loan officer that allowed us to control for characteristics such as gender, age group, skin color, and weight.

We ruled out self-discrimination because we selected extroverted, self-confident actors during the auditions. Furthermore, actors were trained on what we consider as rejection, discrimination, and generally negative perception that allowed all testers to have in mind the same concept. Needless to say, these tactics minimized the problem, but the problem will never be completely solved.

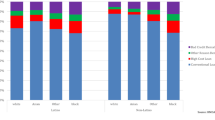

Bank 5 is the one that consistently obtained the lowest proportions of discrimination variables.

References

Adams G, Tormala TT, O’Brien LT (2006) The effect of self-affirmation on perception of racism. J Exper Social Psych 42(5): 616–626. https://doi.org/10.1016/j.jesp.2005.11.001

Agresti A (2010) Categorical data analysis (3rd ed). New York, NY, John Wiley & Sons

Ahlbrandt Jr RS (1977) Exploratory research on the redlining phenomenon. Real Estate Econ 5(4): 473–481. https://doi.org/10.1111/1540-6229.00846

Altamirano M, Trejo G (2016) The Mexican color hierarchy: How race and skin tone still define life chances 200 years after independence. Amer Poli Sci Assoc Mimeo

Arceo-Gómez EO, Campos-Vazquez RM (2014) Race and marriage in the labor market: A discrimination correspondence study in a developing country. Amer Econ Rev 104(5): 376–380. https://doi.org/10.1257/aer.104.5.376

Armendáriz B, Morduch J (2010) The economics of microfinance, 2nd edn. MIT Press, Cambridge

Arrow K (1971) The theory of discrimination. Princeton University, Princeton NJ

Bank of Mexico (2017) Financial System Report. October. Mexico City

Bartoš V, Bauer M, Chytilová J, Matějka, F (2016) Attention discrimination: Theory and field experiments with monitoring information acquisition. Amer Econ Rev 106(6): 1437–1475. https://doi.org/10.1257/aer.20140571

Bates T M (1994) An analysis of Korean-immigrant-owned small-business start-ups with comparisons to African American and nonminority-owned firms. Urban Affairs Quar 30(2): 227–248. https://doi.org/10.1177/004208169403000203

Bates T, Bradford WD, Jackson WE (2018) Are minority-owned businesses underserved by financial markets? Evidence from the private-equity industry. Small Bus Econ 50(3): 445–461. https://doi.org/10.1007/s11187-017-9879-1

Becker G (1971) The economics of discrimination, 2nd edn. University of Chicago Press, Chicago

Berjot S, Gillet N (2011) Stress and coping with discrimination and stigmatization. Frontiers Psych 2(33). https://doi.org/10.3389/fpsyg.2011.00033PubMed: 21713247

Bertrand M, Mullainathan S (2004) Are Emily and Greg more employable than Lakisha and Jamal? A field experiment on labor market discrimination. Amer Econ Rev 94(4): 991–1013. https://doi.org/10.1257/0002828042002561

Bertrand M, Duflo E (2017) Field Experiments on Discrimination. In Handbook of Field Experiments, edited by Abhijit Banerjee and Esther Duflo. Vol. 2. North-Holland

Blanchflower DG, Levine PB, Zimmerman DJ (2003) Discrimination in the small-business credit market. Rev Econ Stat 85(4): 930–943. https://doi.org/10.1162/003465303772815835

Bone SA, Christensen GL, Williams JD (2014) Rejected, shackled, and alone: The impact of systematic restricted consumer choice among minority customers’ construction of self. J Consumer Rese 41(2): 451–474. https://doi.org/10.1086/676689

Bostic RW (2003) A Test of Cultural Affinity in Home Mortgage Lending. J Financ Serv Res 23:89–112. https://doi.org/10.1023/A:1022852230803

Bradbury KL, Case KE, Dunham CR (1989) Geographic patterns of mortgage lending in Boston, 1982–87. New Eng Econ Rev (Sep/Oct): 3–30

Browne LE, Tootell GMB (1995) Mortgage lending in Boston—A response to the critics. New Eng Econ Rev Sep–Oct: 53

Campos R, Medina E (2017) Identidad social y estereotipos por color de piel: Aspiraciones y desempeño en jóvenes mexicanos’, Serie documentos de trabajo del Centro de Estudios Económicos 2017–05, El Colegio de México Centro de Estudios Económicos

Canner GB (1999) Evaluation of CRA Data on small business lending. Business access to capital and credit. Federal Reserve Bank of Chicago, Chicago, pp 53–84

Canner G, Smith D (1991) Home mortgage disclosure act: Expanded data on residential lending. Federal Reserve Bulletin, 77, November: 863–864

Cavalluzzo KS, Cavalluzzo LC (1998) Market structure and discrimination: The case of small businesses. J Money Credit Bank 30(4): 771–791. https://doi.org/10.2307/2601128

Cavalluzzo K, Wolken J (2005) Small business loan turndowns, personal wealth and discrimination. J Business 78(6), 2153–2178. https://doi.org/10.1086/497045

CNBV (2016) ENAFIN (Encuesta Nacional de Competitividad, Fuentes de Financiamiento y Uso de Servicios Financieros de las Empresas). México, DF: Reporte de Resultados

Deaton AS, Cartwright N (2016) Understanding and Misunderstanding Randomized Controlled Trials (Sep 2016). NBER Working Paper No. w22595, Available at SSRN: https://ssrn.com/abstract=2835853

Desai CA, Mollick AV (2014) On Consumer Credit Outcomes in the U.S.-Mexico Border Region. J Financ Serv Res 45, 91–115. https://doi.org/10.1007/s10693-012-0154-y

Dymski G (2006) Discrimination in the credit and housing markets: Findings and challenges. In: Handbook on the economics of discrimination. Rutgers, Piscataway, NJ, pp 215–251

Dymski GA, Veitch JM (1994) Taking it to the bank: Credit, race, and income in Los Angeles. In: Bullard R D, Lee C, Grigsby III J E (eds) Residential segregation: The American legacy, L A Center Afro-Amer Stud. pp 150–179

FINDEX (2017) The Global Findex Database. The World Bank. Washington DC https://globalfindex.worldbank.org/

Gaddis MS (2018) An introduction to audit studies in the social sciences. In: Gaddis M S (ed), Audit studies: Behind the scenes with theory, method, and nuance. Springer International, AG, Berlin

Galster GC (1992) Research on discrimination in housing and mortgage markets: Assessment and future directions. Housing Policy Debate 3(2): 637–683. https://doi.org/10.1080/10511482.1992.9521105

Gamio M (1916) Forjando patria (pro nacionalismo), Porrúa, México, 1992

Garz S, Giné X, Karlan D, Mazer R, Sanford C, Zinman J (2020) Consumer Protection for Financial Inclusion in Low and Middle Income Countries: Bridging Regulator and Academic Perspectives. NBER Working Paper Series, no. w28262. Cambridge, Mass: National Bureau of Economic Research

Grown C, Bates T (1992) Commercial bank lending practices and the development of black owned construction companies. J Urban Affairs 14(1): 25–41. https://doi.org/10.1111/j.1467-9906.1992.tb00273.x

Guryan J, Charles KK (2013) Taste-Based or Statistical Discrimination: The Economics of Discrimination Returns to Its Roots. Econ J 123(572):F417–F432

Hanson A, Hawley Z, Martin H, Liu B (2016) Discrimination in mortgage lending: Evidence from a correspondence experiment. J Urban Econ 92(C), 48–65

Heckman JJ (1998) Detecting discrimination. J Econ Perspec 12(2):101–116. https://doi.org/10.1257/jep.12.2.101

Heckman J, Siegelman P (1993) The Urban Institute audit studies: Their methods and findings. In: Fix M, Struyk R (eds), Clear and convincing evidence: Measurement of discrimination in America. Urban Institute, Fall

Hernández-Trillo F, Villagómez A (2011) Estudio de evaluación de nacional financiera, sociedad nacional de crédito (NAFIN): 2008–2010 Retrieved from https://www.gob.mx/cms/uploads/attachment/file/22326/2010_evaluacion_nafin.pdf

Immergluck D (1999) Intraurban patterns of small business lending: Findings from the new Community Reinvestment Act data. Business access to capital and credit. Federal Reserve Bank of Chicago, Chicago, pp 123–138

INEGI (2019) Censo económico 2019 Retrieved from https://www.inegi.org.mx/programas/ce/2019/

INEGI (2016) Banco de información económica Retrieved from http://en.www.inegi.org.mx/app/indicadores/?tm=0

List JA (2004) The nature and extent of discrimination in the marketplace: Evidence from the field. Quart J Econ 119(1), 49–89. https://doi.org/10.1162/003355304772839524

Mahoney J (2008) Toward a Unified Theory of Causality. J Comparative Political Studies 41:412–436

Martin RE, Hill R (2000) Loan performance and race. Econ Inquiry 38(1): 136–150. https://doi.org/10.1111/j.1465-7295.2000.tb00009.x

McNemar Q (1947) Note on the sampling error of the difference between correlated proportions or percentages. Psychometrika 12(2): 153–157. https://doi.org/10.1007/BF02295996 PubMed: 20254758

Munnell A, Tootell GMB, Browne L, McEneaney J (1996) Mortgage lending in Boston: Interpreting HMDA data. Amer Econ Rev 86(1): 25–53. Retrieved from http://www.jstor.org/stable/2118254

Olney ML (1998) When Your Word is Not Enough: Race. Collateral, and Household Credit in the Journal of Economic History, Jun 58(2):408–431

Pager D (2003) The Mark of a Criminal Record. Am J Sociol 108(5):937–975

Pager D (2007) The use of field experiments for studies of employment discrimination: Contributions, critiques, and directions for the future. ANNALS of the American Academy of Political and Social Science 609(1): 104–133. https://doi.org/10.1177/0002716206294796

Phelps E (1972) The statistical theory of racism and sexism. Amer Econ Rev 62(4):659–661

Riach PA, Rich J (2002) Field experiments of discrimination in the marketplace. Econ J CXII: 480–518

Rojas M (1999) Costo de transacción y discrecionalidad en la asignación del crédito preferencial en México. Trimestre Económico Abril-Junio 66(262 (2)), 227–258

Ross SL (2002) Paired testing and the 2000 housing discrimination study. In: Feinberg S E, Mitchell F, Foster A W (eds), Measuring housing discrimination in a National Study. National Academy Press, Washington, DC, pp Need Pages

Ross SL, Turner MA, Godfrey E, Smith R (2005) Mortgage lending in Chicago and Los Angeles: A paired testing study of the pre-application process. [Unpublished] manuscript, University of Connecticut

Schafer R (1978) Mortgage lending decisions, criteria and constraints. Joint Center for Urban Studies, MIT and Harvard, Cambridge

Shlay AB (1989) Financing community: Methods for assessing residential credit disparities, market barriers, and institutional reinvestment performance in the metropolis. J Urban Affairs 11(3): 201–223. https://doi.org/10.1111/j.1467-9906.1989.tb00189.x

Squires GD, O’Connor S (1999) Access to capital: Milwaukee’s small business lending gaps. Business access to capital and credit. Federal Reserve Bank of Chicago, Chicago, pp 85–122

Storey DJ (2004) Racial and gender discrimination in the micro firms credit market? Evidence from Trinidad and Tobago. Small Bus Econ 23(5): 401–422. https://doi.org/10.1007/s11187-004-7259-0

Turner MA, Skidmore F (1999) Mortgage lending discrimination: A review of existing evidence. Urban Institute, Washington, DC

Vuolo M, Uggen C, Lageson S (2015) Statistical power in experimental audit studies: Cautions and calculations for matched tests with nominal outcomes. Sociolog Methods Res 2015:1–44

Wade P (2010) Race and ethnicity in Latin America. Pluto Press, NY

Acknowledgements

We appreciate the comments received from Eva Arceo, Gustavo del Angel, Mariana Olvera, Paula Leite, Edwin Tapia, an anonymous referee, the editor N. Prabhala; and seminar participants at CIDE, the National Institute for the Prevention of Discrimination, the Mexican Institute of Competitiveness, ITESM, and the University of Coahuila. Finally, we thank CIDE for its financial support. We are solely responsible for any errors.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Hernández-Trillo, F., Martínez-Gutiérrez, A.L. The Dark Road to Credit Applications: The Small-Business Case of Mexico. J Financ Serv Res 62, 1–25 (2022). https://doi.org/10.1007/s10693-021-00356-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-021-00356-x