Abstract

Comparing one hyper-growth venture with one moderate growth venture, we show that growth paths critically depend on the founders’ capability to leverage BAs’ and VCs’ financial and cognitive resources in an ongoing process of interaction. Dynamically matching specific entrepreneurs’ and investors’ decision-making styles is critical for shaping heterogeneous growth paths, as investors and entrepreneurs interact. Specifically, sharing a predictive decision-making style among VCs, BAs and entrepreneurs facilitate mutual communication and shared understanding in the joint pursuit of ambitious growth targets. To the contrary, matching non-predictive and purely control-oriented entrepreneurs with BAs featuring an identical decision-making style locks the venture into a moderate growth trajectory. This has practical implications for entrepreneurs searching for the adequate funding strategy, and for equity investors in their assessment of entrepreneurs’ cognitive profiles.

Plain English Summary

Decision-making style in entrepreneurial finance and growth: how matching predictive entrepreneurs with predictive VCs and business angels boosts venture growth. Predictive decision-making boosts strong venture growth when shared by entrepreneurs, business angels (BAs), and venture capitalists (VCs) alike. Purely control-oriented entrepreneurs get locked into moderate growth when teaming up with control-oriented BAs, unless they dynamically adapt their decision-making style as a result of their interaction. Matching of decision-making styles appears hence to be crucial to sustain growth. Decision-making styles are not necessarily static, and the various actors may adapt their approach to changed circumstances. Certain BAs may play a prominent role in the process of change. Dynamic matching is a relevant avenue for future research. Our findings have also practical implications for the various actors in the field of entrepreneurial finance. Investors targeting especially strong growth should team up with highly predictive entrepreneurs only.

Similar content being viewed by others

Notes

For reasons of confidentiality, the names of the company, the co-founders, and the BAs have been anonymized. Quadro is a fictitious name.

For reasons of confidentiality, the names of the co-founders and the BAs have been anonymized. The CEO/Co-founder has allowed us to mention the name of the company, Primo1D.

Leti is a technology research institute of the CEA (Commissariat à l’énergie atomique et aux énergies alternatives), the French Atomic Energy and Alternative Energy Commission, specializing in micro and nano-technologies and their applications to wireless communication systems and components, to biology and health, to imaging, and to micro-nano systems. (Source: leti-cea.fr)

In 2012, iSource and France Angels created Angel Source, the leading French fund for co-investments with business angel networks. iSource, via the Angel Source fund, invests pari passu with BA networks in promising young technology firms. In 2015, Sofimac Partners (seed capital fund) acquired a majority stake in iSource.

Source: Financial data from the DIANE database

See Appendix 1 for exemplary quotes from the two cases.

E-Thread™ technology is based on the micro-encapsulation of electronic circuits. E-Thread™ is a miniaturized electronic component that can be inserted invisibly into a textile yarn or any material containing textile yarn.

Source AFIC : Association française des investisseurs pour la croissance (French Association of Investors for Growth). www.afic.asso.fr[last accessed 12th April 2020.]

Textile yarn, with an integrated electronic chip in the middle.

References

Aguinis, H., & Solarino, A. M. (2019). Transparency and replicability in qualitative research: The case of interviews with elite informants. Strategic Management Journal, 40(8), 1291–1315. https://doi.org/10.1002/smj.3015.

An, W., Rüling, C. C., Zheng, X., & Zhang, J. (2020). Configurations of effectuation, causation, and bricolage: implications for firm growth paths. Small Business Economics, 54, 843–864. https://doi.org/10.1007/s11187-019-00155-8.

Appelhoff, D., Mauer, R., Collewaert, V. & Brettel, M. (2016). The conflict potential of the entrepreneur’s decision-making style in the entrepreneur-investor relationship. International Entrepreneurship and Management Journal, 1(23).

Barney, J. B., Busenitz, L. W., Fiet, J. O., & Moesel, D. D. (1996). New venture teams’ assessment of learning assistance from venture capital firms. Journal of business venturing, 11(4), 257–272. https://doi.org/10.1016/0883-9026(95)00011-9.

Baum, J. A. C., & Silverman, B. S. (2004). Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology start-ups. Journal of Business Venturing, 30(2), 411–436. https://doi.org/10.1016/S0883-9026(03)00038-7.

Bertoni, F., Colombo, M. G., & Grilli, L. (2011). Venture capital financing and the growth of high-tech start-ups: Disentangling treatment from selection effects. Research Policy, 40(7), 1028–1043. https://doi.org/10.1016/j.respol.2011.03.008.

Bessière, V., Stephany, E., & Wirtz, P. (2020). Crowdfunding, business angels, and venture capital: an exploratory study of the concept of the funding trajectory. Venture Capital, 22(2), 1–26. https://doi.org/10.1080/13691066.2019.1599188.

Biga Diambeidou, M., & Gailly, B. (2011). A taxonomy of the early growth of Belgian start-ups. Journal of Small Business and Enterprise Development, 18(2), 194–218. https://doi.org/10.1108/14626001111127034.

Biga Diambeidou, M., Damien, F., Gailly, B., Janssen, F., Verleysen, M., & Wertz, V. (2007). Les trajectoires de croissance des jeunes entreprises. Gestion 2000, 24(3), 83–102.

Block, J., Fisch, C., Vismara, S., & Andres, R. (2019). Private equity investment criteria: An experimental conjoint analysis of venture capital, business angels, and family offices. Journal of Corporate Finance, 58, 329–352. https://doi.org/10.1016/j.jcorpfin.2019.05.009.

Bonnet, C., & Wirtz, P. (2010). Investor type and new-venture governance: cognition vs. interest alignment. Working Papers CREGO 1100704, Université de Bourgogne - CREGO EA7317 Centre de recherches en gestion des organisations.

Bonnet, C., & Wirtz, P. (2011). Investor type, cognitive governance and performance in young entrepreneurial ventures: A conceptual framework. The Journal of the Academy of Behavioral Economics and Finance, 1(1), 42–62 halshs-00642737.

Bonnet, C., & Wirtz, P. (2012). Raising capital for rapid growth in young technology ventures: When business angels and venture capitalists coinvest. Venture Capital, 14(2-3), 91–110. https://doi.org/10.1080/13691066.2012.654603.

Bonnet, C., Wirtz, P., & Haon, C. (2013). Liftoff: When strong growth is predicted by angels and fuelled by professional venture funds. Revue de l’Entrepreneuriat, 12(4), 59–78. https://doi.org/10.3917/entre.124.0059.

Brown, R., & Mawson, S. (2013). Trigger points and high-growth firms. Journal of Small Business and Enterprise Development., 20(2), 279–295. https://doi.org/10.1108/14626001311326734.

Bruton, G., Fried, V., & Hisrich, R. D. (1997). Venture capitalist and CEO dismissal. Entrepreneurship Theory and Practice, 21(3), 41–54. https://doi.org/10.1177/104225879702100303.

Bruton, G. D., Fried, V. H., & Hisrich, R. D. (2000). CEO dismissal in venture capital-backed firms: Further evidence from an agency perspective. Entrepreneurship Theory and Practice, 24(4), 69–77. https://doi.org/10.1177/104225870002400405.

Capizzi, V., Bonini, S., & Cumming, D. (2019). Emerging trends in entrepreneurial finance. Venture Capital, 21(2-3), 133–136. https://doi.org/10.1080/13691066.2019.1607167.

Cavallo, A., Ghezzi, A., Dell’Era, C., & Pellizzoni, E. (2019). Fostering digital entrepreneurship from startup to scaleup: The role of venture capital funds and angel groups. Technological Forecasting and Social Change, 145, 24–35. https://doi.org/10.1016/j.techfore.2019.04.022.

Chandler, G., DeTienne, D., McKelvie, A., & Mumford, T. (2011). Causation and effectuation processes: a validation study. Journal of Business Venturing, 26(3), 375–390. https://doi.org/10.1016/j.jbusvent.2009.10.006.

Coad, A., Frankish, J., Roberts, R., & Storey, D. (2013). Growth paths and survival chances: An application of Gambler’s ruin theory. Journal of Business Venturing, 28, 615–632. https://doi.org/10.1016/j.jbusvent.2012.06.002.

Colombo, M. G., & Grilli, L. (2010). On growth drivers of high-tech start-ups. The role of founders’ human capital and venture capital. Journal of Business Venturing, 25(6), 610–626. https://doi.org/10.1016/j.jbusvent.2009.01.005.

Cumming, D. J., & Vismara, S. (2017). De-segmenting research in entrepreneurial finance. Venture Capital, 19(1-2), 17–27 https://doi.org/10.2139/ssrn.2740453.

Davidsson, P. (1989). Entrepreneurship – and after? A study of growth willingness in small firms. Journal of Business Venturing, 4(3), 211–226. https://doi.org/10.1016/0883-9026(89)90022-0.

Davidsson, P., Delmar, F., & Wiklund, J. (2002). Entrepreneurship as growth: Growth as entrepreneurship. Strategic entrepreneurship. Ed. Hitt M.A., Ireland, R.D.; Camp, S.M. & Secton, D.L., Blackwell Publishing.

Davila, A., Foster, G., & Gupta, M. (2003). Venture capital financing and the growth of start-up firms. Journal of business venturing, 18(6), 689–708. https://doi.org/10.1016/S0883-9026(02)00127-1.

Dew, N., Read, S., Sarasvathy, S. D., & Wiltbank, R. (2009). Effectual versus predictive logics in entrepreneurial decision-making: Differences between experts and novices. Journal of Business Venturing, 24(4), 287–309. https://doi.org/10.1016/j.jbusvent.2008.02.002.

Drover, W., Wood, M. S., & Zacharakis, A. (2017). Attributes of angel and crowdfunded investments as determinants of VC screening decisions. Entrepreneurship Theory and Practice, 41(3), 323–347. https://doi.org/10.1111/etap.12207.

Dutta, D., & Thornhill, S. (2008). The evolution of growth intentions: Toward a cognition-based model. Journal of Business Venturing, 23(3), 307–332. https://doi.org/10.1016/j.jbusvent.2007.02.003.

Engel, D., & Keilbach, M. (2007). Firm–level implications of early stage venture capital investment - An empirical investigation. Journal of Empirical Finance, 14(2), 150–167. https://doi.org/10.1016/j.jempfin.2006.03.004.

Ferreira, P., Raisch, S., & Klarner, P. (2014). Staying agile in the saddle: CEO tenure, TMT change, and organizational ambidexterity. Paper presented at the Academy of Management Annual Conference. Philadelphia, United States. https://doi.org/10.5465/ambpp.2014.16112abstract.

Galbraith, C. S., DeNoble, A. F., & Ehrlich, S. B. (2009). The use and content of formal rating systems in angel group investment initial screening stages. Journal of Small Business Strategy, 20(2), 61–79.

Garnsey, E. (1998). A theory of the early growth of the firm. Industrial and Corporate Change, Oxford University Press, 7(3), 523–556. https://doi.org/10.1093/icc/7.3.523.

Garnsey, E., & Heffernan, P. (2005). Growth setbacks in new firms. Futures, 37(7), 675–697. https://doi.org/10.1016/j.futures.2004.11.011.

Garnsey, E., Stam, E., & Heffernan, P. (2006). New firm growth: Exploring processes and paths. Industry and Innovation, 13(1), 1–20. https://doi.org/10.1080/13662710500513367.

Gioia, D. A., Corley, K., & Hamilton, A. L. (2013). Seeking qualitative rigor in inductive research: Notes on the Gioia methodology. Organizational Research Methods, 16(1), 15–31. https://doi.org/10.1177/1094428112452151.

Gompers, P. A., Gornall, W., Kaplan, S. N., & Strebulaev, I. A. (2019). How do venture capitalists make decisions? Journal of Financial Economics, 135(1), 169–190. https://doi.org/10.1016/j.jfineco.2019.06.011.

Habermann, H., & Schulte, R. (2017). Analyzing non-linear dynamics of organic growth: Evidence from small German new ventures. Journal of Small Business Strategy, 27(2), 36–64 Retrieved from https://libjournals.mtsu.edu/index.php/jsbs/article/view/582.

Hambrick, D. C. (2007). Upper echelons theory: An update. Academy of Management Review, 32(2), 334–343. https://doi.org/10.5465/amr.2007.24345254.

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9(2), 193–206. https://doi.org/10.5465/amr.1984.4277628.

Harrison, R., & Mason, C. M. (2000). Venture capital market complementarities: The links between business angels and venture capital funds in the United Kingdom. Venture Capital: An International Journal of Entrepreneurial Finance, 2(3), 223–242. https://doi.org/10.1080/13691060050135091.

Hellmann, T., & Puri, M. (2002). Venture capital and the professionalization of start-up firms: Empirical evidence. The Journal of Finance, 57(1), 169–197 Retrieved June 3, 2021, from http://www.jstor.org/stable/2697837.

Hellmann, T., & Thiele, V. (2015). Friends or foes? The interrelationship between angel and venture capital markets. Journal of Financial Economics, 115(3), 639–653. https://doi.org/10.1016/j.jfineco.2014.10.009.

Karlsson, C., Rickardsson, J., & Wincent, J. (2019). Diversity, innovation and entrepreneurship: Where are we and where should we go in future studies? Small Business Economics, 1–14. https://doi.org/10.1007/s11187-019-00267-1.

Knockaert, M., Der Foo, M., Erikson, T., & Cools, E. (2015). Growth intentions among research scientists: A cognitive style perspective. Technovation, 38, 64–74. https://doi.org/10.1016/j.technovation.2014.12.001.

Kraus, S., Ribeiro-Soriano, D., & Schüssler, M. (2018). Fuzzy-set qualitative comparative analysis (fsQCA) in entrepreneurship and innovation research–the rise of a method. International Entrepreneurship and Management Journal, 14(1), 15–33. https://doi.org/10.1007/s11365-017-0461-8.

McMahon, R. G. (2001). Deriving an empirical development taxonomy for manufacturing SMEs using data from Australia’s business longitudinal survey. Small Business Economics, 17(3), 197–212. https://doi.org/10.1023/A:1011885622783.

Miozzo, M., & Di Vito, L. (2016). Growing fast or slow?: Understanding the variety of paths and the speed of early growth of entrepreneurial science-based firms. Research Policy, 45(5), 964–986. https://doi.org/10.1016/j.respol.2016.01.011.

Murnieks, C., Haynie, J., Wiltbank, R., & Harting, T. (2011). ‘I like how you think’: Similarity as an interaction bias in the investor-entrepreneur dyad. Journal of Management Studies., 48(7), 1533–1561. https://doi.org/10.1111/j.1467-6486.2010.00992.x.

Penrose, E. (1959). The theory of the growth of the firm (4th ed.). Oxford University Press.

Pettigrew, Andrew M. (1990). Longitudinal field research on change: Theory and practice. Organization Science, 1(3), 267–292.

Read, S., & Sarasvathy, S. D. (2005). Knowing what to do and doing what you know. The Journal of Private Equity, 9(1), 45–62 http://www.jstor.org/stable/43503446.

Read, S., Song, M., & Smit, W. (2009). A meta-analytic review of effectuation and venture performance. Journal of Business Venturing, 24(6), 573–587. https://doi.org/10.1016/j.jbusvent.2008.02.005.

Read, S., Wiltbank, Robert, Saras, D., & Sarasvathy [not cited],. (2003). What do entrepreneurs really learn from experience? The difference between expert and novice entrepreneurs. Frontiers of Entrepreneurship Research, 22(1), 28.

Reymen, I., Andries, P., Berends, H., Mauer, R., Stephan, U., & van Burg, E. (2015). Understanding dynamics of strategic decision making in venture creation: A process study of effectuation and causation. Strategic Entrepreneurship Journal, 9(4), 351–379. https://doi.org/10.1002/sej.120.

Sarasvathy, S. D. (2001). Causation and effectuation: Toward a theoretical shift from economic inevitability to entrepreneurial contingency. Academy of Management Review, 26(2), 243–288. https://doi.org/10.5465/amr.2001.4378020.

Sarasvathy, S. D. (2008). Effectuation: Elements of entrepreneurial expertise. Edward Elgar.

Sarasvathy, S. (2014). The downside of entrepreneurial opportunities. Management, 17(4), 305.

Siepel, J., Camerani, R., & Masucci, M. (2019). Skills combinations and firm performance. Small Business Economics, 1–23. https://doi.org/10.1007/s11187-019-00249-3.

Smolka, K., Verheul, I., Burmeister-Lamp, K., Pursey, P. M., & Heugens, A. R. (2018). Get it together! Synergistic effects of causal and effectual decision–making logics on venture performance. Entrepreneurship Theory and Practice, 42(4), 571–604. https://doi.org/10.1111/etap.12266.

Stake, R. (1994). Case studies. In N. K. Denzin & Y. S. Lincoln (Eds.), Handbook of qualitative research (pp. 236–247). Sage.

Wallmeroth, J., Wirtz, P., & Groh, A. P. (2018). Venture capital, angel financing, and crowdfunding of entrepreneurial ventures: A literature review. Foundations and Trends® in Entrepreneurship, 14(1), 1–129. https://doi.org/10.1561/0300000066.

Wiklund, J., Davidsson, P., & Delmar, F. (2003). What do they think and feel about growth? An expectancy value approach to small business managers’ attitudes toward growth. Entrepreneurship Theory and Practice, 27(3), 247–270. https://doi.org/10.1111/1540-8520.t01-1-00003.

Wiltbank, R. (2005). Investment practices and outcomes of informal venture investors. Venture Capital, 7(4), 343–357. https://doi.org/10.1080/13691060500348876.

Wiltbank, R., & Sarasvathy, S. D. (2002). Selection and return in angel investment. Babson College Entrepreneurship Research Conference (BCERC), June 2002. angels-selection-return-1.pdf (effectuation.org)

Wiltbank, R., Dew, N., Read, S. & Sarasvathy, S.D (2006). What to do next? The case for non-predictive strategy. Strategic Management Journal, 27(10), 981-998. https://doi.org/10.1002/smj.555

Wiltbank, R., Sudek, R., & Read, S. (2009). The role of prediction in new venture investing. Frontiers of Entrepreneurship Research, 29(2), 1–13 bcerc-prediction-in-new-venture-investing-1.pdf (effectuation.org).

Wirtz, P. (2000). L ' étude de cas : réflexions méthodologiques pour une meilleure compréhension du rôle de la comptabilité financière dans le gouvernement d ' entreprise. Comptabilité Contrôle Audit, 3(3), 121–135. https://doi.org/10.3917/cca.063.0121.

Wirtz, P., Bonnet, C., Cohen, L., & Haon, C. (2020). Investing human capital: Business angel cognition and active involvement in business angel groups. Revue de l’Entrepreneuriat, 19(1), 43–60. https://doi.org/10.3917/entre1.191.0043.

Yin, R. K. (2014). Case study research: Design and methods. Sage.

Acknowledgements

The authors are indebted to Professor Mike Wright for his comments on our work. We are grateful to Vincenzo Butticè, Elisa Ughetto, the participants at the 2019 EU-SPRI Conference, Turin, and the participants at the 4th Entrepreneurial Finance Conference organized by Trier University for very helpful feedback on earlier versions. We are grateful to the editor and three anonymous reviewers for their very helpful comments. Any errors are our responsibility.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

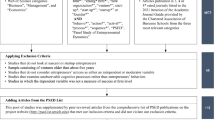

Appendix 1. Summary of source content analysis and examples

Main concepts | Investment process | Exemplary | |

|---|---|---|---|

Quadro | Primo1D | ||

Decision-making style | |||

Control oriented | 35 | 11 | “VCs are used to managing funds. They wanted to apply to Quadro the same methodology, traditional, stupid and heavy that the funds use when they invest. And their goal is short-term profitability. I think the main difference is that BAs favour the long-term. 7 years to 10 years. The BAs are not in a hurry on the contrary, they want to accompany over time. While VCs, their goal is profitability. And every year, they have to show the results of their participation” (Quadro - BA representative, 2014) “The question for us at that point, because we couldn’t do it with them [the VCs], was “how can we run this project with what we have?” So, we changed our strategy and modified our initial fundraising project. We positioned ourselves on the Medtech project [the instrument] at €750” (Quadro - CEO/Co-founder, 2014) |

Predictive | 11 | 32 | “I’m used to doing budgets and keeping an eye on spending. It’s an element of visibility that we need to give our shareholders” (Primo1D - CEO/Co-founder, 2015) “For the VCs, there is a double challenge: at first there is the technological challenge, then the commercial challenge and then the question arises: can this company value itself enough to make investors win multiples? Because we [VCs] are judged on our TRI and if we do a weak TRI, the financial model will not work. See, if it takes ten years, twelve years to liquidate our stakes in a rather long model, it’s a financial failure. Quadro still has a lot to prove to interest VCs” (Quadro – VC CEO of Sofimac Partners, 2015) “I don’t make any differences between the VCs and us [BAs]. In the study or due diligence phase, we all seek to identify and rationalize risks. We are all in an investment perspective, bets on the future (Primo1D - BA representative, 2015). “The particularity of this project, -and what made it interesting for certain BAs and, which led to some form of adherence-, is that BAs may have a significant place. Given the stakes and the amounts involved, it was out of the question for us to be just followers […] We took advice from iSource which invested pari passu at our side and adopted for this deal their operating modes in terms of investment methodology which, it seems to me, is closer to VCs than BAs” (Primo1D - BA representative, 2015) |

Perceived growth and growth path | |||

Growth potential and growth path | 17 | 33 | “I would say that both the strength of the team, its experience on the one hand, the clarity of the growth prospects and the intention of strong growth of the team on the other hand, seemed to us to be very interesting and so we decided to select this project” (Primo1D - VC RAC, 2015) “We perceived the high growth potential, and we wanted to help the company to grow and go international” (Primo1D - VC CEO of Sofimac Partners, 2015). “The investors are also anticipating a third fundraiser within 18 months to support the expected growth and extend more broadly on a global scale” (Primo1D - La Tribune, 15 mars 2019). “2016 was a pivotal year in terms of growth, I think the company is in the most difficult part of its existence, even after 7 years” (Quadro – BA representative, 2017) “What is Quadro’s growth potential? What is the CEO aiming for: 10 machines? This cannot interest a VC” (Quadro – VC-CEO of Sofimac Partners, 2015) |

Interrelations | |||

Interactions Entrepreneur/BAs/VCs As a result of matching or mis-matching decision-making styles | 27 | 78 | “We were looking for €2-3 million. We presented our case to the VCs at the end of 2010, but we quickly realized that they weren’t ready. They were contacted too early in the company ' s maturity” (Quadro - CEO/Co-founder, 2014) “The founder changed strategy […] If you present that to an institutional investor, he’ll say, “but hang on … the first two- or three-year cycle was unsuccessful, and he’s putting money in to restart a new R & D cycle using the [same] technology but on another product!” It was problematic because of that” (Quadro - VC-CEO of Sofimac Partners, 2015) “The approach is to talk with a lot of people, to talk with other start-ups, investment funds, angels to make them tell their stories” (Primo1D - CEO/Co-founder, 2015) “The arrival of iSource, which allowed the BAs to structure an interesting team to conduct due diligence and challenge the entrepreneur; the VCs that were mobilized to raise the necessary funds. All of these elements, the conduct of the investment process and the interactions between us, convinced us all. We have been able to bring value, in tracking, in the network, at commercial ports of entry. And because the objectives are roughly kept and the growth prospects still strong that brings to the society of the value also in the follow-up of the future investments” (Primo1D- VC CEO Sofimac Partners, 2017) “It is part of the interesting discussions we have with our investors because, if it’s continuity, it’s in the order of €5 M. If we start to dream a little more… but the strategy, we will define it together, I need advice and we will do it together” (Primo1D - CEO/Co-founder, 2017). “When we consider that there is potential, we will continue to help them. In the case of Primo1D the company is developing very well, it needs to invest, to go international and there we will help it to develop. And so we decided that we had to integrate investors with this capacity in the second round to be able to support this company in the long term. That’s why we’re doing a syndication” (Primo1D- VC CEO of Sofimac Partners, 2017) |

Appendix 2. Main figures of the two companies

PRIMO1D | QUADRO | |||||

|---|---|---|---|---|---|---|

Balance sheet (Eur) | 31/12/2018 | 31/12/2017 | 31/12/2016 | 31/12/2018 | 31/12/2017 | 31/12/2016 |

Fixed assets | 3,424,933 | 3,014,992 | 1,781,888 | 1,836,695 | 1,493,330 | 1,072,967 |

Current assets | 5,572,603 | 1,964,672 | 2,600,838 | 3,757,939 | 3,691,054 | 3,274,014 |

Total assets | 8,997,536 | 4,979,665 | 4,382,726 | 5,594,634 | 5,184,385 | 4,346,980 |

Capital | 5,001,816 | 677,549 | 577,720 | 1,561,975 | 1,413,161 | 1,609,307 |

Long-term debt | 2,080,166 | 2,207,661 | 2,416,066 | 2,641,496 | 2,575,672 | 1,966,369 |

Current liabilities | 1,915,551 | 1,936,455 | 1,388,939 | 1,352,185 | 1,142,103 | 771,304 |

Total liabilities | 8,997,536 | 4,979,665 | 4,382,726 | 5,594,634 | 5,184,385 | 4,346,980 |

Working capital and cash | ||||||

Working capital | 3,655,291 | 26,304 | 1,206,429 | 2,422,660 | 2,515,741 | 2,615,672 |

Working capital requirement | −513,356 | −1,003,291 | −367,947 | 1,681,095 | 1,313,288 | 1,530,524 |

Net cash | 4,168,647 | 1,029,595 | 1,574,376 | 741,565 | 1,202,453 | 1,085,148 |

Rights and permissions

About this article

Cite this article

Cohen, L., Wirtz, P. Decision-making style in entrepreneurial finance and growth. Small Bus Econ 59, 183–210 (2022). https://doi.org/10.1007/s11187-021-00528-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-021-00528-y

Keywords

- Business angel

- Venture capitalist

- Growth intention

- Cognitive resources.

- Decision-making style

- Growth path