Abstract

This paper provides evidence on the impact of European Banking Union (BU) and the associated Single Supervisory Mechanism (SSM) on the risk disclosure practices of European banks. The onset of BU and the associated rules are considered as an exogenous shock that provides the setting for a natural experiment to analyze the effects of the new supervisory arrangements on bank risk disclosure practices. A Difference-in-Differences approach is adopted, building evidence from the disclosure practices of systemically important banks supervised by the European Central Bank (ECB) and other banks supervised by national regulators over the period 2012–2017. The main findings are that bank risk disclosure increased overall following BU but there was a weakening of disclosure by SSM-supervised banks relative to banks supervised by national authorities. We also find that the overall positive effect of the BU on bank disclosure is stronger for less profitable banks and in the most troubled economies of the Eurozone (GIPSI countries), while the negative effect on centrally supervised banks is stronger if bank CEOs act also as chairmen (CEO duality). We interpret these findings in light of the fact that the new institutional arrangements for bank supervision under which the ECB relies on local supervisors to collect the information necessary to act gives rise to inefficiencies with respect to the speed and completeness of the information flow between SSM supervised banks and the ECB, which are reflected in bank disclosure practices.

Similar content being viewed by others

1 Introduction

This paper aims to investigate the effects that the change in banking supervision and the associated rules of the Banking Union (BU) in Europe has had on the disclosure practices of banks. Banks are notoriously opaque because of their risk-taking and maturity transformation role, which makes them difficult to assess without considerable information on their financial position and risk-taking practices (Morgan 2002; Flannery et al. 2013). If risk disclosure is adequate, it can serve as an outside mechanism for monitoring the behavior of senior management (Eng and Mak 2003) and facilitate access to external finance at a reasonable cost of capital (Botosan 1997; Botosan and Plumlee 2002; Easley and O'Hara 2004; Cheng et al. 2006; Zhang and Ding 2006; Eaton et al. 2007; Kothari et al. 2009). However, voluntary risk disclosures are not always optimal for several reasons. First, disclosures are costly and banks weigh the costs against the potential benefit of lower funding costs when deciding on the quality, level and frequency of disclosures. Second, banks have considerable discretion in deciding on the information to be disclosed, which also means that voluntary disclosures may not necessarily generate optimal outcomes. Landsman (2006) notes that banks may be able to affect disclosure content through the timing of earnings announcements and balance sheet adjustments. Gunther and Moore (2003) show that US banks in poorer financial condition are more likely to understate financial losses. Finally, even if risk disclosure is optimal, the regulatory architecture may mitigate against regulators taking the appropriate action. For example, the literature shows that supervisors have diverging interests when the discharge of supervisory duties affects economies asymmetrically. This may be the case, for example, when the affiliates of a cross-border banking group are of diverging importance for their respective national financial markets (e.g., Holthausen and Rønde 2004; Bolton and Oehmke 2016). In the context of European BU, the potentially diverging interests of supervisors could have important implications as they could result in suboptimal information sharing and cooperation between the European Central Bank and the national bank regulators (see, for example, Carletti, et al. 2015, 2021).

Supervision and bank disclosure are closely related. The existing literature provides evidence that bank supervision has a strong impact on bank disclosure (Barakat and Hussainey 2013; Mester 2017; Costello et al. 2018). Bank supervisory authorities are essential to maintain the integrity and transparency of the whole banking sector. Furthermore, bank disclosure is extremely beneficial for supervisors. Nier and Baumann (2006) show that more transparency decreases equity return volatility, and consequently improve supervisors’ view of the risk and relative performance of the bank. Higher levels of transparency can also supplement conventional supervisory tools, as the increasing complexity of large financial institutions makes them difficult to control using traditional monitoring techniques (Flannery 2001).

Bank opacity and inadequate risk disclosure have been cited as an important factor contributing to the financial crisis (Avgouleas 2009; Gorton 2009; Sowerbutts et al. 2013) in that banks did not report enough information about the risks that they were exposed to. The lack of disclosure by banks magnified uncertainty about the underlying value of assets and off-balance sheet exposures to structured credit products, which led to considerable reluctance by counterparties to trade and further fueled the market turmoil. Gorton and Ordoñez (2014) show how opacity can prevent market participants from distinguishing high-risk from low-risk institutions, with market participants supplying funds to both healthy and unsound banks on similar terms and conditions. These information problems can increase financial fragility.

In response to the financial crisis, financial regulators in major jurisdictions have taken several steps aimed at increasing bank risk disclosures to reduce the likelihood and severity of future crises and promote financial stability. In the European Union (EU), the risk disclosure practices of European banks had been largely harmonized by the requirement that banks (and other firms) report according to International Financial Reporting Standards beginning in 2005. Following the crisis, three further reforms were introduced. First, in 2014 Basel III Pillar 3 disclosures requirements were introduced into EU law through the Capital Requirements Directive IV (CRD IV), which introduced standardized regulatory reporting by specifying the information firms must report to supervisors in areas such as own funds, large exposures and financial information.Footnote 1 Second, the European BU project began to be implemented from late 2014 after the fragmented system of national supervision and bank resolution was viewed as having been characterized by regulators pursuing domestic objectives that exacerbated systemic risk (Draghi 2018). A key pillar of BU is the two-tier single supervisory mechanism (SSM) for banks. The SSM regulation comprises an institutional architecture that sees the European Central Bank (ECB) as the supranational hub at the center of the supervisory network that also assigns important supervisory functions to the national regulator spokes (National Competent Authorities, NCAs). At the hub, banks deemed “significant” are supervised directly by the ECB, though on the basis of information reported by banks to their national regulator and subsequently passed on to the ECB.Footnote 2 The supervision of significant banks includes the ECB conducting stress tests on banks and subjecting them to capital or risk limits and changes in management if problems are found.Footnote 3In the spokes, smaller banks continue to be directly monitored and supervised by their national authorities. The effective functioning of the SSM therefore hinges critically on making the interfaces within the SSM work smoothly and, in particular, on extensive information sharing and cooperation between the ECB and NCAs. The third reform, was the introduction of the Markets in Financial Instruments Directive II in 2018, which imposed more reporting requirements on all EU banks.

The BU and the new disclosure rules were expected to facilitate closer monitoring of banks by regulators and other stakeholders thereby subjecting bank managers to greater discipline and making the financial system more stable. A central supervisory authority would concern itself with stability and welfare at systemic-wide level, above any specific local interests, whereas local supervisors would have specific interests pertaining to the geographic area under their supervision that might be detrimental for the systemic-wide financial stability (Draghi 2018). However, the reliance of the ECB on national regulators to pass-on information reported by significant banks has raised doubts about the legitimacy of the ECB’s supervisory role. As Carletti et al. (2021) note, an institutional design in which a centralized agency has full power over all decisions regarding banks but relies on local supervisors to collect the information necessary to act entails a principal-agent problem between the central and local supervisors if their objective functions differ. As a result of different objective functions, information collection may be inferior to that under either fully independent local supervisors or under centralized information collection and may increase risk-taking by regulated banks. Thus, whether a “tougher” central supervisor—the ECB—would result in more optimal bank disclosure is an open question.

In this paper, we investigate the impact of BU (and the SSM in particular) and the associated Pillar 3 disclosure rules on the risk disclosure activities of EU banks. We treat the onset of BU as an exogenous shock that provides the setting for a natural experiment to analyze the effects of the new supervisory arrangements on bank risk disclosure practices. To this end, we use content analysis techniques and construct an expert-validated dictionary to analyze bank annual reports and exploit the introduction of BU and the new rules. We then employ Difference-in-Differences (DiD) estimation where banks subject to the SSM act as the treatment group and banks that remain subject to supervision by the national authority act as the control group. We test two hypotheses in our analysis. The first hypothesis is that the onset of BU resulted in an overall increase in risk disclosure by European banks (‘significant’ or otherwise). The second hypothesis is that the additional requirements of the SSM decreased risk disclosure by SSM supervised banks (treated entities) relative to that by other banks. To preview the main findings, we find support for the first hypothesis in that risk disclosure by all banks appears to have increased in a number of key categories following the onset of BU and the new disclosure rules. Our results also support the second hypothesis as risk disclosure by SSM supervised banks appears to have worsened in comparison to nationally supervised banks, despite the increase in disclosure overall. We attribute this second finding to inefficiencies associated with the two-tier supervisory mechanism under BU, which are reflected in bank risk disclosure. In order to solve these problems, we suggest that the BU be reformed such that SSM supervised banks report directly to the ECB rather than the present arrangement whereby the ECB relies on national regulators for information on these banks. In an additional analysis, we also find that the overall positive effect of the BU on bank disclosure is stronger for less profitable banks and in the most troubled economies of the Eurozone (GIPSI countries), while the negative effect on SSM supervised banks is stronger in banks where the CEO is also the chairman (CEO duality).

Our study is motivated by the importance of understanding the effects of the new banking supervision structure in Europe on bank disclosure practices. Although the extant literature has shown that banking supervision and disclosure are tightly related, to the best of our knowledge, this is the first study to examine the effects on risk disclosure of the European BU and the associated SSM.

The main contribution of the paper is to extend the limited empirical literature on the effects of BU on bank behavior. Studies of this type to date have focused on the impact on equity prices, credit contagion, market credibility, and public finance implications. We believe that this is the first empirical study on the impact of BU on bank risk disclosure practices. Second, we contribute to the discussion on the effects of bank supervision on bank disclosure practices. More generally, our study extends the limited European banking literature employing content analysis of annual reports.

The remainder of the paper is organized as follows. Section 2 describes the theoretical framework and develops the research hypotheses. Section 3 reviews the related literature on risk disclosure. Section 4 discusses the methodology, identification strategy, and data. Section 5 reports the empirical results and Sect. 6 concludes.

2 Theoretical framework and research hypotheses

The literature offers various theoretical frameworks to explain the effect of banking supervision on bank disclosure practices, and their analysis is important to understand the impact of the BU on bank risk disclosure. In our research setting, we draw upon: (i) the organization society theories (Burgstahler and Dichev 1997; Cho et al. 2015; Cohen et al. 2017) that shed light into the effects of banking supervision on bank disclosure; and (ii) the theories that analyze the effectiveness of the banking supervision in a multi-supervisor setting (Agarwal et al. 2014; Carletti et al. 2021), which provide an explanation on whether or not the supervisory function performed by the SSM is more effective than that of the NCAs.

The organization-society theories (which include stakeholder theory, resource dependence theory and legitimacy theory) (Burgstahler and Dichev 1997; Cho et al. 2015; Cohen et al. 2017) represent a fundamental theoretical framework to explain the role that banking supervisors play in shaping bank disclosure practices (Barakat and Hussainey 2013). These theories posit that banking supervisory authorities that are fully informed and able to promptly and precisely take corrective actions, are effective and influential in motivating bank managers to provide comprehensive disclosure. There are two main conditions essential for supervisors to carry out their supervisory activities effectively: (i) the capability of taking corrective actions to promote changes, and; (ii) the speed and precision of taking these decisions. While both local and central supervisors should be capable of taking corrective action, when it comes to the speed and precision of deciding how to behave, there is a substantial difference between them. Given that the current design of the supervisory mechanism requires NCAs to act as information collector on behalf of the SSM, the central supervisor may not be able to promptly take supervisory corrective actions. This indirect and hence slower flow of information may also result in an information loss for the ultimate supervisor. In addition, given that NCAs have been the sole supervisors until 2014, they may be more precise in taking the right corrective actions, as they can rely also on a more complete set of soft information about the entities they supervise. For these reasons, the central supervisor would be in no position to fulfil its role effectively. On closer inspection, the legitimacy theory (O’Donovan 2002; Cho and Patten 2007; Cho et al. 2015) posits that firms in general and bank in particular may comply with disclosure requirements, in order to confirm and show their full adherence to the institutional values of the society (i.e. to gain institutional legitimacy). The resource dependence theory (Boyd 1990; Cohen et al. 2017) postulates that organization survival and growth depends on some important resources that are available in the external environment. Thus, firms compete with each other in order to control these resources. In Europe, the supervisory authorities can grant and withdraw banking licenses.Footnote 4 The license for the banking activity is a crucial resource for financial institutions and banks can use disclosure as a means to convince the supervisor that the bank continues to merit a license. The stakeholder theory (Bowen et al. 1995; Burgstahler and Dichev 1997) posits that stakeholders have various expectations and influence on the firm. Thus, banks may want to provide an effective disclosure to interact and communicate more effectively with the most influential stakeholders, of which the supervisor is amongst the most important. However, if the central supervisor is not capable of quickly and precisely taking corrective actions, its monitoring function may not be sufficiently effective. A slow, imprecise and not fully informed supranational supervisor may not be able to achieve a high level of institutional legitimacy, show that it controls valuable resources for financial institutions, and that it is an influential stakeholder. In our research setting, given that the SSM still has to rely on the information provided by the NCAs, it may be less informed, slower and less precise, resulting in an inefficient supervisory function. This inefficiency will be reflected also in bank disclosure, resulting in a less comprehensive disclosure for SSM supervised banks in comparison to the financial institutions monitored by national supervisors, after the establishment of the BU.

Given that the current supervisory system in Europe requires the cooperation of national and supranational supervisors, the theories that study the effectiveness of banking supervision in a multi-supervisor setting represent an important point of reference for our research setting (Agarwal et al. 2014; Carletti et al. 2021). Agarwal et al. (2014) analyze the supervisory decisions of US bank regulators, exploiting a legally determined rotation policy, which assigns state or federal supervisors to the same financial institution at predetermined time periods. The authors show that different supervisors implement the same rules inconsistently, due to differences in their utility functions. More specifically, local supervisors carry out their activities in a softer way during stressed economic conditions, because tough supervision might increase the likelihood of bank failures and lead to a loss of local lending activity and banking employment. In contrast, federal supervisors are more concerned about systemic stability at supranational level, rather than about the geographical distribution of banking credit supply and employment. According to this ‘local interest hypothesis’, a central supervisor should perform better than local supervisors, as they do not have specific interests in favour of large banks at local level. In contrast, local supervisors have specific interests on the geographic area under their supervision. Furthermore, local supervisors compete with each other. For instance, they may want to attract banks from closer geographical areas or avoid that their local banks move elsewhere. In order to do so, they could perform a less demanding supervisory function. This circumstance may give financial institutions the chance to exploit a regulatory arbitrage from different jurisdictions. The findings of Agarwal et al. (2014) are crucial to understand the trade-offs related to the distribution of supervisory responsibility and powers across different authorities. The authors themselves argue that their findings should be taken into consideration for the debate concerning the redesign of European bank supervisory system. Although NCAs might have an informational advantage, their utility functions are crucial in determining the efficacy of the supervisory mechanism. In particular, NCAs may want to be softer with distressed banks, if they are too big to fail for their national economy. However, from a theoretical perspective, there are various reasons why the current European supervisory system may not work fully effectively. NCAs still have room to influence the supervisory process carried out by the SSM, given that the latter still relies on the information provided by the former in order to perform its supervisory function. Consequently, these diverging interests between national and central supervisors may result in a lack of effectiveness of the supervisory mechanism. The conflicting utility functions and objectives of the local supervisors may still result in an insufficient effectiveness of the SSM, as long as NCAs can strongly interfere in the supervisory process. Hence, the SSM may be in no position to fulfil its supervisory function effectively. In light of the postulates of the aforementioned organization society theories, this lack of effectiveness may be reflected in the disclosure provided by the banks under SSM supervision.

Carletti et al. (2021) study the behaviour of supervisors in the so called ‘hub-and-spokes’ regime: where a central supervisor has juridical power over all decisions concerning financial institutions, but it relies upon local supervisors in order to collect the information it needs to take the necessary corrective actions. This institutional structure entails a double principal agent problem, between the bank and its supervisor, and between the local and the central supervisor. The latter is a serious issue, because the two supervisors have different utility functions and final objectives. In this situation, the scale of information collection of local supervisors will not only be inferior to that of a central supervisor, which directly collects all information, but also to that of independent local supervisors, which remains inferior to the central supervisor model. The reason behind this suboptimal level of information collection lies on the fact that local supervisors prefer to remain ignorant, rather than learning information that could lead the central supervisory authority to actions that are against their interests. This, in turn, leads to an inefficient supervisory system and to a less sound banking sector. The authors themselves state that their theoretical framework is inspired by the current supervisory design in Europe. This model suggests that unless the spokes (NCAs) and the hub (the ECB) act jointly with the same objectives, the effectiveness of the whole supervisory system will be compromised, suggesting that the current supervisory structure in Europe is far from being able to solve the problems of the fragmentation of bank monitoring activity. In conclusion, in our research setting, this model would predict a worsening in the supervisory function, and, consequently, a less comprehensive bank disclosure for SSM supervised financial institutions after the establishment of the BU. In addition, the European Directive 2013/36 and the Regulation (EU) N. 575/2013 prescribe several national options and discretions that can be applied on the basis of certain national circumstances.Footnote 5

However, there should not be any fear of regulatory and supervisory inconsistency for the financial institutions that are still supervised by the NCAs. These financial institutions are not affected by the aforementioned ‘hub-and-spokes’ regime, as they are supervised by national authorities. Furthermore, after the establishment of the BU, an important message has been sent to the entire banking system: banking supervision and risk disclosure have become a priority at national and international level. Hence, our expectation is that there may be an overall improvement in the supervisory system across Europe, after the establishment of the BU. In addition, after the BU in 2014, the workload of the local supervisory authorities has decreased, as NCAs are no longer responsible for the supervision of the largest financial institutions. Hence, they have more time and resources to monitor the other financial institutions. Based on these considerations and theories, our first research hypothesis is the following:

Hypothesis 1

Overall, the banking system has improved its risk disclosure after the BU.

In contrast, according to the aforementioned theories, the establishment of the BU may result in less comprehensive disclosure specifically for SSM supervised banks, in comparison to NCA monitored financial institutions, because of the aforementioned problems of the ‘hub-and-spokes’ regime. Furthermore, given that the European Directive 2013/36 and the Regulation (EU) N. 575/2013 prescribe several national options and discretions, there might be a fear of regulatory and supervisory inconsistencies for the financial institutions supervised by the SSM (Carboni et al. 2017). This would support the idea that flexible, well informed and quick local supervisors are better than a slow, less informed and potentially inconsistent central supervisor. Hence, we develop our second research hypothesis as follows:

Hypothesis 2

The banks supervised by the SSM have worsened their risk disclosure in comparison to NCA monitored financial institutions after the establishment of the BU.

Both of our research hypotheses are related to the theoretical perspectives proposed by the agency theory (Jensen and Meckling 1976), which represents a suitable framework to analyze the relationships between national and supranational banking authorities within the BU (Nielsen and Smeets 2018; Carletti et al. 2021), and bank disclosure behaviour (Barakat and Hussainey 2013; Al-Hadi et al. 2016). For example, Nielsen and Smeets (2018) analyze the role of EU and national institutions in guiding the reform process of the European Monetary Union. These authors rely on the principal-agent theory to explain how these authorities have cooperated to set up the BU. In contrast, with reference to bank disclosure, Al-Hadi et al. (2016) analyze the impact of corporate governance mechanisms on bank disclosures under the lenses of the agency theory. In particular, the agency theory posits that increased managerial monitoring is positively associated with risk disclosure and bank transparency.

3 Evidence on the determinants of risk disclosure

Failures in bank-risk disclosure emerged as a troublesome feature of the financial crisis. Sowerbutts et al. (2013, p. 327) state that “In plain terms, banks did not report enough information about the assets they were holding or the risks that they were exposed to.” Publishing better information could reduce the probability of future financial crises by making supervision more effective and sudden changes in sentiment of outsider stakeholders less likely. The relevant empirical literature has several strands and much of it relies on content analysis of annual reports and financial statements and relates to non-financial institutions.Footnote 6 One set of studies examines how firm-specific characteristics impact risk-disclosure. For example, Abraham and Cox (2007) find that risk reporting in the annual reports of US corporates is positively related to governance (larger board size and a higher proportion of independent directors) and negatively related to the proportion of institutional share ownership. Linsley and Shrives (2006) report that in a sample of 79 UK company annual reports larger firms with greater environmental risk have higher risk disclosures. Finally, Helbok and Wagner (2006) find that disclosure of operational risk is higher in banks with lower capital-asset and profitability ratios in a sample of 142 banks from North America, Asia, and Europe.

A second set of studies focuses on firms’ incentives to disclose risk (Nissim 2003). For example, Ball et al. (2003) examine the interaction between accounting standards and the incentives of managers and auditors in East Asian countries whose standards derive from common law sources that are widely viewed as being of a higher quality than code law standards. They show that financial reporting quality is not higher than under code law and attribute differences to the low quality of report preparers. Ball and Shivakumar (2005) find that market demand for information results in UK private company financial reporting being of a lower quality than that for public companies, even though both types face broadly equivalent regulations. Miihkinen (2012) finds that firm size, profitability, and foreign listing status were important determinants of disclosure in a sample of listed Finnish firms. Finally, Goncharenko et al. (2018) present a model of the effect of information disclosure on banks’ portfolio risk and show that information disclosure lowers the expected risk-adjusted profits for banks, especially for systemically important institutions.

Studies specifically on the impact of regulatory changes on firms’ risk disclosure practices are quite rare. Woods et al. (2008) find that the increasing adoption of international accounting standards and global convergence of accounting regulations has done little to reduce the diversity of market risk disclosure practices at international and European level. Barakat and Hussainey (2013) report that powerful and independent bank supervisors mitigate the incentives for entrenched bank executives to withhold voluntary disclosure. Barakat and Hussainey’s (2013) work belongs to a developed strand of literature that analyzes the relationship between bank supervision and bank disclosure practices and level of transparency (Mester 2017; Costello et al. 2018). This stream of literature provides evidence that bank supervisory authorities are essential to maintain the integrity and transparency of the whole banking sector. Higher levels of transparency can also supplement conventional supervisory tools, as the increasing complexity of large financial institutions makes them difficult to control using traditional monitoring techniques (Flannery 2001). Burks et al. (2018) use the relaxation of interstate branching restrictions in the US to examine how increases in competition affected voluntary disclosure through press releases. They report that more competition is associated with an increase in press releases that become more negative in tone as entry barriers decrease, and that disclosures by public banks and by banks issuing equity become incrementally positive in tone when entry barriers decrease. They interpret this as the increase in disclosure being aimed at deterring entry via negative information, which is mitigated by an incentive to communicate positive information to investors. Finally, Kleymenova and Zhang (2019) investigate how the Dodd-Frank Act (DFA) affected voluntary disclosures of large bank holding companies relative to other banks and unregulated firms in the financial sector. Using a difference-in-differences research design, they find that following the introduction of the DFA, large banks become less likely to issue earnings forecasts containing bad news, reduce the frequency of issuing earnings forecasts but increase the frequency of providing forecasts for dividends and return on assets; in addition, large banks provided less information than other banks on regulated activities and instead focused on financial performance and market innovation.

Empirical literature specifically on the effects of Banking Union is especially scarce. To date, there have been studies of the impact of BU on bank credit risk (Avignone et al. 2020), on the equity prices of banks to be subjected to the SSM mechanism (Carboni et al. 2017; Sahin and de Haan 2016), on bank and sovereign credit contagion (Sáiz et al. 2019), and on the market credibility (Pancotto, 2019), systemic implications (Hüser et al. 2017), and public finance aspects (Benczur et al. 2017) of the BU’s bank resolution regime. As far as we are aware, there are no empirical studies of the impact of BU and the SSM on the risk disclosure practices of European banks.

4 Methodology and data

4.1 Dependent variable

There is substantial evidence that content analysis techniques are trustworthy tools to extract valuable information from financial reports (Li 2010; Brown and Tucker 2011; Bushman et al. 2016; Andrés et al., 2021). To investigate bank disclosure practices, we create a tailored dictionary designed to analyze bank reports and financial statements, as applying standardized dictionaries outside the context for which they were created might invalidate the analysis (Loughran and McDonald 2011; Beattie 2014; Kearney and Liu 2014). We create the dictionary by selecting the most relevant words to test our research hypotheses by drawing on a selection of specialized banking and finance dictionariesFootnote 7 (Fitch 2018; Rutherford 2013; Shim and Constas 2016; Law and Smullen 2018). The dictionary has been subsequently validated by a panel of experts from the ECB and the academia that were asked to suggest additional words, eliminate those that were not considered relevant and provide suggestions on the categorization.Footnote 8 The procedure resulted in a dictionary of 125 words, aggregated into four different categories, which are shown in Table 1. The category “risk management disclosure” consists of terms that financial institutions are supposed to use to describe the risk management, monitoring, and measurement procedures and functions they adopt for the wide range of risks they are exposed to. The category “risk exposure disclosure” comprises the words that provide information related to the vulnerability of the bank to these risks.Footnote 9 The category “references to the regulatory framework” is a list of terms that identify the most important regulatory and supervisory authorities that influence European banks’ activities at the international level. The category “reassuring disclosure” consists of terms that financial institutions may want to use to reassure stakeholders about the bank’s financial position, performance and risk exposure.

For each category of words, we created a disclosure index (DI) computed as the standardized mean of the relative occurrences of each word belonging to the category,Footnote 10 divided by the total number of words of the entire document, as suggested by previous disclosure studies (Tetlock et al. 2008; Bushman et al. 2016). Formally:

in which: \({\text{mow}}_{{Cat~k}}\) is the mean of the relative occurrences of the words belonging to the generic category k, and \(\mu\) and \(\sigma\) are respectively the mean and the standard deviation.Footnote 11 These disclosure indices represent the dependent variables of our econometric models. More specifically, \({\text{mow}}_{{Catk}}\) is defined as:

in which \(n\) is the number of words belonging to the category \(k\).

4.2 Econometric methodology

To study the effects of BU and the SSM on bank risk disclosure, we employ a difference-in-differences (DiD) methodology.Footnote 12 Formally, for each disclosure index, we estimate the following model:

in which: \({{DI}_{Catk}}_{ijt}\) is the disclosure index of the category k for bank i in country j at time t; BU is the enactment date of Banking Union. It is equal to one after 2014 and zero otherwise. Treat equals zero for the control group (i.e., non-systemically important banks) and one for the treatment group (i.e., significant banks). \(\beta\) 0 is the expected level of disclosure when all dependent variables are equal to zero. \({\beta }_{1}\) captures any change in disclosure in both groups following the onset of BU. \({\beta }_{2}\) captures disclosure differences between the treatment and control groups before BU. \({\beta }_{3}\) represents the main coefficient of interest because it captures the effect of BU on the treatment group. More specifically, it measures the difference in disclosure from the pre-treatment to the post-treatment period between SSM supervised banks relative to banks supervised by the national regulator. A positive (negative) statistically significant sign for \({\beta }_{3}\) would imply ceteris paribus that disclosure increases (reduces) more for SSM-supervised banks than for banks supervised by the national regulator.

Of the other components of the model, \(\gamma Con\) is a vector of bank- and country-specific controls widely used in the banking literature (Richardson and Welker 2001; Linsley et al. 2006; Chen and Vashishtha 2017) to detect cross-bank heterogeneity that could affect bank disclosure independently of the establishment of the BU, and \(\delta CFD\) represents country fixed effects to control for country heterogeneity. The bank-specific controls are: the ratio of equity to total assets (ETA) as measure of bank capital; the return on assets (ROA) as a measure of bank profitability; the ratio of loans to assets (LOANS) to capture credit structure; the ratio of off-balance sheet assets to total assets (OBS) to capture off-balance sheet exposure; the ratio of customer deposits to total liabilities (CUST) to capture funding structure; and the dummy variable (BIG4D) equal to unity for banks whose financial statement is audited by one of the big four audit firms and zero otherwise. The country level controls are: the World Bank’s business disclosure index (WBBDI) to control for the potential effects of different regulatory frameworks for financial disclosure at country level; and a dummy variable (NSAD) equal to unity for the countries that have more than one national supervisor and zero otherwise to capture potential diverging interests between different supervisors at country level.

4.3 Data

The word category variables were obtained by counting the number of occurrences of the words of our tailored dictionary in bank annual reports. The annual reports were collected manually from each bank’s official website with the websites identified using the Orbis Bank Focus (Bureau van Dijk) database. The World Bank’s Business Extent of Disclosure Indexes were collected from the World Bank “Doing Business” database.

The bank sample consists of 75 SSM-supervised significant banks (the treatment group) and 150 other large but less important European financial institutions supervised by national regulators (the control group). More specifically, given that size is the most important parameter taken into account by the ECB to decide upon the systemically importance of the banks of the sample, we selected the largest nationally supervised entities that provide an audited and English version of their annual report.Footnote 13 Balance sheet and performance data covering the period 2011–2017 are from the Orbis Bank Focus database with the balance sheet variables winsorized at the 1% and 99% level to avoid the influence of outliers. For both groups of banks, we excluded those banks that did not provide documentation for all years, and that did not provide audited and English versions of their consolidated annual financial reports. The treatment and control groups both comprise large banks that are important at the national level and all banks in the control group are of a size that they are potentially subject to the supervision of the SSM if they were to grow in size either organically or by merging with other financial institutions. The geographical distribution of the banks in the sample is shown in Table 2. The final sample period is 2012–2017, which includes 3 years before the introduction of the BU and 3 years after its onset. The period is intentionally short as the change in the treatment group should be concentrated around the onset of the treatment (Bertrand et al. 2004). As we are specifically interested in assessing the impact of the BU, the choice of this time period enhances the validity of our analysis. Descriptive statistics for all of the variables are provided in Table 3. We tested the control variables for multicollinearity problems through the Variance Inflation Factor (VIF), which provided an average VIF of 1.14 suggesting that our control variables are not highly correlated. The correlation matrix is provided in Table 4. The regressions were estimated with bank-level clusters, allowing for correlation in the error term (Petersen 2009) and robust standard errors to control for dependence and heteroscedasticity (White 1980).

5 Empirical results

5.1 Baseline results

Table 5 shows the results of the empirical analysis from estimating Eq. (3) for the four bank disclosure categories. For each category of disclosure, the coefficient of the BU onset dummy is statistically significant and positive indicating that, in general, BU was associated with an increase in bank disclosure, consistent with our first research hypothesis. However, in three of the four disclosure categories (columns 1, 2 and 4) the coefficient on BU*Treat is statistically significant and negative, which suggests a reduction in disclosures related to risk management, risk exposure, and reassurances by SSM-supervised banks relative to these disclosures by nationally supervised banks following the onset of BU.Footnote 14 This finding supports our second research hypothesis. In contrast, the coefficient on BU*Treat is positive and statistically significant regarding disclosures that reference the regulatory framework, indicating that SSM supervised banks increased their disclosures in this regard relative to nationally supervised banks. What might explain the reduced disclosure by SSM supervised banks in three of the four disclosure categories? The finding is consistent with the principal-agent problem between the ECB and the national supervisors as suggested by Carletti et al. (2021). This principal-agent problem appears to have resulted in inefficiencies with respect to the speed and completeness of the information flow between SSM supervised banks and the ECB. In this context, the information collection role played by NCAs in the current supervisory system in Europe results in a double principle-agent problem that causes inefficiencies in banking supervision, which are reflected in the disclosure practices of SSM supervised banks. The result also supports the view expressed by Gros and Schoenmaker (2014) that the institutional arrangements under BU are the result of a compromise of national authorities that do not want to give up their political power in favor of a centralized authority. These problems cause inefficiencies in bank supervision, which are reflected in bank disclosure practices.

Of the control variables, more disclosure is provided by banks that are less capitalized and less profitable and have a higher proportion of loans on total assets, which may be because banks are more vulnerable to market shocks and credit risk and wish to allay stakeholder fears about risk exposure. These findings are also in line with the idea that when financial institutions face difficult situations, their shareholders and investors are more willing to reduce the probability of banking crises by exercising market discipline (Nier and Baumann 2006). This market discipline role can be played only if adequate levels of disclosure are provided.Footnote 15 More specifically, the stakeholders of banks that are more vulnerable to credit risk and market shocks demand higher levels of disclosure aiming to reduce bank risk taking incentives by means of market discipline. Disclosure is also likely to be greater if banks are audited by one of the big four audit firms, because external auditors play an important role in ensuring that shareholders and potential investors are adequately informed about the risk exposure of the banks, and consequently they induce banks to provide higher levels of disclosure (Al Lawati et al. 2021). In contrast, banks whose activities are funded by a larger share of customer deposits are associated with less disclosure, probably reflecting the more stable nature of these source of funding and the reduced need to satisfy other stakeholders’ concerns about risk exposure. This finding is in line with the literature that provides evidence that the market discipline role played by depositors is not always fully effective in the banking industry (Berger and Turk-Ariss 2015), or less effective compared to that of investors and shareholders.

5.2 Robustness tests and additional analyses

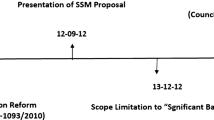

We subject our key results to several robustness tests. First, a possible concern related to estimating Eq. (3) is that bank disclosure may have been affected by events that occurred before 2014 that are not captured in the specification. For example, banks might have changed their risk disclosure practices in response to the announcement of the BU in 2012 that would take place rather than in response to its actual onset in 2014. In order to rule out this hypothesis we carry out a placebo test, widely used in previous studies that adopted the DiD identification strategy (e.g., Hertzberg et al. 2011; Balakrishnan et al. 2014; Schepens 2016). In this test, we assume that the treatment took place in 2012 instead of 2014, and estimate the effect of this fictitious BU. In order to center the time horizon of the analysis around the onset of the false treatment, we analyze the time period running from 2011 to 2014 for this robustness test. The results are reported in Table 6 and show that the fictitious BU had no statistically significant effect on our variables of interest, supporting our finding that it was the onset of BU and the actual change in banking supervision arrangements that triggered the changes in banks’ disclosure practices.

Second, our results are subject to the limitation that our word categorization might not be the correct way to create our disclosure categories. To rule out this hypothesis, we use an alternative purely objective statistical approach to create our disclosure categories. Specifically, we use the k-means clustering algorithm proposed by Hartigan and Wong (1979) to aggregate the words according to the variability of their occurrences in bank annual reports.Footnote 16 The result of this new categorization is a four-category clustering, which shares some common characteristics with our original categorization, supporting its reliability and accuracy. Table 7 reports the relative proportion of words in common between each k-means cluster and our original categorization. The results indicate that a high proportion of the words of each cluster belong to our risk disclosure categories (28%, 100%, 30%, and 73% for clusters 1 to 4, respectively after normalization), suggesting that our original categorization is reliable. We check whether the clusters identified by the k-means approach behave similarly to our original categories by running regressions substituting our original categories with the k-means clusters. These results are reported in Table 8 and show that for each cluster, the regressions are qualitatively unchanged from those of our baseline models. Hence, we can conclude that our original categorization is reliable and accurate as it is validated by an objective statistical methodology.

Third, our results might be affected by the choice of the weights assigned to each word of the four categories we employ. As explained, the term \({\text{mow}}_{{Cat{\text{~}}1}}\) in Eq. (1) is the mean of the relative occurrences of the words belonging to the first category. It is implicit that all words have the same weight equal to unity. To test the robustness of our results, we use principal component analysis to aggregate the occurrences of the words of each category into a single variable.Footnote 17 For each category of our dictionary, we use the first principal component as the dependent variable of our regressions. The results reported in Table 9 are consistent with the risk disclosure regressions proposed in our baseline models.

Fourth, we deal with two potential shortcomings of the DiD methodology that might cast doubt on our baseline results. First, one of the most severe assumptions of the DiD procedure is that the control group is a valid counterfactual of the treatment. Even though our sample selection approach should guarantee that our control group (nationally supervised banks) is similar to the treatment one (SSM-supervised banks), we test the robustness of our model to this assumption by selecting a restricted control group using propensity score matching (Rosenbaum and Rubin 1983) in which the predicted probability (propensity score) of being selected as a SSM-supervised bank is computed by estimating a simple probit model. We use bank capitalization (ETA) and profitability (ROA) to match SSM-supervised banks with nationally supervised banks using the Kernel matching approach (Heckman et al., 1998).Footnote 18 The results of the propensity score matching difference-in-differences estimation are reported in Table 10 and are consistent with those of our baseline models, supporting the robustness of our results. In Table 11, we compare the differences between treated and untreated banks for these two variables. It emerges that these differences are statistically insignificant, further supporting the effectiveness of our propensity score matching methodology. The second potential shortcoming of the DiD methodology is that it might suffer from serial correlation issues (Bertrand et al. 2004). We address this concern by collapsing the time series information into the pre- and post- 2014 period, taking the means of the data of these two time periods separately, and then repeating the DiD regression at the averaged level.Footnote 19 The results are reported in Table 12 and are qualitatively unchanged from our baseline. Hence, our results are still robust after controlling for serial correlation issues.

Fifth, in order to guarantee that the results of our difference-in-differences strategy are reliable and not affected by other concurrent policies, the treatment and the control group must satisfy the parallel trend assumption in the pre-treatment period. Figures 1,2, 3, 4 show the correlation coefficients of the of the mean values of the disclosure indexes of SSM supervised banks and nationally supervised entities in the pre-treatment period. The correlation coefficients are high for all disclosure categories (greater or equal to 0.7) and visual inspection indicates that the trends of the disclosure indexes are parallel. Thus, the control group of nationally supervised banks appears to be a valid counterfactual of the treatment group (SSM supervised banks).Footnote 20In order to formally test the parallel trend assumption, we draw upon the approach proposed by Frankel et al. (2020) and Ahmed et al. (2020). Specifically, we added dummy variables that identify each year before the establishment of the BU, and the interactions between these indicator variables and the variable Treat. Formally, we used the following model:

where dummy_2012, dummy_2013 and dummy_2014 are the dummy variables that identify years 2012, 2013 and 2014 respectively. The results of this test are reported in Table 13. First, for all parameters (with one single exception in column 1) there is no significant differential trend between treated and untreated banks before the establishment of the BU. Second, in order to compare the differences between treated and untreated banks before and after the banking union, we perform t-tests to compare the magnitude of the parameter associated to the interaction dummy BU*Treat (β1), with the average of β5, β6 and β7. The results are reported at the bottom of Table 13. They are all statistically different at conventional levels, suggesting that there is a significant differential decrease in disclosure for SSM supervised banks after the establishment of the BU. These results further support the robustness of our baseline model.

Finally, we examine the robustness of our results to the inclusion in Eq. (3) of corporate governance variables, which might affect the results for two reasons. First, by adding additional control variables, we reduce possible concerns related to omitted variable bias that could affect our econometric model. Second, previous studies provide evidence that corporate governance plays an important role in bank risk taking (Beltratti and Stulz 2012; Minton et al 2014) and disclosure (Forker 1992). Hence, we extend our empirical model by adding the following variables: (i) the CEO’s age in years (CEOage); (ii) CEO’s gender (CEOgen), which is a dummy variable equal to 1 if the CEO is female and zero otherwise; (iii) whether the CEO also holds the post of chairman (CEOdual), which is a dummy variable equal to 1 if the CEO is also the chairman of the bank and zero otherwise; (iv) whether the bank has a two-tier executive board (2TS), which is a dummy variable equal to 1 if the board structure includes supervisors and managers and zero otherwise; and the natural logarithm of the number of senior executives (directors and managers) in the bank (SeniorExec). The sources of these variables are Bordex and Thomson Reuters Eikon. The results of the regressions are reported in Table 14. The signs and statistical significance of the coefficients on the main variable of interest (BU and BU*Treat) are qualitatively unchanged from our baseline model, supporting the robustness of our results. As for the effects of the corporate governance variables, CEOage has a positive and statistically significant effect in three out of four regressions, in line with previous studies that found that the age of the CEO is an important determinant of disclosure (Marquez-Illescas et al. 2019). These results show that older CEOs provide higher levels of disclosure, because of their higher experience that enables them to adopt more effective and risk-oriented disclosure practices. CEOgen is positively related with disclosure, showing that women CEOs are more prone to provide higher levels of disclosure. This supports recent research suggesting that female CEOs are more risk averse (Faccio et al. 2016; Martin et al. 2009). However, it is necessary to be cautious in the interpretation of this effect, because it is statistically significant only in one out of four regressions. CEOdual is negatively and significantly related with two risk disclosure variables. This result shows that when CEOs act also as chairmen in banking institutions, the levels of disclosure are lower. This finding is in line with the agency theory (Jensen and Meckling 1976), given that CEO duality implies higher levels of power for the CEO, who may decide to provide low levels of disclosure, because he/she is not interested in reducing information asymmetries with their shareholders. Lastly, SeniorExec is positively and significantly associated with disclosure in three out of four regressions. suggesting that more experienced directors and managers contribute to increasing the level of disclosure (Adawi and Rwegasira 2011).

We also carry out additional analyses taking into consideration interaction terms between our variables of interest and selected explanatory variables for two main reasons. First, to test whether these variables may affect the relationship between BU and disclosure. Second, because, by including additional variables in our regression model, we can further test the robustness of our baseline results.

Specifically, we investigate into the following aspects: (i) how bank profitability influences the relationship between BU and disclosure; (ii) how the location of banks in GIPSI (Greece, Italy, Portugal, Spain and Ireland) countries influences the relationship between BU and disclosure; (iii) how CEO duality (i.e. the CEO is also the Chairman of the financial institution) affects the relationship between the interaction dummy (BU*Treat) and bank disclosure. The results are reported in the Table 15, 16 and 17. Table 15 shows that the interaction term between BU and ROA is negatively and significantly associated with each of the four dependent variables. This finding means that the relationship between BU and disclosure is influenced by bank profitability. In particular, the positive effect of the BU on bank disclosure is stronger for less profitable banks and weaker for highly profitable banks. This result is important because the disclosures provided by less profitable banks are particularly relevant for investors and stakeholders that are interested in understanding the reasons of their low level of profitability. Table 16 reports the effect of the interaction between the BU indicator variable and a dummy variable that identifies the banks that are located in the GIPSI countries. Shambaugh (2012) uses this acronym to indicate the five most troubled economies of the Eurozone, namely Greece, Italy, Portugal, Spain, Ireland. Previous studies have argued that the effect of the BU in GIPSI countries might be different from the other European countries because of their high levels of sovereign debt (Avignone et al. 2020). In order to investigate into this aspect, we analyze if the location of banks in GIPSI countries affect the way the BU has influenced bank disclosure. The results show that the interaction between BU and the GIPSI dummy variable is positively and significantly associated with two risk disclosure categories. This finding support the idea that the effect of the banking union has been different for these countries, and in particular the positive influence of the BU on disclosure has been stronger in these countries. Similarly to the results obtained in the previous regression, also in this case the disclosure has increased for those banks that were in a more difficult situation, and in particular for those banks that are located in troubled countries characterized by high levels of sovereign debt.Footnote 21 Finally, in Table 17 we report on the interaction between BU, Treat and CEO duality. The results show that for those banks in which the CEO is also the Chairman of the bank (CEO duality), the negative effect of the banking union on the disclosure of SSM supervised banks is stronger. This effect is statistically significant for two out of four disclosure categories. This finding is consistent with previous literature that shows that CEO duality has a negative effect on disclosure (Gul and Leung 2004). The hypothesis that concentrated decision making power, and consequently CEO duality, may negatively influence board’s oversight, including disclosure policies is grounded in agency theory (Fama and Jensen 1983). This is because CEO duality and its associated concentrated decision making power could reduce the ability of the board to exercise effective control. Thus, this mechanism played an important role in determining the effect of BU on the disclosure practices of SSM supervised banks. In Tables 15, 16 and 17, the results of the main variables of interest (BU and BU*TREAT) are qualitatively unchanged from our baseline regressions and they are still statistically significant at conventional levels. These findings further validate the robustness of our baseline results.

6 Conclusions

This paper investigated the impact of BU on bank risk disclosure in a sample of 225 European banks, 75 of which were supervised under the SSM once BU was introduced. It employed content analysis techniques to construct a dictionary designed to assess four categories of disclosure in bank financial statements together with a Difference-in-Differences estimation methodology in which banks supervised under the SSM act as the treatment group and banks supervised by the national supervisor act as the control group. The main hypotheses underlying the analysis were that the onset of BU would increase risk disclosure by all banks and that the additional requirements of the SSM would increase risk disclosure by SSM supervised banks (treated entities) relative to that by other banks. The paper reports two key results that are robust to a battery of tests. First, BU had a positive impact on bank disclosure overall—i.e., bank disclosure in a number of categories increased following the onset of BU. Second, in line with our second research hypothesis, there is evidence that disclosure by SSM-supervised banks worsened relative to that of nationally supervised banks. The latter result likely reflects the shortcoming of a two-tier supervisory system in which the SSM supervisor—the ECB—is dependent on national regulators for the supply of information. This arrangement likely gives rise to inefficiencies with respect to the speed and completeness of the information flow between SSM supervised banks and the ECB, especially as the interest of the ECB and the national regulators are unlikely to always converge. These inefficiencies, already identified by other authors (Carletti et al. 2015, 2021; Gros and Schoenmaker 2014), might affect bank risk disclosure practices, resulting in the lower level of disclosure observed in our empirical analysis. In additional analyses, we also find that the overall positive effect of the BU on bank disclosure is stronger for less profitable banks and in the most troubled economies of the Eurozone, while the negative effect on SSM supervised banks is stronger if bank CEOs act also as Chairman. These results show that bank specific and country characteristics play an important role in determining the impact of banking supervision on bank disclosure practices.

We acknowledge that our paper is potentially affected by a caveat: the results might be partially driven by other competing regulations occurred in 2014, different from the establishment of the BU and its associated rules. However, to our best knowledge, the only regulation that could affect our results is the already mentioned 2014 Basel III Pillar 3 disclosures requirement. In this regard, it is important to notice that this regulation has imposed disclosure requirements exclusively in the Pillar 3 disclosure report, which is provided separately from the annual financial reports of European banks (Scannella and Polizzi 2018). Given that we did not include the Pillar 3 disclosure report in our content analysis, the results of the empirical investigation should not be affected by this regulation. The main policy implication of our results is that efforts are necessary to improve disclosure by SSM-supervised banks to the same extent as that of nationally supervised banks. One way to achieve this goal would be have SSM-supervised banks report directly to the ECB.

Notes

The reform has also embraced subsequent revisions to the disclosure requirements aimed at addressing perceived shortcomings in Pillar 3. In this regard, it is important to notice that 2014 Basel III Pillar 3 disclosures requirements have had an important impact on the disclosure provided by European banks, but exclusively in the Pillar 3 disclosure report, which is provided separately from the annual financial reports (Scannella and Polizzi 2021).

See Tröger (2014) for a detailed description of the division of labor between the ECB and the NCAs in the SSM.

A bank was deemed significant if: assets exceeding €30 billion; assets exceeded both €5 billion and 20% of the GDP of the member state in which it is located; it was among the three most significant banks of the country in which it is located; it had large cross-border activities; and it bank received, or had applied for, assistance from euro-zone bailout funds.

See Regulation (EU) N. 575/2013, Article 400(2)(c) for further information.

Although other disclosure indexes based on qualitative content analysis methodologies have been proposed in the literature (Scannella and Polizzi 2018, 2020), they are not suited to the analysis of large samples. In addition, more sophisticated co-occurrence analyses (Illia et al., 2014) are not suited to our research questions. Hence, we rely on a quantitative content analysis methodologies based on disclosure dictionaries.

We gratefully thank Giuseppe Avignone, Alessio Reghezza and Laura Santucci for the validation of the dictionary.

The first two categories represent different aspects of the same risk disclosure concepts.

The count of the occurrences includes stemmed words. Hence, we count the number of times these stemmed words appear in the annual report.

The standardization may be necessary if our disclosure index is non-stationary, which might happen in case there are regime changes in the word distribution (Tetlock et al. 2008). Because of this standardization, the mean and the standard deviation of the disclosure indexes are zero and one, respectively.

For additional information on the significance criteria adopted by the ECB see: https://www.bankingsupervision.europa.eu/banking/list/criteria/html/index.en.html.

The SIFI and the less significant institutions of our sample kept their significant / less significant status throughout the sample period. Although, potentially, banks could change their significant / less significant status, the number of significant supervised entities has been very stable throughout the sample period, because the ECB is committed “to ensure that high supervisory standards are applied consistently.” (https://www.bankingsupervision.europa.eu/banking/list/criteria/html/index.en.html.). For these reasons, it is not possible to control for bank fixed effect in our empirical analysis, because there would be a multi-collinearity problem with the TREAT dummy that identifies SSM supervised banks.

This finding should be interpreted in light of the fact that the parameter associated with the Treat dummy is positive. This result indicates that while SSM supervised banks were generally characterized by higher levels of disclosure, their disclosure practices worsened after the establishment of the BU compared to nationally supervised banks.”.

The literature suggests that higher levels of disclosure are generally associated with a decreased likelihood of bank failure (Cordella and Yeyati 1998).

See Krink et al. (2007) for insights on the k-means cluster methodology in a banking context.

Principal component analysis is a statistical technique that converts a set of variables into a smaller set of linearly uncorrelated variables, named principal components, which preserve the information and structure of the original variables (Cumming and Wooff 2007). This methodology has been widely used in banking and accounting studies (Larcker et al. 2007; Ludvigson and Ng 2007; Carlson and Wheelock 2018).

We select the variables ETA and ROA to match treated and untreated banks for two main reasons: First, capitalization and profitability are considered amongst the most important determinants of risk disclosure in the banking industry (Helbok and Wagner, 2006; Linsley et al., 2006). Second, the selection of additional control variables in the propensity score matching regression would lead to a significant decrease in the number of observations, thereby undermining the generalizability of our findings to the whole population. According to Shipman et al. (2017), this problem should be avoided when performing propensity score matching.

This procedure for dealing with potential serial correlation is suggested by Bertrand et al. (2004).

We carried out, but do not report, two further robustness tests that support the reliability of our results. First, we excluded non-eurozone countries from our analysis, and second, we computed the regression estimates using only the words ‘risk’ and ‘uncertain’, as they are considered particularly important when it comes to create a quantitative measure of language (Tetlock.et al. 2008). The results are available from the authors upon request.

We build upon the evidence that the effect of the BU is different in the most indebted European countries by performing an additional analysis on the least indebted countries. The results (not reported) show that the negative effect of the banking union on the risk disclosure of SSM supervised banks is less strong in the least indebted European countries. This finding provides additional evidence that the level of sovereign debt of the countries has played an important role in shaping the relationship between the BU and bank disclosure practices. The results of these analyses are available from the authors upon request.

References

Abraham S, Cox P (2007) Analysing the determinants of narrative risk information in UK FTSE 100 annual reports. The Br Account Rev 39:227–248. https://doi.org/10.1016/j.bar.2007.06.002

Adawi M, Rwegasira K (2011) Corporate boards and voluntary implementation of best disclosure practices in emerging markets: evidence from the UAE listed companies in the Middle East. Int J of Discl and Gov 8:272–293. https://doi.org/10.1057/jdg.2011.5

Agarwal S, Lucca D, Seru A, Trebbi F (2014) Inconsistent regulators: evidence from banking. The Q J of Econ 129:889–938. https://doi.org/10.1093/qje/qju003

Al Lawati H, Hussainey K, Sagitova R (2021) Disclosure quality vis-à-vis disclosure quantity: does audit committee matter in Omani financial institutions? Rev of Quant Finan and Account, Forthcoming. https://doi.org/10.1007/s11156-020-00955-0

Al-Hadi A, Hasan MM, Habib A (2016) Risk committee, firm life cycle, and market risk disclosures. Corp Gov: an Int Rev 24:145–170. https://doi.org/10.1111/corg.12115

Ahmed AS, Li Y, Xu N (2020) Tick size and financial reporting quality in small-cap firms: evidence from a natural experiment. J of Account Res 58:869–914. https://doi.org/10.1111/1475-679X.12331

Andrés P, Polizzi S, Scannella E, Suárez N (2021) Corruption-Related Disclosure in the Banking Industry: Evidence From GIPSI Countries. European Corporate Governance Institute (ECGI) finance working paper series 745/2021.

Avgouleas E (2009) The global financial crisis, behavioural finance and financial regulation: in search of a new orthodoxy. J of Corporat Law Stud 9:23–59. https://doi.org/10.1080/14735970.2009.11421534

Avignone G, Altunbas Y, Polizzi S, Reghezza A (2020) Centralised or decentralised banking supervision? evidence from European banks. J of Int Money and Financ 110:1–14. https://doi.org/10.1016/j.jimonfin.2020.102264

Balakrishnan K, Billings MB, Kelly B, Ljungqvist A (2014) Shaping liquidity: on the causal effects of voluntary disclosure. The J of Financ 69:2237–2278. https://doi.org/10.1111/jofi.12180

Ball R, Shivakumar L (2005) Earnings quality in UK private firms: comparative loss recognition timeliness. J of Account and Econ 39:83–128. https://doi.org/10.1016/j.jacceco.2004.04.001

Ball R, Robin A, Wu JS (2003) Incentives versus standards: properties of accounting income in four East Asian countries. J of Account and Econ 36:35–270. https://doi.org/10.1016/j.jacceco.2003.10.003

Barakat A, Hussainey K (2013) Bank governance, regulation, supervision, and risk reporting: evidence from operational risk disclosures in European banks. Int Rev of Financ Anal 30:254–273. https://doi.org/10.1016/j.irfa.2013.07.002

Barth ME, Israeli D (2013) Disentangling mandatory IFRS reporting and changes in enforcement. J of Account and Econ 56:178–188. https://doi.org/10.1016/j.jacceco.2013.11.002

Beattie V (2014) Accounting narratives and the narrative turn in accounting research: issues, theory, methodology, methods and a research framework. The Br Account Rev 46:111–134. https://doi.org/10.1016/j.bar.2014.05.001

Beltratti A, Stulz RM (2012) The credit crisis around the globe: why did some banks perform better? J of Finan Econ 105:1–17. https://doi.org/10.1016/j.jfineco.2011.12.005

Benczur P, Cannas G, Cariboni J, Di Girolamo F, Maccaferri S, Giudici MP (2017) Evaluating the effectiveness of the new EU bank regulatory framework: a farewell to bail-out? J of Financ Stab 33:207–223. https://doi.org/10.1016/j.jfs.2016.03.001

Berger AN, Kick T, Schaeck K (2014) Executive board composition and bank risk taking. J of Corp Financ 28:48–65. https://doi.org/10.1016/j.jcorpfin.2013.11.006

Berger AN, Turk-Ariss R (2015) Do depositors discipline banks and did government actions during the recent crisis reduce this discipline? an international perspective. J of Financ Serv Res 48:103–126. https://doi.org/10.1007/s10693-014-0205-7

Bertrand M, Duflo E, Mullainathan S (2004) How much should we trust differences-in-differences estimates? The Q J of Econ 119:249–275. https://doi.org/10.1162/003355304772839588

Bolton P, Oehmke M (2019) Bank resolution and the structure of global banks. The Rev of Financ Stud 32:2384–2421. https://doi.org/10.1093/rfs/hhy123

Botosan CA, Plumlee MA (2002) A re-examination of disclosure level and the expected cost of equity capital. J of Account Res 40:21–40. https://doi.org/10.1111/1475-679X.00037

Botosan CA (1997) Disclosure level and the cost of equity capital. Account Rev 72:323–349

Bowen RM, DuCharme L, Shores D (1995) Stakeholders’ implicit claims and accounting method choice. J of Account and Econ 20:255–295. https://doi.org/10.1016/0165-4101(95)00404-1

Boyd B (1990) Corporate linkages and organizational environment: a test of the resource dependence model. Strateg Manag J 11:419–430. https://doi.org/10.1002/smj.4250110602

Brown SV, Tucker JW (2011) Large-sample evidence on firms’ year-over-year MD&A modifications. J of Account Res 49:309–346. https://doi.org/10.1111/j.1475-679X.2010.00396.x

Burgstahler D, Dichev I (1997) Earnings management to avoid earnings decreases and losses. J of Account and Econ 24:99–126. https://doi.org/10.1016/S0165-4101(97)00017-7

Burks JJ, Cuny C, Gerakos J, Granja J (2018) Competition and voluntary disclosure: evidence from deregulation in the banking industry. Rev of Account Stud 23:1471–1511. https://doi.org/10.1007/s11142-018-9463-1

Bushman RM, Hendricks BE, Williams CD (2016) Bank competition: measurement, decision-making, and risk-taking. J of Account Res 54:777–826. https://doi.org/10.1111/1475-679X.12117

Carboni M, Fiordelisi F, Ricci O, Lopes FSS (2017) Surprised or not surprised? the investors’ reaction to the comprehensive assessment preceding the launch of the banking union. J of Bank and Financ 74:122–132. https://doi.org/10.1016/j.jbankfin.2016.11.004

Carletti E, Dell’Ariccia G, Marquez R (2015) Supervisory incentives in a banking union. IMF Working Paper 16/186.

Carletti E, Dell’Ariccia G, Marquez R (2021) Supervisory incentives in a banking union. Manag Sci 67:455–470. https://doi.org/10.1287/mnsc.2019.3448

Carlson M, Wheelock DC (2018) Did the founding of the Federal Reserve affect the vulnerability of the interbank system to contagion risk? J of Money Credit and Bank 50:1711–1750. https://doi.org/10.1111/jmcb.12520

Chen Q, Vashishtha R (2017) The effects of bank mergers on corporate information disclosure. J of Account and Econ 64:56–77. https://doi.org/10.1016/j.jacceco.2017.05.003

Cheng CA, Collins D, Huang HH (2006) Shareholder rights, financial disclosure and the cost of equity capital. Rev of Quant Financ and Account 27:175–204. https://doi.org/10.1007/s11156-006-8795-2

Cho CH, Laine M, Roberts RW (2015) Organized hypocrisy, organizational façades, and sustainability reporting. Account, Organ and Soc 40:78–94. https://doi.org/10.1016/j.aos.2014.12.003

Cohen J, Krishnamoorthy G, Wright A (2017) Enterprise risk management and the financial reporting process: the experiences of audit committee members, CFOs, and external auditors. Contemp Account Res 34:1178–1209. https://doi.org/10.1111/1911-3846.12294

Cordella T, Yeyati EL (1998) Public disclosure and bank failures. IMF Econ Rev 45:110–131. https://doi.org/10.2307/3867331

Costello AM, Granja J, Weber J (2018) Do strict regulators increase the transparency of banks? J of Account Res. https://doi.org/10.1111/1475-679X.12255

Cumming JA, Wooff DA (2007) Dimension reduction via principal variables. Comput Stat Data Anal 52:550–565. https://doi.org/10.1016/j.csda.2007.02.012

Draghi M (2018) The benefits of European supervision. Speech at the Autorité de Contrôle Prudentiel et de Résolution Conference on Financial Supervision. https://www.ecb.europa.eu/press/key/date/2018/html/ecb.sp180918.en.html, Accessed 27 February 2020.

Eaton TV, Nofsinger JR, Weaver DG (2007) Disclosure and the cost of equity in international cross-listing. Rev of Quant Financ and Account 29:1–24. https://doi.org/10.1007/s11156-007-0024-0

Easley D, O’Hara M (2004) Information and the cost of capital. J Financ 59:1553–1583. https://doi.org/10.1111/j.1540-6261.2004.00672.x

Eng LL, Mak YT (2003) Corporate governance and voluntary disclosure. J Account Public Policy 22:325–345. https://doi.org/10.1016/S0278-4254(03)00037-1

Faccio M, Marchica M-T, Mura R (2016) CEO gender, corporate risk-taking, and the efficiency of capital allocation. J Corp Financ 39:192–209

Fama E, Jensen MC (1983) Separation of ownership and control. J Econ Law 26:301–325. https://doi.org/10.1086/467037

Fiordelisi F, Ricci O, Stentella Lopes FS (2017) The unintended consequences of the launch of the single supervisory mechanism in Europe. J Financ Quant Anal 52:2809–2836. https://doi.org/10.1017/S0022109017000886

Fitch TP (2018) Dictionary of Banking Terms, 7th. Barron’s Educational Series, New York

Flannery MJ (2001) The faces of “market discipline.” J Financ Serv Res 20:107–119. https://doi.org/10.1023/A:1012455806431

Flannery MJ, Kwan SH, Nimalendran M (2013) The 2007–2009 financial crisis and bank opaqueness. J Financ Intermed 22:55–84. https://doi.org/10.1016/j.jfi.2012.08.001

Forker JJ (1992) Corporate governance and disclosure quality. Account Bus Res 22:111–124

Frankel R, Kim BH, Ma T, Martin X (2020) Bank monitoring and financial reporting quality: the case of accounts receivable-based loans. Contemp Account Res 37:2120–2144. https://doi.org/10.1111/1911-3846.12595

Goncharenko R, Hledik J, Pinto R (2018) The dark side of stress tests: negative effects of information disclosure. J of Financ Stab 37:49–59. https://doi.org/10.1016/j.jfs.2018.05.003

Gorton G, Ordonez G (2014) Collateral crises. American Econ Rev 104:343–78. https://https://doi.org/10.1257/aer.99.2.567

Gorton G (2009) Information, liquidity, and the (ongoing) panic of 2007. American Econ Rev 99:567–572. https://72.https://doi.org/10.1257/aer.99.2.567

Gros D, Schoenmaker D (2014) European deposit insurance and resolution in the Banking Union. J Common Mark Stud 52:529–546. https://doi.org/10.1111/jcms.12124

Gul FA, Leung S (2004) Board leadership, outside directors’ expertise and voluntary corporate disclosures. J Account Public Policy 23:351–379. https://doi.org/10.1016/j.jaccpubpol.2004.07.001

Gunther JW, Moore RR (2003) Loss underreporting and the auditing role of bank exams. J Financ Intermed 12:153–177. https://doi.org/10.1016/S1042-9573(03)00015-9

Hartigan JA, Wong MA (1979) Algorithm AS 136: A k-means clustering algorithm. J Royal Stat Soc Series C (appl Stat) 28:100–108. https://doi.org/10.2307/2346830

Heckman J, Ichimura H, Smith J, Todd P (1998) Characterizing selection bias using experimental data. Econometrica 66:1017–1098. https://doi.org/10.2307/2999630

Helbok G, Wagner C (2006) Determinants of operational risk reporting in the banking industry. The J of Risk 9:49–74. https://doi.org/10.2139/ssrn.425720

Hertzberg A, Liberti JM, Paravisini D (2011) Public information and coordination: evidence from a credit registry expansion. J Financ 66:379–412. https://doi.org/10.1111/j.1540-6261.2010.01637.x