Abstract

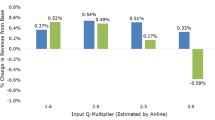

Traditionally, airlines have been limited to a set of fixed fare classes and, in turn, price points, to distribute their fare products. The advent of IATA’s new distribution capability (NDC) will soon enable airlines to quote any fare from a continuous range. In theory, such continuous pricing could increase revenues by extracting more of the consumer surplus, through its ability to offer more granular fares, closer to the customer’s willingness-to-pay (WTP). In this article, we describe several algorithms that lead to the quotation of a single fare from a continuous range. These algorithms either rely on traditional fare classes for the purpose of forecasting and optimization (class-based), or completely abandon the notion of fare classes, instead assuming different WTP distributions within each booking period prior to departure (classless). We describe how these algorithms build upon and differ from their traditional RM counterparts. Performance of these heuristics is then benchmarked against traditional class-based RM, and competitive impacts are analyzed when continuous pricing is adopted by one airline asymmetrically or both airlines symmetrically in a hypothetical 2-carrier network in the passenger origin–destination simulator (PODS). We find that continuous pricing is generally revenue-positive, and the revenue gains can be as high as 2.0% for the first-mover and reach up to 1.2% when both airlines adopt the new method. In addition, we show that these gains depend on the number of fare classes in the traditional fare structure used as a baseline, and that they are smaller under lower demand-to-capacity ratios.

Similar content being viewed by others

References

Belobaba, Peter P. 1989. Application of a probabilistic decision model to airline seat inventory control. Operations Research 37 (2): 183–197.

Belobaba, Peter P. 1992. Optimal vs. heuristic methods for nested seat allocation. Presentation at ORSA/TIMS Joint National Meeting

Belobaba, Peter P., and Craig Hopperstad. 2004. Algorithms for revenue management in unrestricted fare markets. Presentation at the Meeting of the INFORMS Section on Revenue Management. Cambridge, MA: Massachusetts Institute of Technology

Bratu, Stephane. 1998. Network value concept in airline revenue management. Master’s Thesis, Massachusetts Institute of Technology.

Chen, Ming, and Zhi-Long. Chen. 2015. Recent developments in dynamic pricing research: Multiple products, competition and limited demand information. Production and Operations Management 24 (5): 704–731.

Fiig, Thomas, Karl Isler, Craig Hopperstad, and Peter P. Belobaba. 2010. Optimization of mixed fare structures: Theory and Applications. Journal of Revenue and Pricing Management 9 (1–2): 152–170.

Fiig, Thomas, Oriana Goyons, Robin Adelving, and Barry Smith. 2016. Dynamic pricing—The next revolution in RM? Journal of Revenue and Pricing Management 15 (5): 360–379.

Gallego, Guillermo, and Garrett van Ryzin. 1994. Optimal dynamic pricing of inventories with stochastic demand over finite horizons. Management Science 40 (8): 999–1020.

Gallego, Guillermo, and Garrett van Ryzin. 1997. A multiproduct dynamic pricing problem and its applications to network yield management. Operations Research 45 (1): 24–41.

Lautenbacher, Conrad J., and Shaler Stidham Jr. 1999. The underlying Markov decision process in the single-leg airline yield-management problem. Transportation Science 33 (2): 136–146.

Liotta, Nicholas James. 2019. Airline revenue management for continuous pricing: class-based and classless methods. Master’s Thesis, Massachusetts Institute of Technology.

Liu, Qian, and Garrett van Ryzin. 2008. On the choice-based linear programming model for network revenue management. Manufacturing & Service Operations Management 10 (2): 288–310.

Papen, Alexander. 2020. Competitive impacts of continuous pricing mechanisms in airline revenue management. Master’s Thesis, Massachusetts Institute of Technology.

Talluri, Kalyan, and Garrett van Ryzin. 2004. Revenue management under a general discrete choice model of consumer behavior. Management Science 50 (1): 15–33.

Walczak, Darius, Setareh Mardan, and Royce Kallesen. 2010. Customer choice, fare adjustments and the marginal expected revenue data transformation: A note on using old yield management techniques in the brave new world of pricing. Journal of Revenue and Pricing Management 9 (1–2): 94–109.

Westermann, Dieter. 2013. The potential impact of IATA’s new distribution capability (NDC) on revenue management and pricing. Journal of Revenue and Pricing Management 12 (6): 565–568.

Williamson, Elizabeth Louise. 1992. Airline network seat inventory control: methodologies and revenue impacts. Ph.D. Thesis, Massachusetts Institute of Technology.

Wittman, Michael D. 2018. Dynamic pricing mechanisms for airline revenue management: theory, heuristics, and implications. Ph.D. Thesis, Massachusetts Institute of Technology.

Wittman, Michael D., and Peter P. Belobaba. 2019. Dynamic pricing mechanisms for the airline industry: A definitional framework. Journal of Revenue and Pricing Management 18 (2): 100–106.

Zhang, Dan, and Z. Lu. 2013. Assessing the value of dynamic pricing in network revenue management. INFORMS Journal on Computing 25 (1): 102–115.

Acknowledgements

The authors would like to dedicate this paper to the memory of Craig A. Hopperstad, the original developer of the Passenger Origin Destination Simulator (PODS) and a primary source of inspiration for the concepts behind the continuous pricing algorithms described in this paper. Craig continued to work on the implementation of continuous pricing methods into PODS until his death in January 2019, giving us the foundation for further development and testing of these algorithms.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Szymański, B., Belobaba, P.P. & Papen, A. Continuous pricing algorithms for airline RM: revenue gains and competitive impacts. J Revenue Pricing Manag 20, 669–688 (2021). https://doi.org/10.1057/s41272-021-00350-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41272-021-00350-x