Abstract

Masuda et al. (Games Econ Behav 83:73–85, 2014) showed that the minimum approval mechanism (AM) implements the efficient level of public good theoretically and experimentally in a linear public good game. We extent this result to a two-players common pool resource (CPR) game. The AM adds a second stage into the extraction game. In the first stage, each group member proposes his level of extraction. In the second stage, the proposed extractions and associated payoffs are displayed and each player is asked to approve or to disapprove both proposed extractions. If both players approve, the proposals are implemented. Otherwise, a uniform level of extraction, the disapproval benchmark (DB), is imposed onto each player. We consider three different DBs: the minimum proposal (MIN), the maximum proposal (MAX) and the Nash extraction level (NASH). We derive theoretical predictions for each DB following backward elimination of weakly dominated strategies (BEWDS). We first underline the strength of the AM, by showing that the MIN implements the optimum theoretically and experimentally. The sub-games predicted under the NASH are Pareto improving with respect to the Nash equilibrium. The MAX leads, either to Pareto improving outcomes with respect to the free access extractions, or to a Pareto degradation. Our experimental results show that the MAX and the NASH reduce the level of over-extraction of the CPR. The MAX leads above all to larger reductions of (proposed and realized) extractions than the NASH.

Similar content being viewed by others

Notes

The unanimity approval rule is a particular case. One may consider other rules, such as the majority rule.

A pro-social player aims at maximizing the joint payoff of himself and the other party, as the benevolent social planner. On the other hand, a selfish rational player maximizes only his own payoff without regard to the others payoff. Therefore if the AM induces a social optimum level of extraction for a selfish player, it also does so for any player whose preferences support pro-social behavior.

Low contributions to public goods, over-extraction from CPRs or high levels of emission of pollutants.

Under the MIN, voluntariness is satisfied only if total group extraction is above the threshold \(X=(a-p)/b\). However, it is not satisfied under the MAX as mentionned in appendix 6.7.

1 token is equal to 3 units of CPR extraction level.

Secondly, we show that Pareto-efficient sub-game \(({\hat{x}}, {\hat{x}})\) weakly dominates other symmetrical sub-games. The two players determine the outcome of the DB in the set of a uniform extraction vectors. To do so, player i maximizes his payoff under the constraint of uniform extraction vector: maximize \(\pi _{i}(x_{i},x_{j})\) wrt \(x_{i}=x_{j}\). The solution of this problem is the Pareto-efficient extraction level \({\hat{x}}=\frac{a-p}{4b}=6\) tokens, \({\hat{\pi }}=\frac{(a-p)^{2}}{8b}+pw=312\) ecus and \({\hat{X}}=\frac{a-p}{2b}=12\) tokens.

The authors would like to thank Dimitri Dubois, from the Experimental Economic Laboratory of Montpellier (LEEM) for technical support.

Center for environmental economics - Montpellier.

The period dummy corresponds to twice 10 periods in order to take into account the 10 periods timing of the game.

the comparison between NASH and MAX versus MIN, as well as NASH, and MIN versus NASH is not of interest; that is why they are alternatively removed from the sample.

This test is based on 40 independent observations.

This test is based on 20 independent observations (10 observations per sequence).

This test is based on 20 independent observations (10 observations per sequence).

References

Andreoni J, Varian H (1999) Preplay contracting in the prisoners dilemma. Proc Natl Acad Sci 96(19):10933–10938

Davis DD, Holt CA (1999) Equilibrium cooperation in two-stage games: experimental evidence. Int J Game Theory 28(1):89–109

Falkinger J (1996) Efficient private provision of public goods by rewarding deviations from average. J Public Econ 62(3):413–422

Falkinger J, Fehr E, Gächter S, Winter-Ember R (2000) A simple mechanism for the efficient provision of public goods: experimental evidence. Am Econ Rev 90(1):247–264

Hardin G (1968) The tragedy of the commons. Science 162(3859):1243–1248

Lindahl T, Crépin A-S, Schill C (2016) Potential disasters can turn the tragedy into success. Environ Resour Econ 65(3):657–676

Masuda T, Okano Y, Saijo T (2014) The minimum approval mechanism implements the efficient public good allocation theoretically and experimentally. Games Econ Behav 83:73–85

Saijo T, Masuda T, Yamakawa T (2018) Approval mechanism to solve prisoners dilemma: comparison with varians compensation mechanism. Soc Choice Welf 51(1):65–77

Saijo T, Okano Y, Yamakawa T (2016) The approval mechanism experiment: a solution to prisoner’s dilemma. KUT-SDES Working Paper (2015-12)

Saijo T, Okano Y, Yamakawa T et al (2015) The approval mechanism solves the prisoner’s dilemma theoretically and experimentally. Technical report

Varian HR (1994a) Sequential contributions to public goods. J Public Econ 53(2):165–186

Varian HR (1994b) A solution to the problem of externalities when agents are well-informed. Am Econ Rev pp 1278–1293

Walker JM, Gardner R, Herr A, Ostrom E (2000) Collective choice in the commons: experimental results on proposed allocation rules and votes. Econ J 110(460):212–234

Walker JM, Gardner R, Ostrom E (1990) Rent dissipation in a limited-access common-pool resource: experimental evidence. J Environ Econ Manag 19(3):203–211

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Welcome

We thank you for agreeing to participate in this decision-making experiment. This experiment will be paid. Your earnings will depend on your decisions as well as those of the other participants in this experiment. Your identity and decisions will be kept anonymous. You will have to indicate your choices on the computer in front of which you are seated, and the computer will notify your earnings (in points) as the experiment progresses.

From now until the end of the experiment we ask you to stop all communication. If you have any questions, please raise your hand, an instructor will answer you privately.

1.2 General procedure

At the beginning of the experiment you will be randomly assigned to a group of two players. The composition of your group remains unchanged until the end of the experiment. Each member of your group (including you) will have an ID 1 or 2.

The experiment is divided into 2 parts. Each part consists of a series of ten periods. The rest of the instructions concern only part 1. At the end of part 1, you will receive new specific instructions for part 2. At the end of the experiment, one of the 20 periods will be drawn and your earnings (in points) for that period will be converted into euros according to a rule defined at the end of the instructions.

Once all participants have read the instructions, an experimenter will read them out loud again. After reading the instructions, you will be asked to complete a questionnaire to verify your understanding of the experiment. When all participants have completed this questionnaire, the experiment will begin.

1.3 Types of investments

In each period, each player of your group has 10 tokens, which he has to split between two activities: activity A and activity B. activity A is common to both players. Activity B is specific to each player. Each token must be invested, either in activity A or in activity B. Earnings associated with your investment in each activity and the total earnings are described as follows.

1.3.1 Earnings activity A

Your earnings from activity A depend on your investment in activity A and the investment in the activity A of the other player in your group.

1.3.2 Earnings from the investment in activity B

Your earnings from activity B depend solely on your own investment in that activity. Each token invested in activity B earns you 15 points. Similarly, each token that the other player invests in his activity B earns him 15 points.

1.3.3 Total earnings

Your total earnings in each period are equal to your earnings from activity A + your earnings from activity B.

We present the different possibilities of total earnings. They are described in the earnings Table (see sheet “Table of total earnings”) (see Table 1). The first column corresponds to your investment in activity A (between 0 and 10). The other columns correspond to the other player’s investment in activity A (between 0 and 10). Your total earnings and the other player’s earnings are measured in points. There are two values in each cell of the Table: Your total earnings in points and the other player’s total earnings in points (in bold). For example, you decide to invest 8 tokens in activity A and therefore 2 tokens in your activity B. The other player decides to invest 6 tokens in activity A and therefore 4 tokens in his activity B. Your total earnings for the period are 330 points. The total earnings of the other player of your group are 285 points.

1.4 Part 1

In each period, you must split your 10 tokens between your investment in activity A and your investment in your activity B. You are free to choose how you want to allocate your 10 tokens. For example, you can decide whether to allocate all your tokens in activity A or all your tokens in activity B.

In practice, the computer will ask you to indicate the number of tokens you want to invest in activity A. The rest of your 10 tokens will automatically be invested in your activity B. The sum of these two investments is exactly equal to your 10 tokens for this period. As a result, you cannot transfer a part or all of your tokens from one period to another.

You and the other player make your decisions simultaneously. Once the investment decisions have been made, the computer calculates your total earnings, as well as the earnings of the other player for the current period. It will tell you how many tokens you have invested in each of the two activities and your total earnings in points. The same information about the other player will also be displayed on your screen. The next period can then begin. Before each new period, you will be informed about your total earnings from each of the previous periods. When the \(10^{th}\) period will be over, the computer will summarize the amount of your earnings for each of the 10 periods.

1.5 Part 2 [AM treatments]

As in part 1, there are 10 periods in part 2 in which you will interact with the same person as in part 1. You and the other player in your group must decide how much you will invest in activity A. The earnings in activity A and activity B are exactly the same as in part 1, so you will use the same “Table of total earnings” as in part 1.

In part 2, each period consists of two stages: Stage 1 and Stage 2.

Stage 1 corresponds to the investment decision: you and the other player will each have to decide how much to invest in activity A. Stage 1 corresponds exactly to the same investment decision as in part 1. Stage 2 is new. Once the two members of your group have chosen their amount to invest in activity A, these decisions and their associated total earnings are published on the screens of all members (including yourself) and submitted for approval. If the two members of your group approve the proposed investment decisions, they will be applied and everyone will earn the corresponding earnings. If at least one player in your group disapprove, the computer will apply an identical investment level as explained in the following instructions.

In practice, in stage 1, the computer will ask you to indicate the amount of your investment in activity A. In stage 2, the computer will tell you how many tokens you proposed for both activities and how many tokens the other player proposed in the current period. It will also tell you your total earning as well as the total earning of each other player. In addition, the computer will inform you about the minimum (under the MIN) or the maximum (under the MAX) of the proposed investments in activity A and the total associated earnings if all members Of your group invest this amount in activity A. Then, the computer will ask you whether you approve or reject the proposals from the other members of your group. You will click YES if you agree with the proposals, or NO if you disagree with the proposals. At the same time, the other player also has to approve or reject the proposals for the current period.

As aforementioned, if they approve, the computer implements the proposals. Otherwise, it imposes a uniform level of investment in activity A :

-

the minimum of proposals [under MIN DB]

-

the maximum of proposals [under MAX DB]

-

always 8 tokens [under NASH DB]

and the rest of the 10 tokens is invested in activity B. Then the computer will display the investments (tokens in activities A and B respectively) and the total earnings.

At the end of stage 2, the computer displays the final total earnings of each group member for that period. The next period can then start. Before each new period you will know your earnings for each of the previous periods. When the 10th period is over, the computer will summarize the amount of your total earnings for each of the 10 periods.

The exchange rate is 1 euro for 15 points. One of the 20 periods will be randomly chosen to be paid out for real.

1.6 Part 2 [Control treatment]

As in part 1, there are 10 periods in part 2 in which you will interact with the same persons as in part 1. You and the other player in your group must decide how much you will invest in activity A. The earnings in activity A and activity B are exactly the same as in part 1, so you will use the same “Table of total earnings” as in part 1.

You and the other player(s) make your investment decisions simultaneously. Once the investment decisions have been made, the computer calculates your total earnings, as well as the earnings of the other player in your group for the current period. It will show you how many tokens you invested in each of the two activities and your total earnings in points. The same information about the other player will also be displayed on your screen. The next period can then begin. Before each new period, you know your total earnings from each of the previous periods. When the 10th period is over, the computer will summarize the amount of your winnings for each of the 10 periods

The exchange rate is 1 euro for 15 points. One of the 20 periods is randomly drawn to be remunerated.

1.7 CPR properties

-

Linear public good

-

1.

Non-rivalry

-

2.

\(x_{j}<x_{i}\) \(\implies\) \(\pi _{i}(x_{i},x_{j})<\pi _{j}(x_{i},x_{j})\)

-

1.

-

CPR

-

1.

Rivalry

-

2.

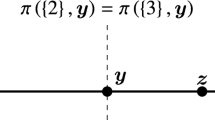

The comparison of payoffs depends on a threshold \({\overline{X}}=\frac{a-p}{b}\)

-

3.

\(x_{j}<x_{i}\) \(\implies\) \(\pi _{i}(x_{i},x_{j})>\pi _{j}(x_{i},x_{j})\) if only if \(X<{\overline{X}}\)

-

4.

\(x_{j}<x_{i}\) \(\implies\) \(\pi _{i}(x_{i},x_{j})<\pi _{j}(x_{i},x_{j})\) if only if \(X>{\overline{X}}\)

-

1.

Rights and permissions

About this article

Cite this article

Yao, K.S.W., Lavaine, E. & Willinger, M. Does the approval mechanism induce the efficient extraction in common pool resource games?. Soc Choice Welf 58, 111–139 (2022). https://doi.org/10.1007/s00355-021-01342-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-021-01342-x