1. Introduction

This is an anti-dumping case that should have never been, a subsidy case that never was. In between you have distortions – in certain circumstances even significant – that lack regulation. The importance of this case is therefore systemic in as much as it may highlight a gap in trade law.

As known, WTO laws permit any country to impose duties on any import which is determined as being dumped, that is when the export price is lower than the domestic price (the normal value) for the like product, and the dumped imports are causing material injury to the domestic industry. The Ukraine–Ammonium Nitrate Footnote 1 dispute is one the latest anti-dumping cases where the core issue was whether state distorted input prices could be taken into account to determine the normal value of the transaction or should rather be rejected in favour of a different, surrogate price.Footnote 2 To paraphrase in even clearer language, the big question was whether the WTO Anti-Dumping Agreement (ADA) could be used to address government subsidy distortions in the market, while the tool to do this is normally the WTO Agreement on Subsidies and Countervailing Measures (ASCM). The dispute also highlighted the difficulties in benchmarking and in interpreting and applying the law.

The practical flexibility between different trade remedies is well-known with concurrent anti-dumping and countervailing proceedings being often taken together, or a safeguard action often being replaced by antidumping/countervailing duties (Sykes, Reference Sykes2006). But the question raised by the Ukraine–Ammonium Nitrate case-law assumes a completely new meaning in the context of the current discussions about increasing state intervention and government-related distortions in the economy and mounting awareness that WTO subsidy and state enterprises disciplines are no longer fit for the job. The dilemmas that emerge from this dispute provide further food for thought for reformers about the goals and scope of traditional trade regulations.

The paper is organized as follows. Section 2 sets out the background to the dispute, describing the connections between natural gas and ammonium nitrate, Russia's price regulation of the domestic gas market, and the measures adopted by Ukraine to counter them in the anti-dumping proceedings under scrutiny in the case. Section 3 inquires into the rationales for countering dumping while Section 4 discusses to what extent, following this dispute, government distortions affecting the normal value can be taken into account in the ADA. Section 5 further investigates whether other methods could accurately determine the natural gas benchmark price and its implications for ammonium nitrate. Section 6 explores to what extent the distortions in the dispute could be addressed under the WTO ASCM. Section 7 concludes.

2. Background to the Dispute: Gas and Ammonium Nitrate, Regulating Prices, Correcting Distortions

In this section, we overview the natural gas market in Russia (Subsection 2.1) and its role in shaping the ammonium nitrate market (Subsection 2.2).

2.1 Russian Natural Gas

Russia has imposed regulations on the natural gas prices since the fall of the Soviet Union in 1991. At the time, the state-owned company Gazprom was producing around 95% of Russia's natural gas output. While the other commodity prices had been liberalized immediately after independence, Gazprom's prices had remained under strict state control. This implied a dual-pricing strategy, with Gazprom charging very low prices to its domestic industrial customers compared to the prices charged to its European customers, which were assumed to reflect the market forces.

During the first decade of the twenty-first century, a series of events impacted the evolution of natural gas prices in Russia leading to a consistent increase over time.Footnote 3 However, as depicted in Figure 1, an important gap has been maintained with respect to export prices to Europe corrected for transport costs, taxes, and import duties (i.e. export netback prices).Footnote 4

Figure 1. Industrial and export netback gas prices (1991–2010)

Note: The industrial and export netback gas prices are expressed in US dollars per thousand of cubic meters (US$/mcm)

Source: Henderson (Reference Henderson2011).

According to Spanjer (Reference Spanjer2007), for some time the customers of Russian natural gas from the Commonwealth of Independent States (CIS), including Ukraine, benefited from a preferential regime, paying lower prices compared to the ones imposed on European customers, but higher than the domestic prices. The logic behind Russia's pricing strategy for the CIS countries was to allow them to gradually pay their debts so as to ensure a smooth transition after the fall of the Soviet Union.

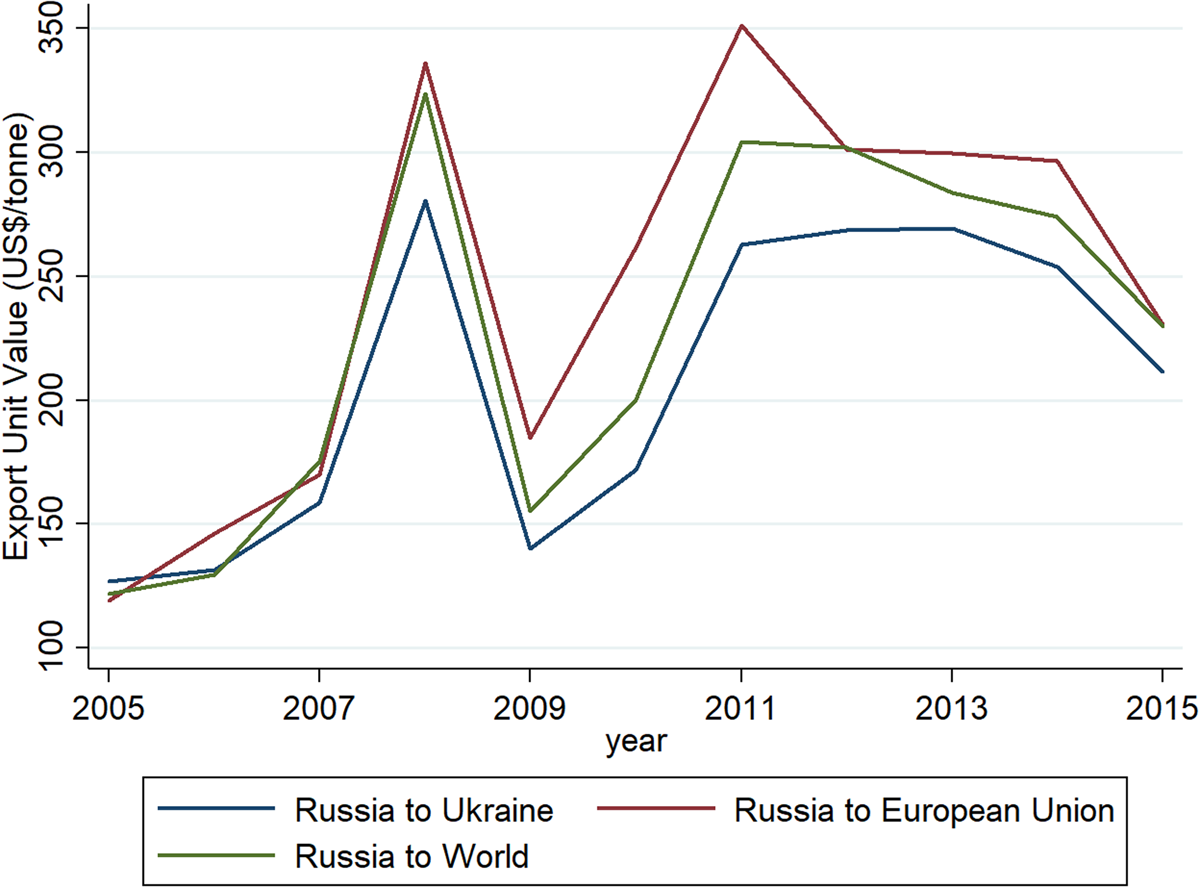

As a major consumer of Russian gas and the most important transit country for Russian gas towards Central and Western Europe, Ukraine was a central figure among the CIS countries.Footnote 5 Nevertheless, despite the fact that Ukraine benefited from low prices of natural gas, it still accumulated important debts to Russia and was also accused of capturing gas from the transit system (Balmaceda, Reference Balmaceda2009). This resulted in several disputes between Russia and Ukraine starting in the mid-2000s, which led to an important increase in natural gas prices charged by Russia to Ukraine.Footnote 6 As shown in Figure 2, until 2010 the average export prices for natural gas charged by Russia to Ukraine (proxied through export unit values) were below the ones charged to the world and the EU. As a direct consequence of the 2009 gas dispute, in 2010, these prices soared. Despite a significant decrease after 2010, they became comparable to the prices charged by Russia to the EU, both being higher than the prices faced by the world.

Figure 2. Evolution of Russian natural gas average export prices over 2005–2015

Source: Authors’ computation based on the BACI–CEPII database.

2.2 Ammonium Nitrate Market

The role of gas prices in shaping the ammonium nitrate prices is apparent from the manufacturing process of ammonium nitrate, which is produced through a reaction between ammonia and nitric acid (also derived from ammonia). Rough estimates show that natural gas costs amount to 70–85% of the ammonia production variable costs (Huang, Reference Huang2007; Vasileios et al., Reference Vasileios, Federico, Giacomo, Simonelli, Wijnand, Jacopo and Colantoni2014), representing, in turn, about 30–50% of ammonium nitrate costs (The US International Trade Commission, 1998).

All in all, the cost of natural gas is a major variable cost in the production of all nitrogen fertilizers, including ammonium nitrate (Al-Mahish, Reference Al-Mahish2017; EU Agricultural Markets Briefs, 2019). Therefore, a low price for domestic natural gas naturally involves a low cost of production of ammonium nitrate, which might be further translated into low prices for ammonium nitrate. Thus, by maintaining artificially low prices on the domestic market for the most important input in the production of ammonium nitrate, the Russian government provides an indirect financial benefit to domestic ammonium nitrate producers.

Figure 3 shows the imports of ammonium nitrate in Ukraine by origin. Russia is systematically the main foreign provider of ammonium nitrate in Ukraine, holding a share of over 70% of the Ukrainian ammonium nitrate import market in 2005–2014. The only significant exception can be observed in 2015, when Russia represents only 42% of the Ukrainian imports of ammonium nitrate.

Figure 3. Imports of ammonium nitrate in Ukraine by origin (2005–2015)

Source: Authors’ computation based on the BACI database (CEPII).

Moreover, as Figure 4 makes it particularly clear, Russia charges lower prices for ammonium nitrate to Ukraine, compared to the prices charged to the EU and the world.

Figure 4. Evolution of Russian ammonium nitrate average export prices over 2005–2015

Source: Authors’ computation based on the BACI–CEPII database.

In this context, Ukraine, as an important importer of Russian ammonium nitrate, argued that price controls on natural gas imposed by the Russian government led to low-priced imports of Russian ammonium nitrate in the Ukrainian territory, which was harmful for the domestic producers of ammonium nitrate. Therefore, following the results of an initial investigation, the Ukrainian authorities decided to impose anti-dumping duties on such imports in 2008. Following a judicial review of this decision before Ukrainian courts, an amendment to the 2008 original decision was made in 2010. Subsequently, Ukraine proceeded to an interim and expiry reviews of the original measures which resulted in the 2014 decision of continuing to impose anti-dumping measures at modified rates.Footnote 7

In the interim and expiry reviews, the Ukrainian authorities argued that the Russian domestic prices of natural gas, which, as seen, is an essential input in the production of ammonium nitrate, were highly distorted due to Russian government's price controls. As a consequence, so they argued, the costs in the records kept by the Russian producers and exporters were not reliable, because these did not reasonably reflect their true costs. They opted for constructing a new value based on the ‘cost of production in the country of origin, plus selling, general, and administrative expenses plus a reasonable amount for profits’ (Article 2.2. ADA). In constructing a new value, they replaced the domestic price of natural gas in the Russian Federation with the export price of natural gas at the German border, adjusted for transport expenses, which was considered to reflect the market conditions in 2012 (Germany being the biggest consumer of Russian natural gas).

3. Anti-Dumping Measures

The initial goal of anti-dumping measures was to protect domestic consumers from the predatory behaviour of their foreign counterparts (Viner, Reference Viner1923). As stated by Bown and McCulloch (Reference Bown and McCulloch2015), their goal was to ‘prevent losses of overall national well-being, rather than to prevent losses to import-competing producers although the latter would be an inevitable result of applying the law’. Nevertheless, it has been shown that, for the predatory behaviour to occur, several market conditions have to be met, which appears highly unlikely (Krishna, Reference Krishna1999; Bown and McCulloch, Reference Bown and McCulloch2015).

Since the late 1980s and with the creation of the WTO in 1995, there has been a global increase in the use of anti-dumping, as recognized by many economists (Prusa, Reference Prusa2001; Zanardi, Reference Zanardi2004; Bown, Reference Bown2006; Meng, Milner, and Song, Reference Meng, Milner and Song2016). Even though anti-dumping measures have been an instrument primarily used by developed countries, over recent years developing nations have become the most frequent new users. Considering this develpment, a large literature developed to address the economic aspects of anti-dumping measures, from the rationale behind their imposition to the economic effects. In what follows, we only focus on a few aspects. For a comprehensive review, see Blonigen and Prusa (Reference Blonigen, Prusa, Bagwell and Staiger2016).

The motivations behind the anti-dumping filings and the imposition of anti-dumping measures in developed and developing nations are both economic and political as demonstrated in the literature. Anti-dumping filings tend to occur in industries confronted with import competition (Blonigen and Bown, Reference Blonigen and Bown2003; Irwin, Reference Irwin2005; Mah and Kim, Reference Mah and Kim2006). Another important determinant of anti-dumping measures has been trade liberalization, more precisely tariff reduction, as demonstrated by Feinberg and Reynolds (Reference Feinberg and Reynolds2006), Bown and Tovar (Reference Bown and Tovar2011), and Moore and Zanardi (Reference Moore and Zanardi2011). In some particular contexts, anti-dumping measures have been used together with other temporary trade barriers as a response to domestic political pressures for import protection, allowing countries to maintain an overall liberal trade policy (Finger and Nogués, Reference Finger and Nogués2005). Anti-dumping measures have also been used to deal with macroeconomic shocks that can potentially jeopardize trade policy cooperation (Crowley, Reference Crowley2010; Bown and Crowley, Reference Bown and Crowley2013, Reference Bown and Crowley2014). To sum up, as also implied by Bown and Crowley (Reference Bown and Crowley2016), anti-dumping measures are more related to the characteristics of domestic industries using them rather than to unfair pricing by foreign suppliers.

Since the authorities enjoy significant discretion in the process of anti-dumping filings and determination of anti-dumping remedies, it comes as no surprise that anti-dumping has continued to be the most frequently used contingent trade policy instrument (Bown, Reference Bown and Evenett2010, Reference Bown2011). Nevertheless, this tool is increasingly used by emerging countries, with different economic and political structures, which operate in a different global context compared to the ones extensively analysed by the existing literature. Thus, as pointed out by Blonigen and Prusa (Reference Blonigen, Prusa, Bagwell and Staiger2016), additional evidence is required to describe the motivation for dumping, in order to better determine the impact of anti-dumping measures and their ultimate welfare effects.

At the same time, there is mounting evidence, going beyond the anecdotal, showing how, in practice, antidumping laws are very pliable and prone to capture with the result that the protectionist effect of antidumping should not be forgotten (see Palmeter, Reference Palmeter1989; Linsdey and Ikenson, Reference Linsdey and Ikenson2003; Ikenson, Reference Ikenson2020).

4. Distortions Don't Matter in the Anti-Dumping Agreement, Do They?

The Ukraine–Ammonium Nitrate dispute is one the latest anti-dumping cases – EU–Biodiesel (Argentina),Footnote 8 EU–Biodiesel (Indonesia) Footnote 9 – to deal with the question of whether the presence of government distorted input product prices should impinge the normal value and to request the identification of a surrogate price. The very latest iteration is the EU–Cost Adjustment Methodologies (a panel report was issued on 24 July 2020).Footnote 10

The scenario takes place when petitioner and/or the investigating authority deem that the product is not sold ‘in the ordinary course of trade in the domestic market’, and thus opt for constructing a ‘new normal value’ based on the ‘cost of production in the country of origin’ (second option provided for under Article 2.2). The key issue then becomes: where this basic indicator, i.e. the cost of production, should be found?

Article 2.2.1.1 of the ADA provides an answer, reading:

For the purposes of paragraph 2, costs shall normally be calculated on the basis of records kept by the exporter or producer under investigation, provided that such records are in accordance with the generally accepted accounting principles of the exporting country and reasonably reflect the costs associated with the production and sale f the product under consideration (emphasis added).

This provision thus says that the costs of production are normally calculated on the be basis of the recorded costs if the records kept follow a generally accepted accounting principle and if they reasonably reflect the costs of production and sale.

One key contention in the Ukraine–Ammonium Nitrate dispute (and in many of other disputes concerning distorted input prices) has focused on the requirement of Article 2.2.1.1 that to be reliable the reports need to ‘reasonably reflect the costs’. The argument has been made that this expression should be construed not only to require that the records ‘reasonably’ reflect the costs actually borne by the producers (irrespective of whether these are high, low, or distorted) but also that the recorded costs themselves should be ‘reasonable’ (and hence not too high, low, or distorted). Ammunition in support of this latter reading has been found in the Appellate Body's recognition in EU–Biodiesel (Argentina) that ‘non-arm's length transactions’ and ‘other practices’ may affect the reliability of the reported costs. While rejecting the idea that those (non-textually-written) criteria would represent an exception to what the explicit letter of Article 2.2.1.1 requires, and rejecting its application in the Ukraine–Ammonium Nitrate dispute, the Appellate Body has not drawn a clear line in the sand – concluding it is all, in the end, a matter to be assessed on a case-by-case basis and in the light of the available evidence.Footnote 11 However, on the basis of what criteria?

The more extensive interpretation – which would provide a critical gateway to take into account government distorted input prices/costs in the assessment of dumping – has never been accepted.Footnote 12 The consistent interpretation of the panels and the AB that the ADA does not allow to depart from the records if these reasonably reflect the costs actually borne by the producer is, perhaps narrow, but essentially correct. This is also what the Appellate Body held in this case. The reasonableness refers to how the records reflect the costs, not to the costs themselves.Footnote 13 Not only does this conclusion turn on the most natural interpretation of the language of the treaty but it is also sound for more important systemic reasons which focus on the answer to the question of what dumping and the remedy of anti-dumping are actually for, and on whether the type of distortions lamented over should really be addressed through anti-dumping investigations with all their known difficulties and opacities.

This is probably also the reason why litigation has surprisingly not focused too much on the adverb ‘normally’ (‘costs shall normally be calculated on the basis of records’) which would arguably offer another entry-point for disregarding recorded costs on the basis of the argument that the input market is heavily distorted and hence the costs are not ‘reasonable’. The lack of arguments on the point (and surely the reluctance of adjudicating bodies in embracing it) perhaps has a reason. It is the recognition that we have reached the limits of the ADA.

The bottom-line is that dumping has always been considered as an unfair private economic behaviour and anti-dumping as a reaction to this unfairness. Government distortions have never really entered the equation.Footnote 14 This is what a natural and systemic interpretation has confirmed us.Footnote 15 If appropriate, a remedy to these distortions should be found elsewhere. If there is a gap in the law, law reform should be considered.

5. The Natural Gas Surrogate Price and Its Implications for Ammonium Nitrate

In this section, we discuss whether the surrogate price chosen by Ukraine in the dumping determinations is correct and what could be the alternatives (Subsection 5.1) and analyze the implications of relying on a surrogate price for the ammonium nitrate market (Subsection 5.2). Our analysis is clearly theoretical, considering that the Appellate Body in the case rejected the need to find an alternative benchmark.

5.1 The Quest for a ‘Constructed Value’ of Natural Gas

The Appellate Body has thus closed the door to the possibility to revert to a surrogate price only because the recorded costs are distorted. Be that as it may, it is however useful to speculate on how one could construe an economically sound alternative cost.

As previously mentioned, in its dumping determinations, Ukraine relied on a constructed value of the cost of production of ammonium nitrate, rejecting the domestic prices of natural gas in Russia and using instead the gas prices charged by Russia to its German customers, corrected for transport expenses.Footnote 16 The panel and Appellate Body rejected this approach underlining that a simple adjustment for transport expenses may not be enough to indicate ‘the cost of production in the country of origin’. The Appellate Body made it crystal-clear that

[w]ith regard to the construction of normal value, the fact that ‘the cost of production’ is that ‘in the country of origin’ defines the parameters of that inquiry. This phrase indicates that whatever information or evidence is used to determine the ‘cost of production’, it must be apt to yield or capable of yielding a cost of production ‘in the country of origin’ (para. 6.83).Footnote 17

The first natural question that arises is whether the method for building a constructed value through an export price, adjusted for transport expenses is also appropriate from an economic perspective. More precisely, under which conditions the price of natural gas exported by Russia to Germany can be used as a benchmark for the Russian domestic price in the dumping determinations? The answer to this question largely depends on the influence that Russia might exert in the global market for natural gas. If Russia is a dominant player in this market, its domestic pricing policies with respect to natural gas, namely the dual pricing system, may not only influence the domestic prices but also the international prices. Over the 2005–2015 period, Russia is the world's first or second producer of natural gas after the United States, with a share ranging between 17.8 and 21.9% of the world output. Russia exports around a third of its total production, being also a top-three exporter of natural gas over the same period, with a share between 10.7 and 23.2% of the total export volume of natural gas. As a major producer and exporter of natural gas, Russia appears to be able to exert some market power over international prices through its dual pricing system. Indeed, maintaining low prices at home ensures an important level of demand of natural gas in the domestic market, which Gazprom is obliged to fulfil first. Under these circumstances, less gas is available for export and Russia, as a major supplier for Europe, can charge a high price in this market, as there is no ‘world price’ to confront. Therefore, claiming that the price of natural gas exported by Russia to Germany reflects the pure market conditions is not appropriate as it disregards Russia's influence in the world market of natural gas. Consequently, it cannot be correctly used as a benchmark for the natural gas price in Russia (i.e. the country of origin).

Nevertheless, other methods could be used to compute a benchmark price for the natural gas market in Russia in absence of dual pricing. For instance, as suggested by Crowley and Hillman (Reference Crowley and Hillman2018) in their analysis of the EU–Biodiesel (Argentina) case, whenever a country is a dominant player in the world market, an econometric analysis would be more appropriate than relying on international prices.Footnote 18 However, to conduct an accurate econometric analysis, allowing to estimate the local input prices in the absence of the dual pricing system, one would need information on the export supply elasticities facing Russia. Export supply elasticities measure the degree of responsiveness of the export supply with respect to a change in the export prices. Note that a perfectly elastic export supply implies that the domestic price in the absence of distortions would be the same as the world price.Footnote 19 Thus, under a perfectly elastic export supply curve, the German price could have been accurately used as a benchmark price in the dumping determinations. However, this situation is rather unrealistic. Moreover, when it comes to Russian gas, there is a wide range of estimates of export supply elasticities.Footnote 20 While most of the evidence points to a rather inelastic natural gas export supply curve facing Russia, the absence of more precise information highlights the difficulty of using the econometric method. Moreover, the econometric method leaves room for discretion, and could be ‘prone to misuse and abuse when in the wrong hands’, as stated by Ikenson (Reference Ikenson2020).

All in all, an inelastic export supply curve implies that the effects of the dual pricing system imposed by Russia are not fully absorbed by the domestic prices in Russia and also influence the world prices of natural gas. If the import demand curve is also inelastic, this implies that the consequences of low gas prices charged to the Russian industrial customers are not only borne by Gazprom, but also by the international customers.Footnote 21

5.2 Implications of Natural Gas Prices for the Ammonium Nitrate Market

While it is widely acknowledged that the dual pricing system for natural gas benefited the downstream producers in Russia, including the ones producing ammonium nitrate, the first question that arises is by how much their costs have been reduced and whether and to what extent this cost reduction has been translated into lower prices for ammonium nitrate.

According to a report published by the European Commission in October 2020,Footnote 22 ‘due to the gas price difference [between Russia and Europe], the direct costs of Russian ammonia per ton are 2–3 times lower than in Europe. Therefore, the profitability of the chemical industry in Russia is mainly achieved by contractual domestic prices of natural gas that are significantly lower than world prices.’ While these figures only refer to Europe, they can give a broad idea of the order of magnitude.

Moreover, focusing on the period after the initial imposition of anti-dumping duties by Ukraine, we notice that the evolution of the average export prices of ammonium nitrate follows closely the evolution of the average domestic prices of natural gas.Footnote 23 The average export price of Russian ammonium nitrate increased from 155.2 US$/ton in 2009 to 304.1 US$/ton in 2011. It has been more or less stable until 2013 and then systematically decreased, reaching a value of 229.5 US$/ton in 2015 (see Figure 4). At the same time, the domestic prices for natural gas have substantially decreased after 2013 (see Footnote 5). This suggests that, indeed, the Russian producers of ammonium nitrate translate any variation of natural gas prices in the prices of ammonium nitrate.

The second question that arises is whether the Ukrainian producers of ammonium nitrate have been placed at a disadvantage compared to their Russian counterparts, precisely because of the dual pricing strategy for natural gas imposed by Russia. As mentioned in Subsection 2.1, starting with 2010, Ukraine has no longer enjoyed a preferential pricing regime for the imports of natural gas originating from Russia. Thus, Ukrainian producers of ammonium nitrate have had to face international prices for the imports of Russian natural gas. Moreover, these international prices for the Russian natural gas were particularly high because of Russia's dual pricing policy, as shown in Subsection 5.1. The dual pricing strategy of Russia regarding natural gas has thus conferred a financial benefit to the Russian producers of ammonium nitrate, similar to an export subsidy, giving them a competitive edge with respect to their Ukrainian counterparts.

On a side note, the prices of ammonium nitrate are shaped by both natural gas prices and the demand for agricultural products. The sharp increase in gas prices faced by Ukraine combined with the low demand for ammonium nitrate in the context of the 2008 crisis seriously affected the ammonium nitrate producers, as suggested by Pirani (Reference Pirani2011). The Russian ammonium nitrate producers have been less severely affected than the Ukrainian ones by the 2008 crisis. While the gas prices have also risen to some extent for the Russian industrial consumers, the increase in their costs was offset by higher revenues generated by the increase in world prices for ammonium nitrate due to an increase in the demand (and higher prices) for agricultural products in the aftermath of the crisis. Thus, since Russia and Ukraine are both important producers of ammonium nitrate in the world market (see Figure 5) and given the global context, the Ukrainian producers appear to have a serious disadvantage compared to their Russian counterparts.

Figure 5. Evolution of share in world exports over 2005–2015 Source: Authors’ computation based on the BACI dataset.

6. Distortions do Matter in the Subsidy Agreement, Don't They?

One of the themes of this paper is that – leaving aside the practical reasons explained below – the ADA was not the tool Ukraine should have used to tackle the distortions caused by Russia. If the disparities in price between Russian and other ammonium nitrate products depends on the government-induced distorted pricing of a key variable cost, the natural route to address government distortions in the economy in the form of financial support is the ASCM.

We have seen already that, from an economic point of view, government-directed dual pricing of inputs may well be construed as a subsidy to downstream producers. Why, then, did the Ukrainian authority not follow directly the subsidy route alternative? Strategically, this may well depend of the fact that the ADA is a far more pliable tool, but also on the fact that the ASCM's legal requirements are more difficult to satisfy. Let's now briefly test the dual-pricing system of our case against the ASCM rules. The snapshot is that, although certain requirements may be more easily met, the overall picture is one of uncertainy. A subsidy claim against dual-pricing would find various obstacles and cannot guarantee success.

Let's start from the task of defining dual-pricing itself as a ‘subsidy’. According to Article 1 ASCM, a subsidy is constituted of both a financial contribution (or any form of income or price support) and a benefit. Leaving aside the possibility that it is the Russian state itself that will provide gas (intended as a ‘good’),Footnote 24 either directly or through the demanding notion of ‘public body’ (via, for example, Gazprom),Footnote 25 the direct price control of natural gas should easily satisfy the requirements of ‘entrustment’ or ‘direction’ of item (iv) of Article 1.1(a)(1) ASCM. Most importantly, the direct public provision of gas has been common for many decades in many jurisdictions and is thus likely to satisfy the admittedly ambiguous language of the two final provisos of letter (i).Footnote 26 Even the benefit assessment may be positive, on the basis of the simple premise that the goal itself of the price control is to keep the domestic price below what it would otherwise be if market forces prevailed (this was the no-nonsense approach put forward by the dissenting panel list in the Canada–Renewable Energy/Canada–Feed-In Tariff Program). Considering the fact that the cost of natural gas is a major variable cost in the production of ammonium nitrate, the benefit to the downstream ammonium nitrate producers would thus be evident. However, a more exact test, requiring the identification of a specific market price benchmark against which the domestic price of natural gas should be compared (this is the Appellate Body's view in Canada–Renewable Energy/FIT) might be less promising. Energy markets are complex and, as section 5 shows, it may be difficult to identify a precise market price. Hence, while a little bit of labouring may be needed, it cannot be excluded that dual-pricing could be defined as a subsidy under Article 1 ASCM.

This is not the end of the story though, but just the beginning. The subsidy needs then to be specific to certain enterprises or industries and should cause adverse effects as explained in Article 6.3 ASCM (which does also include an injury test like that followed in anti-dumping cases). The need to prove the specificity of natural gas dual-pricing is a very testing ground in our case. A subsidy to all users/consumers of natural gas is indeed generally and broadly available throughout the economy and society. Despite the expansive nature of the specificity test and the uncertainty of where to draw the line between general measures and specific subsidies, it looks clear that dual pricing of natural gas would qualify as a general measure. There have been generous interpretations of specificity with respect to natural resources, even concluding that timber, which could be used by about 23 separate industries producing over 200 separate products, is nonetheless specific.Footnote 27 But the truly general and ubiquitous use of natural gas seems not comparable to the still wide usage of timber. A specificity claim is difficult to substantiate.

In conclusion, the lack of specificity would bar any possibility to impose countervailing duties or to render the subsidy actionable in multilateral dispute settlement. There is an alternative route though, one which would spare the proof of specificity, and would rely on the fact that the subsidy is in fact contingent on export performance (Article 3.1(b) ASCM). The idea would be that, when Russian ammonium producers export to Ukraine, they benefit from the lower price of a key input vis-à-vis their competitors. Legally, if the measure is an export subsidy, specificity and harm would be presumed and the subsidy would be immediately prohibited.

To be such, an export subsidy must be ‘geared’ towards exportation. The test of de facto export contingency is met ‘when the subsidy is granted so as to provide an incentive to the recipient to export in a way that is not simply reflective of the conditions of supply and demand in the domestic and export markets undistorted by the granting of the subsidy’ (Appellate Body, EC–Large Civil Aircraft, para. 1102). In other words, the subsidy must be found to incentivize producers towards exporting rather than selling in the domestic market. The counterfactual is that, without the subsidy, they would not export as much as they do (Mavroidis, Reference Mavroidis2016, p. 272).

While normally this test is quite complex, the examination of few data comparing total exports and domestic production seems sufficient to reject the hypothesis in this case.

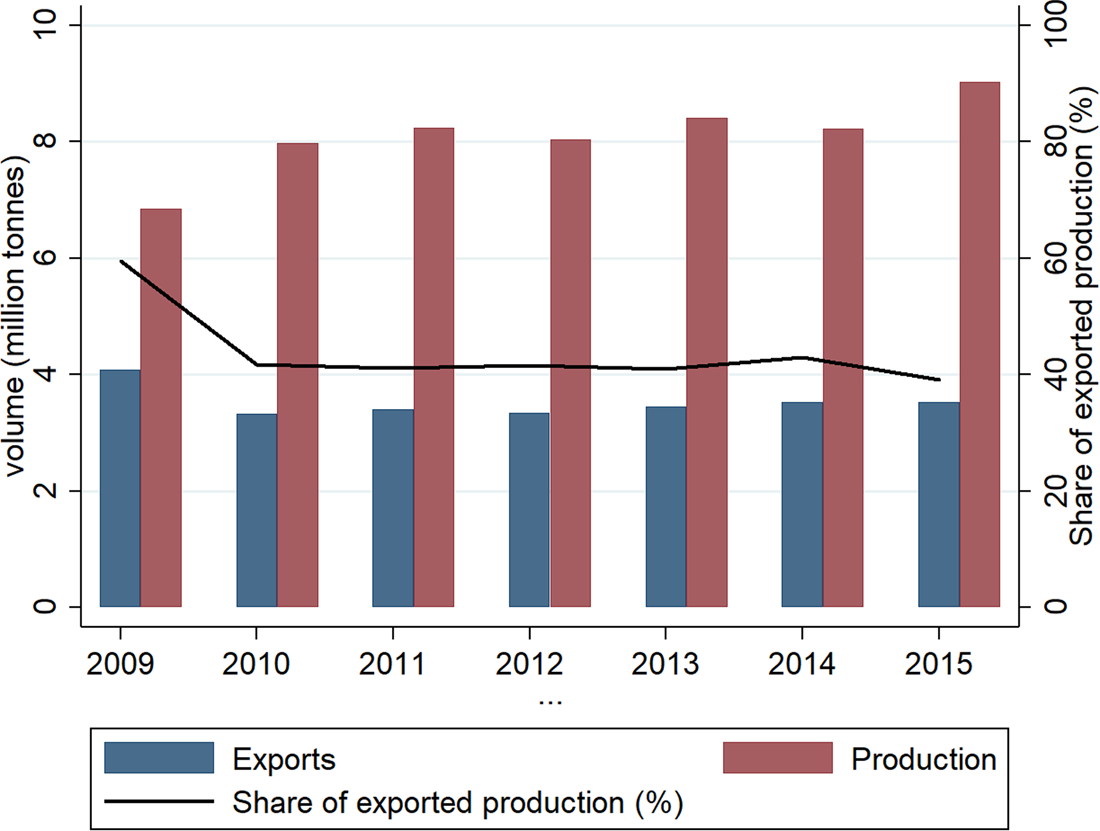

Figure 6 shows the share of exports of ammonium nitrate in the total Russian production for 2009–2015 (no data available before 2009). What can be noted is a sharp decrease in the exported production of ammonium nitrate from 2009 to 2010 (from 59.5% to 41.8%, amounting to an almost 50% drop). The share of exported production then remains stable during the next five-year period with minor variations upwards (43%) and downwards (39.1%) in 2014 and 2015 respectively. The sharp decline in the exported production of Russian ammonium nitrate observed between 2009 and 2010 is not only due to an increase in total production, but also to a drop in total exports of ammonium nitrate. No significant variations in the exports or the production of ammonium nitrate were noticed in Russia after 2010.

Figure 6. Evolution of Russia's share of exports of ammonium nitrate in relation to total production Source: Authors’ computation based on FAO data.

In the absence of other information, we can only speculate whether one of the causes of the sharp 2009–2010 drop in the exported production of ammonium nitrate could be the shock effect of the initial imposition of Ukrainian anti-dumping duties (levied on the basis of the 2008 decision).Footnote 28

Since the world exports of ammonium nitrate have increased between 2009 and 2010, allowing to reject the idea of a decrease in the world demand of ammonium nitrate as a potential cause for the drop in the exported production of Russian ammonium nitrate, the anti-dumping duties imposed by Ukraine could be a pertinent explanation. However, from 2011 onwards, the world exports of ammonium nitrate started to decrease, partly explaining the fact that the exported production of Russian ammonium nitrate has not resumed to its 2009 level. From Figures 5 and 6, it is apparent that Russia's relative share in the world exports increased after 2011, despite its exported quantity being constant, precisely because of a decrease in the world exports of ammonium nitrate.

To sum up, what we cannot possibly infer from the figure and the data at our disposal is any incentive effect of the subsidy towards exports since the export/total production ratio remained essentially stable after 2010.Footnote 29 In general, the nature of the incentive-based test for proving de facto export contingency, with its significant requirement of for data and counterfactual analysis, further shows the difficulty of following the subsidy claim route, and indirectly confirms why the ADA – with all its flexibilities and ambiguities – has been the preferred route in this case.

The important policy conclusion, however, is that we are left with a scenario where we arguably have government-created financial distortions, perhaps even serious, which cannot be addressed either through the disciplines specifically created for government subsidies.

7. Conclusion: ‘Where have all the Distortions Gone?’

This case represents another (failed) attempt to broaden the scope of the notion of dumping and of the ADA, which – we believe – is not desirable (see Palmeter, Reference Palmeter1989). Dumping and the ADA naturally regulate private pricing behaviour, and not government distortions – far less subsidies – that may have an impact on pricing of inputs and end products. There is, or there should be, another specific legal route to deal with this type of distortion. The main rationale for this argument is a systemic one. Each tool should do its job in the WTO legal system. But, more profoundly, the issue boils down to the fact that dumping is by and large a legitimate conduct and anti-dumping remedies notoriously operate as protectionist tools. To make things worse, the ADA offers several opportunities for discretionary – if not even arbitrary – interpretations that eventually result in the imposition of unjustified barriers to trade. See Linsdey and Ikenson (Reference Linsdey and Ikenson2003) and Ikenson (Reference Ikenson2020).

That being said, and assuming that dual pricing can indeed cause undue distortions to international trade, the question is what is the best tool do deal with them. Since dual pricing can be essentially construed as a subsidy, the natural answer would be that it is the specific disciplines for subsidies that should cover it and be able to regulate it. We have seen that, under the current disciplines, this may not be that easy. There are several, and strict, legal requirements to satisfy and they do not often and easily fit the facts (while they should). Given the current law reform discourse, one could think about amending the law so that proper incentives are created for complainants of subsidies to follow the natural path. Changes could be made at various levels, from clarification to the benefit and specificity requirements, up to the test for export subsidies or, as was proposed by the EU in the Doha Round, by creating a new category of prohibited subsidies in the ASCM.Footnote 30 Not that far in the past, some were even suggesting the creation of a sectorial energy agreement specifically devoted to tackling the various issues created by trade in the energy sector.Footnote 31

In a sense, for Russian Federation has in principle already accepted various ‘WTO+’ commitments, also on energy and dual pricing, when it acceded the WTO way back in 2012.

If one looks at the Working Party,Footnote 32 though, the extent of the obligations on dual pricing are not clear at all.Footnote 33 The language does not seem to really prohibit price controls and above all dual pricing.Footnote 34 The Russian Federation confirmed that, while upon accession, producers/distributors of natural gas in the Russian Federation would operate, within the relevant regulatory framework, on the basis of normal commercial considerations, based on recovery of costs and profit;Footnote 35 and the ‘Government would continue to regulate price supplies to households and other non-commercial users, based on considerations of domestic social policy,Footnote 36 from the date of accession, the ‘Russian Federation would apply price controls on produces and services’ contained in certain tables (which include natural gas)Footnote 37 ‘and any similar measures that would be introduced or re-introduced in the future, in a manner consistent with the WTO Agreement’;Footnote 38 ‘Price control measures would not be used for purposes of affording protection to domestic production of goods, or to impair the service commitments of the Russian Federation’.Footnote 39

While the distortions caused by dual-pricing are certainly not gone, the regulatory framework is still not fit to address them.