Abstract

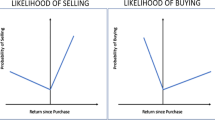

This study is a detailed analysis of Speculation Game, a simple agent-based model of financial markets, in which the round-trip trading and the dynamic wealth evolution with variable trading volumes are implemented. Instead of herding behavior, the authors find that the heterogeneous holding periods in round-trip trades can contribute to the emergence of volatility clustering. In particular, the spontaneous redistribution of market wealth through repetitions of round-trip trades with non-uniform horizons can widen the wealth disparity and establish the Pareto distribution of the capital size. As a result, the intermittent placements of relatively big orders from endogenously emerged rich traders can bring on large fluctuations in price return. Empirical data are used to support the scenario derived from the model.

Similar content being viewed by others

References

Cont R, Empirical properties of asset returns: Stylized facts and statistical issues, Quantitative Finance, 2001, 1: 223–236.

Mantegna R N and Stanley H E, Introduction to Econophysics: Correlations and Complexity in Finance, Cambridge University Press, Cambridge, 1999.

Rydberg T H, Realistic statistical modelling of financial data, International Statistical Review, 2000, 68(3): 233–258.

Zumbach G, The riskmetrics 2006 methodology, Risk Metrics Group, Available at SSRN 1420185, 2007.

Lux T and Marchesi M, Scaling and criticality in a stochastic multi-agent model of a financial market, Nature, 1999, 397(6719): 74–75.

Mandelbrot B B, The Fractal Geometry of Nature, vol. 1, WH Freeman, New York, 1982.

Bollerslev T, Generalized autoregressive conditional heteroskedasticity, Journal of Econometrics, 1986, 31(3): 307–327.

Cont R and Bouchaud J P, Herd behavior and aggregate fluctuations in financial markets, Macroeconomic Dynamics, 2000, 4(2): 170–196.

Stauffer D and Penna T, Crossover in the cont-bouchaud percolation model for market fluctuations, Physica A: Statistical Mechanics and Its Applications, 1998, 256(1–2): 284–290.

Sornette D and Zhou W X, Importance of positive feedbacks and overconfidence in a self-fulfilling ising model of financial markets, Physica A: Statistical Mechanics and Its Applications, 2006, 370(2): 704–726.

Zhou W X and Sornette D, Self-organizing ising model of financial markets, The European Physical Journal B, 2007, 55(2): 175–181.

Kaizoji T, Bornholdt S, and Fujiwara Y, Dynamics of price and trading volume in a spin model of stock markets with heterogeneous agents, Physica A: Statistical Mechanics and Its Applications, 2002, 316(1): 441–452.

Sornette D, Physics and financial economics (1776–2014): Puzzles, ising and agent-based models, Reports on Progress in Physics, 2014, 77(6): 062001.

Sznajd-Weron K and Weron R, A simple model of price formation, International Journal of Modern Physics C, 2002, 13(1): 115–123.

Challet D, Marsili M, and Zhang Y C, Stylized facts of financial markets and market crashes in minority games, Physica A: Statistical Mechanics and Its Applications, 2001, 294(3): 514–524.

Challet D, Marsili M, and Zhang Y C, Minority games and stylized facts, Physica A: Statistical Mechanics and Its Applications, 2001, 299(1–2): 228–233.

Bouchaud J P, Giardina I, and Mézard M, On a universal mechanism for long-range volatility correlations, Quantitative Finance, 2001, 1(2): 212–216.

Challet D and Marsili M, Criticality and market efficiency in a simple realistic model of the stock market, Physical Review E, 2003, 68(3): 036132.

Manuca R, Li Y, Riolo R, et al., The structure of adaptive competition in minority games, Physica A: Statistical Mechanics and Its Applications, 2000, 282(3): 559–608.

Slanina F, Essentials of Econophysics Modelling, OUP Oxford, 2013.

Maslov S, Simple model of a limit order-driven market, Physica A: Statistical Mechanics and Its Applications, 2000, 278(3–4): 571–578.

Andersen T G and Bollerslev T, Heterogeneous information arrivals and return volatility dynamics: Uncovering the long-run in high frequency returns, The Journal of Finance, 1997, 52(3): 975–1005.

Gaunersdorfer A and Hommes C, A nonlinear structural model for volatility clustering, Long Memory in Economics, Springer, 2007, 265–288.

Andersen J V and Sornette D, The $-game, The European Physical Journal B-Condensed Matter and Complex Systems, 2003, 31(1): 141–145.

Ferreira F F and Marsili M, Real payoffs and virtual trading in agent based market models, Physica A: Statistical Mechanics and Its Applications, 2005, 345(3): 657–675.

Challet D, Inter-pattern speculation: Beyond minority, majority and $-games, Journal of Economic Dynamics and Control, 2008, 32(1): 85–100.

Jefferies P, Hart M, Hui P, et al., From market games to real-world markets, The European Physical Journal B-Condensed Matter and Complex Systems, 2001, 20(4): 493–501.

Challet D, Chessa A, Marsili M, et al., From minority games to real markets, Quantitative Finance, 2001, 1: 168–176.

Galla T and Zhang Y C, Minority games, evolving capitals and replicator dynamics, Journal of Statistical Mechanics: Theory and Experiment, 2009, 2009(11): P11012.

Patzelt F and Pawelzik K, An inherent instability of efficient markets, Scientific Reports, 2013, 3: 2784–2788.

Katahira K, Chen Y, Hashimoto G, et al., Development of an agent-based speculation game for higher reproducibility of financial stylized facts, Physica A: Statistical Mechanics and Its Applications, 2019, 524: 503–518.

Challet D and Zhang Y C, Emergence of cooperation and organization in an evolutionary game, Physica A: Statistical Mechanics and Its Applications, 1997, 246(3): 407–418.

Challet D, Marsili M, and Zhang Y, Minority Games, Oxford finance, Oxford University Press, Oxford, 2005.

Katahira K and Akiyama E, Minority game in a heterogeneous population with periodic participations, Journal of Information Processing Society of Japan, 2017, 58(1): 269–277 (in Japanese).

Persky J, Retrospectives: Pareto’s law, Journal of Economic Perspectives, 1992, 6(2): 181–192.

Gillespie C S, Fitting heavy tailed distributions: The poweRlaw package, Journal of Statistical Software, 2015, 64(2): 1–16.

Clauset A, Shalizi C R, and Newman M E, Power-law distributions in empirical data, SIAM Review, 2009, 51(4): 661–703.

Watson T, The World’s 500 Largest Asset Managers, Wills Towers, New York, 2018.

Vuong Q H, Likelihood ratio tests for model selection and non-nested hypotheses, Econometrica: Journal of the Econometric Society, 1989, 57(2): 307–333.

Watson T, The World’s 500 Largest Asset Managers, Wills Towers, New York, 2012.

Watson T, The World’s 500 Largest Asset Managers, Wills Towers, New York, 2016.

Watson T, The World’s 500 Largest Asset Managers, Wills Towers, New York, 2017.

Plerou V and Stanley H E, Reply to comment on tests of scaling and universality of the distributions of trade size and share volume: Evidence from three distinct markets, Physical Review E, 2009, 79(6): 068102.

Roberge M W, Flaherty J C J, Almeida R M J, et al., Lengthening the investment time horizon, Massachusetts Financial Services, 2014.

Cavagna A, Irrelevance of memory in the minority game, Physical Review E, 1999, 59(4): R3783.

Takayasu H, Fractals in Physical Science, Manchester University, Manchester, 1990.

Dorfman R, A formula for the gini coefficient, The Review of Economics and Statistics, 1979, 61(1): 146–149.

Acknowledgements

We sincerely thank Dr. Akiyama for his valuable comments to improve the quality of our paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by JSPS KAKENHI under Grant Nos. JP17J09156 and JP20J00107.

This paper was recommended for publication by Editor CAO Zhigang.

Rights and permissions

About this article

Cite this article

Katahira, K., Chen, Y. Heterogeneous Round-Trip Trading and the Emergence of Volatility Clustering in Speculation Game. J Syst Sci Complex 35, 221–244 (2022). https://doi.org/10.1007/s11424-021-0147-8

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-021-0147-8