Abstract

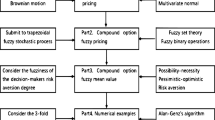

Liu process is a basic process in fuzzy environment. As an extension of Liu process, fractional Liu process has attracted the attention of many scholars. In this paper, a fuzzy stock model driven by fractional Liu process is established, and its European, American, Asian, power options pricing formulas are given. In order to better understand these formulas, we give a few numerical examples to illustrate the changes of European option price with different parameters when time is fixed. However, these examples are not based on real-life data since the lack of parameter estimation method for fuzzy differential equation driven by Liu process. Then the changes of American option price are given when time and parameters are both changed. At the same time, we study the parameter interval where the option price fluctuates greatly. Finally, the fuzzy stock model is extended to the generalized case, and the stock price is given.

Similar content being viewed by others

References

Appadoo S, Thavaneswaran A (2013) Recent developments in fuzzy sets approach in option pricing. J Math Finance 3:312–322

Bo L, You C (2020) Fuzzy interest rate term structure equation. Int J Fuzzy Syst 22(3):999–1006

Chen X, Qin Z (2011) A new existence and uniqueness theorem for fuzzy differential equation. Int J Fuzzy Syst 13(2):148–151

Cheridito P (2003) Arbitrage in fractional Brownian motion models. Finance Stoch 7(4):533–553

Gao X, Chen X (2008) Option pricing formula for generalized stock models. http://orsc.edu.cn/process/080317.pdf

Gao J, Gao X (2008) A new stock model for credibilistic option pricing. J Uncertain Syst 2(4):243–247

Hu H (2013) Power option pricing model for stock price follow geometric fractional Liu process. J Henan Normal Univ (Nat Sci Ed) 41(2):1–5

Lee C, Tzeng G, Wang S (2005) A new application of fuzzy set theory to the Black–Schloes option pricing model. Expert Syst Appl 29:330–342

Li H, Ware A, Di L, Yuan G, Swishchuk A, Yuan S (2018) The application of nonlinear fuzzy parameters PDE method in pricing and hedging European options. Fuzzy Sets Syst 331:14–25

Liu B (2007) Uncertainty theory, 2nd edn. Springer, Berlin

Liu B (2008) Fuzzy process, hybrid process and uncertain process. J Uncertain Syst 2(1):3–16

Liu B, Liu YK (2002) Expected value of fuzzy variable and fuzzy expected value models. IEEE Trans Fuzzy Syst 10(4):445–450

Mandelbrot B, Van Ness J (1968) Fractional Brownian motions, fractional noises and applications. SIAM Rev 10(4):422–437

Namdari M, Yoon JH, Abadi A, Taheri SM, Choi SH (2015) Fuzzy logistic regression with least absolute deviations estimators. Soft Comput 19:909–917

Nowak P, Romaniuk M (2014) Application of Levy processes and Esscher transformed martingale measures for option pricing in fuzzy framework. J Comput Appl Math 263:129–151

Peng J (2008) A general stock model for fuzzy markets. J Uncertain Syst 2(4):248–254

Peters E (1989) Fractal structure in the capital markets. Financ Anal J 45(4):32–37

Pourahmada S, Ayatollahi SMT, Taheri SM, Agahi ZH (2011) Fuzzy logistic regression based on the least squares approach with application in clinical studies. Comput Math Appl 62:3353–3365

Qin Z, Gao X (2009) Fractional Liu process with application to finance. Math Comput Model 50(9–10):1538–1543

Qin Z, Li X (2008) Option pricing formula for fuzzy financial market. J Uncertain Syst 2(1):17–21

You C, Bo L (2020) Option pricing formula for generalized fuzzy stock model. J Ind Manag Optim 16(1):387–396

You C, Hao Y (2018a) Fuzzy Euler approximation and its local convergence. J Comput Appl Math 343:55–61

You C, Hao Y (2018b) Numerical solution of fuzzy differential equation based on Taylor expansion. J Hebei Univ (Nat Sci) 38(2):113–118

You C, Hao Y (2019) Stability in mean for fuzzy differential equation. J Ind Manag Optim 15(3):1375–1385

You C, Wang W, Huo H (2013) Existence and uniqueness theorems for fuzzy differential equations. J Uncertain Syst 7(4):303–315

You C, Ma H, Huo H (2016) A new kind of generalized fuzzy integrals. J Nonlinear Sci Appl 3(9):1396–1402

Zadeh L (1965) Fuzzy sets. Inf Control 8(3):338–353

Zadeh L (1978) Fuzzy sets as a basis for a theory of possibility. Fuzzy Sets Syst 1:3–28

Zhang H, Watada J (2018) A European call options pricing model using the infinite pure jump Levy process in a fuzzy environment. IEEJ Trans Electr Electron Eng 13(10):1468–1482

Zhang Y, You C (2018) Option pricing formula for a new stock model. J Appl Math Prog 7(10):1225–1232

Zhang W G, Li Z, Liu YJ, Zhang Y (2020) Pricing European option under fuzzy mixed fractional Brownian motion model with jumps. Comput Econ. https://doi.org/10.1007/s10614-020-10043-z

Zhu Y (2010) Stability analysis of fuzzy linear differential equations. Fuzzy Optim Decis Making 9(2):169–186

Acknowledgements

This work was supported by Natural Science Foundation of China Grant No.61773150, the Key Research Foundation of Education Bureau of Hebei province No. ZD2020172 and the Youth Research Foundation of Education Bureau of Hebei province No. QN2020124.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Table 5 shows the prices of European call option with different parameters.

In order to study the value of the parameter \(\alpha \) when the option prices increase sharply, we obtain Table 6.

Table 6 shows that if \(\alpha \in \) (0.67, 0.68), the option prices increase sharply. That is to say, in reality, it may be better to choose \(\alpha \in \) [0.68, 1], since in which the option prices remain constant. To obtain more precise parameter interval, one can make analysis on \(\alpha \in \) (0.67, 0.68) in the same way above.

Table 7 shows the prices of European put option with different parameters.

We do the same work to find the interval where the option prices increase sharply, see Table 8.

Table 8 shows that if \(\alpha \in \) (0.67, 0.68), the option prices increase significantly.

To obtain the exact interval where the change located, we used four tables to study the change situation of American call option prices (Tables 9 and 10), American put option prices (Tables 11 and 12).

Rights and permissions

About this article

Cite this article

You, C., Bo, L. Option pricing based on a type of fuzzy process. J Ambient Intell Human Comput 13, 3771–3785 (2022). https://doi.org/10.1007/s12652-021-03334-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12652-021-03334-2