Abstract

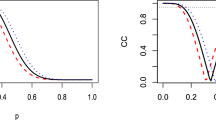

This paper axiomatizes static and dynamic quantile preferences. Static quantile preferences specify that a prospect should be preferred if it has a higher \(\tau \)-quantile, for some \(\tau \in (0,1)\), while its dynamic counterpart extends this to take into account a sequence of decisions and information disclosure. An important motivation for the axiomatization that leads to this preference is the separation of tastes and beliefs. We first axiomatize quantile preferences for the static case with finite state space and then extend the axioms to the dynamic context. The dynamic preferences induce an additively separable quantile model with standard discounting, that is, the recursive equation is characterized by the sum of the current period utility function and the discounted value of the certainty equivalent, which is a quantile function. These preferences are time consistent and have a simple quantile recursive representation, which gives the model the analytical tractability needed in several fields in financial and economic applications. Finally, we study the notion of risk attitude in both the static and recursive quantile models. In quantile models, the risk attitude is completely captured by the quantile \(\tau \), a single-dimensional parameter. This is simpler than in expected utility models, where in general the risk attitude is determined by a function.

Similar content being viewed by others

References

Anscombe, F.J., Aumann, R.J.: A definition of subjective probability. Ann. Math. Stat. 34, 199–205 (1963)

Artzner, P., Delbaen, F., Eber, J.-M., Heath, D.: Coherent measures of risk. Math. Finance 9, 203–228 (1999)

Bhattacharya, D.: Inferring optimal peer assignment from experimental data. J. Am. Stat. Assoc. 104, 486–500 (2009)

Bommier, A., Kochov, A., Le Grand, F.: On monotone recursive preferences. Econometrica 85, 1433–1466 (2017)

Chambers, C.P.: Quantiles and Medians, Social Science Working Paper, 1222. California Institute of Technology, Pasadena, CA (2005)

Chambers, C.P.: Ordinal aggregation and quantiles. J. Econ. Theory 137, 416–431 (2007)

Chambers, C.P.: An axiomatization of quantiles on the domain of distribution functions. Math. Finance 19, 335–342 (2009)

Chew, S.H., Epstein, L.G.: Nonexpected utility preferences in a temporal framework with an application to consumption-savings behaviour. J. Econ. Theory 50, 54–81 (1990)

de Castro, L., Galvao, A.F.: Dynamic quantile models of rational behavior. Econometrica 87, 1893–1939 (2019)

de Castro, L., Galvao, A.F., Montes-Rojas, G., Olmo, J.: Portfolio selection in quantile utility models (2019). https://ssrn.com/abstract=3494601

de Castro, L., Galvao, A.F., Noussair, C.N., Qiao, L.: Do people maximize quantiles? (2020). https://ssrn.com/abstract=3607612

Debreu, G.: Continuity properties of Paretian utility. Int. Econ. Rev. 5, 285–293 (1964)

Epstein, L., Schneider, M.: IID: independently and indistinguishably distributed. J. Econ. Theory 113, 32–50 (2003a)

Epstein, L., Schneider, M.: Recursive multiple-priors. J. Econ. Theory 113, 1–31 (2003b)

Epstein, L.G.: A definition of uncertainty aversion. Rev. Econ. Stud. 66, 579–608 (1999)

Epstein, L.G., Zin, S.E.: Substitution, risk aversion, and the temporal behavior of consumption and asset returns: a theoretical framework. Econometrica 57, 937–969 (1989)

Fishburn, P.C.: Interval models for comparative probability on finite sets. J. Math. Psychol. 30, 221–242 (1986)

Ghirardato, P., Maccheroni, F., Marinacci, M.: Certainty independence and the separation of utility and beliefs. J. Econ. Theory 120, 129–136 (2005)

Gilboa, I., Schmeidler, D.: Maxmin expected utility with a non-unique prior. J. Math. Econ. 18, 141–153 (1989)

Gilboa, I., Maccheroni, F., Marinacci, M., Schmeidler, D.: Objective and subjective rationality in a multiple prior model. Econometrica 78, 755–770 (2010)

Giovannetti, B.C.: Asset pricing under quantile utility maximization. Rev. Financial Econ. 22, 169–179 (2013)

Kochov, A.: Time and no lotteries: an axiomatization of maxmin expected utility. Econometrica 82, 239–262 (2015)

Koopmans, T.C.: Stationary ordinal utility and impatience. Econometrica 28, 287–309 (1960)

Koopmans, T.C.: Representation of preference orderings over time. In: McGuire, C., Radner, R. (eds.) Decision and Organization, pp. 79–100. North-Holland, Amsterdam (1972)

Maccheroni, F., Marinacci, M., Rustichini, A.: Ambiguity aversion, robustness, and the variational representation of preferences. Econometrica 74, 1447–1498 (2006a)

Maccheroni, F., Marinacci, M., Rustichini, A.: Dynamic variational preferences. J. Econ. Theory 128, 4–44 (2006b)

Manski, C.: Ordinal utility models of decision making under uncertainty. Theory Decis. 25, 79–104 (1988)

Mendelson, H.: Quantile-preserving spread. J. Econ. Theory 42, 334–351 (1987)

Rockafellar, R.T.: Convex Analysis (Princeton Mathematical Series). Princeton University Press, Princeton (1970)

Rostek, M.: Quantile maximization in decision theory. Rev. Econ. Stud. 77, 339–371 (2010)

Rothschild, M., Stiglitz, J.E.: Increasing risk: I. A definition. J. Econ. Theory 2, 225–243 (1970)

Savage, L.J.: The Foundations of Statistics. Wiley, New York (1954)

Strzalecki, T.: Temporal resolution of uncertainty and recursive models of ambiguity aversion. Econometrica 81, 1039–1074 (2013)

Weil, P.: Nonexpected utility in macroeconomics. Q. J. Econ. 105, 29–42 (1990)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The authors are grateful to the editor and anonymous referees for their constructive comments and suggestions. In addition, we thank Rabah Amir, José Faro, Peter Klibanoff, Asen Kochov, Marzena Rostek and seminar participants at the University of Rochester, University of Iowa, Insper, 2019 Midwest Economic Theory Conference, and 41st Meeting of the Brazilian Econometric Society for helpful comments and discussions. All the remaining errors are ours.

Rights and permissions

About this article

Cite this article

de Castro, L., Galvao, A.F. Static and dynamic quantile preferences. Econ Theory 73, 747–779 (2022). https://doi.org/10.1007/s00199-021-01355-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-021-01355-8