Abstract

This study investigates the underexplored relationship between revenue management and hotel loyalty programs. Results from a focus group and personal interviews with industry experts reveal that revenue management uses loyalty programs primarily as a tool to track and gather data on the customer, and revenue managers focus more on Average Daily Rate (ADR) than on total guest spend. Additionally, revenue managers are misinformed about the loyalty concept and confuse the connections between transactional, attitudinal, and true loyalty. Suggestions for future research include the investigation of the topic further by conducting a study using quantitative measures and analyses.

Similar content being viewed by others

Introduction

With more than 150,000 hotels rooms, the city of Las Vegas is particularly vulnerable to economic fluctuations. Pressed to gain a competitive advantage and at times just to stay afloat in times of economic downturn, hotels must continuously invest in innovative strategies to retain their current customer base and ideally attract more guests. One such strategy used throughout the service industry has been loyalty programs. Although loyalty programs can be successful at bringing guests back, the effectiveness of such programs in terms of maximizing revenue and profits per guest is unclear. One way to better assess loyalty program effectiveness may be from a revenue management perspective, or how to maximize profitability per guest. This is particularly crucial in the current situation where the hospitality industry is struggling to survive.

Loyalty programs exist to help businesses gain a competitive advantage, which ultimately involves sustained profitability through increased revenue generation from guests. The question is: To what degree are loyalty programs successful at this and what can be done to maximize revenues through the use of such programs? While some research has been conducted on the relationship between customer relationship management and revenue management (Wang 2011), further research is necessary to bridge the gap between hotel loyalty programs and revenue management (Shanshan et al. 2011). The purpose of the study is to uncover the relationship between revenue management and hotel loyalty programs and assess the managerial implications of that relationship in terms of impact on revenue generation.

Literature review

Customer loyalty and the hospitality industry

A loyal customer is a frequent, repeat consumer who feels an attachment to a particular organization and is reluctant to switch brands (McKercher et al. 2012). A consumer can show loyalty to a particular product or service, such as a hotel. Loyalty programs are platforms that are introduced to build consumer loyalty through an arranged reward system based on a consumer’s history (Yi and Jeon 2003; Haley 2006). Loyalty programs can be considered value-sharing instruments (Yi and Jeon 2003), which lead to an increase in value perception, overall improving customer retention (Berezan et al. 2013; Woodruff 1997). Almost every firm in the hospitality industry has developed some type of loyalty program for their guests. Loyalty programs may also have a tiered structure that incentivizes customers to advance in tiers through spending (Tanford 2013) and creates well-defined classes to aid patrons in understanding what benefits they are able to acquire (Drèze and Nunes 2009).

Previous research established that a firm with a 5% increase in loyalty could produce profit increases of 25–85% (Reichheld and Sasser 1990). An increase of that magnitude makes it crucial for companies to participate in loyalty programs. However, there is a lack of research on the feasibility of loyalty programs and a solid basis for profit growth from loyalty has not yet been established. Berezan et al. (2013) suggest that management needs to track whether loyalty program practices lead to the desired true loyalty, or merely a short-term behavioral impact. In terms of impacting hotel booking behavior, numerous factors have been shown to be significantly more important than loyalty program offerings, including value for money, quiet/soundproofed rooms, positive referral from friends, proximity to tourist attractions, and décor (Berezan et al. 2015). Dowling (2002) states that such programs are neither cost effective nor foster true loyalty. Regardless of their effectiveness, loyalty programs are now considered by customers as an expected part of the brand experience and require a constantly evolving strategy in order to be competitive (Tanford et al. 2016; Yoo et al. 2018).

To maximize loyalty, customers need to possess high levels of both behavioral and attitudinal loyalty, or true loyalty (Tanford and Baloglu 2013). It is paramount to differentiate true loyalty from repeat purchasing (Han et al. 2011; Han and Hyun 2012). Behavioral loyalty focuses on repeat purchases and not the psychological decision processes associated. Han and Hyun (2012) also discussed the elevated number of individuals with multiple memberships to customer frequency programs, therefore, not displaying true loyalty. Despite the increased memberships, repeat purchases alone are usually not enough to ensure customers’ positive attitudes toward a product/service (Shoemaker and Lewis 1999; Bowen and Chen 2001; Han and Hyun 2012). Long et al. (2003) also recognized that frequency programs are a widely used method of relationship marketing. They also noted that these programs only increase short-term profitability and often fail to attain these customers long term.

Furthermore, hotels have several revenue centers, such as rooms, food and beverage, casino, spa, entertainment, nightlife, and golf if applicable (Ivanov and Zhechev 2012). Due to the inability to directly measure the impact of loyalty on revenue, it is difficult to determine if in fact, hotel loyalty programs could also be considered revenue generators for hotels.

Measuring customer loyalty

Prior research has not fully explored methods for measuring consumer loyalty or loyalty program success (Aksoy 2013). Historically, managers have used several different measures to track consumer loyalty, such as customer satisfaction (Kandampully and Suhartanto 2003) or customer retention (Bowen and Shoemaker 2003). Over time, one single method or measure has not emerged as an industry standard for tracking or measuring consumer loyalty. This poses interesting questions regarding the actual measurements of loyalty programs.

A method introduced in the 1980’s by Raju was a multiple question version of a Likert scale to attempt to measure the degree to which people exhibited loyalty (Raju 1980). Further, Lichtenstein et al. (1990) modified the scale to have fewer questions and incorporate the behavioral aspect of consumer loyalty. These scales were measuring the likelihood that the consumer would stay with their current product over purchasing a new one (Raju 1980), however, as explained in Shoemaker and Lewis (1999), purchase behavior alone is not sufficient to measure loyalty. As indicated by Oliver (1999), loyalty is a behavioral construct consisting of various cognitive and attitudinal factors. The level of difficulty in developing a method to measure loyalty may be a possible reason as to why no standard method exists.

Kandampully and Suhartanto (2003) explain that there is no standard definition for loyalty and explore the idea of “service loyalty” further, by describing a loyal consumer of the service industry as one who repeats business at a firm and also recommends the firm to others. A loyal consumer’s willingness to recommend the brand/service to others is a crucial aspect of loyalty for businesses (Bowen and Shoemaker 2003). This solidifies the importance of developing a definition for loyalty and a metric with which to measure it.

Bolton et al. (2000) suggest that evidence must be gathered to quantify a program’s effect on a customer’s repurchase intentions. A loyal guest will frequent a brand over a period of time, so the metric must be able to quantify the actions over that period. In another article, Bolton et al. (2000) warn that repurchase intentions must be analyzed carefully due to the relationship between a customer’s prior attitude and repurchase intention. This notion possible suggests that a customer may or may not decide to patronize a brand due to their prior negative attitude at that moment. Further, some research has indicated that repurchasing is not a measurement of loyalty because the act of repurchasing should be intentional (Tepeci 1999).

Mattila (2001, 2004) used a variety of scales to measure consumer loyalty during service failures. The author adapted a version of the Loyalty Scale, developed by Zeithaml, Berry, and Parasuraman (1996, cited in Mattila, 2001), which helped identify behavioral intentions of the participants. The results of the study indicated that loyal consumers might have more realistic or rational expectations in relation to service failures (Mattila 2001). Further, in another study, Matilla utilized the affective commitment scale, which examined emotional attachment to the brand, as well as the loyalty scale that explained word-of-mouth behavior and repurchase intention (Mattila 2004). The study indicated that those with stronger emotional attachments were less likely to be deterred from repurchasing by a service failure.

In an article by Baloglu (2002), the author utilized a Likert scale to measure behavioral and attitudinal characteristics of loyalty in a questionnaire. The author used this loyalty scale to show the different levels of loyalty among consumers, from a low to very strong commitment (Baloglu 2002). Sui and Baloglu (2003) continued to examine the role of an emotional attachment as it related to loyalty in casinos. The authors explored the role of trust and switching costs, and what effect those antecedents had on emotional attachment. The use of Likert scale in the study aided the author in adding to the previous research; the article concluded that casinos should be focusing on increasing trust in loyal consumers, as well as making switching costs higher, to deter their loyal guests from leaving that casino (Sui and Baloglu 2003).

- Research Question 1::

-

How can the financial impact of loyalty programs be determined if the current scales solely measure loyalty type?

Building consumer loyalty

Consumer loyalty is comprised of various dimensions and the reasoning behind a customer’s loyalty will vary with each person and service (Taylor et al. 2006). Oliver (1999, p. 34) defines customer loyalty as “a deeply held commitment to rebuy or re-patronize a preferred product/service consistently in the future.” He also indicates that loyalty can occur at multiple levels, such as cognitive and behavioral.

Research addressing cognitive and behavioral dimensions of loyalty (Baloglu 2002; Mattila 2006; Shoemaker and Lewis 1999; Tanford 2013) has continued to increase in recent years. Shoemaker and Lewis (1999) were the first to recognize a demand to research attitudinal aspects of loyalty. Recently, there has been an emphasis on the attitudinal component of trust and commitment (Mattila 2006; Morgan and Hunt 1994 cited in Tanford 2013) in the loyalty literature (Tanford 2013).

Behavioral loyalty involves the purchasing behavior of a product or service over a period of time (Bowen and Shoemaker 2003). It is vital to many businesses because it involves the literal act of purchasing the service or product, without which there would be no revenue. An aspect of behavioral loyalty incudes this decision to choose one brand over another (Baloglu, 2002; Mattila 2006) when making purchases. Tanford (2013) indicates that in researching behavioral loyalty, the actual behavior cannot always be observed; researchers can also use behavior intention. However, Shoemaker and Lewis (1999) argue that purchase behavior is not sufficient as an indicator for loyalty because it does not discuss motivation for the purchase. Hotels will experience increased business if more guests stay and make purchases at their hotel; however, some indicate (Mattila 2006; Bowen and Shoemaker 2003; Tanford 2013) that it is more important for customers to have a connection to the brand or hotel.

Vence (2002) describes transactional marketing as the “go-to” method for marketing in hospitality. The author states that although relationship marketing is on the rise, firms will still revert to traditional transactional marketing, which only short-term drives sales (Osman et al. 2009). Firms will still benefit from transactional marketing and behavioral loyalty due to the increased revenues; however, as indicated by Osman et al. (2009), it is only in the short term.

The shift from the classic approach to marketing to the customer-focused approach has brought about a newfound importance of loyalty in hospitality firms (Crie 2004). Hospitality firms now consider all aspects of the customer. Some studies have used frequency of visits (Baloglu 2002; Crie 2004; Tanford 2013) as a basis for analyzing behavioral loyalty. Baloglu (2002) examined the proportion of visits to a particular casino as a measure of loyalty, and Tanford (2013) also concluded that percentage of visits, not only frequency, should be included in the analysis of behavioral loyalty.

Attitudinal loyalty includes a customer’s intentions and preferences (Gremler and Brown 1997 cited in Kandampully and Suhartanto 2003). This aspect of loyalty is considered very important because a consumer is more than a transaction or purchase and a consumer with attitudinal loyalty may also have higher behavioral intentions such as repurchase intentions (Mattila 2006). Bowen and Shoemaker (2003) stress the importance of an emotional connection in consumer loyalty. Loyalty is more than customer satisfaction. Kandampully and Suhartanto (2003) examine the existing relationship between satisfaction and loyalty and acknowledge that they are not the same. Satisfaction is considered pleasurable fulfillment (Oliver 1999) and occurs as a customer consumes an item or service, which can lead to pleasure/displeasure.

- Research Question 2::

-

How do loyalty programs address emotional connection to the brand (attitudinal loyalty) and repeat visits/purchases (transactional loyalty)?

A cost perspective of loyalty programs

Research has indicated that consumers are drawn to those loyalty programs that differentiate themselves from others (Chen and Hitt 2006; McCall and Voorhees 2010). This requires constant attention and development to remain attractive to a diverse customer base in addition to the investment in establishing and maintaining the programs. Hanson et al. (2008) described how loyalty program expenses are a subset of sales and marketing expenses, which are one of the largest expenses for a hotel on average. These hotels are paying for the benefits provided to their customers to encourage repeat patronage, which is often in the millions (McCleary and Weaver 1991; Shanshan et al. 2011). Although it is much more expensive to acquire a new customer than to retain an existing one, previous research (Berman 2006; Xie and Chen 2013) discusses circumstances in which loyal customers may have to be additionally compensated when expected rewards are not delivered thereby further adding to the cost of the program.

Loyal consumers are thought to be less price sensitive over time and, therefore, cost less to retain than non-loyal consumers, ultimately reduce marketing and advertising expenses (Bowen and Shoemaker 2003). Tanford et al. (2011) discussed a cost of loyalty programs to the customer in addition to their financial purchase: switching costs. Switching costs are costs associated when changing from one brand to another (Bowen and Shoemaker 2003). Switching costs may involve monetary (Han et al. 2011) costs, such as loss of funds or points redemption, or non-monetary switching costs, such as loss of relationship (Tanford et al. 2011). Switching costs are important deterrents of exit among members in higher tiers (Shoemaker and Lewis 1999). Loyalty programs that can keep their switching costs high will have less trouble retaining their members.

Research indicates a gap between hotel loyalty programs and profitability (Shanshan et al. 2011). Loyal members are rewarded for their continued patronage but at a cost to the hotel. Higher tiered loyalty members receive more expensive benefits at higher costs to the hotel (Tanford 2013). Therefore, although marketing and advertising expenses may be reduced based on price sensitivity (Bowen and Shoemaker 2003), the hotel will still incur larger expenses due to their higher tiered members receiving expensive benefits (Tanford 2013).

- Research Questions 3::

-

How does charging different customers’ different prices for the same room at the same hotel impact consumer loyalty?

- Research Question 4::

-

How do revenue managers view the financial expense of loyalty programs?

Loyalty from the revenue management perspective

Loyalty has been considered from sales and marketing perspectives (Tepeci 1999; Hanson et al. 2008; Vence 2002), financial perspectives (McCleary and Weaver 1991; Shanshan et al. 2011), as well as an internal perspective of structure (Tanford 2013; Tanford et al. 2011; Drèze and Nunes 2009). The dilemma of loyalty programs seems to be that they are a large expense and less incremental revenue for hotels than expected. Loyalty from a revenue management perspective (Shoemaker 2003) appears to be a relationship that has not been fully explored but could possibly shed light on the connection between hotel loyalty programs and revenue management practices.

Revenue management is an essential instrument for matching supply and demand by segmenting customers based on their purchase intentions and assigning them in a way that will maximize the firm’s revenues (Ivanov and Zhechev 2012). Revenue management has been a topic of interest in the world of academia for many years (Tse and Poon 2012), with topics such as pricing (Shoemaker 2003, 2005), price fairness (Kimes and Rohlfs 2007; Kimes and Taylor 2010; Kimes and Wirtz 2007), decision framing (Tversky and Kahneman 1981), as well as its impact on consumers (Choi and Mattila 2004; Heo and Lee 2010). Yield management has had profound effects on capacity-constrained industries by aiding them in their forecasting and anticipating supply and demand (Heo and Lee 2010).

Shoemaker (2005) discusses the practices of revenue management in hotels and its effects on consumer loyalty and suggests that that revenue management techniques can decrease trust and loyalty. Noone et al. (2003) propose that using revenue management and customer relationship management cooperatively, will allow pricing to consider the lifetime value of the customer and not just simply base it on demand. This notion is confirmed by Mathies and Gudergan (2007) who recognize the need to integrate revenue management and customer centric marketing. Kimes (1989) contended that pricing strategies used in revenue management could alienate a portion of the customer base. Therefore, hotels have much to consider when using revenue management pricing strategies that may concern or impact their loyal customers.

Research Question 5: What is the overall relationship between revenue management and hotel loyalty programs?

Methodology

To better understand the relationship between revenue management and hotel loyalty programs, this study first conducted a focus group of revenue management experts from across the U.S. Next, in-depth interviews were conducted with revenue managers from several Las Vegas properties.

Focus Group

A focus group is performed by initiating a planned discussion with a small group of people and led by a moderator (O’Neill 2012). In this form of qualitative research, the participants of the focus group will interact with one another. According to O’Neill (2012), focus groups are a useful tool because they add a social context to the research. As Morgan (1997) explained, focus groups can often serve as the primary means of collecting qualitative data.

A focus group was conducted as part 1 of this exploratory research. The group consisted of eight revenue management experts from hotel properties across the U.S. and the discussion lasted for one hour. A list of seven questions was created for the focus group (Appendix 1), with each question having key words or additional talking points listed for the moderator. The responses from the participants were recorded, transcribed, and used to identify emergent themes and relationships and ultimately construct interview questions for the next portion of the study.

In-Depth Interviews

The second part of this study consisted of in-depth personal interviews with revenue managers from hotels in Las Vegas. Marshall et al. (2013), describes how interviews are another increasingly popular form of qualitative research. According to Webb (1995), in-depth interviews are personal encounters that entail consistent probing of the participant to speak freely and express beliefs or opinions on a certain topic. This has a similar advantage to the focus group in that it adds the social element to the research, which may elicit additional information not available without the researcher present and interacting with the participant.

Hanson and Grimmer (2007) stated that in-depth interviews are an important and proficient tool for qualitative research and are the most frequently used method in qualitative research. In-depth interviews can feature open or closed ended questions, with a specific, overarching subject or research question in mind (Kwortnik 2003). Raab et al. (2018) conducted in person interviews to explore the often-strained relationships between online travel agents and hotel revenue management professionals.

A general interview guide approach (Turner 2010) was used for all interviews. The interviews each consisted of eight questions (Appendix 2) that were based upon the results and conclusions drawn from the focus group in part 1 of the study. Beyond the prescribed interview questions, the interviewer probed participants for to gain a richer perspective of their experience.

13 personal interviews were conducted, which lasted from 45 to 60 min per interview. The sample chosen for the in-depth interviews did not participate in the focus group. All participants in the interview were all revenue management professionals, both men and women, currently employed in the hospitality industry. The sample participants had an average of 4 years working in the hospitality industry, including hotels and hotel casino properties. The sample participants were hand selected by the researcher for their knowledge of the industry and current trends, as well as their experience with and interest in the topic of revenue management and hotel loyalty programs.

Content analysis

Content analysis is a useful technique to researchers who are attempting to identify patterns, frequencies, or potential categories within another subject (Carlson 2008). This study applied the Grounded Theory approach by which an explanatory framework will be discovered which is grounded in the data. This method does not follow established theories but discovers explanatory frameworks for theories from the examined data (Starks and Trinidad 2007). The use of ATLASti5 allowed for the interviews to be dissected using content analysis. Content analysis is a useful tool for examining trends and patterns within documents (Stemler 2001). The transcripts from the interviews were processed using ATLASti5, allowing them to be coded, analyzed, and searched for potential categories. The content analysis included three phases: 1) identifying codes within categories; 2) relating codes to one another to identify emergent themes; and 3) constructing a theoretical model that details perspectives of strategic relationships with hotel revenue managers, and identifying new patterns and categories associated with those relationships.

In this study, 3 researchers conducted content analysis on the interview transcripts and coded keywords and phrases that resulted in emergent themes and relationships. To enhance inter-rater reliability, the interview transcripts were coded by each researcher individually first and then coded again as a group. According to an article by Tierney and Clemens (2011), trustworthiness depends on four factors: credibility, transferability, dependability, and conformability. The researcher attempted to exemplify the methods and research design clearly, as well as present the results in a way that illustrate credibility and conformability.

Results

Interview responses

The first question concerned the financial aspect of loyalty programs. All thirteen of the respondents stated that they do consider the financial impact of loyalty programs. Nine of the thirteen respondents indicated that tracking guest behavior is the primary method for understanding the financial impact of the loyalty program; tracking guest behavior allowed them to incentivize the guest to return and maximize revenue. Four of the respondents indicated that the financial impact of loyalty programs was measured by considering gaming contributions per loyalty program member and the profitability (or loss) of promotions offered to members.

The second research question explored how loyalty programs generate emotional connection to the brand (attitudinal loyalty) and/or repeat visits/purchases (transactional loyalty). Five participants conveyed that a loyalty program is primarily concerned with transactional loyalty and the primary concern is acquiring data on the guest, and that an emotional connection to the brand results from the guest’s efforts, not the hotels. Seven participants articulated the necessity of an emotional connection and felt that hotels should strive for making that emotional connection with their guests. However, these participants explained that their methods for loyalty marketing were purely transactional. One participant stated that they work closely with their customer relationship management team and encourage their staff to make personal connections with guests.

The third research question considered how the revenue management practice of charging customers different prices for the same room at the same hotel impacts consumer loyalty. Two participants contended that price sensitive guests are usually not loyal, and therefore, it has little effect. Three participants stated that dynamic pricing can increase loyalty because guests are given the chance to receive exclusive offers and discounts not normally available to them. Two of the participants explicitly stated that it should have little to no impact if there is rate parity among channels. The remaining participants indicated that due to accessibility and availability of information, guests were very aware of supply/demand and how that affects room prices on rooms and, therefore, had a minimal effect on loyalty.

The fourth research question inquired about revenue managers’ concerns of the expense of loyalty programs. Four participants explained that they were concerned with the reinvestment levels in a guest. Two of the participants mentioned how they were alarmed about the number of redemption reservations in house at one time. Four participants stated that there were specific positions created to handle the loyalty program finances, while revenue management was mainly concerned with the data. Two participants responded that revenue management was strictly involved with revenue generation, while the last participant stated that it depended on the size of a company.

The fifth research question dealt with the overall interaction between revenue management and hotel loyalty programs. Two participants stated that revenue management’s involvement in the loyalty program is sufficient the way it is; revenue management works a little with marketing to yield rates to loyal member segments. Three participants indicated that an intermediary between revenue management and hotel loyalty programs way the best way to operate. At last, eight participants explained that revenue management should have more direct involvement with loyalty programs to be successful, and that hotels should strive for a total hotel revenue management approach.

Codes, subcategories, and emergent themes

Content analysis was conducted on the interview responses resulting in codes, subcategories, and emergent core categories (themes), as summarized in Table 1.

After coding the interview data, a thematic analysis was performed by relating the codes to one another into subcategories, then further grouping the subcategories into resulting emergent themes. Several themes emerged from the data during analysis: goal is to understand the consumer; strategy is at the core of revenue management; the smart consumer, data; and striving for emotional connection through transactional loyalty.

Goal is to understand the consumer

The overall goal of understanding the consumer and their behavior was mentioned several times by the participants. The codes related to this theme are data (14), target marketing (7), and knowledge of consumer behavior (6). The topic of the consumer/consumer behavior was mentioned in all of the interviews, as seen in the sample participant replies below:

…to understand exactly who you are as a consumer, what drives you, and what I can do to keep you loyal to my company.

We can get a little bit of a sense as to who our customer is, and then also, what their willingness to spend is as well…because with revenue management, what we have to understand is ‘how sensitive…or how price sensitive is our customer?’

It’s just understanding the customer and understanding what it is that they want, to try and sort of tailor the rewards.

Using the word count function, heavy emphasis was evident on the words related to understanding the consumer: data (33), consumer (22), consumers (10), customer (54), customers (46), guest (61), and guests (65).

Strategy is at the core of revenue management

The concept of a core strategy was mentioned frequently among the participants, with the word strategy in some form being mentioned 32 times. Among the ideas shared, several strategies, such as forecasting and converting guests to book directly were mentioned often, as shown in the following examples:

…great stats to know, especially with our hotels and the complimentary breakfast. If we can strategize that over certain dates, we’re gonna have more gold and platinum members in house, it just makes us… better at our job…we’re better able to forecast the hotel, and kind of set the expectations out there of how know those dates are going to perform.

So, what you don’t wanna do is sell too many rooms in advance to the lower, lowest end folks, and then not have rooms available for…you know, your higher valued casino customers.

A few of the participants also mentioned strategy and how it related to obtaining and maintaining the ideal mix of customers in the hotel, as the following participants state:

…very focused on the mix of business that’s in the hotel. There’s times where you can maximize every room coming in at retail and super high rates, and there’s times where there are need dates and you need rewards reservations and you need some of the lower priced reservations in the hotel.

You know, if you’re at a hotel where…you know, on any given night where we’re running 70% or 80% of the hotel being a gold or platinum member, that can be very, very costly to the hotel if every one of those rewards members chooses to eat breakfast. So, 80 breakfast times $20 is $1,600; if you’re having that taken out a few times during the week and you’re not bringing in as much as you’re dishing out, umm…it can be very costly, and it’s something you have to monitor very closely.

The strategies that were mentioned by the participants were fairly common to revenue management practices. Two participants mentioned a forecasting strategy that none of the other participants did, that of suspending benefits for loyalty program members:

So although you’re a loyal guest, we can shut off certain times when we really want to maximize revenue from a different market segment, or we wanna minimize it to comp only. So, basically, if you’re a [loyalty] guest, if you can’t get a comp, you can’t stay here, or you can stay here, you just don’t get a discount at this date, you have to pay the full prevailing rate.

…although we love our loyalty members and we want them to be able to book with us, like our platinum members get, umm, guaranteed room access if they let us know within 24 hours, so basically even if we’re sold out they get it, right? And that’s a great program to be a part of because it really makes them feel like they’re valued, however blackout dates are so important for revenue managers to put into place because if I’m selling a group contract, I need to also be committed to that contract as well.

The participants indicated that the loyalty program was open to anyone and everyone; it simply required the guest to sign up for the program. Several participants discussed the idea of exclusivity in the loyalty program as a strategy for obtaining new members:

…you’re gonna give it to them for $200, now they’re seeing that there’s value in the proposition that you’re giving them…that for being a member you’re gonna get a cheap discount. And therefore, you’re being rewarded for that loyalty.

So, if you’re booking [OTA], you won’t get credits on that.

…consumer loyalty as far as they’re concerned should really be held with us because they’re getting these additional certificates that they can only redeem through our reservations.

The smart consumer

The conception of revenue management and dynamic pricing was mentioned by a few participants. There were several related codes cited frequently as well: guest awareness (7); information (3); knowledge (2), and dynamic pricing (4). Many of the participants stated that consumers have information and awareness of different pricing practices in the hospitality industry.

…because dynamic pricing has been around for sufficiently long time now, and of course all this came into focus with the airlines, right?

I think in this era of communication and information, you can Google everything…especially in Las Vegas. They have done so many specials about how you can get the best deals in Las Vegas. I think people are more aware of this now than they have ever been that, you know…when they’re in the hotel, there’s a variety of price points that are out there.

I think that consumers are savvy enough at this point to understand that price is a function of supply and demand, right?

Further, there were references to dynamic pricing and a motive to create a sense of integrity in pricing. The consumer had knowledge and means to seek out information on pricing practices, according to the data. There were several mentions of dynamic pricing creating loyalty in consumers as well.

I would definitely say that it has somewhat of an impact, however we work incredibly hard to keep all of our rates in parity. So, even when you’re looking at our [OTA’s] are the four main ones that we participate with, umm…. we try to keep everything in parity.

…ultimate goal is to create a sense of integrity, I guess, in booking directly with the company…

So, you kind of have to be consistent in a sense that the rates are gonna go higher, rather than lower. And then, when a guest sees that the rate is $500, and you’re gonna give it to them for $200, now they’re seeing that there’s value in the proposition that you’re giving them…that for being a member you’re gonna get a cheap discount. And therefore, you’re being rewarded for that loyalty.

Data

All participants mentioned tracking the guest or tracking in some form during the interviews. The most frequently used words associated with the tracking category are tracking behavior (14), tracking spend (20, and target marketing (7).

…a loyalty program is just a fancy word of being able to track people.

…heavily track our [loyalty] members, because that’s how we get our [loyalty] scores.

A few of the participants indicated the specific methods with which they track guest behavior, such as looking at their guest folio, casino spend, or entertainment purchases.

…we’re able to do this is we track our customer spend…in…like in Las Vegas, we track how often they’re gambling, how much, and if they are staying in the hotel with us, we track their folio spend…

They do take a look at your spent, and what you utilize your spent on, and then they send you offers based upon that.

and you let us track what it is that you’re doing and what it is that you want, so…that way we can give you more of what you’re wanting.

Most of the participants discussed various ways of acquiring guests into their loyalty programs.

And one of our major marketing strategies was to, umm…get [hotel] corporate involved in finding out what [hotel] club members in their database have booked, umm…premium suites within [state] region, and sending them a marketing piece on our new bungalow. So that’s kind of like targeting exactly the consumer that we’re looking for…

Emotional connections through transactional loyalty

Many of the participants did mention an emotional connection to a hotel or brand in some capacity. In doing so, they related the emotion back to “brand loyalty” or “brand recognition.”

I mean you capture a lot of business being with such a great brand, because the brand recognition brings guests in too.

Like here in Vegas, yeah I absolutely want you to be loyal to [hotel brand].

The participants shared an emphasis on repeat guests and enticing the guest to return to the property. The related codes were mentioned often as well: repeat visit (9); transactional loyalty (7); loyalty is repeat business (4); incentive to return (5); and frequency (9). The responses shared a common view of, “striving for an emotional connection,” or “the goal is to have an emotional connection,” and the methods were mainly, “repeat visits,” “offering discounts,” or “motivating by points.”

It addresses the, umm, transactional because it really is based on visits, stays, nights, etc.… you get more, you stay more.

…how often they visit.

We do speak a lot to the repeat guests…

How we draw people into the program is the discounts…

On the major side of loyalty which is the [brand] rewards program, that is almost entirely driven by…by your gaming contribution. So, it has very little to do…the short answer is that it’s…it’s the revenue you contribute from the gaming side.

Two participants emphasized the idea of “quantity” as a motivator for acquiring members into their loyalty program and increasing repeat visits.

They’re just trying to get sheer numbers. I think that’s more so the goal. They think if we get a lot of numbers, then the repeat business will eventually… we’ll see the benefit of the repeat business.

…quantity, quantity, quantity, pushing that…

All participants mentioned the importance of “offers” and “tailoring” offers to meet consumer needs. Most of the participants cited “target marketing” in two ways: targeting exact consumers who they want to return, and acquiring guests into their loyalty program.

and you let us track what it is that you’re doing and what it is that you want, so…that way we can give you more of what you’re wanting.

They do take a look at your spend, and what you utilize your spend on, and then they send you offers based upon that.

And one of our major marketing strategies was to, umm…get [hotel] corporate involved in finding out what [hotel] club members in their database have booked, umm…premium suites within [state] region, and sending them a marketing piece on our new bungalow. So that’s kind of like targeting exactly the consumer that we’re looking for…

And at some point, that’s not the customer that we choose to market too.

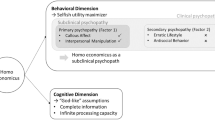

Content model and analysis

All themes were integrated into a content model as displayed in Fig. 1. The central categories in the model were revenue management, loyalty programs, strategy, transactional loyalty, data, smart consumer, and goal of understanding the consumer. Arrows between categories, as well as the direction of the arrows, on the content model indicated some connection or relationship.

The model is interpreted from the top down. It originated with the connection between revenue management and hotel loyalty programs: the goal is to understand the consumer. Revenue management sought to understand the consumer to maximize revenue per customer, while loyalty programs aided in the tracking of spend and behavior in the consumer, gathering massive amounts of data to aid in development of promotions and offers. Revenue management used data from the loyalty program to work with the marketing department, in order to create targeted offers and promotions that will drive business (target marketing).

The first main theme was strategy. The data show that strategy was vital in revenue management; in order to forecast and maximize revenue, there must be a strategy in place for that specific time period. For example, one main strategy mentioned was targeting OTA guests and converting them to book directly with the hotel. Guests, even though they booked with an OTA, would have the chance to experience the service, which will help convince them to book directly with the hotel in the future. This could lead to increased revenues for the hotel as well as a possibility of increased loyalty with that brand. Target marketing is also seen to be vital to attract new guest to the hotel and to ensure their return.

Strategy relies heavily on data to be successful. Data are fundamental to the relationship between revenue management and hotel loyalty programs. Data consist of spending habits, place of spend, preferences, stay patterns, booking windows, customer feedback, and customer information. Data are collected through various methods including the use of rewards cards to track behavior and surveys.

The intent of a loyalty program is to drive loyalty and increase repeat business (Haley 2006). The aforementioned strategy of target marketing is a successful way to increase repeat business (behavioral loyalty), as indicated by many of the study’s participants. Members of the loyalty program were sent offers that are tailored to them, specifically based on their spending habits. Furthermore, participants mentioned the importance of a smart consumer in terms of the impact on behavioral loyalty. The consumer had knowledge and mean to seek out information on pricing practices, according to the data. There were several mentions of dynamic pricing creating loyalty in consumers.

A topic of debate was whether loyalty programs actually drive emotional connections with their brand, or just repeat visits or purchases. A common theme among the participants was striving for the emotional connection by focusing on repeat visits. Participants believe that by increasing the frequency of visits, guests will become more emotionally connected, resulting in increased brand loyalty, which reveals a misunderstanding of the loyalty concept by participants (indicated by white arrow in Fig. 1). Several participants discussed the notion of dynamic pricing, and whether it could increase or decrease consumer loyalty. As shown from the results, interviewees suggested that because consumers are smart and fully capable of searching for pricing information, as long there is rate parity, it should not have a negative effect on customer loyalty. Revenue managers were mainly concerned with maximizing revenues, as indicated by all the participants. Therefore, the results illustrated that revenue managers were more focused on repeat visits to the property with carefully designed offers, incentives, and promotions.

Overall, the study illustrated that the relationship between revenue management and hotel loyalty programs can be described in a single word: data. The data from the loyalty program were crucial to revenue management’s goal of maximizing revenue. Participants expressed that the current focus of the loyalty program was on repeat visits, and utilizing the data collected from the program to incentivize guests to return. Revenue management was not directly involved with the loyalty program, yet as the interview data portrayed, there should be more involvement in the future.

Implications, limitations and future research

Summary of findings

Using a content analysis of in-depth interviews, this study provides an understanding of the relationship between revenue management and hotel loyalty programs. The results of this study indicate that revenue management and hotel loyalty programs, while separate disciplines, rely on the same vital factor to be successful: understanding the consumer. The main themes emerging from the data are as follows: goal of understanding the consumer, strategy, data, the smart consumer, and transactional loyalty as an antecedent of emotional connection. Revenue management utilizes the data collected and tracked by loyalty programs to be more effective at designing promotions and offers, in line with their strategy to maximize revenue.

Although revenue management is not concerned with the financial expense of loyalty programs, the data that loyalty programs track are of the utmost importance to revenue managers. From a revenue management perspective, loyalty programs encourage repeat visits, and in turn, guests may or may not form an emotional connection. Further, dynamic pricing, a core principle of revenue management, could potentially increase loyalty in hotel guests by offering exclusivity to loyal members and those who book directly. Overall, revenue management’s involvement with the loyalty program is limited; it uses the loyalty program mostly as a tool for tracking data on the consumer to maximize revenue.

Theoretical implications

The results of this study contribute to the literature by providing a more thorough understanding of how hotel revenue management interacts with hotel loyalty programs. The common goal of understanding the consumer brings revenue management and hotel loyalty programs together, which coincides with previous research. For example, Aksoy (2013) emphasized information gathering as a necessary step to understand the consumer and used to make decisions. Additionally, Bolton et al. (2000) stressed that data must be gathered to calculate a program’s effect on a customer’s repurchase intentions. Data are a necessary component of revenue management when making decisions regarding consumers, and the loyalty program is the source of that much-needed data.

Strategy is another core element that emerges from the interview data. Revenue management has a variety of functions, such as yielding, pricing, and managing distribution channels. An overarching strategy is essential to revenue management and loyalty programs as highlighted previously by Beck et al. (2011). The current research adds to the literature by accentuating that revenue management cannot only manage the day-to-day yielding but must implement the strategies through daily activities.

The motivations and intentions of a hotel loyalty program have been of some debate in the literature. Participants felt that loyalty programs were mainly concerned with increasing transactional loyalty as a way of developing emotional commitment. These results contradict previous research which shows that behavioral loyalty in itself is not a sufficient antecedent of emotional connection (Baloglu 2002; Bowen and Shoemaker 2003). Revenue managers do not seem to recognize that attitudinal, or emotional, loyalty is actually more important and can be more profitable than transactional loyalty (Mattila 2006). Additionally, the results question the concept of true loyalty, where a combination of high behavioral and high attitudinal loyalty is required (Han and Hyun 2012; Han et al. 2011; Tanford and Baloglu 2013).

Managerial implications

This study reveals several practical implications for management. All participants expressed the importance of data. Revenue management uses the loyalty program for the data collected to make more informed decisions on offers and promotions. Loyalty programs house thousands upon thousands of data points on guests: from where, when, and how often they visit to how much they spend and on what. Given today’s economic climate, with the impact of Covid-19, these loyalty databases can prove to be even more invaluable in targeting customers with specialized messaging and offers to entice their return. Customers who have displayed true loyalty in the past can be targeted to engage in the behavioral aspect of loyalty. This would result in them frequenting the property and provide much-needed cash flow. When the economy improves, managers ideally can focus on turning these behavioral loyalists back into truly loyal guests with a combination of high transactional and high attitudinal loyalty.

Overall, there is misunderstanding among revenue managers regarding the nature of loyalty programs versus frequency programs. Frequency programs encourage repeat business whereas loyalty programs seek to build an attachment to the brand. The results of this study suggest that revenue managers are mainly concerned with repeat visits to the hotel, promoting transactional loyalty. In addition, the study reveals that revenue managers had very limited involvement with loyalty programs, indicating they possess very little understanding of the complete loyalty concept. Revenue managers appear to lack the comprehension of the emotional component (attitudinal) of customer loyalty, thereby potentially missing out on the benefits of truly loyal customers. For example, to have a successful loyalty program, hotels must capitalize on the antecedents of loyalty such as satisfaction, trust, and service quality, which have direct links to emotional commitment of the guest. In turn, guests that possess true loyalty are generally less price sensitive; therefore, dynamic pricing will generally not have negative effects. A more direct connection between revenue management and hotel loyalty programs should be established to increase hotel revenues, as well as decrease promotional allowances due to greater synergies. Loyalty members who have achieved a higher tier receive expensive benefits, such as free room nights or food and beverage, increase costs for the hotel (Tanford 2013). However, management should recognize that the inherent decreased price sensitivity of loyal guests actually has the ability to reduce such costs (Bowen and Shoemaker 2003). Therefore, to reduce costs and more effectively please loyal customers, management must utilize data obtained by the loyalty program and other means to better understand their loyal customers and provide benefits that they truly desire, thereby more effectively retaining and ideally increasing their loyalty beyond the transactional level.

This study reflects that loyalty programs are indeed essential tools for revenue managers, providing vital data to yield rates, send offers, and develop promotions. Moreover, the study may suggest that revenue management’s current business model of maximizing revenues may need to shift more toward the notion of maximizing profits by realizing the profitability potential of true loyal guests. Surprisingly, the current focus of revenue management as indicated by some participants is still the average daily rate (ADR), or the average nightly price paid for the room. Using only ADR may not fully capture what a guest is spending while staying at a hotel. The emphasis should really be on total guest worth over their lifetime of patronage and includes expenditures such as room rate, food and beverage, spa, and gaming, which can be calculated by tracking spend. Again, management should better utilize the richness of the data collected by the loyalty program to determine the actual value of the guest.

Overall, participants stress the importance of understanding the consumer. However, in reality, revenue managers indicate that they are not fully capturing the potential of the valuable data at their disposal. This is especially important in times of economic crisis, such as now, where the richness of guest data should be capitalized on to re-establish diminished revenues caused by the pandemic and the resulting economic devastation.

Limitations and recommendations for future research

Like all studies, this research has some limitations. The presence of the researcher during data collection has the potential to cause social desirability bias (Miyazaki and Taylor 2008). Future research could further explore the topic further through quantitative methods, allowing for a larger sample size, elimination of social desirability bias potential, as well as statistical analysis of the data. The study indicates that revenue managers are not very concerned with the expenses of a loyalty program, offering a path for future research. This study utilizes revenue managers in Las Vegas, a city of extreme supply and demand. Perhaps taking this study to a different area, with more non-gaming hotels, could provide more insight to the topic of transactional loyalty vs. attitudinal loyalty and profitability. Finally, these data were collected prior to the COVID-19 pandemic. Additional research exploring this topic is warranted during and post-COVID-19 times.

References

Aksoy, L. 2013. How do you measure what you can’t define? The current state of loyalty measurement and management. Journal of Service Management 24 (4): 356–381. https://doi.org/10.1108/JOSM-01-2013-0018.

Baloglu, S. 2002. Dimensions of customer loyalty: Separating friends from well-wishers. Cornell Hotel and Restaurant Administration Quarterly 43 (1): 47–59.

Beck, J., B. Knutson, J. Cha, and S. Kim. 2011. Developing revenue managers for the lodging industry. Journal of Human Resources in Hospitality & Tourism 10 (2): 182–194. https://doi.org/10.1080/15332845.2011.536941.

Berezan, O., C. Raab, S. Tanford, and Y. Kim. 2013. Evaluating loyalty constructs among hotel reward program members using eWOM. Journal of Hospitality and Tourism Research 20 (10): 1–27.

Berezan, O., C. Raab, A.S. Krishen, and C. Love. 2015. Loyalty runs deeper than thread count: An exploratory analysis of guest preferences and hotelier perceptions. Journal of Travel and Tourism Marketing 32 (8): 1034–1050.

Berman, B. 2006. Developing an effective customer loyalty program. California Management Review 49 (1): 123–148.

Bolton, R.N., P.K. Kannan, and M.D. Bramlett. 2000. Implications of loyalty program membership and service experiences for customer retention and value. Academy of Marketing Science Journal 28 (1): 95–108.

Bowen, J.T., and Shoemaker, S. 2003. Loyalty: A strategic commitment. Cornell Hotel and Restaurant Administration Quarterly 44 (31): 12–25. https://doi.org/10.1177/001088040304400505.

Bowen, J.T., and S. Chen. 2001. The relationship between customer loyalty and customer satisfaction. International Journal of Contemporary Hospitality Management 13 (4): 213–217.

Carlson, L. 2008. Use, misuse, and abuse of content analysis for research on the consumer interest. The Journal of Consumer Affairs 42 (1): 100–105.

Chen, P.Y., and L.M. Hitt. 2006. Information technology and switching costs. In Economics and information systems, ed. T. Hendershott, 437–470. Amsterdam, The Netherlands: Elsevier.

Choi, S., and A.S. Mattila. 2004. Hotel revenue management and its impact on customers’ perceptions of fairness. Journal of Revenue & Pricing Management 2 (4): 303–314.

Crie, D. 2004. Loyalty-generating products and the new marketing paradigm. Journal of Targeting, Measurement and Analysis for Marketing 12 (3): 242–255.

Dowling, G. 2002. Customer relationship management: In B2C markets, often less is more. California Management Review 44 (3): 87–104.

Drèze, X., and J.C. Nunes. 2009. Feeling superior: The impact of loyalty program structures on consumers’ perception of status. Journal of Consumer Research 35 (6): 890–905.

Haley, M. 2006. Loyalty for sale. Hospitality Upgrade: 25–26. www.hospitalityupgrade.com

Han, H., Y. Kim, and E. Kim. 2011. Cognitive, affective, conative, and action loyalty: Testing the impact of inertia. International Journal of Hospitality Management 30 (4): 1008–1019. https://doi.org/10.1016/j.ijhm.2011.03.006.

Han, H., and S.S. Hyun. 2012. An extension of the four-stage loyalty model: The critical role of positive switching barriers. Journal of Travel & Tourism Marketing 29 (1): 40–56. https://doi.org/10.1080/10548408.2012.638559.

Hanson, D., and M. Grimmer. 2007. The mix of qualitative and quantitative research in major marketing journals, 1993–2002. European Journal of Marketing 41 (1): 58–70. https://doi.org/10.1108/03090560710718111.

Hanson, B., A. Mattila, and J. O’Neill. 2008. The relationship of sales and marketing expenses to hotel performance in the United States. Cornell Hospitality Quarterly 49 (4): 355–363. https://doi.org/10.1177/1938965508324634.

Heo, C.Y., and S. Lee. 2010. Influences of consumer characteristics on fairness perceptions of revenue management pricing in the hotel industry. International Journal of Hospitality Management 30 (2011): 243–251.

Ivanov, S., and V. Zhechev. 2012. Hotel revenue management - A critical literature review. Tourism Review 60 (2): 175–197.

Kandampully, J., and D. Suhartanto. 2003. The role of customer satisfaction and image in gaining customer loyalty in the hotel industry. Journal of Hospitality and Leisure Marketing 10 (1): 3–25.

Kimes, S. 1989. The basics of yield management. Cornell Hotel and Restaurant Administration Quarterly 30 (3): 14–19.

Kimes, S.E., and K. Rohlfs. 2007. Customers’ perceptions of best available hotel rates. Cornell Hotel and Restaurant Administration Quarterly 48 (2): 151–162.

Kimes, S.E., and W.J. Taylor. 2010. How hotel guests perceive the fairness of differential room pricing. Cornell Hospitality Report 10 (2): 4–14.

Kimes, S.E., and J. Wirtz. 2007. The moderating role of familiarity in fairness perceptions of revenue management pricing. Journal of Service Research 9: 229–240.

Kwortnik, R.J. 2003. Clarifying “fuzzy” hospitality-management problems with depth interviews and qualitative analysis. Cornell Hotel and Restaurant Administration Quarterly 44 (2): 117–129.

Lichtenstein, D.R., R.D. Netemeyer, and S. Burton. 1990. Distinguishing coupon proneness from value consciousness: An acquisition-transaction utility theory perspective. Journal of Marketing 54 (3): 54–67.

Long, M., S. Clark, L. Schiffman, and C. McMellon. 2003. In the air again: Frequent flyer relationship programmes and business travellers’ quality of life. International Journal of Tourism Research 5 (6): 421–432. https://doi.org/10.1002/jtr.448.

Long, M., C. McMellon, S. Clark, and L. Schiffman. 2006. Building relationships with business and leisure flyers. Services Marketing Quarterly 28 (1): 1–17. https://doi.org/10.1300/J396v28n01_01.

Las Vegas Convention and Visitors Authority. 2019. Stats & facts. Retrieved from http://www.lvcva.com/stats-and-facts/

Marshall, B., P. Cardon, A. Poddar, and R. Fontenot. 2013. Does sample size matter in qualitative research?: A review of qualitative interviews in is research. The Journal of Computer Information Systems 54 (1): 11–22.

Mathies, C., and S. Gudergan. 2007. Revenue management and customer centric marketing—How do they influence customers’ choices. Journal of Revenue and Pricing Management 6 (4): 331–346. https://doi.org/10.1057/palgrave.rpm.5160109.

Mattila, A.S. 2001. The impact of relationship type on customer loyalty in a context of service failure. Journal of Service Research 4 (2): 91–101.

Mattila, A.S. 2004. The impact of service failures on customer loyalty: The moderating role of affective commitment. International Journal of Service Industry Management 15 (2): 134–149.

Mattila, A.S. 2006. How affective commitment boosts guest loyalty (and promotes frequent guest programs). Cornell Hotel and Restaurant Administration Quarterly 47 (2): 174–181.

McCall, M., and C. Voorhees. 2010. The drivers of loyalty program success. Cornell Hospitality Quarterly 51 (1): 35–52.

McCleary, K.W., and P.A. Weaver. 1991. Are frequent-guest programs effective? Cornell Hotel Restaurant Administration Quarterly 32 (2): 39–45.

McKercher, B., B. Denizci-Guillet, and E. Ng. 2012. Rethinking loyalty. Annals of Tourism Research 39 (2): 708–734.

Miyazaki, A.D., and K.A. Taylor. 2008. Researcher interaction biases and business ethics research: Respondent reactions to researcher characteristics. Journal of Business Ethics 81 (4): 779–795. https://doi.org/10.1007/s10551-007-9547-5.

Morgan, D. L. (1997) (1988). Focus groups as qualitative research. Newbury Park, CA: Sage.

Morgan & Hunt. 1994.

Noone, B.M., S.E. Kimes, and L.M. Renaghan. 2003. Integrating customer relationship management and revenue management: A hotel perspective. Journal of Revenue and Pricing Management 2 (1): 7–22.

Oliver, R.L. 1999. Whence consumer loyalty? JOurnal of Marketing 63: 33–44.

O’Neill, J.W. 2012. Using focus groups as a tool to develop a hospitality work-life research study. International Journal of Contemporary Hospitality Management 24 (6): 873–885. https://doi.org/10.1108/09596111211247218.

Osman, H., N. Hemmington, and D. Bowie. 2009. A transactional approach to customer loyalty in the hotel industry. International Journal of Contemporary Hospitality Management 21 (3): 239–250. https://doi.org/10.1108/09596110910948279.

Raab, C., O. Berezan, N. Christodoulidou, L. Jiang, and S. Shoemaker. 2018. Creating strategic relationships with OTAs to drive hotel room revenue. Journal of Hospitality and Tourism Technology 9 (1): 121–135.

Raju, P.S. 1980. Optimum stimulation level: Its relationship to personality, demographics, and explanatory behavior. Journal of Consumer Research 7 (3): 272–282.

Reichheld, F., and W.E. Sasser Jr. 1990. Zero Defections: Quality Comes to Services. HBR. September–October.

Rowley, J. 2004. Loyalty and reward schemes: How much is your loyalty worth? The Marketing Review 4: 121–138.

Shanshan, N., C. Wilco, and S. Eric. 2011. A study of hotel-frequent guest programs: Benefits and costs. Journal of Vacation Marketing 17 (4): 315–327. https://doi.org/10.1177/1356766711420836.

Shoemaker, S., and R.C. Lewis. 1999. Customer loyalty: The future of hospitality marketing. International Journal of Hospitality Management 18: 345–370.

Shoemaker, S. 2003. The future of pricing in services. Journal of Revenue and Pricing Management 2 (3): 271–279.

Shoemaker, S. 2005. Pricing and the Consumer. Journal of Revenue and Pricing Management 4 (3): 228–236.

Starks, H., and S. Trinidad. 2007. Choose your method: A comparison of phenomenology, discourse analysis, and grounded theory. Qualitative Health Research. 17 (10): 1372–1380. https://doi.org/10.1177/1049732307307031.

Stemler, Steve. 2001. An overview of content analysis. Practical Assessment, Research & Evaluation 7 (1): 17.

Sui, J.J., and S. Baloglu. 2003. The role of emotional commitment in relationship marketing: An empirical investigation of a loyalty model for casinos. Journal of Hospitality & Tourism Research 27 (4): 470–489. https://doi.org/10.1177/10963480030274006.

Tanford, S. 2013. The impact of tier level on attitudinal and behavioral loyalty of hotel reward program members. International Journal of Hospitality Management 34: 285–294. https://doi.org/10.1016/j.ijhm.2013.04.006.

Tanford, S., and S. Baloglu. 2013. Applying the loyalty matrix to evaluate casino loyalty programs. Cornell Hospitality Quarterly 54 (4): 333–346.

Tanford, S., C. Raab, and Y. Kim. 2011. The influence of reward program membership and commitment on hotel loyalty. Journal of Hospitality & Tourism Research 35 (3): 279.

Tanford, S., S. Shoemaker, and A. Dinca. 2016. Back to the future: Progress and trends in hotel loyalty marketing. International Journal of Contemporary Hospitality Management 28 (9): 1937–1967.

Taylor, S.A., G.L. Hunter, and T.A. Longfellow. 2006. Testing an expanded attitude model of goal-directed behavior in a loyalty context. Journal of Consumer Satisfaction, Dissatisfaction and Complaining Behavior 19: 18–39.

Tepeci, M. 1999. Increasing brand loyalty in the hospitality industry. International Journal of Contemporary Hospitality Management 11 (5): 223–229.

Tierney, W., and R. Clemens. 2011. Qualitative research and public policy: The challenges of relevance and trustworthiness. Higher Education: Handbook of Theory and Research. https://doi.org/10.1007/978-94-007-0702-3_2.

Tse, T., and Y. Poon. 2012. Revenue management: Resolving a revenue optimization paradox. International Journal of Contemporary Hospitality Management 24 (4): 507–521. https://doi.org/10.1108/09596111211226798.

Turner, D. 2010. Qualitative interview design: A practical guide for novice investigators. The Qualitative Report 15 (3): 754–760.

Tversky, A., and Kahneman, D. (1981) (1979). Prospect theory: An analysis of decision under risk. Econometrica 47(2): 263–291.

Vence, D. L. (2002). Marketers always will rely on transactional angle. Marketing News 36(13): 1–1,9.

Wang, X. L. (2011)(2012). Relationship of revenue: Potential management conflicts between customer relationship management and hotel revenue management. International Journal of Hospitality Management 31: 864–874. https://doi.org/10.1016/j.ijhm.2011.10.005

Webb, J.R. 1995. Understanding and designing marketing research. London, England: The Dryden Press.

Wilkins, H., B. Merrilees, and C. Herington. 2010. Toward an understanding of total service quality in hotels. International Journal of Hospitality Management 26: 840–853.

Woodruff, R.B. 1997. Customer value: The next source for competitive advantage. Journal of the Academy of Marketing Science 25 (2): 139–153.

Xie, K., and C. Chen. 2013. Progress in loyalty program research: Fact, debates and future research. Journal of Hospitality Marketing and Management 22 (5): 463–489. https://doi.org/10.1080/19368623.2012.686148.

Yi, Y., and H. Jeon. 2003. Effects of loyalty programs on value perception, program loyalty, and brand loyalty. Journal of Academy of Marketing Science. https://doi.org/10.1177/0092070303031003002.

Yoo, M., O. Berezan, and A.S. Krishen. 2018. Do members want the bells and whistles? Understanding the effect of direct and partner benefits in hotel loyalty programs. Journal of Travel & Tourism Marketing 35 (8): 1058–1070. https://doi.org/10.1080/10548408.2018.1473191.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Revenue Management Focus Group Discussion Questions.

I’d like you all to start by discussing the relationship between customer relationship management and revenue management |

Think about a situation in which a highly profitable client was dissatisfied with your business. This may cause a loss in revenue as well as the loss of the client |

How do revenue managers view loyal consumers? |

Discuss your overall opinions of loyalty programs in the hospitality industry |

Explain some ways that loyalty programs affect revenue management |

Discuss whether loyal consumers should always receive a discount compared to unknown customers |

What is the future direction of revenue management concerning loyalty programs? |

Appendix 2

Interview Questions.

1. The current scales of measurement for loyalty programs measure the type of loyalty. How could the financial impact of loyalty programs be determined? |

|---|

2. Do loyalty programs address an emotional connection to the brand (attitudinal), or repeat visits/purchases (transactional loyalty)? |

3. How does charging various customers different prices for the same room at the same hotel impact consumer loyalty? |

4. Is the revenue management department concerned with the financial expense of loyalty programs in any sense? |

5. What is your overall understanding of the interaction between revenue management and hotel loyalty programs? |

6. Some guests may frequent a hotel due to the level of service they receive; others may return to a brand to acquire points to achieve a certain level in the loyalty program. How could a hotel track these specific behaviors in their loyal members? |

7. Is it more important to focus on revenue management at a day-to-day level or at an overall strategic level when it involves hotel loyalty programs? |

8. There are many elements that revenue managers must account for when discussing strategy. Would members of the loyalty program be considered one of those important elements? |

Rights and permissions

About this article

Cite this article

Lentz, M., Berezan, O. & Raab, C. Uncovering the relationship between revenue management and hotel loyalty programs. J Revenue Pricing Manag 21, 306–320 (2022). https://doi.org/10.1057/s41272-021-00331-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41272-021-00331-0