Abstract

The controversial debate on whether high population translates to weak or better economic growth has been a topical discussion in the area of development economics. This study therefore uses the data of the Nigerian economy to investigate the links among population growth, growth in output and income per capita growth for the periods of 1981–2018. The study employs both ARDL bound testing approach to cointegration and fully modified least square methods to evaluate the parameter estimates. We found that there exists a long-run relationship between population growth and economic growth in Nigeria. Further, the study found that the statistical and significant effect of population growth is more on long-run income growth than long-run income per capita growth. Meanwhile, in the short-run, an adverse effect is reported from population growth to economic growth, implying that the former has a detrimental effect on the latter. The reason for the adverse effects of population growth in the short-run results from the high number of dependents, whereas, in the long-run, there is a chance of demographic dividend that makes the young people becomes productive in their adulthood. Our findings, therefore, support the league of many studies that population growth is an asset to the long-run economic growth of Nigeria. In contrast, it has a poor impact on economic performance in the short-run. Thus, there is a need for proper and adequate utilization of the country’s rising population in appropriate areas of the economy where their efforts would be fully utilized towards improving the overall growth of Nigeria.

Similar content being viewed by others

Introduction

In the past decades, output growth has been the most calculated apparatus used by policymakers, scholars, and concerned stakeholders among others to unveil the quality of human life and the possibility of reducing the poverty level in the less-developed countries. The past research studies for cross-country and country-specific cases offer compelling evidence that sustained and robust growth is imperative towards ensuring fast economic progress in every economy [3, 9]. As well, steady growth has an extraordinary tendency of generating a virtuous cycle of prosperity and opportunities in a way that sustainable economic progress and increasing employment opportunities provide the necessary motivation for people to increase their investment on health and education. As a result, it leads to the emergence of quality and dynamic group of entrepreneurs that can generate the momentum for good and better governance [29]. It means that substantial and sustained growth, therefore, improves human development, and by implication, further supports economic growth. For this reason, to achieve sustainable economic growth in a developing country like Nigeria requires a genuine evaluation of factors determining economic progress as well as the significant population growth needed to support the output growth.

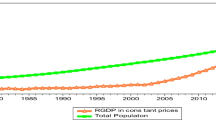

In the theoretical and empirical literature, the discussion of how population size affects economic growth has been an issue debated for long (see [8, 14, 17, 18], Atanda et al. [4, 40] among others). On the first hand, many economic analysts believe that the real output growth of the advanced economies may relatively slow down in the coming years owing to the prediction of slow population growth in these countries [5, 40]. On the other hand, others raised concerns about the problematic nature of the teeming population growth rate particularly in the less-developed countries as it limits the potential of achieving long-term growth because more people are using more of the limited resources [20]. Besides, population growth affects many economic and demographic factors like the labour force size, age structure of a country’s population, local and international migration, economic inequality, and poverty incidence. Thus, these variables are affected and are equally affected by economic growth. This study, therefore, used the data of the Nigerian economy to investigate the existing relationship among population growth, growth rate of income, and per capita income growth in order to unveil whether population growth is an asset or a liability to economic growth. Also, we deduce appropriate policy implications for economic equality, resettlement guiding rules, and overall economic growth (Fig. 1).

The need to establish the link between population growth and economic growth in Nigeria becomes germane due to the following reasons. First, the effect of her high population on the economy can be devastating if not well managed. According to Worldmeter [43], the country is the most populous black nation in the world as well as the most populated country in Africa. Although the country's population can be an enormous economic strength if well managed, and at the same time, it also poses a great challenge and security risk if left unchecked. The British High Commissioner to Nigeria, Paul Arkwright, noted that the poor management of the country's teeming human capital could result to the following problems: a high number of children that are out of school, increase hunger, cause population explosion, high urban resettlement, unhealthy rivalry for limited resources, low access to quality education and healthcare services, and high rate of youth unemployment [39].

Second, Nigeria’s growth rate of output has not been able to lift a sizeable number of poor people out of abject poverty and also improve the living standard of average Nigerians. Scholars such as Sanusi [36], and Maku and Alimi [21] classified the Nigerian economic growth as jobless growth. According to the World Data Lab (2019), approximately half of the country’s citizens live in abject poverty. The institution further noted that about four million new Nigerians joined the poverty club in 2019 as she becomes the poverty capital of the world by overtaking India to take the first position [35]. Also, the sustainability of the Nigerian economic growth is highly uncertain as the statistics published by the National Bureau of Statistics shows that the recent Economic Recovery and Growth Plan (ERGP) launched by the federal government in March 2017 to turn around the slump situation is off-target [16]. According to the institution, the projection of strong GDP growth at 4.5% in 2019 was missed as the economy grows at 2.01% in 1st quarter, falls to 1.94% in 2nd quarter, again rises to 2.28% in quarter three and marginally drops to 2.27% in 4th quarter [27]. While the 2019s overall output growth stood at 2.3%, marginally higher than 1.9% recorded in 2018 [2], yet, only three sectors (i.e. mining and quarrying, arts, entertainment and recreation, and financial and insurance out of the nineteen sectors)Footnote 1 experienced positive shift [27, 28].

Third, there is only little consensus in the literature despite the extensive research on the links between population growth and economic progression. Some scholars provide theoretical and empirical argument to support the notion that population growth enhance economic growth, whereas others offer convincing evidence to oppose the former’s submission (see [8, 14, 17, 18], Atanda et al. [4, 25, 40]). Meanwhile, some provide arguments that the direction of the outcomes depends on the level of development of a country, population source and nature, among others [40]. Heady and Hodge [14] also noted that the differences in empirical findings could be linked to the estimation approaches, time frame, variable measurements, and other controlling factors, and so on.

We thereby contribute to the existing literature in the following ways. First, the research work arguments the empirical model with salient economic drivers of growth like investment, government consumption, and trade openness. We presented the economic variables in a single empirical model to evaluate their effects on economic growth. Second, unlike the previous studies that used either real output growth or per capita income growth as measures of economic growth in a static form, we consider both and also provide empirical outcomes in a dynamic equation form in order to give room for more policy options. Third, the study employs both autoregressive distributed lag (ARDL) to cointegration and fully modified ordinary least square (FM-OLS) as they were found more efficient for studies where the regressors are endogenous [24]. More so, this is an improvement over past studies that employed the residual-based cointegration test linked with Engle and Granger [12] and maximum likelihood test connected with Johansen and Juselius [15]. Finally, as the country aimed towards achieving the first,Footnote 2 second,Footnote 3 thirdFootnote 4 and fourthFootnote 5 agenda of the sustainable development goals (SDGs), the targets can be achieved if the government and its agencies use the outcomes of this research work to inform their policies towards strategizing the current population size as potential assets that could bring about the desired economic growth.

Other parts of this study are divided into four sections. The second section of the study discusses the theoretical and empirical literature while we present the methodology in the third part. The discussion of results and findings are presented in the fourth part while the last section concludes and suggests policy recommendation.

Synthesizing the literature

One of the earliest theories that explain how population growth adversely affects human wellbeing is the Malthusian theory of population by Thomas Robert Malthus in his 1798 write-up titled “Essay on the Principle of Population” [22]. The proponent of the theory believes that population grew at a faster rate than food supplies thereby requiring population reduction through different types of misery to ensure that the number of people is kept at a consistent level with the total quantity food produced. It implies that the average level of income influenced by population growth rate will only be adequate for the populace’s survival. Wesley and Peterson [40] confirm the submissions made by Malthus [22] and also conclude that the findings represent the exact working of the past but completely missed it for the future. Specifically, using the dataset of the World Economics [42] from 1000 to 1820, they found that the rate of population growth in England stood at 0.29%, whereas its income per capita growth and overall economic growth rate averaged at 0.12% and 0.41%, respectively. Malthus [22] further suggests that the two checks that will make population growth to be at the same level as food supply growth are “preventive checks” and “positive checks”. First, the prevention checks consist of self-restraint and denial from nuptials until balanced finance is feasible (moral restraints) and stopping marriage of people who do not have the financial capacity. Second, positive checks such as early deaths resulting from disease outbreaks, hunger, and war, tagged as the “Malthusian catastrophe”. According to Desrochers and Hoffbauer [10] and Marsh and Alagona [23], the disaster would lead to a reduction in population size that is much more sustainable.

What is more, as the world begins to experience the industrial revolution, both population and income started increasing as well as the food supplies. Peterson [33] noted that the growth rate of agriculture food supplies witnessed a faster growth than the population over the last 200 years. Nonetheless, this does not mean that the question of how population growth influenced income per capita growth has been resolved even though technological advance has made income and food supplies grow above their subsistence levels [40]. In the latter part of the twentieth century, many Malthusian scholars like Ehrlich [11], among others, revived the argument of Malthus when the population of the low-income countries started growing at an alarming rate. They were more concern about the population that it would reach a rate that will subdue the capacity of the ecosystem and resources to produce foods and other commodities that will sustain human lives [40]. Scholars such as Boserup [7] and Simon [37] went contrary by arguing that the issue of population growth is overstated. They noted that the growing population would spur technological advancement and more intellects springing from the population growth would be used to solve resource and human problems.

Besides, in the case of some simple growth model, the Harrod–Domar growth model that assumes fixed factor inputs proportions and constant marginal return, suggest that an indirect relationship between population growth and per capita income growth. The constant return to scale is considered neutral in the existing relationship between population growth and overall output growth since the amount of capital investment entirely determines the entire output growth. The model has been mostly abandoned based on the criticisms received on the assumption of fixed factors proportions even though its simple formation have received considerable support for simple cross-country regression model [17, 18].

In the neoclassical growth model, Solow [38] distinguished growth between the steady-state and transitional effects. Under the steady-state, the thought argued that high population growth leads to a low-income per capita, whereas it does not affect income per capita growth. It means that in the steady-state, an economy grows with its population growth rate, including technological advancement. In contrast, income per capita growth is neutral to the rate of population growth. Thus, income per capita growth is influenced negatively by population growth in the transitional effect. The proposition that population growth has an inverse relationship with the steady-state income per capita and transitional per capita income growth follows roughly the submission of the Harrod–Domar model. It implies that an increase in population growth make economies to employ their scarce savings to embark on capital investment widening instead of capital deepening [17, 18]. For example, a preliminary analysis by Wesley and Peterson [40] for the whole world sourced from the World Bank [41] database within the period 1990–2015, found a correlation coefficient of − 0.1849, which implies that the relationship between the two variables is uncorrelated.

Further, Atanda et al. [4] analysed the trend analysis of factors determining population growth as well as its impact on real income per capita of five developing (Bangladesh, Ethiopia, Indonesia, Mexico and Nigeria) and two developed (Germany and United States) countries. The study revealed that socio-economic factors responsible for rapid population growth are birth rate, fertility rate, mortality rate, life expectancy and dependency ratio of children below the age of 15 years. More so, the authors discovered that the developed countries with high population size have a higher real income per capita in contract to the selected less-developed countries. Brander and Dowrick [8] examine the links between fertility, population and output growth using a panel data of 107 countries from 1960 to 1985. They employed a battery of four estimation techniques (namely pooled OLS, fixed, random and instrumental variables) to establish the relationship between the variables. The study found that birth rate influence economic growth negatively through the investment channel possibly through “capital dilution”. Also, its impact on income per capita growth shows a strong medium-term negative effect via labour supply, i.e. “dependence effects” [8]. Likewise, while investigating the links between population, growth and poverty in Uganda within the period 1960–2000, Klasen and Lawson [17, 18] found theoretical supports that population growth is responsible for low-income growth and persistent high increase of poor households in the country. Meanwhile, Mesagan et al. [25] found that population growth and energy consumption lead to an increase in the Nigerian economic growth within the period of 1981 and 2015.

A cursory look at the literature indicates that there are not just litany studies establishing the links between population growth and economic growth in the developing countries including the Nigerian economy but the findings can best be described as inconclusive. Most importantly, relatively few of these studies situate their findings towards the theories of population and economic growth. More so, most of these studies only consider the demographic factors such as birth rate, fertility rate, mortality rate, life expectancy among others in the process of establishing the links between population and output growth, but neglected the effects of key economic drivers of growth such as investment, government consumption and trade openness. Moreover, only a few of these studies consider the dynamic nature of income growth. At the same time, the majority failed to use the appropriate estimation approaches based on the stationary behaviour of the datasets. For that reason, this study aims to use the autoregressive distributed lag (ARDL) model and also employ other economic variables in modelling the growth model of the Nigerian economy in order to gain better insights into growth and demographic policy framework.

Methods

Model specification, theoretical expectation and data source

Following the theoretical foundation of the neoclassical growth model, this study adapts and modifies the models of Brander and Dowrick [8] and Klasen and Lawson [17, 18] to specify the relationship between population growth and economic growth as follows:

Economic growth represented by gdp is determined by factors like investment (gfcf) and population growth (popg), while \(\varphi_{0}\) is the constant, \(\varphi_{1 - 2}\) are the coefficients of the two output growth determinants; t denotes time and \(\mu\) is the disturbance term. In order to accommodate other determinants of economic growth like government consumption (gcon) and trade openness (topen), the model specification is re-specified as:

The explanatory variables included in Eq. (2) are to be estimated. In the model specification, gdp is a vector of economic growth measured by both growth rate of real gross domestic product (GDP) and GDP per capita; gfcf denotes capital investment as a ratio of GDP; popg represents population growth; gcon is government consumption to GDP; topen denotes total trade to GDP;\(\varphi_{0}\), \(\varphi_{1 - 4}\) are parameters; t denotes time and \(\mu\) is the error term.

In regards to the a’priori expectation, the study expects a direct relationship between population growth and economic growth. It means that a high-population growth rate should drive economic growth. Similarly, we presume positive relations from capital investment, government consumption and openness to trade to economic growth. The study employs a time series of data sets covering a period of 1981–2018, sourced from the World Development Indicators (2019).

Estimation approaches

The estimation techniques used to evaluate the parameter estimates are autoregressive distributed lag (ARDL) and fully modified ordinary least square (FMOLS). The ARDL bounds testing method is employed because it has the potential of determining both the short-run and long-run effects of the explanatory variables on economic growth. It also has the advantage of giving reasonable estimates over other estimation approaches when the sample size is small. The method built on the F-statistics (Wald test) to evaluate the economic implication of lagged variables in an unrestricted and conditional dynamic error correction form [31, 32]. Also, the estimation method is applicable whether the stationarity results of the variables are integrated at levels or first difference or both. Based on the specification of Pesaran and Shin [31], the study estimates the unrestricted error correction model:

where gdp stands as the dependent variable, VA is a vector of the explanatory variables, \(\Delta\) is the difference operator, p denotes the lag structure, \(\phi_{0}\) is a drift, \(\phi_{1} ,\phi_{2}^{^{\prime}}\) are the short-run dynamic coefficients, \(\theta_{1} ,\theta_{2}^{^{\prime}}\) are the long-run multipliers relative to the long-run estimates, and \(e\) is the white-noise error. Afterwards, the F-statistics of the joint significance of lagged levels of the variables are examined in order to reject or not to reject the null hypothesis of non-existence of long-run relationship among the variables in the equation. The following null and alternative hypotheses tested are:

The calculated F-values are compared with the values of both the upper and lower bounds of Narayan and Smyth [26]. If the F-test value is greater than the upper critical bound value, we reject the null hypothesis of no long-run relationship. On the contrary, we do not reject if F-statistics is less than the lower bound value. Meanwhile, the result becomes inconclusive if the F-statistics lies between both lower and upper bound values [24].

The study further tests the sensitivity of the long-run coefficients of the ARDL bound approach using the FMOLS method. The FMOLS use a semi-parametric approach while estimating the long-run parameter estimates [6, 13]. The coefficients obtained are consistent even when the sample size is small, and it has the capability of overcoming the problems of serial correlation, endogeneity, measurement errors, omitted variables and heterogeneity in the long-run coefficients [6, 13]. According to Bashier and Siam [6], the technique estimates a single cointegrating equation that has a combination of first difference variables. Park [30] noted that the method makes transformation to both coefficients and data. The FMOLS estimator is given as:

The two terms that correct the problem of endogeneity and serial correlation are \(Y_{t}^{ + }\) and \(\lambda_{{12^{\prime}}}^{ + }\) [34]. Adom et al. [1] noted that the estimator is unbiased asymptotically and also exhibits an efficient normal distribution of the disturbance terms which allows for standard Wald test through the asymptotic chi-square statistical inference.

Results and discussion

Summary statistics and correlation analysis

The summary statistics of the sample data used for the empirical analysis in this study are presented in Table 1. The average values of GDP and GDP per capita are US$235 billion and US$1758.6, while their respective growth rates stand at 3.18% and 0.55%. More so, the mean value of population growth rate at 2.58% has maximum and minimum values of 2.71% and 2.49%, respectively. This shows that the average growth of the population is far higher than the income per capita but less than the overall economic growth. It implies that the rapid growth of real GDP in the country does not improve the overall economic well-being due to its increasing population growth rates. It thus supports the submission of Malthus [22] that population growth drives down the country’s average income per capita growth to a level that only makes it subsistent to her population. The table also shows an indication that the above variables are exemplified by a marked disparity, indicating that they have high values in some years, whereas, in other years they are abysmally low except the population growth that ranges between 2.49 and 2.71%. In terms of their disparity from the average points, the standard deviation values are relatively high for the variables measuring the level of income and economic well-being.

The mean values of investment, trade and government consumption to the size of the Nigerian economy are 3.22%, 32.26% and 3.69%, respectively, while their corresponding standard deviation values stand at 19.57%, 12.57% and 2.87%. Apart from the above statistics, the table also presents the result of other statistics like the skewness, Kurtosis and Jarque–Bera tests. Concerning the results of the skewness test, it shows that all the variables with exemption to GDP growth, GDP per capita growth and trade openness are positively skewed, indicating that the distributions are rightward skewed. The results further indicate that the variables are not normally distributed as they failed to comply with the benchmark of 3.0 for the Kurtosis statistic. Specifically, GDP growth, GDP per capita growth and investment are leptokurtic, i.e. highly peaked, whereas others are platykurtic indicating that they have flat surface.

The correlation matrix revealing the level of association between the variables employed in establishing the links between population growth and economic growth position of Nigeria is presented in Table 2.

Table 3 that population growth has a positive level of association with both income growth and per capita income growth. However, the level of relations is stronger in the former than the latter. It implies that the variables were correlated during the periods, but the relationship is weak. Likewise, it is apparent that trade openness and government consumption have a direct correlation with the indicators of income growth. However, a negative relationship is reported in the case of investment and real income growth and income per capita growth. More so, the correlation coefficients of the explanatory variables are also reported. Their level of association suggests the absence of the presence of multicollinearity problem in the study. Nonetheless, the results are just preliminary analyses which are subject to empirical validation where other critical economic factors are considered.

Stationarity and cointegration test results

The result of the unit root tests using the augmented Dickey–Fuller (ADF) tests is presented in Table 3. The outcomes of the stationarity tests of the variables are reported at both levels and first difference. As well, the results are conducted with constant and trend, and when there is constant and no trend. In the table, we observe that the null hypothesis of unit root cannot be rejected for the variables at the individual linear trend model. It thus suggests that the variables are not stationary at levels. However, in the case of first difference presented in Table 3, we observe that the variables employed in the model are stationary for the periods. In conclusion, the variables are non-stationary at levels, but they are all stationary at first difference.

After confirming the stationarity level of our variables, we can then proceed to find whether there exists a long-run relationship among the variables by using the ARDL bound test and also estimate both the short-run and long-run estimates of our parameters. The null and alternative hypotheses for the models are specified below:

Using the Akaike Information Criterion (AIC) to select the lag length automatically, the result of the ARDL bound tests for establishing the long-run relationship among the variables is presented in Table 4. The values proposed by Pesaran et al. [32] for the restricted intercept and no trend were selected for the critical bounds. The hypothesis was tested across different level of significance with F-statistics at k = 4 against the critical bound values. The results of the ARDL bound test presented in Table 4 show that the F-statistic values are higher than the critical values at the upper bound levels. As a result, we do not accept the null hypothesis of no cointegration for the four models at 1%, 5% and 10% levels. It, therefore, confirms that there is an established and exceptional long-run relationship between population growth and overall output growth, coupled with other economic variables within 1981 and 2018.

Based on the confirmation of the existence of a stable long-run relationship among the estimated variables, we estimated both the short-run and long-run parameters which are presented in Table 5 and Appendixes 1 and 2, respectively. A cursory glance at the empirical results presented in Table 4 showed that population growth positively and significantly impacts the economic growth measured by both the growth rate of real GDP and GDP per capita. However, the impact of population growth is more on the former than the latter. The economic implication of the result is that the population growth of the country has immensely improved economic growth. The findings are in support of the result reported by Brander and Dowrick [8] for a panel of 103 counties and Atanda et al. [4] for some selected developing and developed countries. It, however, opposes the empirical submission of Klasen and Lawson [17, 18] that growth in population is responsible for slow income growth in developing countries. Nevertheless, in the short-run, the effects of population growth at first lag reported negative coefficients and also significant at 5% level (see Appendixes 1 and 2). It means that the rising population growth is equally responsible for the short-run market-determined output growth in Nigeria.

Also, the parameter estimates of investment and government consumption are negative and significant in deteriorating economic growth in Nigeria. The magnitude of the coefficients of investment and government consumption are more for income per capita growth than overall output growth. The result shows the crowd-out effect of government expenditure on both the growth rate of Nigeria’s overall income and her income per capita in the long-run.Footnote 6 It implies that the persistent increase in government deficit financing curtails the private sector spending as it discourages businesses from making capital investments due to the absorbing effect of the country’s lending capacity. However, it shows that the two variables support the growth of income and its per capita growth as their coefficients have positive values and also significant at the conventional level (see Appendixes 1 and 2). It, therefore, supports the findings of Lin [19] conducted for both developed and less-developed countries.

However, the result from the table suggests that trade openness has a positive and insignificant effect on economic growth both in the long- and short-run. It thus means that openness of trade is not a significant factor determining the level of economic growth in Nigeria. The diagnostic test and stability test of the empirical models are also reported in Table 5. The error correction terms (ECT) of − 0.3296 and − 0.9563 mean that the models converge in the long-run as their adjustment rates are at 32.96% and 95.63%. This further gives credence to the existence of a long-run relationship reported between both population and economic growth for Nigeria. The diagnostic test suggests that the models are well-specified, normally distributed, no serial correlation, and absence of heteroskedasticity. The stability of the empirical models is confirmed by the results of both cumulative sums of squared and cumulative sum statistics at a 5% significance level.

Furthermore, the results in line with the specification of Harrod–Domar and Solow models are reported and presented in Table 6. Based on the reported results, population growth has a direct impact on overall economic growth in both model specifications. However, the coefficient of population growth is smaller than one, implying that the new number of a person living in the country has a lower proportion impact on the overall economic growth. It, thus, supports the proposition of the neo-classical thought that high population growth leads to a low-income per capita but negates the presumption of no effect on income per capita growth under the steady-state. The economic implication is that if the country maintains its current level of population growth and also taking the opportunity of its full potentials, the growth rate of income and per capita income will substantially improve. The negative and significant coefficient values of investment further buttress our earlier presumption of the crowd-out effect of government spending on investment. On average, government spending and trade openness have no significant impact on economic growth with the periods under study.

Conclusion

In this research paper, we shed light on whether population growth is an asset or a liability to the economic growth of Nigeria using a time series data set for the sample periods of 1981 to 2018. The study employs a battery of two estimation methods—the ARDL approach to cointegration and fully modified least square, and the datasets were sourced from the World Development Indicator (2019). Apart from applying the primary dataset, i.e. population growth, GDP and GDP per capita; other factor determinants of economic growth considered are capital investment, government consumption and openness to trade. The long-run relationship confirms that a long-run relationship exists between population growth and economic growth in Nigeria. The result confirms that population growth has a positive and significant impact on the overall economic growth measured by both real income growth and income per capita growth. More, so the effect of population growth is more on the former than the latter, thereby supporting the neo-classical propositions of high population growth and low-income per capita under the steady-state. However, the effect of population growth reports a negative coefficient in the short run, meaning that it has a detrimental effect on economic growth.

The policy implication of a positive relationship between population growth and economic growth in the long-run indicates that current population growth of the country has the adequate potential of promoting economic growth. Meanwhile, population growth during the short-run is detrimental to economic growth probable because of the high number of dependents. In the long-run, there are chances of the demographic dividend that makes the young people becomes productive in their adulthood. This study supports the league of many studies that population remain an asset to long-run economic growth whereas a liability to output growth in the short-run. We recommend the proper and adequate utilization of the country’s rising population into the appropriate areas of the economy where their efforts would be fully utilized towards improving the overall economic growth of Nigeria. Also, there is need for governmental support in human capital development (most notably in health and education), empowerment programmes and socio-economic infrastructure in order to make the teeming youths useful to themselves and also become a good ambassador of the country.

Availability of data and material

It will be made available on request.

Notes

The first goal of the joint efforts of the seventh SDGs is to eradicate extreme poverty by 2030 by making sure that resources are available to every person in the world, most notably the vulnerable and the poor.

It is targeted towards putting an end to hunger and malnutrition by providing safe, nutritious and sufficient food to children, and the less-privileges through improved productivity in the agricultural sector and increasing the income of small-scale food producers.

To put an end to child and maternal deaths globally and also eradicate the epidemics of various diseases like malaria, HIV/AIDS, tuberculosis, and other water-borne diseases.

Improve the quality of education by ensuring equal, quality, and affordable education to all girl and boy child from nursery to tertiary education.

Empirical estimation of government consumption impact on investment shows a negative coefficient (− 3.2430) and statistical significant at 5% level. It further confirms the crowd-out effect of government spending on private investment. The results are available on request.

Abbreviations

- ARDL:

-

autoregressive distributed lag

- FM-OLS:

-

fully modified ordinary least square

- WDI:

-

world development indicators

References

Adom PK, Amakye K, Barnor C, Quartey G (2015) The long-run impact of idiosyncratic and common shocks on industry output in Ghana. OPEC Energy Rev 39(1):17–52

African Development Bank (2020) Nigeria economic outlook. Retrieved from https://www.afdb.org/en/countries-west-africa-nigeria/nigeria-economic-outlook

Alimi OY, Alese OJ (2017) Comparative analysis of investment funding in the Nigerian oil and agricultural sector. Int J Econ Account 8(1):67–82

Atanda AA, Aminu SB, Alimi OY (2012) The role of population on economic growth and development: evidence from developing countries. MPRA paper number 37966. Accessed from https://mpra.ub.uni-muenchen.de/37966

Baker D, Delong JB, Krugman PR (2005) Asset returns and economic growth. Brook Pap Econ Act 1:289–330

Bashier A-A, Siam AJ (2014) Immigration and economic growth in Jordan: FMOLS approach. Int J HumanitSocSciEduc 1(9):85–92

Boserup E (1965) The conditions of agricultural growth: the economics of agrarian change under population pressure. Aldine, Chicago

Brander JA, Dowrick S (1993) The role of fertility and population in economic growth: empirical results from aggregate cross-national data. NBER working paper series 2720. Accessed from https://www.nber.org/papers/w4270.pdf

Department for International Development (2008). Growth: building jobs and prosperity in developing countries. Retrieved from https://www.oecd.org/derec/unitedkingdom/40700982.pdf/

Desrochers P, Hoffbauer C (2009) The post war intellectual roots of the population bomb. Electron J Sustain Dev 1(3):73–98

Ehrlich P (1968) The population bomb. Ballantine Books, New York

Engle RF, Granger CJ (1987) Cointegration and error-correction representation, estimation and testing. Econometrica 55:251–278

Fereidouni HG, Al-mulalia U, Mohammed MAH (2014) Wealth effect from real estate and outbound travel demand: the Malaysian case. Curr Issues Tour 20(1):68–79

Heady DD, Hodge A (2009) The effect of population growth on economic growth: a meta-regression analysis of the macroeconomic literature. Popul Dev Rev 35:221–248

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf Bull Econ Stat 52(2):169–210

Kazeem Y (2019) Nigeria’s ambitious “economic recovery plan” is not going according to plan. Quartz Africa. Retrieved from https://qz.com/africa/1624604/nigeria-economy-not-matching-government-projections/

Klasen S, Lawson D (2007a) The impact of population growth on economic growth and poverty reduction in Uganda. Diskussionsbeiträge, No. 133, GeorgAugust-Universität Göttingen, Volkswirtschaftliches Seminar, Göttingen. Accessed from https://www.econstor.eu/dspace/bitstream/10419/31966/1/534768717.pdf

Klasen S, Lawson D (2007b) The impact of population growth on economic growth and poverty reduction in Uganda. Diskussionsbeiträge, No. 133, Georg August-Universität Göttingen, Volkswirtschaftliches Seminar, Göttingen. Accessed from https://www.econstor.eu/dspace/bitstream/10419/31966/1/534768717.pdf

Lin SAY (1994) Government spending and economic growth. Appl Econ 26(1):83–94

Linden E (2017) Remember the population bomb? It’s still ticking. New York Times: Sunday Review, 4. Accessed from https://www.nytimes.com/2017/06/15/opinion/sunday/remember-the-population-bomb-its-still-ticking.html

Maku OE, Alimi OY (2018) Fiscal policy tools, employment generation and sustainable development in Nigeria. ActaUnivDanub Econ 14(3):186–199

Malthus TR (1993) An essay on the principle of population (Edited and with an introduction, Gilbert G). Oxford Press, New York (Original work published 1798).

Marsh M, Alagona PS (2010) Barron’s AP human geography. Barron’s Educational Series, Hauppauge

Mesagan EP, Ogbuji IA, Alimi OY, Odeleye AT (2019) Growth effects of financial market instruments: the Ghanaian experience. Forum SciOecon 7(4):67–82

Mesagan PE, Alimi OY, Adebiyi KA (2018) Population growth, energy use, crude oil price, and the Nigerian economy. Econ Stud 27(2):115–132

Narayan P, Smyth R (2005) Trade liberalization and economic growth in Fiji: an empirical assessment using the ARDL approach. J Asia Pac Econ 10(1):96–115

National Bureau of Statistics (2020) nigerian gross domestic product report (Q1-Q4), various issues. Retrieved from https://nigerianstat.gov.ng/

Owolabi P (2020) Three out of 19 sectors recorded positive growth in Q4 of 2019 GDP-NBS. International Centre for Investigative Reporting. Retrieved from https://www.icirnigeria.org/three-out-of-19-sectors-recorded-positive-growth-in-q4-of-2019-gdp-nbs/

Papademos L (2003) The contribution of monetary policy to economic growth. A paper presented by the Vice President of the European Central Bank for the “31st Economic Conference, Vienna on 12th June, 2003. Retrieved from https://www.ecb.europa.eu/press/key/date/2003/html/sp030612_3.en.html#ftn.fn1

Park JY (1992) Canonical cointegrating regressions. Econometrica 60(1):119–143

Pesaran MH, Shin Y (1999) An autoregressive distributed-lag modelling approach to cointegration analysis. In: Strom S (ed) Econometrics and economic theory in the 20th century. Cambridge University Press, Cambridge, pp 371–413

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J ApplEconom 16(3):289–326

Peterson EWF (2009) A billion dollars a day: the economics and politics of agricultural subsidies. Wiley-Blackwell, Malden

Priyankara E (2018) The long-run effect of services exports on total factor productivity growth in Sri Lanka: based on ARDL, FMOLS, CCR, and DOLS approaches. Int J Acad Res Bus SocSci 8(6):233–253

Saharan Reporters (2019) 91.8 million Nigerians are extremely poor, Says World Poverty Clock: Since June 2018, four million Nigerians have joined the poverty club. Retrieved from http://saharareporters.com/2019/06/05/918-million-nigerians-are-extremely-poor-says-world-poverty-clock

Sanusi AR (2012) Output and unemployment dynamics in Nigeria: Is there evidence of jobless growth? Niger J EconomSoc Stud 54(3):253–272

Simon JL (1981) The ultimate resource. Princeton University Press, Princeton

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

The Guardian (2018) Nigeria’s population as a blessing. Accessed from https://guardian.ng/opinion/nigerias-population-as-a-blessing/

Wesley E, Peterson F (2017) The role of population in economic growth. SAGE Open 7:1–15

World Bank (2017) World development indicators. Retrieved from http://databank.worldbank.org/data/reports.aspx?source=worlddevelopment-indicators

World Economics (2016) Maddison historical GDP data. Retrieved from http://www.worldeconomics.com/Data/MadisonHistoricalGDP/Madison%20Historical%20GDP%20Data.efp

Worldmeter (2019) African countries by population. Accessed from https://www.worldometers.info/population/countries-in-africa-by-population/

Acknowledgements

Not applicable.

Funding

This is not applicable.

Author information

Authors and Affiliations

Contributions

OYA: Conceptualization, methodology, software, formal analysis, data curation, writing—original draft, reviewing and editing. ACF: Resources, data curation, writing—reviewing and editing. MA: Resources, data curation, writing—reviewing and editing. All authors have read and approved the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors have no actual or potential conflict of interest with any individual, groups or organizations.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: ARDL short-run estimates (GDP growth)

Dependent variable: D(GDPG) |

Selected model: ARDL(4, 2, 2, 4, 1) |

Case 2: Restricted constant and no trend |

Sample: 1981 2018 |

Variable | Coefficient | SE | t-Statistic | Prob |

|---|---|---|---|---|

ECM regression | ||||

Case 2: Restricted constant and no trend | ||||

D(GDP(− 1)) | − 0.151292 | 0.148234 | − 1.020631 | 0.3226 |

D(GDP(− 2)) | − 0.208357 | 0.137677 | − 1.513375 | 0.1497 |

D(GDP(− 3)) | − 0.371498 | 0.115222 | − 3.224199 | 0.0053 |

D(GFCF) | − 0.005925 | 0.001090 | − 5.433407 | 0.0001 |

D(GFCF(− 1)) | 0.006551 | 0.001653 | 3.964208 | 0.0011 |

D(POPG) | 4.510312 | 0.957295 | 4.711518 | 0.0002 |

D(POPG(− 1)) | − 4.974229 | 1.018397 | − 4.884369 | 0.0002 |

D(GCON) | − 0.008672 | 0.004181 | − 2.074134 | 0.0546 |

D(GCON(− 1)) | 0.029069 | 0.006181 | 4.703180 | 0.0002 |

D(GCON(− 2)) | 0.017860 | 0.004184 | 4.268821 | 0.0006 |

D(GCON(− 3)) | 0.012695 | 0.004570 | 2.777636 | 0.0134 |

D(TOPEN) | 0.000681 | 0.000478 | 1.424140 | 0.1736 |

ECT(− 1) | − 0.329620 | 0.046877 | − 7.031544 | 0.0000 |

R-squared | 0.804291 | Mean-dependent var | 0.043252 | |

Adjusted R2 | 0.692457 | S.D.-dependent var | 0.036801 | |

S.E. of regression | 0.020408 | Akaike info criterion | − 4.662868 | |

Sum squared resid | 0.008747 | Schwarz criterion | − 4.079259 | |

Log likelihood | 92.26875 | Hannan–Quinn criter | − 4.463840 | |

Durbin–Watson stat | 2.054777 |

Appendix 2: ARDL short-run estimates (GDP Per capita growth)

Dependent variable: D(GDPPC) |

Selected model: ARDL(2, 2, 3, 3, 0) |

Case 2: Restricted constant and no trend |

Sample: 1981 2018 |

Variable | Coefficient | SE | t-Statistic | Prob |

|---|---|---|---|---|

ECM regression | ||||

Case 2: Restricted constant and no trend | ||||

D(GDPPC(− 1)) | 0.254644 | 0.094118 | 2.705578 | 0.0136 |

D(GFCF) | − 0.004931 | 0.000834 | − 5.911279 | 0.0000 |

D(GFCF(− 1)) | 0.006268 | 0.001347 | 4.654886 | 0.0002 |

D(POPG) | 2.864308 | 0.811654 | 3.528975 | 0.0021 |

D(POPG(− 1)) | − 2.845110 | 1.094943 | − 2.598411 | 0.0172 |

D(POPG(− 2)) | − 1.949838 | 0.747668 | − 2.607891 | 0.0168 |

D(GCON) | 0.004689 | 0.003117 | 1.504272 | 0.1481 |

D(GCON(− 1)) | 0.011798 | 0.003847 | 3.066427 | 0.0061 |

D(GCON(− 2)) | 0.009749 | 0.003263 | 2.987438 | 0.0073 |

ECT(− 1) | − 0.956385 | 0.120686 | − 7.924539 | 0.0000 |

R-squared | 0.829562 | Mean-dependent var | 0.015901 | |

Adjusted R-squared | 0.768204 | S.D.-dependent var | 0.037238 | |

S.E. of regression | 0.017928 | Akaike info criterion | − 4.969900 | |

Sum squared resid | 0.008036 | Schwarz criterion | − 4.525514 | |

Log likelihood | 96.97324 | Hannan–Quinn criter | − 4.816498 | |

Durbin–Watson stat | 2.416293 |

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Alimi, O.Y., Fagbohun, A.C. & Abubakar, M. Is population an asset or a liability to Nigeria’s economic growth? Evidence from FM-OLS and ARDL approach to cointegration. Futur Bus J 7, 20 (2021). https://doi.org/10.1186/s43093-021-00069-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s43093-021-00069-6