Abstract

The global energy system has a long way to go to meet international climate goals, and significant investment in renewable energy is required to accelerate the energy transition (IRENA, 2016, 2019). We examine how firm- and country-specific conditions in the electric utility sector impact foreign direct investment (FDI) in renewables. Using a unique dataset of 289 greenfield investments by 17 multinational energy utilities, we employ a fuzzy set qualitative comparative analysis (fsQCA) that yields five causal configurations leading to FDI in renewables and four configurations leading to investment in non-renewables. Our results indicate that private MNEs are at the forefront of investment in renewables, and while state-owned MNEs (SOMNEs) do invest in them, they tend to follow strategies that are less risky compared to private MNEs and more responsive to host-country incentives. Our analysis suggests that for private MNEs, international experience is strongly associated with investment in renewables, while for SOMNEs it is associated with investment in non-renewables. Further, we also identify instances where MNEs contribute simultaneously to a ‘race to the top’ and a ‘race to the bottom’ by investing in both renewables and non-renewables in different markets, thereby reducing the pace of the energy transition.

French

Le système énergétique mondial a un long chemin à parcourir pour atteindre les objectifs climatiques internationaux, et des investissements importants dans les énergies renouvelables sont nécessaires pour accélérer la transition énergétique (IRENA, 2016, 2019). Nous examinons comment les conditions propres à une entreprise et à un pays dans le secteur des services publics d'électricité influent sur l'investissement direct étranger (IDE) dans les énergies renouvelables. En utilisant un ensemble unique de données de 289 investissements ex-nihilo par 17 sociétés multinationales d'énergie, nous utilisons une analyse comparative qualitative de variables floues (ACQvf) qui produit cinq configurations causales menant à l'IDE dans les énergies renouvelables et quatre configurations menant à des investissements dans les énergies non renouvelables. Nos résultats indiquent que les EMN privées sont à l'avant-garde des investissements dans les énergies renouvelables et, bien que les EMN appartenant à l'État (EMNAE) y investissent, elles ont tendance à suivre des stratégies moins risquées que les EMN privées et plus sensibles aux incitations du pays hôte. Notre analyse suggère que pour les EMN privées, l'expérience internationale est fortement associée à l'investissement dans les énergies renouvelables, tandis que pour les EMNAE, elle est associée à l'investissement dans les énergies non renouvelables. En outre, nous identifions également des cas où les EMN contribuent simultanément à une "course vers le haut" et à une "course vers le bas" en investissant à la fois dans les énergies renouvelables et non renouvelables sur différents marchés, réduisant ainsi le rythme de la transition énergétique.

Spanish

El sistema energético global tiene un largo camino por recorrer para alcanzar los objetivos climáticos internacionales, y una inversión significativa en energía renovable es requerida para acelerar la transición energética (IRENA, 2016, 2019). Examinamos como las condiciones específicas de empresa y país en el sector de servicio público eléctrico impacta la inversión extranjera directa (IED) en renovables. Utilizando una base de datos única de 289 inversiones totalmente nuevas realizadas por 17 multinacionales de servicios públicos de energía, empleamos un análisis cualitativo comparado de conjuntos difusos que arroja cinco configuraciones causales que lleva IED en energías renovables y cuatro configuraciones que llevan a inversiones en no renovables. Nuestros resultados indican que las multinacionales privadas están a la vanguardia en inversión en renovables, y mientras tanto las empresas multinacionales estatales (SOMNEs por sus iniciales en inglés) invierten en renovables, tienden a seguir estrategias que son menos arriesgadas comparadas con las empresas multinacionales privadas y que responden mejor a los incentivos del país anfitrión. Nuestro análisis sugiere que para las multinacionales privadas la experiencia internacional está fuertemente asociado con la inversión en energías renovables, mientras que para las multinacionales estatales está asociada con inversión en no renovables. Además, también identificamos casos en los cuales las empresas multinacionales contribuyen simultáneamente hacia una “carrera hacia la cima”, y una “carrera hacia abajo” al invertir en energías renovables y no renovables en diferentes mercados, y de ese modo reduciendo el ritmo de la transición energética.

Portuguese

O sistema global de energia tem um longo caminho a percorrer para atender metas climáticas internacionais, e investimentos significativos em energia renovável são necessários para acelerar a transição energética (IRENA, 2016, 2019). Examinamos como condições específicas da empresa e do país no setor elétrico impactam o investimento estrangeiro direto (FDI) em energias renováveis. Usando um conjunto de dados exclusivo de 289 investimentos greenfield por 17 concessionárias de energia multinacionais, empregamos uma análise comparativa qualitativa de conjunto difuso (fsQCA) que produz cinco configurações causais que levam a FDI em energias renováveis e quatro configurações que levam a investimento em não renováveis. Nossos resultados indicam que MNEs privadas estão na vanguarda do investimento em energias renováveis e, embora MNEs estatais (SOMNEs) invistam nelas, elas tendem a seguir estratégias que são menos arriscadas em comparação com MNEs privadas e mais responsivas aos incentivos do país anfitrião. Nossa análise sugere que, para MNEs privadas, a experiência internacional está fortemente associada ao investimento em energias renováveis, enquanto para SOMNEs está associada ao investimento em fontes não renováveis. Além disso, também identificamos casos em que MNEs contribuem simultaneamente para uma 'corrida para o topo' e uma 'corrida para o fundo', investindo tanto em energias renováveis e não renováveis em diferentes mercados, reduzindo assim o ritmo da transição energética.

Chinese

全球能源系统要实现国际气候目标还有很长的路要走, 需要大量投资可再生能源, 以加速能源转型 (IRENA,2016,2019) 。我们研究了电力行业中特定于公司和国家的情况如何影响对可再生能源的外国直接投资 (FDI) 。我们使用由17个跨国能源公司提供的289个绿地投资的独特数据集, 进行了模糊集定性比较分析 (fsQCA) , 得出了导致对可再生能源的FDI的五种因果配置和导致对非再生能源投资的四种配置。我们的结果表明, 私有跨国公司(MNE)处于可再生能源投资的最前沿, 尽管国有跨国公司 (SOMNE) 确实也进行投资, 但它们倾向于采取相对于私有跨国公司而言风险较小的战略, 并对东道国的激励措施反应更快。我们的分析表明, 对于私有跨国公司而言, 国际经验与对可再生能源投资密切相关, 而对SOMNE而言, 国际经验与对非再生能源投资相关。此外, 我们还找到了实例, 发现跨国公司通过在不同市场既对可再生能源又对非再生能源投资, 同时进行“上限竞争”和“底线竞争”,从而减缓了能源转型的步伐。

Similar content being viewed by others

INTRODUCTION

Utilities would have to modify corporate strategies…Increasing investments in renewables would support profits and help dilute the contribution from legacy assets [fossil fuels]. (Gandolfi et al., 2018: p. 37)

The above quote from an investment banker reflects the transitional phase between the old world of fossil fuels and the new world of renewable energy as well as the core strategic imperative faced by energy utilities. The energy utility sector is among the largest contributors to climate change, with electricity and heat generation being responsible for more than a quarter of all global greenhouse gas (GHG) emissions (IPCC, 2014). Until recently, the sector has been largely locked into carbon-intensive technologies, mainly based on coal and gas (Unruh, 2000). However, renewable technologies such as wind and solar power are quickly gaining market share, prompting hopes of a carbon-free energy system by the mid-21st century (Rockström et al., 2017). These hopes are reinforced by more stringent government policies such as the ‘European Green Deal’ announced in December 2019, which pledges the European Union to reach carbon neutrality by 2050 and tasks the Commission with developing the requisite legislation.1

An important part of the energy transition involves cross-border investment by multinational enterprises (MNEs) that enables more rapid technology diffusion (Cantwell, 1999; Arora, Fosfuri & Gambardella, 2001) and consequently faster and more efficient building of renewable capacity (Hanni, Van Giffen, Krüger & Mirza, 2011). Sustainable FDI flows into renewable energy (Sauvant & Mann, 2019) are particularly important in emerging and developing economies where emissions are increasing rapidly in line with growing energy needs (Benney, 2019; REN21, 2019). Today developing countries in Asia account for over 50% of global growth in generation from renewables, and renewables will provide the cheapest and safest source of energy for almost 1 billion people without electricity access (IEA, 2019). Whereas total (domestic and foreign) investment in power generation still relies quite heavily on fossil fuels, greenfield FDI by MNEs focuses predominantly on renewable energy (UNCTAD, 2019, p. 11). In fact, during the past decade, the value of greenfield FDI in renewables has exceeded that of fossil fuel-based projects every year (Ibid.). Given that renewable energy was the world’s third biggest industry sector for greenfield FDI between December 2013 and November 2018 (fDiIntelligence, 2019), this raises essential questions concerning the determinants of this type of FDI.

When it comes to environmental regulation, the empirical literature at the macro level has examined both the conditions leading to a ‘race to the top’, i.e., increasing flows of ‘clean’ investment, and the conditions leading to a ‘race to the bottom’ (Bu & Wagner, 2016; Cave, 2014). The latter case is often referred to as ‘pollution haven’ investment, denoting ‘dirty’ investments in countries with lax regulations (Levinson, 1997; Lin & Sun, 2016; Madsen, 2009). At the same time, studies at the micro level suggest that firm capabilities matter, and that ‘green’ or ‘clean’ firms might choose to race to the top (Bu & Wagner, 2016), i.e., choose locations with relatively more stringent regulation. In contrast, ‘dirty’ firms prefer locations with lower regulation, leading to adverse selection and a vicious cycle of polluting investment (Pisani, Kolk, Ocelik, & Wu, 2019). As yet, we know relatively little about what leads some multinational energy utilities to engage in FDI in renewables or clean investment, while others continue to invest in non-renewables or engage in dirty FDI. It is also unclear how these strategic alternatives are impacted by the regulatory and economic context in the host countries. Hence, it remains unknown how the drivers that have been identified as important in prior studies influence FDI in renewables (Kolk & Pinkse, 2008; Rugman & Verbeke, 1998; Shapiro, Hobdari & Oh, 2018). We address this gap by asking the following research question: Which combinations of firm- and host-country conditions lead to FDI in renewable energy?

In order to explore the strategic FDI decisions of energy utilities analytically, we draw on the FSA-CSA matrix (Rugman & Verbeke, 2001) together with the literature on state-owned MNEs (SOMNEs) (Aharoni, 2018; Cuervo-Cazurra, Inkpen, Musacchio & Ramaswamy, 2014; Rudy, Miller & Wang, 2016) and the literature specific to the energy sector outside the IB field. We undertake a fuzzy set qualitative comparative analysis (fsQCA) to study 289 foreign investments by 17 large energy utilities between 2010 and 2017. Such an approach is particularly appropriate when the constructs are known (in contrast to inductive qualitative research), but the complexity of relations between constructs remains unexplored (and is often masked by standard statistical analysis). By identifying how combinations of firm-specific advantages (FSAs) and country-specific advantages (CSAs) produce either positive or negative outcomes, configurational analysis is well suited to advance understanding in contexts where the interplay between firm-level conditions and institutional conditions shapes the responses of organizations (Crilly, Zollo & Hansen, 2012). Building on the pioneering analysis of Rugman and Verbeke (1998) concerning the strategic options faced by MNEs as a result of cross-border differences in environmental regulations, we assume that the outcomes are neither purely policy-driven nor simply the result of strategic decision-making by MNEs. By considering both FSAs and CSAs simultaneously as drivers of FDI, we are able to highlight their contingent nature in a field under flux such as the energy utility industry.

We identify five configurations of conditions leading to FDI in renewables and four configurations leading to FDI in non-renewables. We find that while highly internationalized private MNEs with technological capabilities follow renewable-dominated strategies regardless of the presence of CSAs, SOMNEs appear to follow more cautious strategies relying mainly on CSAs. Moreover, we find that high international experience seems to be associated with FDI in renewables and low international experience with FDI in non-renewables for private MNEs, while for SOMNEs it is the opposite. Interestingly, our configurational analysis also suggests that the same MNE may contribute simultaneously to both a ‘race to the top’ and a ‘race to the bottom’, extending and even challenging prior research highlighting the role of firm heterogeneity (Bu & Wagner, 2016).

We make three contributions to the literature. First, we shed light on the conditions, both at the micro (firm) and macro (country) level, which motivate FDI in renewables and non-renewables. Unlike most studies on the energy transition and environmentally responsible management practices in IB in general (Cave, 2014), our analysis highlights the role of endogenous strategic decisions by MNEs in addition to the effects of exogenous policy interventions by governments (Kolk, 2015) or general institutional conditions (Pinkse & Kolk, 2012). Second, we provide a richer understanding of the role and diverse strategies of SOMNEs in the energy transition and how the joint impact of state ownership and international experience influences FDI strategies. Third, by framing the configurational analysis as interplay between firm- and country-level drivers and by mapping these on an FSA-CSA matrix, we are able to demonstrate the net effect of the different configurations on the energy transition, and in doing so, avoid reductionist explanations.

FIRM- AND COUNTRY-SPECIFIC ADVANTAGES

A key element of the FSA-CSA matrix of Rugman and Verbeke (2001) is the need for MNEs to combine non-location bound (transferable) FSAs with host-country CSAs. However, since at least some FSAs are likely to be location-bound, the transfer of FSAs alone is likely to be insufficient, and the MNE also needs to generate some FSAs in the host country to complement the advantages transferred from home. This means that foreign investment entails uncertainties greater than those encountered by the firm in its domestic operations, and only firms with higher than average productivity and capabilities are able to develop transferrable FSAs sufficient to overcome the obstacles in foreign markets and engage in FDI (Dunning & Lundan, 2008; Rugman & Verbeke, 1998). In the IB literature, these obstacles are described as the liability of foreignness, which includes e.g., negative stereotyping and unfamiliarity with local market conditions and institutional environments (Zaheer, 1995) and a position as an outsider with potentially negative effects (Johanson & Vahlne, 2009).

The energy utility sector is characterized by high capital intensity, low R&D intensity, and the prominent role of government policies and state ownership that differentiate it from most manufacturing and service sectors. In the subsequent analysis, we employ the FSA-CSA matrix to identify conditions at the firm and country level that increase the likelihood of FDI in renewables in this sector. These include conditions that can unambiguously be classified as advantages, such as project-related technological capabilities at the firm level or incentives for renewables at the country level. However, they also include conditions that offer a benefit only for some firms in a particular host-country context (a specific combination of FSAs and CSAs). For example, while state ownership does not necessarily constitute a universal advantage owing to the great variety of different kinds of SOMNEs (Grøgaard, Rygh & Benito, 2019), there are specific country contexts that make a renewable investment by some SOMNEs more likely (Rudy et al., 2016).

FSAs Leading to FDI in Renewables

To shed light on the specific FSAs influencing FDI in renewable energy capacity, we draw on the IB literature and the still embryonic literature on SOMNEs and the energy transition. These bodies of literature highlight three potentially important firm-specific conditions influencing cross-border investments in renewables, namely technological capabilities, firm international experience, and state ownership.

Technological capabilities

Much of the attention in the IB literature concerning different types of FSAs relates either to possession of intangible assets, most notably proprietary technology, brands and trademarks, or alternatively to relational advantages with which MNEs are able to engage with actors in the local environment to obtain complementary resources and legitimacy (Rugman & Verbeke, 2001; Lundan, 2010). Both types of FSAs are also relevant in the context of climate change mitigation (Backman, Verbeke & Schulz, 2017) and are closely related to each other in regulated industries such as utilities. Previous studies have found that the possibility to influence the structure of new energy markets rests particularly on the MNE’s organizational and technological capabilities (Kolk, 2015). Such advantages are path dependent and are built through either internal development or acquisitions (Awate, Larsen, & Mudambi, 2015; Kolk & Pinkse, 2008).

Investment by energy utilities in renewable electricity is relatively recent (with the exception of hydropower), beginning in the 1990s. The most active investors have come from countries that incentivized renewables production relatively early on (Kannan & Vakeesan, 2016). Although by conventional measures the R&D intensity of energy utilities – around 0.4 % (IEA, 2018a) – is low, and much of the technology is developed by firms outside the utility sector, some firms in the industry have nonetheless developed FSAs in the operation and scaling up of investment in renewable energy. As utilities’ capacity in renewable power generation grows higher, they can accumulate unique firm-specific capabilities, such as knowledge on how to manage a portfolio of intermittent and non-intermittent energy generation. Therefore, we expect that firms with prior experience of renewables are more likely to have accumulated technological and relational capabilities resulting in transferable FSAs and FDI in renewables.

International experience

The propensity for cross-border investment in renewables is influenced by the accumulated foreign experience of the firm (Johanson & Vahlne, 2009; Kolk & Pinkse, 2008, 2012). Firms that have experience of investment in a greater number or variety of countries are assumed to possess general internationalization experience that can be brought to bear on new investment (Casillas & Moreno-Menéndez, 2014). In addition, firms may have acquired specific competences, such as the ability to apply their accumulated knowledge of policy processes across different institutional settings, which may develop into the ability to manage institutional idiosyncrasies in different contexts (Henisz, 2003). Past studies have shown that MNEs that are highly internationalized also develop capabilities for sustainability activities as they are exposed to global sustainability pressures (Chakrabarty & Wang, 2012). This is also reflected in the oil and gas sector, as more internationalized firms tend to have a higher commitment towards renewable energy (Hartmann, Inkpen & Ramaswamy, 2020). Greater international experience may also allow energy utilities to take advantage of unique locational resource endowments for renewable resources (e.g., high solar irradiance or optimal wind conditions) and develop capabilities that can be leveraged for investing in locations with less optimal conditions. Thus, in line with other industries, we expect the degree of international experience to have a positive effect on all energy-related FDI, including both renewable and non-renewable energy production.

State ownership

The issue of state ownership is particularly salient for the energy transition as SOMNEs control some 70% of oil and gas production (Nelson et al., 2014) and over 60% of total electricity generation capacity (Prag, Röttgers & Scherrer, 2018). SOMNEs in power generation are most prominent in China and Europe, although there are substantial differences in the influence of the state (Röttgers & Below, 2018; UNCTAD, 2017). Whereas full state ownership is common in China and other emerging markets, partially privatized firms where the state holds a majority or minority stake are common in Europe (Dahlmann, Kolk & Lindeque, 2017; Domanico, 2007). Since energy utilities are a critical part of the infrastructure, governments typically retain a regulatory role in overseeing the sector, even when they withdraw as majority owners (Henisz, 2003; Holburn & Zelner, 2010). This oversight is accomplished through direct regulation, energy pricing, and subsidies, the control of transmission networks, or of capacity expansion (Dahlmann et al., 2017). Additionally, governments often remain influential minority shareholders and are consequently important stakeholders in energy utilities (Cuervo-Cazurra, Inkpen, Musacchio & Ramaswamy, 2014; Mbalyohere, Lawton, Boojihawon & Viney, 2017).

Past studies have found that SOMNE investors may be less sensitive to host-country political risk than their private counterparts (Cannizzaro & Weiner, 2018; Vernon, 1979). They are often found to pursue social objectives at home and diplomatic or political objectives abroad (Musacchio & Lazzarini, 2018). Recent studies on European SOMNEs have indicated that European governments prefer a cautious strategy of regionalization in the internationalization paths of firms in which they hold ownership (Burger & Weinmann, 2016; Kolk, Lindeque & van den Buuse, 2014). A study by Benito, Rygh and Lunnan (2016) on Norwegian publicly listed SOMNEs shows that hybrid firms – owned jointly by governments and private investors – exhibit behavior resembling that of privately owned firms. A recent study by Lazzarini, Mesquita, Monteiro and Musacchio (2020) found that SOMNEs may also exhibit higher innovative capacity than their private counterparts, although this is moderated by the degree of government involvement in the SOMNE’s activities. State involvement in the energy sector has been found to favor higher-risk investments in comparison to private investors (Mazzucato & Semieniuk, 2018). Other related studies highlight the role of home-country institutional conditions for FDI. For instance, Grøgaard, Rygh and Benito (2019) find that SOMNEs originating from countries with high institutional quality behave more like private MNEs. Mariotti and Marzano (2019), in turn, suggest that in liberal market economies majority-owned SOMNEs exhibit a lower degree of internationalization than private enterprises (see also Estrin, Meyer, Nielsen, & Nielsen, 2016).

In sum, we expect that the degree of state ownership will have an impact on the investment strategies of SOMNEs (Bass & Chakrabarty, 2014), but it is not clear ex-ante whether this effect will be positive or negative for FDI in renewables, and to what extent is it also dependent on the host-country conditions. Governments may encourage their SOMNES to increase investment in renewables, both at home and abroad, or they may prioritize energy security and affordability, including expanded investment in non-renewables. Alternatively, they may choose to prioritize inward investment in renewables through incentives such as feed-in tariffs or as has been the case more recently, through public auctions (Keeley & Matsumoto, 2018). In line with the literature, we further expect that to the extent that there are differences between state-owned and privately owned MNEs, these differences should be less in the case of firms coming from developed countries and diminish with a lower share of state ownership in publicly listed companies.

CSAs Leading to FDI in Renewables

Beyond firm-specific capabilities, accumulated experience and ownership type, there are economic, institutional, and natural-endowment conditions at the country level that determine the attractiveness of specific markets for investment in renewables. We identify three such CSAs in the host country, namely demand growth, a declining trend in emissions, and the presence of public incentives for investment in renewables.

Host-country Demand Growth

Demand conditions in the host country are a key driver of cross-border investment (Hilleman & Gestrin, 2016; Rugman & Oh, 2008). Since the demand for energy is closely linked to the rate of economic growth, a high economic growth rate is a key driver for cross-border investments, for both renewable and non-renewable energy. In developed markets with lower growth in demand, investment in new power plants generally occurs only when existing plants are decommissioned and replaced (Lund et al., 2019). Although the decreasing cost of renewables has rapidly increased investment globally, in growing markets such as China, strong growth has also generated fossil-fuel-based investments (IEA, 2018b; UNEP, 2019). SOMNEs in particular may be inclined to continue investing domestically in fossil fuels because of their mandate to ensure energy security, which may take precedence over environmental concerns (Röttgers & Below, 2018). Thus, we expect that high rates of economic growth should result in high levels of investment in both renewables and non-renewables.

Host-country Declining Emissions

In developed countries where economic growth is more modest, it has been possible to decouple the link between economic growth and greenhouse gas emissions through various policy measures (Sharma, Smeets & Tryggestad, 2019). Favorable institutional change including both energy policy and other aspects such as incentives for green purchasing and efficiency enhancing investment (Haley & Schuler, 2011) should be reflected in reduced emissions. Since the opportunities for MNEs to co-evolve with new institutions are the greatest when institutional systems are in flux (Henisz & Zelner, 2005; Cantwell, Dunning & Lundan, 2010), we would expect cross-border investment in renewables to be particularly strong in countries that have made substantial positive changes to their climate-related policies. However, due to the strong correlation between economic growth and emissions in emerging markets with high rates of economic growth, favorable policy changes may not yet be reflected in reduced GHG emissions, but rather in a declining rate of growth in emissions. Thus, we expect that a declining trend in emissions in the host country will be favorable for FDI in renewables, although this will not be observed in emerging markets where economic growth and emissions have not yet been decoupled.

Host-country Public Incentives

The presence of incentive policies aimed specifically at accelerated investment in renewables (Awate et al., 2015) is likely to have a favorable impact on both domestic and cross-border investment in renewable technologies (Tarim, Finke & Liu, 2020). Through renewable-friendly policy instruments such as feed-in tariffs, countries may encourage a ‘race to the top’ resulting in higher levels of investment in renewable energy sources (Madsen, 2009: 1298). At the same time, to the extent that renewable incentive policies might be accompanied by overall higher levels of environmental regulation, this might deter FDI. However, there is tentative evidence from the electronics and automotive industries that MNEs might even favor ‘green havens’ with stringent environmental policies (Poelhekke & van der Ploeg, 2015). Recent empirical evidence from China also indicates that the largest US MNEs with high environmental capabilities are more likely to invest in more stringently regulated Chinese provinces, while firms with weaknesses in environmental management tend to invest in provinces with more lax regulations (Bu & Wagner, 2016). Incentives for investment in renewables might also be used if the general investment conditions in the country are less favorable (Hanni, Van Giffen, Krüger & Mirza, 2011). In that case, it is possible that incentives may create a ‘market for lemons’ (Akerlof, 1970), where the firms that are the most likely to be attracted are those with lower than average capabilities. Overall, since renewable energy needs to be generated where it is consumed, we expect incentives to play an important role in promoting the generation of new capacity, particularly in low-growth markets that are otherwise not as attractive.

The firm- and country-specific conditions we have identified are often interdependent, i.e., a specific condition may materialize as an advantage only in combination with another condition. In the empirical analysis that follows we operationalize these firm- and country-specific conditions into a configurational model, with the aim of identifying the combinations of conditions that lead to investment in renewables and those that lead to investment in non-renewables. To better understand the interacting conditions leading to (net) investment in renewables, and thus contributing to the energy transition, we then map the resulting configurations into an FSA-CSA matrix, indicating the generating capacity associated with each path.

DATA AND METHODOLOGY

Empirical Setting and Data

Our unit of analysis is a cross-border greenfield investment by a large energy utility. We employ a unique dataset consisting of 289 investments by 17 parent firms from 14 home countries into 42 host countries undertaken in 2010–2017. This period marks an important stage in the energy transition, as it has been characterized by explosive growth in the deployment of new renewable technologies, catalyzed by reduced production costs and strong policy support in many countries across the world (REN21, 2017). We chose the firms from the Platts list of the world’s 250 largest energy companies, focusing on the electric utilities category, which comprises 63 firms. We further narrowed the sample to firms that had conducted greenfield FDI during the time period in focus, that had released information on these investments in English, and that had data available on the conditions examined. These criteria left us with a sample of 17 firms. Each case in the sample consists of a unique firm–host-country pair. Our dataset contains a total of 84 of these firm-country pairs. We focused specifically on subsidiaries with active capacity investments and ruled out subsidiaries focused on other areas such as energy distribution.

Table 1 contains information on the parent companies, including the share of state ownership, the firm’s average generating capacity, and the proportion of investment in renewables at the beginning and end of the period. It also includes information on total new investment and investment in renewables included in our dataset, as well as the proportion of total investment contributed by FDI. Ten of the parent companies had at least some state ownership, which is in line with the industry overall.2

A Configurational Approach

For the analysis, we used a configurational approach. Whereas statistical methods assume symmetrical and additive relationships between conditions and the outcome, a configurational method has specific advantages in contexts where the causal links are complex. Due to the heterogeneity of the firms in the utility sector and the wide range of policies concerning climate change (Steen & Weaver, 2017), we think it is reasonable to assume that different configurations of firm- and country-specific conditions can lead to the outcome of FDI in renewables. This feature of causal complexity is called equifinality (Fiss, 2007; Rihoux & Ragin, 2009). Furthermore, conjunctural causation may also be at play. This means that firm- and country-specific conditions do not operate in isolation, but are interdependent (Misangyi et al., 2016). Examining this interdependency can reveal important details about the joint effects of FSAs and CSAs. For instance, it is possible that certain FSAs, e.g., state ownership, complement other conditions and may be determinants of FDI in renewables only in the presence of CSAs such as incentives, and conditions may also substitute for each other. While we do not claim that a configurational approach will always be superior to statistical methods, we do contend that the fsQCA method (Fiss, 2007) can provide interesting insight into the causal complexity that leads to the outcome of (net) investment in renewables and consequently to the energy transition.

While QCA has been widely used in the social sciences, studies using a configurational approach have gained wider traction relatively recently in IB ( Misangyi et al., 2016; Verbeke, Ciravegnada, Lopez & Kundu, 2019). Fuzzy set qualitative comparative analysis has been used to study, among other things, the pattern of FDIs (Pajunen, 2008), institutional configurations (Schneider, Schulze-Bentrop & Paunescu, 2010) and models of capitalism (Judge, Fainshmidt & Brown, 2014). In a configurational approach a case is described by the combination of causal conditions and the outcome. The links between these conditions and the outcome are formulated as necessary and sufficient conditions, which we analyse separately. The QCA literature recommends using from four to seven theoretical conditions (Rihoux & Ragin, 2009). We base our model on six conditions that are summarized in Table 2. These include three FSA conditions, namely technological capabilities, international experience and state ownership. They also include three CSA conditions, namely growth in host-country demand, host-country declining emissions trend, and host-country public incentives for investment in renewables. Our outcome variable is FDI in renewables, with investment in renewables coded as positive and investment in non-renewables coded as negative.

Outcome

Data on the outcome variable (greenfield FDI in renewables) were collected from corporate press releases. Press releases (combined with annual reports) were used because they convey information about the strategic decisions behind a new investment, while actual deployment of the investment might take notably longer. Corporate press releases typically contain basic information about the firm, key characteristics of the investment (e.g., technology type, investment size, location) and motivation. We coded the key data regarding the investment characteristics into a spreadsheet, which was then used as a basis for fsQCA. Each case (firm-country pair) could contain multiple individual investments (ranging from 1 to 19) in the same host country within the same time period. For the measurement, we first aggregated these investments together to calculate the total capacity invested in the host country within the time period, with renewables (wind, solar, hydro, ocean, biofuels, and geothermal) calculated as a positive number and non-renewables (coal, gas, oil and nuclear) as a negative number. This approach was purposely chosen to ensure that cases leading to a positive outcome truly contribute to the energy transition. Second, to take into account firm size and to produce an intensity measure, the previous aggregate value was divided by the firm’s average total capacity in 2010–2017. For example, in Mexico Iberdrola invested a total of 1.0 GW in renewables and 2.2 GW in non-renewables yielding an aggregate value of – 1.2 GW and a net renewable intensity of – 0.026 when divided by the firm’s average total capacity of 46.7 GW.

The investments included in our sample involve greenfield or brownfield investment and thus represent capacity additions. The data do not include large-scale acquisitions (i.e., of another firm), which only contribute to the energy transition at firm level and not at industry level. However, some of the greenfield power plant investments included acquisition of the utility from a contractor. Following the fsQCA analysis, the press releases and annual reports related to key cases in the configurations were analyzed in more depth to gain insight into the motivations for the investment.

Firm-specific Conditions

Data on firm-specific conditions (technological capabilities, international experience, and state ownership) were collected from annual reports and websites. Technological capability in renewables was measured as the average of the firm’s renewable energy capacity as a proportion of total capacity in 2010 and 2017, which ranged from 4.54 to 100%. We measured firm international experience by using the entropy measure (Palepu, 1985), which is designed to measure international experience not only in terms of the amount of capacity invested abroad but also regarding how that capacity is spread across different markets. The measure is defined by the ratio of foreign assets in a given region to the total assets of the firm. In this case, the regions examined were continents (North America, South America, Europe, Asia-Pacific, Africa), with the Middle East and Russia included as separate regions. This ratio is then multiplied by the natural logarithm of its inverse and summed over the total number of geographical regions in which the firm has activities. For the purposes of our study, we also treated the home country as a separate region so that we could count foreign investments made into neighboring countries. The final measure is an average of the values in 2010 and 2017. State ownership was measured as the share of ownership in 2010, which ranged from 0 to 84.5%. In the discussion that follows, we refer to MNEs that have a state majority ownership (> 50%) as SOMNEs, and other firms as private MNEs, although some of them have a minority state ownership stake.

Country-specific Conditions

Data for country-specific conditions (host-country demand growth, host-country declining emissions, and host-country public incentives) were collected from three different sources. First, we analyzed the demand growth of the host country during the investment timeframe by using the average of the annual GDP growth rate during the time period 2010–2017 from the World Bank.

Second, to proxy the host country’s institutional change with respect to the energy transition, we used the trend in GHG emissions. The trend in GHG emissions within a country reflects changes in the institutional environment, such as general climate policies and direct emissions regulations, and a declining trend in emissions signals a favorable environment for investment in renewables.3 However, since the trend in emissions is related to the rate of economic growth, an active climate policy should lead to declining GHG emissions, but in emerging markets, with rapid economic growth, an active climate policy may be reflected instead in a declining trend in the growth of GHG emissions. We collected data on host-country trends in emissions from the Emissions Database for Global Atmospheric Research (EDGAR v5.0), which includes country-specific GHG emissions. This includes all human activities except large scale biomass burning and land use, land-use change, and forestry (European Commission, 2019). We used the average rate of growth in emissions during the time period 2010–2017.

Lastly, to analyse incentives, we measured the number of distinct policies incentivizing renewables in the host country. We collected these data from the World Bank’s Regulatory Indicators for Sustainable Energy-RISE (Banerjee et al., 2017). The report measures seven different indicators for renewable energy support. Three of these have direct relevance: incentives and regulatory support, network connection and access, and carbon pricing and monitoring. Each of these indicators is ranked from 0 to 100, and we formed a composite measure by adding the three indicators. The composite measure thus has a scale of 0–300.

Calibration

Fuzzy set analysis provides a way to define whether a case belongs to a particular condition. The outcome and all the conditions, except state ownership, are calibrated to fuzzy sets (continuous value between 0 and 1) by using the direct method (Ragin, 2008: 85) with anchor points listed in “Appendix” and the calibration table provided in the online appendix. The current study uses prior theoretical knowledge, case knowledge and visible value breaks to define the anchor points for the fuzzy set calibrations. While state control over enterprises is not always strictly related to ownership share, 50% ownership can be regarded as a crucial threshold that separates majority state-owned companies from predominantly private firms. Thus, for state ownership we have used a crisp set value, 0 for companies with 50% or less state ownership, and 1 for companies with state ownership above 50%.4

RESULTS

We conducted the analysis of necessary and sufficient conditions by using the QCA package for R (‘QCA’ version 3.6). We began our analysis by testing whether any of the conditions can be considered necessary. Necessity would require the presence of a particular condition in all instances of the outcome; this is seldom observed in reality. It has become a convention with fsQCA to use consistency measures to decide whether a condition can be considered necessary; the consistency score should exceed 0.9. We analyzed whether the presence or absence of any of the six causal conditions is necessary for FDI in renewables or non-renewables. None of the conditions met the criteria.

We next proceeded to analyse whether a set of conditions joined by a logical “or” (“+”) constitutes a necessary condition for a positive or negative outcome. For this purpose, we used the SuperSubset procedure in the R software package. We followed the three-step procedure of Thomann & Wittwer (2017)5 and found two potential substitutable conditions for a positive outcome and none for a negative outcome. None of these substitutable conditions could be deemed necessary for the outcome.

Next, we analyzed sufficient conditions. We used a consistency threshold of 0.8, following the fsQCA method literature (Schneider & Wagemann, 2012). We set the minimum acceptable frequency of cases for solutions at 1 and a PRI cut-off to 0.6 for both analyses (leading to a positive and negative outcome) in order to achieve the best trade-off between consistency and coverage.6 The intermediate solution presents an acceptable fit as it accounts for 67% of membership in the positive outcome and 33% in the negative outcome. The lower score in negative outcome analysis implies that our solution, which leads predominantly to FDI in renewables, is empirically more powerful than the solution leading predominantly to FDI in non-renewables. We found five configurations leading to FDI in renewables (R1-R5), as well as four configurations leading to investment in non-renewables (NR1-NR4). Since configurations R1-R3 do not have contradictory conditions, they share some cases.

Table 3 illustrates the results of this analysis graphically. The columns of the table provide configurations that lead to FDI in renewables (five configurations) and FDI in non-renewables (four configurations). Full circles represent the presence of a condition. The absence of the condition is marked with crossed-out circles. Although the table is based on a so-called intermediate solution, we use parsimonious solutions to make a distinction between core and peripheral conditions in each configuration.7 Large circles represent core conditions, i.e., conditions where the evidence indicates a strong causal relationship with the outcome. A small circle represents peripheral conditions that have a weaker causal relationship with the outcome (Fiss, 2011). Blank spaces indicate a situation in which the causal condition may be either present or absent. The table also provides a coverage score for each configuration; this reveals the contribution to the outcome of the combination of conditions represented in each configuration.

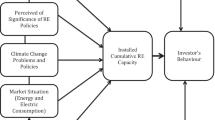

We then mapped the configurations to the FSA-CSA matrix as shown in Fig. 1. For the purposes of this mapping, we determined that high FSAs were represented by the presence of technological capabilities and/or international experience, and high CSAs by the presence of growth in demand and/or public incentives. Correspondingly, an absence of these conditions resulted in FSAs and CSAs being classified as low. Ambiguous configurations where these conditions were neither present nor absent are shown in the middle. As described in the theoretical background, we did not make ex-ante predictions regarding the relationship between state ownership and emissions trend and high/low FSAs/CSAs. The signs (+) and (–) denote how the specific condition appears in the configuration. A bold text and sign denote the presence of a core condition. Additionally, we provide the (net) positive or negative changes to capacity accounted for by the cases in each configuration. We will proceed by analyzing these configurations in more detail.

Explaining FDI in Renewables (R1–R5)

Our analysis reveals five configurations leading to FDI in renewables, three of which involve MNEs and two SOMNEs.

Internationalized technology forerunners

Configurations R1–R3 include renewable-focused strategic investments by internationalized MNEs with high technological capabilities in renewables. There is a high overlap between the subsidiaries in these configurations. Altogether, the configurations R1–R3 included 40 subsidiaries of the southern European utilities Acciona, Iberdrola, Enel, and EDP. These firms are forerunners in renewable investments, as the renewable capacity in 2010 for each was higher than the median (20%) in our dataset (see Table 1). These configurations were differentiated by the CSAs included in them. R1 has absence of growth in host-country demand as a core condition, R2 has public incentives as a peripheral condition, and R3 has an increasing trend in emissions as a core condition.

The Italian Enel exemplifies R1 which is characterized by strong technological capabilities in renewables and significant international experience. During the period of investigation, Enel more than doubled its capacity in renewables. A total of 7.8 GW of Enel’s investment across the world in nine different host countries (Argentina, Australia, Brazil, Canada, Germany, Greece, Russia, South Africa, and the USA) was included in this configuration. The largest investments were in wind power with 5.7 GW capacity additions. The interplay between technological capabilities and accumulated international experience has enabled Enel to aggressively strengthen its position also in solar energy particularly in Brazil where the company started the “construction of Latin America’s largest solar plant” (press release 5 July 2016). During the study period, the share of Enel held by the Italian state and individual investors declined, while that of institutional investors rose from 37 to 57,5 % (Annual reports 2010–2017). This, and the inclusion of Enel in e.g., BlackRock Sustainable Energy Fund, is likely to have further accelerated the investments in renewables.8 The configuration was characterized by low CSAs in the host countries, with low demand growth and included neither the presence of incentives nor the decline of emissions. This suggests that the subsidiaries in this configuration were located either in relatively mature economies or in countries that have undergone economic crises.

Configuration R2 is represented by the Spanish Iberdrola, which ranks among the world’s largest producers of wind energy with high technological capabilities and international experience. Iberdrola had 18.2 GW of investments in this configuration located in France, Germany, Greece, Italy, Mexico, Poland, Romania, the UK, and the USA, which were characterized by the presence of incentives for renewable energy. Iberdrola actively pursued incentives for its strategic investments, as illustrated in a press release of August 16, 2017: “Iberdrola chose Mexico for this new renewable energy commitment due to its excellent regulatory conditions and its solar resource”.

The Spanish group Acciona’s subsidiaries in Brazil, Canada, Chile, Egypt, India, Mexico, Morocco, South Africa, and UAE belong to configuration R3, which includes host countries with increasing emissions. These countries (with the exception of Canada) are emerging economies with rising emissions despite increased investment in renewables (IRENA, 2019). Among these rising energy markets targeted by Acciona is India, which: “is the fourth wind power market in the world in terms of installed capacity (only behind China, the USA, and Germany)… and it is one of the countries with the best prospects for growth in the sector” (press release 13 Sept. 2017).

Collectively, these configurations (R1-R3) show how MNEs use their FSAs in rapidly scaling up their capacity in renewables in diverse markets across the world. The presence of privately owned firms with strong FSAs was the common condition across all three of these configurations. We next describe two additional configurations leading to renewable investments conducted by SOMNEs.

Incentive-driven home region-based SOMNEs

Configurations R4 and R5 are characterized by state ownership, low international experience, and defensive strategies in developed markets. Host countries in these configurations reflected CSAs in the form of incentives, and they were also characterized by a declining trend in emissions as a core condition, suggesting relatively low-risk targets for investment in renewables.

Investments by the Austrian Verbund in Germany and Romania exemplify R4, which includes technological capabilities in renewables as a core condition. Both host countries scored high in the overall RISE indicator (Banerjee et al., 2017) and their decreasing trend in emissions suggests that they have made substantial gains in decreasing their dependence on fossil fuels. In these subsidiaries, Verbund invested in the mature wind power and hydropower, which “has always been the backbone of our Group” (Annual Report 2010, p. 6). In its corporate strategy, Verbund highlights the significance of “subsidised renewable energy and flexible electricity generation and regulated grids” (Annual Report 2016, p. 9). Therefore, the firm’s FDI decisions are characterized by low risk, which was reflected in investments in mature markets and technologies coupled with the presence of host-country CSAs such as public incentives and a decreasing trend in emissions.

Configuration R5 has growth in host-country demand as a core condition and it includes two subsidiaries in Romania from Verbund and the Czech CEZ. While CEZ is a latecomer to renewable energy, it is the largest investor in wind energy in Romania (Cîrstea et al., 2018); nearly half of its total investments went to renewables during our period of study (see Table 1). These developments reflect a shift in CEZ’s corporate strategy. Indeed, the balancing act between the old world of fossil fuels and the new world of renewables is tangible in the group’s annual report: (2017, p. 10): “It remains our task to take care of the traditional energy segment, that is, nuclear, coal-fired, and hydroelectric power plants, and further dynamic growth in…renewable energy sources…smart energy solutions, which I [Chairman of the Board, CEO] consider the future of the energy sector as a whole and the future of CEZ Group.” This configuration reflects the dominant role of CSAs in investment decisions. The host-country conditions in this configuration included both high growth in demand and a declining trend in emissions as core conditions, as well as the presence of incentives as a peripheral condition. The configuration includes the absence of international experience as a core condition, implying a primary focus on the domestic market and existing operations.

MNEs and SOMNEs differ in their approach to investment in renewables; the former rely on FSAs (both technological capabilities and international experience), while the latter rely on CSAs and favor less risky, geographically proximate host countries (see Figure 1). In order to shed further light on the drivers of the energy transition, we will next examine the inverse of this outcome, i.e., the drivers of FDI in non-renewables.

Explaining FDI in Non-renewables (NR1–NR4)

While conventional quantitative methods assume causal symmetry, i.e., that the absence of conditions leading to a positive outcome will predict a negative outcome and vice-versa, QCA allows analysis of causal asymmetry. Hence, we also checked for the association of causal conditions with a negative outcome (i.e., predominantly non-renewable energy investments). This analysis resulted in four configurations leading to a negative (net non-renewable) outcome. These configurations include a total of ten subsidiaries. All four configurations were characterized by a lack of technological capabilities (as a core condition), although two configurations had firms with FSAs in the form of high international experience.

Configurations NR1 and NR2 were characterized by low technological capabilities in renewables and private ownership as core conditions and low international experience as a peripheral condition. These configurations included subsidiaries from North American and Asian utilities such as Duke Energy, Fortis, CLP, Kyushu, and Chubu. NR1 included host countries with a decreasing trend in emissions as a core condition (Australia and the USA), while NR2 had high growth in demand and public incentives as core conditions and an increasing trend in emissions as a peripheral condition (China and Chile). In light of the configurations leading to FDI in renewables, it seems that FSAs are key drivers of investment in renewables for MNEs and that MNEs lacking FSAs will tend to invest in fossil-fuel capacity even in the presence of incentives for renewables and high growth in demand (e.g., China).

Configurations NR3 and NR4 in turn include firms with high international experience and state ownership. These include four subsidiaries from the Finnish Fortum and French EDF. Both SOMNEs place substantial emphasis on development of renewables in their corporate strategies and both were above the median (2.2 GW) in our sample of firms for total investment in renewable capacity during the timeframe (see Table 1). However, the two configurations suggest that these firms still focus on non-renewable strategic investments in some markets, supported by their existing technological capabilities, which favor non-renewables. The CSAs in these two configurations are starkly different from one another. NR3 is characterized by low growth in host-country demand and lack of incentives for renewables as core conditions, as well as an increasing trend in emissions as a peripheral condition. This configuration includes two subsidiaries in emerging markets, e.g., Russia, where Fortum has a long history of operating mainly gas-fired combined heat and power plants.

NR4 is characterized by high growth in demand and a decreasing trend in emissions as core conditions and incentives for renewables as a peripheral condition. It includes the Polish subsidiaries of both firms. NR4 appears paradoxical at first since both the FSAs and CSAs appear to favor renewables. The negative outcome may be explained by the unique characteristics of Poland as a host country, which has a strong coal industry, and possibly other factors favoring fossil-fuel-based investments not captured by our model. Compared with configurations R4 and R5, these results suggest that SOMNEs are also driven by existing FSAs when investing in renewables, but this is more nuanced than with MNEs, as high international experience for SOMNEs seems to be more associated with investment in non-renewables than in renewables.

DISCUSSION

The global energy system still has a long way to go to reach international climate goals, and substantial investments are required to accelerate the energy transition (IEA, 2018b; IRENA, 2019). It is unlikely that the necessary growth in renewable capacity can be achieved without the catalytic influence of FDI, particularly in emerging and developing countries (Wall, Grafakos & Gianoli, 2019). This study offers a fine-grained understanding of the relative importance of different forms of location- and non-location bound advantages of the classic FSA-CSA matrix for a range of MNEs, including SOMNEs, during technological disruption in the electric utility sector.

We make three specific contributions to the IB literature. Our first contribution is adding new insight into the conditions that drive either a ‘race to the top’ or a ‘race to the bottom’ in the energy transition. By taking net renewable investment as the outcome variable, and accounting for the drivers leading to investment in both renewables and non-renewables, we ensure that the analysis is focused on substantial contributions towards the energy transition. Our findings suggest that existing technological capabilities are the single most important determining factor for new FDI in renewables. For MNEs, high international experience was also present in all of the configurations leading to FDI in renewables and low international experience in all of those leading to FDI in non-renewables. This was somewhat surprising for high international experience, which could also be expected to contribute to FDI in non-renewables. However, this does support earlier studies that have found that highly internationalized MNEs face relatively higher scrutiny and pressure for sustainability beyond engaging in merely symbolic activities (Chakrabarty & Wang, 2012). The high share of technological capabilities allows the incumbent firms to follow aggressive international expansion strategies in renewables rather than having energy transition ‘imposed’ upon them by national governments (Verbeke, Osiyevskyy & Backman, 2017). These firms act as efficient vehicles for transferring technology and knowledge across borders (Kogut & Zander, 1993) and speed up the transition to low-carbon energy systems. Interestingly, we found that these forerunner firms, which have typically benefited from favorable home market conditions (natural endowments and policies), appear less sensitive to CSAs (aside from R2), but rather rely on their FSAs in order to scale up rapidly across selected strategic markets. For these MNEs, FDI in renewables has become business-as-usual.

By contrast, we find two FSA/CSA-configurations of subsidiaries, which have made some renewable investments, but whose non-renewable investments are still larger. These include subsidiaries of home-region-based MNEs without technological capabilities or SOMNEs with high international experience. Their investments in non-renewables seem to focus either on relatively large and developed economies with declining emissions, which may nonetheless still have a favorable environment for non-renewables (such as the USA and Australia), or alternatively on high-growth markets that offer renewable incentives, but may still power their growth with investment in non-renewables (e.g., China and Chile). Overall, our results demonstrate a situation where cross-border investment by MNEs results in both a ‘race to the top’ and a ‘race to the bottom’, not only between heterogeneous firms, as has been examined in prior studies (Bu & Wagner, 2016; Li & Zhou, 2017), but within the same firm and across different markets. By framing the configurational analysis as interplay between firm- and country-level drivers we are able to demonstrate how these paradoxical outcomes come about, and how the joint impact of state ownership and international experience impacts FDI strategies.

Our second contribution is a fresh view on SOMNEs as foreign investors and their role in the energy transition, building on the contributions of Cuervo-Cazurra et al. (2014) and Mariotti and Marzano (2019). Our findings show distinct FSA/CSA-configurations characterized by SOMNEs. We find that SOMNEs in the utility sector tend to follow somewhat less-risky strategies than MNEs. When following strategies based on renewables, they will invest in geographically proximate countries with an already declining trend in emissions and available incentives, as was seen in configurations R4-R5, which include subsidiaries by the Czech CEZ and the Austrian Verbund. This is in strong contrast to the subsidiaries of privately owned MNEs in R1-R3, many of which were located in emerging markets with an increasing emissions trend. And when SOMNEs lacked technological capabilities in renewables, they could also leverage international experience by seeking attractive markets for investment in non-renewables (as illustrated by configurations NR3-NR4).

Previous research has suggested that SOMNE investors are often less sensitive than private firms to political risk in host countries (Musacchio & Lazzarini, 2018; Vernon, 1979) and have a higher risk appetite enabled by the long-term investment horizons of governments (Cannizzaro & Weiner, 2018; Mazzucato & Semieniuk, 2018; Prag et al., 2018; Rudy et al., 2016). Our results suggest substantial heterogeneity among the majority-owned SOMNEs. While some SOMNE strategies are characterized by low-risk regionalization with renewables (Burger & Weinmann, 2016; Kolk et al., 2014), we found that some firms with high international experience effectively delay the transition by investing in non-renewables, despite having a declared strategic focus on renewables. While our findings regarding MNEs confirm previous studies suggesting that highly internationalized firms will be more inclined to undertake sustainability-oriented investments due to global sustainability pressures (Chakrabarty & Wang, 2012; Hartmann et al., 2020), our findings on SOMNEs show the opposite relationship between international experience and renewable investments, suggesting that SOMNEs may be more shielded from international pressure to transition to renewable technologies. It is notable that Fortum and EDF, both SOMNEs originating in countries with strong institutions for a low-carbon transition (IEA, 2016, 2018c), included several subsidiaries that engaged in FDI in predominantly non-renewable investments. This may in part be explained by the specific historical legacy of these firms. EDF has a long history with nuclear power in France and abroad and may thus favor continued investments in nuclear or other types of centralized production over renewables. Fortum on the other hand has a strong presence in natural gas production in Russia and may be encouraged to leverage this experience in other countries which still favor fossil-based production. At the same time, one of the most active private forerunner investors in renewables has been Enel, which retains minority government ownership following its privatization. Enel’s strategic shift to renewables may be partly explained by the higher share of institutional investors, which are increasingly concerned about carbon-related risk in their investments (Eccles & Klimenko, 2019a, b). Yet, more research is needed to better understand the relationship between specific ownership structures and investment types. State ownership has also raised concerns among some competitors about potentially unfair competitive advantages, for instance, in the form of better terms and easier access to capital markets.9 Our results thus encourage further work on the role of corporate ownership in the energy transition, particularly by governments and institutional investors.

As our third contribution, we add to a small but growing number of studies that employ a configurational analysis to examine the interaction between MNEs and different host-country settings (e.g., Crilly, 2011; Judge et al., 2014; Pajunen, 2008). Although we indicate for each FSA and CSA condition whether we expect it to affect the transition positively or negatively, the configurations we identify demonstrate that some investments in renewables are strongly driven by firm capabilities, while others seem to be influenced more by host-country characteristics. QCA allows us to explore which combinations of conditions are empirically relevant for both positive and negative outcomes, and we employ the FSA-CSA matrix to present the results in a novel way that illustrates the net effect of each of the identified paths on the outcome of the energy transition. Presented in Figure 1, these results demonstrate that configurations R1-R3 account overwhelmingly for the investment facilitating the energy transition totaling 70.5 GW net renewable investment (including overlapping cases), while configurations NR1-NR4 account for substantial additions to net non-renewable capacity totaling 20.6 GW. By focusing on MNEs and the role of FDI in the global energy transition, our paper complements the few existing studies that have addressed the responses of firms to changing institutional conditions within comparative single country settings (Tarim et al., 2020).

LIMITATIONS AND FUTURE RESEARCH

The energy transition is one of the truly grand challenges facing the global economy and society (Buckley, Doh & Benischke, 2017). Although FDI is only one part of the energy transition, with domestic investment playing an important role, the large volume of cross-border investment suggests that investment by MNEs contributes substantially to the increase in renewable capacity globally (UNCTAD, 2017). Our analysis of the role of FDI in the energy utility sector suggests that SOMNEs and private firms originating from developed markets contribute to both positive and negative outcomes concerning the energy transition.

Our findings help managers and policy makers better understand the foreign investment strategies of different actors in the energy utility sector. While private MNEs are in the vanguard of cross-border investment in renewables, it is clear, that due to their prominent role in the sector, SOMNEs will have to become more active in the energy transition. Although SOMNEs have more than doubled the proportion of renewables in capacity additions to around 20%, this shift is not fast enough (Röttgers & Below, 2018). Therefore an important avenue for future research is to examine in greater depth the role and activities of SOMNEs in implementing public policy objectives in the energy transition, and how institutional diversity in SOMNEs' home countries (Jackson & Deeg, 2008; Mariotti & Marzano, 2019) impacts their transition towards renewable energy. It seems that some MNEs, including SOMNEs, are more likely to ‘walk the talk’ on energy transition than others (Backman et al., 2017) and we think that home country resources, policies and institutions are likely to play an important role in explaining the differences.

A limitation of our study is that while the evidence based on press releases and annual reports gives an indication of the underlying strategies and motivations of the firms, it does not allow us to study how the strategic decisions behind the investments in renewable energy capacity were taken. A complementary topic for future research would therefore be to investigate how investment in renewables is driven by managerial perceptions of issues and opportunities and factors such as the degree of international experience of top management (Levy & Kolk, 2002; Kolk & Pinkse, 2012). Our analysis also suggests that paying closer attention to the influence of institutional investors in driving the transition is justified alongside the discussion of the role of state ownership.

Finally, we note that although the opportunity to invest in both renewable and non-renewable projects abroad may make optimal use of the mix of capabilities within the firm, it reduces the pace of the transition at the firm level as well as for the energy system as a whole. Based on existing forecasts of renewables development it is unclear who will be the winners and losers of the energy transition. While we showed how some global utilities powering new growth through renewables, a recent study argued that much of the utility field is characterized by inertia with regard to the renewables transition (Alova, 2020). This opens up interesting areas for further research on the interactions between firm strategies and public policy. As long as energy is still predominantly generated with non-renewable sources, firms have an incentive to leverage and invest in their legacy capabilities. There may be little effect in terms of reputational cost, since the transition at the national or regional level has been slower than at the firm level, even in jurisdictions that have profiled themselves as progressive on climate issues such as the European Union (European Council, 2019; Parker & Karlsson, 2017). If countries were to abide by their recent commitments to credibly and substantially shorten the timeframe for reaching carbon neutrality, this would decrease the incentives for energy utilities to continue to capitalize on fossil fuel assets, while at the same time increasing the incentives for cross-border investment in renewables. This requires credible government policy – national commitments to reach carbon neutrality that would shorten the useful lifetime of the existing stock of non-renewable facilities and reduce the attractiveness of investment in new fossil-based power generation capacity.

NOTES

-

1

https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en#actions.

- 2

-

3

The trend in emissions is an ‘output’ measure in the sense that it measures the actual increase or decrease in emissions. In additional analyses, we used a mixed input-output measure based on the Climate Change Performance Index compiled by Germanwatch, but since this partly overlaps with the incentive measure, we chose to use the trend in emissions instead. We are grateful to one of the reviewers for this suggestion.

-

4

We also checked for the robustness of our results by comparing the results obtained by using a fuzzy and crisp state ownership measure. Our main results remained unchanged and a fuzzy calibration also resulted in five configurations leading to renewable investments and four configurations leading to non-renewable investment. The details of these tests are available upon request.

-

5

Once the superset is found using the SuperSubset function, the next step is to check for deviant cases consistency, which requires plotting the results (Thomann & Wittwer, 2017). The analysis continues by checking for empirical relevance or trivialness (Goertz, 2006). Finally, it must be identified whether the superset makes theoretical sense as a necessary condition, in other words whether the sets combined with the logical ‘or’ represent some higher-order concept (see Schneider & Wagemann, 2012). We were not able to find high relevance of necessity (RoN).

-

6

We conducted several robustness tests to make sure that our analysis and results follow the good practices of QCA (Schneider & Wagemann, 2010). We reached a good solution coverage of 0.67, which indicates that the configurations identified are able to explain a large proportion of the empirical cases (Misangyi et al., 2016). We also tested the stability of these configurations by running several checks with different consistency and PRI thresholds. The details of these robustness tests are available upon request.

-

7

FsQCA analysis can provide three types of solution terms: a complex solution, a parsimonious solution, and an intermediate solution. These terms differ only in their degree of precision. The complex solution term does not include simplifying assumptions. The parsimonious solution is based on simplifying assumptions while the intermediate solution is based on so-called easy counterfactuals and leads to intermediate complexity (Schneider and Wagemann, 2010). In our analysis, based on extant literature, we made three simplifying assumptions and assumed an association between the presence of technological capabilities in renewables, international experience and provision of incentives in the host country with a positive outcome. The absence of these conditions was marked as an easy counterfactual for the analysis of a negative outcome.

-

8

Institutional investors can drive firms’ environmental and social investments, particularly when their home countries have strong social norms concerning sustainability (see e.g., Dyck, Lins, Roth & Wagner, 2019).

-

9

See e.g., https://www.reuters.com/article/iberdrola-enel-commission-idUSL8N1S3438. Accessed June 24, 2020.

REFERENCES

Aharoni, Y. 2018. The evolution of state-owned multinational enterprise theory. In A. Cuervo-Cazurra (Ed.), State-owned multinationals: Governments in global business: 9–44. Cham: Springer.

Alova, G. A. 2020. Global analysis of the progress and failure of electric utilities to adapt their portfolios of power-generation assets to the energy transition. Nature Energy. https://doi.org/10.1038/s41560-020-00686-5.

Arora, A., Fosfuri, A., & Gambardella, A. 2001. Specialized technology suppliers, international spillovers and investment: Evidence from the chemical industry. Journal of Development Economics, 65(1): 31–54.

Awate, S., Larsen, M. M., & Mudambi, R. 2015. Accessing vs sourcing knowledge: A comparative study of R&D internationalization between emerging and advanced economy firms. Journal of International Business Studies, 46(1): 63–86.

Akerlof, G. 1970. The market for lemons: quality uncertainty and the market mechanism. Quarterly Journal of Economics, 84: 488–500.

Backman, C. A., Verbeke, A., & Schulz, R. A. 2017. The drivers of corporate climate change strategies and public policy. Business & Society, 56(4): 545–575.

Banerjee, S. G., Moreno, F. A., Sinton, J. E., Primiani, T., & Seong, J. 2017. Regulatory indicators for sustainable energy: a global scorecard for policy makers (English). Washington, DC: World Bank Group. http://documents.worldbank.org/. Accessed 5.11.2018.

Bass, A. E., & Chakrabarty, S. 2014. Resource security: Competition for global resources, strategic intent, and governments as owners. Journal of International Business Studies, 45(8): 961–979.

Benney, T.M. 2019. Varieties of capitalism and renewable energy in emerging and developing economies. Journal of Economic Policy Reform. https://doi.org/10.1080/17487870.2019.1637584

Benito, G.R.G., Rygh, A., & Lunnan, R. 2016. The benefits of internationalization for state-owned enterprises. Global Strategy Journal, 6: 269–288.

Bu, M. & Wagner, M. 2016. Racing to the bottom and racing to the top: The crucial role of firm characteristics in foreign direct investment choices. Journal of International Business Studies, 47: 1032–1057.

Buckley, P. J., Doh, J. P., & Benischke, M. H. 2017. Towards a renaissance in international business research? Big questions, grand challenges, and the future of IB scholarship. Journal of International Business Studies, 48(9): 1045–1064.

Burger, C., & Weinmann, J. 2016. European utilities: Strategic choices and cultural prerequisites for the future. In F. P. Sioshansi (Ed.), Future of utilities—utilities of the future: How technological innovations in distributed energy resources will reshape the electric power sector: 303–322. Amsterdam: Elsevier.

Cannizzaro, A. P., & Weiner, R. J. 2018. State ownership and transparency in foreign direct investment. Journal of International Business Studies, 49(2): 172–195.

Cantwell, J. A. 1999. Foreign direct investment and technological change (Volume 2). Cheltenham, U.K. and Northampton, Mass.: Edward Elgar.

Cantwell, J. A., Dunning, J. H., & Lundan, S. M. 2010. An evolutionary approach to understanding international business activity: The co-evolution of MNEs and the institutional environment. Journal of International Business Studies, 41(4): 567–586.

Casillas, J. C., & Moreno-Menéndez, A. M. 2014. Speed of the internationalization process: The role of diversity and depth in experiential learning. Journal of International Business Studies, 45(1): 85–101.

Cave, A. H. 2014. Environmentally responsible management in international business: A literature review. Multinational Business Review, 22(1): 78–102.

Chakrabarty, S., & Wang, L. 2012. The long-term sustenance of sustainability practices in MNCs: A dynamic capabilities perspective of the role of R&D and internationalization. Journal of Business Ethics, 110(2): 205–217.

Cîrstea, S., Martiş, C., Cirstea, A., Constantinescu-Dobra, A., & Fülöp, M. 2018. Current situation and future perspectives of the Romanian renewable energy. Energies, 11(12): 3289.

Crilly, D. 2011. Predicting stakeholder orientation in the multinational enterprise: A mid-range theory. Journal of International Business Studies, 42: 694–717.

Crilly, D., Zollo, M., & Hansen, M. T. 2012. Faking it or muddling through? Understanding decoupling in response to stakeholder pressures. Academy of Management Journal, 55(6): 1429–1448.

Cuervo-Cazurra, A., Inkpen, A., Musacchio, A., & Ramaswamy, K. 2014. Governments as owners: State-owned multinational companies. Journal of International Business Studies, 45(8): 919–942.

Dahlmann, F., Kolk, A., & Lindeque, J. 2017. Emerging energy geographies: Scaling and spatial divergence in European electricity generation capacity. European Urban and Regional Studies, 24(4): 381–404.

Domanico, F. 2007. Concentration in the European electricity industry: The internal market as solution? Energy Policy 35(10): 5064–5076

Dunning, J. H., & Lundan, S. M. 2008. Multinational enterprises and the global economy, 2nd edition. Cheltenham: Edward Elgar.

Dyck, A, Lins,K.V., Roth, L., & Wagner, H.F. 2019, Do institutional investors drive corporate social responsibility? International evidence, Journal of Financial Economics 131: 693–714.

Eccles R.G. & Klimenko, S. 2019. The investor revolution. Harvard Business Review (May–June):106–116.

Estrin, S., Meyer, K. E., Nielsen, B. B., & Nielsen, S. 2016. Home country institutions and the internationalization of state-owned enterprises: A cross-country analysis. Journal of World Business, 51(2): 294–307.