Abstract

We evaluate stock market indexes by the Aumann–Serrano (AS) performance index for multi-period gambles and one-period gambles and the Sharpe ratio. Our results show the AS performance index is more distinct for multi-period gambles than for one-period gambles in evaluation of the Japanese stock market indexes. In other words, a favorable evaluation score as compared to the Sharpe ratio becomes even better in multi-period gambles than in one-period gambles while an unfavorable evaluation score compared to the Sharpe ratio becomes even worse in multi-period gambles than in one-period gambles.

Similar content being viewed by others

Notes

Kadan and Liu (2014) proposed two performance measures based on risk measures proposed by Aumann and Serrano (2008) and Foster and Hart (2009). However, we only consider the performance measure based on the risk measure by Aumann and Serrano (2008) in this paper. We remark the performance and risk measures by Foster and Hart (2009) do not exist for many common distributions (cf. Riedel and Hellmann 2015). Therefore, the performance measure by Foster and Hart (2009) is limited in its applications.

There are currently three other stock exchanges in Japan, namely, the Nagoya Stock Exchange, Sapporo Securities Exchange, and Fukuoka Stock Exchange. They are local stock exchanges, when compared to the TSE, and the market capitalization of companies listed in the three exchanges is small when compared to that in the TSE.

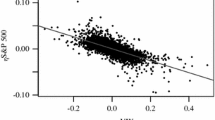

The Nikkei 225 and TOPIX are, more specifically, respectively an equal weighted average of stock prices of the 225 companies and a value weighted average of stock prices of all the companies listed in the first section of the TSE compared to that at certain time point. The difference between the two indexes is similar to that between DOW and S&P500 in the U.S. stock market.

It is well-known that the EM algorithm works well in estimation of normal mixture processes or normal mixture distributions. See, e.g., Hastie et al. (2001).

The Ljung-Box statistics we use here are modified ones by Diebold (1988) who corrected the original Ljung-Box statistic which is known to reject the null hypothesis too often.

A market with low mean may not necessarily imply investors in that market unprofitable. Investors can earn profits by various strategies using options and futures. Foreign investors in the Japanese stock market are well-known to use derivatives of options and futures.

References

Alexander, C. (2004). Normal mixture diffusion with uncertain volatility: Modelling short- and long-term smile effects. Journal of Banking and Finance, 28, 2957–2980.

Alexander, C., & Lazar, E. (2009). Modelling regime-specific stock price volatility. Oxford Bulletin of Economics and Statistics, 71, 761–797.

Aumann, R., & Serrano, R. (2008). An economic index of riskiness. Journal of Political Economy, 116, 810–836.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31, 309–328.

Diebold, F. X. (1988). Empirical modeling of exchange rate dynamics. Berlin: Springer.

Engle, R. F. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica, 50, 987–1007.

Engle, R. F. (1990). Stock volatility and the crash of ’87: discussion. The Review of Financial Studies, 3, 103–106.

Engle, R. F., & Ng, V. K. (1993). Measuring and testing the impact of news on volatility. Journal of Finance, 48, 1749–1778.

Everitt, B. S., & Hand, D. J. (1981). Finite mixture distributions. New York: Chapman and Hall.

Foster, D., & Hart, S. (2009). An operational measure of riskiness. Journal of Political Economy, 117, 785–814.

Glosten, L. R., Jagannathan, R., & Runkle, D. E. (1993). On the relationship between expected value and the volatility of excess returns on stocks. Journal of Finance, 48, 1779–1801.

Haas, M., Mittnik, S., & Paolella, M. S. (2004). Mixed normal conditional heteroskedasticity. Journal of Financial Econometrics, 2, 211–250.

Hart, S. (2011). Comparing risks by acceptance and rejection. Journal of Political Economy, 119, 617–638.

Hastie, T., Tibshirani, R., & Friedman, J. (2001). The elements of statistical learning. New York: Springer.

Heathcote, C. R. (1977). Integrated mean square error estimation of parameters. Biometrika, 64, 255–264.

Hodoshima, J. (2019). Stock performance by utility indifference pricing and the Sharpe ratio. Quantitative Finance, 19, 327–338.

Hodoshima, J., & Miyahara, Y. (2020). Utility indifference pricing and the Aumann–Serrano performance index. Journal of Mathematical Economics, 86, 83–89.

Homm, U., & Pigorsch, C. (2012a). Beyond the Sharpe ratio: An application of the Aumann–Serrano index to performance measurement. Journal of Banking & Finance, 36, 2274–2284.

Homm, U., & Pigorsch, C. (2012b). An operational interpretation and existence of the Aumann–Serrano index of riskiness. Economics Letters, 114, 265–267.

Kadan, O., & Liu, F. (2014). Performance evaluation with high moments and disaster risk. Journal of Financial Economics, 113, 131–155.

Kon, S. J. (1984). Models of stock returns-a comparison. Journal of Finance, 39, 147–165.

McLachlan, G., & Peel, D. (2000). Finite Mixture Models: Inference and Applications to Clustering. Marcel Dekker.

Miyahara, Y. (2010). Risk-sensitive value measure method for projects evaluation. Journal of Real Options and Strategy, 3, 185–204.

Miyahara, Y. (2014). Evaluation of the scale risk. RIMS Kokyuroku. No. 1886. Financial Modeling and Analysis (2013/11/20-2013/11/22), pp. 181–188.

Niu, C., Guo, X., McAleer, M., & Wong, W. K. (2018). Theory and application of an economic performance measure. International Review of Economics and Finance, 56, 383–396.

Riedel, F., & Hellmann, T. (2015). The Foster-Hart measures of riskiness for general gambles. Theoretical Economics, 10, 1–9.

Sculze, K. (2014). Existence and computation of the Aumann–Serrano index of riskiness. Journal of Mathematical Economics, 50, 219–224.

Titterington, D. M., Smith, A. F. M., & Makov, U. F. (1985). Statistical analysis of finite mixture distributions. New York: Wiley.

Xu, D., & Wirjanto, T. S. (2010). An empirical characteristic function approach to VaR under a mixture-of-normal distribution with time-varying volatility. The Journal of Derivatives, 18, 39–58.

Acknowledgements

The authors thank the reviewer for valuable comments.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

None

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

J. Hodoshima: This research was financially supported by JSPS KAKENHI Grant Number JP17K03667.

Rights and permissions

About this article

Cite this article

Hodoshima, J., Yamawake, T. Comparing Dynamic and Static Performance Indexes in the Stock Market: Evidence From Japan. Asia-Pac Financ Markets 29, 171–193 (2022). https://doi.org/10.1007/s10690-021-09343-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-021-09343-7