Abstract

We show that in finite settings with identical firms and consumers, asymmetric pure price equilibria with positive profits exist. We consider a price competition duopoly for a homogeneous product. Demand stems from a second-stage consumption game at posted prices, with consumers’ behavior impacted by negative network effects. We characterize equilibrium prices and demand. In all subgame-perfect pure price equilibria, both firms have positive profits, and in some, firms charge different prices.

Similar content being viewed by others

Notes

In Section 5 we discuss the interpretation of \(\mathcal {I}\) representing n groups instead of individual consumers.

It’s possible to consider a benefit, \(b>0\), such that \(U^i_1\equiv b -p_1 -\alpha \sum _{i'\in \mathcal {I}} a^{i'}\) and similarly for choosing firm 2. In that case consumer payoffs would be positive, if b is sufficiently high. As we follow a von Neumann–Morgenstern approach to expected utility, and \(U_1-U_2\) would be the same, this would induce the exact same consumption equilibria and have no impact in results. For simplicity we consider \(b=0\). If we considered that consumers only buy a product when payoff is positive, then the subsequent analysis would carryover, with a dependence on b, but would require a 3 action strategy space for the consumption subgame.

Whether one considers i counts or not in the network effects summation has no impact on results.

There should be a \(-\alpha\) term added to the formula, but we have removed it as it has no impact on choices. It represents the fact that a consumer is always ‘with herself’, which could be assumed zero in the network effects presented in pure strategy payoffs.

Note that the threshold is constructed in terms of firm 1 for simplicity. After loosing all consumers, there’s no limit to price, thus T(0) has no meaning. We observe that there is no problem with infinite prices, since firms are not allowed to collude, and will have the incentive to deviate from a high price of the other firm.

Although associated to each demand characterization \((l_1,m,l_2)\) is a unique pair of outcome prices and demand, this does not mean there is a unique strategy leading up to that outcome, that’s why we partition strategies into classes that produce the same outcomes. Note this does not mean there cannot be equilibria from different classes with the same prices! However, these have different outcome demand (thus consumer behavior).

We will address invariance in Section 5

Consumer welfare being negative is an artifact of the simplification of considering utility as just the cost. As mentioned before, a consumption benefit parameter, equal for both firms, will have no impact on results and would make utility, and thus consumer welfare, positive.

References

Allen B, Thisse JF (1992) Price equilibria in pure strategies for homogeneous oligopoly. J Eco Manag Strat 1(1):63–81

Bagh A (2010) Pure strategy equilibria in bertrand games with discontinuous demand and asymmetric tie-breaking rules. Econ Lett 108(3):277–279

Baye MR, Kovenock D (2008) Bertrand competition. In The New Palgrave Dictionary of Economics. Palgrave Macmillan UK, pp. 1–7

Bertrand J (1883) Review of theorie mathematique de la richesse social par leon walras and recherches sur les principes de la theorie du richesses par augustin cournot. Journal des Savants 67:499–508

Bornier JMD (1992) Thecournot - bertrand debate: A historical perspective. History of Political Economy 24(3):623–656

Bos I, Vermeulen D (2020) On the microfoundation of linear oligopoly demand. The B.E. J Theo Eco

Burdett K, Judd KL (1983) Equilibrium price dispersion. Econometrica 51(4):955–969

Caplin A, Nalebuff B (1991) Aggregation and imperfect competition: On the existence of equilibrium. Econometrica 25–59(1):25

Carmona G, Podczeck K (2018) Invariance of the equilibrium set of games with an endogenous sharing rule. J Eco Theo 177:1–33

Conley JP, Wooders MH (1997) Equivalence of the core and competitive equilibrium in a tiebout economy with crowding types. J Urban Econ 41(3):421–440

Cournot A (1839) Researches into the Mathematical Principles of Wealth. The Macmilian Company, New York. Translation by Nathaniel Bacon 1897

Dastidar KG (2011) Existence of bertrand equilibrium revisited. Int J Econ Theo 7(4):331–350

de Palma A, Ginsburgh V, Papageorgiou YY, Thisse JF (1985) The principle of minimum differentiation holds under sufficient heterogeneity. Econometrica 53(4):767–781

Diamond PA (1971) A model of price adjustment. Journal of Economic Theory 3(2):156–168

Fudenberg D, Tirole J (1991) Game Theory. MIT Pres

Hoernig SH (2007) Bertrand games and sharing rules. Econ Theor 31(3):573–585

Hopkins E (2008) Price Dispersion. In: Macmillan Palgrave (ed) The New Palgrave Dictionary of Economics. Palgrave Macmillan UK, London, pp 1–4

Leibenstein H (1950) Bandwagon, snob, and veblen effects in the theory of consumers’ demand. Q J Econ 64(2):183–207

Saporiti A, Coloma G (2010) Bertrand competition in markets with fixed costs. The B.E. J Theo Eco 10:1

Shy O (2011) A Short Survey of Network Economics. Rev Ind Organ 38(2):119–149

Soeiro R, Mousa A, Oliveira TR, Pinto AA (2014) Dynamics of human decisions. J Dyna Games 1(1):121–151

Tirole J (1988) The theory of industrial organization. MIT Press, Cambridge, Mass. 1994 edition

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Proofs

Proofs

Let us define for ease of notation the function

1.1 Lemma 1

Proof

Let \((\mathbf {p}^*,\varvec{\sigma }^*)\) be a subgame-perfect equilibrium with positive profits for both firms, hence, where \(p_1^* \ne 0\ne p_2^*\). We will do the proof in terms of firm 1, firm 2 is analogous. Let us denote equilibrium outcome demand by \(D_1^*\equiv D_1(\mathbf {p}^*,\varvec{\sigma }^*(\mathbf {p}^*))\) and let \((l_1^*, m^*, l_2^*)\) be the outcome demand characterization. Note that \(D_1^* \in \mathbf {ED}(\Delta p^*)\), which is formed by the union of horizontal (\(m=0\)), vertical (\(m=1\)) and oblique (\(m>1\)) line segments. As both prices are positive and part of equilibrium, \(D_1^*\) must have the same right and left limit (a discontinuity would be an incentive for a small price change). Therefore, \(D_1^*\) is either located at a point whose neighborhood has constant demand characterization (deviation demand stays in the same segment), or at an intersection point (if it changes segment). Suppose demand stays in the same segment for an interval containing \(\Delta p^*\). Then, \(m^*\ne 1\), because for \(m=1\) the domain is a single point. But if \(m^*=0\) a price change would produce no change in demand for at least one of the firms. As such, \(m^*>1\), which means demand is on an oblique segment, given by \(Q_1(\Delta p; l_1,m,l_2)\). Suppose now that \(D_1^*\) lies at an intersection point, possibly leading to a change of demand characterization. Note that the slope of each line is (completely) determined by m (for obliques it is \(-\frac{m}{2\alpha (m-1)}\)). Furthermore, characterization preserving functions with the same m start at different points \(T(l_1+m)\) (note that \(l_1+m=n-l_2\) and n is fixed). Thus, different demand characterizations (line segments) which intersect, have different slopes. Furthermore, the number of possible demand characterizations is finite, hence, all the intersection points of these segments are isolated, that is, there is a neighborhood (of \(\Delta p\)), for which they are unique. As such, there is a neighborhood of \(\Delta p^*\) for which, at most, there is a unique change of demand characterization, in this case happening at \(\Delta p^*\). Seen that at \(D_1^*\) the right and left slope must be the same, this means that the demand characterization on the left and right of \(\Delta p^*\) must be the same. Therefore, there must be an interval containing \(\Delta p^*\) for which the demand characterization is constant, except possibly at \(\Delta p^*\). That is, there is \((l_1, m, l_2)\) such that in the neighbourhood of \(\Delta p^*\) demand is given by \(Q_1(\Delta p; l_1,m,l_2)\). But if \(\Delta p^*\) is an intersection point, although it may have a different demand characterization, demand value is the same, that is, \(D_1^*=Q_1(\Delta p^*; l_1,m,l_2)\). Note that in particular, this means the equilibrium must lie at an interior point of the price domain, as at the boundary there must be a change to a different demand characterization.

1.2 Proposition 1

Proof

The idea of this proof is to find the profit maximum for each demand characterization, which is produced by Lemma 1. Let \((\mathbf {p}^*,\varvec{\sigma }^*)\) be a subgame-perfect equilibrium with positive profits for both firms. For each demand characterization consider the function \(F_1\equiv F_1(l_1,m,l_2): ( \ p_2^*+T(l_1+m), p_2^*+T(l_1+1)) \rightarrow \mathbb {R}\), given by \(F_1( \ p_1)=p_1Q_1( \ p_1,p_2^*; l_1,m,l_2)\). According to Lemma 1 there is \((l_1,m, l_2)\) with \(m>1\) and a neighbourhood \(V(\Delta p^*) \in (T(l_1+m), T(l_1+1))\) such that, for \(p_1-p_2^* \in V(\Delta p^*)\) we have \(\Pi _1( \ p_1,p_2^*,\varvec{\sigma }^*( \ p_1, p_2^*))=F_1( \ p_1)\). Therefore (see equation 2 for \(Q_1\)),

Note that, as \(\Delta p^* \in (T(l_1+m), T(l_1+1))\), we have \(p_1^*<p_2^*+T(l_1+1)\), and as \(p_1^*>0\) by assumption, so is \(p_2^*+T(l_1+1)\). A first question is whether the underlying quadratic function maximum is interior to the domain of \(F_1\), or if it is outside and the maximum of \(F_1\) at the boundary of its domain. Suppose the maximum of \(F_1\) is \(p^M\) at the boundary. Then \(p^M-p_2^*=T(l_1+1)\) or \(p^M-p_2^*=T(l_1+1)\), which means \(\Delta p^*\) would not be an interior point of \((T(l_1+m), T(l_1+m))\). According to the last note on the proof of Lemma 1, \((\mathbf {p}^*,\varvec{\sigma }^*)\) cannot be a subgame-perfect equilibrium. This is a contradiction, hence the maximum of \(F_1\) must be interior. Using the first order condition, we get

Analougously we get

From here,

noting that \(T(l_1+m)=\alpha (n-2l_1-2m+1)\) and \(T(l_1+1)=\alpha (n-2l_1-1)\) (see equation 1) we get that

The fixed point, \(p_1^*=P_1( \ p_2( \ p_1^*))\) is

noting that \(l_1+l_2=n-m\), we get

From \(P_2( \ p_1^*)\) we get \(p_2^*\).

1.3 Theorem 2

Proof

Consider an outcome with demand characterization \((l_1^*, m^*, l_2^*)\) and prices \(\mathbf {p}^*=( \ p_1^*(l_1,m,l_2),p_2^*(l_1,m,l_2))\) where \(\Delta p^*\in \mathcal {PD}(l_1^*, m^*, l_2^*)\). These are necessary conditions on the outcome. The aim of this proof is to find sufficient and necessary conditions for existence of a strategy profile \((\mathbf {p}^*, \varvec{\sigma }^*)\) which is a subgame-perfect equilibrium and produces the above mentioned outcome.

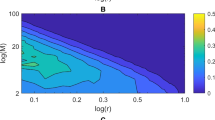

We will do the analysis in terms of firm 1, firm 2 is analogous. It is helpful to keep in mind Fig. 4 throughout the proof.

Recall that non-monopolistic equilibrium demand exists only for \(p_1 \in [p_2^*+T(n), p_2^*+ T(1)]\), an interval which is partioned in \(n-1\) blocks of size \(2\alpha\) by the thresholds \(T(l_1)\) for each \(l_1\in \{2, 3, \ldots , n-1 \}\). At each threshold point, say \(p_1=p_2^*+T(l_1)\), the minimum and maximum value in \(\mathbf {ED}( \ p_1-p_2^*)\) are, respectively, \(l_1-1\) and \(l_1\). As such, (demand) values in \(\mathbf {ED}( \ p_1-p_2^*)\) are bounded above by the line \(\overline{d}_1( \ p_1)\equiv n-( \ p_1-( \ p_2^*+T(n)))/2\alpha\).

The outcome extension strategies in \((\underline{l_1^*, m^*, l_2^*})\) differ only in the specifications \(f_L\) and \(f_R\). Let us denote \(Q_1^*( \ p_1)\equiv Q_1( \ p_1-p_2^*; l_1^*, m^*, l_2^*)\), and \(\text {I}^*\equiv ( \ p_2^*+T(l_1^*+m^*), p_2^*+T(l_1^*+1))\). For all \(p_1 \in \text {I}^*\), any of the above outcome extension strategies induce \(D_1( \ p_1,p_2^*)=Q_1^*( \ p_1)\). Let \(\Pi _1^*\equiv \Pi _1(\underline{l_1^*, m^*, l_2^*})\). The isoprofit demand curve for firm 1, \(h_1( \ p_1; (\mathbf {p}^*,\varvec{\sigma }^*(\mathbf {p}^*)))=\Pi _1^*/p_1\), which we abbreviate to \(h_1( \ p_1)\), is tangent to \(Q_1^*( \ p_1)\) at \(p_1^*\). As \(Q^*_1\) is linear, \(h( \ p_1)\ge Q_1^*( \ p_1)\) for all \(p_1\in \text {I}^*\). The question is thus, are there specifications \(f_L\) and \(f_R\) for price deviations outside \(\text {I}^*\) that lead to demand continuations of \(Q_1^*\) below \(h_1\)?

Let \(tl\equiv p_2^*+T(l_1^*+m^*)\) and \(tr\equiv p_2^*+T(l_1^*+1)\), so that \(\text {I}^*=(tl,tr)\). Let us start with the case \(p_1\le tl\). Note that \(Q_1^*\) and \(\overline{d}_1\) are both linear and cross at \(Q_1^*(tl)=\overline{d}_1(tl)\). For \(p_1>tl\), we have \(Q_1^*( \ p_1)<\overline{d}_1( \ p_1)\) and for \(p_1< tl\), we have \(Q_1^*( \ p_1)>\overline{d}_1( \ p_1)\). As \(Q_1^*\le h_1\), then \(h_1\) crosses \(\overline{d}_1\) at a point \(p_1>tl\). As such, for \(p_1\le tl\), we obtain \(h_1( \ p_1)>\overline{d}_1( \ p_1)\). As for all possible choices of \(f_L\), it holds that \(f_L( \ p_1)\le \overline{d}_1( \ p_1)\), then, for all \(f_L\) we must have that \(f_L( \ p_1)<h_1( \ p_1)\) for all \(p_1\le tl\).

Let us now look at the case \(p_1 \ge tr\). When \(p_1>p_2^*+T(1)\), the unique equilibrium demand is \(D_1=0\), therefore, we need only look at the interval \([tr, p_2^*+T(1))\), which is partitioned into \(l_1^*-1\) blocks by thresholds \(T(l_1^*+1), T(l_1^*), T(l_1^*-1), \ldots , T(1)\). Note that, we must have \(m^*>1\) and thus, \(0\le l_1^*<n-2\).

Claim

In every interval (block) \([p_2^*+T(l_1+2), p_2^*+ T(l_1+1)]\), where \(l_1\in \{0, \ldots , n-2\}\), demand for firm 1 is bounded below by

where

Taking into account the above claim, we need only guarantee that \(h_1( \ p_1)\ge \underline{d_1}( \ p_1)\) for \(p_1 \in [p_2^*+T(l_1^*+1), p_2^*+T(1))\). Note that \(\underline{d_1}( \ p_1)\) is continuous (though not differentiable at \(P^I_1\)), thus, as \(Q_1\) decreases with price, it suffices to show that \(h_1( \ p_1^I(l_1))\ge \underline{d_1}( \ p_1^I(l_1))\) in the aforementioned blocks (intervals), i.e. for every \(l_1\in \{0, \ldots , l_1^*-1\}\). If this is the case, then at least the outcome extension strategy with specification \(f_R( \ p_1)=\underline{d_1}( \ p_1)\) has no incentives for firm 1 to deviate, and is part of an equilibrium. We have thus to show that for every \(l_1\in \{0, \ldots , l_1^*-1\}\), it holds that \(\Pi _1^* / P_1^I(l_1)\ge l_1+1\). As \(P_1^I(l_1)>p_1^*>0\), we can rewrite this as \(\Pi _1^* \ge P_1^I(l_1)(l_1+1)\).

Proof (Proof of Claim)

Recall that \(\mathbf {ED}\) is formed by the union of oblique line segments determined by \(Q_1\) for characterizations with \(m>1\), and horizontal and vertical segments for \(m=0\) and \(m=1\). In this proof, when mentioning lines/ segments we will be always referring to this equilibrium demand space. For \(m>1\), each \(Q_1\) segment is completely determined by \(l_1\) and m (note that \(l_2=n-l_1-m\)), with price domain \([p_2^*+T(l_1+m), p_2^*+T(l_1+1)]\). Consider now a block \(( \ p_2^*+T(l_1+2), p_2^*+T(l_1+1))\) for some \(l_1\in \{0, \ldots , n-2\}\). The minimum value of demand at \(p_1=p_2^*+T(l_1+2)\) is \(l_1+1\) and the maximum value at \(p_1=p_2^*+T(l_1+1)\) is \(l_1+1\). As such, all oblique lines whose domain contains this block, cross the horizontal line \(l_1+1\) (the unique non-oblique line in the mentioned interval). The first intersection happens at some point, call it \(p_1^I\), such that \(Q_1( \ p_1^I -p_2^*; l_1', m', l_2') =l_1+1\) for some characterization \((l_1', m', l_2')\). We will now show that this characterization is of a particular form determined by \(l_1\). Given a fixed \(\overline{l}_1\), for every possible value of \(m'\), i.e. \(1<m'\le n-\overline{l}_1\), the segments determined by \((\overline{l}_1, m', n-\overline{l}_1-m')\) intersect (end) at \(p_2^*+T(\overline{l}_1+1)\). The slope of lines determined by \(Q_1\) is \(-m'/[2\alpha (m'-1)]\), hence, among characterizations with \(\overline{l}_1\), the first to cross is of the form \((\overline{l}_1, n-\overline{l}_1, 0)\) (maximum \(m'\) for lowest slope because \(\alpha >0\)). As such, characterizations with \(l_2'=0\) are the candidates to originate the first crossing at \(p_1^I\). For all \(l'_1\), characterizations of the form \((l_1',n-l_1',0)\) intersect (start) at \(p_2^*+T(n)\). As such the first crossing is provided by the line which ends first, that is, where \(p_2^*+T(l_1'+1)\) is smallest (the steepest line is where \(l_1'\) is higher because \(m'=n-l_1'\)). Taking into account that it must contain the domain, (thus end after \(p_2^*+T(l_1+2)\)) we must have \(l_1'<l_1+1\), and so we get \(l_1'=l_1\). The first crossing in the interval \(( \ p_2^*+T(l_1+2), p_2^*+T(l_1+1))\) is thus determined by solving \(Q_1( \ p_1^I -p_2^*; l_1, n-l_1, 0) =l_1+1\), which is \(p_1^I=P_1^I(l_1)\). From \(p_2^*+T(l_1+1)\) to \(P_1^I(l_1)\) minimum demand is \(l_1+1\), then it follows \(Q_1( \ p_1-p_2^*; l_1, n-l_1, 0)\).

Ilustration for the proof of Theorem 2

1.4 Theorem 3

Proof

Consider the classes \(\underline{(l_1,m, 0)}\) where \(l_1\ge 1\) and \(m\ge 3l_1\). Note that, \(p_j(l_1,m, 0) >0\) for \(j=1,2\) and \(\Delta p^*\ne 0\). So these classes have positive and different prices. The proof follows by showing that for \(n\ge 4\) these classes exist and satisfy Theorem 2, hence a subgame-perfect equilibrium with positive profit always exists.

To show that the classes satisfy Theorem 2, we need to show that \(\Delta p^* \in \mathcal {PD}(l_1,m,0)\) and that conditions (i) and (ii) are satisfied.

For \(\Delta p^* \in \mathcal {PD}(l_1,m,0)\), we must show that \(T(l_1+m)<\Delta p^*<T(l_1+1)\). Observe that \(\Delta l =l_1\) and \(l_1+m=n\). Recall \(T(x)=\alpha (n-2x+1)\). We thus have to show that

Because \(l_1\ge 1\) and \(m>2l_1\), we have that \(l_1+m > 1 +2l_1\), hence, \(n-1>2l_1\), which means \(\alpha (n-1)>2\alpha l_1\) and the above holds.

Now for conditions (i) and (ii), note that (ii) is trivially satisfied when \(l_2=0\), thus we need only show condition (i), that is, we need to show that for all \(k\in \{0, \ldots , l_1-1\}\) we have

This is,

As \(2\alpha >0\), it can be removed. As \(k\in \{0,\ldots ,l_1-1\}\), we get that \(n-k>n-l_1=m\), thus the (new) right hand side is smaller than the following quadratic in \(k+1\),

with maximum at \(k+1=\dfrac{1}{2}\left( n-1-\dfrac{l_1}{3m}+\dfrac{1}{m}\right)\). Therefore it is enough to show that,

Note that \(m>1\), hence this can be rewritten as

and developped into

Thus,

which multiplied by 4 leads to

obtaining

and getting (note that \(n-l_1=m\))

Eliminating the term \(\frac{(l_1-3)^2}{m}\), which is positive, it suffices to show that

Recall that we are considering the classes with \(l_1\ge 1\), \(m\ge 3l_1\), and \(l_2=0\). The inequality \(15l_1^2\ge -6l_1+9\) holds for \(l_1\ge 1\). For the left one, as the left-hand side decreases with \(l_1\), the right-hand side increases, and the maximum for \(l_1\) is m/3, it is enough to show that \(6m^2-29m+18\ge 0\). This holds for \(m>4\). Therefore, for \(n\ge 6\) the proof is done. For \(n=4\) and \(n=5\), we observe that, respectively, the classes \(\underline{(1, 3, 0)}\) and \(\underline{(1, 4, 0)}\), are an equilibrium, which can be seen directly (in this cases \(k=0\)). That is, it holds that \(\Pi _1(\underline{1, 3, 0})\ge P_1(0, (1, 3, 0))\) and \(\Pi _1(\underline{1, 4, 0}) \ge P_1(0, (1, 4, 0))\).

1.5 Proposition 5.1

Proof

Let \(\mathbf {EL}\) be the set of classes \(\underline{(l_1, m, l_2)}\) that contain a subgame-perfect equilibrium with positive profits for both firms. We will show that for all \(L\in \mathbf {EL}\) we have \(\Pi _j^*(L)<\Pi _j^*(\underline{0, n, 0)}\). Fix \(m^*>1\). Consider two classes \(L, L' \in \mathbf {EL}\) such that \(L=\underline{(l_1, m^*, l_2)}\), \(L'=\underline{(l_1', m^*, l_2')}\) and, without loss of generality, suppose \(l_1<l_1'\). Then, by Equation 3 we have \(\Pi _1^*(L)>\Pi _1^*(L')\). Therefore, the highest profit for firm j is in a class with \(l_j=0\). We will now show that equilibrium profit for classes of the form \(\underline{(0, m, n-m)}\) is increasing in m for \(2\le m \le n\). For firm 2 the reasoning is analogous and concludes the proof. Note that, using Equation 3, equilibrium profit in these classes can be rewritten as a function of m

We now observe that

Let \(A\equiv m(3n-1)-2n\) and \(B=3n-1\). Then, we have,

As \(\Pi _1^*(\underline{0,m,n-m})>0\) then \(A\ne 0\), thus,

Noting \(A=Bm-2n\), we get

The solution is \(m=\frac{2n}{n+1}\) which is smaller than 2. Hence, there is no critical point for \(m>2\), which means \(\Pi _1^*(\underline{0,m,n-m})\) is monotonous in \(2\le m \le n\). As \(\Pi _1^*(\underline{0,2,n-2})\le \Pi _1^*(\underline{0,n,0})\) for \(n\ge 2\), then \(\Pi _1^*(\underline{0,n,0})\) is maximal.

About this article

Cite this article

Soeiro, R., Pinto, A.A. Negative network effects and asymmetric pure price equilibria. Port Econ J 22, 99–124 (2023). https://doi.org/10.1007/s10258-021-00199-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-021-00199-3