Abstract

Nowadays, due to globalization, many domestic manufacturers have gone bankrupt after foreign manufacturers’ products entering their market. Obviously, pricing on products plays a crucial role in maintaining the market share and profit of the domestic manufacturers. In this paper, a Stackelberg game using the bi-level programming model approach is presented in order to analyze a pricing problem in which two manufacturers, one foreign and one domestic, compete. The domestic and foreign manufacturers sell their products in a competitive environment considering three different market segments, respectively with high, medium and low income levels of customers. Also, the domestic manufacturer plays the role as the game leader and foreign manufacturer the follower. In this problem, mill price and quality of product are considered as effective factors on customers’ utility in each market. Furthermore, the customers’ buying tendency from each manufacturer in each market is captured by the multinomial logit model. To solve the proposed model, a hybrid method based on Lambert-W function and Path-Following method has been used. Then, in order to investigate the domestic manufacturer’s profit versus the foreign manufacturer’s profit, the optimal prices of manufacturers are calculated by using different instances, based on product’s price and product’s quality of each manufacturer. Finally, the results conclude that the market segmentation with respect to the income levels leads to an increase in the profit of the domestic manufacturer. The proposed method can improve the competitive advantage of the domestic manufacturer vis-à-vis the foreign manufacturer.

Similar content being viewed by others

1 Introduction

In twenty first century, the number of manufacturers who sell similar products to customers is increasing. Thereby, we are witnessing an everyday growth of competitive environment amongst manufacturers for gaining their shares and profits of the markets. Therefore, considering the severe competitive environment, manufacturers inevitably need pay more attention to designing their strategies and also precisely estimating the customers’ requirements such as product quality, price and after-sales services, etc. For example, Li et al [1] investigated how to get more market share in the computer microprocessor industry by setting appropriate pricing on products. The authors chose Intel company for their research. They showed that Intel can get more profit by market segmentation based on customers’ preferences. Then, they considered some features that are important for the customers of this industry. They also stated that one of the most important features is pricing problems on the products so that customers, with different levels of willingness to pay, buy Intel products.

In order to precisely analyze the inclination of customers towards each manufacturer, the effective factors need to be properly included to reflect the utility functions of each manufacturer. It is noteworthy to point out that, manufacturers cannot determine the suitable strategy only by analyzing the market and forming utility functions. This is due to the fact that, determining a suitable sell strategy is highly dependent on the rivals’ strategies and also the general policy of governments who are present in a particular market. For example, some governments set tariffs on products of foreign manufacturers in order to protect the domestic human resources and also limit the outgoing of foreign currency. In fact, by practicing this method, the government limits the chances of a foreign manufacturer to compete in a market which is controlled by the government. On the contrary, some governments seek free and competitive market in which foreign and domestic manufacturers can readily compete with each other. The motivation of this policy is that, by freeing the market the competition between manufacturers increase and consequently their quality of products and after-sale services increase. Therefore, researchers propose different expressions for the utility function in order to sufficiently describe the share of each manufacturer in a particular market with the consideration of other competitors’ strategies. In the literature, the most important ones are Multinomial Logit (MNL) model function and Multiplicative Interaction (MCI) model which are widely used as a share determiner in competitive markets. Actually, both of these models are introduced as suitable models for market share modeling. But, there are some differences between them, such as the MNL model is known as an exponential function and the MCI model is known as a fractional function. Also, the MCI model assumes that the elasticity of market attributes, such as price and quality decreases with increasing the values of these variables, while in the MNL model the elasticity grows up to a certain level and then declines.

Another influential factor in the selling strategy can be referred to the society’s median income level in the target market as well as the willingness of the market to buy domestic or foreign goods. Obviously, when the customers of the market have low incomes, customers’ sensitivity to price and quality of goods is different from the situation of high incomes. Also, when customers have more willingness to buy domestic commodities, the condition of the domestic and foreign manufacturer in order to enter the market is totally different compared with the situation that customers have more willing to buy foreign commodities. Therefore, it seems that each manufacturer must first achieve complete information about the capabilities of its own and competitors in manufacturing technology, customer’s income level, and also the inclination rate of customers towards manufacturers' products (sense of patriotism toward the domestic's products), in order to examine the effects of these factors on its sell strategy and subsequently determine the best sell strategy.

By taking the above-mentioned points into consideration, in this paper, a bi-level model is applied based on a Stackelberg game. To better express, a domestic manufacturer and a foreign manufacturer compete with each other in order to gain more market share. Such that the domestic manufacturer acts as the leader (upper level) and the foreign manufacturer acts as the follower (lower level). Indeed, the foreign manufacturer reacts with the best response against the domestic manufacturer’s power of pricing in order to gain more market share and profit. In order to increase their profitability, these two manufacturers seek to determine the most proper selling strategy in three different markets. Such that these markets consist of customers with different sensibility coefficient towards price and quality of products. In fact, manufacturers are facing three kinds of customers with low level, medium level and high level incomes. Also, in this paper, price and quality are considered as major factors which affect the purchase rate of customers. Or alternatively, the utility function of manufacturers is based on each manufacturer’s product quality and price. Obviously, the sensitivity toward price and quality are different in each market. Note that, in this paper price is known as a decision factor and product quality is known as an exogenous factor. Therefore, manufacturers will offer their products at different prices in each market, with the aim to gain the maximum profit considering the sensibility coefficient towards price in each market. Also, it is noteworthy that in this paper, different sensibility coefficients are used to indicate the customers' willingness to buy from domestic and foreign manufacturer. By considering this assumption, the patriotic feeling of the customers of each market towards domestic and imported goods can be examined. The above-mentioned method is exploited in a variety of different industries practically, e.g., McDonald's has different prices to sell its products in varying markets [2]. The method in which variant prices are chosen for different markets or facilities is referred to as mill pricing. In order to determine the share of each manufacturer in each market, the MNL function is used in this study.

It should be noted that, since the government who is present in markets can provide information and legislative support to domestic manufacturer, the domestic manufacturer is considered as the leader of the proposed problem. Also, regarding the foreign manufacturer intends to enter a market where the domestic manufacturer is working there, therefore first the foreign manufacturer monitors the sales strategy of the domestic manufacturer, then decides how to enter the market in order to obtain maximum profit. This means that, practically the foreign manufacturer reacts with the best response against the domestic manufacturer’s power of pricing in order to obtain market more profit. In fact, given that the domestic manufacturer performs the first move and then the foreign manufacturer decides how to react with that strategy, thereby the assumption of the domestic manufacturer is leader and the foreign manufacturer is follower can be more reliable. It is important to point out this fact that, in this paper bi-level programming models have been used, considering the problem settings in this study.

Especially this study will propose a model and answer the following questions:

What strategy is considered as optimal for a domestic manufacturer in a market where a foreign manufacturer offers an imported product?

What is the effect of customers’ sensitivity towards the price of the product on the optimal decision of manufacturers, and subsequently their profits and shares in each market?

What is the effect of the society’s median income level on optimal decisions of each manufacturer?

What is the best pricing strategy for each manufacturer, in order to gain maximum share and profit in each market, when customers have a sense of patriotism toward the domestic manufacturer’s product?

The main contribution of this paper can be divided into three perspectives: First, as far as we are concerned, there are a small number of papers using the bi-level programming solution to design a pricing model in a Stackelberg game. In this paper, we exploited a new bi-level optimization model to tackle this leader–follower competitive pricing model, which includes mill pricing and competition. Also, we applied the MNL model in order to examine customer behavior better. In addition, we divided market into three parts based on customers’ median income level. So that customers with different income levels have different sensitivities to the price and quality of products. Second, some appealing findings and managerial insights pertaining to pricing strategies are derived by examining different aspects of the proposed model. Indeed, the mathematical model is analyzed based on some important parameters such as products’ quality, and products’ cost. Then, changes in manufacturers' pricing strategies, market share, and profits of each of them have been studied and researched. For example, model behavior has shown market segmentation based on society's income level can help the domestic manufacturer to increase its profit against the foreign manufacturer. Third, a hybrid method based on Lambert-W function and Path-Following method has been presented. In fact, two solution approaches which are Lambert-W function and Path-Following method have been used at some papers separately (please see references [3,4,5] and [6]). But, this hybrid method which uses both methods are novel and also we have not seen this hybrid method in any other article. It is noteworthy that, these type of methods are used in order to solve the model in many papers in this area which has a single level objective function. But since our model is a bi-level programming, we used this hybrid method and the results show that this approach could solve the problem and be reliable.

The rest of this paper is arranged as follows: Section 2 presents a short literature review. In section 3, the problem is defined and its mathematical formulation is introduced. To address the proposed model, a hybrid method is introduced in section 4. Section 5 delivers the computational experiments and illustrates the findings. Finally, the conclusions and the proposed future researches are given in section 6.

2 Literature review

In recent years, papers have been published so that the competition between manufacturers has been addressed regarding various aspects such as supply change network design, pricing and revenue management, attracting suppliers, competitive locating, etc. Amongst above-mentioned issues pricing and revenue management have been paid more attention in the last few years. The main concentration of this paper is on pricing policies in a global platform. Hence, the literature review mainly focuses on three major issues including pricing competition between manufacturers, bi-level programming and also the impact of multi-brands of a single product on the market share of each brand. It should be noted that, the focus was more on the articles that have examined these issues in the field of global supply chain.

2.1 Pricing competition between manufacturers

Product pricing is actually one of the most important aspects of strategy due to the effects of product’s price on attracting customers. Also, nowadays we are witnessing severe competition in products pricing because of the emergence of global competition between foreign and domestic manufacturers. In recent years many studies have analyzed the competition between manufacturers regarding their pricing decisions, with the following studies partly connected to our paper. Choi [7] has studied the competition between two manufacturers and a retailer who sells the products of these manufacturers. The study focuses on three non-cooperative games pertaining different power structures between the two manufacturers and their retailer, i.e., two Stackelberg and one Nash games. The study outcome shows that the less distinguished the products, the higher the prices and profits of the supply chain members. Anderson and Bao [8] have analyzed the effect of price competition on the optimum decision and profit of members of supply chain while considering linear demand function, in both centralized and decentralized situations. The results show that, a proper level of price competition will ensure a superiority of decentralized systems compared to centralized systems. Xiao et al [9] have studied an outsourcing decision-making model considering two manufacturers with competition on retail price and product quality. They studied the effect of varying elements such as production cost on the optimal outsourcing decisions. Xiao et al [10] has designed a model based on the game theory including a competition between a supply chain and an outside manufacturer. The competitive elements include pricing and lead-time, which have an effect on attracting the customers. Recently, Li and Chen [11] have developed a model based on the Stackelberg game considering two quality-differentiated manufacturers, i.e. with low and high quality products, and also a retailer. The retailer is introduced as the leader and possesses three choices to integrate with the manufacturers of low and high quality. Considering nowadays domestic market with globalization and presence of foreign products, a growing amount of foreign manufacturers have appeared in national markets. Meixel and Gargeya [12] have studied the effect of patriotic sentiment on perception of the customers regarding the imported products, by presenting a literature review paper on global supply chains. In other words, they have shown that, patriotism of the customers can have an enormous effect on the market share and profit of domestic and foreign manufacturers. For example, people who are more sensitive and more concerned with the economic power of their region, will view buying foreign produced products an unfavorable action and blame it for unemployment of the domestic labor force. Elliot and Cameron [13] have studied the inclination of the customers considering the effect of product quality and also country-of-origin. Interested readers can refer to studies [14,15,16] for further details on this issue. The emergence of foreign manufacturers can have a substantial effect on pricing strategies and consequently on share and profit of domestic manufacturers. However, to the extent of our knowledge, pricing strategy in a global scale has not been attended sufficiently. Amongst other papers in the literature, the below-mentioned ones are pertinent to our study: He and Xiao [17] have designed a supply chain model in a global setting, by considering a competition between two foreign manufacturers and one monopolized supplier in which pricing decisions are based on a no-cooperation assumption. Seppälä et al [18] by exploiting invoice-level data for a single product on a global scale, have studied logistics costs and transfer-pricing issue in a supply chain operation. Also, de Matta and Miller [19] have presented a model to maximize the profit based on a multinational supply chain, for a firm who operates globally. Their model considers all the factors which are important in designing a global manufacturing network, such as transfer price, simultaneously. These factors are dependent on exchange rate and tax in relevant countries. Nagurney and Li [20] have defined a game model with quality and pricing competition featured with globalization. Additionally, they have surmised, in their model, that products are distinguished by various brands including a possibility for outsourcing. Recently, Huang et al [21] have studied the competition between manufacturers and parallel importers, so as to determine distribution and pricing strategies of manufacturers. By considering a multinational firm, Niu et al [22] have designed a new model to investigate trade-offs between channel decentralization loss and global tax-planning gains.

2.2 Bi-level programming

The second arm of pertinent literature considers the bi-level programming approach deliberated by many researchers, among which only a limited number of them have considered pricing problems. Gao et al [23] have designed a nonlinear bi-level programming model for a pricing problem in which, the buyer plays the role of the leader and the vendor plays the role of the follower. In addition, Sadigh et al [24] have developed two bi-level models using the Stackelberg game in a supply chain producing different products. In the first model, manufacturer acts as the leader and in the second model the retailer acts as the leader. They have considered price and advertising cost as effective factors in each product’s demand. Also, Mokhlesian and Zagordi [25] have proposed a nonlinear bi-level model, by focusing on coordinating the inventory-pricing decisions in a bi-level supply chain with multi-products which includes a manufacturer and multiple retailers. Zhang et al [26] have designed two bi-level pricing models in order to study the optimal price and replenishment decisions in a leader–follower supply chain for high-tech products, in which the buyer acts as the leader and the vendor acts as the follower. By exploiting two bi-level programming models, Ma et al [27] have formed a joint lot sizing and pricing model in two supply chains consisting of the leader–follower approach. In recent years, Wang et al [28] have formed a bi-level programming model based on the Stackelberg game framework to obtain the optimal decisions on ordering, pricing, advertising, and environmental efforts respectively with a vender-led supply chain and buyer led-supply chain with multiple products. In addition, Amirtaheri et al [29] have investigated a supply chain led by manufacturer to study the optimal pricing and advertising solution by applying a bi-level optimization approach.

2.3 Multi-brands of a single product

Nowadays, manufacturers offer same products with different brands to the market. Therefore, this difference in brands ensures an inevitable effect on market share of each manufacturer [30, 31]. For example, a manufacturer can design its selling strategy based on offering low prices and with less concern on product quality. Such a manufacturer can attract customers with low level income, but it has no competition chance in the markets with high level income customers. Consequently, different characteristics of various brands of a product, have a substantial effect on the market share of each brand. Choi and Coughlan [32] have studied retailer’s decision problem by considering quality and product features and also the difference between manufactured brands. Recently, Giri et al [33] have optimized the pricing and quality decisions of a single retailer by considering various brands and multiple manufacturers competing to well-establish their brands and gain more market share. Pang and Tan [34] have designed based on differential games in which two manufacturers are competing against each other by producing the same product with different brands in a supply chain. They have analyzed the profit of firms under four different conditions, in order to understand the strategies of optimal quality.

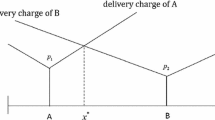

Generally speaking, in order to determine the outcomes of market share of each competing manufacturer, studies have applied various methods considering the effective factors such as price, quality, etc. [35]. Multiplicative Interaction (MCI) model [36, 37] and Multinomial Logit (MNL) model [38] are among the most developed and popular used ones in the literature of marketing and economy. In addition, MNL model is a well-established and commonly used customer decision model [39]. In this paper in order to express the influence of the price and quality in the market share of each manufacturer, MNL model has been used. The following works are partly related to our study. Huang [40] has designed three transport pricing models in which the mode choice behavior is formulated using the MNL model. Hence, the demand for the transportation system is found to be elastic. Lüer-Villagra and Marianov [3] have designed a pricing and hub location problem. In their work, two transportation companies are competing against each other in order to gain the market share. From their vantage point, MNL model has been used to create a model of customers’ behavior, more specifically to determine the percentage of the attracted customers by each transportation company. Zhang [4] has designed an optimization model of pricing and location in a competitive environment including retailers. The study has used MNL function in order to demonstrate the effect of travel cost and mill price on the market share of each retailer. Also, it has used path-following method in order to find a solution for the proposed problem. Recently, Gandomi and Zolfaghari [41] have designed an MNL model in which two manufacturers are competing against each other. While one offers lower prices, the other offers some rewards in three different levels, according to the loyalty of its customers.

According to the literature review, it is fairly obvious that, there is no presented study on the competition for pricing between a domestic manufacturer and a foreign manufacturer who are producing different brands in markets with different levels of income, in the Stackelberg game framework using bi-level programming method. In addition, very few researches have considered patriotic sentiments of customers towards domestic manufactured products. Therefore, this paper attempts to fill this research gap. Also, in order to determine the market share of each manufacturer MNL model has been utilized.

3 Problem definition and mathematical model

Nowadays due to the increase of similar products with varying qualities produced by different manufacturers in a special market, there is an intense competition engrossing manufacturers. Therefore, the necessity to devise a proper selling strategy in any desired market for attracting customers seems inevitable. As discussed previously, the most important factors in attracting customers is to determine a proper price and deliver the proper quality in accordance to market’s potential and the decisions of other competing manufacturers. For instance, in a market with lucrative customers, the quality of the products becomes the main issue instead of pricing. Also in a market with low income customers, the price of a products plays the crucial role in attracting the desired customers. Consequently, manufacturers have different prices for their products in any market.

According to the above mentioned, this research has investigated the competition among two manufacturers that one is a domestic manufacturer and the other is a foreign manufacturer who aims to achieve the maximal profits in the markets consisting of customers with different income levels.

In summary, this paper has tried to implement an important real-world problem based on a mathematical model by considering the competition on pricing problem between domestic and foreign manufactured goods that today many companies are involved with this problem. For this purpose, the following aspects are considered for the model environment: (A) Designing Stackelberg game between domestic and foreign manufacturer that the domestic manufacturer is considered as a leader and the other one is known as a follower. (B) Using the bi-level programming so that the domestic and foreign manufacturers are considered as the upper level and the lower level of the model, respectively. (C) Considering price and quality factors as influential factors in the market share of each manufacturer. (D) Implementing MNL function to determine the utility of each manufacturer. (E) Considering markets based on customer’s income level. (F) Considering mill pricing approach for each market. (G) Applying an exponential function in order to determine part of production cost that depends on the quality.

The following section has discussed in detail these assumptions and also why these assumptions are considered.

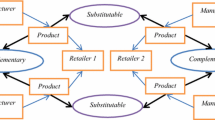

As it is shown in figure 1, two manufacturers named F and D, are considered in this paper, with D - a Domestic Manufacturer and F - a Foreign Manufacturer selling imported goods.

It is vital to point out that, the main purpose of this paper is to determine a proper pricing strategy by manufacturer D which will lead them to get more market share against manufacturer F and achieve maximal profit. To achieve this purpose, a mathematical model has been designed, using the concept of the Stackelberg game on the basis of bi-level programming (figure 2). As you know in the real world, the market share of manufacturers depends not only on their own decisions but also on the decisions of their competitors on product quality and prices. Hence, the need to apply an appropriate utility function to determine the market share of each manufacturer will be made more sense. In this paper, in order to determine the share and the profit of each manufacturer, MNL model has been exploited. It should be noted that this type of modeling method is usually used when we want to investigate the market share of each competitor based on some discrete features like price, quality, etc. Actually, this method has been used by many researchers to determine the market share of companies. Readers interested in these related issues can refer to the articles by Lüer-Villagra and Marianov [3], Zhang [4] and Hanson and Martin [42]. It is noteworthy to consider that, in this paper the quality of manufacturers’ products is hypothesized as an exogenous factor. The notation for the proposed bi-level programming model for the leader-follower competitive pricing problem (BLFCP) is as follows:

Set:

\(M\) | Set of markets (M={Low-income, Medium-income, High-income}) |

\(j\) | the index of market set |

Parameters:

\(d_{j}\) | Potential demand at market \(j^{th}\) |

\(\beta^{^{\prime}}\) | Sensitivity parameter of the customers to the product quality |

\(QD\) | Quality of product the domestic manufacturer |

\(QF\) | Quality of product the foreign manufacturer |

\(CD\) | Purchase fixed cost of the product for the domestic manufacturer |

\(CF\) | Purchase fixed cost of the product for the foreign manufacturer |

\(\theta D_{j}\) | Sensitivity parameter of the customers at market \(j^{th}\) to the product price of the domestic manufacturer |

\(\theta F_{j}\) | Sensitivity parameter of the customers at market \(j^{th}\) to the product price of the foreign manufacturer |

\(Pmax\) | Maximum price of the each manufacturer’s product due to government control policies |

Decision Variables:

\(p_{j}\) | product price of the domestic manufacturer at market \(j^{th}\) |

\(q_{j}\) | product price of the foreign manufacturer at market \(j^{th}\) |

\(u_{j}\) | The utility of a customer from the domestic manufacturer at market \(j^{th}\) |

\(uu_{j}\) | The utility of a customer from the foreign manufacturer at market \(j^{th}\) |

\(x_{j}\) | Market share of the domestic manufacturer at market \(j^{th}\) |

\(z_{j}\) | Market share of the foreign manufacturer at market \(j^{th}\) |

In this paper, the expenses concerning the products of domestic and foreign manufacturers are stated in the form of expressions (1) and (2).

As it is notable in expressions (1) and (2), the costs of producing the product in each manufacturing consist of two parts: first, varying costs which depend on quality of every product; second, fixed costs which depend on manufacturing technology, labor cost, set-up cost and also R&D (Research and Development) unit related costs. Furthermore, the foreign manufacturer must take into account the tariffs and customs fees for its goods as fixed costs. Since in most reality cases, increment of product’s quality in lower level is less costly than the higher level, e.g. from 0.5 to 1 is less expensive than 1.5 to 2, in this paper an exponential function is used to calculate the quality depending costs (figure 3) [43].

In this paper, potential customers of the market can decide to buy from whichever manufacturer that they desire. Moreover, two effective factors with an effect on customer’s decision have been considered. (i) The product mill price in the market, and (ii) Product’s quality. Therefore, expressions (3) and (4) describe the utility function of each manufacturer based on customers’ inclination towards each manufacturer and also customers’ sensitivity toward price and quality at each market.

where \(\beta^{^{\prime}}\), \(\theta D_{j}\) and \(\theta F_{j}\) are positive parameters.

Considering the effective factors in attracting the customers by every manufacturer, the MNL function, which is used to calculate the probability of attraction of market’s customers of each manufacturer, is stated as:

Expressions (5) and (6) measure the desire of customers towards the products of domestic and foreign manufacturers, respectively. In other words, \(x_{j}\) and \(z_{j}\) show the manufacturers’ market share.

Finally, in order to find the optimal competing price for each manufacturer, the bi-level problem is formulated as follows:

S.T.

S.T.

The objective (7) and constraints (8) and (9) depict ULP; whereas the objective (10) and constraint (11) indicate LLP of the model. Objective functions \(F_{D}\) and \(F_{F}\) are aimed to maximize the profit of domestic and foreign manufacturer respectively (expressions 7 and 10). Constraints (8) demonstrates that, the proposed prices of domestic manufacturers cannot be higher than a predetermined price. This is due to long term policies of government which are designed to regulate the market. Finally, constraints (9) and (11) manifest the positivity and continuousness of every manufacturer’s prices.

4 Solution method

In this paper, a pricing competitive model based on bi-level programming problem (BOP) has been designed. Many researchers have used BOP in different fields such as Hierarchical planning, Pricing, Transportation, Economics Machine Learning, Stackelberg game and Electricity, with different proposals of solution methods [44]. Generally speaking, solving these types of models is categorized into two main types, Classical Approaches and Evolutionary Approaches [44]. The Classical Approaches are then subcategorized into four subsections, single-level reduction, descent methods, penalty function methods, and trust-region methods, whereas Evolutionary Approaches are subcategorized into three subsections as nested method, single-level reduction and meta modeling-based methods. We refer the successful methods for solving BOPs to studies [5, 45,46,47,48,49,50] for details.

We have to decide two things in the BLFCP model: first pricing decision of the domestic manufacturer in the ULP, and second pricing decision of the foreign manufacturer in the LLP, with continuous pricing variables. To tackle this problem, first single-level reduction has been used and the problem becomes a single level problem (see section 4.1). Afterwards, to solve the single level problem, the path-following method has been used in section 4.2. It is important to consider that, the path-following method is practical and common to solve problems containing MNL function.

4.1 Reformulation of the pricing problem

In the bi-level models and Stackelberg game, every decision maker has controlled only over its own decision variables whereas decision variables of other decision makers are assumed to be constant. Thus, in the proposed BLFCP model, decision variables of the first level are assumed to be constant in the second level which are \(\left\{ {\mathop {P_{j} }\limits^{ \wedge } } \right\}_{j \in M}\) and \(\left\{ {\mathop {u_{j} }\limits^{ \wedge } } \right\}_{j \in M}\). Hence, if \(\eta_{j}\) is defined as:

Using expression (12), foreign manufacturer’s objective function in LLP will be shown as follows:

Therefore, by performing differentiation on expression (13) with respect to \(q_{j}\) and putting the expression equal to zero, the optimum price of foreign manufacturer is as follows:

Then:

Noting the linear nature of utility functions of domestic and foreign manufacturer (expressions 3 and 4) and also considering the exponential nature of foreign manufacturer’s market share (expression 6), it is observable that expression (15) results a function of price. Nevertheless, it is possible to obtain an optimum solution by using Lambert-W function [3, 6]. The foreign manufacturer’s optimum price at each market is stated in the next theorem.

Theorem 1

The optimal price of foreign manufacturer at each market is calculated as follows:

Proof

See Appendix.

It should be noted that, Lambert-W can be defined as the inverse function of \(f(w) = we^{w}\). Therefore, based on Theorem 1 the proposed bi-level model can be reformulated to a single-level model which is presented as following:

S.T.

4.2 Optimizing single-level problem

In this section, we will try to solve the single level model indicated in section 4.1. We determine the optimal price and share of domestic manufacturer in each market. Also, with a given pricing strategy of domestic manufacturer, we examine the optimal decision of foreign manufacturer about its products in the market. In order to solve the obtained single level model, the path-following method has been used.

Considering that the objective function of the problem (expression 17) is an MNL profit function model, common approaches, like Newton’s method and gradient descent, will result in local optimum. It is due to the fact that, the nature of these functions in relation with price, is not concave [42, 51]. Therefore, Hanson and Martin [42] have presented a novel method, named path-following method, in order to solve this type of functions and overcome their non-concavity feature. The main idea of this method is to shape a price "path" from the global optimum of an associated, but concave logit profit function, to the global optimum of the true (but non-concave) logit profit function. The study result showed that their proposed method has a better functionality comparing to other existing methods.

Path-following method is based on two principals [4]. First, if some changes are applied to utility function (expression 3) as follows, expression 17 will become concave. The following function is called modified utility function.

whereas \(t\) is a parameter varying in the period of (0,1], and also \(\lambda\) is a positive parameter. Hanson and Martin [6] proved that \(t\) always exists, even in very small fractions, in order to have a obtain concave expression (22). In another words, there always exists a valuable \(t\) which considering it, the above-mentioned \(t\) (in expression 22) has a global optimum solution. It is important to note that given \(t = 1\) the modified utility function transforms to the expression (3)’s utility function.

Second, in the path-following approach, a “path” of prices can be obtained from modified utility function which can be a local or even global optimum solution for non-concavity utility function. Then, using an iterative algorithm, this approach is launched until \(t = 1\), which drives to a local or even global domestic manufacturer’s prices.

Albeit adequate settings were presented for path-following solution to develop a result to find a global optimal solution (it might not be the singular global optimal solution), it is nearly impracticable for a problem to determine if the provisos can be fulfilled or not [42]. Consequently, the solution obtained using the path-following method is in many cases merely a rather well local optimal solution. It is important to note that, in every repetition of the path-following algorithm, in this paper, the gradient descent method has been used to find the local optimum solution. To use gradient descent method, it is necessary to calculate vector of domestic manufacturer’s pricing objective function. Therefore, equations (23) to (26) are used to calculate vector of domestic manufacturer’s pricing objective function.

Considering the above-mentioned arguments, in this section, first the domestic manufacturer optimal price is determined by using path-following method. Afterwards, noting these prices, the foreign manufacturer optimum price in each market is determined. Finally, the optimum profit of each manufacturer is calculated in accordance with their respective functions.

5 Computational results

The main purpose of this section is to analyze the proposed model and solution method. Also, in order to have a better understanding of the model behavior, a sensitivity analysis conducted for different parameters of BLFCP model so that a managerial insight is obtained in this study.

In order to analyze the share and the profit of each manufacturer in each market, we define \(\alpha_{j}\), which is a determiner of the effect of each market on the profit of each manufacturer. This parameter is obtained based on the population of customers in each market, in proportion to the population of all the customers.

Therefore, the profit of each domestic and foreign manufacturer in each market, are calculated respectively:

Also three different markets are representing customers with different income ranges, meaning: low income, medium income, high income (figure 1). It is fairly obvious that, the market with low income level customers is more sensitive towards products’ price whereas the market with high income costumers is more sensitive towards the quality of the products. Therefore, in this paper, the parameters of sensitivity coefficient are defined as follows, regarding the quality and price of each market.

As it is shown in expressions (30) and (31), regarding the nature of utility functions and also market share equations of each manufacturer (expressions 5 and 6), in increasing \(\theta D_{j}\) and \(\theta F_{j}\) indicates that costumers are more sensitive towards price, whereas decreasing \(\beta_{j}^{^{\prime}}\) indicates that customers are more sensitive towards the quality of product.

We also note that, in order to use the path-following method, this paper sets \(\lambda = 10\) and also the initial \(t\) as \(t_{0} = 0.001\), which are similar to Zhang [4]. Also in order to determine the steps of path-following approach, the equation \(t_{i} = t_{0} + {\raise0.7ex\hbox{${i \times (1 - t_{0} )}$} \!\mathord{\left/ {\vphantom {{i \times (1 - t_{0} )} {20}}}\right.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{${20}$}}\) is used as stated by Hanson and Martin [42]. Or in short, considering the mentioned equations, in order to achieve a solution, 21 steps should be gone through.

Due to lacking of real data in the literature of studied problem, a number of random problems are generated to analyze the proposed model. The mentioned solving algorithm is implemented on Matlab 2012a and ran on a PC, featuring a 2.9 GHz Intel Core i5 processor and 8 GB 2133 MHz LPDDR3 internal memory.

It is worthwhile to mention, the authors of this paper believe that this model is almost practical in the field of auto parts industry and electronic home appliances industry in the real world. This belief stems from the fact that in these domains and other similar industries, manufactures always compete to each other in foreign and domestic market in order to get more market share and profit. So that in any country can be seen all kinds of domestic and foreign products of these industries. In addition, it can be seen at each country there are different kinds of customers with various income levels that have different sensitivities to the price and quality of the product of these industries. Furthermore, these industries have the same behavioral of cost function of quality as this paper assumed (see figure 3). For example, when auto parts manufacturer wants to improve the quality of its product, it faces behavioral of an exponential cost function. These examples show that proposed model assumptions can be almost aligned to these real world cases.

5.1 Problem instance generation

In this section, in order to illustrate the mathematical model, in some of the important parameters the behavior of the proposed model in three different random instances has been studied. Hence, changes in the value of sensitivity parameter of the customers to the product quality (\(\beta_{j}^{^{\prime}}\)) and sensitivity parameter of the customers to the product price (\(\theta F_{j}\) and \(\theta D_{j}\)) are examined. For this purpose, in each instance the rest of the parameters of foreign and domestic manufacturer are considered the same. Also, table 1 indicates the results of optimal price, profit of each manufacturer in each market, total profit of each manufacturer in selling their products and the effect of each market on the total profit of manufacturers for these parameters.

Given that the leader performs the first move, practically the leader has a wider solution space than the follower. On the other hand, given that the other parameters of the model are the same in instances 1-3, the foreign manufacturer (follower) will not always earn a better profit than the domestic manufacturer (leader). The correctness of this rational behavior of the model is shown in table 1.

Also, another point to be made in order to verify the behavior of the model is that when the market has low income level customers, the price sensitivity enhances. Thus, Manufacturers have to apply lower prices on their products in order to gain maximum profit. The correctness of this behavior is visible in the proposed model in instances 1-3.

Some other points that can be inferred from table 1 are as follows. First, as the quality sensitivity coefficient increases (\(\beta_{j}^{^{\prime}}\)), the two manufacturers practically apply higher prices on their products (see instances 1 and 2). Second, when the customers show a more sensitive response regarding the price of manufacturers’ products, (\(\theta F_{j}\) and \(\theta D_{j}\)), two manufacturers practically apply lower prices on their products (see instances 1 and 3). In fact, with the decrease of \(\beta_{j}^{^{\prime}}\), markets will value the quality of product more than its price, hence, manufacturers can maneuver more easily to apply a higher price for their products. On the other, by increasing \(\theta F_{j}\) and \(\theta D_{j}\) markets show more sensitivity to the price of product therefore, manufacturers are forced to apply lower prices. Both of these results show the manufacturers' reasonable behavior towards the quality and price coefficients.

5.2 Sensitivity analyze according to products’ price in different markets

This section analyses the effect of sensitivity coefficient variation regarding the price of domestic and foreign manufacturer product, on market share and profit of each of the manufacturer. In this section markets have been studied considering three different scenarios: (i) when almost all of the customers of the markets are low level income customers, (ii) when almost all the customers of the markets are high level income customers and (iii) when customers have a sense of patriotism toward domestic manufactured product. It should be noted that, when it is stated that the income level of markets’ customers is high or low, in fact it has been studied from two different point of views: (i) the population of each market (\(d_{j}\)) and (ii) the level of sensitivity towards products’ prices (\(\theta D_{j} ,\theta F_{j}\)). As seen in the table 2, instances 4 and 5 are pertaining to the markets with more low level income customers comparing to others. Even though, instance 5 has the lowest level income customers due to high sensitivity toward prices. In contrast, instances 7 and 8 are pertaining to the markets with high level income customers. Instance 8 has a higher income level due to less sensitivity toward prices comparing to other instances. Instance 6 is patriot society because the sensitivity coefficient towards domestic product is lower than foreign product in it thus it supports domestic manufacturer products.

Figure 4 compares instances 4 and 5 in each market. As it is shown in figure 4a, when the customers of a society become poorer, the profit of the two manufacturer lessens. There is an interesting point in comparing these two instances and that is, considering this fact that in the instance with lower income level practically the price becomes the decisive factor and also domestic manufacturer has less pricing limits than foreign manufacturer, a market with lower income level has more market shares of domestic manufacturer than the other (figure 4b). In contrast, when the income level of customers increases, the value of the products’ price parameter becomes lower and consequently the competition between manufacturers in order to obtain each market’s share and profit, becomes fierce. This issue is depicted very well in comparison between instances 7 and 8 in figure 5.

In figure 6a comparison between instances 6 and 4 is done in each market. When customers have a sense of patriotism towards domestic manufacturer’s product, the domestic manufacturer obtains a bigger market share comparing to before and thus has a monopoly on the market and consequently, the profit of the domestic manufacturer increases substantially (figures 6a and 6c). As a result of this monopoly, a negative side effect forms up in which domestic manufacturer will offer very high process for products with no noticeable improvements and also foreign manufacturer, in order to save its market share, has to decrease its marginal profit ensuing a lower price for its products (figure 6b). In order to avoid this negative side effect, governments usually use the policy of pricing threshold on domestic manufacturer’s product ( \(Pmax\) ) to avoid the irrational price increment of domestic manufacturer.

5.3 Sensitivity analyze according to products’ quality in different markets

In this section, the effect of changing quality of domestic and foreign manufacturer’s products on market share and profit has been studied. As seen in table 3, instance 9 is pertaining to a state in which the two manufacturers have the same quality. Furthermore, instances 10 and 11 represent a state in which the product’s quality of the domestic manufacturer is better than the foreign one and also instances 12-14 represent a state in which the product’s quality of the foreign manufacturer is better than the domestic one.

In figure 7, a comparison between instances 9-11 has been depicted. As it is shown in figure 7a, when the domestic product’s quality is higher than the foreign one, market share of domestic manufacturer increases in the markets with high quality sensitive customers (Market 3). In contrast, taking into notice that, increment of quality ensues higher manufacturing costs, therefore, it is reasonable that, domestic manufacturer applies higher prices on its products and consequently, loses its share in markets with price sensitive customers (Market 1). But, due to high level of competitiveness of domestic manufacturers comparing to foreign ones, with determining the right pricing policy strategy, market share and profit losses become less effective than before (figure 7b). Also in figure 8 instances 9 and 12-14 are studied. As it is demonstrated in figure 8a, as the quality of foreign manufacturer’s product increases, like the above-mentioned point, market share of foreign manufacturer increases in Market 3 and decreases in Market 1. However, with a comparison between instances 13 and 14 this interesting fact can be inferred that, if foreign manufacturer increases its product’s quality more than a certain point, its profit decreases even in markets with high quality sensitive customers (figure 8b). This is due to the fact that, by increasing the quality, the foreign manufacturer cannot obtain noticeable market share thus unable to compensate for the quality increment costs and its profit decreases.

By studying and analyzing this section, an interesting conclusion can be found that, manufacturers should consider the sensitivity of customers before entering a market and determining the level of quality of their products. Afterwards, they should consider the amount of market profit percentage proportional to total market share (\(\alpha_{j}\)), and this element depends on the population of each market. For instance, when the population of high level income customers is not considerable, there is no practical and economic reason for manufacturers to increase the quality of their products which will result in loss of market share in markets with low level income customers and losing a substantial amount of their total profit which depends on this market.

5.4 Model analysis in the overall market situation

The purpose of this section is to demonstrate the benefits of market segmentation with respect to the income level of customers. Hence, in this section, the domestic manufacturers' profit in two modes, the overall market and the market segmentation according to customer income level, is compared. As seen in table 4, instance 15 is indicating a state in which the two manufacturers have the same parameters. In addition, instance 16 represents a state in which the domestic manufacturer has better conditions than the foreign manufacturer in terms of sensitivity parameter to product price and fixed costs. In contrast, instance 17 depicts a state in which the foreign manufacturer has better conditions than the domestic manufacturer in the aforementioned parameters.

It is important to mention, in this section \(\theta D,\theta F\) and \(\beta\) for the overall market are calculated through weighted mean. For example, the parameters mentioned in instance 16 is calculated as follow:

As it is shown in figure 9, the domestic manufacturers' profit in all situations (instances) is improved when the markets segmented with respect to the income level of customers. In fact, the results show that market segmentation with respect to the income level leads to an increase in profit of the manufacturers. But this method can be one way for the domestic manufacturer to raise its profits. Indeed, the domestic manufacturer can increase its competitive advantage in selling products by this segmentation.

By studying this section, it is found that, manufacturers before pricing on their products should divide markets with respect to income level of customers. Practically, manufacturers can increase their chance to sell their products by this method.

6 Remarks and suggestions

Nowadays, the competition for gaining share and profit in different markets is fierce. Due to this fact, manufacturers pay more attention to effective factors such as price and quality which play a crucial role in appealing the customers. This attention is paid to guarantee a sufficient share in the current competitive environment, by determining the right price and quality. Hence, in this paper a competitive pricing problem is presented in which, domestic and foreign manufacturers are competing in order to gain the maximum share in three different markets consisting of high, medium and low level income customers.

The proposed mathematical problem is modeled as a bi-level programming problem, by using Stackelberg game concept. The domestic and foreign manufacturers play the role of a leader and a follower respectively. In this paper, the effective factors with an impact on the share of each manufacturer, are assumed to be mill price and quality of product. Also to determine the customers’ buying tendency from each manufacturer, the MNL model has been used. Meanwhile, with the consideration that the proposed model is a bi-level model and the utility function is non-linear, a hybrid method based on Lambert-W function and Path-Following method have been used to solve the problem.

Our mathematical model confirms that, in competitive environment, obtaining the highest market share is highly dependent on customers' behavior and customers' sensitivity to price and quality of the products. Considering customers' sensitivity brings new insights about the competitive pricing problem between domestic and foreign manufacturers. We have shown how this customers' behavior plays a crucial role on the optimal pricing decisions of the domestic and foreign manufacturers. Also, the results indicate that when customers have patriotic sentiments towards purchase of the domestic product, the domestic manufacturer has better opportunity to sell its good in comparison to the foreign manufacturer. But, this situation may lead to form a monopoly in the market by the domestic manufacturer. Hence, governments should put a price threshold on the domestic manufacturer’s goods to avoid the formation of monopoly. In addition, the computational results discover that one alternative that the domestic manufacturer can improve its competitive advantage is to segment the market with respect to the income level of customers.

In this paper, quality is considered as an exogenous factor with an effect on the utility of the manufacturers. It is proposed, for future works, to consider the product quality as a decision variable which in fact means that it could be considered as an endogenous factor. Also in order to make the problem’s environment more realistic, some factors like lead time and advertisement which affect the utility of each manufacturer for the customers, can be considered. Furthermore, by adding the probabilistic nature of the customers’ demand in each market to the proposed mathematical model, a more realistic model can be designed. Also the concept can be used in sustainable environment including the main aspects of retail supply chain [52,53,54,55,56].

References

Li H, Webster S, Mason N and Kempf K 2019 Product-line pricing under discrete mixed multinomial logit demand: winner—2017 M&SOM practice-based research competition. Manufacturing & Service Operations Management 21(1): 14–28

Thomadsen R 2007 Product positioning and competition: the role of location in the fast food industry. Marketing Science 26(6): 792–804

Lüer-Villagra A and Marianov V 2013 A competitive hub location and pricing problem. European Journal of Operational Research 231(3): 734–744

Zhang Y 2015 Designing a retail store network with strategic pricing in a competitive environment. International Journal of Production Economics 159: 265–273

Parvasi S P, Tavakkoli-Moghaddam R, Taleizadeh A A and Soveizy M 2019 A bi-level bi-objective mathematical model for stop location in a school bus routing problem. IFAC-PapersOnLine 52(13): 1120–1125

Aravindakshan A and Ratchford B T 2010 Solving share equations in logit models using the lambertw function. Review of Marketing Science 9(1): 1–17

Choi S C 1991 Price competition in a channel structure with a common retailer. Marketing Science 10(4): 271–296

Anderson E J and Bao Y 2010 Price competition with integrated and decentralized supply chains. European Journal of Operational Research 200(1): 227–234

Xiao T, Xia Y and Zhang G P 2014 Strategic outsourcing decisions for manufacturers competing on product quality. IIE Transactions 46(4): 313–329

Xiao T, Shi J and Chen G 2014 Price and leadtime competition, and coordination for make-to-order supply chains. Computers & Industrial Engineering 68: 23–34

Li W and Chen J 2018 Backward integration strategy in a retailer Stackelberg supply chain. Omega 75: 118–130

Meixell M J and Gargeya V B 2005 Global supply chain design: a literature review and critique. Transportation Research Part E: Logistics and Transportation Review 41(6): 531–550

Elliott G R and Cameron R C 1994 Consumer perception of product quality and the country-of-origin effect1. Journal of International Marketing 2(2): 49–62

Bilkey W J and Nes E 1982 Country-of-origin effects on product evaluations. Journal of International Business Studies 13(1): 89–100

Netemeyer R G, Durvasula S and Lichtenstein D R 1991 A cross-national assessment of the reliability and validity of the CETSCALE. Journal of Marketing Research 28(3): 320–327

Kucukemiroglu O 1999 Market segmentation by using consumer lifestyle dimensions and ethnocentrism: an empirical study. European Journal of Marketing 33(5/6): 470–487

He J F and Xiao W 2009 No-cooperation pricing strategies of global supply chain against monopoly suppliers. In: 2009 International Conference on Information Engineering and Computer Science (pp. 1–4). IEEE

Seppälä T, Kenney M and Ali-Yrkkö J 2014 Global supply chains and transfer pricing. Supply Chain Management: An International Journal 19(4): 445–454

de Matta R and Miller T 2015 Formation of a strategic manufacturing and distribution network with transfer prices. European Journal of Operational Research 241(2): 435–448

Nagurney A and Li D 2015 A supply chain network game theory model with product differentiation, outsourcing of production and distribution, and quality and price competition. Annals of Operations Research 226(1): 479–503

Huang H, He Y and Chen J 2019 Competitive strategies and quality to counter parallel importation in global market. Omega 86: 173–197

Niu B, Liu Y, Liu F and Lee C K 2019 Transfer pricing and channel structure of a multinational firm under overseas retail disruption risk. International Journal of Production Research 57(9): 2901–2925

Gao Y, Zhang G, Lu J and Wee H M 2011 Particle swarm optimization for bi-level pricing problems in supply chains. Journal of Global Optimization 51(2): 245–254

Sadigh A N, Mozafari M and Karimi B 2012 Manufacturer–retailer supply chain coordination: a bi-level programming approach. Advances in Engineering Software 45(1): 144–152

Mokhlesian M and Zegordi S H 2014 Application of multidivisional bi-level programming to coordinate pricing and inventory decisions in a multiproduct competitive supply chain. The International Journal of Advanced Manufacturing Technology 71(9–12): 1975–1989

Zhang G, Lu J and Gao Y 2015 Bi-level pricing and replenishment in supply chains. In: Multi-Level Decision Making (pp. 325–336). Springer, Berlin

Ma W, Wang M and Zhu X 2014 Improved particle swarm optimization based approach for bilevel programming problem-an application on supply chain model. International Journal of Machine Learning and Cybernetics 5(2): 281–292

Wang M, Zhang R and Zhu X 2017 A bi-level programming approach to the decision problems in a vendor-buyer eco-friendly supply chain. Computers & Industrial Engineering 105: 299–312

Amirtaheri O, Zandieh M, Dorri B and Motameni A R 2017 A bi-level programming approach for production-distribution supply chain problem. Computers & Industrial Engineering 110: 527–537

Katz M L 1984 Firm-specific differentiation and competition among multiproduct firms. Journal of Business S149–S166

Gilbert R J and Matutes C 1993 Product line rivalry with brand differentiation. The Journal of Industrial Economics 223–240

Choi S C and Coughlan A T 2006 Private label positioning: quality versus feature differentiation from the national brand. Journal of Retailing 82(2): 79–93

Giri B C, Roy B and Maiti T 2017 Multi-manufacturer pricing and quality management strategies in the presence of brand differentiation and return policy. Computers & Industrial Engineering 105: 146–157

Pang J and Tan K H 2018 Supply chain quality and pricing decisions under multi-manufacturer competition. Industrial Management & Data Systems 118(1): 164–187

Haynes K E and Fotheringham A S 2020 Gravity and spatial interaction models. Beverly Hills, CA: Sage

Huff D L 1963 A probabilistic analysis of shopping center trade areas. Land Economics 39(1): 81–90

Nakanishi M and Cooper L G 1974 Parameter estimation for a multiplicative competitive interaction model—least squares approach. Journal of Marketing Research 11(3): 303–311

McFadden D 1973 Conditional logit analysis of qualitative choice behavior. In P. Zarembka (Ed.), Frontiers in econometrics. New York: Academic Press

Haase K and Müller S 2014 A comparison of linear reformulations for multinomial logit choice probabilities in facility location models. European Journal of Operational Research 232(3): 689–691

Huang H J 2002 Pricing and logit-based mode choice models of a transit and highway system with elastic demand. European Journal of Operational Research 140(3): 562–570

Gandomi A and Zolfaghari S 2018 To tier or not to tier: an analysis of multitier loyalty programs optimality conditions. Omega 74: 20–36

Hanson W and Martin K 1996 Optimizing multinomial logit profit functions. Management Science 42(7): 992–1003

Zugarramurdi A, Parin M A and Lupin H M 1995 Economic engineering applied to the fishery industry (Vol. 351). Food & Agriculture Org

Sinha A, Malo P and Deb K 2017 A review on bilevel optimization: from classical to evolutionary approaches and applications. IEEE Transactions on Evolutionary Computation 22(2): 276–295

Shimizu K 1981 Two-level decision problems and their new solution methods by a penalty method. IFAC Proceedings Volumes 14(2): 1303–1308

Vicente L N and Calamai P H 1994 Bilevel and multilevel programming: a bibliography review. Journal of Global Optimization 5(3): 291–306

Colson B, Marcotte P and Savard G 2005 A trust-region method for nonlinear bilevel programming: algorithm and computational experience. Computational Optimization and Applications 30(3): 211–227

Mahmoodjanloo M, Parvasi S P and Ramezanian R 2016 A tri-level covering fortification model for facility protection against disturbance in r-interdiction median problem. Computers & Industrial Engineering 102: 219–232

Parvasi S P, Mahmoodjanloo M and Setak M 2017 A bi-level school bus routing problem with bus stops selection and possibility of demand outsourcing. Applied Soft Computing 61: 222–238

Parvasi S P, Tavakkoli-Moghaddam R, Bashirzadeh R, Taleizadeh A A and Baboli A 2019 Designing a model for service facility protection with a time horizon based on tri-level programming. Engineering Optimization

Taleizadeh A A, Niaki S T A and Hosseini V 2009 Optimizing multi product multi constraints bi-objective newsboy problem with discount by hybrid method of goal programming and genetic algorithm. Engineering Optimization 41(5): 437–457

Taleizadeh A A, Alizadeh-Pasban N and Sarker B R 2018 Coordinated contracts in a two-echelon green supply chain considering pricing strategy. Computers and Industrial Engineering 124: 249–275

Alizadeh-Basbam N and Taleizadeh A A 2020 A hybrid circular economy- game theoretical approach in a dual-channel green supply chain considering sale’s effort, delivery time, and hybrid re-manufacturing. Journal of Cleaner Production 250: 119521

Taleizadeh A A, Soleymanfar V R and Govindan K 2018 Sustainable EPQ models for inventory systems with shortage. Journal of Cleaner Production 174: 1011–1020

Taleizadeh A A, Kalantary S S and Cárdenas-Barrón L E 2016 Pricing and lot sizing for an EPQ inventory model with rework and multiple shipments. TOP 24: 143–155

Taleizadeh A A, Khanbaglo M P S and Cárdenas-Barrón L E 2016 An EOQ inventory model with partial backordering and reparation of imperfect products. International Journal of Production Economics 182: 418–434

Author information

Authors and Affiliations

Corresponding author

Appendix A

Appendix A

1.1 Proof of Theorem 1.

Expression (15) should be simplified to following:

By replacing equation (6) in (A-1) expression:

Then it is simplified as following:

By multiplying (A-3) by \(\theta F_{j}\) and then subtracting \(\beta^{^{\prime}}\) from both sides, it can be concluded that:

Rewriting (A-4) we have:

By taking exponentials on both sides and dividing both sides by \(\eta_{j}\), the following can be achieved:

If we assume \(W = \frac{{e^{{\beta^{^{\prime}} e^{QF} - (\theta F_{j} \times q_{j}^{*} )}} }}{{\eta_{j} }}\), then we rewrite (A-6) as \(We^{W} = \frac{{e^{{ - 1 + \beta^{^{\prime}} e^{QF} - (\theta F_{j} \times CFtotal)}} }}{{\eta_{j} }}\). This expression and Lambert-W are the same, considering the expression \(f(w) = we^{w}\), so:

Substituting for \(W\), we find:

Then, by exploiting the logarithmic property of the Lambert-W function (i.e. \(\ln (W(x)) = \ln (x) - W(x)\)) and taking the natural logarithms on both sides, the following can be calculated:

Then, we have:

Which can be simplified (A-10) as follow:

Rights and permissions

About this article

Cite this article

PARVASI, S.P., TALEIZADEH, A.A. Competition pricing between domestic and foreign manufacturers: a bi-level model using a novel hybrid method. Sādhanā 46, 110 (2021). https://doi.org/10.1007/s12046-021-01627-y

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12046-021-01627-y