Abstract

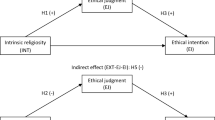

We extend the literature by providing evidence that a cultural variable, intrinsic Islamic religiosity is important in understanding auditors’ judgement in the Islamic context of Pakistan. The intrinsic Islamic religiosity theoretical construct examined is Islamic Worldview (IW) which represents deeply held enduring and stable values which are likely to be dominant in influencing professionals’ judgements. Moreover, theoretical underpinning and empirical evidence in social psychology and organisational behaviour have established the critical role of intrinsic religiosity in influencing behaviour. Our first objective is to examine whether IW impacts auditors’ judgements in the context of their acceptance of uncorroborated low-reliability client-provided evidence. Understanding the potential impact of cultural factors on auditors’ acceptance of client-provided information is an essential factor in improving audit quality. Our findings support the hypothesis that auditors with high (low) IW scores are more (less) likely to accept uncorroborated low-reliability client-provided evidence. Our second objective is to examine the relationship between IW and auditors’ preference for exercising more or less judgements. Examining this topic is important because auditing is a judgement-based process: auditors’ judgements determine audit quality and, by extension, the quality of associated financial reports. Our findings provide overall support for the hypothesis that auditors with high (low) IW scores have a preference for exercising more (less) judgement. Our findings have implications for global and national standard setters, regulators, practitioners, and researchers. The results are also relevant to global audit firms and their affiliates, particularly networks operating in Islamic countries, in ensuring global consistency of audits.

Similar content being viewed by others

Notes

Prior studies provide evidence that extrinsic religiosity whereby the utility of religion is in achieving self-interested, non-spiritual goals, is unrelated and does not lead to moral behaviour (Arli & Tjiptono, 2014; Arli, Septianto, & Chowdhury, 2020; Vitell, 2015). Moreover, Shahid (2021) measured accountants and business executives' extrinsic religiosity using the Islamic Religious Personality scale and established that subjects’ extrinsic religiosity is unrelated to their judgements in the context of social responsibility investments.

Additional details regarding religiosity related auditing research are provided in “Background: Country Selection and Literature Review” section.

In this study the audit evidence is uncorroborated internal information provided by the client. ISA 500 Audit Evidence (paragraph A31) sets out guidelines on the level of audit evidence reliability: “The reliability of information to be used as audit evidence, and therefore of the audit evidence itself, is influenced by its source and its nature …” According to ISA 500 (A31), “The reliability of audit evidence is increased when it is obtained from independent sources …” (i.e. uncorroborated client-provided internal evidence has a relatively low level of reliability).

Islamic religiosity is a multi-dimensional construct related to the belief that Islam should direct one’s social, political, personal, and professional life (Al-Goaib, 2003; Fuller & Kurpershoek, 2013). It also refers to the extent of one’s beliefs and level of agreement with Islamic religious doctrines and adherence to rituals such as prayer and worship (Al-Goaib, 2003; Krauss et al., 2005). Given the theoretical and empirical support in the social psychology and organisational behaviour literature for intrinsic religiosity, we examine the intrinsic Islamic religiosity theoretical construct because this represents core deeply held enduring and stable values which are likely to be dominant in influencing auditors’ professionals’ judgements.

In our study, we only measure auditors’ acceptance of client-provided evidence. It is important to note that our study is not designed to capture the quality of auditors’ judgements, which is a complex and multifaceted construct and needs to be examined from multiple dimensions (Martinov-Bennie & Pflugrath, 2009; IAASB, 2018).

We cross-checked the country profile of ISA adoption published in the IFAC website (2020) and the member states of Organisation of Islamic Cooperation (2020) and identify 21 Islamic countries that have adopted ISAs. These include Albania, Bangladesh, Benin, Burkina Faso, Cameroon, Guyana, Indonesia, Jordan, Lebanon, Malaysia, Mozambique, Nigeria, Pakistan, Saudi Arabia, Senegal, Suriname, Togo, Tunisia, Turkey, Sierra Leone, and Uganda. In addition, eight other Islamic countries have partially adopted ISAs, including Azerbaijan, Egypt, Iraq, Kazakhstan, Kuwait, Morocco, Palestine, and Uzbekistan.

Professional auditors in Pakistan have completed all academic and professional examination requirements and hold a minimum 3 years’ professional experience or they may hold recognised professional international qualifications (ICAP, 2017).

Medium-tier auditing firms in Pakistan include local and international firms that need to have satisfactory Quality Control Review ratings from the Institute of Chartered Accountants of Pakistan (ICAP, 2016). All medium-tier auditing firms in Pakistan have adopted the ISAs.

For example, Islam is also the second-largest religion in Europe, and it is projected that the Muslim population of Europe will reach between 7 and 14% by 2050 (Pew Research Center, 2017).

The Sunni Hanafi School is one of the four principal Sunni schools of Islamic jurisprudence and was founded in the eighth century by Abū Ḥanīfa (Ramadan, Hisham M. (2006). Understanding Islamic Law: From Classical to Contemporary. Rowman Altamira. pp. 24–29.

In survey studies conducted in Islamic countries, the response rates reported by Ahmad et al. (2003), Lee et al. (2008), and Awang et al. (2019) are 41%, 46%, and 59% respectively. In the U.S., Behn et al. (2006) and Almer et al. (2014) reported response rates of 46% and 53%, respectively. In the U.K., Beattie et al. (2013) reported a response rate of 36%. In Hong Kong, Shafer (2015) reported a response rate of 30%.

SDR bias is a known issue in religiosity studies and is a type of response bias where survey participants may have a tendency to answer questions to meet the expectations of others (Batson, Naifeh, & Pate, 1978). Prior research suggests that religiosity data should not be reported without an SDR check. To address the SDR bias in this study, the MPRI scale contains a lie scale to remove very high SDR responses from the sample.

The items included in the lie scale were (1) I use the lessons from the Qur’an/Holy book/Scriptures in my conversations; (2) I am the first to greet when meeting another person; (3) I fulfil all my promises; (4) I perceive those who are not the same religion as mine as potential believers of my religion; (5) I gossip about others (reverse-scored item).

Feedback was sought from 13 professional auditors, three senior academic researchers, and three regulators in Pakistan. Their comments were incorporated into the final version of the questionnaire to improve its readability and understandability.

All number values are in Pakistani rupees (PKR) which is the official currency of Pakistan (1 USD = 104.8 PKR).

Participants with a preference for the percentage method (i.e. less judgement) were expected to make no adjustment or only a small adjustment if they accepted that the debts would not be repaid. However, if they accepted that the two debts would be repaid in full, a reduction of the full amount of 1000 PKR million (USD 9.54 million) or close to it was expected. On the other hand, a wider range of adjustment (between zero and 1000 PKR million [USD 9.54 million]) was expected for participants with a preference for exercising more judgement, depending on whether they believed that the two doubtful debts were collectible or not.

References

Abdullah, M., & Nadvi, M. J. (2011). Understanding the principles of Islamic world-view. Dialogue (Pakistan), 6(3), 268–289.

Adeel, N. (2019). The influence of Islam on auditors’ professional judgments in Pakistan. Doctoral dissertation, Macqurie University, Australia.

Ahmad, N. N. N., Sulaiman, M., & Alwi, N. M. (2003). Are budgets useful? A survey of Malaysian companies. Managerial Auditing Journal, 18(9), 717–724.

Ahmad, A., Rahman, A. A., & Ab Rahman, S. (2015). Assessing knowledge and religiosity on consumer behavior towards halal food and cosmetic products. International Journal of Social Science and Humanity, 5(1), 10.

Al-Goaib, S. (2003). Religiosity and social conformity of university students: An analytical study applied at King Saoud University. Arts Journal of King Saoud University, 16(1), 51–99.

Ali, A. J., & Weir, D. (2005). Islamic perspectives on management and organisation. Taylor & Francis.

Allport, G. W. (1950). The individual and his religion: A psychological interpretation. Macmillan.

Allport, G. W. (1963). Behavioural science, religion, and mental health. Journal of Religion and Health, 2(3), 187–197.

Allport, G. W., & Ross, J. M. (1967). Personal religious orientation and prejudice. Journal of Personality and Social Psychology, 5(4), 432.

Allport, G. W., Vernon, P. E., & Lindzey, G. (1960). Study of values. Houghton Mifflin.

Almer, E. D., Philbrick, D. R., & Rupley, K. H. (2014). What drives auditor selection? Current Issues in Auditing, 8(1), A26–A42.

Anderson, J. C., & Fleming, D. M. (2014). Client ethical behavior contrast effects on auditors’ evaluations of real earnings management. Research on Professional Responsibility and Ethics in Accounting, 18, 69–87.

Arham, M. (2010). Islamic perspectives on marketing. Journal of Islamic Marketing, 1(2), 149–164.

Arli, D., & Tjiptono, F. (2014). The end of religion? Examining the role of religiousness, materialism, and long-term orientation on consumer ethics in Indonesia. Journal of Business Ethics, 123(3), 385–400.

Arli, D., Septianto, F., & Chowdhury, R. M. (2020). Religious but not ethical: The effects of extrinsic religiosity, ethnocentrism and self-righteousness on consumers’ ethical judgments. Journal of Business Ethics. https://doi.org/10.1007/s10551-019-04414-2.

Asian-Oceanian Standard-Setters Group (AOSSG). (2011). Accounting for Islamic Financial Transactions and Entities. AOSSG Working Group on Islamic Finance. December 11. http://www.aossg.org/docs/Publications/AOSSG_Survey_Report_2011_FINAL_CLEAN_29_12_2011.pdf. Accessed 20 Dec 2019.

Asian-Oceanian Standard-Setters Group (AOSSG). (2014). Financial reporting relating to Islamic Finance. http://www.aossg.org/working-groups/financial-reporting-relating-to-islamic-finance. Accessed 20 Dec 2019.

Asian-Oceanian Standard-Setters Group (AOSSG). (2015). Financial Reporting by Islamic Financial Institutions: A Study of Financial Statements of Islamic Financial Institutions: Malysia. Asian Oceanic Standard Setters Group.

Asian Development Bank. (2016). Female labor force participation in Pakistan. ADB Briefs, December 16. https://www.adb.org/sites/default/files/publication/209661/female-labor-force-participation-pakistan.pdf. Accessed 20 Dec 2019.

Askari, H., Iqbal, Z., & Mirakhor, A. (2010). Globalisation and Islamic finance: Convergence, prospects and challenges. Wiley.

Asri, M., & Fahmi, M. (2004). Contribution of The Islamic Worldview Towards Corporate Governance. A paper at the International Islamic University, Malaysia. http://www.iium.edu.my/iaw/Students%20Term%20Papers_files/Asri%20and%20Fahmi%20IslWWandCG.htm.

Astrachan, J. H., Astrachan, C. B., Campopiano, G., & Baù, M. (2020). Values, spirituality and religion: Family business and the roots of sustainable ethical behavior. Journal of Business Ethics, 163, 637–645.

Awang, Y., Rahman, A. R. A., & Ismail, S. (2019). The influences of attitude, subjective norm and adherence to Islamic professional ethics on fraud intention in financial reporting. Journal of Islamic Accounting and Business Research, 10(5), 710–725.

Badawi, J. A. (2002). Islamic worldview: Prime motive for development. Humanomics, 18(3), 3–25.

Bamber, E. M., & Iyer, V. M. (2007). Auditors’ identification with their clients and its effect on auditors’ objectivity. Auditing: A Journal of Practice & Theory, 26(2), 1–24.

Batson, C. D., & Venus, W. L. (1982). The religious experience: A social-psychological perspective. Oxford University.

Batson, C. D., Naifeh, S. J., & Pate, S. (1978). Social desirability, religious orientation, and racial prejudice. Journal for the Scientific Study of Religion, 17(1), 31–41.

Beattie, V., Fearnley, S., & Hines, T. (2013). Perceptions of factors affecting audit quality in the post-SOX UK regulatory environment. Accounting and Business Research, 43(1), 56–81.

Behn, B. K., Searcy, D. L., & Woodroof, J. B. (2006). A within firm analysis of current and expected future audit lag determinants. Journal of Information Systems, 20(1), 65–86.

Belzen, J. A. (1999). Religion as embodiment: Cultural-psychological concepts and methods in the study of conversion among “Bevindelijken.” Journal for the Scientific Study of Religion, 3(2), 236–253.

Bik, O., & Hooghiemstra, R. (2016). The effect of national culture on auditor-in-charge involvement. Auditing: A Journal of Practice & Theory, 36(1), 1–19.

Bik, O., & Hooghiemstra, R. (2018). Cultural differences in auditors’ compliance with audit firm policy on fraud risk assessment procedures. Auditing: A Journal of Practice and Theory, 37(4), 25–48.

Blokdijk, H., Drieenhuizen, F., Simunic, D. A., & Stein, M. T. (2003). Determinants of the mix of audit procedures: Key factors that cause auditors to change what they do. Sauder School of Business, The University of British Columbia, Working paper. https://doi.org/10.2139/ssrn.415200.

Bonner, S. E. (1990). Experience effects in auditing: The role of task-specific knowledge. Accounting Review, 65(1), 72–92.

Bonner, S. E., & Walker, P. L. (1994). The effects of instruction and experience on the acquisition of auditing knowledge. Accounting Review, 69(1), 157–178.

Brasel, K. R., Hatfield, R. C., Nickell, E. B., & Parsons, L. M. (2019). The effect of fraud risk assessment frequency and fraud inquiry timing on auditors’ skeptical judgments and actions. Accounting Horizons, 33(1), 1–15.

Bruce, S. (1993). Religion and rational choice: A critique of economic explanations of religious behavior. Sociology of Religion, 54(2), 193–205.

Carson, E., Redmayne, N. B., & Liao, L. (2014). Audit market structure and competition in Australia. Australian Accounting Review, 24(4), 298–312.

Choudhury, M. A. (2015). The nature of business social ethics in mainstream and Islamic worldview. In A. J. Ali (Ed.), Handbook of research on Islamic business ethics (pp. 85–125). Edward Elgar Publishing, Inc.

Chung, J., & Monroe, G. (2000). The effects of experience and task difficulty on accuracy and confidence assessments of auditors. Accounting & Finance, 40(2), 135–151.

Cohen, A. B., Wu, M. S., & Miller, J. (2016). Religion and culture: Individualism and collectivism in the East and West. Journal of Cross-Cultural Psychology, 47(9), 1236–1249.

Corbin, H. (1993). History of Islamic philosophy. P. Sherrard. Kegan Paul International.

Daniels, T. (2009). Islamic spectrum in Java. Ashgate Publishing.

Dunkel, C. S., & Dutton, E. (2016). Religiosity as a predictor of in-group favoritism within and between religious groups. Personality and Individual Differences, 98, 311–314.

Durkin, P. (2017). Big four accounting CEOs meet on cultural targets. Business. December 17. http://www.afr.com/leadership/big-four-accounting-ceos-meet-on-cultural-targets-20170811-gxulud#ixzz4x3KtD7yr. Accessed 20 Dec 2019.

Dyreng, S. D., Mayew, W. J., & Williams, C. D. (2012). Religious social norms and corporate financial reporting. Journal of Business Finance & Accounting, 39(7–8), 845–875.

El-Bassiouny, N. (2014). The one-billion-plus marginalization: Toward a scholarly understanding of Islamic consumers. Journal of Business Research, 67(2), 42–49.

Eutsler, J., Norris, A. E., & Trompeter, G. (2018). A live simulation-based investigation: Interactions with clients and their effect on audit judgment and professional skepticism. Auditing: A Journal of Practice and Theory, 37(3), 145–162.

Fuller, G., & Kurpershoek, M. (2013). What future for political Islam. WRR.

Fullerton, A. S. (2009). A conceptual framework for ordered logistic regression models. Sociological Methods & Research, 38(2), 306–347.

Geyer, A. L., & Baumeister, R. F. (2005). Religion, morality, and self-control: Values, virtues, and vices. Journal of Business, Finance and Accounting, 39(7–8), 845–875.

Griffith, E. E., Kadous, K., & Young, D. (2015). How insights from the “new” JDM research can improve auditor judgment: Fundamental research questions and methodological advice. Auditing: A Journal of Practice & Theory, 35(2), 1–22.

Gul, F. A., & Ng, A. C. (2018). Auditee religiosity, external monitoring, and the pricing of audit services. Journal of Business Ethics, 152(2), 409–436.

Gul, F. A., Wu, D., & Yang, Z. (2013). Do individual auditors affect audit quality? Evidence from archival data. The Accounting Review, 88(6), 1993–2023.

Halliday, F., & Alavi, H. (1988). State and ideology in the Middle East and Pakistan. Macmillan.

Hampden-Turner, C., & Trompenaars, F. (2011). Riding the waves of culture: Understanding diversity in global business. Hachette, UK.

Harding, N., Hughes, S., & Trotman, K. T. (2005). Auditor calibration in the review process. In V. Arnold (Ed.), Advances in accounting behavioral research (pp. 41-57). Emerald Group Publishing Limited.

Hatfield, R. C., Jackson, S. B., & Vandervelde, S. D. (2011). The effects of prior auditor involvement and client pressure on proposed audit adjustments. Behavioral Research in Accounting, 23(2), 117–130.

Hilary, G., & Hui, K. W. (2009). Does religion matter in corporate decision making in America? Journal of Financial Economics, 93(3), 455–473.

Huang, S. M., Ku, C. Y., Chu, Y. T., & Hsueh, H. Y. (2002). A study of value factors for adopting information technology in professional service industry—A demonstrative case of accounting firms in Taiwan. Review of Pacific Basin Financial Markets and Policies, 5(4), 509–519.

Hunter, J. A. (2001). Self-esteem and in-group bias among members of a religious social category. The Journal of Social Psychology, 141(3), 401–411.

Hurtt, R. K., Brown-Liburd, H., Earley, C. E., & Krishnamoorthy, G. (2013). Research on auditor professional skepticism: Literature synthesis and opportunities for future research. Auditing: A Journal of Practice & Theory, 32, 45–97.

Ilyas, S., Hussain, M. F., & Usman, M. (2011). An integrative framework for consumer behavior: Evidence from Pakistan. International Journal of Business and Management, 6(4), 120–128.

Institute of Chartered Accountants of Pakistan (ICAP). (2015). International Standards on Auditing (ISAs). ISA Due Process and Adoption Status. June 15. http://www.icap.net.pk/standards/isaadoption. Accessed 20 Dec 2019.

Institute of Chartered Accountants of Pakistan (ICAP). (2016). List of Practicing Firms having Satisfactory QCR Rating. April, 16. http://www.icap.org.pk/wp-content/uploads/QA/qcr-list12april2016.pdf. Accessed 20 Dec 2019.

Institute of Chartered Accountants of Pakistan (ICAP). (2017). Membership requirements. December 17. https://www.icap.org.pk/members/how-to-become-a-member/. Accessed 20 Dec 2019.

Institute of Chartered Accountants of Pakistan (ICAP). (2020). How to Do CA. https://www.icap.org.pk/students/faqs/. Accessed 10 Oct 2020.

International Auditing and Assurance Standards Board (IAASB). (2015). Enhancing Audit Quality in the Public Interest—A Focus on Professional Skepticism, Quality Control and Group Audits. December 15. https://www.iaasb.org/system/files/meetings/files/20151207-IAASB-Agenda_Item_2B-Draft_Overview_of_the_ITC-Final.pdf. Accessed 20 Dec 2019.

International Auditing and Assurance Standards Board (IAASB). (2018). Handbook of International Quality Control, Auditing, Review, Other Assurance, and Related Services Pronouncements: 2018 Edition. International Federation of Accountants (IFAC). https://www.ifac.org/publications-resources/2018-handbook-international-quality-control-auditing-review-other-assurance. Accessed 20 Dec 2019.

International Federation of Accountants (IFAC). (2014a). Consultative Group for Shariah-Compliant Instruments and Transactions. December 12. http://www.ifrs.org/Alerts/Meeting/Pages/Consultative-Group-for-Shariah-Compliant-Instruments-and-Transactions-February-2014.aspx. Accessed 20 Dec 2019.

International Federation of Accountants (IFAC). (2014b). A framework for audit quality: Key elements that create an environment for audit quality. December 14. https://www.ifac.org/publications-resources/framework-audit-quality-key-elements-create-environment-audit-quality. Accessed 20 Dec 2019.

International Federation of Accountants (IFAC). (2016). Action Plan Developed by Institute of Chartered Accountants of Pakistan (ICAP). https://www.ifac.org/system/files/compliance-assessment/part_3/201611-Pakistan-ICAP.pdf. Accessed 10 Sept 2020.

International Federation of Accountants (IFAC). (2020). IFAC Global Impact Map: Country Profiles. https://www.ifac.org/what-we-do/global-impact-map/country-profiles. Accessed 8 June 2020.

Janin, H., & Kahlmeyer, A. (2007). Islamic law: The Sharia from Muhammad’s time to the present. McFarland.

Jha, A., & Chen, Y. (2015). Audit fees and social capital. The Accounting Review, 90(2), 611–639.

Kent, P., & Weber, R. (1998). Auditor expertise and the estimation of dollar error in accounts. Abacus, 34(1), 120–139.

Khilji, S. E. (2003). ‘To adapt or not to adapt’: Exploring the role of national culture in HRM—A study of Pakistan. International Journal of Cross Cultural Management: CCM, 3(1), 109–132.

Kahoe, R. D. (1985). The development of intrinsic and extrinsic religious orientations. Journal for the Scientific Study of Religion, 24(4), 408–412.

Krauss, S. E. (2011). MPRI Scoring Manual.

Krauss, S. E., Hamzah, A. H., Suandi, T., Noah, S., Mastor, K., Juhari, R., & Manap, J. (2005). The Muslim religiosity-personality measurement inventory (MRPI)’s religiosity measurement model: Towards filling the gaps in religiosity research on Muslims. Pertanika Journal of Social Sciences & Humanities, 13(2), 131–145.

Krauss, S. E., Hamzah, A. H., & Idris, F. (2007). Adaptation of a Muslim religiosity scale for use with four different faith communities in Malaysia. Review of Religious Research, 49(2), 147–164.

Lee, T., Ali, A. M., & Gloeck, J. (2008). A study of auditors’ responsibility for fraud detection in Malaysia. Southern African Journal of Accountability and Auditing Research, 8(1), 27–34.

Leventis, S., Dedoulis, E., & Abdelsalam, O. (2018). The impact of religiosity on audit pricing. Journal of Business Ethics, 148(1), 53–78.

Lewis, M. K. (2001). Islam and accounting. Accounting Forum, 25(2), 103–127.

Martinov-Bennie, N., & Pflugrath, G. (2009). The strength of an accounting firm’s ethical environment and the quality of auditors’ judgments. Journal of Business Ethics, 87(2), 237–253.

Mazereeuw-van der Duijn SchoutenGraafland, C. J., & Kaptein, M. (2014). Religiosity, CSR attitudes, and CSR behavior: An empirical study of executives’ religiosity and CSR. Journal of Business Ethics, 123(3), 437–459.

Messier, W. F., Jr., & Schmidt, M. (2018). Offsetting misstatements: The effect of misstatement distribution, quantitative materiality, and client pressure on auditors’ judgments. The Accounting Review, 93(4), 335–357.

McGuire, S. T., Omer, T. C., & Sharp, N. Y. (2012). The impact of religion on financial reporting irregularities. The Accounting Review, 87(2), 645–673.

Mehmet, O. (1990). Islamic identity and development: Studies of the Islamic periphery. Forum.

Mladenovic, R., & Simnett, R. (1994). Examination of contextual effects and changes in task predictability on auditor calibration. Behavioral Research in Accounting, 6, 178–203.

Myers, R. H. (1990). Classical and modern regression with applications. (2nd ed.). Duxbury Press.

Nelson, M., & Tan, H. T. (2005). Judgment and decision making research in auditing: A task, person, and interpersonal interaction perspective. Auditing: A Journal of Practice & Theory, 24(1), 41–71.

Ng, T.B.-P., & Tan, H.-T. (2007). Effects of qualitative factor salience, expressed client concern, and qualitative materiality thresholds on auditors’ audit adjustment decisions. Contemporary Accounting Research, 24(4), 1171–1192.

Nolder, C., & Riley, T. J. (2013). Effects of differences in national culture on auditors’ judgments and decisions: A literature review of cross-cultural auditing studies from a judgment and decision making perspective. Auditing: A Journal of Practice & Theory, 33(2), 141–164.

O’Connell, A. A. (2006). Logistic regression models for ordinal response variables. Sage.

Omer, T. C., Sharp, N. Y., & Wang, D. (2018). The impact of religion on the going concern reporting decisions of local audit offices. Journal of Business Ethics, 149(4), 811–831.

Organisation of Islamic Cooperation. (2020). Member States. https://www.oic-oci.org/states/?lan=en. Accessed 8 June 2020.

Othman, R., & Hariri, H. (2012). Conceptualizing religiosity influence on whistle-blowing intentions. British Journal of Economics, Finance and Management Sciences, 6(1), 62–92.

Owhoso, V., & Weickgenannt, A. (2009). Auditors’ self-perceived abilities in conducting domain audits. Critical Perspectives on Accounting, 20(1), 3–21.

Pakistan Bureau of Statistics. (2019). Population by Religion. http://www.pbs.gov.pk/content/population-religion. Accessed 10 Apr 2019.

Patel, C. (2006). A comparative study of professional accountants’ judgments. Emerald Group Publishing.

Patel, C., Harrison, G. L., & McKinnon, J. L. (2002). Cultural influences on judgments of professional accountants in auditor–client conflict resolution. Journal of International Financial Management & Accounting, 13(1), 1–31.

Peecher, M. E., & Solomon, I. (2001). Theory and experimentation in studies of audit judgments and decisions: Avoiding common research traps. International Journal of Auditing, 5, 193–203.

Pew Research Center. (2017). Europe's Growing Muslim Population. November 29. https://www.pewforum.org/2017/11/29/europes-growing-muslim-population/. Accessed 25 Nov 2020.

Public Company Accounting Oversight Board (PCAOB). (2011). Staff audit practice alert no 8: Audit risks in certain emerging markets. October 11. https://pcaobus.org/Standards/QandA/2011-10-03_APA_8.pdf. Accessed 13 Oct 2016.

Public Company Accounting Oversight Board (PCAOB). (2012). Maintaining and applying professional skepticism in audits: Staff audit practice alert No. 10. December 4. http://pcaobus.org/Standards/QandA/12-04-2012_SAPA_10.pdf. Accessed 10 Oct 2019.

Public Company Accounting Oversight Board (PCAOB). (2013). Remarks on the Global Audit. December 13. https://pcaobus.org/News/Speech/Pages/02082013_Texas.aspx. Accessed 13 Oct 2016.

Public Company Accounting Oversight Board (PCAOB). (2016). Proposed Amendments Relating to Supervision of Audits Involving Other Auditors and Proposed Auditing Standard: Dividing Responsibility for the Audit with Another Accounting Firm. December 17. https://pcaobus.org/Rulemaking/Docket042/2016-002-other-auditors-proposal.pdf. Accessed 10 Oct 2018.

Rahman, A. R. A. (2010). Introduction to Islamic accounting theory and practice. Cert Publication.

Ramasamy, B., Yeung, M. C., & Au, A. K. (2010). Consumer support for corporate social responsibility (CSR): The role of religion and values. Journal of Business Ethics, 91(1), 61–72.

Rashid, M. Z., & Ibrahim, S. (2008). The effect of culture and religiosity on business ethics: A cross-cultural comparison. Journal of Business Ethics, 82(4), 907–917.

Reimers, J. L., & Fennema, M. (1999). The audit review process and sensitivity to information source objectivity. Auditing: A Journal of Practice & Theory, 18(1), 117–123.

Saroglou, V., & Cohen, A. B. (2013). Cultural and cross-cultural psychology of religion. Handbook of the psychology of religion and spirituality. Guilford Press.

Sauerwein, J. (2017). The intersection of religiosity, workplace spirituality and ethical sensitivity in practicing accountants. Journal of Religion and Business Ethics, 3(2), 1–20.

Schneider, H., Krieger, J., & Bayraktar, A. (2011). The impact of intrinsic religiosity on consumers’ ethical beliefs: Does it depend on the type of religion? A comparison of Christian and Moslem consumers in Germany and Turkey. Journal of Business Ethics, 102(2), 319–332.

Sekaran, U., & Bougie, R. (2009). Research methods for business: A skill building approach (5th ed.). Wiley.

Sela, Y., Shackelford, T. K., & Liddle, J. R. (2015). When religion makes it worse: Religiously motivated violence as a sexual selection weapon. In D. Sloane & J. Van Slyke (Eds.), The attraction of religion: A new evolutionary psychology of religion. Bloomsbury.

Shafer, W. E. (2008). Ethical climate in Chinese CPA firms. Accounting, Organizations and Society, 33(7–8), 825–835.

Shafer, W. E. (2015). Ethical climate, social responsibility, and earnings management. Journal of Business Ethics, 126(1), 43–60.

Shahid, A. (2021). Islamic Religiosity, Socially Responsible Investing Decisions, and Corporate Social Responsibility Assurance. Doctoral dissertation, Macqurie University, Australia.

Shariff, A. F., & Norenzayan, A. (2007). God is watching you: Priming God concepts increases prosocialbehavior in an anonymous economic game. Psychological Science, 18(9), 803–809.

Simnett, R., & Trotman, K. T. (2018). Twenty-five-year overview of experimental auditing research: Trends and links to audit quality. Behavioral Research in Accounting, 30(2), 55–76.

Smith, A., & Hume, E. C. (2005). Linking culture and ethics: A comparison of accountants’ ethical belief systems in the individualism/collectivism and power distance contexts. Journal of Business Ethics, 62(3), 209–220.

Solomon, I., Ariyo, A., & Tomassini, L. A. (1985). Contextual effects on the calibration of probabilistic judgments. Journal of Applied Psychology, 70(3), 528.

Spilka, B., Hood, R. W., Hunsberger, B., & Gorsuch, R. L. (2003). The psychology of religion: An empirical approach. Guilford.

Stern, J. (2000). Pakistan’s Jihad culture. Foreign Affairs, 79(6), 115–126.

Suhartanto, D. (2019). Predicting behavioural intention toward Islamic bank: A multi-group analysis approach. Journal of Islamic Marketing, 10(4), 1091–1103.

Svanberg, J., & Öhman, P. (2014). Auditors’ identification with their clients: Effects on audit quality. The British Accounting Review, 47(4), 395–408.

Taurian, K. (2017). New client demand prompts big 4 team shifts. Professional Development. December 17. https://www.accountantsdaily.com.au/professional-development/10927-new-client-demand-prompts-big-four-team-shifts. Accessed 20 Dec 2019.

The Constitution of Pakistan. (1973). Article 251. https://pakistanconstitutionlaw.com/article-251-national-language/#:~:text=251.,years%20from%20the%20commencing%20day. Accessed October 10, 2020.

Tomassini, L. A., Solomon, I., Romney, M. B., & Krogstad, J. L. (1982). Calibration of auditors’ probabilistic judgments: Some empirical evidence. Organizational Behavior and Human Performance, 30(3), 391–406.

Tracey, P. (2012). Religion and organization: A critical review of current trends and future directions. Academy of Management Annals, 6(1), 87–134.

Trotman, K. T., Bauer, T. D., & Humphreys, K. A. (2015). Group judgment and decision making in auditing: Past and future research. Accounting, Organizations and Society, 47, 56–72.

Turco, A. L., & Maggioni, D. (2018). Effects of Islamic religiosity on bilateral trust in trade: The case of Turkish exports. Journal of Comparative Economics, 46(4), 947–965.

Verkuyten, M. (2007). Religious group identification and inter-religious relations: A study among Turkish-Dutch Muslims. Group Processes & Intergroup Relations, 10(3), 341–357.

Vitell, S. J. (2015). A case for consumer social responsibility (CnSR): Including a selected review of consumer ethics/social responsibility research. Journal of Business Ethics, 130(4), 767–774.

Vitell, S. J., & Paolillo, J. G. (2003). Consumer ethics: The role of religiosity. Journal of Business Ethics, 46(2), 151–162.

Vitell, S. J., Paolillo, J. G., & Singh, J. J. (2005). Religiosity and consumer ethics. Journal of Business Ethics, 57(2), 175–181.

Vitell, S. J., Paolillo, J. G., & Singh, J. J. (2006). The role of money and religiosity in determining consumers’ ethical beliefs. Journal of Business Ethics, 64(2), 117–124.

Vitell, S. J., Singh, J. J., & Paolillo, J. G. (2007). Consumers’ ethical beliefs: The roles of money, religiosity and attitude toward business. Journal of Business Ethics, 73(4), 369–379.

Vitell, S. J., Keith, M., & Mathur, M. (2011). Antecedents to the justification of norm violating behavior among business practitioners. Journal of Business Ethics, 101(1), 163–173.

Wehr, H. (1976). A dictionary of modern written Arabic. Spoken Language Services Inc.

Welzel, C. (2014). Freedom rising: Human empowerment and the quest for emancipation. Cambridge University Press.

Wicks, A. (2014). Stakeholder theory and spirituality. Journal of Management, Spirituality & Religion, 11(4), 294–306.

Winter, C. (2017). Muslim Population in Europe Projected to Rise. November 30. https://www.dw.com/en/muslim-population-in-europe-projected-to-rise/a-41554982. Accessed 10 Mar 2019.

Wu, H., & Patel, C. (2015). Adoption of Anglo-American models of corporate governance and financial reporting in China (Vol. 29). Emerald Group Publishing.

Ye, K., Cheng, Y., & Gao, J. (2014). How individual auditor characteristics impact the likelihood of audit failure: Evidence from China. Advances in Accounting, 30(2), 394–401.

Ying, S. X., & Patel, C. (2016). Skeptical judgments and self-construal: A comparative study between Chinese accounting students in Australia and China. Journal of International Accounting Research, 15(3), 97–111.

Ying, S. X., Patel, C., & Pan, P. (2020). The influence of peer attitude and inherent scepticism on auditors’ sceptical judgments. Accounting and Business Research, 50(2), 179–202.

Yusuf, F., Yousaf, A., & Saeed, A. (2018). Rethinking agency theory in developing countries: A case study of Pakistan. Accounting Forum, 42(4), 281–292.

Zaidi, S. B., & Zaki, S. (2017). English language in Pakistan: Expansion and resulting implications. Journal of Education & Social Sciences, 5(1), 52–67.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

This project was not funded by a research grant. All authors declare that they have no conflict of interest.

Ethical Approval

All procedures performed in our study involving human participants were in accordance with the ethical standards of our respective institutions.

Informed Consent

Informed consent was obtained from all individual participants included in the study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Adeel, N., Patel, C., Martinov-Bennie, N. et al. Islamic Religiosity and Auditors’ Judgements: Evidence from Pakistan. J Bus Ethics 179, 551–572 (2022). https://doi.org/10.1007/s10551-021-04829-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-021-04829-w