Abstract

In this paper, we analyse retirees’ decision-making from the different bids made available by life insurance companies in the Chilean annuity market. We find that choosing the highest annuity payout was positively (negatively) correlated with the advice given by independent brokers (sales agents and average years of education in the municipality) for a January 2008–May 2018 sample. We also found that retirees were willing to pay for firm reputation. In addition, people who are more likely to take a pension payout without consulting intermediaries are older, married, have a higher pension balance and purchase an immediate annuity. These findings are of interest to those seeking to improve the efficiency and effectiveness of the annuity system.

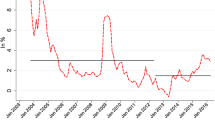

Source Authors’ calculations, based on CMF data

Source Authors’ own elaboration

Source Authors’ own elaboration

Similar content being viewed by others

Notes

The Unidad de Fomento (UF) is a unit of account used in Chile and is adjusted by inflation. 1 UF is equivalent to USD 31.5, as of 31 December 2019.

References

Agnew, J.R., L.R. Anderson, J.R. Gerlach, and L.R. Szykman. 2008. Who chooses annuities? An experimental investigation of the role of gender, framing, and defaults. American Economic Review 98 (2): 418–422.

Alcalde, P., and B. Vial. 2016. Willingness to pay for firm reputation: Paying for risk rating in the annuity market. MPRA Paper 68993, University Library of Munich.

Anagol, S., S. Cole, and S. Sarkar. 2017. Understanding the advice of commissions-motivated agents: Evidence from the Indian life insurance market. Review of Economics and Statistics 99 (1): 1–15.

Bergstresser, D., J.M. Chalmers, and P. Tufano. 2008. Assessing the costs and benefits of brokers in the mutual fund industry. The Review of Financial Studies 22 (10): 4129–4156.

Bolton, P., X. Freixas, and J. Shapiro. 2007. Conflicts of interest, information provision, and competition in the financial services industry. Journal of Financial Economics 85 (2): 297–330.

Calcagno, R., and C. Monticone. 2015. Financial literacy and the demand for financial advice. Journal of Banking & Finance 50: 363–380.

Calvet, L.E., J.Y. Campbell, and P. Sodini. 2009. Measuring the financial sophistication of households. American Economic Review 99 (2): 393–398.

Casassus, J., and E. Walker. 2013. Adjusted money's worth ratios in life annuities. Working Paper No. 434, Pontificia Universidad Católica de Chile.

Cici, G., A. Kempf, and C. Sorhage. 2017. Do financial advisors provide tangible benefits for investors? Evidence from tax-motivated mutual fund flows. Review of Finance 21 (2): 637–665.

Chang, B., and M. Szydlowski. 2020. The market for conflicted advice. The Journal of Finance 75 (2): 867–903.

Clark, G.L., M. Fiaschetti, and P. Gerrans. 2019. Determinants of seeking advice within defined contribution retirement savings schemes. Accounting & Finance 59: 563–591.

CMF. 2019. Informe del Mercado Asegurador a Diciembre 2019. Comisión del Mercado Financiero. http://www.cmfchile.cl/portal/estadisticas/606/articles-28638_recurso_1.pdf. Accessed May 22 2020.

Hastings, J., and O.S. Mitchell. 2020. How financial literacy and impatience shape retirement wealth and investment behaviors. Journal of Pension Economics & Finance 19 (1): 1–20.

Hofmann, A., and R. Rogalla. 2020. Intermediary compensation under endogenous advice quality in insurance markets. Journal of Insurance Issues 43 (1): 79–108.

Inderst, R., and M. Ottaviani. 2009. Misselling through agents. American Economic Review 99: 883–908.

James, E., G. Martínez, and A. Iglesias. 2006. The payout stage in Chile: Who annuitizes and why? Journal of Pension Economics & Finance 5 (2): 121–154.

Jappelli, T., and M. Padula. 2015. Investment in financial literacy, social security, and portfolio choice. Journal of Pension Economics & Finance 14 (4): 369–411.

Lachance, M.E. 2014. Financial literacy and neighborhood effects. Journal of Consumer Affairs 48 (2): 251–273.

Landerretche, O.M., and C. Martínez. 2013. Voluntary savings, financial behavior, and pension finance literacy: Evidence from Chile. Journal of Pension Economics & Finance 12 (3): 251–297.

Lin, C., Y.J. Hsiao, and C.Y. Yeh. 2017. Financial literacy, financial advisors, and information sources on demand for life insurance. Pacific-Basin Finance Journal 43: 218–237.

Lusardi, A., and O.S. Mitchell. 2014. The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature 52 (1): 5–44.

Migliavacca, M. 2020. Keep your customer knowledgeable: Financial advisors as educators. The European Journal of Finance 26 (4–5): 402–419.

Modigliani, F. 1986. Life cycle, individual thrift, and the wealth of nations. The American Economic Review 76 (3): 297–313.

Morales, M., and G. Larraín. 2017. The Chilean Electronic Market for Annuities (SCOMP): Reducing information asymmetries and improving competition. The Geneva Papers on Risk and Insurance—Issues and Practice 42 (3): 389–405.

Moure, N.G. 2016. Financial literacy and retirement planning in Chile. Journal of Pension Economics & Finance 15 (2): 203–223.

Rocha, R., M. Morales, and C. Thorburn. 2008. An empirical analysis of the annuity rate in Chile. Journal of Pension Economics & Finance 7 (1): 95–119.

Ruiz, J. 2014. Annuity choice in Chile: A dynamic approach. Emerging Markets Finance and Trade 5 (5): 6–21.

Stoughton, N.M., Y. Wu, and J. Zechner. 2011. Intermediated investment management. Journal of Finance 66: 947–980.

Walker, E. 2006. Annuity markets in Chile: Competition, regulation-and myopia? The World Bank.

Xiao, J.J., and N. Porto. 2019. Financial education and insurance advice seeking. The Geneva Papers on Risk and Insurance—Issues and Practice 44 (1): 20–35.

Yaari, M.E. 1965. Uncertain lifetime, life insurance, and the theory of the consumer. The Review of Economic Studies 32 (2): 137–150.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf all the authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables 5, 6, 7, 8, 9, 10, 11, 12.

Rights and permissions

About this article

Cite this article

Escudero, C., Ruiz, J.L. Choosing the highest annuity payout: the role of intermediation and firm reputation. Geneva Pap Risk Insur Issues Pract 47, 973–1004 (2022). https://doi.org/10.1057/s41288-021-00236-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-021-00236-4