Abstract

We study the impact of the risk retention rule - requiring 5% of underlying credit risk for commercial mortgage backed securities - on commercial real estate markets. Since the primary objective of this rule is for the deal sponsors to have skin in the game, we expect that underwriting standards should tighten following the implementation of the rule. Consistent with this notion, we find the reform led to a decrease in price premium and probability of rating shopping by the sponsors, as well as longer time-to-securitization and lower default probability. We also show that the Dodd-Frank risk retention rule can impact banks’ credit supply by curtailing credit growth. As a result, we provide novel evidence on the effect of the risk retention rule on underwriters most exposed to the regulation.

Similar content being viewed by others

Notes

The Dodd-Frank Act is available online at http://www.cftc.gov/idc/groups/public/@swaps/documents/file/hr4173_enrolledbill.pdf.

The risk retention rule became effective on December 24, 2016 as a joint regulation of the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Securities and Exchange Commission as specified in Section 941 (Regulation of credit risk retention), Subtitle D (Improvements to the Asset-Backed Securitization Process), of Title IX (Investor Protections and Improvements to the Regulation of Securities), which amended the Securities Exchange Act of 1934 (15 U.S.C. 78a et seq.).

Section 15G (Credit Risk Retention) of the Securities Exchange Act of 1934 (as amended by Section 941 of the Dodd-Frank Act) outlines the exemptions and exceptions to the credit risk retention rule for Qualified Residential Mortgages (see Section 15G.–Credit Risk Retention, paragraph (e)–Exemptions, Exceptions, and Adjustments, subparagraph (B)–Qualified Residential Mortgage.) Furthermore, Sections 1234.15 “Qualifying commercial loans, commercial real estate loans, and automobile loans” and 1234.17 “Underwriting standards for qualifying CRE loans” of Subpart D–Exceptions and Exemptions of Part 1234–Credit Risk Retention (Eff. 2-23-15) of Chapter XII–Federal Housing Finance Agency of Title 12–Banks and Banking of the Code of Federal Regulations outline the exemptions for qualifying commercial real estate loans.

McBride (2014) notes that only between 3.6% to 15.6% (by loan balance) of Trepp’s public conduit universe of CMBS deals issued between 1997 and 2013 would meet the qualified CRE exemption. Thus, the vast majority of CMBS transactions are subject to the risk retention rules set forth by the Dodd-Frank Act.

Deal coupon is the weighted average interest rate on the underlying mortgages backing the security.

Frame (2018) provides an exhaustive survey of the existing literature, focusing on securitizaiton of residential mortgages.

See also Bougheas (2014) for a model of the incentives for MBS sponsors to retain risk in securitization deals during the pre-crisis period.

Willen (2014) is also highly critical of risk retention regulations and points out a number of problems with justifications for government intervention.

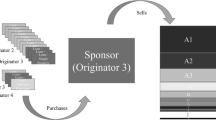

Section 15G of the Exchange Act defines the sponsor as persons who organize and initiate an asset backed securities transaction by selling or transferring assets, either directly or indirectly, including through an affiliate, to the issuer.

More information about Trepp is available at http://www.trepp.com/about-us.

Agency securities are backed by guarantees issued by government sponsored enterprises such as Freddie Mac and Fannie Mae.

One concern in comparing Agency and Conduit CMBS is that Conduit deals cover a variety of commercial property types while Agency deals are almost exclusively concentrated in the multifamily sector. In Tables 11 and 12 in the A, We confirm that the analysis reported below is robust to focusing only on multifamily loans.

The inclusion of year-month fixed effects subsumes the variable Postt. We include the Postt variable in specifications without year-month fixed effects.

The specification is similar to Eq. 1 for deal-level analysis.

As such, the regression is similar to an asset pricing model with various factors.

For example, Acharya et al. (2017) note that Nomura Holdings Inc. is among the foreign banks that do not file regulatory reports.

The ten US banks are Bank of America, Barclays Capital, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, JP Morgan, Morgan Stanley, UBS, and Wells Fargo.

Based on this classification, small underwriters are Barclays Capital, Credit Suisse, Deutsche Bank, Morgan Stanley, and UBS, while large underwriters are Bank of America, Citigroup, Goldman Sachs, JP Morgan, and Wells Fargo. The classification stays the same if we use post-reform average total assets.

Note, our analysis does not imply that banks with capital ratios below the sample median are at greater risk than the other banks, but rather that they are relatively weaker than banks with capital ratios above the median. The banks below the median capital ratio are Barclays Capital, Deutsche Bank, Goldman Sachs, JP Morgan, and Morgan Stanley, while those above the median are Bank of America, Citigroup, Credit Suisse, UBS, and Wells Fargo.

Call Reports data are publicly accessible at the website of the Federal Reserve Bank of Chicago (www.chicagofed.org).

We only include banks that serve as the leading underwriter of CMBS originated during 2014Q1 to 2018Q1.

Column (1) includes the variable Post while column (2) includes quarter fixed effects.

References

Acharya, V.V., Afonso, G., & Kovner, A. (2017). How do global banks scramble for liquidity? Evidence from the asset-backed commercial paper freeze of 2007. Journal of Financial Intermediation, 30, 1–34.

Agarwal, S., Chang, Y., & Yavas, A. (2012). Adverse selection in mortgage securitization. Journal of Financial Economics, 105(3), 640–660.

Ambrose, B.W., LaCour-Little, M., & Sanders, A.B. (2005). Does regulatory capital arbitrage, reputation, or asymmetric information drive securitization? Journal of Financial Services Research, 28(1), 113–133.

Ashcraft, A.B., Gooriah, K., & Kermani, A. (2019). Does skin-in-the-game affect security performance? Journal of Financial Economics, 134(2), 333–354.

Begley, T.A., & Purnanandam, A. (2017). Design of financial securities: empirical evidence from private-label rmbs deals. The Review of Financial Studies, 30(1), 120–161.

Bougheas, S. (2014). Pooling, tranching, and credit expansion. Oxford Economic Papers, 66(2), 557–579.

Cornett, M.M., McNutt, J.J., Strahan, P.E., & Tehranian, H. (2011). Liquidity risk management and credit supply in the financial crisis. Journal of Financial Economics, 101(2), 297–312.

Demiroglu, C., & James, C.M. (2014). The dodd-frank act and the regulation of risk retention in mortgage-backed securities. In Schultz, P.H. (Ed.) Perspectives on dodd-frank and finance (pp. 201–216).

Fender, I., & Mitchell, J. (2009). Incentives and tranche retention in securitisation: a screening model. BIS Working Papers. Available at https://ideas.repec.org/p/bis/biswps/289.html.

Floros, I., & White, J.T. (2016). Qualified residential mortgages and default risk. Journal of Banking & Finance, 70, 86–104.

Flynn, S., & Ghent, A. (2018). Competition and credit ratings after the fall. Management Science, 64(4), 1672–1692.

Frame, W.S. (2018). Agency conflicts in residential mortgage securitization: what does the empirical literature tell us? Journal of Financial Research, 41 (2), 237–251.

Furfine, C. (2020). The impact of risk retention regulation on the underwriting of securitized mortgages. Journal of Financial Services Research, 58, 91–114.

Guo, G., & Wu, H.-M. (2014). A study on risk retention regulation in asset securitization process. Journal of Banking & Finance, 45, 61–71.

Harris, M., Simonds, R., & Liebherr, L. (2015). Risk retention and RMBS. Alstron & Bird: Finance, 1–7. https://www.alston.com/-/media/files/insights/publications/2015/10/ifinance-advisoryi-risk-retention-and-rmbs/files/view-advisory-as-pdf/fileattachment/15253risk-retention-and-rmbs.pdf.

Hartman-Glaser, B. (2017). Reputation and signaling in asset sales. Journal of Financial Economics, 125(2), 245–265.

Hartman-Glaser, B., Piskorski, T., & Tchistyi, A. (2012). Optimal securitization with moral hazard. Journal of Financial Economics, 104(1), 186–202.

Hattori, M., & Ohashi, K. (2011). Detrimental effects of retention regulation: incentives for loan screening in securitization under asymmetric information. IMES Discussion Paper Series (11-E-17). https://ideas.repec.org/p/ime/imedps/11-e-17.html.

Jiang, W., Nelson, A.A., & Vytlacil, E. (2014). Securitization and loan performance: ex ante and ex post relations in the mortgage market. The Review of Financial Studies, 27(2), 454–483.

Kiff, J., & Kisser, M. (2010). Asset securitization and optimal retention. IMF Working Papers.

McBride, J. (2014). What qualifies? Risk retention in CMBS. Trepp: Available at http://info.trepp.com/TreppTalk/bid/333936/What-Qualifies-Risk-Retention-in-CMBS.

Sargent, P.C., & Jewesson, M.D. (2016). The dawn of CMBS 4.0: changes and challenges in a new regulatory regime. Alstron & Bird: Finance, 1–19. Available at https://www.alston.com/-/media/files/insights/publications/2016/10/the-dawn-of-cmbs-40-changes-and-challenges-in-a-ne/files/thedawnofcmbs40/fileattachment/thedawnofcmbs40.pdf.

Sweet, C.A. (2018). A guide to the credit risk retention rules for securitizations. Morgan Lewis, 1–32. Available at https://www.morganlewis.com/pubs/2014/11/a-guide-to-the-credit-risk-retention-rules.

Titman, S., & Tsyplakov, S. (2010). Originator performance, CMBS structures, and the risk of commercial mortgages. Review of Financial Studies, 23 (9), 3558–3594.

Willen, P. (2014). Mandated risk retention in mortgage securitization: an economist’s view. American Economic Review, 104(5), 82–87.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Andra Ghent and the seminar participants at Fudan University, SHUFE University, Baruch College, Xi’an Jiaotong University, the 2019 Real Estate Research Institute, the 2018 Multinational Finance Society, the 2018 EFMA, and the 2018 AREUEA International meeting in Guangzhou for helpful comments and suggestions. We also gratefully acknowledge the financial support of the Real Estate Research Institute.

Appendix : Risk Retention and Qualified Commercial Mortgages

Appendix : Risk Retention and Qualified Commercial Mortgages

Rights and permissions

About this article

Cite this article

Agarwal, S., Ambrose, B.W., Yildirim, Y. et al. Risk Retention Rules and the Issuance of Commercial Mortgage Backed Securities. J Real Estate Finan Econ (2021). https://doi.org/10.1007/s11146-021-09837-1

Accepted:

Published:

DOI: https://doi.org/10.1007/s11146-021-09837-1