Abstract

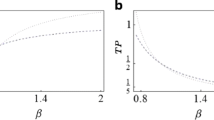

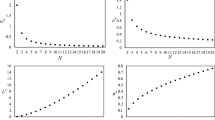

We devise an analytical framework where the distribution of factor income across agents and the distribution of labor earnings across workers is influenced by the possibility of profit sharing with workers. Firms choose periodically to compensate workers with only a real base wage or a share of profits in addition to this real base wage as alternative productivity-enhancing strategies. As supported by robust empirical evidence, labor productivity is higher in profit-sharing firms than in non-sharing firms. The frequency distribution of productivity-enhancing strategies and labor productivity across firms are co-evolutionarily time-varying, which impacts on the distribution of factor income between profits and wages and thereby on the rates of employment and output growth, as well as on the distribution of labor earnings across workers. Heterogeneity in productivity-enhancing strategies across firms (and hence labor earnings inequality across workers) may be a stable long-run equilibrium outcome. This polymorphic equilibrium features the frequency of profit-sharing firms and the employment rate varying positively (negatively) with the real base wage (profit-sharing coefficient). Yet the employment rate is path dependent in the polymorphic equilibrium. As shown analytically and with numerical simulations, the microdynamics landscape is shaped by the real base wage and the profit-sharing coefficient as bifurcation parameters.

Similar content being viewed by others

Notes

For instance, Lima and Silveira (2015) offer evolutionary foundations to the nominal adjustment of the price level to a monetary shock by introducing the notion of ‘boundedly rational inattentiveness’. A firm either pays a cost (featuring a random component) to update its information set to establish the optimal price or use costless non-updated information establish a lagged optimal price. Instead of the standard replicator dynamic used herein, Lima and Silveira (2015) use an asymmetric evolutionary protocol (only firms that choose not to pay the information-updating cost rely on random pairwise comparisons of losses).

Weitzman (1985) use a Keynesian model to claim that profit sharing can deliver full employment with low inflation. If part of workers’ total compensation is shared profits, so that the base wage is lower, the marginal cost of labor is lower and firms will be willing to hire more workers. As the marked up price is lower, a real balance effect creates a higher aggregate demand and hence a higher desired output. In our analytical framework, in contrast, the fraction of sharing firms and the average productivity are endogenously time-varying. Also, we explore the implications of profit sharing for long-run output growth in a supply-led dynamic model, in which the distribution of factor income plays a key role as a source of savings.

For instance, Walsh (2017) develops a sticky-price, sticky-wage model with workers and capitalists where the distribution of factor income matters because wage income affects aggregate demand. Meanwhile, Broer et al. (2020) set forth a two-agent version of the standard New Keynesian model (featuring a worker who receives only labor income and a capitalist who receives only profit income) to explore how income inequality affects the monetary transmission mechanism.

Although the externality in our analytical framework differs from the one in Weitzman’s (1985) model, one similar issue worth exploring is whether coordination is also needed in our analytical framework to induce the conversion to profit sharing. Analogously, one possibility would be to have the government reward sharing firms by preferential tax treatment. However worth exploring this possibility might be, especially in light of the suggestive evidence reported in Bryson et al. (2011) that some countries use (or used in the past) tax incentives to stimulate the adoption of profit sharing by firms, we leave it for future research.

Empirical evidence shows that profit sharing has a meaningful effect on worker total compensation (Long and Fang 2012; Bryson et al. 2011). As found in Capelli and Neumark (2004), total labor costs exclusive of the sharing component do not fall significantly in pre/post comparisons of firms that adopt profit sharing, which suggests that profit sharing tends to come on top of, rather than in place of, a base wage. Meanwhile, Long and Fang (2012) also find that, although adoption of profit sharing increases fluctuations in employee earnings, it also increases the growth of these earnings in the longer term.

As in the next section we explore the behavior of the economy in the transition from the short to the long run, thereafter we attach a subscript t to the short-run value of all variables (be they endogenous or predetermined).

This replicator dynamic can be formally derived from a model of (social or individual) learning as in Weibull (1995, sec. 4.4).

Note that the denominator of the second expression in (25) is strictly positive, while its numerator is a quadratic function in v, the graph of which is a concave up parabola, given that β − 1 + δ > 0. The vertical intercept and the vertex of this parabola are (0, βδ) and \( \left(\frac{2\beta \delta}{\beta -1+\delta },\frac{\left(\beta -1\right)\left(1-\delta \right)}{\beta -1+\delta}\right) \), respectively. Since βδ > 0 and \( \frac{\left(\beta -1\right)\left(1-\delta \right)}{\beta -1+\delta }>0 \), it follows that βδ − 2βδv + (β − 1 + δ)v2 > 0 for any v ∈ (0, 1) ⊂ ℝ.

Note that the denominator of the second expression in (26) is strictly positive, while its numerator is a quadratic function in v, the graph of which is a concave up parabola. The vertical intercept and the vertex of this parabola are represented by (0, δ) and (δ, δ(1 − δ)), respectively. Since δ > 0 and δ(1 − δ) > 0 for any δ ∈ (0, 1) ⊂ ℝ, it follows that v2 − 2δv + δ > 0 for any v ∈ (0, 1) ⊂ ℝ.

All these numerical simulations (along with the respective graphical representations) were obtained with the open-source software E&F Chaos, version 1.03, which is available at https://cendef.uva.nl/software/ef-chaos/ef-chaos.html?cb. The routines of the E&F Chaos software are described in detail in Diks et al. (2008). The source code used to generate the numerical simulation results that follow is obtainable upon request to the authors.

References

Akerlof G (1982) Labor contracts as partial gift exchange. Q J Econ 87:543–569

Atkinson AB (2008) The distribution of earnings in OECD countries. Oxford University Press, Oxford

Atkinson AB, Piketty T, Saez E (2011) Top incomes in the long run of history. J Econ Lit 49(1):3–71

Blasi J, Freeman R, Mackin C, Kruse D (2010a) Creating a bigger pie? The effects of employee ownership, profit sharing, and stock options on workplace performance. In: Kruse D, Freeman R, Blasi J (eds) Shared capitalism at work. University of Chicago Press, Chicago

Blasi J, Kruse D, Freeman R (2010b) Epilogue (and Prologue). In: Kruse D, Freeman R, Blasi J (eds) Shared capitalism at work. University of Chicago Press, Chicago

Blasi J, Freeman R, Kruse D (2013) The Citizen’s share: putting ownership Back into democracy. Yale University Press, New Haven

Broer T, Hansen N-JH, Krusell P, Öberg E (2020) The new Keynesian transmission mechanism: a heterogeneous-agent perspective. Rev Econ Stud 87:77–101

Bryson A, Freeman R (2010) How does shared capitalism affect economic performance in the United Kingdom? In: Kruse D, Freeman R, Blasi J (eds) Shared capitalism at work. University of Chicago Press, Chicago

Bryson A, Freeman R, Lucifora C, Pellizzari M, Perotin V (2011) Paying for performance: incentive pay schemes and employees’ financial participation. Report for the Fondazione Rodolfo DeBenedetti, Technical

Cahuc P, Dormont B (1997) Profit-sharing: does it increase productivity and employment? A theoretical model and empirical evidence on French micro data. Labour Econ 4:293–319

Capelli P, Neumark D (2004) External churning and internal flexibility: evidence on the functional flexibility and core-periphery hypotheses. Ind Relat 43(1):148–182

Carpenter JP, Andrea A, Akbar P (2018) Profit sharing and peer reporting. Manag Sci 64(9):4261–4276

Caselli F (2005) Accounting for cross-country income differences. In: Aghion P, Durlauf S (eds) Handbook of economic growth. North-Holland Press, Amsterdam, pp 679–741

Caselli F, Feyrer J (2007) The marginal product of capital. Q J Econ 122(2):535–568

Conyon M, Freeman R (2004) Shared modes of compensation and firm performance: U.K. evidence. In: Blundell R, Card D, Freeman R (eds) Seeking a premier league economy. University of Chicago Press, Chicago

D’Art D, Turner T (2004) Profit sharing, firm performance and union influence in selected European countries. Pers Rev 33(3):335–350

D’Art D, Turner T (2006) Profit sharing and employee share ownership in Ireland: a new departure? Econ Ind Democr 27(4):543–564

Diks CC, Hommes C, Panchenko V, Van der Weide R (2008) E&F Chaos: a user friendly software package for nonlinear economic dynamics. Computational Econnomics 32(1–2):221–244

Doucouliagos C (1995) Worker participation and productivity in labor-managed and participatory capitalist firms: a meta-analysis. Ind Labor Relat Rev 49(1):58–77

Dube A, Freeman R (2010) Complementarity of shared compensation and decision-making systems: evidence from the American labor market. In: Kruse D, Freeman R, Blasi J (eds) Shared capitalism at work. University of Chicago Press, Chicago

Farebrother (1973) Simplified Samuelson conditions for cubic and quartic equations. Manch Sch 41(4):396–400

Freeman R, Kruse D, Blasi J (2010) Worker responses to shirking under shared capitalism. In: Kruse D, Freeman R, Blasi J (eds) Shared capitalism at work. University of Chicago Press, Chicago

Georges C (1994) Unemployment persistence under profit sharing. Econ Lett 45(3):329–334

Jerger J, Michaelis J (2011) The fixed wage puzzle: why profit sharing is hard to implement? Econ Lett 110(2):104–106

Kaldor N (1961) Capital accumulation and economic growth. In: Lutz FA, Hague DC (eds) The theory of capital. St. Martin’s Press, New York, pp 177–222

Karabarbounis L, Neiman B (2014) The global decline of the labor share. Q J Econ 129(1):61–103

Kato, T., J.H. Lee and J.-S. Ryu (2010) ‘The productivity effects of profit sharing, employee ownership, stock option and team incentive plans: evidence from Korean panel data’, in T. Eriksson (ed.), Advances in the economic analysis of participatory and labor-managed firms, Volume 11, Bingley: Emerald, pp. 111–135

Kraft K, Ugarkovic M (2006) Profit sharing and the financial performance of firms: evidence from Germany. Econ Lett 92:333–338

Kruse D, Blasi J, Park R (2010a) Shared capitalism in the U.S. economy: prevalence, characteristics, and employee views of financial participation in enterprise. In: Kruse D, Freeman R, Blasi J (eds) Shared capitalism at work. University of Chicago Press, Chicago

Kruse D, Freeman R, Blasi J (2010b) Do workers gain by sharing? Employee outcomes under employee ownership, profit sharing, and broad-based stock options. In: Kruse D, Freeman R, Blasi J (eds) Shared capitalism at work. University of Chicago Press, Chicago

Lima GT, Silveira JJ (2015) Monetary neutrality under evolutionary dominance of bounded rationality. Econ Inq 53(2):1108–1131

Long RJ, Fang T (2012) Do employees profit from profit sharing? Evidence from Canadian panel data. Ind Labor Relat Rev 65(4):899–927

Magnan M, St-Onge S (2005) The impact of profit sharing on the performance of financial services firms. J Manag Stud 42(4):761–791

Mitchell DB, Lewin D, Lawler EE (1990) Alternative pay systems, firm performance, and productivity. In: Blinder AS (ed) Paying for productivity. Washington, D.C, Brookings Institution, pp 15–88

Peterson S, Luthans F (2006) The impact of financial and nonfinancial incentives on business-unit outcomes over time. J Appl Psychol 91(1):156–165

Piketty T (2014) Capital in the Twenty-First Century. Harvard University Press, Cambridge, MA

Piketty T, Zucman G (2014) Capital is back: wealth-income ratios in rich countries 1700–2010. Q J Econ 129(3):1255–1310

Robinson AM, Wilson N (2006) Employee financial participation and productivity: an empirical reappraisal. Br J Ind Relat 44(1):31–50

Walsh, C. E. (2017) ‘Workers, capitalists, wage flexibility and welfare’, Department of Economics, University of California, Santa Cruz, mimeo

Weibull JW (1995) Evolutionary game theory. The MIT Press, Cambridge, MA

Weitzman M (1985) The simple macroeconomics of profit sharing. Am Econ Rev 95:937–953

Weitzman M, Kruse D (1990) Profit sharing and productivity. In: Blinder AS (ed) Paying for productivity. Washington, D.C, Brookings Institution, pp 95–140

Funding

The authors gratefully acknowledge research funding provided by CNPq (National Council of Scientific and Technological Development – Brazil) [grants 311811/2018–3 (GTL) and 312432/2018–6 (JJS)]. This study was also financed in part by the Coordenação de Aperfeiçoamento de Pessoal de Nível Superior - Brasil (CAPES) - Finance Code 001 and the São Paulo Research Foundation – Brazil (FAPESP) [grant 2019/03148–5].

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

1.1 Proof of Proposition 2 on the stability properties of the long-run equilibrium

The Jacobian matrix evaluated around the monomorphic equilibrium \( \left(\overline{\alpha},0\right)\subset \Theta \) is:

where \( {\pi}_s^c\left(\overline{\alpha}\right)=\left(1-\delta \right)\left(1-\frac{v}{\overline{\alpha}}\right) \) and πn = 1 − v.

Let ξ be an eigenvalue of the Jacobian matrix in (32). The eigenvalues of the Jacobian matrix in (32) are given by:

Given that 0 < δ < 1, it follows that |ξ1| < 1.

Let us investigate the absolute value of ξ2. We want to find out under what condition(s) it follows that −1 < ξ2 < 1. Per (33), it follows that −1 < ξ2 < 1 obtains if, and only if, \( -2<\left[{\pi}_s^c\left(\overline{\alpha}\right)-{\pi}_n\right]k<0. \)

Given that \( 0<{\pi}_s^c\left(\overline{\alpha}\right)<1 \) and 0 < πn < 1, we find that \( -1<{\pi}_s^c\left(\overline{\alpha}\right)-{\pi}_n<1 \). Since the output to capital ratio, k, typically satisfies the condition given by 0 < k < 1 (see, e.g., Caselli 2005, and Caselli and Feyrer 2007), it follows that \( -2<-k<\left[{\pi}_s^c\left(\overline{\alpha}\right)-{\pi}_n\right]k \). Note that \( {\pi}_s^c\left(\alpha \right)-{\pi}_n=\left(1-\delta \right)\left(1-\frac{v}{\alpha}\right)-\left(1-v\right) \) is increasing in α. Given (20), it then follows that \( {\pi}_s^c\left({\alpha}^{\ast}\right)-{\pi}_n=0 \). Since \( \overline{\alpha}-{\alpha}^{\ast }=0\ \mathrm{at}\ \delta =\overline{\delta} \) and \( {\left.\frac{\partial \left(\overline{\alpha}-{\alpha}^{\ast}\right)}{\partial \delta}\right|}_{\delta =\overline{\delta}}=\frac{-{\left({v}^2-2v+\beta \right)}^3}{{\left(v-1\right)}^3v\left(v-\beta \right)}<0 \) for all v ∈ (0, 1) ⊂ ℝ and β > 1, if \( \delta >\overline{\delta} \), we then obtain \( \overline{\alpha}<{\alpha}^{\ast } \), so that \( {\pi}_s^c\left(\overline{\alpha}\right)-{\pi}_n<0 \) and hence \( \left[{\pi}_s^c\left(\overline{\alpha}\right)-{\pi}_n\right]k<0 \). Thus, it follows from \( \delta >\overline{\delta} \) that |ξ2| < 1. Meanwhile, if \( \delta >\overline{\delta} \), so that \( \overline{\alpha}>{\alpha}^{\ast } \), it follows that \( {\pi}_s^c\left(\overline{\alpha}\right)-{\pi}_n>0 \) and hence \( \left[{\pi}_s^c\left(\overline{\alpha}\right)-{\pi}_n\right]k<0 \). Thus, it follows from \( \delta <\overline{\delta} \) that |ξ2| > 1. As it turns out, at \( \delta =\overline{\delta} \) the system undergoes a bifurcation characterized by a change in both the stability property of the monomorphic equilibrium \( \left(\overline{\alpha},0\right)\subset \Theta \) and the existence status of the polymorphic equilibrium (α∗, λ∗) ⊂ Θ. If the threshold given by \( \delta =\overline{\delta} \) is crossed from below (above), the bifurcation is characterized by the monomorphic equilibrium \( \left(\overline{\alpha},0\right)\subset \Theta \) ceasing to be a repulsor (an attractor) to become an attractor (a repulsor), and by the polymorphic equilibrium (α∗, λ∗) ⊂ Θ ceasing (coming) to exist. In any case, this completes the demonstration that the long-run equilibrium with no firm playing the profit-sharing strategy, \( \left(\overline{\alpha},0\right)\subset \Theta \), is an attractor if \( \delta >\overline{\delta} \) and a repulsor if \( \delta <\overline{\delta} \).

The Jacobian matrix evaluated around the monomorphic equilibrium \( \left(\overset{\sim }{\alpha },1\right)\subset \Theta \) is:

where \( {\pi}_s^c\left(\beta \right)=\left(1-\delta \right)\left[1-\left(v/\beta \right)\right] \) and πn = 1 − v.

Let ξ be an eigenvalue of the Jacobian matrix in (34). In this case, the eigenvalues of the Jacobian matrix is (34) are also easily computed:

Therefore, the local stability of \( \left(\overset{\sim }{\alpha },1\right)\subset \Theta \) depends on the absolute value of ξ2. Given (35), it follows that −1 < ξ2 < 1 obtains if, and only if, \( 0<\left[{\pi}_s^c\left(f(0)\right)-{\pi}_n\right]k<2 \).

Since \( 0<{\pi}_s^c\left(\beta \right)<1\ \mathrm{and}\ 0<{\pi}_n<1 \), it follows that \( -1<{\pi}_s^c\left(\beta \right)-{\pi}_n<1 \). Therefore, given that it is typically the case that 0 < k < 1, we can infer that \( \left[{\pi}_s^c\left(\beta \right)-{\pi}_n\right]k<2 \).

It can be seen that \( {\pi}_s^c\left(\alpha \right)-{\pi}_n=\left(1-\delta \right)\left(1-\frac{v}{\alpha}\right)-\left(1-v\right) \) is increasing in α. Given (20), it follows that \( {\pi}_s^c\left({\alpha}^{\ast}\right)-{\pi}_n=0 \). Given that \( \beta -{\alpha}^{\ast }=0\ \mathrm{at}\ \delta =\underline{\delta} \) and \( \frac{\partial \left(\beta -{\alpha}^{\ast}\right)}{\partial \delta }=\frac{-\left(1-v\right)v}{{\left(v-\delta \right)}^2}<0 \) for all v ∈ (0, 1) ⊂ ℝ and \( \delta \ne v,\mathrm{if}\ \delta >\underline{\delta} \), we then obtain β < α∗, so that \( {\pi}_s^c\left(\beta \right)-{\pi}_n<0 \) and therefore \( \left[{\pi}_s^c\left(\beta \right)-{\pi}_n\right]k<0 \). Thus, it follows from \( \delta >\underline{\delta} \) that |ξ2| > 1. Meanwhile, if \( \delta <\underline{\delta} \), so that β > α∗, it follows that \( {\pi}_s^c\left(\beta \right)-{\pi}_n>0 \) and hence \( \left[{\pi}_s^c\left(\beta \right)-{\pi}_n\right]k>0 \). Thus, it follows from \( \delta <\underline{\delta} \) that |ξ2| < 1. As it turns out, at \( \delta =\underline{\delta} \) the system undergoes a bifurcation characterized by a change in both the stability property of the monomorphic equilibrium \( \left(\overset{\sim }{\alpha },1\right)\subset \Theta \) and the existence status of the polymorphic equilibrium (α∗, λ∗) ⊂ Θ. In fact, if the threshold given by \( \delta =\underline{\delta} \) is crossed from below (above), the bifurcation is characterized by the monomorphic equilibrium \( \left(\overset{\sim }{\alpha },1\right)\subset \Theta \) ceasing to be an attractor (a repulsor) to become a repulsor (an attractor), and by the polymorphic equilibrium (α∗, λ∗) ⊂ Θ coming (ceasing) to exist. In any case, this completes the demonstration that the long-run equilibrium with all firms playing the profit-sharing strategy, \( \left(\overset{\sim }{\alpha },1\right)\subset \Theta \), is an attractor if \( \delta <\underline{\delta} \) and a repulsor if \( \delta >\underline{\delta} \).

The Jacobian matrix evaluated around the polymorphic equilibrium (α∗, λ∗) ⊂ Θ is:

Let ξ be an eigenvalue of the Jacobian matrix in (36). We can set the characteristic equation of the linearization around the equilibrium as:

where a ≡ δ(1 − λ∗) > 0, b ≡ δ(α∗ − v) > 0, and \( c\equiv {\lambda}^{\ast}\left(1-{\lambda}^{\ast}\right)\left(1-\delta \right)\frac{v}{{\left({\alpha}^{\ast}\right)}^2}k>0 \).

We can use the Samuelson stability conditions for a second order characteristic equation to determine under what conditions the two eigenvalues are inside the unit circle. Based on Farebrother (1973, p. 396, inequalities 2.4 and 2.5), we can establish the following set of simplified Samuelson conditions for the quadratic polynomial in (37):

Let us prove that these conditions are satisfied if a + bc < 1.

First, note that 1 + a + bc > a + 1 simplifies to bc > 0, which is trivially satisfied given that b > 0 and c > 0.

Meanwhile, the second inequality, a + bc < 1, can be expressed as follows:

Substitution of (20) and (21) in the expression a + bc yields:

Note that at δ = v it follows that a + bc = 1. Besides, we have that:

if we assume that the following condition is satisfied:

Thus, since a + bc = 1 at δ = v and given (40), it follows that the inequality in (39) holds for all δ ∈ (0, v) ⊂ ℝ. As a result, by assuming that (41) is satisfied, we can conclude that for all \( \delta \in \left(\underline{\delta},\overline{\delta}\right)\subset \left(0,v\right)\subset \mathbb{R} \) the stability condition in (39) is satisfied as well, so that the polymorphic equilibrium represented by (α∗, λ∗) ⊂ Θ is an attractor.

Appendix 2

1.1 A specific derivation of the replicator dynamic in (17)

In order to specifically deal with the employment rate in the polymorphic equilibrium, we can derive the replicator dynamic in (1) as follows. Let us consider that the probability with which a type n firm contemplates the convenience of switching productivity-enhancing strategy is determined by the popularity of the alternative, profit-sharing strategy, which is measured by λt. Having a type n firm become a potential strategy switcher, the probability with which the actual strategy switch materializes is assumed to be given by \( \mathit{\operatorname{Max}}\left\{{r}_{s,t}^c-{r}_n,0\right\}= kMax\left\{{\pi}_{s,t}^c-{\pi}_n,0\right\} \), where we assume that 0 < k < 1, as we have already done in Appendix 1. As a result, assuming that these two events are independent, the probability that a type n firm switches strategy to become a type s firm in a certain period t is represented by \( {\lambda}_t kMax\left\{{\pi}_{s,t}^c-{\pi}_n,0\right\} \). It follows that the estimated inflow to the subpopulation of type s firms is given by:

Analogously, the estimated inflow to the subpopulation of type n firms in a given period t is given by:

Therefore, the net inflow to the subpopulation of type s firms in a given period t can be obtained by subtracting (43) from (42), which yields:

Notice that the resulting expression in (44) corresponds precisely to the replicator dynamic in (17). Moreover, it follows that \( \left(1-{\lambda}_t\right){\lambda}_t kMax\left\{{\pi}_{s,t}^c-{\pi}_n,0\right\}=0 \) and \( {\lambda}_t\left(1-{\lambda}_t\right) kMax\left\{{\pi}_n-{\pi}_{s,t}^c,0\right\}>0 \) if \( {\pi}_n>{\pi}_{s,t}^c \), and that \( \left(1-{\lambda}_t\right){\lambda}_t kMax\left\{{\pi}_{s,t}^c-{\pi}_n,0\right\}>0 \) and \( {\lambda}_t\left(1-{\lambda}_t\right) kMax\left\{{\pi}_n-{\pi}_{s,t}^c,0\right\}=0 \) if \( {\pi}_{s,t}^c>{\pi}_n \). Therefore, the specification in (44) describes an evolutionary dynamic characterized only by inflow of firms to the strategy yielding the highest net profit rate. Also, this inflow varies positively with the excess of the net profit rate of the respective more profitable strategy over the net profit rate of the alternative strategy.

Let us now describe the flows of capital across productivity-enhancing strategies that go along with the flow of firms across these strategies, recalling there is neither capital mobility across firms nor depreciation of individual capital stocks. Let us consider that the distribution of the aggregate capital stock across strategies in a certain period t, (Ks, t, Kn, t), is given, with Kt = Ks, t + Kn, t. Considering (9), the capital stock of the subpopulation of type n firms will have grown at a rate given by γkπn = γk(1 − v) ≡ gn in period t + 1, whereas per (11) the capital stock of the subpopulation of type s firms will have grown at a rate represented by \( \gamma k{\pi}_{s,t}^c=\gamma k\left(1-\delta \right)\left(1-\frac{v}{\alpha_t}\right)\equiv {g}_s^c\left({\alpha}_t\right) \). Thus, by the end of period t (and before that any flows across strategies will have materialized), the capital stocks of the subpopulations of type n and type s firms are respectively the following:

and:

The capital stock in the subpopulation of type s firms in period t + 1 is represented by the proportion of firms that have remained following the profit-sharing strategy across periods t and t + 1 multiplied by their capital stock in period t + 1, plus the proportion of type n firms in period t that have become of type s in period t + 1 multiplied by their capital stock in period t + 1. Using (42), (43), (45) and (46), the capital stock of the subpopulation of type s firms in period t + 1 is then formally represented by:

Analogously, the capital stock in the subpopulation of type n firms in period t+1 is formally given by:

Dividing both sides in (47) and (48) by Nt + 1 and rearranging, we obtain:

and:

where κi, t = Ki, t / Nt denotes the total amount of capital of firms of type i = s, n as a proportion of the supply of labor in period t. In arriving at (49) and (50), we have made use of our assumption that Nt + 1 = [1 + g(αt, λt)]Nt, where it is to be remembered that g(αt, λt) is the short-run equilibrium average output growth rate defined in (14).

As demonstrated in Appendix 1, and summarized in Propositions 1 and 2, the coevolution of the frequency distribution of productivity-enhancing strategies and labor productivity across firms takes the economy to one of three evolutionary equilibria. Each one of these evolutionary equilibria features a different configuration in terms of the total amount of capital owned by firms of type i = s, n as a proportion of the supply of labor. If \( 0<\delta <\underline{\delta} \), the economy converges to the monomorphic equilibrium represented by \( {E}_1=\left(\overline{\alpha},0\right)=\left(\frac{\beta - v\delta}{1-\delta },0\right)\in \Theta \), which features no firm following the profit-sharing compensation strategy. Since the average output growth rate is \( g\left(\overline{\alpha},0\right)={g}_n=\gamma k\left(1-v\right) \), it follows from (49)-(50) that κs,t + 1 = κs,t = 0 and \( {\kappa}_{n,t+1}={\kappa}_{n,t}={\overline{\kappa}}_s>0 \) for all t ∈ {t0, t0 + 1, t0 + 2, …} when the economy is at the monomorphic equilibrium E1 in period t0. If \( \overline{\delta}<\delta <1 \), the economy converges to the monomorphic equilibrium represented by \( {E}_2=\left(\overset{\sim }{\alpha },1\right)=\left(\beta, 1\right)\in \Theta \), which is characterized by all firms following the profit-sharing compensation strategy. Given that the average output growth rate is represented by \( g\left(\overset{\sim }{\alpha },1\right)={g}_s^c\left(\beta, 1\right)=\gamma k\left(1-\delta \right)\left(1-\frac{v}{\beta}\right) \), it results from (49)-(50) that \( {\kappa}_{s,t+1}={\kappa}_{s,t}={\overset{\sim }{\kappa}}_s>0 \) and κn, t + 1 = κn, t = 0 for all t ∈ {t0, t0 + 1, t0 + 2, …} when the economy is at the monomorphic equilibrium E2 in period t0. Meanwhile, if \( \underline{\delta}<\delta <\overline{\delta} \), the economy converges to the polymorphic equilibrium represented by \( {E}_3=\left({\alpha}^{\ast },{\lambda}^{\ast}\right)=\left({\alpha}^{\ast },\frac{\beta - v\delta -\left(1-\delta \right){\alpha}^{\ast }}{\delta \left({\alpha}^{\ast }-v\right)}\right)\in \Theta \), at which the average output growth rate is given by \( g\left(\overline{\alpha},0\right)={g}_n=\gamma k\left(1-v\right) \). Therefore, it follows from (49)-(50) that \( {\overset{\frown }{\kappa}}_{s,t+1}={\overset{\frown }{\kappa}}_{s,t}={\kappa}_s^{\ast }>0 \) and \( {\overset{\frown }{\kappa}}_{n,t+1}={\overset{\frown }{\kappa}}_{n,t}={\kappa}_n^{\ast }>0 \) for all t ∈ {t0, t0 + 1, t0 + 2, …} when the economy is at the polymorphic equilibrium E3 in period t0.

Rights and permissions

About this article

Cite this article

Lima, G.T., da Silveira, J.J. Evolutionary microdynamics of employee profit sharing as productivity-enhancing device. J Evol Econ 31, 417–449 (2021). https://doi.org/10.1007/s00191-021-00723-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-021-00723-w

Keywords

- Profit sharing

- Labor productivity

- Evolutionary microdynamics

- Distribution of factor income

- Labor earnings inequality