Abstract

While much literature has focused on preferences regarding risk, preferences over skewness also have significant economic implications. An important and understudied aspect of skewness preferences is how they affect risk taking. In this paper, we design a novel laboratory experiment that elicits certainty equivalents over lotteries where the variance and skewness of the outcomes are orthogonal to each other. This design enables us to cleanly measure both skewness seeking/avoiding and risk taking behavior, and their interaction, without needing to make parametric assumptions. Our experiment includes both left- and right-skewed lotteries. The results reveal that the majority of subjects are skewness avoiding risk takers who correspondingly also take more risk when facing less skewed lotteries. Our second contribution is to link these choices to individual rank-dependent utility preference parameters estimated using a separate lottery choice protocol. Using a latent-class model, we are able to identify two classes of subjects: skewness avoiders with the classic inverse s-shaped probability weighting function and skewness neutral subjects that do not have an inverse s-shaped probability weighting function. Our results thus demonstrate the link between probability distortion and skewness seeking/avoidance choices. They also highlight the importance of accounting for individual heterogeneity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

While much literature has focused on preferences regarding risk, preferences over skewness also have important economic implications. Skewness seeking, for example, can explain the overpricing and less than average returns of (right-) skewed securities (Barberis 2013), overinvestment in winner-take-all careers and the high rates of small business failures, the attraction of lotteries (Garrett and Sobel 1999), and even the well-known “favorite – long shot bias” where people overprice long shots and underprice favorites (Golec and Tamarkin 1998).

An important and understudied aspect of skewness preferences is how they affect risk taking. That is, are people more or less willing to take risk when facing more skewed outcomes? Answering this question is important for many economic decisions. For example, people may purchase less insurance as skewness increases if they are more willing to take risks, and new crop varieties that reduce downside risk (i.e. technologies that reduce the probability of crop failure) may affect farmers’ willingness to adopt new technologies or to buy insurance.Footnote 1

To study how the skewness of outcomes affects risk taking we design a novel laboratory experiment that elicits certainty equivalents over lotteries where the variance and skewness of the outcomes are orthogonal to each other. Our design enables us to cleanly measure both skewness seeking/avoiding and risk taking behavior, and their interaction, without needing to make parametric assumptions. An important part of our design is the inclusion of both right- and left-skewed lotteries, with the latter less commonly studied. However, left skewness is a feature in many important economic decisions such as financial markets, agricultural production, insurance risks, health outcomes, and employment incomes. In these situations, there is a small likelihood of very unfavorable outcomes such as negative profits, unemployment, and serious illness. As Barberis (2013, p.182) describes, while some individual securities are right-skewed, “the aggregate stock market is negatively skewed: it is subject to occasional large crashes”. Increasing global connectivity magnifies these potential financial risks as exemplified by the recent global stock market crash associated with the coronavirus (COVID-19) pandemic. Similarly, the threat of climate changes brings an increased likelihood of extremely bad (catastrophic even) outcomes (e.g. Hanemann et al. 2016).

The most common pattern we observe in our experiment is skewness avoidance and risk taking, which is particularly prevalent when considering lotteries with the same direction of skewness (i.e. all left- or all right-skewed). Correspondingly, subjects also take more risk when facing less skewed lotteries. Nevertheless, we observe considerable heterogeneity in behavior. Our second novel contribution is to link these behaviors to individual structural risk preference parameters estimated using a separate lottery choice task. This allows us to investigate the role of individual heterogeneity, particularly utility curvature and probability weighting, in a manner that previous studies have only hinted at. For this purpose, we use the Harrison and Rutström (2009) protocol, which is specifically designed to measure individual risk preference parameters. For each subject, we estimate their utility curvature and probability weighting parameters in the rank-dependent utility (RDU) model (Quiggin 1982). We find two classes of subjects: skewness avoiders who have an inverse s-shaped probability weighting function, and skewness neutral subjects that do not have an inverse s-shaped probability weighting function.Footnote 2 Our results are the first to demonstrate the relationship between skewness seeking/avoiding and probability distortion at the individual level.Footnote 3

Several other studies investigate how skewness affects risk taking behavior. Grossman and Eckel (2015) use a variation of their Eckel and Grossman (2002, 2008) risk elicitation task and find that when choosing among options with greater skewness, subjects tend to choose riskier options than they did when facing options with lower skewness. In their experiment, subjects choose from six lotteries with the same skewness (and kurtosis) but different expected values or variances. Subjects make (up to) three lottery choices with skewness increasing from zero to two positive levels. However, when controlling for the largest gain in the lottery, their results reverse with subjects taking less risky choices as skewness increases. While Grossman and Eckel (2015) note this is consistent with overweighting the long shot, their experiment is not designed to provide evidence of probability weighting.Footnote 4 Astebro et al. (2015) use a variation of the Holt and Laury (2002) risk elicitation task, modified for different levels of (right) skewness. They find that greater skewness leads to greater risk taking among both students and executives, and with low and high incentives. Using the same choices to estimate average preference parameters for their samples, they rule out risk loving as an explanation but provide support for optimism and likelihood insensitivity. In a different experimental setting using binary lotteries, Ebert (2015) finds that with a symmetric risk, subjects are mostly risk averse but with a right-skewed risk they are mostly risk loving. Thus, similar to these other studies, he finds that risk taking increases with greater skewness. The result in Dertwinkel-Kalt and Köster (2020) is similar, with subjects in their Experiment 1 more willing to choose the lottery over the safe option yielding the lottery’s expected value as the skewness of the lottery increases.

In contrast to these studies, we structurally estimate individual risk preference parameters using a standard protocol and relate these to decisions over skewness and risk observed in a separate experimental task. Our results demonstrate the important relationship between probability distortion and skewness seeking/avoiding, as well as revealing considerable individual heterogeneity. In addition to measuring individual risk preference parameters, our experiment also differs by using mixed lotteries that are both left- and right-skewed, whereas the three studies described above use only right-skewed lotteries over gains.Footnote 5 Finally, our design allows us to study not only how skewness affects risk taking but also how the risk of lotteries affects observed skewness-related behavior.Footnote 6

Our paper is also related to the “favorite – long shot bias”; a robust finding in horse betting that long shots (right-skewed lotteries) are overpriced, leading to lower returns on average than favorites. While earlier explanations were that bettors were risk lovers, Golec and Tamarkin (1998) provide evidence consistent with skewness seeking and risk aversion rather than risk loving preferences. In later work, both Jullien and Salanié (2000) and Snowberg and Wolfers (2010) found that models allowing for bettor misperceptions fit the racetrack data better than risk loving preferences do. Importantly, both of these papers rely on a representative agent model and so do not study individual heterogeneity as we do. Further, controlled laboratory experiments can properly isolate factors in a way that is not possible with naturally occurring data where the variance and skewness of bet returns are correlated. Nevertheless, an implication from the long-shot bias is that bettors’ preference for skewness is sufficiently strong to overcome aversion to risk and lower expected returns, which reinforces the importance of studying the interaction between risk and skewness.

It is important to note that we study skewness seeking/avoiding behavior rather than prudence. Consistent with Ebert and Wiesen (2011), we define skewness seeking as preferring a lottery with a larger skewness over another lottery with a smaller skewness but the same expected value, variance, and kurtosis.Footnote 7 In contrast, prudence is a stricter feature of preferences, implying skewness seeking behavior that is robust to different levels of kurtosis. Ebert and Wiesen (2011) find evidence of prudence, with most prudent subjects also being skewness seeking but not necessarily vice versa.Footnote 8 In our experiment, we hold kurtosis constant and use the terminology “skewness seeking” to mean subjects prefer a lottery with larger skewness to one with smaller skewness and exactly the same mean, variance, and kurtosis. Similarly, we study “risk taking” rather than risk preference, with the former referring to preferences over changes in standard deviation holding the other moments constant.Footnote 9

As mentioned earlier, most studies include only right-skewed lotteries. Exceptions include Ebert and Wiesen (2011) who study eight pairs of binary lotteries that have the same expected value, variance, (and kurtosis, by definition because they are binary lotteries) and absolute skewness, but one is right-skewed and the other left-skewed. They find significant evidence of skewness seeking (defined here as choosing the right-skewed lottery) with 77% of choices in this direction. Ebert (2015) includes both left- and right-skewed lotteries in his experiment involving binary lottery choices, as well as symmetric (i.e. zero-skew) lotteries. He finds that subjects care about differences in the direction of the skewness but less about the magnitude of skewness, finding no evidence of skewness seeking when comparing two right-skewed lotteries. Ebert (2015, p. 86) finds evidence for skewness preferences, “that individuals both like right-skew and dislike left-skew, and we do not find that one is more important than the other”.Footnote 10 In a striking contrast, Symmonds et al. (2011), in a neuroeconomics study, consider lotteries with both left and right skewness and finds that preference for left skewness is actually more prevalent than skewness seeking. The design is very different in this study, which involves complicated lotteries with between three to nine outcomes.Footnote 11 More generally, these contrasting findings suggest that it is important to study skewness seeking/avoiding behavior across different domains including both left and right skewness.

2 Experimental design and methodology

Our experiment consists of the three following tasks always presented in the same order: eliciting willingness to pay for lotteries varying in standard deviation and skewness, eliciting individual structural risk preference parameters (utility curvature and probability weighting), and a final questionnaire eliciting standard demographic information.Footnote 12 The tasks are always presented in the same order so that our primary task always comes first before subjects become bored or fatigued. We discuss the two first tasks in turn. Experimental instructions (translated from French) are provided in Online Appendix A.

2.1 Eliciting willingness to pay for lotteries varying in standard deviation and skewness

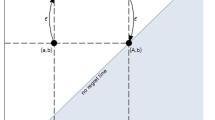

We designed eight lotteries varying in standard deviation and skewness but with a constant mean and kurtosis, for which we seek to elicit certainty equivalents (CEs). As shown in Table 1, the lotteries have two different levels of standard deviation but four different levels of skewness, two negative and two positive, but with the same absolute value. Positively skewed lotteries are right-skewed, while negatively skewed lotteries are left-skewed. We use lotteries with three possible outcomes as this allows us to control the kurtosis, mean, and variance, while changing the skewness. We keep the probabilities fixed but change the outcomes, which always include a mix of gains and losses. Subjects are endowed with €6 at the beginning of this first task to cover the largest possible loss.Footnote 13 Each lottery is defined as {(X1, 0.5), (X2, 0.4), (X3, 0.1)}, with X1, X2, X3 representing the outcomes and 0.5, 0.4 and 0.1 their respective probabilities. All amounts are in Euros.

We elicit willingness to pay for each lottery using the CE method commonly used in the risk literature. The subject makes a series of binary choices between the lottery and a sure amount using the multiple price list technique. Following the recent literature (Etchart-Vincent and L’Haridon 2011; Diecidue et al. 2015; Cubbitt et al. 2015; Ifcher and Zarghamee 2016), each binary choice involves a sure amount varying from the lowest to the highest payoff of the lottery with a €0.50 step. To avoid inconsistencies in behavior (switching back and forth), some studies (Etchart-Vincent and L’Haridon 2011; Cubbitt et al. 2015) ask subjects to state the row at which they would switch from choosing the lottery to choosing the sure amount. In our setting, we also decided to constrain subjects to switch only once.

To help subject comprehension, the lottery options were presented to subjects using pie charts. Figure 1 shows an example for Lottery F.

We employ a within-subject design and ask each subject to reveal their willingness to pay for each of the eight lotteries. To control for potential order effects, although they seem unlikely as each lottery is quite different, we created eight sequences that were randomized across subjects.Footnote 14

2.2 Eliciting individual structural risk preference parameters

To elicit risk preferences (utility curvature and probability distortion) for each subject in our sample we use the “mixed frame” protocol of Harrison and Rutström (2009) who use a modified Hey and Orme (1994) protocol. In this part of the experiment, subjects are presented with 60 lottery pairs, each represented as a “pie” showing the probability of each prize. Figure 2 shows an example. Subjects could choose the lottery on the left or the right, or explicitly express indifference (then the experimenter flips a coin on the subject’s behalf).

Following the protocol of Harrison and Rutström (2009), our design consists of 60 lottery choices per subject. Subjects are given an initial endowment of €8 (which covers the largest possible loss) and the prizes are −€8, −€3, €3, and €8. The probabilities used in each lottery ranged roughly evenly over the unit interval. The 60 lottery choices are listed in Online Appendix B.

In order to avoid long delays and an unnecessarily long session, after the first three choices we set a 30-s time limit on choices in this part of the experiment. We chose no timer for the first three tasks so that subjects can familiarize themselves with the design. The time limit was based on subjects’ decision times in Harrison and Rütström (2009), which went from 3 to 30 s per task (figures computed from the dataset). In the case of indifference or the time expiring, subjects were told that the experimenter would flip a coin on the subject’s behalf for payment.

We collected data from 210 subjects making 12,600 binary choices. Of these choices, 95 (0.75%) resulted in the time expiring, which we exclude from our analysis, leaving 12,505 observations.Footnote 15 About 6% of these choices consisted of indifference between the two lotteries, which is somewhat higher than the 1.7% in Harrison and Rutström (2009) but may reflect subject fatigue as this task comes after the elicitation of CEs.

Our design allows structural estimation of individual risk preference parameters; specifically, utility curvature and probability weighting. We use a RDU model (Quiggin 1982), which extends Expected Utility Theory (EUT) by considering probability distortion. The utility function over income x is as follows:

where α is the shape parameter of the utility function and x is the lottery prize plus the endowment.Footnote 16 Under RDU, probabilities p are transformed by a probability weighting function, which we specify according to Tversky and Kahneman (1992)Footnote 17:

where γ is a parameter describing the shape of the probability weighting function.

We follow the empirical modelling strategy of Harrison and Rutström (2008) to estimate individual structural parameters in our sample. Details are provided in Online Appendix D. We perform two estimations. We first estimate one concavity parameter and one probability weighting parameter for the whole sample of 210 subjects, clustering at the individual level, using all 12,505 observations. Then we estimate one concavity parameter and one probability weighting parameter for each individual using the 60 lottery choices per subject, except for missing observations due to time expiring as mentioned above.

2.3 Implementation

At the end of the experiment, one of three tasks (the 8-lottery task, the 60-lottery task and a third unrelated task not reported in this paper) was randomly chosen for payment. Then one out of eight choices (if 8-lottery task) or one out of 60 choices (if 60-lottery task) or one out of five choices (if unreported task) was randomly chosen and played out for real. If the 8-lottery task was chosen, then a particular row was also randomly selected for the chosen lottery with the subject paid either the sure amount for that row, if they choose that, or the lottery is played according to the probabilities indicated. Subjects were paid these lottery outcomes plus the initial endowment of either €6 (8-lottery task) or €8 (60-lottery task).

The experiment was computerized and programmed using the LE2M software developed at the Laboratory for Experimental Economics – Montpellier (France).Footnote 18 We conducted 12 sessions at the University of Montpellier in June 2018, with approximately 20 subjects per session. The first session with 20 subjects was a pilot to check our program and is excluded from the analysis. We have complete data from 210 subjects. The subjects, recruited using ORSEE (Greiner 2015), were mostly students and 55% were male. While most had experience in experiments (89%), none had previously participated in a similar experiment. The experiment typically lasted for one hour and average earnings were €8, ranging from €1.50 to €16.50. These earnings were added to the show up fee of €2 for students of the Economics Department (where the experimental lab is located) and €6 for those from outside the department.

3 Results I: Skewness seeking and risk taking behavior

Our results are structured as follows. First, we describe the evidence for skewness seeking among our subjects, distinguishing between left- and right-skewed lotteries. Second, we study how risk taking changes as skewness increases. Third, we look at the interaction. These results derive purely from the first (8-lottery) part of the experiment and do not rely on parametric assumptions. In the following section, we explain our findings by examining individual level behavior using structural parameters estimated using the second (60-lottery) part of the experiment. Unless stated otherwise, all reported p values are from paired two-sided t-tests.

3.1 Aggregate level behavior

For each of our 210 subjects we elicited the CE for the eight different lotteries in part one of the experiment. Choices were made in €0.50 steps. We computed the CE for each lottery by taking the midpoint of the range where the subject switched from the lottery to the sure amount. Table 2 summarizes the distribution of elicited CEs for each of the eight lotteries.

Figure 3 shows the mean CE for each lottery where the eight lotteries are arranged according to skewness and standard deviation. On the arrows, we report the results of paired t-tests comparing the CEs of two orthogonal lotteries. Horizontal comparisons involve lotteries that differ only in skewness, while vertical comparisons compare pairs of lotteries that differ only in standard deviation. Diagonal arrows combine the two effects.

Recall that we use the terminology “skewness seeking” when subjects prefer a lottery with a larger skewness to one with a smaller skewness and the same mean, standard deviation, and kurtosis. Note that “larger” skewness also encompasses the case of a smaller negative skewness. In addition, the terminology of “risk taking” behavior or preferring a “riskier” lottery refers only to an increase in standard deviation of a lottery.

Consider first the four right-skewed lotteries, A, B, E, and F. These are shown on the right panel of Fig. 3. The two horizontal comparisons show that the more (right) skewed lotteries are valued less than the lower skewed lottery with the same expected value, variance and kurtosis; i.e. \( \overline{\mathrm{CE}} \)B < \( \overline{\mathrm{CE}} \)A and \( \overline{\mathrm{CE}} \)F < \( \overline{\mathrm{CE}} \)E, and these differences are highly significant (p values <0.01). These results suggest that rather than being skewness seeking, subjects are skewness avoiding, and this is true for lotteries with both low and high standard deviation. The two vertical comparisons in the right panel show that subjects value riskier lotteries more than a lottery with lower standard deviation but the same expected value, skewness and kurtosis; i.e. \( \overline{\mathrm{CE}} \)A > \( \overline{\mathrm{CE}} \)E and \( \overline{\mathrm{CE}} \)B > \( \overline{\mathrm{CE}} \)F, and these differences are significant (p values<0.05). These results imply that subjects are risk takers, and this is true for lotteries with both low and high positive skewness. The diagonal compares the combined effect of an increase in standard deviation and an increase in skewness. Since \( \overline{\mathrm{CE}} \)B < \( \overline{\mathrm{CE}} \)E this implies that the skewness effect dominates; subjects value less lotteries that are more skewed to the right and riskier, although the difference is only weakly significant (p value<0.10).

Next, consider the four left-skewed lotteries, C, D, G, and H, shown in the left panel of Fig. 3. Again, the horizontal comparisons show that lotteries with a larger skewness are valued less, with \( \overline{\mathrm{CE}} \)C < \( \overline{\mathrm{CE}} \)D and \( \overline{\mathrm{CE}} \)G < \( \overline{\mathrm{CE}} \)H, and these differences are significant (p values<0.05). Subjects are again skewness avoiding. The vertical comparisons show that subjects value the higher standard deviation lottery more but only when the lottery is highly skewed to the left; i.e. \( \overline{\mathrm{CE}} \)D > \( \overline{\mathrm{CE}} \)H and the difference is significant (p value<0.05). In contrast, the CE of lotteries C and G is not significantly different. The combined effect of an increase in standard deviation and an increase in skewness (shown on the diagonal) is again negative, with \( \overline{\mathrm{CE}} \)C < \( \overline{\mathrm{CE}} \)H implying that the skewness effect dominates. The difference is weakly significant (p value<0.10).

Overall, the two panels show a consistent pattern of skewness avoiding and risk taking behavior, which is true with both right- and left-skewed lotteries. Next, we compare lotteries with the same absolute level of skewness but different directions. On average, subjects continue to be skewness avoiders when we compare lotteries with a large absolute skewness (0.397) as \( \overline{\mathrm{CE}} \)F < \( \overline{\mathrm{CE}} \)H (significant at 0.01) and \( \overline{\mathrm{CE}} \)B < \( \overline{\mathrm{CE}} \)D (although not significant at usual levels).Footnote 19 However, the results differ when we compare lotteries with the same small absolute skewness (0.105), as subjects prefer the right-skewed lottery to the left-skewed one. Specifically, \( \overline{\mathrm{CE}} \)A > \( \overline{\mathrm{CE}} \)C and \( \overline{\mathrm{CE}} \)E > \( \overline{\mathrm{CE}} \)G, and these differences are highly significant (p values<0.01).

While skewness avoidance is the dominant behavior, these different results when considering lotteries A and E suggests that subject decisions are influenced by factors beyond the moments of the lotteries. In particular, consider how X3, the least likely outcome which occurs with p = 0.10, varies across the eight lotteries. As reported in Table 1, lotteries A, D, E, and H all have their best lottery outcome as X3, while lotteries F, G, B, and C all have their worst outcome (always a loss) as X3. In the four pairwise lottery comparisons where only the magnitude of skewness is changing and not the direction (i.e. CD, BA, FE, GH), the four more right-skewed lotteries (C, B, F, G) all have their worst outcome as X3, and skewness avoiding is the predominant behavior. In contrast, when we compare lotteries that have the same absolute skewness (e.g. AC and EG), the more right-skewed lotteries (A and E) have their best outcome as X3, and then behavior reverses as subjects are predominantly skewness seeking. This might explain the differences we find and could relate to subjects overweighting the least likely (X3) outcome.Footnote 20 This motivates the second part of our experiment.

3.2 Individual level behavior

Taken at the aggregate level, subjects are predominantly skewness avoiding risk takers. In this section, we examine individual behavior. For each horizontal pairwise comparison of lotteries (e.g. lottery B versus A) we count the number of individuals that reported CEs consistent with skewness seeking (i.e. CEB > CEA), skewness neutrality (CEB = CEA) or skewness avoidance (CEB < CEA). For each pairwise comparison, the percentages of skewness seeking and skewness avoiding behaviors are shown in Fig. 4.Footnote 21 In seven out of the twelve pairwise horizontal comparisons the proportion of skewness avoiders is larger than the proportion of skewness seekers. Consistent with the results discussed above, the highest shares of skewness avoiders are observed where the two lotteries have the same direction of skewness (either right- or left-skewed). This implies that our average findings are reflective of general behavior among our subjects.

Our aggregate level results suggested that risk taking was the predominant decision among our subjects. In a similar manner, we now consider individual risk taking behavior by examining the four vertical comparisons among lotteries that differ only in standard deviation. We classify an individual as a risk taker if their CE is higher for the lottery with the higher standard deviation, risk neutral if the same, and risk avoiding if the other way around. The results are summarized in Fig. 5. These results also confirm what was observed at the aggregate level: in three out of the four pairwise comparisons, the majority of subjects are risk taking.Footnote 22

While these results show that our aggregate level findings reflect the predominant individual behavior, the results in Figs. 4 and 5 also reveal considerable heterogeneity in behavior, which we seek to account for in the next section. In addition, the risk taking behavior of individuals appears to vary with the skewness of the lotteries. In particular, for each individual we counted the number of risk taking choices out of four. Of the 210 subjects, only 34 exhibit risk taking behavior in all four cases, while 18 subjects are risk avoiders in all four cases. These mixed results suggest that risk taking changes with skewness, reiterating the importance of studying the interaction between skewness and variance.

3.3 Skewness and variance

We next ask whether subjects are more or less willing to take on risk as skewness increases. If subjects are more risk taking as skewness increases, then the difference in CEs between lotteries B and F will be larger than the difference between CEs for lotteries A and E. Said differently, is the extra amount that subjects are willing to pay for a riskier lottery larger when the lottery is more right-skewed? In fact, we find the opposite: \( \overline{\mathrm{CE}} \)B – \( \overline{\mathrm{CE}} \)F = 0.52 is less than \( \overline{\mathrm{CE}} \)A – \( \overline{\mathrm{CE}} \)E = 0.66 although the difference is small in magnitude and not significant (p value = 0.51). When comparing left-skewed lotteries, however we find a significant difference: \( \overline{\mathrm{CE}} \)C – \( \overline{\mathrm{CE}} \)G = −0.09 is less than \( \overline{\mathrm{CE}} \)D – \( \overline{\mathrm{CE}} \)H = 0.46 (p value = 0.0053). Moreover, this difference is economically important, with the absolute difference of 0.55 around 15–20% of the base CEs. Therefore, subjects are willing to pay both substantially and significantly more for riskier lotteries that are more left-skewed. Alternatively, since they are skewness avoiding they prefer to take on risks they like. When looking at individual behavior we find 89 subjects for whom (CEB – CEF) is larger than (CEA – CEE), i.e. 42% of our subjects are more risk taking as right-skewness increases. With left-skewed lotteries we find 126 subjects for which (CEC – CEG) is smaller than (CED – CEH), hence 60% of subjects are more risk taking when the lottery is more left-skewed.

We also ask if subjects’ attitudes to skewness are different as variance increases. That is, are subjects more skewness avoiding when the lottery has a higher variance? With right-skewed lotteries we find no significant difference, although \( \overline{\mathrm{CE}} \)A – \( \overline{\mathrm{CE}} \)B = 1.10 is greater than \( \overline{\mathrm{CE}} \)E – \( \overline{\mathrm{CE}} \)F = 0.94 (p = 0.50). The difference is however significant and substantial for left-skewed lotteries, with \( \overline{\mathrm{CE}} \)D – \( \overline{\mathrm{CE}} \)C = 0.89 greater than \( \overline{\mathrm{CE}} \)H – \( \overline{\mathrm{CE}} \)G = 0.34 (p = 0.0035). When making these comparisons at the individual level, we have 97 subjects (46%) for whom (CEA – CEB) is greater than (CEE – CEF) and 126 subjects (60%) for whom (CED – CEC) is greater than (CEH – CEG).

In summary, we find a significant and economically important interaction of variance and skewness when considering left-skewed lotteries. However, it is also evident that there is considerable heterogeneity in behavior, which may explain the insignificant effect for right-skewed lotteries as subjects respond differently to changes in variance and skewness. In the next section, we seek to model and understand where this heterogeneity comes from.

4 Results II: Can individual risk preference parameters explain behavior?

In this section, we first describe the estimation of mean and individual risk preferences using the RDU model based on the 60 lottery choices in the second part of the experiment (Section 4.1). We then link these individual risk preference parameters with heterogeneous skewness seeking/avoiding and risk taking behavior in the eight lotteries in the first part of the experiment (Section 4.2).

4.1 Estimation of individual risk preference parameters

The two parameters of the RDU model, utility curvature and probability weighting as shown in Eqs. (1) and (2), are estimated with Maximum Likelihood (ML) using the 12,505 active choices of the 210 subjects. The mean results assuming all individuals come from the same data generating process are reported in Table 3. As shown, the estimated parameters \( \hat{\alpha} \) and \( \hat{\gamma} \) are both significantly lower than one, which is indicative of a concave utility function and an inverse s-shaped probability weighting function, respectively. The latter indicates that, on average, subjects overweight small probabilities and underweight large probabilities.

We next estimate risk preference parameters for each individual in the sample. The estimated mean value for the \( \hat{\alpha} \) parameter is 0.98 and varies from 0.18 to 1.94, with a median equal to 0.97, so we have both concave and convex utility functions in our subject pool. The estimated mean \( \hat{\gamma} \) parameter is 0.946 and varies from 0.12 to 3.59 with a median at 0.88. The mean of both parameters is close to 1.Footnote 23

Each risk preference parameter was estimated for each individual in the sample. In what follows, we label as “risk averse” those subjects whose estimated \( \hat{\alpha} \)parameter is strictly lower than 1 (defined by the value 1 not being included in the corresponding 95% confidence interval). Subjects who are not classified as risk averse can be either risk neutral or risk seeking (\( \hat{\alpha}\ge 1 \)). Similarly, subjects for whom the estimated \( \hat{\gamma} \) parameter is strictly lower than 1 (that is, the value 1 is not included in the corresponding 95% confidence interval), are characterized as having “inverse s-shaped probability weighting” functions. The rest of the subjects include those who do not distort probabilities and those who are characterized by an s-shaped probability weighting function (\( \hat{\gamma}\ge 1 \)). Using these definitions, eight out of ten subjects (80%) are found to have a concave utility function (i.e., to be risk averse) and almost 9 out of 10 subjects (89%) exhibit an inverse s-shaped probability weighting function. Based on these two estimated characteristics we classify subjects into four categories as summarized in Table 4. The most common pattern (71% of the sample) is to exhibit both concave utility (risk aversion) and inverse s-shaped probability weighting.

4.2 Can individual risk preference parameters explain behavior?

In this section, we aim to link subjects’ individual risk preference parameters to their behavior in the first part of the experiment. The results discussed in Section 3 showed evidence of considerable heterogeneity in behavior. In line with earlier literature (e.g. Harrison and Rütström 2009) we allow for heterogeneous behavior by specifying a latent-class Logit (LCL) model (a type of finite mixture model) to describe the decision made by each subject when facing the choice between a lottery and a sure amount in part one of the experiment (see Online Appendix E for a description of the LCL model).

Each subject in the first part of our experiment made 170 binary choices (between a lottery and a sure amount).Footnote 24 We characterize each alternative by its first three moments (mean, standard deviation, and skewness). For the alternative corresponding to the sure amount, the second and third moments are equal to zero. The specification that best fits the data models the discrete choice between the lottery and the sure amount as a function of the mean, standard deviation, and skewness of each alternative. Rather than restricting all subjects to respond in the same way to the lottery moments, the model allows the effects of the moments to differ across two different classes of subjects. Probability of class membership depends on the two parameters characterizing a subject’s utility curvature and probability distortion (as obtained from the estimation of the RDU model, as summarized in Table 4), as well as gender (a dummy variable that takes the value one if the subject is a male, and zero otherwise). As described earlier, we use binary variables that describe whether each subject is risk averse or not, and whether they are characterized by an inverse s-shaped probability weighting function or not. Other subject characteristics such as age, university major, and current degree were insignificant and were excluded from the model.

The LCL model is suitable to analyze heterogeneity in discrete choice behavior and is an alternative to the traditional multinomial logit model and the mixed logit model (Greene and Hensher 2003). The underlying theory behind the LCL model assumes that the discrete choice made by each individual depends on observable characteristics of the alternatives she is facing and on latent heterogeneity which is unobserved by the econometrician. Contrary to the mixed logit model, which relies on continuous distributions of heterogeneity, the LCL model approximates the underlying continuous distributions of parameters with discrete distributions. This is done by assuming that the population is implicitly sorted into C classes characterizing heterogeneity, with class-membership being unknown to the analyst. Since the LCL model relies on a discrete approximation of continuous distributions it might be considered less flexible than the mixed logit model but the discrete approximation makes the model free of any assumptions about the distributions of parameters across individuals.Footnote 25

To determine the appropriate number of (latent) classes in the LCL researchers commonly use criteria such as the Akaike and the Bayesian Information Criterion that are based on the log-likelihood the model reached at convergence. In our model, both criteria were minimized for a number of classes equal to 21. We therefore faced a tradeoff between increasing the number of classes (which would improve the overall statistical fit of the model) but at the cost of making our results increasingly difficult to interpret. In addition, when increasing the number of classes, the size of each class becomes smaller, making the coefficient estimates in the models describing the probability of each class membership become less precise. Since our primary purpose is to test for the relationship between subjects’ risk preferences and probability weighting in explaining lottery choices, we gave priority to interpretable results and chose to limit our model to two classes.Footnote 26

Estimation results using 35,700 observations (170 binary choices made by each of the 210 subjects) are shown in Table 5.Footnote 27 Subjects in both classes value the mean positively, and the coefficient is of the same magnitude in the two classes. However, subjects in Class 1 prefer alternatives with a lower standard deviation but are indifferent to skewness, whereas subjects in Class 2 prefer alternatives with a higher standard deviation and a lower skewness.

To estimate the magnitude of these effects, we compute the marginal rate of substitution between the mean and the standard deviation, and the mean and the skewness. The marginal rate of substitution measures the change in mean (expressed in EUR) that subjects are willing to substitute for a one-unit increase in either standard deviation or skewness. We find that the absolute effects are larger for Class 2 than for Class 1. The largest effect is obtained for standard deviation for Class 2 where subjects are willing to accept a €0.50 decrease in mean (20% decrease) for a one-unit increase in standard deviation. The lowest effect is observed for standard deviation for Class 1 where subjects require a €0.19 increase in mean in order to accept a one-unit increase in standard deviation. Finally, subjects in Class 2 dislike skewness and require a €0.39 increase in mean to compensate for a one-unit increase in skewness.

We find that the probability of being in Class 1 increases if the subject is a female or risk averse, but decreases for subjects who are characterized by an inverse s-shaped probability weighting function. On the contrary, male subjects, those who are not risk averse (i.e., either risk neutral or risk seeking) and who exhibit an inverse s-shaped probability weighting function are more likely to be in Class 2. In our lotteries, preference for a lower standard deviation is related to risk aversion while preference for lower skewness is related to inverse s-shaped probability weighting. The LCL model demonstrates the importance of individual heterogeneity and suggests there may be a connection between probability weighting and skewness seeking/avoidance behavior.

To check how well the model performs in differentiating between the two classes, we look at the highest (posterior) probability of class membership (the higher this probability, the better the model in terms of class differentiation). Over the 210 subjects, the average highest probability is greater than 0.99 and the minimum is 0.80, which indicates that the model performs well in distinguishing between subjects’ preference patterns.

Table 6 reports the average characteristics within each class where each subject is assigned to either Class 1 or Class 2 based on the highest posterior probability of membership in one class or the other. Approximately half of the sample falls into each class. As expected, we find a lower proportion of males in Class 1 compared to Class 2. The average subject in Class 1 is more risk averse and less likely to have an inverse s-shaped probability weighting function.

We then try to answer the question: are subjects more risk taking when skewness increases? To do this we create an interaction term between standard deviation and skewness and re-estimate the two-class LCL model assuming that the choice between the lottery and the sure amount depends on the mean, the standard deviation, and the above interaction term. Results are shown in Table 7. For those in Class 1 the interaction term is not significant so subjects do not take more or less risk if skewness increases. This is consistent with Class 1 members being indifferent to skewness. Marginal rates of substitution remain unchanged.

For those in Class 2, the interaction term has a positive sign, which indicates that subjects in this class are willing to accept a €0.26 EUR decrease in the mean (10% decrease), as their dislike for skewness is reduced if standard deviation increases. If we look at the main effect of skewness, subjects are willing to accept a €1.49 EUR increase in the mean to compensate for a one-unit increase in skewness. This corresponds to a 60% increase in the mean, which is the largest effect measured so far.

5 Discussion

In order to study skewness seeking/avoiding behavior and its interaction with risk taking, we designed a novel laboratory experiment that elicits CEs over lotteries where the standard deviation and skewness of the outcomes are orthogonal to each other. We then related these choices to individual structural preference parameters elicited in a separate experimental task and estimated using the RDU model. At the aggregate level, we observed frequent skewness avoiding and risk taking behavior. However, these aggregate level results mask considerable individual heterogeneity in behavior. By linking these decisions to estimated individual risk preference parameters, we identified two classes of subjects. Slightly over half of our subjects (56%) dislike variance but are indifferent to skewness, while the remainder (44%) like greater variance but dislike greater skewness. Importantly, class membership is related to individual risk preference parameters. Specifically, the average member in the first class is more risk averse and is not characterized by an inverse s-shaped probability weighting function, while those in Class 2 are less likely to be risk averse and more likely to have inverse s-shaped probability weighting function implying they overweight small probabilities and underweight large ones. Our results are the first to demonstrate the link between probability weighting and skewness seeking/avoidance behavior at the individual level. Crucially, our findings highlight the importance of accounting for individual heterogeneity.

At the aggregate level, we found evidence of an interaction between risk taking and skewness avoiding behavior only for left-skewed lotteries, where subjects are more risk taking the smaller the skewness was. This interaction effect is consistent with the average finding of risk taking skewness avoiders being more willing to take on risks they like. However, we also find evidence of substantial individual heterogeneity in this behavior. Our LCL model finds that subjects who are indifferent to skewness (i.e. those in Class 1), are similarly unaffected by the interaction with variance. On the other hand, those in Class 2 dislike skewness, although this dislike is moderated by greater variance. That is, the interaction between variance and skewness seeking is positive for those in Class 2.

Our finding of skewness avoiding behavior is novel in the experimental literature. Even though this aggregate level behavior masks individual level heterogeneity, our LCL model reveals that nearly half of our subjects (i.e. those in Class 2) display similar behavior. Further, even those in Class 1 are actually neutral about skewness. In contrast, the predominant finding in the previous literature is skewness seeking (e.g. Ebert 2015; Ebert and Wiesen 2011), or the even stricter criteria of prudence (see Trautmann and van de Kuilen 2018 for a survey of prudence experiments).Footnote 28 Nevertheless, almost all of these existing studies consider only the special case of choosing between simple binary lotteries. Our design instead uses a more general form of lottery that involves three outcomes over mixed gains and losses and includes both left- and right-skewed lotteries. Our more complex lottery design generates results closer to those of Symmonds et al. (2011) who found that preference for left skewness was actually more prevalent than skewness seeking in a neuroeconomics experiment involving complicated lotteries with between three to nine outcomes.Footnote 29

Another difference in our experimental design is that we elicit certainty equivalents rather than using lottery choices. This is crucial for our purpose because measuring the intensity of preferences allows us to study the interaction between risk taking and skewness seeking/avoiding behavior.Footnote 30 Our method of eliciting CEs is employed in numerous recent experimental studies of individual behavior (e.g. Etchart-Vincent and L’Haridon 2011; Diecidue et al. 2015; Cubbitt et al. 2015; Ifcher and Zarghamee 2016). Even within the experimental prudence literature, the prevalence of prudence varies greatly with the elicitation method. In particular, significantly less prudence is observed with simple compared with compound lottery formats (Maier and Ruger 2012; Haering et al. 2020). On the other hand, while Deck and Schlesinger (2018) find no difference in aggregate prudence preferences between simple and compound lottery formats, at the individual level the correlation between what people do in the two formats was insignificant.

6 Conclusion

Overall, our study finds evidence of frequent skewness avoiding or neutral behavior and uniquely links this behavior to individual risk preference parameters of utility curvature and probability weighting. Our results regarding the prevalence of skewness avoiding and neutral behavior are unusual in the experimental literature. This suggests caution on two levels. First, researchers should be cautious when extrapolating that subjects are universally skewness seeking based on experiments that use only a very specific design (i.e. compound binary lottery choices). Our results suggest very different behavior when lotteries are more complex and certainty equivalents are elicited. While the focus on prudence is of theoretical importance, we suggest that it has limited the scope of experimental designs and resulted in missing other potentially important patterns of behavior. Second, we should be similarly cautious when extrapolating from our single set of experimental results based on a novel design. Because our design involved mixed gain and loss lotteries in the context of both left- and right-skewed lotteries, the stakes had to be relatively low in order to keep net payments non-negative. An obvious extension would develop a similar design involving larger stakes and possibly just gain lotteries. Our design also omitted symmetric lotteries (i.e. with zero skew) although arguably this should not matter as the lotteries are presented in a non-transparent manner. Overall, we encourage future researchers to explore different types of lotteries using a similarly orthogonal design in order to verify the robustness of our findings and to explore skewness seeking/avoiding behavior in different contexts. Other studies could vary the likelihood of the different options to check the robustness of the relationship to probability distortion.

Our findings also generally reinforce the call for the use of more flexible models than EUT (such as Rank-Dependent Utility or Cumulative Prospect Theory models) to describe observed behavior under risk (Barberis 2013; Bayrak and Hey 2020). Risk aversion may not be sufficient to fully characterize individuals’ preferences under risk in most risky situations. Parameters such as preference towards skewness (either positive or negative) as well as probability weighting and loss aversion may help better understanding individuals’ decisions. This is true in both experimental and real life settings. The latter can be exemplified by the agricultural economics literature, which is producing growing empirical evidence on the role of downside risk aversion and probability weighting in explaining farmers’ decisions such as technology adoption and insurance contracting (Chavas and Nauges 2020). Among other examples, Liu (2013) showed that Chinese cotton farmers who are more risk averse, or more loss averse, adopt the genetically modified Bt cotton later, whereas farmers who overweight small probabilities adopt Bt cotton earlier. In addition, Babcock (2015) showed that loss aversion and the choice of the reference point that determines gains and losses are major factors in predicting crop insurance decisions of US farmers.

Notes

Subjects characterized by an inverse s-shaped probability weighting function overweight small probabilities and underweight large probabilities.

There are two reasons why we do not estimate a model such as cumulative prospect theory (CPT) that allows for subject loss aversion. First, the existing literature on the interaction between variance and skewness has focussed on the role of probability distortion and not on loss aversion. Since ours is the first study to estimate individual structural parameters and link them to skewness and risk taking behavior, we focus on the key concept in the literature. Second, as noted by Barberis (2013), a weakness of CPT is the need to make assumptions regarding the appropriate reference point.

In a recent study, Taylor (2020) shows that some of the skewness seeking behavior observed in Grossman and Eckel (2015) results from order effects and loss aversion. Importantly, he also finds that after controlling for order effects, the impact of skewness on risk taking becomes mixed with changes observed in both directions.

While Ebert (2015) does include left-skewed lotteries in his experiment (as discussed below), he only studies the interaction of risk taking and skewness seeking with right-skewed lotteries (as compared to symmetric, or zero-skew ones).

We know of only one study that asks this reverse question although this is not isolated in the experimental design but revealed in regression results. Specifically, Brunner et al. (2011) finds that higher variance generates more skewness-seeking choices in their experiment using binary lotteries.

Larger skewness can therefore mean either a more right-skewed lottery or a less left-skewed lottery.

Trautmann and van de Kuilen (2018) survey the growing number of experimental studies that study prudence using the risk apportionment task theoretically developed by Eeckhoudt and Schlesinger (2006). The aggregate level findings regarding prudence are considered inconsistent with standard models of expected utility, and while the potential for non-EU models is noted, these are not investigated using individual level data (e.g. Ebert and Wiesen 2014).

This is true for the first part of the experiment where we observe behavior towards standard deviation and skewness. In the second part of the experiment, we use lottery choices to elicit risk preferences, that is, the curvature of the utility function and a parameter of probability distortion. These elicited risk preference parameters are then used to explain behavior in the first part of the experiment.

Dertwinkel-Kalt and Koster (2020) also include several binary lotteries with negative skewness in their experimental tests of salience theory.

Symmonds et al. (2011) is the closest in design to our experiment in the sense that they use an orthogonal design involving six levels of skewness and ten levels of variance. However, in their design rather than explicitly eliciting the certainty equivalent, the subject chooses between each gamble and a single sure amount. The single sure amount has three levels, and this choice is repeated for each gamble using each level. In total, each subject makes 180 decisions in rapid succession.

The experiment also involved an additional unrelated task, however as the results from this task are not used in this article, we do not discuss it further.

This is a losses-from-an-initial-endowment payment scheme as widely used by experimentalists both for practical and ethical reasons. As shown by Etchart-Vincent and L’Haridon (2011), in a similar CE elicitation task, such a payment scheme does not suffer from bias towards more risk-seeking or more risk-averse behavior.

The eight sequences are shown in Online Appendix C. Each lottery appears once in each sequence; each lottery appears in a given rank (1 to 8) in each sequence; each lottery is always played with the same preceding lottery except when it is played first: for example, D is always played after C (except in sequence 6 where it is played first), so there is more control.

From the subject’s point of view, choosing indifference or letting the time expire leads to the same incentive structure (i.e. the experimenter flips a coin). Thus, a subject might let time expire to express indifference but we have no way of knowing this.

Alternative specifications of the utility function such as U(x) = x1 − r/(1 − r) when r ≠ 1 and U(x) = log(x) when r = 1, and the contextual utility model of Wilcox (2011) yield similar estimates of the mean preference parameters.

These results are not shown in Figure 3 to avoid cluttering the diagram.

Exploring probability weighting is especially relevant. As mentioned earlier, Grossman and Eckel (2015) find that when controlling for the largest gain in the lottery, subjects take less risky choices, instead of riskier choices, as skewness increases. Bordalo et al. (2012) offer an alternative theory, salience theory, to explain why subjects might be risk averse in some situations and risk seeking in others. Some payoffs might draw subjects’ attention (be salient). Subjects are then risk seeking when a lottery’s upside is salient and risk averse when its downside is salient. Dertwinkel-Kalt and Koster (2020) provide experimental evidence that salience (in particular, the contrast effect) can explain skewness preferences. Bayrak and Hey (2020) develop a different, behaviorally motivated, model of risky choices, where the skewness of the outcomes (as well as lottery dispersion and individual optimism) explicitly factors into the decision making process. Their experimental tests show that this new model outperforms other common models including salience theory.

For each lottery pair we use a chi-square test (of equality of proportions) to compare the observed proportions of skewness seeking, skewness neutral, and skewness avoiding subjects to random proportions. The latter are obtained by drawing randomly 10,000 CEs for each lottery in uniform distributions and counting the number of draws falling in each of the three categories. The null hypothesis that the choices are random is strongly rejected in each case.

Here too the chi-square test (of equality of proportions) rejects the null hypothesis that the choices and proportions are random for each of these pairwise comparisons.

Figure F1 in Online Appendix F shows the distribution of the two parameters in the sample.

Recall that since each binary choice involves a sure amount varying from the lowest to the highest payoff of the lottery with a €0.50 step, some lotteries involve a higher number of sure amounts than others.

The multinomial logit model relies on the assumption of independence from irrelevant alternatives, which is considered strong in most settings. For this reason, the mixed logit model and the LCL model are often preferred. Various competing models have been tried (multinomial logit, conditional logit, mixed logit) with the latent-class logit model offering the best compromise since it allows identifying sub-groups of subjects with heterogeneous underlying preference patterns, and also performs well in terms of parameter significance.

Estimated parameters (and corresponding standard errors) obtained for a three-class LCL model do not allow identifying a third group of subjects in addition to the two classes identified with the two-class LCL. Since we only identify three observable determinants of class membership, allowing for more than three classes would make it difficult to characterize each class based on these three determinants.

Estimates were obtained using the lclogit2 module in Stata (Yoo 2020).

Recall that prudence is a preference for skewness that is robust to changes in kurtosis.

Diecidue et al. (2015) demonstrate how the measurement of second-order risk preferences (also via CEs) is similarly affected by lottery complexity. Specifically, they find evidence of risk seeking behavior over complicated lotteries (defined as having three or five outcomes) but risk aversion when lotteries were less complex (having only two outcomes).

Most prudence experiments use compound binary lottery choices to align with theoretical constructs. Exceptions are Ebert and Wiesen (2014) who elicit how much compensation subjects require to choose the imprudent option over the prudent one, and Heinrich and Mayrhofer (2018) who use the same method to investigate if higher order risk preferences are influenced by social settings.

References

Astebro, T., Mata, J., & Santos-Pinto, L. (2015). Skewness seeking: Risk loving, optimism or overweighting of small probabilities? Theory and Decision, 78(2), 189–208.

Babcock, B. A. (2015). Using cumulative prospect theory to explain anomalous crop insurance coverage choice. American Journal of Agricultural Economics, 97(5), 1371–1384.

Barberis, N. C. (2013). Thirty years of prospect theory in economics: A review and assessment. Journal of Economic Perspectives, 27(1), 173–196.

Bayrak, O. K., & Hey, J. D. (2020). Decisions under risk: Dispersion and skewness. Journal of Risk and Uncertainty, 61(1), 1–24.

Bordalo, P., Gennaioli, N., & Shleifer, A. (2012). Salience theory of choice under risk. Quarterly Journal of Economics, 127(3), 1243–1285.

Brünner, T., Levínský, R., & Qiu, J. (2011). Preferences for skewness: Evidence from a binary choice experiment. The European Journal of Finance, 17(7), 525–538.

Chavas, J.P., & Nauges, C. (2020). Uncertainty, learning and technology adoption in agriculture. Applied Economic Perspectives and Policy, 42(1), special issue: Adoption of agricultural innovations, 42–53.

Chavas, J. P., & Shi, G. (2015). An economic analysis of risk, management and agricultural technology. Journal of Agricultural and Resource Economics, 40(1), 63–79.

Cubitt, R. P., Navarro-Martinez, D., & Starmer, C. (2015). On preference imprecision. Journal of Risk and Uncertainty, 50(1), 1–34.

Deck, C., & Schlesinger, H. (2018). On the robustness of higher order risk preferences. The Journal of Risk and Insurance, 85(2), 313–333.

Dertwinkel-Kalt, M., & Köster, M. (2020). Salience and skewness preferences. Journal of the European Economic Association, 18(5), 2057–2107.

Diecidue, E., Levy, M., & van de Ven, J. (2015). No aspiration to win? An experimental test of the aspiration level model. Journal of Risk and Uncertainty, 51(3), 245–266.

Ebert, S. (2015). On skewed risks in economic models and experiments. Journal of Economic Behavior & Organization, 112, 85–97.

Ebert, S., & Wiesen, D. (2011). Testing for prudence and skewness seeking. Management Science, 57(7), 1334–1349.

Ebert, S., & Wiesen, D. (2014). Joint measurement of risk aversion, prudence, and temperance. Journal of Risk and Uncertainty, 48(3), 231–252.

Eckel, C. C., & Grossman, P. J. (2002). Sex differences and statistical stereotyping in attitudes toward financial risk. Evolution and Human Behavior, 23(4), 281–295.

Eckel, C. C., & Grossman, P. J. (2008). Forecasting risk attitudes: An experimental study using actual and forecast gamble choices. Journal of Economic Behavior & Organization, 68(1), 1–17.

Eeckhoudt, L., & Schlesinger, H. (2006). Putting risk in its proper place. American Economic Review, 96(1), 280–289.

Emerick, K., de Janvry, A., Sadoulet, E., & Dar, M. H. (2016). Technological innovations, downside risk, and the modernization of agriculture. American Economic Review, 106(6), 1537–1561.

Etchart-Vincent, N., & l’Haridon, O. (2011). Monetary incentives in the loss domain and behavior toward risk: An experimental comparison of three reward schemes including real losses. Journal of Risk and Uncertainty, 42(1), 61–83.

Garrett, T. A., & Sobel, R. S. (1999). Gamblers favor skewness, not risk: Further evidence from United States’ lottery games. Economics Letters, 63(1), 85–90.

Golec, J., & Tamarkin, M. (1998). Bettors love skewness, not risk, at the horse track. Journal of Political Economy, 106(1), 205–225.

Greene, W. H., & Hensher, D. A. (2003). A latent class model for discrete choice analysis: Contrasts with mixed logit. Transportation Research Part B, 37(8), 681–698.

Greiner, B. (2015). Subject pool recruitment procedures: Organizing experiments with ORSEE. Journal of the Economic Science Association, 1(1), 114–125.

Grossman, P. J., & Eckel, C. C. (2015). Loving the long shot: Risk taking with skewed lotteries. Journal of Risk and Uncertainty, 51(3), 195–217.

Haering, A., Heinrich, T., & Mayrhofer, T. (2020). Exploring the consistency of higher-order risk preferences. International Economic Review, 61(1), 283–320.

Hanemann, M., Sayre, S. S., & Dale, L. (2016). The downside risk of climate change in California’s Central Valley agricultural sector. Climatic Change, 137(1), 15–27.

Harrison, G., & Rutström, E. (2009). Expected utility theory and prospect theory: One wedding and a decent funeral. Experimental Economics, 12(2), 133–158.

Heinrich, T., & Mayrhofer, T. (2018). Higher-order risk preferences in social settings. Experimental Economics, 21(2), 434–456.

Hey, J. D., & Orme, C. (1994). Investigating generalizations of expected utility theory using experimental data. Econometrica, 62(6), 1291–1326.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92(5), 1644–1655.

Ifcher, J., & Zarghamee, H. (2016). Pricing competition: A new laboratory measure of gender differences in the willingness to compete. Experimental Economics, 19(3), 642–662.

Jullien, B., & Salanié, B. (2000). Estimating preferences under risk: The case of racetrack bettors. Journal of Political Economy, 108(3), 503–530.

Liu, E. M. (2013). Time to change what to sow: Risk preferences and technology adoption decisions of cotton farmers in China. Review of Economics and Statistics, 95(4), 1386–1403.

Maier, J., & Ruger, M. (2012). Experimental evidence on higher-order risk preferences with real monetary losses. Working Paper, University of Munich.

Prelec, D. (1998). The probability weighting function. Econometrica, 66(3), 497–527.

Quiggin, J. (1982). A theory of anticipated utility. Journal of Economic Behavior & Organization, 3(4), 323–343.

Snowberg, E., & Wolfers, J. (2010). Explaining the favorite–long shot bias: Is it risk-love or misperceptions? Journal of Political Economy, 118(4), 723–746.

Symmonds, M., Wright, N. D., Bach, D. R., & Dolan, R. J. (2011). Deconstructing risk: Separable encoding of variance and skewness in the brain. NeuroImage, 58(4), 1139–1149.

Taylor, M. P. (2020). Liking the long-shot…but just as a friend. Journal of Risk and Uncertainty, 61(3), 245–261. https://doi.org/10.1007/s11166-020-09342-5.

Trautmann, S. T., & van de Kuilen, G. (2018). Higher order risk attitudes: A review of experimental evidence. European Economic Review, 103, 108–124.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representations of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Wilcox, N. T. (2011). ‘Stochastically more risk averse:’ A contextual theory of stochastic discrete choice under risk. Journal of Econometrics, 162(1), 89–104.

Yoo, H. I. (2020). Lclogit2: An enhanced command to fit latent class conditional logit models. The Stata Journal, 20(2), 405–425.

Acknowledgements

We thank Jean-Marc Rousselle for assistance in programming and running the experiment, and Olivier L’Haridon for sharing his experimental instructions (in French) on certainty equivalent elicitation. We are also grateful for helpful comments provided by Philip Grossman, and conference and seminar audiences at the Center of Environmental Economics of Montpellier, Toulouse School of Economics, the BEST Conference on Human Behavior and Decision Making, and the UQ BESC social sciences workshop. We thank the University of Queensland for supporting our collaboration and funding the subject payments. Céline Nauges acknowledges funding from the French National Research Agency (ANR) under the Investments for the Future (Investissements d’Avenir) program, grant ANR-17-EURE-0010. Douadia Bougherara acknowledges funding from the project ‘Facilitate public Action to exit from peSTicides (FAST)’ as part of the French Priority Research Programme ‘Growing and Protecting Crops Differently’ of the French National Research Agency (ANR).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

ESM 1

(PDF 257 kb)

Rights and permissions

About this article

Cite this article

Bougherara, D., Friesen, L. & Nauges, C. Risk Taking with Left- and Right-Skewed Lotteries*. J Risk Uncertain 62, 89–112 (2021). https://doi.org/10.1007/s11166-021-09345-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-021-09345-w