Abstract

This work provides analysis of a variant of the Risk-Sharing Principal-Agent problem in a single period setting with additional constant lower and upper bounds on the wage paid to the Agent. The effect of the extra constraints on optimal contract existence is studied and leads to conditions on the underlying utility functions under which an optimum may be attained. Solution characterization is then provided along with the derivation of a Borch rule for Limited Liability. Finally, some applications, including the CARA utility case, are discussed.

Similar content being viewed by others

Notes

This “one-sided” optimization for the Principal may, with good reason, seem unfair. This problem is in fact a benchmark problem that is often used as a measure of comparison with other Principal-Agent problems such as Moral Hazard where optimization for the Agent also comes into play. One may also note that in our increasingly digitalized economies with an ever growing use of machines, analysis of optimal contracting without Moral Hazard (and thus in a Risk-Sharing setting) is increasingly relevant in itself too.

These are variants on classical utility functions whose validity has been extensively studied.

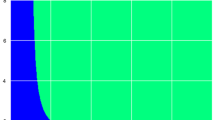

\(x \mapsto \frac{U''(x)}{U'(x)}\) is increasing up to 0 and is worth 1 beyond 0. On \({\mathbb {R}}^-\) it thus exposes “IARA” (increasing absolute risk aversion).

References

Borch, K.: Equilibrium in a reinsurance market. Econometrica 30(3), 424–444 (1962)

Brezis, H.: Functional Analysis, Sobolev Spaces and Partial Differential Equations. Springer, Berlin (2011)

Cvitanić, J., Zhang, J.: Contract Theory in Continuous-Time Models. Springer, Berlin (2013)

Dewatripont, M., Matthews, S.A., Legros, P.: Moral Hazard and Capital Structure Dynamics. J. Eur. Econ. Assoc. 1(4), 890–930 (2003)

Friend, I., Blume, M.: The Demand for Risky Assets. Am. Econ. Rev. 65(5), 900–922 (1975)

Holmström, B.: Moral Hazard and Observability. Bell J. Econ. 10(1), 74–91 (1979)

Innes, R.: Limited liabilities and incentive contracting with ex-ante action choices. J. Econ. Theory 52(1), 45–67 (1990)

Jewitt, I., Kadan, O., Swinkels, J.M.: Moral hazard with bounded payments. J. Econ. Theory 143(1), 59–82 (2008)

Kadan, O., Reny, P., Swinkels, J.M.: Existence of optimal mechanisms in principal agent problems. Econometrica 85(3), 769–823 (2017)

Kadan, O., Swinkels, J.M.: Minimum Payments and Induced Effort in Moral Hazard Problems. Games Econ. Behav. 82, 468–489 (2013)

Kim, S.K.: Limited liability and bonus contracts. J. Econ. Manag. Strategy 6(4), 899–913 (1997)

Kurdila, A., Zabarankin, M.: Convex Functional Analysis. Birkhäuser (2005)

Luenberger, D.: Optimization by Vector Space Methods. Wiley (1967)

Martin, J., Réveillac, A.: Analysis of the Risk-Sharing Principal-Agent problem through the Reverse-Hölder inequality. arXiv:1809.07040v3 (2019)

Matthews, S.A.: Renegotiating moral hazard contracts under limited liability and monotonicity. J. Econ. Theory 97(1), 1–29 (2001)

Mirrlees, J.: The optimal structure of incentives and authority within an organization. Bell J. Econ. 7(1), 105–131 (1976)

Müller, H.: The first-best sharing rule in the continuous-time principal-agent problem with exponential utility. J. Econ. Theory 79(2), 276–280 (1998)

Page, F.: The existence of optimal contracts in the principal-agent model. J. Math. Econ. 16(2), 157–167 (1987)

Park, E.-S.: Incentive contracting under limited liability. J. Econ. Manag. Strategy 4(3), 477–490 (1995)

Ross, S.: The economic theory of agency: the principal’s problem. Am. Econ. Rev. 63(2), 134–139 (1973)

Sannikov, Y.: A continuous-time version of the principal-agent problem. Rev. Econ. Stud. 75(3), 957–984 (2008)

Sappington, D.: Limited liability contracts between principal and agent. J. Econ. Theory 29(1), 1–21 (1983)

Tihonov, A.N.: On the solution of ill-posed problems and the method of regularization. Dokl. Akad. Nauk SSSR 151(3), 501–504 (1963)

Acknowledgements

The author wishes to thank Stéphane Villeneuve for the introduction to Principal-Agent problems and for many interesting discussions on the subject. She is also extremely grateful to Frédéric de Gournay for numerous discussions on optimization, and to the anonymous reviewer for his insightful remarks on this work. Finally, she thanks the ANR Pacman for financial support.

Author information

Authors and Affiliations

Corresponding author

Additional information

Communicated by Nizar Touzi.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Martin, J. The Risk-Sharing Problem Under Limited Liability Constraints in a Single-Period Model. J Optim Theory Appl 189, 854–872 (2021). https://doi.org/10.1007/s10957-021-01861-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-021-01861-8