Abstract

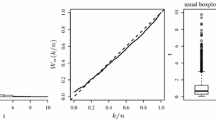

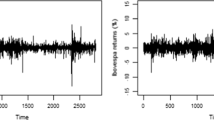

An efficient market is often related to the market liquidity in a certain sense. In this paper, the autoregressive conditional duration (ACD) model is used for modeling and analyzing the market liquidity based on high-frequency financial data, which takes the volume duration as its measure index. Considering the high peak and heavy tail of high-frequency financial data, the self-weighted quantile regression (SQR) estimators for the unknown parameters in ACD model are constructed. The consistency and asymptotic properties of the estimators are proved. Furthermore, Monte Carlo simulation shows that the SQR estimators with data-driven weights are more accurate than those by traditional quantile regression (QR). Moreover, the performance of SQR estimation performs better with the increase of the proportion of outliers. The mean deviation and mean square error are reduced up to 96.24% and 91.83%, respectively. Finally, we illustrate the SQR method by an empirical analysis of the volume duration for Industrial And Commercial Bank Of China (ICBC) and PingAn Bank stocks in China. Through the Akaike Information Criterion (AIC) and other evaluation criteria, the SQR estimators at different quantiles all possess better performance.

Similar content being viewed by others

Availability of Data and Code

The datasets and codes used during the current study are available from the corresponding author on reasonable request.

References

Bauwens, L., & Giot, P. (2000). The logarithmic ACD model: An application to the bid-ask quote process of three NYSE stocks. Annals of Economics and Statistics, 60, 117–149

Chaboud, A. P., Chiquoine, B., Hjalmarsson, E., & Loretan, M. (2009). Frequency of observation and the estimation of integrated volatility in deep and liquid financial markets. Journal of Empirical Finance, 17(2), 212–240

Chaboud, A. P., Chiquoine, B., Hjalmarsson, E., & Vega, C. (2014). Rise of the machines: Algorithmic trading in the foreign exchange market. Journal of Finance, 69(05), 2045–2084

Chen, Z., Li, R., & Wu, Y. (2012). Weighted quantile regression for AR model with infinite variance errors. Journal of Nonparametric Statistics, 24(3), 715–731

Dufour, A., & Engle, R. F. (2000). Time and the price impact of a trade. The Journal of Finance, 55(6), 2467–2498

Easley, D., & O’Hara, M. (1987). Price, trade size, and information in securities markets. Journal of Financial Economics, 19(1), 69–90

Engle, R. F., & Lange, J. (2001). Predicting VNET: A model of the dynamics of market depth. Journal of Financial Markets, 4(2), 113–142

Engle, R. F., & Russell, J. (1998). Autoregressive conditional duration: A new model for irregularly spaced transaction data. Econometrica, 66, 1127–1162

Fama, E. F. (1970). Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance, 25(2), 383–417

Gençay, R., & Gradojevic, N. (2013). Private information and its origins in an electronic foreign exchange market. Economic Modelling, 33, 86–93

Gradojevic, N., Erdemlioglu, D., & Gençay, R. (2020). A new wavelet-based ultra-high-frequency analysis of triangular currency arbitrage. Economic Modelling, 85, 57–73

Huber, P. J. (1977). Robust Statistical Procedures. Philadelphia: Society for Industrial and Applied Mathematics

Karnaukh, N., Ranaldo, A., & Söderlind, P. (2015). Understanding FX liquidity. Review of Financial Studies, 28(11), 3073–3108

Knight, K. (1998). Limiting distributions for L1 regression estimators under general conditions. The Annals of Statistics, 26(2), 755–770

Koenker, R. W., & Bassett, G. W. (1978). Regression quantile. Econometrica, 46(1), 33–50

Ling, S. (2005). Self-weighted least absolute deviation estimation for infinite variance autoregressive models. Journal of the Royal Statistical Society: Series B (Statistical Methodology), 67(3), 381–393

Ling, S. (2007). Self-weighted and local quasi-maximum likelihood estimators for ARMA-GARCH/IGARCH models. Journal of Econometrics, 140(2), 849–873

Ling, S., & McAleer, M. (2003). Asymptotic theory for a new vector ARMA-GARCH model. Econometric Theory, 19(2), 280–310

Liu, W., Wang, H., & Chen, M. (2011). Least absolute deviation estimation of autoregressive conditional duration model. Acta Mathematicae Applicatae Sinica (English Serie), 27(2), 243–254

Lu, W., & Ke, R. (2019). A generalized least squares estimation method for the autoregressive conditional duration model. Statistical Papers, 60(1), 123–146

Mancini, L., Ranaldo, A., & Wrampelmeyer, J. (2013). Liquidity in the foreign exchange market: Measurement, commonality, and risk premiums. Journal of Finance, 68(5), 1805–1841

O’Hara, M. (2003). Presidential address: Liquidity and price discovery. The Journal of Finance, 58(4), 1335–1364

Funding

This research work is supported by National Natural Science Foundation of China (11901397), Ministry of Education, Humanities and Social Sciences project (18YJCZH153), National Statistical Science Research Project (2018LZ05), Youth Academic Backbone Cultivation Project of Shanghai Normal University (310-AC7031-19-003021), General Research Fund of Shanghai Normal University (SK201720) and Key Subject of Quantitative Economics of Shanghai Normal University (310-AC7031-19-004221) and Academic Innovation Team of Shanghai Normal University (310-AC7031-19-004228).

Author information

Authors and Affiliations

Contributions

YS has designed the framework of this paper, drafted the work and substantively revised it. XW has performed the corresponding detailed proof and numeral calculations.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Rights and permissions

About this article

Cite this article

Wang, X., Song, Y. Self-weighted quantile estimation of autoregressive conditional duration model. J. Korean Stat. Soc. 51, 87–108 (2022). https://doi.org/10.1007/s42952-021-00121-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42952-021-00121-9