Abstract

Online reviews have become an increasingly popular information source in consumer’s decision making process. To help consumers make informed decisions, how to select products through online reviews is a valuable research topic. This work deals with a personized product selection problem with review sentiments under probabilistic linguistic circumstances. To this end, we propose a multi-criteria decision making (MCDM) method incorporating personalized heuristic judgments in the prospect theory (PT). We focus on the role of personalized heuristic judgments on review helpfulness in the final decision outcomes. We demonstrate the consistency between the three common heuristic judgments (with respect to review valence, sentiment extremity, and aspiration levels) and the three behavioral principles of the PT. Then, the products are ranked with the probabilistic linguistic term set (PLTS) input, based on the proposed adjustable PT framework, in which the coefficients of negativity bias are derived from the consumer’s heuristic judgments. Finally, a real case on TripAdvisor.com and two simulation experiments are given to illustrate the validity of the proposed method.

Similar content being viewed by others

Notes

The open source software, Stanford Core NLP, can be found in https://stanfordnlp.github.io/CoreNLP/.

Note that \(e_{j}\) should first be normalized and ordered. To avoid confusion, the processed aspiration is still denoted as \(e_{j}\).

References

Chevalier, J. A., & Mayzlin, D. (2006). The effect of word of mouth on sales: Online book reviews. Journal of Marketing Research, 43(3), 345–354.

Forman, C., Ghose, A., & Wiesenfeld, B. (2008). Examining the relationship between reviews and sales: The role of reviewer identity disclosure in electronic markets. Information Systems Research, 19(3), 291–313.

Friedman, M., & Savage, L. J. (1948). The utility analysis of choices involving risk. Journal of Political Economy, 56(4), 279–304.

Gigerenzer, G., & Gaissmaier, W. (2011). Heuristic decision making. Annual Review of Psychology, 62(1), 451–482.

Gou, X., Xu, Z., Liao, H., & Herrera, F. (2020). Probabilistic double hierarchy linguistic term set and its use in designing an improved VIKOR method: The application in smart healthcare. Journal of the Operational Research Society. https://doi.org/10.1080/01605682.2020.1806741.

Gu, J., Zheng, Y., Tian, X., & Xu, Z. (2020). A decision-making framework based on prospect theory with probabilistic linguistic term sets. Journal of the Operational Research Society, 1–10.

Haug, J., Hens, T., & Woehrmann, P. (2013). Risk aversion in the large and in the small. Economics Letters, 118(2), 310–313.

Kahneman, D., & Tversky, A. (1979). Prospect thoery: An analysis of decision under risk. Econometrica, 47(2), 263–292.

Liao, H., Jiang, L., Xu, Z., Xu, J., & Herrera, F. (2017). A linear programming method for multiple criteria decision making with probabilistic linguistic information. Information Sciences, 415–416, 341–355.

Liao, H., Mi, X., & Xu, Z. (2020). A survey of decision-making methods with probabilistic linguistic information: bibliometrics, preliminaries, methodologies, applications and future directions. Fuzzy Optimization and Decision Making, 19(1), 81–134.

Liu, J., Liao, X., Huang, W., & Liao, X. (2019). Market segmentation: A multiple criteria approach combining preference analysis and segmentation decision. Omega, 83, 1–13.

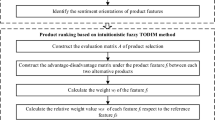

Liu, P., & Teng, F. (2019). Probabilistic linguistic TODIM method for selecting products through online product reviews. Information Sciences, 485, 441–455.

Liu, Y., Bi, J. W., & Fan, Z. P. (2017a). Ranking products through online reviews: A method based on sentiment analysis technique and intuitionistic fuzzy set theory. Information Fusion, 36, 149–161.

Liu, Y., Bi, J. W., & Fan, Z. P. (2017b). A method for ranking products through online reviews based on sentiment classification and interval-valued intuitionistic fuzzy topsis. International Journal of Information Technology and Decision Making, 16(6), 1497–1522.

Nazlan, N. H., Tanford, S., & Montgomery, R. (2018). The effect of availability heuristics in online consumer reviews. Journal of Consumer Behaviour, 17(5), 449–460.

Pang, Q., Wang, H., & Xu, Z. (2016). Probabilistic linguistic term sets in multi-attribute group decision making. Information Sciences, 369, 128–143.

Park, S., & Nicolau, J. L. (2015). Asymmetric effects of online consumer reviews. Annals of Tourism Research, 50, 67–83.

Rozin, P., & Royzman, E. B. (2001). Negativity bias, negativity dominance, and contagion. Personality and Social Psychology Review, 5(4), 296–320.

Socher, R., Perelygin, A., Wu, J. Y., Chuang, J., Manning, C. D., Ng, A. Y., & Potts, C. (2013). Recursive deep models for semantic compositionality over a sentiment treebank. In Proceedings of the Conference EMNLP 2013–2013 Conference on Empirical Methods in Natural Language Processing, (pp. 1631–1642).

Taylor, S. E. (1991). Asymmetrical effects of positive and negative events: The mobilization-minimization hypothesis. Psychological Bulletin, 110(1), 67–85.

Tian, X., Niu, M., Zhang, W., Li, L., & Herrera-Viedma, E. (2020). A novel TODIM based on prospect theory to select green supplier with q-rung orthopair fuzzy set. Technological and Economic Development of Economy, 1–27.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Yoon, Y., Polpanumas, C., & Park, Y. J. (2017). The impact of word of mouth via twitter on moviegoers’ decisions and film revenues: Revisiting prospect theory: How WOM about movies drives loss-aversion and reference-dependence behaviors. Journal of Advertising Research, 57(2), 144–158.

Zhang, D., Wu, C., & Liu, J. (2020). Ranking products with online reviews: A novel method based on hesitant fuzzy set and sentiment word framework. Journal of the Operational Research Society, 71(3), 528–542.

Acknowledgements

This work was supported by the National Natural Science Foundation of China (Grant Nos. 71701037, 71971051), and Youth Top-notch Talent Support Program of Hebei province (No. BJ2020211).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

The proof of Proposition 1

(1) The derivative \(f^{\prime}\left( {{\text{AI}}} \right) = \left( {1 - \frac{{{\text{AI}}}}{2}} \right)^{\eta } + \left( {1 + \frac{{{\text{AI}}}}{2}} \right)^{\eta } - {2} \times \left( {\frac{{\text{AI + 1}}}{2}} \right)^{\eta } > 0\) for any \({\text{AI}} \in (0,\;1)\) and \(\eta \ge 1\). So \(f({\text{AI}})\) is monotonically increasing with respect to the level of \({\text{AI}}\). \(\min f({\text{AI}}) = f(0) = - \frac{2}{\eta + 1}\left[ {2 \times \left( \frac{1}{2} \right)^{\eta + 1} - \frac{1}{{2^{\eta } }} + 1^{\eta + 1} - 1^{\eta + 1} } \right] = 0\), hence we have \(U(0,X) = U(0,Y)\) and \(U({\text{AI}},Y) > U({\text{AI}},X)\) for any \({\text{AI}} \in (0,\;1)\). The results mean that when \({\text{AI}} \in (0,\;1)\), a greater expected utility is brought by fixed income than that by uncertain returns. Thus, we prove that the decision-maker is risk averse when \({\text{AI}} \in (0,\;1)\), and risk neutral when \({\text{AI}} = 0\).

(2) The proof of loss neutral for \({\text{AI}} = 0\) can be directly derived because \(U(y) + U( - y) - \left[ {U(x) + U( - x)} \right] = 0\) hold when \({\text{AI}} = 0\). For any \(x > y \ge 0\), we have three possible cases. Consider the case \(x > y > {\text{AI}}\), there is \(U(y) + U( - y) - \left[ {U(x) + U( - x)} \right] = y\left[ {\left( {\frac{{y - {\text{AI}} + 1}}{2}} \right)^{\eta } - \left( {\frac{{{\text{AI}} + y + 1}}{2}} \right)^{\eta } } \right] - \left[ {x\left( {\frac{{x - {\text{AI}} + 1}}{2}} \right)^{\eta } - \left( {\frac{{{\text{AI}} + x + 1}}{2}} \right)^{\eta } } \right]\). If \(\eta = 1\),\(U(y) + U( - y) - \left[ {U(x) + U( - x)} \right] = - {\text{AI}}\left( {y - x} \right) > 0\). If \(\eta \ge 2\), according to the equation of difference of two nth powers, \(U(y) + U( - y) - \left[ {U(x) + U( - x)} \right] = - {\text{AI}}\left( {yG_{1} - xG_{2} } \right)\), where \(G_{1} = \left( {\frac{{y - {\text{AI}} + 1}}{2}} \right)^{\eta - 1} + \left( {\frac{{y - {\text{AI}} + 1}}{2}} \right)^{\eta - 2} \times \left( {\frac{{{\text{AI}} + y + 1}}{2}} \right) + \left( {\frac{{y - {\text{AI}} + 1}}{2}} \right)^{\eta - 3} \times \left( {\frac{{{\text{AI}} + y + 1}}{2}} \right)^{2} \cdots + \left( {\frac{{{\text{AI}} + y + 1}}{2}} \right)^{\eta - 1} > 0\) and \(G_{2} = \left( {\frac{{x - {\text{AI}} + 1}}{2}} \right)^{\eta - 1} + \left( {\frac{{x - {\text{AI}} + 1}}{2}} \right)^{\eta - 2} \times \left( {\frac{{{\text{AI}} + x + 1}}{2}} \right) + \left( {\frac{{x - {\text{AI}} + 1}}{2}} \right)^{\eta - 3} \times \left( {\frac{{{\text{AI}} + x + 1}}{2}} \right)^{2} \cdots + \left( {\frac{{{\text{AI}} + x + 1}}{2}} \right)^{\eta - 1} > 0\). Since \(x > y > {\text{AI}} > 0\), there is \(0 < G_{1} < G_{2}\), So, there is \(U(y) + U( - y) > U(x) + U( - x)\) for any \(x > y > {\text{AI}}\). The proofs for \(x > {\text{AI}} > y\) and \({\text{AI}} > x > y\) are similar. So, we prove the decision-maker is loss averse when \({\text{AI}} \in (0,\;1)\). □

The proof of Proposition 2

(1) We have proved that \(f({\text{AI}})\) is monotonically increasing as \({\text{AI}} \in (0,\;1)\) in the aforementioned proofs. The greater superiority possessed by the expected utility from fixed income is indicative of a greater degree of risk aversion. So, we prove that the degree of risk aversion increases with the increase of AI.

(2) We code the reward \(x\) as a gain or loss relative to the sentimental neutral point, for any \(x \in (0,1)\), the ratio of absolute utility value with respect to AI, denote by \(\lambda ({\text{AI}},x)\), is calculated as \(\lambda ({\text{AI}},x){ = }\left( {\frac{{{\text{AI}} + x + 1}}{{\left| {{\text{AI}} - x} \right| + 1}}} \right)^{\eta }\), where \(\lambda ({\text{AI}},x) > 1\) means loss aversion, and a greater \(\lambda\) indicates more loss sensitive. We have \(\lambda \left( {{\text{AI}}_{1} ,x} \right) - \lambda \left( {{\text{AI}}_{2} ,x} \right) = \left| {{\text{AI}}_{2} - x} \right|\left( {{\text{AI}}_{1} + x + 1} \right) - \left| {{\text{AI}}_{1} - x} \right|\left( {{\text{AI}}_{2} + x + 1} \right) + {\text{AI}}_{1} - {\text{AI}}_{2}\). Three possible position for \(x\) relative to \({\text{AI}}\) should be discussed separately. (i) For any \(x > {\text{AI}}_{2} > {\text{AI}}_{1}\), there is \(\lambda ({\text{AI}}_{1} ,x) - \lambda ({\text{AI}}_{2} ,x) = 2({\text{AI}}_{1} - {\text{AI}}_{2} )(x + 1) < 0\). (ii) For any \({\text{AI}}_{2} > {\text{AI}}_{1} > x\), there is \(\lambda \left( {{\text{AI}}_{1} ,x} \right) - \lambda \left( {{\text{AI}}_{2} ,x} \right) = 2x\left( {{\text{AI}}_{2} - {\text{AI}}_{1} } \right) > 0\). (iii) Consider the case \({\text{AI}}_{2} > x > {\text{AI}}_{1}\), the sign of \(\lambda ({\text{AI}}_{1} ,x) - \lambda ({\text{AI}}_{2} ,x) = 2\left[ { - x^{2} - x + {\text{AI}}_{1} (1 + {\text{AI}}_{2} )} \right]\) is not fixed. However, only the case for any \(x > {\text{AI}}_{2} > {\text{AI}}_{1}\) makes perfect sense, because the loss aversion coefficient is meaningful only when the gain and loss coexist. So, the result in Proposition 2.(2) holds. □

Rights and permissions

About this article

Cite this article

Zhao, M., Shen, X., Liao, H. et al. Selecting products through text reviews: An MCDM method incorporating personalized heuristic judgments in the prospect theory. Fuzzy Optim Decis Making 21, 21–44 (2022). https://doi.org/10.1007/s10700-021-09359-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10700-021-09359-8