“The varying expectations of business men... and nothing else, constitute the immediate cause and direct causes or antecedents of industrial fluctuations.”

– Arthur C. Pigou, 1927.

Abstract

The aim of this paper is twofold. Firstly, we present a model in which both income and income inequality are jointly determined in a counter-cyclical manner via self-fulfilling expectation. We argue that multiple equilibria can arise in the presence of inelastic labor demand, a minimum investment requirement, and imperfections in the credit market. In one equilibrium, the market wage and labor income are both low. Young agents who become entrepreneurs work harder and save more than young agents who become depositors. As a result, the equilibrium is characterized by low-income and high-income inequality. In another equilibrium, the market wage and labor income are both high. Young agents supply the same amount of labor and save the same. As a result, the equilibrium is characterized by high-income and low-income inequality. Secondly, we present different dynamic scenarios predicted by the model and analyze the role of self-fulfilling expectations. The paper ends by providing some policy recommendations on how the coordination of agents’ expectations about labor market conditions and how improvements in financial development may affect the long-run income and income inequality.

Similar content being viewed by others

Notes

A self-fulfilling expectation occurs when the adoption of a certain expectation about current and future economic conditions affects agents’ behavior in such a way that the expectation becomes a reality.

Agents in the proposed model face equality of opportunities, and thus, income inequality is not a result of historically shaped inequalities of opportunities, transmitted across generations through education, social position, place of birth, etc. Banerjee and Newman (1993), Galor and Zeira (1993), Aghion and Bolton (1997), Piketty (1997), Piketty (2000), Matsuyama (2000), Mookherjee and Ray (2002, 2003), and others argue that imperfections in the credit market may generate entry barriers, offer fewer opportunities for the poor, and cause the access to credit and the borrowing rate to depend on wealth and social status. As a result, long-run living standards can become dependent on the initial inequality which can persist or even be magnified over time. We do not argue that inequality of opportunities transmitted across generations is an unimportant factor for generating income inequality; instead, we argue that the endogenous income inequality is possible even when agents face equalities of opportunities.

To reduce the complexity of the model and avoid unnecessary complications, we assume here that firms employ a Leontief production technology. In “Appendix,” we relax this assumption and allow firms to employ a constant elasticity of substitution (CES) production technology. This way we demonstrate the robustness of the main results.

Of course, occupation, labor supply, and portfolio choices are not independent of each other, but we consider them in separation and connect them later to reduce the notational complexity and make the exposure of the model more intuitive. As we demonstrate below, all these choices depend on the pair \((w_t,\frac{\rho _{t+1}}{r_{t+1}})\).

To reduce the complexity of the model and avoid unnecessary complications, we assume here that agents neither value the first-period consumption nor they discount the utility from the second-period consumption. In “Appendix,” we relax both assumptions and demonstrate the robustness of the main results under alternative specifications.

Macroeconomic literature offers several alternative justifications for a partial pledgeability of a firm’s profit for debt repayment. In particular, there is a costly-state-verification approach of Townsend (1979), Bernanke and Gertler (1989), and others, a moral hazard approach of Holmström and Tirole (1997) and others and an adverse selection approach of Hart and Moore (1994), Kiyotaki and Moore (1997), and others. In this paper, we will not argue which of the above stories offer a more plausible explanation for credit market imperfection. Instead, we will rely on the reduced form approach of Matsuyama (2007), and Holmström and Tirole (2011), to parameterize the severity of the credit market imperfections and analyze its role in the joint dynamics of income and income inequality.

As we see later, \(\ell _t=0.5\) is the optimal labor supply of depositors and the rental rate of capital is equal to the interest rate, \(\rho _{t+1}=r_{t+1}\), and guarantees young agents’ indifference between becoming a depositor or an entrepreneur.

When the rental rate of capital is greater than the interest rate, \(\rho _{t+1}>r_{t+1}\), then young agents have the incentive to supply more labor than depositors do, \(\ell _t>0.5\), and earn the higher labor income in order to overcome a borrowing constraint and the minimum investment requirement for setting up a firm.

Indeed, the empirical measure of the fraction of the population who plan to become entrepreneurs is too small for changes in their labor supply behavior to have large effects on the aggregate labor supply. However, one can interpret young agents in the model more broadly as ones who are working to buy a house, send their children to college, or make other discrete choices that are associated with the minimum investment requirements.

It should be highlighted here that the equilibrium wage satisfies \(w_t \in [A,T]\) and the aggregate labor supply curve is backward bending for \(w_t \in [\lambda m, 2\lambda m]\). This means that the necessary condition for multiplicity of equilibria is the equilibrium wage to belong simultaneously to both sets [A, T] and \([\lambda m, 2\lambda m]\). That is, a necessary condition for multiplicity of equilibria is \([A,T] \cap [\lambda m,2\lambda m] \ne \varnothing \).

Self-employment opportunity is eliminated when \(A=0\).

Throughout the paper, the terms (a) income and labor income, and (b) income inequality and labor income inequality, are used interchangeably.

Existence of multiple equilibria with different income levels is consistent with the empirical finding of Kar et al. (2018).

It is worthwhile to highlight here that the relationship between the next period capital stock, \(k_{t+1}\), and the current capital stock, \(k_t\), is a correspondence rather than a function when there exist multiple equilibria. This complicates the identification and statistical inference of the model. This is because for some income levels there are multiple values of income inequality levels consistent with the model. This issue is mainly ignored in the econometric literature.

\(k_M\) given in (30) is the unique solution of \(W_2(k)=1\) if \(1 \in (\lambda m,2\lambda m)\).

Almost all countries have a minimum wage. Some countries, such as France, have a universal minimum across the entire economy, while other countries, such as New Zealand and South Africa, differentiate between sectors and types of workers. Typically, the minimum wage is set by the government and is revised periodically in consultation with business and labor organizations. Italy, Sweden, Norway, Finland, and Denmark are examples of developed nations where there is no minimum wage that is required by legislation. However, these countries (especially Nordic ones) have very high union participation rates. That is, minimum wage standards in these countries are set by collective bargaining agreements.

Based on British firm-level data, Draca et al. (2011) reports that an increase in the minimum wage has a significant and negative impact on the profitability of firms but has no significant effects either on employment or on productivity.

References

Acemoglu D (1995) Public policy in a model of long-term unemployment. Economica 62(246):161–178

Aghion P, Bolton P (1997) A theory of trickle-down growth and development. Rev Econ Stud 64(2):151–172

Agliari A, Rillosi F, Vachadze G (2015) Credit market imperfection, financial market globalization, and catastrophic transition. Math Comput Simul 108:41–62

Agliari A, Vachadze G (2011) Homoclinic and heteroclinic bifurcations in an overlapping generations model with credit market imperfection. Comput Econ 38(3):241–260

Agliari A, Vachadze G (2014) Credit market imperfection, labor supply complementarity, and output volatility. Econ Model 38:45–56

Albanesi S (2007) Inflation and inequality. J Monet Econ 54(4):1088–1114

Arrow K (1974) The theory of discrimination. In: Ashenfelter O, Rees A (eds) Discrimination on labor markets. Princeton University Press, Princeton

Banerjee A, Newman AF (1993) Occupational choice and the process of development. J Polit Econ 101(2):274–298

Barsky R, Sims E (2012) Information, animal spirits, and the meaning of innovations in consumer confidence. Am Econ Rev 102(4):1343–1377

Bernanke B, Gertler M (1989) Agency costs, net worth, and business fluctuations. Am Econ Rev 79(1):14–31

Berndt E (1976) Reconciling alternative estimates of the elasticity of substitution. Rev Econ Stat 58(1):59–68

Blanchard O (1993) Consumption and the recession of 1990–1991. Am Econ Rev 83(2):270–274

Blank R (1989) Disaggregating the effect of the business cycle on the distribution of income. Economica 56:141–163

Botta A, Caverzasi E, Russo A, Gallegati M, Stiglitz J (2019) Inequality and finance in a rent economy. J Econ Behav Organ. https://doi.org/10.1016/j.jebo.2019.02.013

Brueckner M, Kikuchi T, Vachadze G (2016) Effects of income growth on domestic saving rates: the role of poverty and borrowing constraints. ANU working papers in economics and econometrics, Australian National University, College of Business and Economics, School of Economics

Card D, Krueger A (1994) Minimum wages and employment: a case study of the fast-food industry in New Jersey and Pennsylvania. Am Econ Rev 84(4):772–793

Card D, Krueger A (2000) Minimum wages and employment: a case study of the fast-food industry in New Jersey and Pennsylvania. Am Econ Rev 90(5):1397–1420

Cardaci A, Saraceno F (2019) Between Scylla and Charybdis: income distribution, consumer credit, and business cycles. Econ Inq 57(2):953–971

Carroll C, Fuhrer J, Wilcox D (1994) Does consumer sentiment forecast household spending? If so, why? Am Econ Rev 84(5):1397–1408

Castaneda A, Diaz-Gimenez J, Rios-Rull J (1998) Exploring the income distribution business cycle dynamics. J Monet Econ 42(1):93–130

Chirinko R (2008) \(\sigma \): The long and short of it. J Macroecon 30(2):671–686

Coate S, Loury G (1993) Will affirmative-action policies eliminate negative stereotypes? Am Econ Rev 83(5):1220–1240

Dolmas J, Huffman G, Wynne M (2000) Inequality, inflation, and central bank independence. Can J Econ 33:271–287

Draca M, Machin S, Reenen J (2011) Minimum wages and firm profitability. Am Econ J Appl Econ 3(1):129–151

Galli R, van der Hoeven R (2001) Is inflation bad for income inequality: the importance of the initial rate of inflation. International Labor Organization Employment Paper 2001/29

Galor O, Zeira J (1993) Income distribution and macroeconomics. Rev Econ Stud 60(1):35–52

Garner C (1991) Forecasting consumer spending: Should economists pay attention to consumer confidence surveys? Econ Rev 76(3):57–71

Hall R (1993) Macro theory and the recession of 1990–1991. Am Econ Rev 83(2):275–279

Hamermesh D (1996) Labor demand. Princeton University Press, Princeton

Hart O, Moore J (1994) A theory of debt based on the inalienability of human capital. Quart J Econ 109(4):841–879

Hassler J, Storesletten K, Zilibotti F (2007) Democratic public good provision. J Econ Theory 133(1):127–151

Heer B, Sussmuth B (2007) Effects of inflation on wealth distribution: Do stock market participation fees and capital income taxation matter? J Econ Dyn Control 31(1):277–303

Hirsch B, Kaufman B, Zelenska T (2015) Minimum wage channels of adjustment. Ind Relat J Econ Soc 2(54):199–239

Holmström B, Tirole J (1997) Financial intermediation, loanable funds, and the real sector. Quart J Econ 112(3):663–691

Holmström B, Tirole J (2011) Inside and outside liquidity. MIT Press, Cambridge

Howrey P (2001) The predictive power of the index of consumer sentiment. Brook Pap Econ Activity 2001(1):175–207

Huang H, Lin S (2009) Non-linear finance-growth nexus. Econ Transit 17:439–466

Kar M, Nazlioglu S, Agir H (2011) Financial development and economic growth nexus in the MENA countries: bootstrap panel Granger causality analysis. Econ Model 28(1):685–693

Kar S, Roy A, Sen K (2018) The double trap: institutions and economic development. Econ Model (forthcoming)

Kikuchi T, Vachadze G (2018) Minimum investment requirement, financial market imperfection and self-fulfilling belief. J Evol Econ 28:305–332

Kiyotaki N, Moore J (1997) Credit cycles. J Polit Econ 105(2):211–248

Law S, Singh N (2014) Does too much finance harm economic growth? J Bank Finance 41:36–44

Lommerud K, Straume O, Vagstad S (2015) Mommy tracks and public policy: on self-fulfilling prophecies and gender gaps in hiring and promotion. J Econ Behav Organ 116:540–554

Maliar L, Maliar S, Mora J (2005) Income and wealth distributions along the business cycle: implications from the neoclassical growth model. B E J Macroecon 5(1):1–28

Matsuyama K (2000) Endogenous inequality. Rev Econ Stud 67(4):743–759

Matsuyama K (2007) Credit traps and credit cycles. Am Econ Rev 97(1):503–516

Mookherjee D, Ray D (2002) Contractual structure and wealth accumulation. Am Econ Rev 92(4):818–849

Mookherjee D, Ray D (2003) Persistent inequality. Rev Econ Stud 70(2):369–393

Nabi M (2015) Equity-financing, income inequality and capital accumulation. Econ Model 46:322–333

Parker J (1999) Spendthrift in America? On two decades of decline in the US saving rate. In: Bernanke B, Rotemberg J (eds) 1999 NBER macroeconomics annual, technical report, NBER

Phelps E (1972) The statistical theory of racism and sexism. Am Econ Rev 62(4):659–661

Piketty T (1995) Social mobility and redistributive politics. Quart J Econ 110(3):551–585

Piketty T (1997) The dynamics of the wealth distribution and the interest rate with credit rationing. Rev Econ Stud 64(2):173–189

Piketty T (1998) Self-fulfilling beliefs about social status. J Public Econ 70(1):115–132

Piketty T (2000) Theories of persistent inequality and intergenerational mobility. In Atkinson A, Bourguignon F (eds) Handbook of income distribution, 1st edn, vol 1, Chapter 08, Elsevier, pp 429–476

Reichlin P (1986) Equilibrium cycles in an overlapping generations economy with production. J Econ Theory 40(1):89–102

Slottje D (1987) Relative price changes and inequality in the size distribution of various components of income. J Bus Econ Stat 5:19–26

Stuart A, Ord K (1963) Kendall’s advanced theory of statistics. Distribution theory. Grifin, London

Townsend RM (1979) Optimal contracts and competitive markets with costly state verification. J Econ Theory 21(2):265–293

Vachadze G (2018) Credit market imperfection, minimum investment requirement, and endogenous income inequality. J Math Econ 76:62–79

Waltman J, McBride A, Camhout N (1998) Minimum wage increases and the business failure rate. J Econ Iss 32(1):219–223

Woodford M (1986) Stationary sunspot equilibria in a finance constrained economy. J Econ Theory 40(1):128–37

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I benefited from comments and suggestions made by Linda Coull, Richard Nugent, Thomas Hauner, and Bryan Weber on an earlier draft of the paper. This work was supported by Provost’s Research Scholarship Award and City University of New York PSC-CUNY Research Award TRADA-61020-00-49.

Appendix

Appendix

Lemma 1

Suppose population consists of I groups. Let the relative size of group \(i=1,2,...,I\) is \(p_i\) and everyone in that group earns the income \(y_i\). Then, the Gini index of income inequality in the entire population is

Proof of Lemma 1: can be found in Stuart and Ord (1963).

Proof of Proposition 1

Entrepreneur’s optimization problem is (time subscripts are eliminated for notational convenience):

If \(\rho >r\), then the entrepreneur’s objective function is strictly increasing with respect to i. As a result, \(i=\frac{\ell w r}{r -(1-\lambda )\rho }\), \(\frac{i}{w}\frac{\rho -r}{r}+\ell =\frac{\lambda \rho }{r-(1-\lambda )\rho }\ell \), and thus, the entrepreneur’s optimization problem is

The solution of (34) is

If \(\rho =r\), then the entrepreneur’s objective function is given by (34), the solution of which is given by (35). This implies that the optimal investment is

Since \(m=\frac{\ell w r}{r-(1-\lambda )\rho }\) \(\Leftrightarrow \) \(\ell =\left( 1-\frac{(1-\lambda )\rho }{r}\right) \frac{m}{w}\), we consider the following three cases separately.

-

(a)

If \(\left( 1-\frac{(1-\lambda )\rho }{r}\right) \frac{m}{w} \in [0,\frac{1}{2}]\) \(\Leftrightarrow \) \(m \le \frac{\ell w r}{r-(1-\lambda )\rho }\), then \(\ell ^e=\frac{1}{2}\), \(i^e=\frac{r}{r-(1-\lambda )\rho }\frac{w}{2}\), and thus \(V^e=\frac{1}{4}\frac{\lambda \rho }{r-(1-\lambda )\rho }\).

-

(b)

If \(\left( 1-\frac{(1-\lambda )\rho }{r}\right) \frac{m}{w} \in (\frac{1}{2},1)\) \(\Leftrightarrow \) \(m>\frac{\ell w r}{r-(1-\lambda )\rho }\), then \(\ell ^e=(1-\frac{(1-\lambda )\rho }{r})\frac{m}{w}\), \(i^e=m\), and thus \(V^e=(1-\frac{m}{w}+\frac{(1-\lambda )m}{w})\frac{\rho }{r})\frac{\lambda m}{w}\frac{\rho }{r}\).

-

(c)

If \(\left( 1-\frac{(1-\lambda )\rho }{r}\right) \frac{m}{w} \ge 1\) \(\Leftrightarrow \) \(m>\frac{\ell w r}{r-(1-\lambda )\rho }\), then \(\ell ^e=1\), \(i^e=m\), and thus \(V^e=0\).

\(\square \)

Proof of Proposition 2

We drop time subscript for notational convenience. We consider two cases separately.

-

(a)

If \((1-\frac{(1-\lambda )\rho }{r})\frac{m}{w} \in [0,\frac{1}{2}]\), then it follows from Proposition 1 that \(V^e=V^d\) is equivalent to \(\frac{\lambda \rho }{r-(1-\lambda )\rho }=1\) \(\Leftrightarrow \) \(\frac{\rho }{r}=1\). If \(\frac{\rho }{r}=1\), then \((1-\frac{(1-\lambda )\rho }{r})\frac{m}{w} \in [0,\frac{1}{2}]\) becomes \(\frac{\lambda m}{w} \le \frac{1}{2}\) \(\Leftrightarrow \) \(w \ge 2\lambda m\).

-

(b)

If \((1-\frac{(1-\lambda )\rho }{r})\frac{m}{w} \in (\frac{1}{2},1)\), then it follows from Proposition 1 that \(V^e=V^d\) is equivalent to \((1-\frac{m}{w}+\frac{(1-\lambda )m}{w})\frac{\rho }{r})\frac{\lambda m}{w}\frac{\rho }{r}=\frac{1}{4}\). This is a quadratic equation solution of which is

$$\begin{aligned} \displaystyle \frac{\rho }{r}=\frac{1}{1-\lambda }\left( \frac{1}{2}-\frac{w}{2m}+\sqrt{\frac{1}{4}-\frac{w}{2m}+\frac{w^2}{4\lambda m^2}}\right) . \end{aligned}$$(37)If the ratio \(\frac{\rho }{r}\) is given by (37), then \((1-\frac{(1-\lambda )\rho }{r})\frac{m}{w}=\frac{1}{2}+\frac{m}{2w}-\sqrt{\frac{m^2}{4w^2}-\frac{m}{2w}+\frac{1}{4\lambda }}\) and thus \((1-\frac{(1-\lambda )\rho }{r})\frac{m}{w} \in (\frac{1}{2},1)\) \(\Leftrightarrow \) \(w<2\lambda m\). \(\square \)

1.1 Alternative specifications

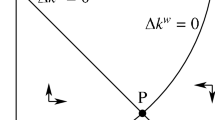

In the main text of the paper, we made several simplifying assumptions in order to minimize the dimension of the parameter space and avoid unnecessary complications while analyzing the model. Of course, some of the results obtained in this paper depend on these simplifying assumptions; however, the main results are robust to alternative specifications as well. The main features of the model would remain as long as (a) agents face the minimum investment requirement for setting up a firm, (b) financial market is imperfect, (c) labor demand is sufficiently inelastic, and (d) there is a self-employment opportunity for young agents. As long as these features of the model are maintained, alternative assumptions about the consumer utility function or the firm’s production function would not invalidate the key results, although they might considerably complicate the analysis. This is so because (a) and (b) imply a backward bending (i.e., an inverted “U” shaped) aggregate labor supply curve. This along with (c) implies the multiplicity of equilibria, and (d) guarantees a minimum aggregate saving so that the corner steady state is not globally attractive. This section gives a brief sketch of how the analysis needs to be modified to alternative specifications.

1.1.1 CES production function

In the basic model of Sect. 3, we assumed that a firm’s production function to be one of a Leontief’s type. Under this assumption, we demonstrate the possibility of multiple equilibria and determined analytically equilibrium wages, employment, incomes, and income inequalities. In this section, we demonstrate numerically that multiplicity of equilibria persists even under alternative specification of the production function. Suppose firm’s production function is one of CES type

where parameter \(\alpha \in (0,1)\) measures the importance of capital stock in production, while parameter \(\sigma \in (0,1)\) represents the elasticity of substitution between capital and labor inputs. This specification of the production function includes a Leontief technology (considered above) as a limit case when \(\sigma \downarrow 0\). Firm’s profit maximization implies that for a given pair \((w_t,k_t)\), the aggregate demand of labor at time t is \(k_tN^d(w_t)\), where

One can easily verify that the elasticity of labor demand for \(w \in \left( A,\left( 1-\alpha \right) ^{-\frac{\sigma }{1-\sigma }}T\right) \) is

It follows from (40) that if the production function is Leontief, then the elasticity of labor demand is \(\lim _{\sigma \downarrow 0}\epsilon ^d(w)=0\), while if the production function is Cobb–Douglas, then the elasticity of labor demand is \(\lim _{\sigma \uparrow 1}\epsilon ^d(w)=-\frac{1}{\alpha }\). Figure 10 visualizes the configurations of the aggregate labor demand and its elasticity for different values of parameter \(\sigma \). It follows from (39) and (40) that the aggregate demand for labor and the elasticity of the aggregate demand for labor both decrease with \(w_t\). This monotonicity property of the labor demand elasticity plays an important role in the existence of multiple equilibria.

Proposition 3

If \(\sigma \in (0,\lambda )\), \(A<2\lambda m<T<2m\), and

then there exist multiple equilibria for intermediate values of \(k_t\).

Proof of Proposition 3

We drop the time subscript for notational convenience. Multiple equilibria exist when \(kN^d(w)=N^s(w)\) admits multiple solutions. This is possible when \(w \mapsto \frac{N^s(w)}{N^d(w)}\) is a non-monotonic function. Since \(w \mapsto 1/N^d(w)\) is a strictly increasing function, while \(w N^s(w)\) has inverted “U” shape, it follows that the function \(w \mapsto N^s(w)/N^d(w)\) may be either a strictly increasing or may have an inverted “U” shape. \(w \mapsto N^s(w)/N^d(w)\) has an inverted “U” shape if an only if

On the one hand, it follows from (15), (16), (18) and (19) that \(\lim _{w \uparrow 2\lambda m}L^e(w)=1/2\), \(\lim _{w \uparrow 2\lambda m}\epsilon ^e(w)=-1\), \(\lim _{w \uparrow 2\lambda m}N^s(w)=1/2\), implying \(\lim _{w \uparrow 2\lambda m}\epsilon ^s(w)=-\lambda \). On the other hand, it follows from (40) that

This with (42) implies that the multiple equilibria exist if and only if \(k_t\) takes an intermediate value, \(\sigma <\lambda \), and parameters satisfy the inequality given in (41). \(\square \)

Expression (41) deserves some interpretations. First, the multiplicity of equilibria cannot occur when the firm’s production function is Cobb–Douglas, \(\sigma =1\), and the possibility of multiple equilibria widens as \(\sigma \) becomes smaller.Footnote 18 Second, \(A<2\lambda m<T<2m\) and (41) can hold simultaneously only if

Berndt (1976) and Hamermesh (1996) surveyed a number of studies and reported the elasticity of factor substitution in the USA is in the ranging from 0.32 to 1.16. Chirinko (2008) reported a considerable cross-country variation of elasticity parameter in a range of 0.4 to 0.6. Figure 11a displays the plots of \(\alpha =1-\left( \frac{\lambda -\sigma }{\lambda ^{2-\sigma }}\right) ^{\frac{1}{\sigma }}\) for different values of parameter \(\sigma \). As the figure indicates, the existence of multiple equilibria is possible when parameters \(\alpha \) and \(\lambda \) both take sufficiently large values. Parameter \(\alpha \) takes a large value when physical and human capital plays an important contribution to the production process, while parameter \(\lambda \) takes a large value when the credit market is highly imperfect. It follows from Proposition 3 that is the parameter pair \((\alpha ,\lambda )\) satisfies (44) and then the multiple equilibria is possible for a sufficiently large value of parameter \(\frac{T}{m}\) and for an intermediate value of \(k_t\).

1.1.2 Consumption during the first period

In the basic model of Sect. 3, we assumed that young agents do not value the first period consumption and they have no time discount for the utility from the second period consumption. In this section, we demonstrate that the inverted “U” shape of the aggregate labor supply curve persists even under alternative specification. Suppose agent’s lifetime utility is given by

where \(1-\ell _t\) is the first period leisure, while \(c_{1t}\) and \(c_{2t+1}\) are the first and second period consumptions of the final commodity. Parameter \(\beta \in (0,1)\) represents the time discount.

Young agents optimal behavior Suppose a young agent supplies \(\ell _t\) units of labor and saves \(s_t w_t\) units of the final commodity during the first period. If the agent becomes a depositor during second period, then her optimization problem is

where \(s_t \in [0,\ell _t]\) is the saving rate. First-order condition for optimality implies that

Depositor’s lifetime utility is \(\ln V^d + (1+\beta )\ln w_t+\beta \ln r_{t+1}\), where

If an agent becomes an entrepreneur during the second period, then her optimization problem is

subject to the borrowing constraint, \(m \le i_t \le \frac{s_t w_t r_{t+1}}{r_{t+1}-(1-\lambda )\rho _{t+1}}\). First-order condition for optimality implies that \(s^{e}_{t}=2\ell _t^e-1\),

and

Entrepreneur’s lifetime utility is \(\ln V^e_t + (1+\beta )\ln w_t+\beta \ln r_{t+1}\), where

If \(\left( 1-(1-\lambda )\frac{\rho _{t+1}}{r_{t+1}}\right) \frac{m}{w_t}>1\), then the young agent cannot simultaneously overcome the borrowing and the minimum investment requirements and thus \(V_t^e=0\).

Equilibrium in the financial market As above, let \(\frac{k_{t+1}}{m} \in [0,1]\) denote the share of young agents who become entrepreneurs in period \(t+1\). Since young agents who become entrepreneurs borrow \(m-s_t^ew_t\) units of the final commodity, while young agents who become depositors lend \(s^dw_t=\frac{\beta }{2+\beta }w_t\) units of the final commodity, it follows that the financial market equilibrium is established when

If \(\frac{w_t}{m} \ge \frac{2+\beta }{\beta }\lambda \), then it follows from (50) that the equilibrium in the financial market is established when \(\frac{\rho _{t+1}}{r_{t+1}}=0\). As a result, \(s_t^e=s^d=\frac{\beta }{2+\beta }\), \(\ell _t^e=\ell ^d=\frac{1+\beta }{2+\beta }\), and \(i_t^e=\frac{\beta }{2+\beta }\frac{w_t}{\lambda }\). This implies that the aggregate labor supply is \(\frac{1+\beta }{2+\beta }\). This case is possible when \(k_{t+1} \ge \lambda m\).

If \(\frac{w_t}{m}<\frac{2+\beta }{\beta }\lambda \), then the equilibrium ratio \(\frac{\rho _{t+1}}{r_{t+1}}\) satisfies

Since \(s_t^e=\left( 1-(1-\lambda )\frac{\rho _{t+1}}{r_{t+1}}\right) \frac{m}{w_t}\), it follows from (50) that

After substituting (52) into (51), we obtain that equilibrium wage satisfies

(47), (52), and (53) imply that the labor supply and the saving rate of young agents who become entrepreneurs are

and \(s_t^e=2\ell _t^e-1\), respectively. Since young agents who become depositors supply \(\ell ^d\) units of labor, while young agents who become entrepreneurs supply \(\ell ^e_t\) units of labor, it follows that aggregate labor supply is

This case is possible when \(k_{t+1}<\lambda m\).

To summarize the above-considered two cases, the aggregate labor supply is \({\widehat{N}}^s(k_{t+1})\), where

Figure 11b displays the plots of \(k \mapsto {\widehat{N}}^s(k)\) for different values of parameter \(\lambda \). As the figure indicates, \({\widehat{N}}^s\) sustains its inverted “U” shape even under alternative specification of the agents’ utility function. Let \(k_{t+1}=K(w_t)\) denote a solution of

Then, the aggregate labor supply, consistent with the equilibrium in the financial market, is \(N^s(w_t)={\widehat{N}}^s[K(w_t)]\).

Proposition 4

The aggregate labor supply curve \(w \mapsto N^s(w)\), consistent with the equilibrium in the financial market, is an inverted “U”-shaped curve for \(w \in (0,\frac{2+\beta }{\beta }\lambda m)\) and \(N^s(w)=\frac{1+\beta }{2+\beta }\) for \(w \in [\frac{2+\beta }{\beta }\lambda m,\frac{2+\beta }{\beta }m]\). In addition, \(N^s\) has the following boundary behavior \(\lim _{w \downarrow 0}N^s(w)=\lim _{w \uparrow \frac{2+\beta }{\beta }\lambda m}N^s(w)=\frac{1+\beta }{2+\beta }\).

Proof of Proposition 4

It can be easily verifies that

is a continuous and a strictly decreasing function. This implies that for any \(w \in [0,\frac{2+\beta }{\beta }m]\), there exists a unique and strictly increasing function K such that \(k=K(w)\) solves (56). If \(w \in [0,\frac{2+\beta }{\beta }\lambda m)\) then \(k=K(w)\in [0,\lambda m)\) and if \(w \in [\frac{2+\beta }{\beta }\lambda m,\frac{2+\beta }{\beta }m]\), then \(k=K(w)=\frac{\beta }{2+\beta }w \in [\lambda m,m]\). If \(w \in [\frac{2+\beta }{\beta }\lambda m,\frac{2+\beta }{\beta } m]\), then \(N^s(w)=\frac{1+\beta }{2+\beta }\). Suppose \(w \in [0,\frac{2+\beta }{\beta }\lambda m)\) then K(w) is a strictly increasing function while

is an inverted “U”-shaped curve. As a result, one can conclude that \(N^s(w)={\widehat{N}}^{s}[K(w)]\) is also an inverted “U”-shaped curve. In order to demonstrate boundary behavior of \(N^s\), we observe that

\(\square \)

Proposition 4 confirms that the inverted “U” shape of the aggregate labor supply curve persists even under alternative specifications of agent’s utility function. This implies that the main results of the paper hold even in a more general setting as well.

Rights and permissions

About this article

Cite this article

Vachadze, G. Financial development, income and income inequality. J Econ Interact Coord 16, 589–628 (2021). https://doi.org/10.1007/s11403-021-00321-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-021-00321-w

Keywords

- Backward-bending labor supply curve

- Counter-cyclical income inequality

- Endogenous fluctuation

- Financial development

- Multiple equilibria

- Self-fulfilling expectations