Abstract

We simultaneously optimize multiple tax instruments (fuel tax, car-ownership tax, and tolls) when these instruments are used as public funds with distortionary labor tax, accounting for pollution, congestion, accident externalities, and fiscal constraints of the tax-related agency and the toll-collecting agency. We quantitatively optimize taxes and tolls using parameters for Japan under three scenarios: (1) imposition of peak and off-peak tolls at different rates and simultaneous optimization of all tax instruments; (2) optimization of only car-related taxes without consolidation of the toll-collecting agency’s fiscal constraints; (3) optimization of only fuel tax. We find that peak toll and fuel tax should be higher, and off-peak toll and car-ownership tax should be lower than the current rate under Scenario 1. Scenarios 1 can improve welfare by 1000 to 2400 dollars/car, and Scenarios 2 and 3 can achieve more than 90% and 20–60% of the welfare gain in Scenario 1, respectively.

Similar content being viewed by others

Notes

For simplicity, we use a currency conversion rate of 100.0 yen/dollar or 1.0 yen/cent throughout this paper because, between 2010 and 2017, the lowest rate was 75.7 yen/dollar and the highest was 125.6 yen/dollar.

In Japan, fuel taxes and annual ownership taxes were earmarked for investment in local roads (i.e., non-highway roads) until 2007. On the other hand, tolls were collected in order to improve highways. These systems have changed at least nominally. For example, these tax revenues are now classified as general funds that can be used for anything other than roads.

This system has been changing recently. For example, some deficits in the construction sector have been financed by general budgets.

Another important proposition is the cost recovery theorem (Mohring and Harwitz, 1962). Actually, when MCF > 1, this proposition does not hold as it is (Morisugi and Kono (2012)). In particular, in the presence of the following preexisting distortions: (1) MCF > 1, (2) fuel taxes and (3) congestions on a parallel local road, the cost recovery theorem cannot be used to decide whether additional investments are required or not. They show that (1) MCF > 1 makes the optimal toll revenue larger; (2) fuel taxes make the optimal toll lower; (3) congestion on the parallel local road makes the optimal toll lower. The intuitive reason is that the optimal toll value becomes higher due to the presence of (1) MCF > 1, whereas it becomes smaller due to the presence of (2) fuel taxes and (3) congestion on the parallel local road. Considering these distortions simultaneously, their effect can be either positive or negative.

Many papers, some of which are reviewed by Parry et al. (2007), estimate optimal fuel tax considering various externalities including congestion, accidents, and CO2, or considering income distribution effects. Further, some papers (e.g., Ueda et al. 1998; Fujiwara et al. 2002), use computable general equilibrium models to analyze how the levels of car-related taxes affects CO2 levels and car ownership. However, these studies focus on total volumes of CO2 rather than optimal levels of taxes.

According to the data on the website of the Ministry of Land, Infrastrucure, Transport and Tourism, Japan (2016) (http://www.mlit.go.jp/k-toukei/22/annual/22a0excel.html), in Japan, all vehicles are categorized into gasoline-powered cars and diesel-powered cars. Each of them is further categorized into cars for commerce and for private use. In 2016, the total distance traveled of (1) gasoline-powered cars for private use, (2) gasoline-powered cars for commerce, (3) diesel-powered cars for private use, and (4) diesel-powered cars for commerce are 597,642 million km, 7814 million km, 52,432 million km, and 63,129 million km, respectively.

We define “local roads” as roads other than highways. For example, in the case of the UK, a ‘motorway’ is a highway and ‘A roads’ and ‘B roads’ are local roads.

Gas mileage depends on traffic volume or travel speed. In this study, however, we assume a constant gas mileage mainly because the calculation burden is heavy while credible data for the change in gas mileage for the average car is unobtainable. These days, the latest technologies, such as start–stop systems (or idling-stop systems), improve gas efficiency in congestion. Accordingly, the effect of traffic volume on gas mileage due to reduction of travel speeds is relatively mild.

Fuel tax is an insufficient way to reduce traffic congestion because it just raises the cost of all trips regardless of where and when the congestion occurs. In contrast, tolls can roughly change over space and time, which makes people avoid a congested route as well as the peak of rush hour. However, we focus on the mechanisms of multiple car-related taxes and tolls when determining these tax and toll levels. To show the mechanism simply, we would like to use a simple static model.

This paper does not differentiate trips from the viewpoint of their purpose because this paper assumes the same toll and tax regardless of the purpose of the trips. Indeed, this is the case in Japan. Then, the estimated consumer surplus without differentiating between commuting trips and other trips is equal to the consumer surplus that is estimated by adding the consumer surplus of commuting trips and that of other trips. If charging different tolls for commuting trips and other trips, we should estimate corresponding consumer surpluses separately.

The assumption of a quasi-linear utility function is not essential. Even if we use a general form of the utility function, maximizing an appropriate welfare index, such as equivalent variation, compensating variation, and Allais surplus (Tsuneki 1987; Kono and Kishi 2018), yields essentially the same result, although Marshallian demand functions should be replaced by Hicksian demand functions.

This replacement is for simplicity only. Even if \(x_{p}^{i}\) is added to the utility function as a variable, there is no change in the results at all.

The demand functions have \(w^{i}\) as explanatory variables, but we suppress them because they are fixed.

Travel time on highways depends on the expenditure by the road authority, such as investments in new highway junctions and electronic toll collection systems, which save time. However, for simplicity, we assume that \(\bar{H}\) is exogenously fixed as in Parry and Small (2005). This consideration remains for a future study.

However, in practice, toll revenue has affected the government general budget in Japan. For example, deficits in highway construction sectors have been paid by the government.

The fiscal structure within a federal system has been explored, starting from Oates (1972).

As another setting, we can suppose a situation in which the agency determining tolls optimizes tolls given tax rates while the agency determining tax rates optimizes taxes given tolls. In this situation, the equilibrium is determined as a Nash equilibrium. However, we do not explore this situation. The current paper focuses on the importance of considering all the public revenues (i.e., including toll revenue) appropriately for optimizing tax rates..

Other forms can be assumed. Nevertheless, constant elasticity demand function is not appropriate for our model because one distortion cannot be treated properly, as shown in Appendix B or in Morisugi and Kono (2012). In the current paper, deadweight losses arising from tax play an important role in determining the tax rates. In the linear demand function, the deadweight losses can be calculated by triangles. Actually, triangles can approximate the area of deadweight losses shaped by some nonlinear demand functions. Therefore, we use the linear form demand function. The linear form of demand can be derived from a quadratic form of utility function such as in Ottaviano et al. (2002).

We assume some cross-elasticities of substitution between times and road type are zero: the peak toll elasticity of off-peak local road demand and the off-peak toll elasticity of peak local road demand are both zero.

For sensitivity analysis, we set another case in which toll elasticity of highway demand and of local road demand is 0.5 and 0.01. This means that the substitution between highway and local road is very low. For example, this situation represents no parallel general road. In this case, we set peak highway demand \(X_{Hk} = 12895.8 \times 10^{6} - 15194.4 \times 10^{4} p_{k} + 27350.0 \times 10^{3} p_{o} + 11053.4 \times 10^{2} f - 1551.3s\), off-peak highway demand \(X_{Ho} = 11090.9 \times 10^{7} + 14752.4 \times 10^{4} p_{k} - 12293.7 \times 10^{5} p_{o} - 72046.7 \times 10^{2} f - 12551.9s\), peak local road demand \(X_{k} = 48038.9 \times 1 0^{6} { + 13558} . 1\times 1 0^{3} p_{k} - 1 3 6 0 8. 5\times 1 0^{4} f - 6921.4s\), off-peak local road demand \(X_{o} = 38867.8 \times 1 0^{7} { + 10969} . 7\times 1 0^{4} p_{o} - 1 1 0 1 0. 5\times 1 0^{5} f - 56001.0s\), and the car ownership function \(N_{1} = 7 0 8 9 0. 8\times 1 0^{3} - 1551.3p_{k} - 12551.9p_{o} - 7 5 3 3. 8f - 1 8 7. 0 7s\).

We use the price elasticities at a certain time and the assumption of linear functions to estimate the demand function. As an alternative method, we can adopt an econometric approach.

The BPR function was constructed by the Bureau of Public Roads in the US in 1964. This function is used widely in research and in practice.

A widely cited study by Small and Kazimi (1995) estimates marginal air pollution costs based on many detailed studies of ozone formation, exposure analysis, and willingness-to-pay to reduce health risk. Their projection is 2.3 cents/mile for the Los Angeles region for the year 2000, with a range of 1–8 cents/mile.

Letting H be a bordered Hessian matrix, in the numerical simulation, the Hessian is negative definite because the determinants of the border-preserving principle minor matrices satisfy \(\left| {H_{2} } \right| > 0, \, \left| {H_{3} } \right| < 0\), and \(\left| {H_{4} } \right| > 0\) regardless of the values of policy variables. So, in the numerical simulation, the second order conditions of the optimization always hold and the solution satisfying the first order conditions is globally unique.

The welfare gain can be expressed as a function using a path integral:\(\oint_{A \to B} {d\varPhi } = \oint_{A \to B} {\sum\limits_{{Q \in \{ p_{k} ,p_{o} ,f,s\} }}^{{}} {\frac{{{\text{d}}\varPhi }}{{{\text{d}}Q}}} {\text{d}}t = \oint_{A \to B} {\sum\limits_{{Q \in \{ p_{k} ,p_{o} ,f,s\} }}^{{}} {\left[ {\sum\limits_{i = 1}^{N} {\frac{{{\text{d}}V^{i} }}{{{\text{d}}Q}} + } {\text{MCF}}\frac{{{\text{d}}K + {\text{d}}R}}{{{\text{d}}Q}}} \right]{\text{d}}t} } }\), where A is the initial values of pk, po. f, and s, and B is the optimal values of pk, po. f, and s. t expresses the path from A to B. Our model has a path independency. In addition, \(\sum\limits_{i = 1}^{N} {\frac{{{\text{d}}V^{i} }}{{{\text{d}}Q}}}\) and \(\frac{{{\text{d}}K + {\text{d}}R}}{{{\text{d}}Q}}\) can be expressed by observable variables, as shown in Eqs. (13c)–(13e). This function is, however, not so informative because we need know the optimal values of pk, po. f, and s to calculate the welfare change.

According to Parry et al. (2014, Fig. 1.1), corrective fuel taxes are about $1.2/l in Japan, which reflect environmental costs such as carbon, local pollution, accidents, and congestion.

Scenario 1 simultaneously optimizes all of the tax instruments, Scenario 2 optimizes multiple tax instruments, except tolls, and Scenario 3 optimizes only fuel tax and labor tax given that the other tax instruments are set at the present levels. This implies that since, in Scenario 3, constraints are added to Scenarios 1 and 2, welfare in Scenarios 1 and 2 is necessarily higher than Scenario 3. This mechanism resembles the generalized Le Chatelier principle.

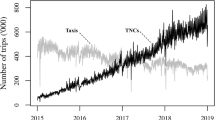

The social experiment was conducted by MLIT on Hanshin Highway (Ikeda section) and Tohoku Highway (Fukushima-nishi Interchange–Fukushima-Iizaka Interchange). According to the Road and Public Information Center (2004), when the toll was discounted 33%, the traffic volume rose 20% (from 2500 to 3000 cars) at Hanshin Highway and decreased 3% (from 19,426 to 18,791) on the parallel local road. According to Fukushima Prefecture Tohoku Highway Social Experiment Council materials (2004), when the toll was discounted 50% in the morning and at night, the traffic volume rose 45% on Tohoku Highway and decreased 3% on the parallel local road.

This is the volume of passenger cars, according to the Annual Report of Road Transport Statistics.

This percentage is from 2003 data of the Ministry of Land, Infrastructure, Transport and Tourism.

Tanishita and Kashima (2002) construct a dynamic applied general equilibrium model in which car ownership and usage are modeled. They examine the effects of car-related tax changes on equilibrium. Model parameters are calibrated using 1996–2010 data (e.g., fuel consumption, annual travel distance, car ownership, and income).

References

Amano, A. (2008). Estimating price elasticity of energy demand in Japan, presentation material. In Central Environment Council’s general policy global environmental meeting (Second meeting) (in Japanese).

Auerbach, A.J., Hines, J.R. Jr. (2002). Taxation and economic efficiency, Ch. 21. In A. J. Auerbach, M. Feldstein (Eds.), Handbook of public economics, vol. 3 (pp. 1347–1421). North-Holland, .

Bessho, S., Akai, N., & Hayashi, M. (2003). Marginal cost of public funds. JCER Economic Journal, 47, 1–19. (in Japanese).

Bovenberg, A. L., & de Mooij, R. A. (1994). Environmental levies and distortionary taxation. The American Economic Review, 84(4), 1085–1089.

Bovenberg, A. L., & Goulder, L. H. (1996). Optimal environmental taxation in the presence of other taxes: general-equilibrium analyses. The American Economic Review, 86(4), 985–1000.

Cabinet office of the Japanese government. (2011). On the tax payment for car acquisition, car ownership, and usage, document presented to the 17th Government Tax Commission. Retrieved July 31, 2013 from http://www.cao.go.jp/zei-cho/history/2009-2012/gijiroku/zeicho/2011/__icsFiles/afieldfile/2011/11/15/23zen17kai5.pdf.

De Borger, B. (2001). Discrete choice models and optimal two-part tariffs in the presence of externalities: optimal taxation of cars. Regional Science and Urban Economics, 31(4), 471–504.

De Borger, B., & Mayeres, I. (2007). Optimal taxation of car ownership, car use and public transport: Insights derived from a discrete choice numerical optimization model. European Economic Review, 51(5), 1177–1204.

Dockery, D. W., Arden Pope, C., Xu, X., Spengler, J. D., Ware, J. H., Fay, M. E., et al. (1993). An association between air pollution and mortality in six US cities. New England Journal of Medicine, 329, 1753–1759.

Fujiwara, T., Kanemoto, Y., Hasuike, K. (2002). Evaluation of measures against global warming using car tax system, RIETI discussion paper 02-J-004 (in Japanese).

Fukushima Prefecture Tohoku Highway Social Experiment Council materials. (2004). Retrieved July 28, 2017 from http://www.thr.mlit.go.jp/fukushima/kousokudoro/jikken/.

Fullerton and West. (2000). Tax and subsidy combinations for the control of car pollution. The B.E. Journal of Economic Analysis Policy, 10(1), ISSN (Online) 1935–1682. https://doi.org/10.2202/1935-1682.2467.

Futamura, M. (2000). The analysis of global warming and automobile–reducing carbon dioxide from automobile and green tax reform, Koutsugaku kenkyu, pp. 137–146 (in Japanese).

Harberger, A. C. (1971). Three basic postulates for applied welfare economics: an interpretive essay. Journal of Economic literature, 9(3), 785–797.

Jacobs, B., & de Mooij, R. A. (2015). Pigou meets Mirrlees: On the irrelevance of tax distortions for the second-best Pigouvian tax. Journal of Environmental Economics and Management, 71, 90–108.

Japanese Society of Civil Engineering. (2003). Theory and Applications of Traffic Demand Forecasting, Maruzen (in Japanese).

Kanemoto, Y. (2007). Economic analysis of road-specified budget system in Japan, The Japan Research Center for Transport Policy, pp. 1–32 (in Japanese).

Kawase, A. (2010). Fuel tax rate from the perspective of optimal taxation: a comparison of Japan, the US, and the UK. JCER Economic Journal, 62, 85–104. (in Japanese).

Kono, T., & Kishi, A. (2018). What is an appropriate welfare measure for efficiency of local public policies inducing migration? Mathematical Social Sciences, 91, 25–35.

Koyama, S., & Kishimoto, A. (2001). External costs of road transport in Japan. Transport Policy Studies, 4(2), 19–30. (in Japanese).

Mayeres, I., Ochelen, S., & Proost, S. (1996). The marginal external costs of urban transport. Transportation Research Part D: Transport and Environment, 1, 111–130.

Mayeres, I., & Proost, S. (1997). Optimal tax and public investment rules for congestion type of externalities. The Scandinavian Journal of Economics, 99(2), 261–279.

Ministry of Finance, Japan. (2010). Retrieved June 30, 2017 from https://www.stat.go.jp/data/roudou/rireki/nen/ft/pdf/2010.pdfhttp://www8.cao.go.jp/kisei-kaikaku/kaigi/meeting/2013/discussion/140325/gidai2/gidai2-3_2.pdf(in Japanese).

Ministry of Land, Infrastructure, Transport and Tourism, Japan. (2016). Retrieved June 30, 2017 from http://www.mlit.go.jp/k-toukei/22/annual/22a0excel.html(in Japanese).

Mohring, H., & Harwitz, M. (1962). Highway benefits: An analytical framework. Evanston: Northwestern University Press.

Morisugi, H., & Kono, T. (2012). Efficient highway toll level with marginal cost of funding for road investment. JCER Economic Journal, 67, 1–12. (in Japanese).

National Research Council. (2002). Effectiveness and impact of corporate average fuel economy (CAFE) standards. Washington, DC: National Academy of Sciences.

Nordhaus, W.D., Boyer, J. (1999), Roll the DICE again: economic models of global warming, working paper. Retrieved November 27, 2013 from http://aida.wss.yale.edu/~nordhaus/homepage/rice98%20pap%20121898.PDF.

Oates, W. E. (1972). Fiscal federalism. NY: Harcourt Brace Jovanovich.

Ottaviano, G., Tabuchi, T., & Thisse, J. F. (2002). Agglomeration and trade revisited. International Economic Review, 43(2), 409–435.

Parry, I. W. H. (2004). Comparing alternative policies to reduce traffic accidents. Journal of Urban Economics, 56, 346–368.

Parry, I. W., Heine, M. D., Lis, E., Li, S. (2014). Getting energy prices right: From principle to practice. International Monetary Fund.

Parry, I., & Small, K. (2005). Does Britain or the United States have the right gasoline tax? American Economic Review, 95, 1276–1289.

Parry, I. W., Walls, M., & Harrington, W. (2007). Automobile externalities and policies. Journal of Economic Literature, 45(2), 373–399.

Road and Public Information Center. (2004). Social experiences on highway tolls. (in Japanese).

Small, K. A., & Kazimi, C. (1995). On the costs of air pollution from motor vehicles. Journal of Transport Economics and Policy, 29, 7–32.

Tanishita, M., Kashima, S. (2002). Impact analysis of car-related tax on ownership and usage of passenger cars. In Proceedings of Japanese Society of Civil Engineering No. 709/IV-56, pp. 39–49. (in Japanese).

Tol, R. S. J. (2005). The marginal damage costs of carbon dioxide emissions: an assessment of the uncertainties. Energy Policy, 33, 2064–2074.

Tsuneki, A. (1987). The measurement of waste in a public goods economy. Journal of Public Economics, 33(1), 73–94.

Ueda, T., Muto, S., Morisugi, H. (1998). The national economic evaluation of policies for the regulation of automobile-related external diseconomies—comparative analysis between CGE and DCGE, Transport Policy Studies, pp. 39–53 (in Japanese).

West, S. E., & Williams, R. C. (2007). Optimal taxation and cross-price effects on labor supply: estimates of the optimal gas tax. Journal of public Economics, 91, 593–617.

Acknowledgements

This research was supported by the Ministry of Education, Culture, Sports, Science and Technology, which are gratefully acknowledged (Grant-in-Aid for Scientific Research B) 17H02517). We started an earlier version with the late Hisa Morisugi. We are grateful to Hisa Morisugi, Motohiro Sato, Yukihiro Kidokoro, Yuichiro Yoshida and anonymous referees for their useful comments. Despite assistance from many sources, any remaining errors in the paper are the sole responsibility of the authors.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Alphabetical listing of authorship.

Appendices

Appendix A1: The interpretation of parameters for demand functions

See Table 8.

Appendix A2: Estimating elasticity of car ownership

The number of owned cars is assumed to be a function of car price, income, and the consumption mindset. We use 3-year average data to consider a long-term trend in car numbers, while we use 12-year average data for real GDP per capita and car price. To consider a temporal change in demand, we consider “consumers’ mind index” provided by the Cabinet Office of the government. This index is on average three years.

The estimated demand function is

where the numbers in parentheses are t-values. The adjusted R squared is 0.996. There are 21 observations. The data is from 1991 to 2011. Table 9 summarizes the data sources.

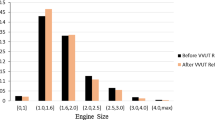

To calculate the car ownership tax elasticities of car ownership, which are shown in Table 1, we have to multiply the car ownership tax rate (= car ownership tax payment/car prices) with the car price elasticity. The car ownership tax rate is about 20–30%. So, the car ownership tax elasticities are estimated to be 0.17–0.25. Table 1 shows the median value, 0.21. Regarding the car ownership tax elasticities of fuel consumption, we use the same value as the car ownership tax elasticities of car ownership.

Appendix A3: Calibrating parameters of demand functions

To estimate demand functions, we use the toll elasticities of demand estimated by using some social experiments on highway tolls in 2003 and 2004 (Road and Public Information Center 2004; Fukushima Prefecture Tohoku Highway Social Experiment Council materials 2004).Footnote 28 Most social experiments in Japan changed tolls only for certain periods, such as rush hours. This study uses social experiment data from 2003–2004 in which tolls are changed for a whole day along several routes. We chose four highways: Hanshin Highway (Ikeda section), which is an urban highway; Tohoku Highway (Fukushima-Nishi Interchange–Fukushima-Iizaka Interchange), which is an arterial highway; Biwako-Nishi Juukann Highway; and Hiroshima–Kure Highway. To use the elasticities in these experiments for estimating the demand function, we ignore the change in the number of trips through changes in congestion, which is affected by changes in toll. Exactly speaking, the change in congestion can change the demand. However, compared with the direct change in toll, the effect is limited.

Table 10 summarizes demand for these highways, parallel local roads, and their toll elasticities. Supposing that the origin and destination of each trip is fixed, we can set the elasticities of demand for the total travel distance (the sum of trips multiplied by travel distances) equal to the above elasticity settings. The total travel distance in Japan in 2010 was 467.629136 billion vehicle-km.Footnote 29 We assume that 13% of this distance is on highways and the remainder on local roads.Footnote 30

The fuel tax elasticity of fuel consumption is set at 0.18 by transforming the long-term price elasticity of fuel consumption, which was estimated by Amano (2008), into the fuel tax elasticity. Futamura (2000) also uses almost the same elasticity for analyzing a global warming problem. On the other hand, the fuel tax elasticity of car ownership is set at 0.07, which was estimated by Tanishita and Kashima (2002).Footnote 31

In our setting, the car ownership tax includes the car acquisition tax, which is annualized assuming the owner owns a car for 6 years. Appendix B estimates the car ownership function. The price elasticity of car demand is estimated to be 0.84. If the ratio of the car ownership tax to its price is set at 25%, this price elasticity implies that the tax elasticity of car demand is 0.21.

Using the above elasticities, we have calibrated the parameters of demand functions.

Appendix B: Problem with constant elastic demand functions

If we assume constant elastic demand functions, our model encounters a problem. We explain the problem using highway demand. To simplify the explanation, we suppose there are no congestion or environmental externalities (i.e., \(\partial T_{H} /\partial X_{H} = 0\), \(\partial T/\partial X = 0\), \(\partial E_{H} /\partial X_{H} = 0\), and \(\partial E/\partial X = 0\))and no fuel tax (i.e., \(f = 0\) ). The optimal toll condition is reduced to \({{ - X} \mathord{\left/ {\vphantom {{ - X} {\left( {X + p{{dX} \mathord{\left/ {\vphantom {{dX} {dp}}} \right. \kern-0pt} {dp}}} \right)}}} \right. \kern-0pt} {\left( {X + p{{dX} \mathord{\left/ {\vphantom {{dX} {dp}}} \right. \kern-0pt} {dp}}} \right)}} = MCF\). If we apply a constant elastic demand (e.g., \({\text{In}}X = \alpha + \varepsilon_{X} {\text{In}}(p)\)) to this condition, \({{ - 1} \mathord{\left/ {\vphantom {{ - 1} {\left( {1 - \varepsilon_{X} } \right)}}} \right. \kern-0pt} {\left( {1 - \varepsilon_{X} } \right)}} = MCF\). However, \(\varepsilon_{X}\) is constant while MCF is also exogenously constant, which implies that this optimal condition does not hold generally. Therefore, we cannot use constant elastic demand functions in our model.

Appendix C: Integrability conditions

To satisfy integrability conditions (i.e., in order to set the utility function which can generate the demand functions),

For the conditions to hold, we estimate \(\beta_{Hk}\), \(\beta_{Ho}\), \(\beta_{k}\), \(\beta_{o}\), \(\gamma_{k}\), \(\gamma_{o}\), \(\beta_{Nk}\), \(\beta_{No}\), and \(\gamma_{N}\) using the elasticities obtained from other papers or estimated by us. The other parameters of the demand functions are derived by using Eqs. (A2)–(A5) with the set-elasticities. In the base case, the derived elasticities are as follows. The fuel tax elasticity of highway demand is 0.004. The ownership tax elasticity of demands for local roads and highways is 0.001. In the low substitution case, the fuel tax elasticity of highway demand is 0.056. The ownership tax elasticities of demands are the same.

Rights and permissions

About this article

Cite this article

Kono, T., Mitsuhiro, Y. & Yoshida, J. Simultaneous optimization of multiple taxes on car use and tolls considering the marginal cost of public funds in Japan. JER 72, 261–297 (2021). https://doi.org/10.1007/s42973-019-00029-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42973-019-00029-4