Abstract

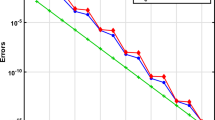

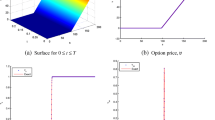

We study both analytic and numerical solutions of option pricing equations using systems of orthogonal polynomials. Using a Galerkin-based method, we solve the parabolic partial differential equation for the Black-Scholes model using Hermite polynomials and for the Heston model using Hermite and Laguerre polynomials. We compare the obtained solutions to existing semi-closed pricing formulas. Special attention is paid to the solution of the Heston model at the boundary with vanishing volatility.

Similar content being viewed by others

References

M. Abramowitz, I. A. Stegun (eds.): Handbook of Mathematical Functions with Formulas, Graphs, and Mathematical Tables. National Bureau of Standards Applied Mathematics Series 55. U. S. Department of Commerce, Washington, 1964.

D. Ackerer, D. Filipović: Option pricing with orthogonal polynomial expansions. Math. Finance 30 (2020), 47–84.

B. Alziary, P. Takáč: Analytic solutions and complete markets for the Heston model with stochastic volatility. Electron. J. Differ. Equ. 2018 (2018), Article ID 168, 54 pages.

B. Alziary, P. Takáč: The Heston stochastic volatility model has a boundary trace at zero volatility. Available at https://arxiv.org/abs/2004.00444 (2020), 48 pages.

J. P. Aubin: Behavior of the error of the approximate solutions of boundary value problems for linear elliptic operators by Galerkin’s and finite difference methods. Ann. Sc. Norm. Super. Pisa, Sci. Fis. Mat., III. Ser. 21 (1967), 599–637.

D. S. Bates: Jumps and stochastic volatility: Exchange rate processes implicit in Deutsche mark options. Rev. Financ. Stud. 9 (1996), 69–107.

F. Baustian, M. Mrázek, J. Pospíšil, T. Sobotka: Unifying pricing formula for several stochastic volatility models with jumps. Appl. Stoch. Models Bus. Ind. 33 (2017), 422–442.

G. Birkhoff, M. H. Schultz, R. S. Varga: Piecewise Hermite interpolation in one and two variables with applications to partial differential equations. Numer. Math. 11 (1968), 232–256.

F. Black, M. Scholes: The pricing of options and corporate liabilities. J. Polit. Econ. 81 (1973), 637–654.

J. H. Bramble, A. H. Schatz, V. Thomée, L. B. Wahlbin: Some convergence estimates for semidiscrete Galerkin type approximations for parabolic equations. SIAM J. Numer. Anal. 14 (1977), 218–241.

J. H. Bramble, V. Thomée: Discrete time Galerkin methods for a parabolic boundary value problem. Ann. Mat. Pura Appl., IV. Ser. 101 (1974), 115–152.

C. J. Corrado, T. Su: Skewness and kurtosis in S&P 500 index returns implied by option prices. J. Financ. Research 19 (1996), 175–192.

J. C. Cox, J. E. Ingersoll, Jr., S. A. Ross: A theory of the term structure of interest rates. Econometrica 53 (1985), 385–407.

J. Daněk, J. Pospíšil: Numerical aspects of integration in semi-closed option pricing formulas for stochastic volatility jump diffusion models. Int. J. Comput. Math. 97 (2020), 1268–1292.

M. Davis, J. Obłój: Market completion using options. Advances in Mathematics of Finance. Banach Center Publications 83. Polish Academy of Sciences, Warsaw, 2008, pp. 49–60.

J. Douglas, Jr., T. Dupont: Galerkin methods for parabolic equations. SIAM J. Numer. Anal. 7 (1970), 575–626.

T. Dupont: Some L2 error estimates for parabolic Galerkin methods. The Mathematical Foundations of the Finite Element Method with Applications to Partial Differential Equations. Academic Press, New York, 1972, pp. 491–504.

L. C. Evans: Partial Differential Equations. Graduate Studies in Mathematics 19. American Mathematical Society, Providence, 2010.

K. Filipová: Solution of Option Pricing Equations Using Orthogonal Polynomial Expansion: Master’s Thesis. University of West Bohemia, Plzen, 2019.

G. Fix, N. Nassif: On finite element approximations to time-dependent problems. Numer. Math. 19 (1972), 127–135.

J.-P. Fouque, G. Papanicolaou, K. R. Sircar: Derivatives in Financial Markets with Stochastic Volatility. Cambridge University Press, Cambridge, 2000.

D. Funaro: Polynomial Approximation of Differential Equations. Lecture Notes in Physics: Monographs 8. Springer, Berlin, 1992.

W. Gautschi: Orthogonal Polynomials: Computation and Approximation. Numerical Mathematics and Scientific Computation. Oxford University Press, New York, 2004.

S. L. Heston: A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6 (1993), 327–343.

S. L. Heston, A. G. Rossi: A spanning series approach to options. Review Asset Pricing Studies 7 (2017), 2–42.

J. C. Hull: Options, Futures, and Other Derivatives. Pearson, New York, 2018.

J. C. Hull, A. D. White: The pricing of options on assets with stochastic volatilities. J. Finance 42 (1987), 281–300.

R. Jarrow, A. Rudd: Approximate option valuation for arbitrary stochastic processes. J. Financ. Econ. 10 (1982), 347–369.

O. Kallenberg: Foundations of Modern Probability. Probability and Its Applications. Springer, New York, 2002.

I. Karatzas, S. E. Shreve: Brownian Motion and Stochastic Calculus. Graduate Texts in Mathematics 113. Springer, New York, 1991.

A. Kufner: Weighted Sobolev Spaces. Teubner-Texte zur Mathematik 83. B. G. Teubner, Leipzig, 1980.

A. Kufner, A.-M. Sändig: Some Applications of Weighted Sobolev Spaces. Teubner-Texte zur Mathematik 100. B. G. Teubner, Leipzig, 1987.

N. N. Lebedev: Special Functions and Their Applications. Prentice-Hall, Englewood Cliffs, 1965.

A. L. Lewis: Option Valuation Under Stochastic Volatility: With Mathematica Code. Finance Press, Newport Beach, 2000.

A. L. Lewis: Option Valuation Under Stochastic Volatility II: With Mathematica Code. Finance Press, Newport Beach, 2016.

F. W. J. Olver, D. W. Lozier, R. F. Boisvert, C. W. Clark (eds.): NIST Handbook of Mathematical Functions. Cambridge University Press, Cambridge, 2010.

J. Pospíšil, V. Švígler: Isogeometric analysis in option pricing. Int. J. Comput. Math. 96 (2019), 2177–2200.

W. H. Press, S. A. Teukolsky, W. T. Vetterling, B. P. Flannery: Numerical recipes: The Art of Scientific Computing. Cambridge University Press, Cambridge, 2007.

M. Reed, B. Simon: Methods of Modern Mathematical Physics. I: Functional Analysis. Academic Press, New York, 1980.

F. D. Rouah: The Heston Model and Its Extensions in Matlab and C#. Wiley Finance Series. John Wiley & Sons, Hoboken, 2013.

E. M. Stein, J. C. Stein: Stock price distributions with stochastic volatility: An analytic approach. Rev. Financ. Stud. 4 (1991), 727–752.

B. Swartz, B. Wendroff: Generalized finite-difference schemes. Math. Comput. 23 (1969), 37–49.

G. Szegö: Orthogonal Polynomials. Colloquium Publications 23. American Mathematical Society, Providence, 1975.

S. Thangavelu: Lectures on Hermite and Laguerre expansions. Mathematical Notes 42. Princeton University Press, Princeton, 1993.

V. Thomée: Some error estimates in Galerkin methods for parabolic equations. Mathematical Aspects of Finite Element Methods. Lecture Notes in Mathematics 606. Springer, Berlin, 1977, pp. 343–352.

V. Thomée: Galerkin-finite element methods for parabolic equations. Proceedings of the International Congress of Mathematicians. Vol. 2. Academia Scientiarum Fennica, Helsinki, 1980, pp. 943–952.

V. Thomée: Galerkin Finite Element Methods for Parabolic Problems. Springer Series in Computational Mathematics 25. Springer, Berlin, 2006.

L. von Sydow: BENCHOP — the BENCHmarking project in option pricing. Int. J. Comput. Math. 92 (2015), 2361–2379.

M. F. Wheeler: A priori L2 estimates for Galerkin approximations to parabolic partial differential equations. SIAM J. Numer. Anal. 10 (1973), 723–759.

P. Wilmott: Derivatives: The Theory and Practice of Financial Engineering. John Wiley & Sons, Chichester, 1998.

D. Xiu: Hermite polynomial based expansion of European option prices. J. Econom. 179 (2014), 158–177.

Acknowledgements

This work is based on the Master’s thesis Filipová [19] titled Solution of option pricing equations using orthogonal polynomial expansion that was written by Kateřina Filipová and supervised by Jan Pospíšil. The thesis was also advised by Falko Baustian during the two months internship of Kateřina Filipová at the University of Rostock.

Our sincere gratitude goes to Prof. Peter Takáč from the University of Rostock, who introduced us to the problem and provided us with valuable suggestions and insightful criticism, and to both anonymous referees for their valuable comments and extensive suggestions.

Computational resources were provided by the CESNET LM2015042 and the CERIT Scientific Cloud LM2015085, provided under the programme “Projects of Large Research, Development, and Innovations Infrastructures”.

Author information

Authors and Affiliations

Corresponding author

Additional information

The work was partially supported by the Czech Science Foundation (GACR) grant no. GA18-16680S “Rough models of fractional stochastic volatility”.

Rights and permissions

About this article

Cite this article

Baustian, F., Filipová, K. & Pospíšil, J. Solution of option pricing equations using orthogonal polynomial expansion. Appl Math 66, 553–582 (2021). https://doi.org/10.21136/AM.2021.0361-19

Received:

Published:

Issue Date:

DOI: https://doi.org/10.21136/AM.2021.0361-19