Abstract

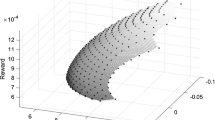

For the multiplicative background risk model, a distortion-type risk measure is used to measure the tail risk of the portfolio under a scenario probability measure with multivariate regular variation. In this paper, we investigate the tail asymptotics of the portfolio loss \(\sum _{i=1}^{d}R_iS\), where the stand-alone risk vector \({\mathbf {R}}=(R_1,\ldots ,R_d)\) follows a multivariate regular variation and is independent of the background risk factor S. An explicit asymptotic formula is established for the tail distortion risk measure, and an example is given to illustrate our obtained results.

Similar content being viewed by others

References

Artzner, P., Delbaen, F., Eber, J., Heath, D.: Coherent measures of risk. Math. Finance 9(3), 203–228 (1999)

Bai, Z., Hui, Y., Wong, W.K., Zitikis, R.: Prospect performance evaluation: making a case for a nonasymptotic UMPU test. J. Finance Econom. 10, 703–732 (2012)

Chan-Lau, J.A.: Systemic Risk Assessment and Oversight. Risk Books, London (2013)

Balbás, A., Garrido, J., Mayoral, S.: Properties of distortion risk measures. Methodol. Comput. Appl. Probab. 11(3), 385–399 (2009)

Chen Y., Gao Y., Gao W.X., Zhang W.P.: Second-order asymptotics of the risk concentration of a portfolio with deflated risks. Math. Prob. Eng., 4689479, 1–12 (2018)

Das, B., Kratz, M.: Diversification benefits under multivariate second order regular variation. (2017) arXiv preprint arXiv:1704.02609

Degen, M., Lambrigger, D.D., Segers, J.: Risk concerntration and diversification: second-order properties. Insur. Math. Econ. 46, 541–546 (2010)

Dhaene, J., Vanduffel, S., Goovaerts, M.J., Kaas, R., Tang, Q., Vyncke, D.: Risk measures and comonotonicity: a review. Stoch. Models 22(4), 573–606 (2006)

De Haan, L., Ferreira, A.: Extreme Value Theory: An Introduction. Springer, New York (2006)

Denuit, M., Dhaene, J., Goovaerts, M.J., Kaas, R.: Actuarial Theory for Dependent Risks: Measures, Orders and Models. Wiley, Chichester (2005)

Hardy, M., Wirch, J.: Ordering of risk measures for capital adequacy. Institute of Insurance and Pension Research, University of Waterloo, Research Report 00–03 (2003)

Hua, L., Joe, H.: Second order regular variation and conditional tail expectation of multiple risks. Insur. Math. Econ. 49, 537–546 (2011)

Mainik, G., Ruschendorf, L.: Ordering of multivariate risk models with respect to extreme portfolio losses. Stat. Risk Modell. 29, 73–105 (2012)

Resnick, S.I.: Hidden regular variation, second order regular variation and asymptotic independence. Extremes 5(4), 303–336 (2002)

Resnick, S.I.: Extreme Values, Regular Variation and Point Processes. Springer Series in Operations Research and Financial Engineering. Springer, New York. Reprint of the 1987 original (2008)

Tsanakas, A.: Dynamic capital allocation with distortion risk measures. Insur. Math. Econ. 35(2), 223–43 (2004)

Valdez, E., Chernih, A.: Wang’s Capital allocation formula for elliptically contoured distributions. Insur. Math. Econ. 33(3), 517–32 (2003)

Wang, S.S.: Premium calculation by transforming the layer premium density. ASTIN Bull. J. IAA 26(1), 71–92 (1996)

Wang, S.: A universal framework for pricing financial and insurance risks. ASTIN Bull. J. IAA 32(2), 213–34 (2002)

Xing, G.D., Li, Y., Yang, S.: On the second-order asymptotics of tail distortion risk measure for portfolio loss under the framework of multivariate regularly variation. Commun. Stat. Simul. Comput. 49(2), 491–503 (2020)

Zhu, L., Li, H.: Tail distortion risk and its asymptotic analysis. Insur. Math. Econ. 51(1), 115–21 (2012)

Acknowledgements

The work is supported by the National Key Research and Development Plan (No. 2016YFC0800104) and the National Science Foundation of China (No. 71771203, No. 11671374).

Author information

Authors and Affiliations

Corresponding author

Additional information

This work is supported by the National Key Research and Development Plan (No. 2016YFC0800100) and the NSFC of China (Nos. 11671374, 71771203, 71631006).

Appendix

Appendix

We discuss results and assumptions from Section 4.2 in Resnick (2002) that are used in this paper for the sake of completeness. The following results provide conditions under which the second-order regular variation of Definition 2.4 can be represented as vague convergences of measures. Assumption 6.1 gives the appropriate conditions when the limit measure \(\nu (\cdot )\) as obtained in Definition2.3 has a density with respect to the Lebesgue measure; hence \({\mathbf {X}}\) is not asymptotically independent. On the other hand, Assumption 6.3 gives appropriate conditions when \(\nu (\cdot )\) does not has a density, it means that asymptotic independence holds for the tail distribution of \({\mathbf {X}}\). Suppose \({\mathbf {X}}\) is a d-dimensional non-negative random vector with distribution function F and identical one-dimensional marginals \(F_1\).

Assumption 6.1

We assume the following on F.

-

1.

Let F have a density \(F'\) such that for \(b(t)\rightarrow \infty \),

$$\begin{aligned} \lim _{t\rightarrow \infty } |b(t)^dtF'(b(t){\mathbf {x}})-p({\mathbf {x}})|=0, {\mathbf {x}}\in {\mathbb {E}}, \end{aligned}$$(6.1)where \(p(\cdot )\ne 0\) is bounded on \({\mathcal {N}}\) and moreover

$$\begin{aligned} \lim _{t\rightarrow \infty } \sup \limits _{{\mathbf {a}}\in {\mathcal {N}}}|b(t)^dtF'(b(t){\mathbf {a}})-p({\mathbf {a}})|=0,{\mathbf {x}}\in {\mathbb {E}}, \end{aligned}$$(6.2)The limit function \(p({\mathbf {x}})\) necessarily satisfies \(p(t{\mathbf {x}})=t^{-\alpha -d}p({\mathbf {x}})\). This implies from Resnick (2008) that there exists \(V \in {RV}_{-\alpha }\) such that

$$\begin{aligned} \lim _{t\rightarrow \infty } \frac{1-F(b(t){\mathbf {x}})}{V(b(t))}= \int \limits _{[{\mathbf {0}},{\mathbf {x}}]^c} p({\mathbf {u}})d{\mathbf {u}} = \nu ([{\mathbf {0}},{\mathbf {x}}]^c) , {\mathbf {x}}>{\mathbf {0}}. \end{aligned}$$(6.3)Thus, conditions (6.1) and (6.2) imply the multivariate regular variation. Instead of conditions (6.1) and (6.2), it is sufficient to assume \({\overline{F}}_1\in {RV}_{-\alpha }\) and

$$\begin{aligned} \lim \limits _{t\rightarrow \infty }\Big |\frac{F^{'}(t{\mathbf {x}})}{t^{-d}{\overline{F}}_1(t)}-p({\mathbf {x}})\Big |=0,{\mathbf {x}}\in {\mathbb {E}}, \quad and\quad \lim \limits _{t\rightarrow \infty } \sup \limits _{{\mathbf {a}}\in {\mathcal {N}}}\Bigg |\frac{F^{'}(t{\mathbf {a}})}{t^{-d}{\overline{F}}_1(t)} -p({\mathbf {a}})\Bigg |=0\nonumber \\ \end{aligned}$$(6.4)and we can take \(V={\overline{F}}_1\).

-

2.

Assume that the second-order condition given in (2.2) holds for \({\overline{F}}_1\) so that \({\overline{F}}_1\in {RV}_{-\alpha }\) and \(A \in {RV}_\rho \), \(\rho \le 0\), \(A\rightarrow 0\) and for \({\mathbf {x}}\in {\mathbb {E}}\),

$$\begin{aligned} \lim \limits _{t\rightarrow \infty }\Bigg |\frac{\frac{F^{'}(t{\mathbf {x}})}{t^{-d}{\overline{F}}_1(t)}-p({\mathbf {x}})}{A(t)}-\chi ^{'}({\mathbf {x}})\Bigg |=0, \end{aligned}$$(6.5)where \(\chi ^{'}\ne 0\) is integrable on sets bounded away from \({\mathbf {0}}\). We also assume uniform convergence on \({\mathcal {N}}\):

$$\begin{aligned} \lim _{t\rightarrow \infty } \sup \limits _{{\mathbf {a}}\in {\mathcal {N}}}\Bigg |\frac{\frac{F^{'}(t{\mathbf {a}})}{t^{-d}{\overline{F}}_1(t)}-p({\mathbf {a}})}{A(t)}-\chi ^{'}({\mathbf {a}})\Bigg |=0, \end{aligned}$$(6.6)

Also assume that \(\chi ^{'}\) is finite and bounded on \({\mathcal {N}}\).

Remark 6.2

For \({\mathbf {X}}\sim F\) with identical marginals \(F_1\), assuming conditions (6.4) – (6.6) is sufficient for (6.1) – (6.3) to hold with \(V={\overline{F}}_1\).

Using \(\nu \) as defined in (6.3), we define the signed measure

which has a density given by

Assumption 6.3

We assume the following on F.

-

1.

Suppose (2.4) holds with \(\nu ([{\mathbf {0}},{\mathbf {x}}]^c)=k \sum _{i=1}^d x_i^{-\alpha }\), where k is some constant.

-

2.

Moreover, the one-dimensional marginals are identical and satisfy the second-order condition as in Definition 2.2 such that we also have

$$\begin{aligned} \mu _{t1}^\pm :=\Bigg ( \frac{t{\mathbb {P}}[\frac{X_1}{b(t)}\in \cdot ]-\nu _\alpha (\cdot )}{A(b(t))} \Bigg )^\pm {\mathop {\rightarrow }\limits ^{v}}\chi _1^\pm \end{aligned}$$(6.9)

on \((0,\infty ]\) where \(\chi _1(x,\infty ]=cx^{-\alpha }\frac{x^\rho -1}{\rho }.\)

Rights and permissions

About this article

Cite this article

Chen, Y., Wang, J. & Zhang, W. Tail Distortion Risk Measure for Portfolio with Multivariate Regularly Variation. Commun. Math. Stat. 10, 263–285 (2022). https://doi.org/10.1007/s40304-020-00223-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40304-020-00223-6