Abstract

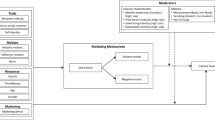

Gold and silver prices have surged since the 1980s, and they have been used as a store of value for fear of a financial meltdown. However, gold and silver in the form of bullion are still not so popular compared with other gold and silver products (jewellery) and other financial instruments in Malaysia. Limited study has actually verified the factors that affect the investors’ intention to purchase bullion. Thus, this study explores factors affecting investors’ behaviour and their intention to purchase bullion based on the Theory of Planned Behaviour. This study also examines the moderating effect of scepticism between investors’ behaviour and their intention to purchase bullion. A total of 208 sets of data collected in a self-administered online structured survey was analysed using PLS-SEM. This study finds that investors’ behavioural belief and control belief significantly and positively affect their respective attitude towards behaviour and perceived behavioural control and, thus, intention to purchase bullion. Results are found insignificant for normative belief, normative attitude and intention to purchase bullion and the moderating effect of scepticism in affecting investors’ intention to purchase bullion. The findings of this study hope to provide insight and deeper understanding to bullion traders and financial advisors in improving their marketing strategies in growing interest in the bullion market.

Similar content being viewed by others

References

Aggarwal, V.K., S. Jain, and A. Aggarwal. 2014. Gold vs Gold ETFs : Evidences from India. International Journal of Scientific Research and Management 2 (4): 758–762.

Ajzen, I. 1985. ‘From intentions to actions: A theory of planned behavior’, in Action Control. Berlin: Springer.

Ajzen, I. 1991. The theory of planned behavior. Organizational Behavior and Human Decision Processes 50 (2): 179–211. https://doi.org/10.1016/0749-5978(91)90020-T.

Ajzen, I. 2002. Perceived behavioral control, self-efficacy, locus of control, and the theory of planned behavior. Journal of Applied Social Psychology 32 (4): 665–683. https://doi.org/10.1111/j.1559-1816.2002.tb00236.x.

Ajzen, I. 2011. The theory of planned behaviour: Reactions and reflections. Psychology and Health 26 (9): 1113–1127. https://doi.org/10.1080/08870446.2011.613995.

Anuar, M.M., and O. Mohamad. 2012. Effects of Skepticism on consumer response toward cause-related marketing in Malaysia. International Business Research. https://doi.org/10.5539/ibr.v5n9p98.

Armitage, C.J., and M. Conner. 2001. Efficacy of the theory of planned behaviour: A meta-analytic review. British Journal of Social Psychology 40 (4): 471–499. https://doi.org/10.1348/014466601164939.

Aspara, J., and H. Tikkanen. 2008. Interactions of Individuals Company-Related Attitudes and Their Buying of Companies’ Stocks and Products. Journal of Behavioral Finance 9 (2): 85–94. https://doi.org/10.1080/15427560802107462.

Burn-Callander, R. (2014) ‘The history of money: from barter to bitcoin’, The Telegraph. Available at: https://www.telegraph.co.uk/finance/businessclub/money/11174013/The-history-of-money-from-barter-to-bitcoin.html (Retrieved December 5 2019).

De Cannière, M.H., P. De Pelsmacker, and M. Geuens. 2009. Relationship quality and the theory of planned behavior models of behavioral intentions and purchase behavior. Journal of Business Research 62 (1): 82–92. https://doi.org/10.1016/j.jbusres.2008.01.001.

Capon, N., G.J. Fitzsimons, and R.A. Prince. 1996. An individual level analysis of the mutual fund investment decision. Journal of Financial Services Research 10 (1): 59–82. https://doi.org/10.1007/BF00120146.

Caporin, M., A. Ranaldo, and G.G. Velo. 2015. Precious metals under the microscope: A high-frequency analysis. Quantitative Finance 15 (5): 743–759. https://doi.org/10.1080/14697688.2014.947313.

Chaisuriyathavikun, N., and P. Punnakitikashem. 2016. A study of factors influencing customers’ purchasing behaviours of gold ornaments. Journal of Business and Retail Management Research 10 (3): 147–159.

Cook, A.J., and J.R. Fairweather. 2007. Intentions of new Zealanders to purchase lamb or beef made using nanotechnology. British Food Journal 109 (9): 675–688. https://doi.org/10.1108/00070700710780670.

Fan, W., S. Fang, and T. Lu. 2014. Macro-factors on gold pricing during the financial crisis. China Finance Review International 4 (1): 58–75. https://doi.org/10.1108/CFRI-09-2012-0097.

Faul, F., et al. 2007. G*Power 3: A flexible statistical power analysis program for the social, behavioral, and biomedical sciences. Behavior Research Methods 39 (2): 175–191. https://doi.org/10.3758/BF03193146.

Figuerola-Ferretti, I., and J.R. McCrorie. 2016. The shine of precious metals around the global financial crisis. Journal of Empirical Finance. https://doi.org/10.1016/j.jempfin.2016.02.013.

Fishbein, M., and I. Ajzen. 1977. Belief, attitude, intention and behavior: An introduction to theory and research. MA: Addison-Wesley. https://doi.org/10.2307/2065853.

Forehand, M.R., and S. Grier. 2003. When Is honesty the best policy? The effect of stated company intent on consumer Skepticism. Journal of Consumer Psychology 13 (3): 349–356. https://doi.org/10.1207/s15327663jcp1303_15.

Ghazali, M.F., H.H. Lean, and Z. Bahari. 2015. ‘Is gold a good hedge against inflation? Empirical evidence in Malaysia’, Kajian Malaysia 33: 69–84.

Gopi, M., and T. Ramayah. 2007. Applicability of theory of planned behavior in predicting intention to trade online: Some evidence from a developing country. International Journal of Emerging Markets 2 (4): 348–360. https://doi.org/10.1108/17468800710824509.

Hair., J. F. et al. (2017) A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), Sage

Hegner, S.M., A. Fenko, and A. Teravest. 2017. Using the theory of planned behaviour to understand brand love. Journal of Product and Brand Management 26 (1): 26–41. https://doi.org/10.1108/JPBM-06-2016-1215.

Henseler, J., C.M. Ringle, and M. Sarstedt. 2015. A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science 43 (1): 115–135. https://doi.org/10.1007/s11747-014-0403-8.

Huang, X., and J. Ge. 2019. Electric vehicle development in Beijing: An analysis of consumer purchase intention. Journal of Cleaner Production 216: 361–372. https://doi.org/10.1016/j.jclepro.2019.01.231.

Ibrahim, M.H. 2012. Financial market risk and gold investment in an emerging market: The case of Malaysia. International Journal of Islamic and Middle Eastern Finance and Management 5 (1): 25–34. https://doi.org/10.1108/17538391211216802.

Isa, S.M., P.N. Chin, and I. Liew. 2019. Exploring the role of corporate social responsibility skepticism in ethical purchase intention. Social Responsibility Journal. https://doi.org/10.1108/SRJ-01-2018-0003.

Jain, S., and M.N. Khan. 2017. Measuring the impact of beliefs on luxury buying behavior in an emerging market: Empirical evidence from India. Journal of Fashion Marketing and Management 21 (3): 341–360. https://doi.org/10.1108/JFMM-07-2016-0065.

Japutra, A., et al. 2019. Travellers’ mindsets and theory of planned behaviour. Tourism Management Perspectives 30: 193–196. https://doi.org/10.1016/j.tmp.2019.02.011.

Jensen, G.R., R.R. Johnson, and K.M. Washer. 2018. All that’s gold does not glitter. Financial Analysts Journal 74 (1): 59–76. https://doi.org/10.2469/faj.v74.n1.5.

Jones, A.T., and W.H. Sackley. 2016. An uncertain suggestion for gold-pricing models: The effect of economic policy uncertainty on gold prices. Journal of Economics and Finance 40 (2): 367–379. https://doi.org/10.1007/s12197-014-9313-3.

Judge, M., G. Warren-Myers, and A. Paladino. 2019. Using the theory of planned behaviour to predict intentions to purchase sustainable housing. Journal of Cleaner Production 215: 259–267. https://doi.org/10.1016/j.jclepro.2019.01.029.

Khan, F.M.A., and L. Ramani. 2014. Relationship between spot & future prices of silver and copper in the indian commodity market: A literature review. FIIB Business Review 3 (2): 13–19. https://doi.org/10.1177/2455265820140202.

Kumar Mukul, M., V. Kumar, and R. Sougata. 2012. Gold ETF performance: A comparative analysis of monthly returns. The IUP Journal of Financial Risk Management 9 (2): 60–63.

Laohapensang, O. 2009. Factors influencing internet shopping behaviour: A survey of consumers in Thailand. Journal of Fashion Marketing and Management 13 (4): 501–513. https://doi.org/10.1108/13612020910991367.

Lim, Y.J., et al. 2016. Factors influencing online shopping behavior: The mediating role of purchase intention. Procedia Economics and Finance 35: 401–410. https://doi.org/10.1016/s2212-5671(16)00050-2.

Lucey, B.M., and S. Li. 2015. What precious metals act as safe havens, and when? Some US evidence. Applied Economics Letters 22 (1): 35–45. https://doi.org/10.1080/13504851.2014.920471.

Maichum, K., S. Parichatnon, and K.C. Peng. 2016. Application of the extended theory of planned behavior model to investigate purchase intention of green products among Thai consumers. Sustainability (Switzerland) 8 (10): 1–20. https://doi.org/10.3390/su8101077.

McKay, D.R., and D.A. Peters. 2017. The midas touch: Gold and its role in the global economy. Plastic Surgery 25 (1): 61–63. https://doi.org/10.1177/2292550317696049.

Morel, K.P.N., and A.T.H. Pruyn. 2003. Consumer Skepticism toward new products. European Advances in Consumer Research 6: 351–358.

Oteng-Peprah, M., N. de Vries, and M.A. Acheampong. 2020. Households’ willingness to adopt greywater treatment technologies in a developing country – Exploring a modified theory of planned behaviour (TPB) model including personal norm. Journal of Environmental Management 254: 109807. https://doi.org/10.1016/j.jenvman.2019.109807.

de Pechpeyrou, P., and P. Odou. 2012. Consumer Skepticism and promotion effectiveness. Recherche et Applications en Marketing (English Edition) 27 (2): 45–69. https://doi.org/10.1177/205157071202700203.

Pellinen, A., et al. 2015. Beliefs affecting additional investment intentions of mutual fund clients. Journal of Financial Services Marketing 20 (1): 62–73. https://doi.org/10.1057/fsm.2014.32.

Peters, D.A., A.Z. Vale, and D.A. McKay. 2013. Where do I put my money? Mutual funds versus exchange-traded funds. Canadian Journal of Plastic Surgery 21 (3): 197–198. https://doi.org/10.1177/229255031302100311.

Ramayah, T. et al. (2018) Partial Least Squares Structural Equation Modeling (PLS-SEM) using SmartPLS 3.0: An updated and practical guide to statistical analysis, Handbook of Market Research. doi: https://doi.org/10.1213/01.ane.0000105862.78906.3d

Raygor, A. D. (2016) The Theory of Planned Behavior: Understanding Consumer Intentions to Purchase Local Food in Iowa. Iowa State University. Available at: https://lib.dr.iastate.edu/cgi/viewcontent.cgi?article=6805&=&context=etd&=&sei-redir=1&referer=https%253A%252F%252Fscholar.google.com%252Fscholar%253Fhl%253Den%2526as_sdt%253D0%25252C5%2526q%253DThe%252BTheory%252Bof%252BPlanned%252BBehavior%25253A%252BU

Reuters (2019) China’s gold reserves rise for 1st time in over two years in Dec, Thomson Reuters. Available at: https://www.reuters.com/article/china-economy-reserves-gold/chinas-gold-reserves-rise-for-1st-time-in-over-two-years-in-dec-idUSAZN002AOC (Accessed: 10 December 2019)

Rowling, R. and Barton, S. (2019) Central Banks Are on the Biggest Gold-Buying Spree in a Half Century, Bloomberg. Available at: https://www.bloomberg.com/news/articles/2019-01-31/gold-demand-up-amid-biggest-central-bank-buying-spree-in-decades (Accessed: 10 December 2019)

Ru, X., H. Qin, and S. Wang. 2019. Young people’s behaviour intentions towards reducing PM2.5 in China: Extending the theory of planned behaviour. Resources, Conservation and Recycling 141: 99–108. https://doi.org/10.1016/j.resconrec.2018.10.019.

Salem, S.F., and S.O. Salem. 2018. Self-identity and social identity as drivers of consumers’ purchase intention towards luxury fashion goods and willingness to pay premium price. Asian Academy of Management Journal 23 (2): 161–184. https://doi.org/10.21315/aamj2018.23.2.8.

Sanchez, G. (2013) PLS Path Modeling with R, Trowchez Editions. Berkeley. Available at: https://www.gastonsanchez.com/PLS_Path_Modeling_with_R.pdf (Accessed: 10 October 2019)

Shah Alam, S., and N. Mohamed Sayuti. 2011. Applying the theory of planned behavior (TPB) in halal food purchasing. International Journal of Commerce and Management 21 (1): 8–20. https://doi.org/10.1108/10569211111111676.

Skarmeas, D., and C.N. Leonidou. 2013. When consumers doubt, watch out! The role of CSR skepticism. Journal of Business Research 66 (10): 1831–1838. https://doi.org/10.1016/j.jbusres.2013.02.004.

Smith, J.R., et al. 2008. The attitude-behavior relationship in consumer conduct: The role of norms, past behavior, and self-identity. Journal of Social Psychology 148 (3): 311–333. https://doi.org/10.3200/SOCP.148.3.311-334.

Teng, C.C., and Y.M. Wang. 2015. Decisional factors driving organic food consumption: Generation of consumer purchase intentions. British Food Journal 117 (3): 1066–1081. https://doi.org/10.1108/BFJ-12-2013-0361.

Tran, T.N., C.D. Le, and T.T.P. Hoang. 2017. Does the State bank widen the gap between international and domestic gold prices? evidence from Vietnam. Global Business Review 18 (1): 45–56. https://doi.org/10.1177/0972150916666853.

Vigne, S.A., et al. 2017. The financial economics of white precious metals — A survey. International Review of Financial Analysis 52 (July): 292–308. https://doi.org/10.1016/j.irfa.2017.04.006.

Vinzi, V.E., et al. 2010. Handbook of partial least squares: concepts, methods and applications. New York: Springer.

Walt, E. van der (2018) Russia’s Central Bank Gold Hoard Is Now Bigger Than China’s, Bloomberg. Available at: https://www.bloomberg.com/news/articles/2018-02-21/russia-s-central-bank-gold-hoard-is-now-bigger-than-china-s (Accessed: 10 November 2019)

Wang, S., et al. 2018. Consumer familiarity, ambiguity tolerance, and purchase behavior toward remanufactured products: The implications for remanufacturers. Business Strategy and the Environment 27 (8): 1741–1750. https://doi.org/10.1002/bse.2240.

Yaacob, S. E. (2012) ‘The reality of gold dinar application in Malaysia’, Advances in Natural and Applied Sciences, 6(3 SPECL.ISSUE 2), pp. 341–347

Yadav, R., and G.S. Pathak. 2016. Young consumers’ intention towards buying green products in a developing nation: Extending the theory of planned behavior. Journal of Cleaner Production 135: 732–739. https://doi.org/10.1016/j.jclepro.2016.06.120.

Yunus, N.S.N.M., et al. 2014. Muslim’s purchase intention towards non-muslim’s halal packaged food manufacturer. Procedia - Social and Behavioral Sciences 130 (May): 145–154. https://doi.org/10.1016/j.sbspro.2014.04.018.

Činjarević, M., E. Agić, and A. Peštek. 2019. When consumers are in doubt, you better watch out! the moderating role of consumer skepticism and subjective knowledge in the context of organic food consumption. Zagreb International Review of Economics and Business 21 (s1): 1–14. https://doi.org/10.2478/zireb-2018-0020.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Verghese, J., Chin, P.N. Factors affecting investors’ intention to purchase gold and silver bullion: evidence from Malaysia. J Financ Serv Mark 27, 41–51 (2022). https://doi.org/10.1057/s41264-021-00092-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41264-021-00092-2