Abstract

The euro area emerged from the euro crisis without meeting the conditions presented by the theory of optimum currency area. The decisive policy that ended this crisis was the Outright Monetary Transactions policy. Besides, the quantitative easing policy supports the economy of the euro area after this crisis. To examine the impact of these supranational monetary policies on the business cycles in the euro area, which is not covered by optimum currency area theory, we use a Kaldorian two-country model featuring a monetary union and imperfect capital mobility. We find that an increase in government bond purchases is a stabilizing factor, whereas an extreme increase in the degree of counter-cyclical fiscal policy is a destabilizing factor. Nevertheless, as long as the fiscal and monetary policies of two countries are not extremely active, but active to a certain extent, the equilibrium point becomes locally stable. Furthermore, even if the business cycles are not synchronized, the purchase of government bonds of a particular country is effective in stabilizing the business cycles of both countries. From these results, we suggest that the euro area satisfies the metacriteria of an optimum currency area through the implementation of a government bond purchase system by a supranational central bank system.

Similar content being viewed by others

1 Introduction

The euro area took various measures to deal with the euro crisis, but the decisive policy that ended this crisis was the Outright Monetary Transactions (OMT) policy. The OMT was introduced by the European Central Bank (ECB) in 2012 and allows the ECB to make unlimited purchases of government bonds issued by crisis-hit countries. The introduction of the OMT has also helped to clarify the ECB’s stance on the euro crisis. De Grauwe (2018) notes that the OMT addresses concerns that were destabilizing the system, and values the OMT as a lender of last resort.

Even as the euro area started to emerge from this crisis, it was pointed out that the region was not an optimum currency area (OCA). This was a set phrase that had been gaining ground even before the crisis began. The theory of optimum currency area is a summary of the pre-requisites for successful currency integration. Its foundation was developed by Mundell (1961), McKinnon (1963), and Kenen (1969). Since the 1960s, various economists have discussed the conditions for the establishment of an optimal currency area [see Mongelli (2002), De Grauwe (2018), and Baldwin and Wyplosz (2019)].

However, critics have alleged a problem in the OCA theory itself, in that the different criteria cannot be integrated within a uniform framework. According to Gächter et al. (2012), the discussion of this problem led to the development of a few “metacriteria” that implicitly subsume some of the individual conditions; the synchronization of business cycles has been established as a key metacriterion [(e.g., De Haan et al. (2008) and De Grauwe and Ji (2016, 2017)].

The euro has had a different effect on the synchronization of business cycles before and after its introduction. As the time of the introduction of the euro approached, the business cycle converged [e.g., Altavilla (2004), Camacho et al. (2006), and Darvas and Szapáry (2008)]. This is because it was necessary to converge economic fundamentals, such as the inflation rate and the interest rate, as a precondition for the introduction of the euro. However, since the establishment of the euro, the synchronicity of business cycles among countries within the euro area disappeared. It was under these circumstances that the euro crisis broke out and the possibility of a euro collapse was briefly discussed [see Krugman (2012)]. The euro area is not an OCA, and the need for a fiscal union, which is one of the conditions for an optimal currency area, was pointed out in particular.

However, the euro area survived this crisis without meeting the conditions presented by the OCA theory. The OCA theory has not discussed supranational monetary policy, such as the OMT that contributed to the exit from this crisis. One of the reasons for this is that countries lose their independent monetary policy in a single currency area considered to be a type of fixed exchange rate system, as described in the impossible trinity. Then, it is assumed that they will not be able to make monetary policies that are appropriate to their respective situations. The loss of an independent monetary policy, as pointed out in the impossible trinity, occurs in a single currency area; however, it differs from a fixed exchange rate system such as the gold standard. The difference is the presence of a supranational central bank.

Regarding the supranational system of controlling the value of gold to maintain the gold standard, Keynes (1930) states:

“The ideal arrangement would surely be to set up a supranational bank to which the central banks of the world would stand in much the same relation as their own member banks stand to them.” [(Keynes (1930, p. 399)]

In the context of the euro area, this supranational bank is the ECB, as the current central bank. Keynes (1930) also notes important implications for the ECB’s monetary policy in response to the euro crisis.

“The supernational bank should also have a discretionary power to conduct open-market operations, by the purchase or sale on its own initiative either of long-term or short-term securities, with the assent, in the case of a purchase though not necessarily in the case of a sale, of the adherent central bank in whose national money the securities in question are payable.” [Keynes (1930, pp. 400–401)]

This idea is an important point that is also relevant to the policies of OMT and quantitative easing (QE). However, this suggestion about supranational central banks has been underutilized in OCA theory, even though it is related to how the ECB would eventually deal with the euro crisis.

Although the euro crisis ended, the euro area is still experiencing prolonged economic stagnation. In the context of the post-euro crisis, the ECB launched the Public Sector Purchase Programme in March 2015, which was a so-called quantitative easing initiative. Moreover, even as some countries struggle to emerge from the economic stagnation that followed the euro crisis, the COVID-19 epidemic has caused further economic stagnation since February 2020. Under these circumstances, the role of the ECB’s supranational monetary policy has become increasingly important in the euro area, where fiscal policy is constrained.

This study contributes to the construction of a uniform framework for the OCA theory by analyzing supranational monetary policy from the perspective of the synchronization of business cycles. Moreover, this study allows us to consider the conditions necessary for the euro area to survive.

Therefore, this study examines the impact of government bond purchases by the Eurosystem on the business cycles of countries. The Eurosystem is the monetary authority of the euro area and is headed by the ECB, which is a supranational central bank. In doing so, we carry out a stability analysis of the business cycle with a Kaldorian two-country model with imperfect capital movement. We are interested in how the demand-led economies under currency integration with Keynesian underemployment fluctuate through time and whether the system is dynamically stable or not. Kaldorian business cycle model developed by Kaldor (1940) is a suitable Keynesian model that can analyze these issues. This paper extends the Kaldorian business cycle model of a closed economy to a two-country model under currency integration that is suitable for our purpose. If the purchase of government bonds of a particular country by a supranational central bank stabilizes the business cycles of that country as well as those of other euro area countries and converges them to an equilibrium point, then the synchronicity of business cycles is likely to increase.

The results of this study show the purchase of government bonds of a country that is facing a crisis can stabilize the business cycle of the country. The euro area satisfies the metacriteria of an OCA through the purchase of government bonds by the supranational central banking system. These results will help to build institutions for the successful implementation of ECO, which is a common currency that is scheduled to be introduced in the Economic Community of West African States (ECOWAS) in 2020.

The rest of this paper is organized as follows. In Sect. 2, we formalize the two-country Kaldorian model with currency integration, which consists of an eight-dimensional system of nonlinear differential equations. In Sect. 3, we investigate the conditions for local stability of the equilibrium point mathematically. In Sect. 4, we present the results of some numerical simulations that support the theoretical analysis in Sect. 3. Finally, Sect. 5 concludes this article.

2 Formulation of the model on government bond purchase

In this section, we analyze the effect of government bond purchases by central banks in the monetary union using the Kaldorian two-country model with currency integration. The two-country version of Kaldor (1940)’s model of business cycle has been discussed extensively in previous literature. Asada et al. (2001) analyzed the stability conditions of the business cycles in two regions using the two-country discrete-time Kaldorian model of business cycles under fixed exchange rates and imperfect capital mobility. Asada (2004) used a continuous-time Kaldorian imperfect capital movement two-country model to consider the stability conditions of business cycles in the two regions with fixed exchange rates, with a particular focus on the speed of adjustment in the goods market. Asada et al. (2003) performed a more complex business cycle analysis in the context of a multidimensional two-country model. Inaba and Asada (2020) considered the Kaldorian three-country model with fixed exchange rates. Nakao (2017) argued that an increase in capital mobility between countries in a capital markets union is a destabilizing factor, whereas an increase in fiscal transfers between such countries is a stabilizing factor, using Keynesian and Kaldorian two-country models. Nakao (2019) proved that a high degree of economic openness can adjust a shock in the monetary union regardless of whether the shock is asymmetric, using Keynesian and Kaldorian two-country models with a monetary union system.

To analyze a monetary union, such as the euro area, we represent the exchange rate as follows:

where E is the exchange rate and \(E^e\) is the expected exchange rate in the near future. We assume that the exchange rate and expected exchange rate are one because a single currency is used in a monetary union.

Furthermore, to simplify the analysis, we focus on a fixed price economy.

Assumption 1

The subscript i (\(i=1,2\)) is the index number of a country and \(p_i\) is the price level of country i. This assumption eliminates price fluctuations. This study considers an economy in the medium-term, in which the changes of prices are neglected although the changes of the real capital stocks are allowed for, and we do not deal with the problem of inflation and deflation in this paper.

Under these assumptions about the exchange rate and prices, our model consists of the following system of dynamic equations over the medium-term with flexible capital stockFootnote 1.

Disequilibrium quantity adjustment process in the goods market in country i is

Keynesian consumption function in a country i is

Standard Kaldorian investment function in a country i is:

Government expenditure function in a country i is

Standard tax function in a country i is

Dynamic equation of capital stock in a country i is

Outstanding nominal government bond of a country i is

Budget constraint of a country i is

Dynamic equation of the outstanding nominal government bonds of a country i is

Dynamic equation of the outstanding nominal government bonds of country i held by country j is

From Eq. (12), the following equation holds.

Net export (current account) function in a country i is:

Capital account functions in a country 1 is

The definition of total balance of payments of country i is

The relationship between the first and second countries with respect to net exports, capital account, and balance of payments is, respectively,

The following equation describes the total nominal money supply of two countries belonging to a monetary union that is equal to the money supply of the supranational central bank.

The money supply in the monetary union depends on purchasing government bonds of both countries by the supranational central bank.

The nominal money supply of country i increases (decreases) according to the total balance of payment surplus (deficit) of country i.

The equilibrium condition in the monetary market is

The meanings of the symbols are as follows. \(Y_i\) is real net national income. \(C_i\) is real private consumption expenditure. \(c_i\) is the marginal propensity to consume. \(C_{0i}\) is basic consumption. \(I_i\) is real net private investment expenditure. \(G_i\) is real government expenditure. \(G_{0i}\) is basic government expenditure. \(K_i\) is real capital stock. \(B_i\) is the outstanding nominal government bonds. \(B_i^i\) is the outstanding nominal government bonds of country i held by the private sector in country i. \(B_i^j\) is the outstanding nominal government bonds of country i held by the private sector in country j. \(r_i\) is the nominal rate of interest.Footnote 2\(\bar{Y_i}\) is the level of real national income that helps a government determine the counter-cyclical government expenditure (this is not necessarily natural output). \(T_i\) is the real income tax. \(\tau _i\) is the marginal tax rate. \(T_{0i}\) is negative income tax (or basic income). M is the nominal money supply in the whole monetary union. \(M_i\) is the nominal money supply. \(J_i\) is real net exports. \(Q_i\) is the real capital account balance. \(A_i\) is the real total balance of payments. Parameter \(\alpha _i\) represents the adjustment speed of the goods market. Parameter \(\beta\) indicates the degree of mobility of international capital flows; the larger the value of \(\beta\) is, the higher is the degree of mobility of international capital flows.Footnote 3 Parameter \(\gamma _i\) says the degree of counter-cyclical fiscal policy and a large \(\gamma _i\) implies a large counter-cyclical government expenditure. Parameter \(\theta _i\) is the outstanding nominal government bond of country i held by the supranational central bank.

Equation (9) is the definitional equation of the outstanding nominal government bonds of country i, representing that a nominal government bond of country i is held by both i and j. Equation (11) reflects that the outstanding nominal government bond of country i depends on the amount of bonds held by both countries. Equations (17), (18), and (19) imply that the net export surplus, capital account balance surplus, and the total balance of payments surplus of a country must be accompanied by the same amount of the current account deficit, capital account balance deficit, and the total balance of payments deficit of another country, respectively.

We transform these equations into a more compact system. We obtain the following equation by solving Eq. (23) with respect to \(r_i\).

Furthermore, we assume the following equations.

Assumption 2

The central bank can increase \({\bar{M}}\). To simplify the discussion, we assume that \(\theta _i\) is a parameter rather than a variable. However, since its magnitude affects performance, we perform a comparative dynamic analysis with \(\theta _i\) as a policy parameter. On this assumption, the nominal money supply in the whole monetary union is fixed.

Therefore, we transform Eqs. (21) and (22) into the following equations.

Combining Eqs. (3)–(28), we obtain the following eight-dimensional system of nonlinear differential equations, given policy parameters \(G_{0i}\), \(\tau _i\), and \({\bar{M}}\).

3 Analysis of local stability

In this section, assuming the existence and uniqueness of an equilibrium solution \((Y_1^*\), \(K_1^*\), \(B_1^*\), \(B_1^{2*}\), \(Y_2^*\), \(K_2^*\), \(B_2^*\), \(M_1^*)\) \(>(0, 0, 0, 0, 0, 0, 0, 0)\), we analyze the stability of such as an equilibrium solution. The numerical simulation in the next section provides a case in which such an equilibrium point exists.

We assume the following inequality for the interest rate at the equilibrium point.

Assumption 3

This assumption implies that a negative interest rate at the equilibrium point should not be considered.

The Jacobian matrix of the system of Eqs. (29)–(36) that is evaluated at the equilibrium point can be written as follows.

where the following relationships are satisfied.

We shall study the local stability/instability of the equilibrium point under the following set of assumptions.

Assumption 4

-

(i)

\(\varPhi _{11}(0,0)>0\) and \(\varPhi _{55}(0,0)>0\).

-

(ii)

Parameter \(\beta\) is fixed at such a sufficiently large value that we have \(F_{81}(\beta )>0\), \(F_{85}(\beta )<0\), and \(F_{88}(\beta )<0\).

Assumption 4 (i) implies that the marginal propensities of investment of both countries (\(I_{Y_1}^1\) and \(I_{Y_2}^2\)) are sufficiently large at the equilibrium point, which is a standard assumption of the Kaldorian business cycle theory, as proposed by Kaldor (1940). Assumption 4 (ii) implies that the capital movement between countries is sufficiently active. We can write the characteristic equation of this system at the equilibrium point as follows.

We can express the coefficients \(a_m\) (\(m=1,2,\ldots 8\)) as follows, where \(\upsilon _n\), \(\phi _n\), \(\chi _n\), \(\psi _n\) and \(\omega _n\) (\(n=1,2,\ldots 12\)) may be functions of the parameters \(\gamma _1\), \(\theta _1\), \(\gamma _2\), and \(\theta _2\).

where

We can write the Routh–Hurwitz terms as follows.

A set of necessary and sufficient conditions for the local stability of the eight-dimensional nonlinear system given by Eqs. (29)–(36) is provided by the following “Routh–Hurwitz theorem” [cf. Gandolfo (2009: p. 239)]:

The following set of inequalities is a set of necessary (but not sufficient) conditions for the local stability of this dynamic system, which is a corollary of the Liénard–Chipart theorem [cf. Gandolfo (2009: p. 240)].

In other words, a set of inequalities (49) implies a set of inequalities (50), but not vice versa. The following proposition provides a set of sufficient conditions for dynamic instability of the equilibrium point.

Proposition 1

Suppose that the adjustment speeds of the goods market in two countries, \(\alpha _1\) and \(\alpha _2\), are sufficiently large and all of the fiscal and monetary policy parameter values \(\gamma _1\), \(\theta _1\), \(\gamma _2\), and \(\theta _2\) are close to zero. Then, the equilibrium point of the dynamic system (29)–(36) becomes unstable under Assumptions 2–4.

Proof

See Appendix 1.

This proposition means that the equilibrium point of the system becomes unstable if the adjustment speeds of the goods market in the two countries are sufficiently high, and the fiscal and monetary policies of both countries are sufficiently inactive. On the other hand, the following proposition provides an essential set of necessary (but not sufficient) conditions for the local stability of the equilibrium point of the system. \(\square\)

Proposition 2

Suppose that the parameter values \(\alpha _1\), \(\alpha _2\), \(\beta\), \(\gamma _1\), and \(\gamma _2\) are sufficiently large, and both \(\theta _1\) and \(\theta _2\) are close to their economically meaningful upper bounds, (\({\bar{\theta }}_1\) and \({\bar{\theta }}_2\)). Then, the following set of inequalities are satisfied for all positive but sufficiently small values of \(r_1\) and \(r_2\) under Assumption 4.

Proof

See Appendix 3.

We can make use of the following lemma to prove this proposition. \(\square\)

Lemma 1

Suppose that the parameter values \(\alpha _1\), \(\alpha _2\), \(\gamma _1\), and \(\gamma _2\) are sufficiently large, and both \(\theta _1\) and \(\theta _2\) are close to their economically meaningful upper bounds (\({\bar{\theta }}_1\) and \({\bar{\theta }}_2\)). Then, the following set of conditions are satisfied under Assumption 4 if \(r_1=r_2=0\).

Proof

See Appendix 2.

The only missing inequality in Proposition 2 is \(a_8>0\). If we have this inequality in addition to a set of inequalities (51), we also have \(\varDelta _8=a_8\varDelta _7>0\). In this case, all of the Routh–Hurwitz conditions for the local stability of the equilibrium point (49) are satisfied. However, we can show that \(\psi _7\) in Eq. (46) becomes negative so that we have \(a_8<0\) when the fiscal parameter values \(\gamma _1\) and \(\gamma _2\) are too large.

This result means that the equilibrium point of this dynamic system becomes unstable if the fiscal policies of two countries are extremely active, because of the “overshooting” phenomenon. Nevertheless, it may be possible that the equilibrium point of this system becomes locally stable when the fiscal and monetary policies of two countries are considerably, but not extremely, active. Kaldorian investment function holds instability. When the government increases government spending excessively to prevent a recession, the policy makes the economy too good, and when the government suppresses the economy excessively, it makes it more recessionary. To avoid overshooting, policies that are neither overly passive nor overly aggressive are necessary. In this case, the destabilizing ‘overshooting’ fluctuations occur. In the next section, we shall present some numerical examples that support this conjecture. In these examples, cyclical fluctuations occur not only when the equilibrium point becomes locally stable, but also when it is unstable. \(\square\)

4 Numerical simulations

In this section, we present numerical simulations that support the theoretical analysis regarding relationships between \(\alpha _i\), \(\beta\), \(\theta _i\), and \(\gamma _i\) from the previous sections. The setting of the parameters and the functional forms of the numerical simulations are contained in Appendix 4.

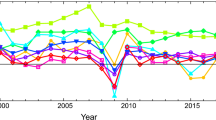

Figures 1, 2, 3, 4, 5, 6, 7 and 8 illustrate the trajectories of \(Y_1\) and \(Y_2\) by numerical simulation. Figure 1 shows a time pattern of \(Y_1\) and \(Y_2\) when a central bank does not purchase government bonds (\(\theta _1=0\) and \(\theta _2=0\)), and the economies are unstable because business cycles diverge. Furthermore, an increase in the adjustment speed of goods markets \(\alpha _i\) intensifies the instability of business cycles. Figure 2 shows the case of a higher adjustment speed of the goods market.

However, when only country 1 performs QE under the same fiscal policy parameters (\(\theta _1=0.6\), \(\theta _2=0\), and \(\alpha _i=1.2\)), as shown in Fig. 3, there are large fluctuations immediately after the shock, but then the economy converges to the equilibrium point. This is also true in Fig. 4 (\(\theta _1=0\), \(\theta _2=0.9\), and \(\alpha _i=1.2\)), which shows the case where only the second country buys government bonds.

The critical point is that the central bank stabilizes not only the economies of the countries that have purchased government bonds but also the economies of countries that have not purchased the bonds. This shows that the OMT does work, as it purchased unlimited amounts of government bonds of crisis-stricken countries during the euro crisis. It also implies that OMT can stabilize the business cycle in the overall euro area.

Figure 5 shows the case where the central bank purchases government bonds of both countries. By purchasing government bonds throughout the single currency area, it is possible to stabilize the business cycle with smaller parameters \(\theta _i\) than if only country 1 or country 2 were to purchase government bonds individually. Belke et al. (2017) points out that different monetary policies are required when the amplitude of the business cycle is different, even when the correlation of business cycle factors is high between the countries. However, a single monetary policy of purchasing the same amount of government bonds stabilizes the business cycle even though the amplitudes of the two countries’ cycle are not synchronized, as shown in Fig. 5. In other words, the ECB’s supranational monetary policy affects the euro area, even though it is a single monetary policy.

Figure 6 shows the business cycle for the entire single currency area when the central bank does not purchase government bonds, and the counter-cyclical fiscal policy parameters \(\gamma _i\) are larger than those in Figs. 1, 2, 3, 4 and 5. The economy converges to the equilibrium point and stabilizes in this case as well. This effect means that expansionary fiscal policies, instead of austerity policies, are needed to stabilize the business cycles in the euro area. Furthermore, when both bond purchases and expansionary fiscal policies are combined, the economy reaches the equilibrium point in a shorter period and stabilizes, as shown in Fig. 7.

Figure 8 illustrates how extremely active fiscal policies of the two countries diverge business cycles from the equilibrium point. Nevertheless, if the fiscal and monetary policies of the two countries are considerably active, then the equilibrium point becomes locally stable, as indicated in Figs. 5 and 6.

Figures 1, 2, 3, 4, 5, 6, 7 and 8 show that the entire single currency area has moved away from its equilibrium point due to shocks. Therefore, the shocks are symmetric. Figures 9, 10, 11 and 12 show the case of asymmetric shocks, where one country is near the equilibrium point, and the other country is relatively farther from the equilibrium point due to the shock.

Figure 9 illustrates a case where country 1 with a relatively small economy deviates from the equilibrium point due to shock, while country 2, with a relatively large economy, is less affected by the shock. In this case, the amplitude of the business cycles diverges, as in Figs. 1, 2, 3, 4, 5, 6, 7 and 8. Figure 10 describes the case where the central bank purchases the government bonds of country 1 in response to the same shock as in Fig. 9. The business cycle is stabilized in this case as well.

Figure 11 illustrates the opposite case of Fig. 9, where country 2 deviates from the equilibrium point due to a shock. Figure 12 describes the case where the central bank purchases the government bonds of country 2 in the event of a shock, as in Fig. 11. As a result, the business cycle is stabilized by purchasing government bonds.

Table 1 shows the equilibrium national income for each of the cases shown in Figs. 1, 2, 3, 4, 5, 6, 7, 10 and 12. There are two points worth discussing here. First, the purchase of government bonds raises the equilibrium national income. Second, when either country purchases government bonds, not only does the equilibrium national income of that country increase, but the equilibrium national income of the other country also increases.

The result that bond purchases achieve both a stabilization of the business cycle and an increase in equilibrium national income has important implications for the economic recovery of peripheral countries that were severely shocked by the euro crisis. The results that show the business cycle stabilizes and the equilibrium national income are raised when the central banks of euro member countries purchase their government bonds show the positive effect of the OMT. This has also had a positive effect on other euro member states. Moreover, this means that the QE is an essential policy for the euro area because the uniform purchasing of government bonds within the euro area also contributes to stabilizing the business cycle as well as increasing the equilibrium national income. The existence of the ECB, which manages policies regarding government bond purchase policies, is also significant for the euro area, and its supranational monetary policy will determine the future of the eurozone’s economy. It is an essential factor in maintaining the eurozone as a monetary union.

5 Conclusion

We found the following results. First, the purchase of government bonds of a country that is facing a crisis, through policies such as OMT or others, can stabilize the business cycle of the country. This means that setting up a government bond purchasing system like the OMT can help end the crisis. Second, a steep increase in the degree of counter-cyclical fiscal policy is a destabilizing factor. However, if the fiscal and monetary policies of the two countries are active to a certain degree only, and not extremely active, the equilibrium point becomes locally stable. Third, the simulations show that even if the business cycles are not synchronized, the purchase of government bonds of a particular country is effective in stabilizing the business cycles of both countries. We found that the implementation of the OMT not only helped the crisis-stricken countries, but also reduced the negative impact on the euro area as a whole.

As a result, the euro area satisfies the metacriteria of an OCA that Gächter et al. (2012) point out through the purchase of government bonds by the supranational central banking system. This result is essential because it helps to construct a uniform framework for the OCA theory. Therefore, this construction also helps to introduce ECO in the ECOWAS.

The ECB is the only organization capable of supporting the macroeconomy of the euro area as a whole, and the importance of the ECB in the euro area has increased relatively due to fiscal constraints. The ECB has implemented a QE policy to fulfill its role. This study shows that the implementation of QE in the euro area can stabilize the business cycle and increase the equilibrium national incomes of euro area countries as well as can be achieved through the OMT policy.

In this study, there is no discussion of how price fluctuations and risk premium might have affected the stability of models. Given that the inflation rate, the expected inflation rate, and risk premium play important roles in the stability, this limitation must be borne in mind. This means that we abstracted from the effect of potential instability that is due to the changes of the prices, risk premium, and price expectation for simplicity’s sake. Furthermore, we did not take into account the presence of countries outside the euro area. Therefore, in reality, capital flows to third countries may affect the effectiveness of the policy. Asada (2018) formulated a three-country Mundell–Fleming model with mixed types of fixed and flexible exchange rates. This model assumed that an integrated currency region and a third country are economically connected through a flexible exchange rate. However, the analysis becomes extremely complicated and does not yield precise results without making some limiting assumptions.

Even though QE is a necessary condition for the euro area economy to turn around and stabilize, it is not a sufficient condition. The euro area needs to continue its attempts to achieve solutions to its structural problems. These attempts include structural reforms to meet other OCA conditions, appropriate fiscal policy management, efforts toward fiscal union, and reform of the euro system. To counteract the short-term adverse effects of structural reforms, these reforms need to be carried out while the stimulus measures through QE policies are in effect. In time, through these efforts, the euro area can become an optimal currency area. These efforts may prove to be extremely important in saving the economies of the euro area countries from the turmoil caused by COVID-19.

Change history

18 April 2021

Figures were placed under section 2 incorrectly in PDF and aligned corrected in this version.

Notes

In the conventional dichotomy, the short-run model consists of fixed prices without capital accumulation, and the long-run model consists of flexible prices, capital accumulation, population growth, and technical progress. Thus, in this study, we assume that the medium-term model consists of a fixed price with capital accumulation and we omit growth factors because the economies in this model do not grow at the equilibrium point.

In this study, for the sake of simplicity, public bonds and stock are treated as perfect substitute goods. Therefore, the interest rate \(r_i\) is an average of various kinds of interest rates.

The model of perfect capital mobility is a special case in which \(\beta\) is infinite, and in this case the following equation is always established in the case of a fixed exchange rate system: \(r_1=r_2\).

References

Altavilla C (2004) Do EMU members share the same business cycle? J Common Mark Stud 42(5):869–896

Asada T (2004) A two-regional model of business cycles with fixed exchange rates: a Kaldorian approach. Stud Reg Sci 34(2):19–38

Asada T (2018) Koteisouba sei hendousouba sei kongou 3goku Mundell-Fleming model nitsuite: hukanzen shihonidou no baai (On a three country Mundell-Fleming model with mixed type of fixed and flexible exchange rates: the case of imperfect capital mobility). Chuo Daigaku Keizai Kenkyujo Nenpo Annu Inst Econ Res Chuo Univ 50:605–640

Asada T, Inaba T, Misawa T (2001) An interregional dynamic model: the case of fixed exchange rates. Stud Reg Sci 31(2):29–41

Asada T, Chiarella C, Flaschel P, Franke R (2003) Open economy macrodynamics: an integrated disequilibrium approach. Springer-Verlag, Berlin

Baldwin RE, Wyplosz C (2019) The economics of European integration, 4th edn. McGraw Hill

Belke A, Domnick C, Gros D (2017) Business cycle synchronization in the EMU: core vs. periphery. Open Econ Rev 28(5):863–892

Camacho M, Perez-Quiros G, Saiz L (2006) Are European business cycles close enough to be just one? J Econ Dyn Control 30(9–10):1687–1706

Darvas Z, Szapáry G (2008) Business cycle synchronization in the enlarged EU. Open Econ Rev 19(1):1–19

De Grauwe P (2018) Economics of Monetary Union, 12th edn. Oxford University Press

De Grauwe P, Ji Y (2016) Flexibility versus stability: a difficult tradeoff in the Eurozone. Credit Cap Mark Kredit Kap 49(3):375–413

De Grauwe P, Ji Y (2017) The international synchronisation of business cycles: the role of animal spirits. Open Econ Rev 28(3):383–412

De Haan J, Inklaar R, Jong-A-Pin R (2008) Will business cycles in the Euro area converge? A critical survey of empirical reserch. J Econ Surv 22(2):234–273

Gächter M, Riedl A, Ritzberger-Grünwald D (2012) Business cycle synchronization in the Euro area and the impact of the financial crisis. Monet Policy Econ Q2:33–60

Gandolfo G (2009) Economic dynamics, 4th edn. Springer, Berlin

Inaba T, Asada T (2020) On dynamics of a three-country Kaldorian model of business cycles with fixed exchange rates. In: Szidarovszky F, Bischi GI (eds) Games and dynamics in economics. Springer, Singapore, pp 103–124

Kaldor N (1940) A model of the trade cycle. Econ J 50(197):78–92

Kenen PB (1969) The theory of optimum currency areas: an eclectic view. The University of Chicago Press, pp 41–60

Keynes JM (1930) Problems of supernationl management. In: A treatise on money, vol 2. Applied theory of money, 1st edn, Macmillan, London

Krugman P (2012) Revenge of the optimum currency area. NBER Macroecon Annu 27(1):439–448

McKinnon RI (1963) Optimum currency areas. Am Econ Rev 53(4):717–725

Mongelli FP (2002) ‘New’ views on the optimum currency area theory: What is EMU telling us? In: European Central Bank working paper series (138)

Mundell R (1961) A theory of optimum currency areas. Am Econ Rev 51:657–665

Nakao M (2017) Macroeconomic instability of a capital markets union and stability of a fiscal union in the Euro area: Keynesian and Kaldorian two-country models. Int Econ 20:13–46

Nakao M (2019) Stability of business cycles and economic openness of monetary union: a Kaldorian two-country model. Evol Inst Econ Rev 16(1):65–89

Acknowledgements

An earlier version of this paper was presented at the 11th Nonlinear Economic Dynamics conference at Kyiv School of Economics, Kyiv, Ukraine, September 5, 2019. We would like to thank the participants for helpful comments. Any remaining error is due to solely our responsibility.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflict of interest to declare that is relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Proof of Proposition 1

Proof

It follows from Assumption 4 that we have \(\varPhi _{11}(\gamma _1, \theta _1)>0\) and \(\varPhi _{55}(\gamma _2, \theta _2)>0\) if all of the parameter values \(\gamma _1\), \(\theta _1\), \(\gamma _2\), and \(\theta _2\) are sufficiently close to zero. In this case, we have \(a_1<0\) for all sufficiently large values of the parameters \(\alpha _1\) and \(\alpha _2\) from Eq. (39), which violates one of the necessary conditions for the local stability of the equilibrium point [a set of inequalities (50)]. \(\square\)

Appendix 2: Proof of Lemma 1

Proof

Suppose that \(r_1=r_2=0\). In this case, it is obvious that \(a_6=a_7=a_8=\varDelta _6=\varDelta _7=\varDelta _8=0\) from Eqs. (44), (45), (46), (48f), (48g), and (48h). In addition, we have \(\varPhi _{11}(\gamma _1, \theta _1)<0\) and \(\varPhi _{55}(\gamma _2, \theta _2)<0\) if \(\gamma _1\) and \(\gamma _2\) are sufficiently large and both \(\theta _1\) and \(\theta _2\) are close to their economically meaningful upper bounds. Then, we have \(a_1=\varDelta _1>0\) for all sufficiently large values of \(\alpha _1>0\) and \(\alpha _2>0\) from Eqs. (39) and (48a).

We have \(\psi _1>0\), \(\psi _2>0\), \(\psi _3>0\), and \(\psi _4>0\) in Eqs. (40)–(43) for all sufficiently large values of \(\gamma _1>0\) and \(\gamma _2>0\) because of \(\lim _{\gamma _1 \rightarrow +\infty } \varPhi _{11}(\gamma _1, {\bar{\theta }}_1) = \lim _{\gamma _2 \rightarrow +\infty } \varPhi _{55}(\gamma _2, {\bar{\theta }}_2)=+\infty\). Then, we have \(a_2>0\), \(a_3>0\), \(a_4>0\), and \(a_5>0\) for all sufficiently large values of \(\alpha _1>0\), \(\alpha _2>0\), \(\gamma _1>0\), and \(\gamma _2>0\) from Eqs. (40) to (43).

If \(\alpha _1>0\) and \(\alpha _2>0\) are sufficiently large, the term \(\alpha _1\alpha _2>0\) dominates other term in Eq. (48b), so that we have \(\varDelta _2>0\). Next, the term \(\alpha _3\varDelta _2>0\) dominates the term \(-a_1^2a_4<0\) in Eq. (48c), so that we have \(\varDelta _3>0\). In addition, we obtain \(\varDelta _4=a_4\varDelta _3>0\) and \(\varDelta _5=a_5\varDelta _4>0\) from Eqs. (48d) and (48e) because of the assumption that \(r_1=r_2=0\). This proves Lemma 1. \(\square\)

Appendix 3: Proof of Proposition 2

Proof

Suppose that the parameter values \(\alpha _1\), \(\alpha _2\), \(\beta\), \(\gamma _1\), and \(\gamma _2\) are sufficiently large, and both \(\theta _1\) and \(\theta _2\) are close to their economically meaningful upper bounds, in addition to Assumption 4. Furthermore, suppose that \(r_1\) and \(r_2\) are positive, but they are sufficiently close to zero. In this case, we have the following set of inequalities from Lemma 1 because of the continuities of the functions with respect to the changes in the parameter values.

In Eq. (44), the term \(\alpha _1 \alpha _2 \psi _5\) dominates other terms and \(\psi _5\) becomes positive if \(r_1\) and \(r_2\) are positive but sufficiently close to zero and the parameter values \(\alpha _1>0\), \(\alpha _2>0\), \(\gamma _1>0\) and \(\gamma _2>0\) are sufficiently large. In this case, we have \(a_6>0\). The same reasoning applies to Eq. (45) so that we have \(a_7>0\) because

Furthermore, we can see that

Therefore, we obtain the following results:

In this case, we obtain \(\varDelta _6>0\) and \(\varDelta _7>0\). This proves Proposition 2. \(\square\)

Appendix 4: setting in numerical simulations

Based on the work of Asada (2004), we assume the following parameter values.

Furthermore, we assume that the functional forms of the LM equation, investment function, and current account function are as follows:

In this case, the eight-dimensional dynamical system (29)–(36) becomes as follows:

The equilibrium values of Eqs. (60)–(67) depend on the size of the parameters \(\gamma _1\), \(\gamma _2\), \(\theta _1\), and \(\theta _2\).

Now, we compute the trajectories produced by Eqs. (60)–(67) by selecting several values of \(\gamma _1\), \(\gamma _2\), \(\theta _1\), and \(\theta _2\) and the following initial conditions of variables in Figs. 1, 2, 3, 4, 5, 6, 7 and 8:

Initial conditions of variables in Figs. 9 and 10 are as follows.

Furthermore, initial conditions of variables in Figs. 11 and 12 are as follows.

About this article

Cite this article

Nakao, M., Asada, T. Purchase of government bonds by a supranational central bank: its impact on business cycles. Evolut Inst Econ Rev 19, 395–424 (2022). https://doi.org/10.1007/s40844-021-00207-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40844-021-00207-3

Keywords

- Optimum currency area

- Business cycle stability

- Kaldorian two-country model

- Euro area

- Outright monetary transactions

- Quantitative easing