Abstract

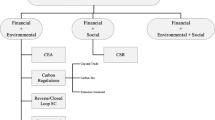

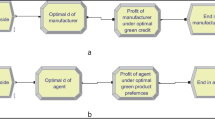

We identify that the United Nations (UN) Sustainable Development Goals (SDGs) of 7, 9, 12 pertaining to industry investment, innovation, affordability, clean product, and responsible consumption/production are relevant for the firms operating in closed-loop supply chain (CLSC) structures. We show how these goals can be implemented into a CLSC in which downstream manufacturer serves different types of consumers and engages in vertical relations with a supplier in the upstream. While the supplier invests in a green component, the manufacturer produces the final green product. The manufacturer diversifies its customer base and meet their demands through contracts and a variety of pricing options. Specifically, at the end of the supply chain there are three different customer groups: “contract customers”, “green-conscious customers”, and “wholesale market customers”. While the firms execute sustainability Goals of 7 and 9, the behavioral consumers who are the contract and green-conscious customers are altruistic, consume responsibly, and hence fulfill the Goal 12. We show that green consciousness and altruism play an important role on firm profitability and production. Furthermore, the SDGs proposed by the UN have welfare-improving implications. In particular, when the SDGs are implemented, all parties (firms and consumers) are better off compared to the benchmark case under which no SDGs are applied.

Similar content being viewed by others

Notes

While two-tier supply chains have been commonly examined, the performance assessments of supply chains with more than three connected tiers are rare (Wilhelm et al. 2016). In order to deal with effective management of sustainability issues, Sauer and Seuring (2019) perform a Delphi study (a structured group communication) and propose a cascaded multi-tier sustainable supply chain (MT-SSCM) approach linking the upstream and the downstream in minerals supply chain.

On the other hand, it could happen that the cost of production would go up, even if the investment is positive. An example for this case is that supplier engages in battery development for electric cars produced by downstream manufacturer. In that case, \(d_{I}<0\) might hold. Therefore, depending on the industry \(d_{I}\) could take a positive or a negative value in the model setting. If \(d_{I}>0\) then it is called “positive process innovation”. If \(d_{I}<0\) then it is called “negative process innovation”.

We assume that process innovation may reduce the marginal cost of production so that \(f_{I}\ge 0\). However, in some industries process innovation could increase the cost of production. In that case, one should assume \(f_{I}<0\).

References

Chavez, R., Yu, W., Jacobs, M., Fynes, B., Wiengarten, F., & Lecuna, A. (2015). Internal lean practices and performance: The role of technological turbulence. International Journal of Production Economics, 160, 157–171.

De Giovanni, P., Reddy, P. V., & Zaccour, G. (2016). Incentive strategies for an optimal recovery program in a closed-loop supply chain. European Journal of Operational Research, 249(2), 605–617.

Fliedner, G., & Majeske, K. (2010). Sustainability: The new lean frontier. Production and Inventory Management Journal, 46(1), 6–13.

Genc, T. S., & De Giovanni, P. (2021). Dynamic pricing and green investments under conscious, emotional, and rational consumers. Cleaner and Responsible Consumption, https://doi.org/10.1016/j.clrc.2021.100007.

Genc, T. S., & De Giovanni, P. (2020). Closed-loop supply chain games with innovation-led lean programs and sustainability. International Journal of Production Economics, 219, 440–456.

Genc, T. S., & De Giovanni, P. (2017). Trade-in and save: A two-period closed-loop supply chain game with price and technology dependent returns. International Journal of Production Economics, 183, 514–527.

Genc, T. S. (2017). The impact of lead time on capital investments. Journal of Economic Dynamics and Control, 82, 142–164.

Gimenez, C., & Sierra, V. R. J. (2012). Sustainable operations: Their impact on the triple bottom line. International Journal of Production Economics, 140, 149–159.

Gino, F., & Pisano, G. (2008). Toward a theory of behavioral operations. Manufacturing and Service Operations Management, 10(4), 676–691.

Gotschol, A., De Giovanni, P., & Vinzi, V. E. (2014). Is environmental management an economically sustainable business? Journal of Environmental Management, 144, 73–82.

Govindan, K., Soleimani, H., & Kannan, D. (2015). Reverse logistics and closed-loop supply chain: A comprehensive review to explore the future. European Journal of Operational Research, 240, 603–626.

Guide, V. D. R, Jr., & Van Wassenhove, L. N. (2009). The evolution of closed-loop supply chain research. Operations Research, 57(1), 10–18.

Hong, X., Govindan, K., Xu, L., & Du, P. (2017). Quantity and collection decisions in a closed-loop supply chain with technology licensing. European Journal of Operational Research, 256(3), 820–829.

Jasti, N., & Kodali, R. (2015). Lean production: literature review and trends. International Journal of Production Research, 53(3), 867–885.

Kaya, O. (2010). Incentive and production decisions for remanufacturing operations. European Journal of Operational Research, 201(2), 442–453.

Kobayashi, S. (2015). On a dynamic model of cooperative and noncooperative R and D in oligopoly with spillovers. Dynamic Games and Applications, 5(4), 599–619.

Laroche, M., Bergeron, J., & Barbaro-Forleo, G. (2001). Targeting consumers who are willing to pay more for environmentally friendly products. Journal of Consumer Marketing, 18(6), 503–520.

Loch, C. H., & Wu, Y. (2007). Behavioral operations management, foundation and trends. Delft.

Martinez-Jurado, P. J., & Moyano-Fuentes, J. (2013). Lean management, supply chain management and sustainability: A literature review. Journal of Cleaner Production, 85, 134–150.

Rothenberg, S., Pil, F. K., & Maxwell, J. (2001). Lean, green, and the quest for superior environmental performance. Production and Operations Management, 10(3), 228–243.

Sauer, P. C., & Seuring, S. (2019). Extending the reach of multi-tier sustainable supply chain management—insights from mineral supply chain. International Journal of Production Economics, 217, 31–43.

Savaskan, R. C., Bhattacharya, S., & Van Wassenhove, L. N. (2004). Closed-loop supply chain models with product remanufacturing. Management Science, 50(2), 239–252.

Wilhelm, M., Blome, C., Wieck, E., & Xiao, C. Y. (2016). Implementing sustainability in multi-tier supply chains: Strategies and contingencies in managing sub-suppliers. International Journal of Production Economics, 182, 196–212.

Yang, M. G. M., Hong, P., & Modi, S. B. (2011). Impact of lean manufacturing and environmental management on business performance: An empirical study of manufacturing firms. International Journal of Production Economics, 129(2), 251–261.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I thank Kannan Govindan, anonymous referees, and seminar participants at McMaster, Catholic Milan, LUISS, and Jinan-Birmingham for useful suggestions and comments.

Appendix

Appendix

Proof of Proposition 1:

Assuming that all three goals (of 7,9, and 12) are executed the optimality conditions are as follows.

The first order necessary condition with respect to optimal output in market T1 is

\(\frac{\partial E\Pi ^{M}}{\partial q_{1}}=p_{1}-2(c_{M}-d_{I})q_{1}-w+\alpha (Ep_{3}-p_{1}-\epsilon _{1})=0\). The second order condition satisfies \(\frac{\partial ^2\Pi ^{M}}{\partial q_{1}^2}=-2(c_{M}-d_{I})<0\) because \(c_{M}-d_{I}>0\) by assumption. This implies

The expected profit maximizing level of production in market T2 satisfies

\(\frac{\partial E\Pi ^{M}}{\partial q_{2}}=a_{2}-2b_{2}q_{2}+c_{2}eI-2(c_{M}-d_{I})q_{2}-w=0\). The second order condition satisfies \(\frac{\partial ^2\Pi ^{M}}{\partial q_{2}^2}=-2(b_{2}+c_{M}-d_{I})<0\) because \(c_{M}-d_{I}>0\) and \(b_{2}>0\) by assumption. This implies

In the wholesale market T3, the optimal output satisfies

\(\frac{\partial E\Pi ^{M}}{\partial q_{3}}=Ep_{3}-2(c_{M}-d_{I})q_{3}-w=0\). The second order condition is \(\frac{\partial ^2\Pi ^{M}}{\partial q_{3}^2}=-2(c_{M}-d_{I})<0\) because \(c_{M}-d_{I}>0\) by assumption. This implies

The outputs in (32)–(34) are the best response functions of M for a given level of wholesale price w and the investment I chosen by S to satisfy the Goal 9. Observe that the Goal 7 leads to higher outputs in the respective customer groups.

In the upstream layer of the industry, given the production strategies of M, S will maximize its profit function in (11) to choose its investment level (Goal 9) as well as its wholesale price, which will be affected by the SGs in the CLSC:

The first order necessary condition with respect to wholesale price is

\(\frac{\partial \Pi ^{S}}{\partial w}=(w-(f_{S}-f_{I}))[-2/2(c_{M}-d_{I})-1/(2(c_{M}-d_{I})+2b_{2})]+(q_{1}(w)+q_{2}(w,\,I)+q_{3}(w))=0\). The second order condition is \(\frac{\partial ^2\Pi ^{S}}{\partial w^2}=-[6(c_{M}-d_{I})+4b_{2}]/[4(c_{M}-d_{I})(c_{M}-d_{I}+b_{2})]<0\) because \(c_{M}-d_{I}>0\) by assumption. Here the total output produced by the S or the M in all markets is

Then the equilibrium wholesale price as a function of the “green investment” is

Observe that the wholesale price is increasing in the expected price (\(Ep_{3}\)) charged to the wholesale market customers T3, and increasing in greenness level of the product (eI), defined in expression (4).

The profit maximizing level of green investment satisfies

\(\frac{\partial \Pi ^{S}}{\partial I}=(w-(f_{S}-f_{I}))\frac{\partial q_{2}}{\partial I}-h_{1}I=0\)

The second order condition satisfies \(\frac{\partial ^2\Pi ^{S}}{\partial I ^2}=-h_{1}<0\) because \(h_{1}>0\) by assumption. This implies

Solving (36) and (37) together we obtain Stackelberg equilibrium wholesale price and investment as a function of model parameters.

The expression in (36) becomes

where \(c=(c_{M}-d_{I})\), \(f=(f_{S}-f_{I})\), \(K_{0}=c+b_{2}\), and \(K_{1}=3c+2b_{2}\).

Note that the equilibrium wholesale price w charged to the manufacturer increases in retail prices. \(\square \)

Proof of Lemma 1:

This case boils down to involve no investment, \(I=0\), because the Goal 9 is not pursued. Then, demand, return, and cost functions reach to their reduced forms as such the following model parameters become zero: \(\gamma =c_{2}=e=f_{I}=d_{I}=0\). Furthermore, \(h_{1}=0\) which is implied by zero investment cost so that \(D(I)=0\).

Inserting these parameter values into the equilibrium conditions in the proof of Proposition 1 we obtain that

The production for the second market is

In market \(T_{3}\), the optimal output is

The total output produced for all markets is

When S does not invest its objective function becomes

The first order necessary condition with respect to the wholesale price is

\(\frac{\partial \Pi ^{S}}{\partial w}=(w-f_{S})[-2/2c_{M}-1/2(c_{M}+b_{2}]+(q_{1}(w)+q_{2}(w)+q_{3}(w))=0\)

which implies that

Hence, the result. \(\square \)

Proof of Proposition 2:

When the investment (Goal 9) provides benefit only to returns and demand so that the Goal 12 is satisfied, all model parameters will be positive but \(f_{I}=d_{I}=0\), which are the cost improvement parameters. Inserting these parameters into the equilibrium outcomes in the proof of Proposition 1 we obtain that in the T1 market

The expected profit maximizing level of production in market T2 satisfies

In the wholesale market T3, the optimal output satisfies

In the upstream layer of the industry, the equilibrium wholesale price as a function of the “green investment” is

The profit maximizing level of innovation satisfies

\(\frac{\partial \Pi ^{S}}{\partial I}=(w-f_{S})\frac{\partial q_{2}}{\partial I}-h_{1}I=0\)

which implies

Inserting this investment function into the wholesale price results in

where \(K_{2}=c_{M}+b_{2}\), and \(K_{3}=3c_{M}+2b_{2}\). \(\square \)

Proof of Proposition 3:

M will maximize its expected profit function:

The first order necessary condition with respect to output in market T1 is

\(\frac{\partial E\Pi ^{M}}{\partial q_{1}}=p_{1}-2(c_{M}-d_{I})q_{1}-w+\alpha (Ep_{3}-p_{1}-\epsilon _{1})=0\)

This condition implies

The expected profit maximizing level of production in market T2 satisfies

\(\frac{\partial E\Pi ^{M}}{\partial q_{2}}=a_{2}-2b_{2}q_{2}-2(c_{M}-d_{I})q_{2}-w=0\)

which implies

In the wholesale market T3, the optimal output satisfies

\(\frac{\partial E\Pi ^{M}}{\partial q_{3}}=Ep_{3}-2(c_{M}-d_{I})q_{3}-w=0\)

which implies

Given the production strategies of M, S will maximize its profit function:

The first order necessary condition with respect to wholesale price is

\(\frac{\partial \Pi ^{S}}{\partial w}=(w-(f_{S}-f_{I}))[-2/2(c_{M}-d_{I})-1/(2(c_{M}-d_{I})+2b_{2})]+(q_{1}(w)+q_{2}(w,\,I)+q_{3}(w))=0\)

where the total output in all markets is

Then the equilibrium wholesale price as a function of the “green investment” is

Observe that the wholesale price is increasing in the expected price (\(Ep_{3}\)) charged to the wholesale market customers.

The profit maximizing level of innovation satisfies

\(\frac{\partial \Pi ^{S}}{\partial I}=-h_{1}I<0\)

which implies \(I=0\).

No investment by the supplier will imply that the CLSC will experience no cost reductions. Therefore, the cost coefficients will be \(d_{I}=f_{I}=0\). Consequently the result in the proposition holds. \(\square \)

Proof of Proposition 4:

When the industry innovation (i.e., investment) only impacts returns and demand (Proposition 2), so that the production costs are intact, the following parameters will be zero: \(f_{I}=d_{I}=0\). Clearly \(c_{2},\,h_{1},\,e\,>0\) which are demand and investment function coefficients.

At \(f_{I}=d_{I}=0\) the wholesale price in (21) gets

When SDGs are not implemented we know from Lemma 1 that

Clearly \(w_{P2}>w_{L1}\) because \(I_{P2}>0\) in Proposition 2, and \(c_{2},\,e>0\), and \(p_{1}\) is fixed at the contract, and \(Ep_{3}\) is the same market shock in both cases.

As the wholesale price is higher in the upstream, downstream prices will also be higher because output prices increase in input prices. Alternatively, when SDGs are not applied, the outputs satisfy, as in Lemma 1,

The production for the second market is

In the third market the optimal output is

When the investment is strategic so that it benefits the demand and returns in market \(T_2\), we obtain

Because \(w_{P2}(I)>w_{L1}\) and \(I_{P2}>0\) we obtain that

\(q_{1,L1}>q_{1,P2}\) and \(q_{3,L1}>q_{3,P2}\). Therefore, the M produces less in markets T1 and T3. As M is a price taker in market T3 and already set the price in market T1 through contract, prices \(p_{1}\) and \(p_{3}\) will be intact.

However, the M will produce more and charge a higher price when it invests because this shifts demand upward. Therefore, \(q_{2,P2}>q_{2,L1}\) and \(p_{2,P2}>p_{2,L1}\). Alternatively, as wholesale price increases, that is \(w_{P2}>w_{L1}\), the retail price goes up \(p_{2,P2}>p_{2,L1}\) too.

An alternative proof to show that \(q_{2,P2}>q_{2,L1}\) is as follows:

It holds that\(\underset{I_{P2}\rightarrow 0}{lim}\,q_{2,P2}=q_{2,L1}\) and \(\partial q_{2,P2}/\partial I_{P2}>0\), that is the output with SDGs is increasing in investment and the lower bound of output with SDGs approaches the output without SDGs, therefore \(q_{2,P2}>q_{2,L1}\) must hold.

The result with respect to returns directly follows from the ranking of outputs in T1 market (higher output higher returns) and investment ranking in T2 market (higher investment lower returns).

Finally, using the limit argument \(\underset{I_{P2}\rightarrow 0}{lim}\,\Pi _{P2}^{S}=\Pi _{L1}^{S}\) furthermore \(\Pi _{P2}^{S}\) is concave in investment \(I_{P2}\) as it gets its maximum in Proposition 2. Therefore, an incremental investment by S under the SDGs would lead its profit to go up. Similar arguments also hold for M. \(\square \)

Rights and permissions

About this article

Cite this article

Genc, T.S. Implementing the United Nations sustainable development Goals to supply chains with behavioral consumers. Ann Oper Res (2021). https://doi.org/10.1007/s10479-021-04037-9

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-021-04037-9