Abstract

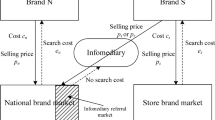

Online platforms provide sellers’ products on their websites and earn a commission fee for each unit sold. Recently, many platforms have tried to refer customers to their direct competitors. In this paper, we explain this counter-intuitive practice by developing a game-theoretic model where two competing platforms contracting with one common seller or two competing sellers. We first analyze a benchmark case where platforms and sellers are integrated, finding that competitor referral will aggregate competition and thus neither platform is willing to refer its competitor voluntarily. However, when each platform serves as a marketplace for an independent seller, it is possible that a platform voluntarily refers its competitor. The rationale is that there exists a double marginalization problem when platforms set commission fees and sellers set prices, resulting in low efficiency of product selling. By referring visitors to their competitors, platforms can introduce cannibalization to cope with the double marginalization problem. We also investigate the case when the two platforms serve one common seller, finding that as long as the seller does not charge discriminated prices for the same product, the platforms may also apply referral. This is because the benefits of the two platforms are more aligned when the common seller sets a common price. Thus, online referral which helps the competitor may also help the referring platform itself. This paper also makes serval extensions to check the robustness of the model.

Similar content being viewed by others

Notes

There are two ways to model the commission fee in the literature: a fixed commission (our paper, Jiang et al. 2011; Mantin et al. 2014; Hagiu and Wright 2015) and a revenue sharing commission (Ryan et al. 2012; Abhishek et al. 2016; Kwark et al. 2017). When there is competition and commission fee is endogenously chosen, researchers often use the fixed commission model rather than the revenue sharing model, simply because the latter is too complicated to obtain analytical solutions. However, as discussed in (Mantin et al. 2014), the two commission forms influence prices toward the same direction, and thus the results do not qualitatively change if we use the revenue sharing model.

A comparison between the benchmark and the two-seller format reveals that the role of competitor referral critically interplays with the vertical relationship in a platform context.

As will be shown in the extensions, if competitor referral is not 100% perfect, in equilibrium the two platforms may simultaneously refer each other.

Note that this indirect effect does not exist under DP where the seller can always benefit from referral by simply charging a high price on the referring platform whilst charging a low price on the referred platform. Under this circumstance, the referring platform would not be more powerful when contracting with the seller.

References

Abhishek, V., Jerath, K., & Zhang, Z. J. (2016). Agency selling or reselling? Channel structures in electronic retailing. Management Science, 62(8), 2259–2280.

Arbatskaya, M., & Konishi, H. (2012). Referrals in search markets. International Journal of Industrial Organization, 30(1), 89–101.

Armelini, G., Barrot, C., & Becker, J. U. (2015). Referral programs, customer value, and the relevance of dyadic characteristics. International Journal of Research in Marketing, 32(4), 449–452.

Bhargava, H. K., & Choudhary, V. (2004). Economics of an information intermediary with aggregation benefits. Information Systems Research, 15(1), 22–36.

Cai, G. (2010). Channel selection and coordination in dual-channel supply chains. Journal of Retailing, 86(1), 22–36.

Cai, G., & Chen, Y. (2011). In-store referrals on the internet. Journal of Retailing, 87(4), 563–578.

Cai, G., Dai, Y., & Zhou, S. X. (2012). Exclusive channels and revenue sharing in a complementary goods market. Marketing Science, 31(1), 172–187.

Chen, Y., Iyer, G., & Padmanabhan, V. (2002). Referral infomediaries. Marketing Science, 21(4), 412–434.

Dixit, A. (1979). A model of duopoly suggesting a theory of entry barriers. Bell Journal of Economics, 10(1), 20–32.

Dose, D., Walsh, G., Beatty, S. E., & Elsner, R. (2019). Unintended reward costs: The effectiveness of customer referral reward programs for innovative products and services. Journal of the Academy of Marketing Science, 47(3), 438–459.

Garicano, L., & Santos, T. (2004). Referrals. American Economic Review, 94(3), 499–525.

Garnefeld, I., Eggert, A., Helm, S. V., & Tax, S. S. (2013). Growing existing customers’ revenue streams through customer referral programs. Journal of Marketing, 77(4), 17–32.

Ghose, A., Mukhopadhyay, T., & Rajan, U. (2007). The impact of internet referral services on a supply chain. Information Systems Research, 18(3), 300–319.

Goyal, M., & Netessine, S. (2007). Strategic technology choice and capacity investment under demand uncertainty. Management Science, 53(2), 192–207.

Hagiu, A., & Wright, J. (2015). Multi-sided platforms. International Journal of Industrial Organization, 43, 162–174.

Hagiu, A., Jullien, B., & Wright, J. (2020). Creating platforms by hosting rivals. Management Science. https://doi.org/10.1287/mnsc.2019.3356. (forthcoming).

Ingene, C. A., & Parry, M. E. (2004). Mathematical models of distribution channels. New York: Springer.

Ingene, C. A., & Parry, M. E. (2007). Bilateral monopoly, identical distributors, and game-theoretic analyses of distribution channels. Journal of the Academy of Marketing Science, 35(4), 586–602.

Jiang, B., Jerath, K., & Srinivasan, K. (2011). Firm strategies in the “mid tail” of platform-based retailing. Marketing Science, 30(5), 757–775.

Kuksov, D., Prasad, A., & Zia, M. (2017). In-store advertising by competitors. Marketing Science, 36(3), 402–425.

Kwark, Y., Chen, J., & Raghunathan, S. (2017). Platform or wholesale? A strategic tool for online retailers to benefit from third-party information. MIS Quarterly, 41(3), 763–785.

Lal, R., Little, J. D. C., & Villas-Boas, J. M. (1996). A theory of forward buying, merchandising, and trade deals. Marketing Science, 15(1), 21–37.

Lus, B., & Muriel, A. (2009). Measuring the impact of increased product substitution on pricing and capacity decisions under linear demand models. Production and Operations Management, 18(1), 95–113.

Mantin, B., Krishnan, H., & Dhar, T. (2014). The strategic role of third-party marketplaces in retailing. Production and Operations Management, 23(11), 1937–1949.

McGahan, A. M., & Ghemawat, P. (1994). Competition to retain customers. Marketing Science, 13(2), 165–176.

Narasimhan, C. (1988). Competitive promotional strategies. Journal of Business, 61(4), 427–449.

Ryan, J. K., Sun, D., & Zhao, X. (2012). Competition and coordination in online marketplaces. Production and Operations Management, 21(6), 997–1014.

Ryu, G., & Feick, L. (2007). A penny for your thoughts: Referral reward programs and referral likelihood. Journal of Marketing, 71(1), 84–94.

Singh, N., & Vives, X. (1984). Price and quantity competition in a differentiated duopoly. RAND Journal of Economics, 15(4), 546–554.

Schmitt, P., Skiera, B., & Van den Bulte, C. (2011). Referral programs and customer value. Journal of Marketing, 75(1), 46–59.

Spence, M. (1976). Product differentiation and welfare. American Economic Review, 66(2), 407–414.

Van den Bulte, C. V., Bayer, E., Skiera, B., & Schmitt, P. (2018). How customer referral programs turn social capital into economic capital. Journal of Marketing Research, 55(1), 132–146.

Varian, R. H. (1980). A model of sales. American Economic Review, 70(4), 651–659.

Verlegh, P. W., Ryu, G., Tuk, M. A., & Feick, L. (2013). Receiver responses to rewarded referrals: The motive inferences framework. Journal of the Academy of Marketing Science, 41(6), 669–682.

Viswanathan, S., Kuruzovich, J., Gosain, S., & Agarwal, R. (2007). Online infomediaries and price discrimination: Evidence from the automotive retailing sector. Journal of Marketing, 71(3), 89–107.

Weber, T. A., & Zheng, Z. (2007). A model of search intermediaries and paid referrals. Information Systems Research, 18(4), 414–436.

Wu, H., Cai, G., Chen, J., & Sheu, C. (2015). Online manufacturer referral to heterogeneous retailers. Production and Operations Management, 24(11), 1768–1782.

Zhang, J., Liu, Z., & Rao, R. S. (2018). Flirting with the enemy: Online competitor referral and entry-deterrence. Quantitative Marketing and Economics, 16(2), 209–249.

Acknowledgements

This work is supported by the National Natural Science Foundation of China [Grants No. 71972173, No. 71801206, No. 71520107002] and USTC Research Funds of the Double First-Class Initiative (YD 2040002004).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Zhang, J., Cao, Q. & He, X. Competitor referral by platforms. Ann Oper Res 329, 757–780 (2023). https://doi.org/10.1007/s10479-021-04020-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04020-4