Abstract

This paper proposes a method for project selection based on stochastic dominance (SD) and fuzzy theory. Using fuzzy theory and stochastic dominance, the method is tested using data from real-world projects. The findings show the importance of the proposed methodology improved existing methods in two ways: (1) This research alleviates the subjective bias in risk assessment in estimating the expected value hidden in the project portfolio (2) Adding the stochastic dominance rule to the fuzzy ranking process contributes to efficiency in project portfolio selection. The study contributes to the literature by exploring the combination of both fuzzy theory and stochastic dominance. For practitioner significance, managers can identify key uncertainty factors and estimate value in managing project portfolios.

Similar content being viewed by others

References

Aarseth, W., Ahola, T., Aaltonen, K., Økland, A., Andersen, B.: Project sustainability strategies: a systematic literature review. Int. J. Project Manage. 35(6), 1071–1083 (2017)

Akkermans, J., Keegan, A., Huemann, M., Ringhofer, C.: Crafting project managers’ careers: integrating the fields of careers and project management. Project Manag. J. 51(2), 135–153 (2020)

Alghamdi, M., Alshehri, N.O., Akram, M.: Multi-criteria decision-making methods in bipolar fuzzy environment. Int. J. Fuzzy Syst. 20(6), 2057–2064 (2018)

Anantatmula, V.S., Rad, P.F.: Role of organizational project management maturity factors on project success. Eng. Manage. J. 30(3), 165–178 (2018)

Archer, N.P., Ghasemzadeh, F.: An integrated framework for project portfolio selection. Int. J. Project Manage. 17(4), 207–216 (1999)

Arvanitis, S., Scaillet, O., Topaloglou, N.: Spanning tests for Markowitz stochastic dominance. J. Econometr. 217(2), 291–311 (2020)

Awasthi, A., Omrani, H.: A goal-oriented approach based on fuzzy axiomatic design for sustainable mobility project selection. Int. J. Syst. Sci. 6(1), 86–98 (2019)

Azimi, S., Rahmani, R., Fateh-rad, M.: Investment cost optimization for industrial project portfolios using technology mining. Technol. Forecast. Soc. Chang. 138, 243–253 (2019)

Baccarini, D.: The concept of project complexity—a review. Int. J. Project Manage. 14(4), 201–204 (1996)

Ballesteros-Pérez, P., Cerezo-Narváez, A., Otero-Mateo, M., Pastor-Fernández, A., Zhang, J., Vanhoucke, M.: Forecasting the project duration average and standard deviation from deterministic schedule information. Appl. Sci. 10(2), 654 (2020)

Banerjee, S.: Contravention between NPV & IRR due to timing of cash flows: a case of capital budgeting decision of an oil refinery company. Am. J. Theor. Appl. Bus. 1(2), 48–52 (2015)

Baqeri, K., Mohammadi, E., Gilani, M.: Multi objective project portfolio selection. J. Project Manage. 4(4), 249–256 (2019)

Barucke Marcondes, G.A., Leme, R.C., Leme, M.D.S., Sanches da Silva, C.E.: Using mean-Gini and stochastic dominance to choose project portfolios with parameter uncertainty. Eng. Econ. 62(1), 33–53 (2017)

Batselier, J., Vanhoucke, M.: Construction and evaluation framework for a real-life project database. Int. J. Project Manage. 33(3), 697–710 (2015)

Biswas, T.K., Zaman, K.: A fuzzy-based risk assessment methodology for construction projects under epistemic uncertainty. Int. J. Fuzzy Syst. 21(4), 1221–1240 (2019)

Black, M.: Vagueness. An exercise in logical analysis. Philosophy of science 4(4), 427–455 (1937)

Błaszczyk, T., Nowak, M.: Multiple-criteria interactive procedure in project management. In: A. K. Zavadskas, M. J. Skibniewski (eds.) The 25th International Symposium on Automation and Robotics in Construction, Lithuania, pp. 533–540 (2008)

Bruni, R., Cesarone, F., Scozzari, A., Tardella, F.: On exact and approximate stochastic dominance strategies for portfolio selection. Eur. J. Oper. Res. 259(1), 322–329 (2017)

Buch, V., Damle, P.: Project portfolio stakeholder identification and classification: an empirical study. J. Manage. Res. 19(3), 145–156 (2019)

Cakmakci, M.: Interaction in Project Management Approach Within Industry 4.0. Advances in Manufacturing II, pp. 176–189. Springer, New York (2019)

Carlsson, C., Fullér, R., Heikkilä, M., Majlender, P.: A fuzzy approach to R&D project portfolio selection. Int. J. Approximate Reason. 44(2), 93–105 (2007)

Chen, S.-P., Hsueh, Y.-J.: A simple approach to fuzzy critical path analysis in project networks. Appl. Math. Model. 32(7), 1289–1297 (2008)

Cheng, C.-H.: A new approach for ranking fuzzy numbers by distance method. Fuzzy Sets Syst. 95(3), 307–317 (1998)

Cheshmberah, M.: Projects portfolio determination based on key stakeholders’ expectations and requirements: evidence from public university projects. J. Project Manage. 5(2), 139–150 (2020)

Costa, H.R., Barros, M.D.O., Travassos, G.H.: Evaluating software project portfolio risks. J. Syst. Softw. 80(1), 16–31 (2007)

Damnjanovic, I., Reinschmidt, K.: Project Risk Management Fundamentals. Data Analytics for Engineering and Construction Project Risk Management, pp. 23–41. Springer, New York (2020)

Danesh, D., Ryan, M.J., Abbasi, A.: A systematic comparison of multi-criteria decision making methods for the improvement of project portfolio management in complex organisations. Int. J. Manage. Decision Making 16(3), 280–320 (2017)

Daskalaki, C., Skiadopoulos, G., Topaloglou, N.: Diversification benefits of commodities: a stochastic dominance efficiency approach. J. Emp. Finance 44, 250–269 (2017)

Di Matteo, M., Maier, H.R., Dandy, G.C.: Many-objective portfolio optimization approach for stormwater management project selection encouraging decision maker buy-in. Environ. Model. Softw. 111, 340–355 (2019)

Dixit, V., Tiwari, M.K.: Project portfolio selection and scheduling optimization based on risk measure: a conditional value at risk approach. Ann. Oper. Res. 285(1–2), 9–33 (2020)

Dubois, D., Prade, H.: Operations on fuzzy numbers. Int. J. Syst. Sci. 9(6), 613–626 (1978)

Durmuşoğlu, Z.D.U.: Assessment of techno-entrepreneurship projects by using Analytical Hierarchy Process (AHP). Technol. Soc. 54, 41–46 (2018)

Esfahani, H.N., Hossein Sobhiyah, M., Yousefi, V.R.: Project portfolio selection via harmony search algorithm and modern portfolio theory. Procedia-Soc. Behav. Sci. 226, 51–58 (2016)

Gemünden, H.G., Lehner, P., Kock, A.: The project-oriented organization and its contribution to innovation. Int. J. Project Manage. 36(1), 147–160 (2018)

Haehl, C., Spinler, S.: Technology choice under emission regulation uncertainty in international container shipping. Eur. J. Oper. Res. 284(1), 383–396 (2020)

Hillier, F.S.: The derivation of probabilistic information for the evaluation of risky investments. Manage. Sci. 9(3), 443–457 (1963)

Hopkinson, M.: The case for project net present value (NPV) and NPV risk models. PM World J. 5(6), 1–9 (2016)

Huang, X., Zhao, T., Kudratova, S.: Uncertain mean-variance and mean-semivariance models for optimal project selection and scheduling. Knowl.-Based Syst. 93, 1–11 (2016)

Jafarzadeh, H., Akbari, P., Abedin, B.: A methodology for project portfolio selection under criteria prioritisation, uncertainty and projects interdependency–combination of fuzzy QFD and DEA. Expert Syst. Appl. 110, 237–249 (2018)

Jeng, D.J.-F., Huang, K.-H.: Strategic project portfolio selection for national research institutes. J. Bus. Res. 68(11), 2305–2311 (2015)

Jeunet, J., Orm, M.B.: Optimizing temporary work and overtime in the Time Cost Quality Trade-off Problem. Eur. J. Oper. Res. 284(2), 743–761 (2020)

Jin, G., Sperandio, S., Girard, P.: Management of the design process: human resource allocation and project selection in factories of the future. Syst. Issue 22(4), 17–19 (2020)

Karasakal, E., Aker, P.: A multicriteria sorting approach based on data envelopment analysis for R&D project selection problem. Omega 73, 79–92 (2017)

Kay, J., King, M.: Radical Uncertainty: Decision-Making Beyond the Numbers. WW Norton & Company, New York (2020)

Kerzner, H., Kerzner, H.R.: Project Management: A Systems Approach to Planning, Scheduling, and Controlling. Wiley, Hoboken (2017)

Kopmann, J., Kock, A., Killen, C.P.: Project Portfolio Management: The Linchpin in Strategy Processes. Cambridge Handbook of Organizational Project Management. Cambridge University Press, Cambridge (2017)

Kordova, S., Katz, E., Frank, M.: Managing development projects—The partnership between project managers and systems engineers. Syst. Eng. 22(3), 227–242 (2019)

Korhonen, T., Laine, T., Martinsuo, M.: Management control of project portfolio uncertainty: a managerial role perspective. Project Manage. J. 45(1), 21–37 (2014)

Korotkov, V., Wu, D.: Evaluating the quality of solutions in project portfolio selection. Omega 91, 102029 (2020)

Kusy, M.I., Ziemba, W.T.: A bank asset and liability management model. Oper. Res. 34(3), 356–376 (1986)

Lahtinen, N., Mustonen, E., Harkonen, J.: Commercial and technical productization for fact-based product portfolio management over lifecycle. IEEE Trans. Eng. Manage. (2019). https://doi.org/10.1109/TEM.2019.2932974

Lee, E., Li, R.-J.: Comparison of fuzzy numbers based on the probability measure of fuzzy events. Comput. Math. Appl. 15(10), 887–896 (1988)

Levy, H.: Stochastic dominance: Investment decision making under uncertainty. Springer, New York (2015)

Li, X., Huang, Y.-H., Fang, S.-C., Zhang, Y.: An alternative efficient representation for the project portfolio selection problem. Eur. J. Oper. Res. 281(1), 100–113 (2020)

Liu, F., Chen, Y.-W., Yang, J.-B., Xu, D.-L., Liu, W.: Solving multiple-criteria R&D project selection problems with a data-driven evidential reasoning rule. Int. J. Project Manage. 37(1), 87–97 (2019)

Liu, P., Zhu, B., Wang, P.: A multi-attribute decision-making approach based on spherical fuzzy sets for Yunnan Baiyao’s R&D project selection problem. Int. J. Fuzzy Syst. 21(7), 2168–2191 (2019)

Ma, J., Harstvedt, J.D., Jaradat, R., Smith, B.: Sustainability driven multi-criteria project portfolio selection under uncertain decision-making environment. Comput. Ind. Eng. 140, 106236 (2020)

Martinsuo, M., Korhonen, T., Laine, T.: Identifying, framing and managing uncertainties in project portfolios. Int. J. Project Manage. 32(5), 732–746 (2014)

Martinsuo, M., Lehtonen, P.: Role of single-project management in achieving portfolio management efficiency. Int. J. Project Manage. 25(1), 56–65 (2007)

Martinsuo, M., Lehtonen, P.: Project autonomy in complex service development networks. Int. J. Manag. Projects Bus. 2(2), 261–281 (2009)

Meskendahl, S.: The influence of business strategy on project portfolio management and its success—a conceptual framework. Int. J. Project Manage. 28(8), 807–817 (2010)

Moeini, M., Rivard, S.: Sublating tensions in the IT project risk management literature: a model of the relative performance of intuition and deliberate analysis for risk assessment. J. Assoc. Inf. Syst. 20(3), 243–284 (2019)

Mohamed, S., McCowan, A.K.: Modelling project investment decisions under uncertainty using possibility theory. Int. J. Project Manage. 19(4), 231–241 (2001)

Moselhi, O., Deb, B.: Project selection considering risk. Constr. Manage. Econ. 11(1), 45–52 (1993)

Muhuri, P.K., Nath, R., Shukla, A.K.: Energy efficient task scheduling for real-time embedded systems in a fuzzy uncertain environment. IEEE Trans. Fuzzy Syst. (2020). https://doi.org/10.1109/TFUZZ.2020.2968864

Namazian, A., Haji Yakhchali, S., Rabbani, M.: Integrated bi-objective project selection and scheduling using Bayesian networks: a risk-based approach. Scientiairanica 26(6), 3695–3711 (2019)

Ogwueleka, A.: Stochastic dominance in projects. Int. J. Project Organ. Manage. 2(2), 208–217 (2010)

Olson, D.L., Wu, D.: Portfolio Selection Under Fuzzy and Stochastic Uncertainty. Enterprise Risk Management Models, pp. 171–183. Springer, New York (2010)

Orgut, R.E., Batouli, M., Zhu, J., Mostafavi, A., Jaselskis, E.J.: Critical factors for improving reliability of project control metrics throughout project life cycle. J. Manage. Eng. 36(1), 04019033 (2020)

Owusu, E.K., Chan, A.P., Shan, M.: Causal factors of corruption in construction project management: an overview. Sci. Eng. Ethics 25(1), 1–31 (2019)

Pajares, J., López, A.: New methodological approaches to project portfolio management: the role of interactions within projects and portfolios. Procedia 119, 645–652 (2014)

Pal, N.R., Bezdek, J.C.: Measuring fuzzy uncertainty. IEEE Trans. Fuzzy Syst. 2(2), 107–118 (1994)

Park, C.S., Sharp-Bette, G.P.: Advanced Engineering Economics. Wiley, Hoboken (1990)

Perez, F., Gomez, T.: Multiobjective project portfolio selection with fuzzy constraints. Ann. Oper. Res. 245(1–2), 7–29 (2016)

Petro, Y., Ojiako, U., Williams, T., Marshall, A.: Organizational ambidexterity: using project portfolio management to support project-level ambidexterity. Prod. Plan. Control 31(4), 287–307 (2020)

Piryonesi, S.M., Nasseri, M., Ramezani, A.: Resource leveling in construction projects with activity splitting and resource constraints: a simulated annealing optimization. Can. J. Civ. Eng. 46(2), 81–86 (2019)

Pramanik, D., Mondal, S.C., Haldar, A.: A framework for managing uncertainty in information system project selection: an intelligent fuzzy approach. Int. J. Manage. Sci. Eng. Manage. 15(1), 70–78 (2020)

Qi, Y., Li, X., Zhang, S.: Optimizing 3-objective portfolio selection with equality constraints and analyzing the effect of varying constraints on the efficient sets. J. Ind. Manage. Opt. 13(5), 1 (2017)

Radziszewska-Zielina, E., Śladowski, G., Kania, E., Sroka, B., Szewczyk, B.: Managing information flow in self-organising networks of communication between construction project participants. Arch. Civil Eng. 65(2), 133–148 (2019)

Ringuest, J.L., Graves, S.B., Case, R.H.: Mean–Gini analysis in R&D portfolio selection. Eur. J. Oper. Res. 154(1), 157–169 (2004)

Saaty, T.L., Vargas, L.G.: Hierarchical analysis of behavior in competition - prediction in chess. Behav. Sci. 25(3), 180–191 (1980)

Sanchez, O.P., Terlizzi, M.A.: Cost and time project management success factors for information systems development projects. Int. J. Project Manage. 35(8), 1608–1626 (2017)

Schreiber, S., Zöphel, C., Fraunholz, C., Reiter, U., Herbst, A., Fleiter, T., Möst, D.: Experience Curves in Energy Models—Lessons Learned from the REFLEX Project. Technological Learning in the Transition to a Low-Carbon Energy System. Academic Press, London (2020)

Shaygan, A., Testik, Ö.M.: A fuzzy AHP-based methodology for project prioritization and selection. Soft. Comput. 23(4), 1309–1319 (2019)

Son, J., Khwaja, N., Milligan, D.S.: Planning-phase estimation of construction time for a large portfolio of highway projects. J. Constr. Eng. Manage. 145(4), 04019018 (2019)

Stamelos, I., Angelis, L.: Managing uncertainty in project portfolio cost estimation. Inf. Softw. Technol. 43(13), 759–768 (2001)

Sundqvist, E.: The role of project managers as improvement agents in project-based organizations. Project Manage. J. 50(3), 376–390 (2019)

Szilágyi, I., Sebestyén, Z., Tóth, T.: Project ranking in petroleum exploration. Eng. Econ. 65(1), 66–87 (2020)

Tayyab, M., Sarkar, B., Yahya, B.N.: Imperfect multi-stage lean manufacturing system with rework under fuzzy demand. Mathematics 7(1), 13 (2019)

Toloo, M., Nalchigar, S., Sohrabi, B.: Selecting most efficient information system projects in presence of user subjective opinions: a DEA approach. CEJOR 26(4), 1027–1051 (2018)

Tonchia, S.: Industrial Project Management. Springer, Berlin (2018)

Tseng, C.-C., Liu, B.-S.: Hybrid Taguchi-genetic algorithm for selecting and scheduling a balanced project portfolio. J. Sci. Eng. Technol. 7(1), 11–18 (2011)

Tsetlin, I., Winkler, R.L.: Multivariate almost stochastic dominance. J. Risk Insurance 85(2), 431–445 (2018)

Vanhoucke, M.: Measuring the efficiency of project control using fictitious and empirical project data. Int. J. Project Manage. 30(2), 252–263 (2012)

Vanhoucke, M., Coelho, J., Batselier, J.: An overview of project data for integrated project management and control. J. Modern Project Manage. 3(2), 6–21 (2016)

Voss, M., Kock, A.: Impact of relationship value on project portfolio success—investigating the moderating effects of portfolio characteristics and external turbulence. Int. J. Project Manage. 31(6), 847–861 (2013)

Wei, C.-C., Cheng, Y.-L., Lee, K.-L.: How to select suitable manufacturing information system outsourcing projects by using TOPSIS method. Int. J. Prod. Res. 57(13), 4333–4350 (2019)

Wong, E.T., Norman, G., Flanagan, R.: A fuzzy stochastic technique for project selection. Constr. Manage. Econ. 18(4), 407–414 (2000)

Wu, L.-C., Ong, C.-S.: Management of information technology investment: a framework based on a Real Options and Mean-Variance theory perspective. Technovation 28(3), 122–134 (2008)

Yan, S., Ji, X.: Portfolio selection model of oil projects under uncertain environment. Softw. Comput. 22(17), 5725–5734 (2018)

Yang, Y.-Y., Liu, X.-W., Liu, F.: Trapezoidal interval type-2 fuzzy TOPSIS using alpha-cuts. Int. J. Fuzzy Syst. 22(1), 293–309 (2020)

Yitzhaki, S.: Stochastic dominance, mean variance, and Gini’s mean difference. The American Economic Review 72(1), 178–185 (1982)

Zadeh, L.A.: Fuzzy sets. Inf. Control 8(3), 338–353 (1965)

Zhai, J., Bai, M.: Mean-risk model for uncertain portfolio selection with background risk. J. Comput. Appl. Math. 330, 59–69 (2018)

Zhang, J., Chen, X., Sun, Q.: An assessment model of safety production management based on fuzzy comprehensive evaluation method and behavior-based safety. Math. Probl. Eng. 219, 1–11 (2019)

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Illustrative Real-World Case. Staff Authorization System (Project Code C2015-11)

Under the work breakdown structure (WBS), a project consists of five major activities and 13 sub-activities, as shown in Table 13. Using the connections between activities in the Gantt chart, the relationships are shown clearly (Fig. 6). The baseline schedule is used to modify and execute the project on time.

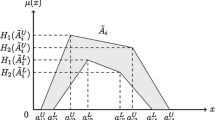

Because activities may not complete in a pre-defined duration, the uncertainty should be given as a fuzzy characteristic. Generally, managers define activities using different uncertainties in three scenarios: optimistic, most probable, and pessimistic. For convenience of analysis, this paper defines a symmetric triangular fuzzy number for each activity with uncertainty, as shown in Fig. 7.

After constructing the baseline schedule and estimating the uncertainty in the activity durations, manager performs the schedule risk analysis (SRA). The SRA analysis is based on the CPM, which calculates the longest path of the planned activities. The importance of CPM is that it identifies the critical activities in the project. If the activity is marked critical, its total float should be zero and it should not delay the termination of the project (Table 14). Finally, after 1000 Monte Carlo simulation runs, the average number of the critical indicator is about 30.3%. This metric helps managers to quantify the schedule risk (endogenous risk) and is useful in defining the fuzzy number of the expected value.

Rights and permissions

About this article

Cite this article

Wu, LH., Wu, L., Shi, J. et al. Project Portfolio Selection Considering Uncertainty: Stochastic Dominance-Based Fuzzy Ranking. Int. J. Fuzzy Syst. 23, 2048–2066 (2021). https://doi.org/10.1007/s40815-021-01069-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40815-021-01069-y