Abstract

A considerable number of companies focus solely on maximizing their profit and give less or almost no concern about environmental sustainability and protection. Financial institutions being a part of these developmental entities tend to play a crucial role in economies' development and sustainability due to their intermediary role between economies and the investing industries. Despite the belief that banks do not directly contribute to the emission maximization or carbon footprint still, evidence reported that they are indirectly contributing to that by financing those projects which may harm the environment and its surroundings. Accordingly, the concept of green banking practices has been recently introduced in support of the theory of socially responsible investment (SRI), which looks for both financial return and social/environmental good to bring about social change regarded as positive by proponents. Hence, this study investigates green banking practices' relevance among banks in Saudi Arabia and their effect on the Saudi banks' green image with the mediating effect of the employees' green behaviour. The study targeted all banks operating in Saudi Arabia, and results were tabulated and analyzed with the help of the structural equation modeling partial least square (PLS) and SPSS software. The study's findings revealed a significant positive relationship between green banking practices and the Saudi banks' green image, indicating that the more green banking practices are practiced, the more the banks' image improves. The results further disclosed that the green behaviour of employees is affected by green banking practices directly. However, employees' green banking behaviour does not mediate the relationship between green banking practices and the Saudi banks' green image. Since green banking practices impact the banks' green image, banks should spread awareness among their employees, clients, and other stakeholders to ensure more benefits. Since it is in some studies reported as a voluntary behaviour, not a compulsory one, which may affect the seriousness of employees to follow it.

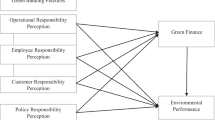

Source: Author (2020)

Source: Primary Data

Source: Primary Data

Similar content being viewed by others

References

Achieng Owino, W. 2016. Influence of selected green human resource management practices on environmental sustainability at Menengai oil refinery limited Nakuru. Kenya. Journal of Human Resource Management 4 (3): 19.

Andreassen, T.W., and B. Lindestad. 1998. The effect of corporate image in the formation of customer loyalty. Journal of Service Research 1 (1): 82–92. https://doi.org/10.1177/109467059800100107.

Aruna Shantha, A. 2019. Customer’s intention to use green banking products: Evidence from Sri Lanka. International Journal of Scientific and Research Publications (IJSRP) 9 (6): 9029.

Bansal, P. 2005. Evolving sustainably: A longitudinal study of corporate sustainable development. Strategic Management Journal 26 (3): 197–218. https://doi.org/10.1002/smj.441.

Bhardwaj, B.R., and A. Malhotra. 2013. Green banking strategies: Sustainability through corporate entrepreneurship. Greener Journal of Business and Management Studies 3 (4): 180–193.

Biswastrum, N. 2011. Sustainable green banking approach: The need of the hour. Business Spectrum 1: 32–38.

Boyd, B.K., D.D. Bergh, and D.J. Ketchen. 2010. Reconsidering the reputation-performance relationship: A resource-based view. Journal of Management 36 (3): 588–609. https://doi.org/10.1177/0149206308328507.

Chen, Y.S. 2008. The positive effect of green intellectual capital on competitive advantages of firms. Journal of Business Ethics 77 (3): 271–286. https://doi.org/10.1007/s10551-006-9349-1.

Chen, Y.S., S.B. Lai, and C.T. Wen. 2006. The influence of green innovation performance on corporate advantage in Taiwan. Journal of Business Ethics 67 (4): 331–339. https://doi.org/10.1007/s10551-006-9025-5.

Crede, M., and P. Harms. 2019. Questionable research practices when using confirmatory factor analysis. Journal of Managerial Psychology 34 (1): 18–30. https://doi.org/10.1108/JMP-06-2018-0272.

Derwall, J., N. Guenster, R. Bauer, and K. Koedijk. 2005. The eco-efficiency premium puzzle. Financial Analysts Journal 61 (2): 51–63. https://doi.org/10.2469/faj.v61.n2.2716.

Falcone, P.M., P. Morone, and E. Sica. 2018. Greening of the financial system and fuelling a sustainability transition: A discursive approach to assess landscape pressures on the Italian financial system. Technological Forecasting and Social Change 127: 23–37. https://doi.org/10.1016/j.techfore.2017.05.020.

Francoeur, V., P. Paillé, A. Yuriev, and O. Boiral. 2019. The measurement of green workplace behaviours: A systematic review. Organization and Environment. https://doi.org/10.1177/1086026619837125.

Griffin, A. (2014). Introduction to Standardization and Collaboration. New York Green Bank Academy, Washington, DC, 2014. http://www.greenbankacademy.com/

Grönroos, C. 1984. A service quality model and its marketing implications. European Journal of Marketing 18 (4): 36–44.

Hair, J.F., M. Sarstedt, T.M. Pieper, and C.M. Ringle. 2012. The use of partial least squares structural equation modeling in strategic management research: A review of past practices and recommendations for future applications. Long Range Planning 45 (5–6): 320–340. https://doi.org/10.1016/j.lrp.2012.09.008.

Hellström, T. 2007. Dimensions of environmentally sustainable Innovation: The structure of eco-innovation concepts. Sustainable Development 15 (3): 148–159. https://doi.org/10.1002/sd.309.

Ibe-enwo, G., N. Igbudu, Z. Garanti, and T. Popoola. 2019. Assessing the relevance of green banking practice on bank loyalty: The mediating effect of green image and bank trust. Sustainability (Switzerland). https://doi.org/10.3390/su11174651.

Iqbal, Q., S.H. Hassan, S. Akhtar, and S. Khan. 2018. Employee’s green behaviour for environmental sustainability: a case of banking sector in Pakistan. World Journal of Science, Technology and Sustainable Development 15 (2): 118–130. https://doi.org/10.1108/wjstsd-08-2017-0025.

Kuenzi, M., and M. Schminke. 2009. Assembling fragments into a lens: A review, critique, and proposed research agenda for the organizational work climate literature. Journal of Management 35 (3): 634–717. https://doi.org/10.1177/0149206308330559.

Li, C.H. 2016. Confirmatory factor analysis with ordinal data: Comparing robust maximum likelihood and diagonally weighted least squares. Behaviour Research Methods 48 (3): 936–949. https://doi.org/10.3758/s13428-015-0619-7.

Makanyeza, C., and L. Chikazhe. 2017. Mediators of the relationship between service quality and customer loyalty: Evidence from the banking sector in Zimbabwe. International Journal of Bank Marketing 35 (3): 540–556. https://doi.org/10.1108/IJBM-11-2016-0164.

Mayer, R., T. Ryley, and D. Gillingwater. 2012. Passenger perceptions of the green image associated with airlines. Journal of Transport Geography 22: 179–186. https://doi.org/10.1016/j.jtrangeo.2012.01.007.

Miah, M.D., S.M. Rahman, and M. Mamoon. 2020. Green banking: the case of commercial banking sector in Oman. Environment, Development and Sustainability,. https://doi.org/10.1007/s10668-020-00695-0.

Saha, M., and G. Darnton. 2005. Green companies or green con-panies: Are companies really green, or are they pretending to be? Business and Society Review 110 (2): 117–157. https://doi.org/10.1111/j.0045-3609.2005.00007.x.

Muhamat, A.A., M. Nizam Bin Jaafar, and N. Binti Ali Azizan. 2012. The development of ethical banking concept amongst the Malaysian islamic banks. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1558165.

Ng, P.F., M.M. Butt, K.W. Khong, and F.S. Ong. 2014. Antecedents of green brand equity: An integrated approach. Journal of Business Ethics 121 (2): 203–215. https://doi.org/10.1007/s10551-013-1689-z.

Organ, D.W. 1997. Organizational citizenship behaviour: It’s construct clean-up time. Human Performance 10: 85–97.

Nguyen, N., and G. Leblanc. 1998. The mediating role of corporate image on customers’ retention decisions: An investigation in financial services. International Journal of Bank Marketing 16 (2): 52–65. https://doi.org/10.1108/02652329810206707.

Norton, T.A., H. Zacher, and N.M. Ashkanasy. 2014. Organizational sustainability policies and employee green behaviour: The mediating role of work climate perceptions. Journal of Environmental Psychology 38: 49–54. https://doi.org/10.1016/j.jenvp.2013.12.008.

Ottman, J.A. 2008. The five simple rules of green marketing. Design Management Review 19 (4): 65–69. https://doi.org/10.1111/j.1948-7169.2008.tb00143.x.

Paillé, P., and J.H. Mejía-Morelos. 2014. Antecedents of pro-environmental behaviours at work: The moderating influence of psychological contract breach. Journal of Environmental Psychology 38: 124–131. https://doi.org/10.1016/j.jenvp.2014.01.004.

Peattie, K., and M. Ratnayaka. 1992. Responding to the green movement. Industrial Marketing Management 21 (2): 103–110. https://doi.org/10.1016/0019-8501(92)90004-D.

Prakash, A. 2002. Policy and managerial. Business Strategy and the Environmen 297 (11): 285–297. https://doi.org/10.1002/bse.338.

Ramus, C.A., and U. Steger. 2000. The roles of supervisory support behaviours and environmental policy in employee “ecoinitiatives” at leading-edge European companies. Academy of Management Journal 43 (4): 605–626. https://doi.org/10.2307/1556357.

Ritu. (2014). Green Banking: Opportunities and Challenges. International Journal of Informative and Futuristic Research, II(1): 34–37. http://www.ijifr.com/pdfsave/25-09-2014828V2-E1-015.pdf.

Ruepert, A., K. Keizer, L. Steg, F. Maricchiolo, G. Carrus, A. Dumitru, and D. Moza. 2016. Environmental considerations in the organizational context: A pathway to pro-environmental behaviour at work. Energy Research and Social Science 17: 59–70. https://doi.org/10.1016/j.erss.2016.04.004.

Shakil, M.H., M.K.G. Azam, M. Tasnia, and Z.H. Munim. 2014. An evaluation of green banking practices in Bangladesh. IOSR Journal of Business and Management 16 (11): 67–73. https://doi.org/10.9790/487x-161146773.

Sharmeen, K., R. Hasan, and M.D. Miah. 2019. Underpinning the benefits of green banking: A comparative study between Islamic and conventional banks in Bangladesh. Thunderbird International Business Review 61 (5): 735–744. https://doi.org/10.1002/tie.22031.

Shau, T.V. 2017. The Confirmatory factor analysis (CFA) of preschool management model in Sarawak. International Journal of Academic Research in Business and Social Sciences 7 (6): 221–231. https://doi.org/10.6007/ijarbss/v7-i6/2959.

Shaumya, K., and A.A. Arulrajah. 2016. Measuring green banking practices: Evidence from Sri Lanka. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2909735.

Sudhalakshmi, K., and K.M. Chinnadorai. 2014. Green banking practices in Indian. International Journal of Management and Commerce Innovations 2 (1): 232–235.

Van Dooren, B., and R. Galema. 2018. Socially responsible investors and the disposition effect. Journal of Behavioural and Experimental Finance 17: 42–52. https://doi.org/10.1016/j.jbef.2017.12.006.

Vaske, J.J., J. Beaman, and C.C. Sponarski. 2017. Rethinking internal consistency in cronbach’s alpha. Leisure Sciences 39 (2): 163–173. https://doi.org/10.1080/01490400.2015.1127189.

Welsch, H., and J. Kühling. 2018. How green self image is related to subjective well-being: pro-environmental values as a social norm. Ecological Economics 149: 105–119. https://doi.org/10.1016/j.ecolecon.2018.03.002.

Worcester, R.M. 1997. Managing the image of your bank: The glue that binds. International Journal of Bank Marketing 15 (5): 146–152. https://doi.org/10.1108/02652329710175244.

Yuan, F., and K.P. Gallagher. 2018. Greening development lending in the Americas: Trends and determinants. Ecological Economics 154 (April): 189–200. https://doi.org/10.1016/j.ecolecon.2018.07.009.

Zhang, Y., Y. Luo, X. Zhang, and J. Zhao. 2019. How Green human resource management can promote green employee behaviour in China: A technology acceptance model perspective. Sustainability (Switzerland). https://doi.org/10.3390/su11195408.

Acknowledgements

The author acknowledges the Deanship of Scientific Research at King Faisal University of the Financial Support under Nasher Track (Grant No. 206123).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that there is no conflict of interest in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Alshebami, A.S. Evaluating the relevance of green banking practices on Saudi Banks’ green image: The mediating effect of employees’ green behaviour. J Bank Regul 22, 275–286 (2021). https://doi.org/10.1057/s41261-021-00150-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41261-021-00150-8