Abstract

By using implicit function, utility and demand functions with inferior goods are developed. It has an advantage in tractability and extendability. But, the systematic data fitting method is not developed yet. This article presents a discussion of this fitting method and other matters: (1) a utility and demand function suitable for data fitting; (2) a systematic method for the data fitting; and (3) a 48-good utility function that generated income demand curves that are well fitted to 48-good data of the Japanese Household Survey 2018.

Similar content being viewed by others

Notes

According to Takahashi (2019a,b), the utility function is specified as \(u={\sum }_{k}{u}^{-{c}_{k}}{x}_{k}^{{a}_{k}}\), (\({\mathrm{c}}_{\mathrm{k}}\ge 0\)). This formulation has merit in mathematical discussion. However, for data fitting, the function must represent various shapes such as S-shapes or waves. We change the function from \(u={\sum }_{k}{u}^{-{c}_{k}}{x}_{k}^{{a}_{k}}\) to (1), a generalized one.

The program file used for this illustration is available upon a request. The filename is “310 2GoodsModel-JQE.m”. This program generates tables and figures.

This calculation is done using the “leasqr” or “polyfit” commands of the GNU octave.

If \({\widehat{g}}_{1}\left(u\right)\) and \({\widehat{g}}_{2}\left(u\right)\) are not estimated as a positive and non-increasing in\(u\in [ 1.000, 4.177 ]\), then our model contradicts economic theory.

The source of data is “Average of Monthly Receipts and Disbursements per Household by Yearly Income Group” (Workers' Households of One-person Households), 2018 Yearly Average Survey Results, Statistics Bureau, Ministry of Internal Affairs and Communications, Japan.

Yearly income of \(t=2\) is less than that of \(t=1\), although t is sorted by monthly expenditure m. The order of high yearly income is \(t=\mathrm{2,1},\mathrm{3,4},\mathrm{5,6},7\), not \(t=\mathrm{1,2},\mathrm{3,4},\mathrm{5,6},7\). This reversed order is attributable to government support, assets, and to the age of the sampled persons.

These data include “the saving, insurance, and carry-over to the next month”, as \({x}_{48}\) in Table 2. For simplicity, the price of this 48th good is assumed to be 1, although these are not consumption.

Unfortunately, \({\widehat{g}}_{13}(u)\) and \({\widehat{g}}_{46}(u)\) are estimated as partially increasing in u. To enforce \({g}_{13}(u)\) and \({g}_{46}(u)\) decreasing in u, we manually reduced the order of \({g}_{k}\left(u\right)\) into one, \({g}_{k}\left(u\right)={\beta }_{k0}+{\beta }_{k1}u\) for \(k=13, 46\).

\(RMSPE=\sqrt{(1/7)\sum_{t=1}^{7}{\left[\left({x}_{kt}-{\widehat{x}}_{kt}\right)/{x}_{kt}\right]}^{2}}\)

References

Epstein, G.S., and Spiegel, U. 2000. A production function with an inferior input. The Manchester School 68: 503–515.

Moffatt, P.G. 2002. Is Giffen behavior compatible with the axioms of consumer theory? Journal of Mathematical Economics 37: 259–267.

Sasaki, H. 1992. KakyuzaiToGiffenzai—Jakkan No Rei, 1–24. Nagoya: Oikonomika. Nagoya City University. (Japanese paper).

Takahashi, S. 2019a. Demand functions with inferior goods: The implicit function approach. Hitotsubashi Journal of Economics 60: 79–105.

Takahashi, S. 2019b. The N-goods utility function for inferior goods. Implicit Function Approach. https://doi.org/10.13140/RG.2.2.22419.22563.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proof of Proposition 1(i) and 1(ii)

Appendix: Proof of Proposition 1(i) and 1(ii)

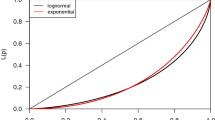

In (6), \(u\), \(a\), and c are fixed values. The second term of (6) is a fixed value \(u\), then drawn as the horizontal line T2 in Fig. 5. The first term of (6) is drawn as a T1 curve in Fig. 5. It is increasing in \({x}_{j}\), taking a value from zero to infinity. Point A gives \({x}_{j}\left(p,u\right)>0\).

If \(\mathrm{u}\to 0\), then T2 and T1 shifts downward. Point A approaches (0,0). Therefore, \({x}_{j}\left(p,u\right)\to 0\).

Rights and permissions

About this article

Cite this article

Takahashi, S. The Income-Demand Curve: Implicit Function and Data Analysis Methods. J. Quant. Econ. 19, 51–66 (2021). https://doi.org/10.1007/s40953-020-00217-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-020-00217-9