Abstract

We analyze transfer channels of radical innovations launched by small and medium-sized firms (SMEs) using an ego network approach. Based on a unique longitudinal dataset covering the observation period 1996–2016, we identify and trace back radical innovations of SMEs in German Biotech in order to analyze the extent to which SMEs themselves—or eventually also other organizations in their direct cooperation surrounding—benefit from radical innovations in terms of subsequent innovation performance. Results from negative binomial panel regressions indicate that direct cooperation partners of radical innovators show higher innovative performance than partners of the control group, i.e., statistical twin firms without radical innovations. Our results confirm that radical innovations initiate a positive impulse for innovation through direct cooperative relationships. Interestingly, geographical proximity does not play a role, and especially technologically different partners benefit from direct cooperation with radical innovators.

Plain English Summary Radical innovations are rare but have a great importance for the economy. Our study shows that not only radically innovating biotech SMEs themselves but also various types of directly linked cooperation partners benefit significantly. We investigate whether directly linked cooperation partners of radically innovating firms benefit from knowledge spillover transferred through formal cooperation. A radical innovation represents a novel and often complex combination of already existing knowledge. Thus, knowledge transfer process differs for radical and non-radical innovations. Project-based formal cooperation can support the transfer of radical knowledge. In this context geographical and technological factors matter. Using the example of German small and medium-sized biotechnology firms, we show that collaboration with radical firms is positively related to innovation performance of directly linked project partners. Interestingly, this effect is higher for partners located in other regions as well as for technologically distant partners. Our study extends the research on knowledge transfer by emphasizing the role of formal collaboration projects, especially in knowledge intensive high-tech industries.

Similar content being viewed by others

1 Introduction

Radical innovations are of key importance from an economic point of view since they bear the potential to trigger the emergence of entirely new technological trends, cause far-reaching structural change, and fuel economic prosperity. The ability of firms to create novelty in terms of innovation is considered to be a necessary prerequisite for gaining a sustainable competitive advantage and keeping pace with competitors. Firms typically follow unique innovation strategies to cope with high levels of ambiguity and complexity, particularly prevalent in knowledge intensive technological fields such as biotechnology.

In this paper we turn our attention to the innovation activities of biotechnology-focused small and medium-sized enterprises (SMEs)Footnote 1 involved in the application of biotechnology techniques for the production of goods or services, and actively involved in research and development (R&D). These types of firms are typically referred to as dedicated biotech firms (DBFs) (OECD 2005). DBFs have highly specialized business models that are typically reflected in a very unique resource and knowledge endowment, and their R&D activities often carry high risks. Accordingly, entry and exit dynamics, as well as the chance of discovering entirely new methods and applications in terms of products and services, are certainly overrepresented among DBFs. The research intensity, the focus on narrow market niches, as well as the high agility and risk affinity of DBFs, can be seen not only in a high innovation intensity (e.g., Dalpé 2002; Nesta and Dibiaggio 2003), but also in the degree of novelty of the patents generated by these firms. At the same time, we know from previous research (Baum et al. 2000) that entrepreneurial ventures can initially profit from collaborating with the ‘right’ partners.Footnote 2 This means that the kind of network composition is crucially important for successful collaboration. However, it is usually only the radical inventor’s performance that is discussed (e.g., Katila 2000), even though their radical innovation has the potential to affect other actors and/or change the technological landscape in a fundamental way (Dahlin and Behrens 2005). Therefore, we choose to focus on the collaborative nature of DBFs’ radical innovations and the impact of this collaboration on the innovation performance of directly linked cooperation partners.

By definition, radical innovations differ significantly from ordinary patent applications, particularly in terms of combinatory complexity. It is still anything but clear if these innovations benefit only the radical innovator, or if follow-up innovations in the closer cooperation environment are also triggered. We also do not know whether radical innovation spillovers are bounded to geographically or technologically proximate partners (e.g., Boschma 2005; Nooteboom 2000; Nooteboom et al. 2007). Accordingly, in this paper we are primarily interested in understanding the impact a DBF’s radical innovations exert on other actors’ innovation activities. More precisely, we apply an ego networkFootnote 3 perspective and analyze the extent to which the formal partnerships with radical innovators enables the transfer of knowledge to direct partners and enhances their subsequent innovative performance. Our approach answers the question: Do directly linked partners of radical innovators in German biotechnology benefit from these radical innovation events?

We contribute to the existing body of literature in several ways. First, by combining different raw data sources we compile a unique longitudinal unbalanced panel dataset encompassing the full set of DBFs in Germany between 1996 and 2016. Second, we combine a variety of methods and analytical approaches. In other words, we identify radical innovators based on technology class and forward patent citations, we construct ego networks based on funding data for all identified radical innovators, we identify statistical twins for benchmarking purposes, and conduct an econometric estimation of patent counts. This combination of various data sources and methods allows us to gain an in-depth understanding of how knowledge embodied in radical innovations spills over to other actors in the field. In doing so, we break new ground by analyzing the way in which geographical and technological determinants affect the transfer of knowledge underlying radical innovations. Instead of restricting our analysis to the radical inventors themselves, we pay special attention to the subsequent innovation effects for the partner companies, a perspective that has not yet been explicitly addressed.

The paper is structured as follows: In Section 2 we first summarize the main contributions of previous research in general, and discuss existing literature on radical innovation and knowledge spillovers. In Section 2 we develop a set of testable hypotheses. Section 3 provides an overview of our data sources, and of the development of the biotechnology industry in Germany. In Section 4 we outline our research methodology. Section 5 provides basic descriptive statistics and results from our statistical analyses. Finally, in Section 6 we provide a brief discussion of our main findings and outline some fruitful avenues for further research.

2 Theory background, state of the art, hypotheses

2.1 Theory and concepts

Joseph Alois Schumpeter was among the first to emphasize the importance of entrepreneurs and their innovative activities (Malerba and Orsenigo 1997; Witt 2008). In the late 1970s, the role of knowledge, innovation, and endogenous change for economic growth and prosperity was brought to the center of the economic debate (Nelson and Winter 1974, 1982). Subsequent literature outlined the importance of the context and environment (e.g., technological, institutional or social) on the emergence and diffusion of entrepreneurial innovation (Autio et al. 2014). These ideas still constitute the intellectual cornerstones of evolutionary economics literature (Nelson et al. 2018). Interestingly, there is still no unified definition of a radical innovation in the literature. In this paper we draw on a general notion based on the Schumpeterian idea of innovation as a recombination of existing knowledge (Weitzman 1998). The degree of radicality is reflected by the innovation’s impact on firms, markets or entire technological fields. The transformative, and sometimes disruptive, character of innovation was described by Schumpeter as ‘creative destruction’. Evolutionary economics also contributes to the debate on the systemic character of innovation processesFootnote 4 (Lundvall 1992) by emphasizing the role of formal and informal networks (Freeman 1991) for intra-industry and inter-industry knowledge transfer processes. In general, networks include a well-defined set of actors and the direct or indirect connections among them (Wasserman and Faust 1994). The specification of actors and ties determines the type of network. Innovation networks are embedded in a broader socio-economic environment, and are considered to be an integral part of an industry’s innovation system (Kudic 2015). Inter-organizational innovation networks incorporate all types of actors involved in R&D processes. Formal and informal connections between these actors allow for the unilateral, bilateral, or multilateral exchange of ideas, information, knowledge, and expertise. This, in turn, enables the actors involved to recombine and generate new knowledge incorporated in novel goods or services to meet market demands and customer needs (cf. Kudic 2015, p. 47).

To analyze whether the radical innovations of SMEs’ spillover to direct partners, we focus on egocentric, inter-firm innovation networks composed of formal links within the technological field of biotechnology. Ego networks are composed of one focal actor (ego), his directly connected partners (alters) and connections among the alters (Ahuja 2000; Hite and Hesterly 2001). In other fields, ego networks are also referred to as ‘alliance network compositions’ (Baum et al. 2000), ‘alliance constellations’ (Das and Teng 2002; Gomes-Casseres 2003), ‘alliance portfolios’ (George et al. 2001; Hoffmann 2005; Hoffmann 2007; Lavie and Miller 2008), or ‘portfolios of interfirm agreements’ (Wuyts et al. 2004). In this context it is important to note that the existence of direct and indirect ties among network actors does not necessarily mean that knowledge identification, transfer, and learning across firm boundaries takes place without any obstacles or frictions. Cohen and Levinthal (1990) were among the first to acknowledged this issue by introducing the concept of ‘absorptive capacity’, which draws attention to an actor’s ability to identify, assimilate, and use externally available knowledge to commercial ends.Footnote 5 In a similar vein, Simonin (1999) provided us with insights on the simultaneous effects of knowledge ambiguity and its antecedents (i.e., tacitness, asset specificity, prior experience, complexity, partner protectiveness, cultural distance, and organizational distance) for the successful transfer of technological knowledge through inter-firm alliances. In the context of radical innovations and related knowledge transfer processes, firms face a qualitatively new situation. Radical innovations that result in significant novelties require the integration of completely new elements of knowledge that combine and recombine with existing knowledge. Specifically, links to directly connected partners actively operating in other technological fields may provide innovators with access to new knowledge that fuels the emergence of radically new ideas.

Economic geographers contributed to the debate by introducing the concept of proximity (Boschma 2005). In its most general sense, proximity can be defined as “[…] being close to something measured on a certain dimension” (Knoben and Oerlemans 2006, pp. 71-72). The concept acknowledges that firms are simultaneously exposed to a variety of proximity dimensions, such as: institutional proximity, organizational proximity, cultural proximity, technological proximity, network proximity and geographical proximity (Knoben and Oerlemans 2006, p. 71). Boschma’s (2005) proximity framework offers a process-oriented perspective that encompasses both positive, as well as negative effects of proximity on knowledge transfer, interactive learning and firm innovativeness. This framework also allows for the analysis of each proximity dimension separately, as well as the interplay between proximity dimensions.

2.2 Prior research on networks and radical innovation

In recent years, the relationship between R&D cooperation, knowledge transfer, and firm innovativeness has been the subject of numerous case studies (e.g. Dyer and Nobeoka 2000; Ciesa and Toletti 2004; Eraydin and Aematli-Köroglu 2005; Capaldo 2007), as well as several survey-based empirical studies. For instance, De Propris (2000) analyzes the link between innovation performance and upstream (as well as downstream) interfirm partnerships drawing on a unique dataset compromised of 435 firms located in the West Midlands, UK. Estimation results underline the role of R&D cooperation as a driver of firm innovativeness. Harabi (2002) found statistically significant support for the impact of vertical R&D cooperation on firm-level innovation outcomes based on a sample of 370 German SMEs. The results indicate that informal modes of cooperation are apparently more important than formal modes. In a similar vein, Freel and Harrison (2006) investigated the impact of cooperation on a firm’s innovation output. They conducted a survey-based study compromising 1347 small firms from Northern Britain in both the manufacturing and service sectors. They report a positive correlation between product innovation success and cooperation with customers and public sector organizations. Despite the important insights provided by these studies, they suffer from several limitations. Most survey-based cooperation studies neglect the structural dimension of cooperation, and these studies typically draw on cross-sectional data that overlooks the dynamic nature of cooperation activities and the subsequent consequences of innovation.

We employ an ego network approach based on a longitudinal co-patenting dataset. Jaffe et al. (1993) showed that patent citation networks can serve as an appropriate measure for exploring spillovers. Other data sources have also been used to trace cooperation and network patterns over time, such as bibilomentric data (Abramo et al. 2009), press announcements in industry magazines (Al-Laham et al. 2010), or data on publicly funded research and development projects (Scherngell and Barber 2009; Kudic 2015). Most longitudinal network studies focus on the extent to which network positioning, ego network composition, or overall network characteristics affect knowledge transfer, learning, and the performance of actors involved. For instance, Powell et al. (1996) provide a comprehensive longitudinal study on the role of network positioning and portfolios of collaborative activities for interorganizational learning. Ahuja (2000) focuses on the relatedness between three aspects of a firm’s ego network characteristics: direct ties, indirect ties, and structural holes. He also discusses subsequent firm-level innovation outcomes and raises awareness of the negative innovation effects of structural holes at the network level. Baum et al. (2000) demonstrate that the early innovative performance of Canadian biotech startups’ (measured by patent counts, R&D spending, and growth) is strongly affected by the alliance network composition of these firms at founding. Wuyts et al. (2004) explore the impact of different types of alliance portfolio characteristics on firms’ incremental and radical innovations, as well as on firm profitability. Broekel and Boschma (2012) explore Dutch aviation industry network in order to assess the importance of different proximity measures for knowledge transfer. They identify their network based on interview data. Fornahl et al. (2011) employ R&D subsidies data to analyze the factors affecting patent performance in German biotechnology.

Recently, a small but vibrant research community began investigating the very nature of radical innovations. Conceptual and methodological contributions dealing with radical innovations can be divided into two streams: the first stream focuses on the identification and measurement of radical innovations (Dahlin and Behrens 2005; Fleming 2001; Arts et al. 2012; Verhoeven et al. 2016), and the second stream uses these methods to address contemporary issues in innovation research (Fleming 2007; Hao and Feng 2016; Grashof et al. 2019; Arant et al. 2019). Fleming (2001) viewed ‘radicalness’ as the experimentation with new configurations of already existing knowledge. The results of his negative binomial regression analysis based on patent citation data show that experimentation with new combinations of knowledge increases the variability of innovation, and produces innovations with a higher degree of radicalness. Dahlin and Behrens (2005) emphasize the transformative power of innovations by arguing that the impact on future developments in the field is an important characteristic of a radical innovation. They argue that a radical innovation should possess three properties: novelty, uniqueness and influence on future inventions. These properties can be measured by backward and forward patent citation data. Arts et al. (2012) and Verhoeven et al. (2016) combine the approaches described above, as well as other indicators, in order to establish a clearer definition of radical innovations that might be used in further research. Arts et al. (2012) estimate the efficiency of several indicators to measure radical innovation in US biotechnology. These indicators include unique backward citations, new combinations of patent citations and the number and structure of forward citations. The authors argue that forward citations and the pattern of patent citations provide a more valid picture of radical innovation than indicators based on backward citations or combinations of IPC classes. Verhoeven et al. (2016) evaluate and compare two indicators: novelty in recombination (based on new combinations of IPC classes) and novelty of knowledge origins (based on backward citations and other non-patent references). Their broad dataset includes almost 8.5 million patents from a variety of patent offices. The results of their analysis show the validity of all proposed indicators. The authors argue that patents that combine different indicators have a high potential to be radical breakthroughs.

The second group of studies applies these indicators to investigate certain issues in the field of innovation research. These papers often deal with different network structures that may lead to the creation of radical innovations. For instance, the idea of knowledge recombination was later used by Fleming (2007) to measure collaborative creativity. Their analysis shows that relations with mutually unconnected partners positively influence the creation of innovations, but slow down its diffusion. Hao and Feng (2016) investigate how different types of networks influence radical innovation creation. Specifically looking at buyer-supplier, peer collaboration and equity ties, the authors find that a higher number of ties leads to a higher potential for a firm to create radical innovations. This is particularly evident for buyer-supplier and peer collaborators. Grashof et al. (2019) employ a German patent data sample and show that a firm’s location in a cluster has a positive effect on the emergence of radical innovations. Arant et al. (2019) report a positive relatedness between industry-university collaborations and the creation of radical innovations. The authors also explore the impact of geographic and cognitive distance on the probability of creating radical innovations. Their results suggest that the collaboration between geographically, but not cognitively distant partners appears to be the most efficient.

In this sense, previous research is still mainly limited to the radical firms themselves. Previous studies deal with the effects that seizing new technological opportunities may have on the subsequent firm’s creation (Shane 2001). Apart from that, the importance of cooperation patterns for the introduction of the radical innovation was subject to empirical research (Tether 2002). However, to the best of our knowledge, no prior research has focused on the extent to which directly connected alters are affected by the radical innovations of a focal actor, which is the central issue addresed in this paper.

2.3 Hypotheses

The empirical evidence on knowledge spillovers induced by radical innovations is still scant. In order to approach this issue, it is necessary to first distinguish between ‘knowledge accessing’ and ‘knowledge acquiring’ processes through collaborative partnerships (Grant and Baden-Fuller 2004). The first process involves firms cooperating in order to gain access to complementary stocks of codifiable knowledge (Grant and Baden-Fuller 2004) without necessarily internalizing the partner’s skills (Doz and Hamel 1997). The second process refers to the exchange of non-codifiable (tacit) knowledge. The exchange of tacit knowledge requires a certain degree of trust and the engagement in interorganizational learning processes of all partners involved (Lui 2009). Radical innovations fall into the latter category due to the high degree of novelty and combinatory complexity of the underlying knowledge base. Grant and Baden-Fuller (2004) argue that especially direct relationships can be regarded as ‘vehicles of learning’, allowing firms to transfer non-codifiable knowledge across firm boundaries. Not only a firm’s individual absorptive capacity (Cohen and Levinthal 1990), but also the cooperation partners’ relative absorptive capacity (Lane and Lubatkin 1998), plays a key role in identifying the right partner. Accordingly, we argue that radical innovations spill over particularly to directly linked partners through interorganizational learning processes that enhances mutual innovativeness in subsequent time periods.

-

H1: Direct partners (alters) of a DBF with at least one radical innovation (ego) experience a higher degree of innovativeness, measured by the alters’ number of patent applications in subsequent periods.

It has been argued that geographical proximity is conducive to localized knowledge spillovers. The underlying rationales and justifications are manifold. Breschi and Lissoni (2001) suggest at least three underlying mechanisms that are assumed to be responsible for localized knowledge spillovers: local labor markets (Almeida and Kogut 1999; Zucker et al. 1998), local markets for technologies (Lamoreaux and Sokoloff 1999) and the low propensity of skilled workers to relocate in space (Breschi and Lissoni 2009). Hohberger (2014) emphasizes that firms located close to each other can better observe the activities and development trajectories of their neighbors. This is especially important for the transmission of tacit knowledge. To a certain degree, proximity explains the successful facilitation of firm innovativeness induced by technological parks (Díez-Vial and Fernández-Olmos 2015) and geographic clusters (Gilbert et al. 2008). Others emphasize the importance of spatial (or face-to-face) interactions for the success of interactive learning processes (Saxenian 1990; Maskell and Malmberg 1999). However, geographical proximity does not always have a positive effect on knowledge transfer and learning processes (Boschma 2005). Spatial lock-in effects and a lack of openness to the outside world may hamper innovation. Firms become inward looking and separate themselves from other organizations. This can cause local knowledge to become quickly outdated. In line with previous findings (Breschi and Lissoni 2005; Broekel and Boschma 2012; Caragliu and Nijkamp 2016), we assume that the benefits of geographical closeness overcompensate the negative effect. Thus, we hypothesize that:

-

H2: Direct partners (alters) of a DBF with at least one radical innovation (ego), located in the same region, experience a higher degree of innovativeness, measured by the alters’ number of patent applications in subsequent periods.

Besides geographical proximity, firms might experience cognitive or technological proximity (Boschma 2005; Knoben and Oerlemans 2006). For a successful generation of new ideas, companies should have common ground, but also not be too similar (Boschma 2005). Biotechnology firms that engage in collaborations in order to develop new products and services prefer seeking collaborations that complements their capabilities, e.g., clinical testing, marketing, management, distribution (Hohberger 2014). However, it has also been reported that biotechnology SMEs would rather communicate with pharmaceutical corporations than with peers (Kahl 2015). In the context of our investigation, the central issue is determining those partners that benefit the most from DBFs radical innovations, cognitively proximate DBFs, or other more cognitively distant firms. We argue that the novelty content of DBFs’ radical innovations provides greater information value for companies with more distant technological background. It is plausible to assume that non-biotechnology partners experience an intermediate level of cognitive proximity to DBFs, which, according to Nooteboom et al. (2007), is favorable to mutual learning and subsequent innovativeness. Non-biotech firms gain insights from collaborations with DBFs that they can recombine with a broad and qualitatively different body of knowledge in their own technological field. Because we expect increased innovation activity given this scenario, we hypothesize that:

-

H3: Non-biotechnology partners (alters) of a DBF with at least one radical innovation (ego) experience a higher degree of innovativeness, measured by the alters’ number of patent applications in subsequent periods.

3 Technological field and data

3.1 Technological field

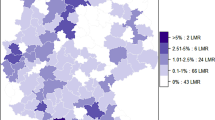

The emergence of the biotech industry in Germany was strongly driven by the political willingness to establish this strategically important field. This political imperative can be seen in a number of policy initiatives, some of which began in the early 1990s (e.g., BioRegio Competition, BioFuture, BioChance and BioChance Plus or BioProfile). These initiatives were designed to promote the emergence of start-ups (e.g., BioChance and BioChance Plus) and facilitate the creation of biotechnology clusters (BioRegio). The consequences of these early policy measures are still evident today. For instance, the winning regions of the BioRegio competition (a cluster policy initiated the 1990s), Munich, Rhineland, Rhine-Neckar and Jena, still represent geographical agglomerations that inform the topology of the industry (Fornahl et al. 2011).

The German biotechnology industry incorporates a broad range of organizations, each specializing in a variety of activities such as: production, research and development, and the provision of services to other firms (such as creation of test kits). The biotech industry in German includes pharmaceutical, chemical and biotechnological corporations (e.g., Bayer, BASF, Qiagen, Milentyi Biotech), as well as research institutes and laboratories that are based at universities, or institutions like the Fraunhofer Society or the Max Planck Society. However, the field in Germany is clearly dominated by SMEs. According to BIOCOM AG, only around 2% of dedicated biotechnology firms have more than 250 employees. Even if direct subsidiaries are excluded, around 80% of German biotech firms are independent SMEs.

Although the initial emergence of German biotech firms was pushed by policy initiatives, many of the firms experienced hard times when many funding programs were terminated or reoriented in the mid-2000s. This was especially true for SMEs. Due to a lack of transferable resources, small entrepreneurial firms typically fail more often than their larger competitors. The literature refers to this as the ‘liability of smallness’ (Aldrich and Auster 1986). In order to mitigate the lack of resources, the SMEs that survived the initial crisis had two ways of successful development: 1) use the external knowledge of big corporations and research institutions, and/or, 2) find a specific innovative niche in which to operate, thereby distinguishing themselves from other actors.

Because the field includes different types of firms (big pharma and biotech corporations, SMEs and research institutions), there is a symbiotic relationship between the actors. The symbiotic alliances in biotechnology have been analyzed in a number of studies (e.g., Gay and Dousset 2005; Zidorn and Wagner 2012; Shin et al. 2016) that indicate the alliances have a positive effect on a firm’s performance, especially the innovative potential of project partners. There is generally high risk associated with the creation of biotechnology products. As a result, many SMEs shifted to service-oriented business models (Kahl 2015). SMEs still in operation in the biotech field typically operate in a narrow niche and focus their activities toward very specific solutions (Zidorn and Wagner 2012). This tendency offers the potential for entirely new products and processes. Successful SMEs are usually not only distinguished by unique product portfolio, but also well-embedded in networks. Thus, there is no reason to doubt, that their innovation may spillover and enhance the knowledge of their partners.

3.2 Data sources

Our analytical approach places high demands on the scope and granularity of the data. To achieve the goals of our analysis, we needed data on (1) dedicated biotechnology firms in Germany, (2) funded collaborative projects, and (3) innovative output of radical innovators and their project partners. Our industry-level data provides a complete picture of all DBFs actively operating in biotechnology in Germany between 1996 and 2016. We accessed a longitudinal database provided by BIOCOM AG, and used a professional information agency specializing in the Life Science industry in Germany to access additional information. BIOCOM AG data categorizes and provides detailed information on the actors in German biotechnology, including dedicated biotech firms, pharma companies and research institutions. BIOCON AG’s IND1 category includes information on dedicated biotechnology firms, and serves as the initial data source used in our study. This narrow dataset is also used to identify the radical innovators analyzed in our study. The information included in the BIOCOM AG dataset includes firm location, founding year and number of employees per year.

Because the BIOCOM AG dataset did not include information about a firm’s ownership structure, we had to turn to other sources of information to determine whether a radical innovator was a SME. We used the Amadeus database from Bureau van DijkFootnote 6 to determine a firm’s ownership structure and status in a particular year. This information was augmented by the Wiso-Net databaseFootnote 7 that provided us with information about firm events, e.g., liquidation, insolvency or merger. To zoom in deeper into firm history, we also accessed firms’ websites.

Our data for funded collaborative projects comes from a funding database, the subsidies catalogue of Federal Ministry of Education and Research (in German: Förderkatalog). In addition to identifying radical innovators, we needed to identify their public project partners. It is, in fact, these partners that represent our primary research focus, and who are the core of the unbalanced panel. Förderkatalog includes statistics on the on-going and finished projects of the Ministry. These statistics can be sorted by type of funding, funding program, geographic location, specialization, and recipients. Förderkatalog is an especially well-suited data source when working with longitudinal data, as it provides information about timeframe of the funding process, and when a cooperative effort was initialized.Footnote 8 All of this information is quite relevant for biotechnology SMEs, which, as mentioned in Section 3.1, are highly dependent on external and public funding.

Having identified our sample of radical innovators’ project partners, firm-year entries were created that serve as the base of our unbalanced panel. We then used information provided by Amadeus and Wiso-Net to create our panel structure using control variables such as age, size, ownership (subsidiary/not, spin-off/not). Förderkatalog and Amadeus were consulted to complement our dataset by adding start and end points of observation for each firm.

Finally, as our research scope is primarily concerned with the innovative performance of radical innovators and their partners, we used patents to measure innovative performance, as well as to track knowledge spillovers (e.g., Jaffe et al. 1993; Katila 2000). We used the PATSTAT Database,Footnote 9 which includes patents applied by firms worldwide, to create our patent dataset. Apart from being a reliable source of patent data, PATSTAT combines data on the application itself with information about the applicants and inventors, as well as technological classes (IPC and CPC) and the number of citations the patent received. PATSTAT is also suitable for the unbalanced structure of our dataset, as it allows us to create individual measures of innovative output at the firm-year level, measured by the number of patent applications (on family level) made by a particular firm per year.

4 Methodology

4.1 Research design

In order to test our hypotheses, we perform five analytical steps (Fig. 1). The first step is the identification of the population of dedicated biotechnology SMEs, and the full set of patents assigned to these firms. The next step is to identify all radical patents by using various indicators based on technology class information and citation data and by following a sequential identification procedure. Steps three and four, which include the creation of radical innovators’ ego networks and defining the control group, are executed simultaneously. The outcomes of the initial analytical steps are included in our estimation model, as our fifth and final step. The model estimates the innovative performance of the radical innovators’ directly linked partners. The results of our radical innovators’ model are compared with the innovative performance of the partners of our benchmark group of statistical twins.

-

1.

Specification of the population of dedicated biotechnology firms (DBFs)

DBFs usually meet the classification criteria of SMEs. For the purpose of this paper we are interested in the innovation potential of small and medium sized firms. Accordingly, we need to separate independent SMEs from subsidiaries of large companies. At this stage we also excluded SMEs that were founded as subsidiaries, as they were not of our primary research interest. After drafting a list of independent SMEs, we identified their patents.

-

2.

Identification of radical patents

In this step, we identify patents with a radical character based on definitions found in the literature (e.g., Verhoeven et al. 2016; Dahlin and Behrens 2005), and match the SMEs with the patent application (so-called ‘radical innovators’). Additionally, several plausibility checks were applied to ensure that only SMEs are included in the radical innovators’ sample.

-

3.

Creation of ego networks of radical innovators

In this step, we identify all directly linked partners of a radical innovator by using an ego network approach based on a comprehensive publicly funded project database. This step is necessary in order to shift the focus of the analysis from the radical innovators to their contractual partners. Radical innovators without publicly funded projects were excluded.

-

4.

Identification of statistical twins of radical innovators

In this step, we create a population of statistical twins for our sample of radically innovative DBFs. Partners of our statistical twins served as the control group for our subsequent econometric analysis.

-

5.

Econometric estimation approach

Finally, we test our hypotheses using a negative binomial regression model. We also conduct several robustness checks, including lags for the dependent variable, and including different control groups.

4.2 Specification of dedicated biotechnology SME’s population

The identification of all actively operating small and medium sized dedicated biotech firms (DBFs) in Germany between 1996 and 2016 allows us to trace back some key developments in German biotech, including: emergence of the field, founding of entrepreneurial ventures and the rapid development of the industry by the end of the 1990s. At the beginning of 2000, we observe the exit of numerous firms, and a significant decline of patenting activities. Thereafter, we observe the appearance of new related technological fields originating from biotechnology. This is also reflected in a period of pronounced technological change starting at the beginning of the 21 century and lasting for more than ten years.

After combining yearly firm datasets and identifying firms that appear in the dataset several times under different names, we are left with 1583 DBFs that were actively operating during this time period.Footnote 10 A majority of our identified firms can be classified as SMEs. Even accounting for firms founded as subsidiaries, 75-85% of the firms identified in each year are independent SMEs (Fig. 2).Footnote 11

For these independent SMEs, the full set of patent data was systematically unified and cleaned. For example, applicant names were standardized, and we checked patent families to avoid double counting patents.Footnote 12 Patents belonging to a patent family are included in our sample using their earliest mentioned priority filing date. As a result, 4521 family IDs, or 4937 unique applications were identified. These patents are also used to identify the radical entities.

In order to determine whether a patent represents a radical innovation, we analyze the full set of available industry data provided by BIOCOM AG. This dataset includes 2200 dedicated biotechnology firms (both SMEs and large companies), pharmaceutical firms, and research institutions.Footnote 13 Based on this analysis, we are able to create a benchmark (control) group of patents that allows us to determine whether a new patent is in line with the established knowledge in the field, or radically new. For that, we extracted all available patents for these organizations from the PATSTAT database and ended up with a total number of 17280 unique patent applications.Footnote 14

Figure 3 shows that the trend of SMEs patents roughly corresponds to our baseline patent statistics. Most of the patents for both samples occur in the period 2000-2003, which is a couple of years after most of the firms were founded. The rapid decline in patents after 2003 can be explained by tendencies in the field mentioned previously (e.g., Kahl (2015) suggests the re-profiling of many of SMEs as an explanation), and also the negative attention directed at genetic research.

4.3 Identification of radical patents and radical innovators

As outlined above, our analysis proceeds with the identification of radical innovations using patent data. Previous research proposes a variety of procedures to identify radical innovations (e.g., Fleming 2001; Dahlin and Behrens 2005; Verhoeven et al. 2016). However, there is still no unified consensus regarding the attributes a patent should have in order to be considered radical. Thus, we apply a procedure originally proposed and applied by Fleming (2001, 2007). The procedure attempts to find combinations of existing knowledge that are new to a specific industry. We implement this approach on the benchmark patent population of 17280 unique patent applications described above. We checked each new patent application (on an annual basis) to determine whether its technological imprint (reflected by the technology classes on the patent document) has appeared in this specific combination before in the field. The emergence of very unusual combinations of patent classes qualifies the respective patent to be radically new, at least against the benchmark.

To ensure the reliability of our results, we combine the first identification procedure with a second approach that uses composite indicators (Verhoeven et al. 2016). Accordingly, in addition to the technology class assessment, we also take into account the impact that a potentially radical innovation exerts on the technological field. A common way to measure this impact is by using a forward citations indicator (e.g., Dahlin and Behrens 2005). Footnote 15 We apply this approach taking into account the fact that in some cases the application of important knowledge created by a radical patent may take some time. Hence, we included second-order forward citations in our identification procedure. The entire process is illustrated in Appendix Fig. 6

The operational implementation of the identification procedure outlined above is by no means trivial from a methodological perspective. First, we had to identify all possible dyads of IPC subclassesFootnote 16 belonging to the patents of both our SME sample and our benchmark sample. If we found patents that had more than two technology classes, we built permutations in order to decompose the technology class set assigned to a patent into dyads.Footnote 17 Our efforts resulted in a total of 31727 such combinations for SMEs, and 111272 for benchmark sample.Footnote 18 Next, SMEs dyads were juxtaposed to benchmark dyads. The patent was suspected to be radical if it: 1) was not found within our benchmark sample, or 2) appeared in our benchmark sample later than or in the same year as in SME sample, or 3) appeared in benchmark sample 1 year earlier than in SME sample. The latter condition was introduced because of an 18 months lag between patent application and publication. In this case, the SME’s patent contained the same unique combination of classes as the not yet published patent from the benchmark sample. If the patent from benchmark sample was not yet public knowledge at the time of SME’s invention, it cannot be said that the SME’s invention was based on that knowledge.

Our identification procedure resulted in 396 potentially radical IPC classes dyads, belonging to 286 patents (Fig. 4). Looking at the timeline of these innovations, one can see that most of them occur in 1998 or 1999, which is in line with the general peak in biotechnology patents. The most common patent classes are related to red biotechnology, or to enzymes and peptides research.Footnote 19

Finally, we checked for the intensity of forward citations of previously identified patents. In order to guarantee that a patent (at least the initial ones) could potentially be cited, we only included patents with a priority filing date before or during 2012. The full set of 286 patent applications satisfied this condition, but only 108 of them appear to have forward citations. Our threshold value was set at 3 citations, which corresponds to about the upper 30%.Footnote 20 The number of citations of forward citations corresponds to forward citations statistics. Here two cases can be especially noted: “Kopplung von Proteinen an ein modifiziertes Polysaccharid” (English: "Coupling proteins to a modified polysaccharide") – four 1st order citations and 83 2nd order citations; “Verfahren zur Gewinnung von Proteinen aus Pflanzen in reiner Form” (English: "Process for extracting proteins from plants in their pure form") – eight 1st order citations, 153 2nd order citations.

As a result, 77 patents belonging to 43 firms remain. These firms were examined to ensure that only independent SMEs are left in the sample. The reason for this is straight forward: biotechnology is characterized by a high level of acquisition. Thus, even if a particular firm was initially founded as an independent SME, we needed to make sure it still had this characteristic when the patent was applied for. Our final sample consists of 29 firms that are radical innovators.

4.4 Creation of ego networks of radical innovators

In this paper, we are not primarily interested in the innovative performance of radical innovators themselves, but rather in the innovative outcomes of their partners. Our aim is to understand whether and to what extent the radical innovations of our sample of 29 radical innovators affect the innovation performance of their directly linked cooperation partners. Accordingly, based on publicly funded project data, we create an ego network for each of the 29 radical innovators (‘ego’) and the full portfolio of partners (‘alters’). These networks also include ties between alters, but exclude second tier ties by definition (e.g., Borgatti et al. 2018). We use an ego network instead of full network approach because we what to learn more about the role of direct partnerships in transferring knowledge that is attached to a radical innovator. Structural characteristics of the overall network, or positioning measures of individual actors are outside the scope of our investigation.

A systematic screening of Förderkatalog reveals a total of 13 firms with projects that include two or more partners. The ego networks for this subset of firmsFootnote 21 are presented in Fig. 5. We can see that there are two large components and several small components. Connectivity in the ego network is mostly facilitated by universities or big corporations. For the purpose of our investigation, only small and medium firms are considered. Large firms were taken into account only if they were independent and not the part of the corporate group at the time of cooperation. After excluding other actors (for example large corporations or universities and research institutions), 35 actors remain. Starting from the year of collaboration, the number of applied patent families per firm was checked for each firm using PATSTAT (Autumn 2016 edition).Footnote 22 The annual number of patents is also used as the dependent variable for our count model.

4.5 Identification of statistical twins

In order to analyze the effect of radical innovation on a directly linked partner, we identify a control sample of firms (statistical twins), which are—in a statistical sense—very similar to our sample of radical innovators. The main difference is that the firms in our control group have not produced a radical innovation. Our approach is to determine whether the direct partners of the control group firms systematically underperform in terms of patenting performance.

Hence, we employ a propensity score matching technique to match each firm from our sample of radical innovators to one or more statistical twins, based on characteristics that both firms share. The baseline covariates (or matching variables) must fulfill the following properties: 1) be independent from each other, and 2) have an influence on the outcome and differ between conditions at baseline (Tanner-Smith and Lipsey 2014). It is important to note, that this method is usually used for sociology studies, or to test the effect of a particular treatment. In these cases, the baseline covariates reflect the status of the subjects to be divided into groups before the treatment. Using this approach to identify statistical twins of radical innovators is more complicated, because of the time-sensitive nature of patent applications and the tacitness of knowledge creation. These characteristics of radical innovation make it difficult to establish a before and after picture of the ‘radicalness’ of a firm. Thus, we stick to the following basic characteristics:

-

Number of employees that a firm has;

-

Size of the network, measured by the number of unique project partners;

-

Whether the firm was founded as a spin off (1) or not (0);

-

Whether the firm has universities in the network (1) or not (0);

-

Whether firm is situated in a technology center (1) or not (0).

These characteristics are based on previous empirical studies related to the innovative performance of firms. Firm size and overall network variables are frequently used as control variables that may influence a firm’s performance or survival (e.g., Fleming 2007; Shin et al. 2016). There is also empirical evidence that emphasizes the importance of industry-university collaboration (e.g., Beaudry and Kananian 2012), as well as the involvement of university researchers in firm activities, this is especially true for biotechnology (Zucker and Darby 1996). Our technology center variable is based on the fact, that technological centers promote communication between firms and encourage innovative performance, both necessary conditions for radical innovation creation.

For each of the radical firms, five potential twins were identified from the SME sample, after excluding our radical firms and their partners. The best fitting twins were chosen based on a qualitative analysis that included a screening of firms’ websites and an investigation into the specific focus of the firm’s activities. To ensure that the composition of our control group did not occur by chance, we conducted two robustness checks. First, we selected a different sample of statistical twins composed of the second-best candidates, and then we selected two samples of statistical twins using a random numbers generator. These three samples were also compiled and tested to ensure the robustness of our selection process.Footnote 23

4.6 Econometric approach

We estimate the innovative performance of the two samples: 1) partners of radical innovators, and 2) partners of their statistical twins. Patents are a well-accepted proxy for measuring innovative performance, especially for industries such as biotechnology or pharmaceuticals, where patent applications are important and a common form of invention protection and appropriation (e.g., Aggarwal and Hsu 2014; Hohberger 2014). Thus, our dependent variable is the annual number of patents applied for by a partner firm after initiating cooperation with a radical innovator. As radical patents usually come close after the founding of the firm, and are usually the result of a long process, no projects had to be excluded from the sample. When using patent counts as a dependent variable, an appropriate lag-structure needs to be integrated in the model. Because biotechnology and related fields possess high dynamics, we started measuring patents for the partners from the year of cooperation with a radical innovator (or its statistical twin). Patent lags of one and two years are presented in our paper as robustness checks.

Several controls were introduced in the model. Our variable AGE represents the number of years between a firm’s founding and the year of observation, and EMPL represents the number of employees reported by the firm in the observation year. The variable SUBS is used to determine if a firm is a subsidiary, or an independent entity in a year of observation, whereas SPINOFF indicates whether the firm was founded as a university or industry spin off. Our variable UNI identifies those firms that cooperated with a university in the form of a joint project. This variable takes the value of 1 if there was a cooperative effort with a university, and zero if no cooperation took place.

In order to test our three hypotheses, we specify three separate models. To check whether the partnership with radical innovators is beneficial, we introduce the variable RADICAL, which takes a value of 1 for partner firms of radical innovators, and zero for partner firms of our statistical twins control group. The variable is constant for a particular firm across years. If the same firm appears in both radical and non-radical ego networks, it is deleted from the panel. The second model addresses the role of geographical distance. The variable REGION takes a value of 1 for interregional, and zero for intraregional partners at the NUTS2 level.Footnote 24 The third model considers the possibility that partner firms may have the same technological background, or operate in a very different technological field. The binary variable BIOTECH takes the value of 1 if partner firms have a biotechnology background, and zero otherwise. This variable was coded based on the BIOCOM yearbook data. The variables REGION and BIOTECH according to stated hypotheses were identified only for the partners of radical innovators. Table 1 presents a brief description of the variables and data sources.

Our dependent variable (number of patents per year) has a count character and is represented by the equation below. Patents per firm are not normally distributed. The distribution is typically right skewed. Therefore, a count model is preferable, rather than using a linear model specification (Cincera 1997). Furthermore, our data indicates overdispersion, confirmed by likelihood-ratio test of alpha. In this case, a negative binomial (NB) regression is usually used instead of a poisson specification (e.g., Petruzzelli et al. 2015). Accordingly, we employ a NB model characterized by the following form (Petruzzelli et al. 2015; Beaujean and Morgan 2016; Cincera 1997):

where X refers to the independent and control variables. The variables are tested for firm i in time period t, reflecting firm-year entries.

Our data is characterized by a panel structure, as we are dealing with patent applications per firm per year. This allows us to account for different firm-specific characteristics and firm heterogeneity, and addresses the problem of multicollinearity (Kennedy 2003). Also, a likelihood-ratio test vs. a pooled model favors a panel structure.

5 Results

5.1 Basic descriptive statistics

Our approach includes a firm-year level analysis. By constructing an unbalanced panel dataset, we explicitly account for the entry and exit dates for the partners of our radical innovators and partners of our statistical twins.Footnote 25 A firm-specific observation window of our radical innovators’ partners starts with the first year of cooperation and ends in 2016, or the year a firm was dissolved. In the latter case, the year of dissolution was taken from Amadeus, or the WISO-net database. Our sample of partners includes 56 firms, 35 partners of radical firm and 21 partners of statistical twins, giving us a total 532 firm-year observations. Out of 35 firms partnering with our radical firms, 21 are dedicated biotech firms (BIOTECH), and 20 are located in the same region their radical collaborator (REGION).Footnote 26

Basic descriptive statistics on patenting activities of the firms in our sample are presented in Table 2. As can be seen, many of the firms, especially those partnering with our non-radical twins, do not possess a patent. Among the firms that have a patent, more than half have 1-10 patents. The partners of our radical firms show a much higher diversity in the types of patent applications. The most patents (107) were applied for by Vectura GmbH, a small firm that is a subsidiary of an international corporation Vectura Group.

The main descriptive statistics for our control variables, across both radical and non-radical firms’ partners, are provided in Table 3.

A closer look at these measures allows us to make the following observations. First, the partners of our radical firms are, on average, much younger than the partners of our non-radical ‘twins’. Even not accounting for outliers, we see a 3-year difference based on the median value. This suggests that our radical innovators seek to partnership with younger firms. Firms that partners of our radical innovators are also generally larger and more independent (not subsidiaries) than those of our non-radical ‘twins’. Interestingly, partners of our non-radical ‘twins’ are more frequently founded as spin-offs, and have joint projects with universities and research institutions. In order to check for possible multicollinearity, we estimated the correlations between variables. We observed a low to medium level of pairwise correlations, so none of the variables were excluded from the model (Table 4).

5.2 Results of the panel regression analysis

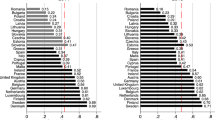

The results of our four model specifications analysisFootnote 27 are provided in Table 5. Model (1) represents our baseline specification, and is a test for Hypothesis 1. In this model estimation, we include only the variable RADICAL and the control variables, and include the partners of both radical and non-radical firms (532 observations). Models (2)–(4) are designed to test Hypotheses 2 and 3, and include only the partners of our radical innovators (288 observations). Model (2) includes the variable REGION in order to determine the influence of geographical proximity on the collaborative partnership. Model (3) includes the BIOTECH variable to determine the influence of cognitive proximity on the collaborative partnership, and Model (4) includes both variables. All model specifications are estimated with zero-, one- and two-year lags.

When we analyze the results of the baseline negative binomial regression for an unbalanced panel (Model 1), we see that the coefficients remain stable for almost all variables. However, the significance of the coefficients generally decreases when lags are introduced. The main variable of interest, RADICAL, shows a positive significant coefficient. This suggests that our sample partners of radical innovators show a higher innovative performance than our sample partners of their twins. This result confirms our Hypothesis 1, showing the presence of positive externalities. Apart from that, across all model specifications, the variables AGE and EMPL show consistent results. A closer reading of these results indicates that younger and larger partners have a higher innovative performance. Interestingly, the variable SUBS shows a slightly significant negative coefficient, meaning that stand-alone SMEs generally tend to patent more than subsidiaries.

The negative binomial regression (Model 2) reveals a negative significant coefficient for the variable REGION. This suggests that, based on using NUTS2 to define our regional variable, interregional partners profit from cooperation with radical partner more than intraregional ones. Although this finding contradicts our Hypothesis 2, it is in line with some of the literature. Of special note are the findings of Breschi and Lissoni (2003), showing that today, even tacit knowledge can be transferred over distance. Another possible explanation for our finding is that competition with other proximate SMEs may hinder cooperation.

The results from Model 3 reveal a negative significance for the variable BIOTECH. This suggests that the innovative performance of firms working in the same field as their radical innovator partner are less impacted by the cooperative effort. This result confirms our Hypothesis 3. Thus, radical innovators rather prefer sharing their experience with firms that complement their capabilities, rather than with ones that may substitute them.

When we examine Model 4, with both our geographical (REGION) and technological (BIOTECH) dimensions, we see the direction of the coefficients is stable. Notice, however, that the geographical dimension loses its significance. Model 4 does confirm the significance of our AGE and EMPL variables that was revealed in all the other models. The UNI variable also shows a slightly positive coefficient in our final specification, meaning that firms cooperating with universities have a higher number of patent applications than non-cooperating ones.

In sum, we find support for Hypotheses 1 and 3, and a contradiction to Hypothesis 2. Our results indicate that partners of radical innovators are more innovative in terms of patent counts than partners of their statistical twins. Radical innovators are also more likely to seek partnerships and exchange knowledge with firms operating in diverse regions and industries.

6 Discussion and conclusion

In this paper, we turn our attention to a topic that is still largely unexplored, namely: how (and/or whether) the unique knowledge embodied in radical innovations spreads out across firm boundaries and influences the innovation performance of directly linked cooperation partners. Since radical innovations carry a special kind of knowledge, it is still anything but clear how related knowledge transfer processes take place, and which determinants influence them.

Our findings confirm our initial expectations, and show that directly linked partners of radical innovators benefit from this partnership. Our sample of firms that partnered with our sample of radical innovators outperformed the firms in our control group of statistical twins in terms of patent applications. To gain deeper insights into the mechanisms that improve the performance of the firms partnering with our radical innovators, we examined the partners’ geographical location and technological orientation in more detail. Our results indicate—contrary to our original expectations—that geographically distant partners of radical innovators show significantly higher innovation outcomes in subsequent time periods. This finding echoes Boschma’s (2005) argument that geographically proximate firms may become too inward looking over time, and the knowledge base becomes more and more similar over time. Our results also show—in line with our expectations—that firms operating in a field different than that of the radical innovator derive more benefit from the partnerships. In other words, firms with a notably different knowledge background seem to gain more from their partnership with radically innovative DBFs in terms of subsequent innovation outcomes. The fact that we focus on radical innovators involved in biotechnology could drive our results, in the sense that a non-biotech firm cooperating with a radically innovative biotech DBF sensitizes the cooperating firm to completely new business opportunities in their own field, initiates ideas for novel products and services, and broadens their innovation horizon. In a nutshell our results show that both geographically and technologically distant partners seem to profit more significantly from their partnership with a radical innovator.

Our findings have far-reaching implications for policy makers and managers. Policy measures designed to stimulate innovations at the regional level, especially among SMEs in a knowledge intensive field such as biotechnology (e.g., BioRegio, BioChance), may also have positive consequences for more distant firms and organizations. Given the risks and high economic potential inherent to radical innovations, continuous support of radical innovators should be institutionalized. Against this background, it is interesting to note that the Agency for Radical Innovation (SprinD GmbH) was recently founded in Leipzig on December 16, 2019, by the Federal Ministry of Education and Research (BMBF) and the Federal Ministry of Economics and Energy (BMWi). SprinD aims to actively promote radical innovation in Germany. The agency is intended to be a flexible and responsive government funding instrument that supports and accelerates the breakthrough of highly innovative ideas into the market. The primary goal of the agency is the discovery and further development of research ideas that break completely new ground. Another insight that can be drawn from our investigation is that directly linked partners of radically innovative DBFs experience a positive innovation effect, too. Formal cooperation ties between radically innovating SMEs and their direct partners allow for bridging long geographical distances and thus serve as an important interregional transmission channels for knowledge spill overs. Even more important, radical innovations also spill over to companies from other fields of technology. Hence, our findings suggest that technology-centered funding programs may exert a much broader impact than previously assumed. However, programs and initiatives that aim to produce radical innovations should be oriented towards interdisciplinarity and transdisciplinarity. Technological boundaries should be removed, and thinking and acting across regions should be encouraged. The design of cooperation-based funding instruments that aim to bring engineers, creative thinkers and practitioners from different technological field into a closer exchange, could provide one way to facilitate radical innovations. At the same time, our study allows for deriving some interesting recommendations for managers and decision makers in companies. The establishment and maintenance of partnerships with companies that produce radically new ideas from other technological fields can pay off in terms of innovation outcomes. Our results also suggest, that when choosing a partner, geographical closeness is often overestimated, especially in the age of digital technologies. Thus, managers should encourage their R&D personnel to seek collaborative activities with R&D departments outside the direct regional surrounding and which differ from the own company’s competence and technology portfolio.

There are limitations to our study. First, we only focus on the ego networks of radical innovators, and do not take into account second or third tier partnerships. Including full networks in a research design may provide a more complete understanding of knowledge spill overs seen in a more complex full network. Extending our analysis to include an investigation of non-contractual relationships, e.g., communication networks or labor mobility, might shed light on informal modes of knowledge transfers. Although the propensity score matching technique used in our analysis is a useful technique, it is also a sensitive instrument. A slight change in the parameters can change the results, and lead to a slightly different benchmark group. Data availability is always an issue in empirical research. Had we been able to develop a more complete or larger dataset, we could have run more specifications and performed more robustness checks. The geographical measure used in our study is very simplistic and coarse. An alternative measure of the geographic distance could be more precise if one considers distance in kilometers or hours of travelling, rather than a simple regional variable. Even our measurement of technological proximity is somewhat simplistic. Instead of using a binary variable, one could use a continuous variable based on the similarity of technological profiles of radical innovators and their partners. And finally, it would be interesting to include additional proximity measures in our analysis, such as social, institutional, and organizational proximity.

Notes

Here we use the definition of SME proposed by European Commission: the enterprise is considered an SME, if it has less than 250 employees and “annual turnover not exceeding EUR 50 million, and/or an annual balance sheet total not exceeding EUR 43 million” (Recommendation 2003/361/EC).

Meaning diverse specialization and access to differentiated information.

Ego networks encompass the ego itself and all its directly linked partners. We measure the network’s structure based on the publicly funded project data. Indirect connections between the alters are included, but second tier ties are not included (Hite and Hesterly 2001).

Based on the initial ‘national innovation system’ approach (Lundvall 1992; Nelson 1992; Freeman 1992), various specifications were developed, including ‘regional innovation systems’ (Braczyk et al. 1998), ‘sectoral innovation system’ (Malerba 2002), ‘technological innovation systems’ (Carlsson et al. 2002).

Accessed in January 2019.

Accessed in December 2018.

An alternative way of measuring cooperation, i.e., the number of co-applied or co-invented patents, was also checked. However, common subsidized projects seem to be a better measure of cooperative activity for several reasons, apart from those stated above. First, funding projects present an external source of data, whereas patents were included in the model as a dependent variable. Thus, we avoid selectivity issues by including only those firms in the model that have patents. Second, cooperation may not always be revealed by a patent. When project partners operate in different biotechnology sectors, overarching projects may be better source of information. We also checked the CORDIS Database of EU-supported projects, but that dataset did not provide enough information for this SMEs population.

Autumn edition 2016 and Spring edition 2019

Help in creating the firm dataset for project purposes was provided by Leonard Prochaska, University of Greifswald.

These firms were independent at founding, which does not mean that they were not acquired at some point in time. This factor was then taken into account after patent identification.

A patent family indicates several patents that are related to the same or similar invention (EPO). We use DOCDB simple patent families for our analysis. Priority application year is used for the analysis. Thus, double counts of the same invention applied by a firm in different patent offices can be avoided. For more information: https://www.epo.org/searching-for-patents/helpful-resources/first-time-here/patent-families/docdb.html

The information on actively operating research facilities reported by BIOCOM AG is not available for every year. Over time, however, the population of research facilities appears to be rather stable. Detailed information is available upon request.

Here no filter on application year was needed.

A measure of the number of patent families that cite or reference focal patents.

We are performing a comparison at the level of four digits or the level of subclasses, e.g., A01H. This level of analysis provides enough information to be able to differentiate between technological fields, and identify patents that come from different subject areas. If we compare at the level of main or subgroups, a patent might be classified as radical even though it includes two technologically similar groups, especially as we take only one industry into account. This level was also used in the work of Fleming (2007), who introduced this method of radical patents definition.

For example, if a patent had three IPC classes (on the main group level) assigned, e.g. G01N 5, C12N 7 and C12M 7, three dyads were built: G01N 5 - C12N7, G01N 5 - C12M 7 and C12N 7 - C12M7.

Number of patents x number of IPC codes combinations.

The threshold level was identified based on the break in a forward citation graph. Several robustness checks were conducted using four, five and six citation threshold values. Our four and five citations check gave us nearly the same number of radical innovators. In case of our six citations check, one SME had to be excluded from the sample. Results are available upon request.

A list of the nodes can be found in Appendix Table 7. Universities are presented at the level of working groups. Firms are presented on the unit level, or in the case of large firms on the department level. If a network is built on the university level, much higher connectivity is seen. Universities thus serve as bridges between SMEs. However, in the scope of this paper we are not primarily interested in university-SME cooperation, therefore no detailed analysis of this issue is provided. Large firms and SMEs were presented at the unit level.

We also added PATSTAT 2019 Spring edition for 2016 patents.

A list of twins and all matches can be found in Appendix Table 8.

Using the NUTS3 level as a category to measure this variable did not significantly change the results.

Here, the results of our analysis using the first manually chosen twins sample are presented.

Two firms moved to different region during the observation time period, changing the value of the REGION variable for the corresponding year.

This analysis in based on our first self-matched sample. Other matching samples, as well as different model specifications are presented in Appendix Table 9 as robustness checks.

References

Abramo, G., D’Angelo, C. A., Di Costa, F., & Solazzi, M. (2009). University–industry collaboration in Italy: A bibliometric examination. Technovation, 29(6-7), 498–507.

Aggarwal, V. A., & Hsu, D. H. (2014). Entrepreneurial exits and innovation. Management Science, 60(4), 867–887.

Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly, 45(3), 425–455.

Aldrich, H., & Auster, E. R. (1986). Even dwarfs started small: Liabilities of age and size and their strategic implications. Research in Organizational Behavior, 8, 165–198.

Al-Laham, A., Amburgey, T. L., & Baden-Fuller, C. (2010). Who is my partner and how do we dance? Technological collaboration and patenting speed in US biotechnology. British Journal of Management, 21(3), 789–807.

Almeida, P., & Kogut, B. (1999). Localization of knowledge and the mobility of engineers in regional networks. Management Science, 45(7), 905–917.

Arant, W., Fornahl, D., Grashof, N., Hesse, K., & Söllner, C. (2019). University–industry collaborations—The key to radical innovations? Review of Regional Research, 39(2), 119–141.

Arts, S., Appio, F., & Van Looy, B. (2012). Validating patent indicators that asses technological radicalness: The case of biotechnology. In Proceedings of 17th international conference on science and technology indicators (pp. 82-97). Science-Metrix and OST.

Autio, E., Kenney, M., Mustar, P., Siegel, D., & Wright, M. (2014). Entrepreneurial innovation: The importance of context. Research Policy, 43(7), 1097–1108.

Baum, J. A., Calabrese, T., & Silverman, B. S. (2000). Don't go it alone: Alliance network composition and startups' performance in Canadian biotechnology. Strategic Management Journal, 21(3), 267–294.

Beaudry, C., & Kananian, R. (2012). Impact of university–industry contracts resulting in patents on the quality of patenting in biotechnology. In DRUID 2012 Conference, Copenhagen, Denmark, June (pp. 19-21).

Beaujean, A. A., & Morgan, G. B. (2016). Tutorial on using regression models with count outcomes using R. Practical Assessment, Research & Evaluation, 21.

Borgatti, S. P., Everett, M. G., & Johnson, J. C. (2018). Analyzing social networks (2nd edn.). Los Angeles: SAGE Publications Ltd.

Boschma, R. (2005). Proximity and innovation: a critical assessment. Regional Studies, 39(1), 61–74.

Braczyk, H. J., Cooke, P. N., & Heidenreich, M. (Eds.). (1998). Regional innovation systems: The role of governances in a globalized world. London: UCL Press.

Breschi, S., & Lissoni, F. (2001). Knowledge spillovers and local innovation systems: A critical survey. Industrial and Corporate Change, 10(4), 975–1005.

Breschi, S., & Lissoni, F. (2003). Mobility and social networks: Localised knowledge spillovers revisited. CESPRI Working Paper no. 142, University Bocconi, Milan.

Breschi, S., & Lissoni, F. (2005). “Cross-firm” inventors and social networks: Localized knowledge spillovers revisited. Annales d'Economie et Statistique, 79, 189–209.

Breschi, S., & Lissoni, F. (2009). Mobility of skilled workers and co-invention networks: An anatomy of localized knowledge flows. Journal of Economic Geography, 9(4), 439–468.

Broekel, T., & Boschma, R. (2012). Knowledge networks in the Dutch aviation industry: The proximity paradox. Journal of Economic Geography, 12(2), 409–433.

Capaldo, A. (2007). Network structure and innovation: The leveraging of a dual network as a distinctive relational capability. Strategic Management Journal, 28, 585–608.

Caragliu, A., & Nijkamp, P. (2016). Space and knowledge spillovers in European regions: The impact of different forms of proximity on spatial knowledge diffusion. Journal of Economic Geography, 16(3), 749–774.

Carlsson, B., Jacobsson, S., Holmén, M., & Rickne, A. (2002). Innovation systems: analytical and methodological issues. Research Policy, 31(2), 233–245.

Ciesa, V., & Toletti, G. (2004). Network of collaborations for innovation: The case of biotechnology. Technology Analysis & Strategic Management, 16(1), 73–96.

Cincera, M. (1997). Patents, R&D, and technological spillovers at the firm level: Some evidence from econometric count models for panel data. Journal of Applied Econometrics, 12(3), 265–280.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Dahlin, K. B., & Behrens, D. M. (2005). When is an invention really radical?: Defining and measuring technological radicalness. Research Policy, 34(5), 717–737.

Dalpé, R. (2002). Bibliometric analysis of biotechnology. Scientometrics, 55(2), 189–213.

Das, T. K., & Teng, B. S. (2002). Alliance constellations: A social exchange perspective. Academy of Management Review, 27(3), 445–456.

De Propris, L. (2000). Innovation and inter-firm co-operation: The case of the West Midlands. Economics of Innovation and New Technology, 9(5), 421–446.

Díez-Vial, I., & Fernández-Olmos, M. (2015). Knowledge spillovers in science and technology parks: How can firms benefit most? The Journal of Technology Transfer, 40(1), 70–84.

Doz, Y. L., & Hamel, G. (1997). The use of alliances in implementing technology strategies. Managing strategic innovation and change. New York: Oxford University Press.

Dyer, J. H., & Nobeoka, K. (2000). Creating and managing a high-performance knowledge-sharing network: The Toyota case. Strategic Management Journal, 21(3), 345–367.

Eraydin, A., & Aematli-Köroglu, B. (2005). Innovation, networking and the new industrial clusters: the characteristics of networks and local innovation capabilities in the Turkish industrial clusters. Entrepreneurship and Regional Development, 17, 237–266.

Fleming, L. (2001). Recombinant uncertainty in technological search. Management Science, 47(1), 117–132.

Fleming, L. (2007). Breakthroughs and the" long tail" of innovation. MIT Sloan Management Review, 49(1), 69.

Fornahl, D., Broekel, T., & Boschma, R. (2011). What drives patent performance of German biotech firms? The impact of R&D subsidies, knowledge networks and their location. Papers in Regional Science, 90(2), 395–419.