Abstract

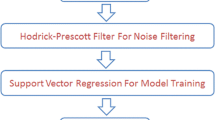

In this paper, a new machine learning (ML) technique is proposed that uses the fine-tuned version of support vector regression for stock forecasting of time series data. Grid search technique is applied over training dataset to select the best kernel function and to optimize its parameters. The optimized parameters are validated through validation dataset. Thus, the tuning of this parameters to their optimized value not only increases model’s overall accuracy but also requires less time and memory. Further, this also minimizes the model from being data overfitted. The proposed method is used to analysis different performance parameters of stock market like up-to-daily and up-to-monthly return, cumulative monthly return, its volatility nature and the risk associated with it. Eight different large-sized datasets are chosen from different domain, and stock is predicted for each case by using the proposed method. A comparison is carried out among the proposed method and some similar methods of same interest in terms of computed root mean square error and the mean absolute percentage error. The comparison reveals the proposed method to be more accurate in predicting the stocks for the chosen datasets. Further, the proposed method requires much less time than its counterpart methods.

Similar content being viewed by others

References

Malkiel BG (2003) The efficient market hypothesis and its critics. J Econ Perspect 17(1):59–82. https://doi.org/10.1257/089533003321164958

Henrique BM, Sobreiro VA, Herbert K (2018) Stock price prediction using support vector regression on daily and up to the minute prices. J Finance Data Sci 4(3):183–201. https://doi.org/10.1016/j.jfds.2018.04.003

Preeti N, Tu NN, Shivani A, Jude HD (2021) Capsule and attention layer augmented convolutional methods for review categorization in Amazon dataset. Comput Electr Eng (Early Access)

Nguyen GL, Dumba B, Ngoc Q-D, Le H-V, Tu NN (2021) A collaborative approach to early detection of IoT Botnet. Comput Electr Eng (Early Access)

Nguyen CH, Pham TL, Nguyen TN, Ho CH, Nguyen TA (2021) The linguistic summarization and the interpretability, scalability of fuzzy representations of multilevel semantic structures of word-domains. Microprocess Microsyst 81:103641

Pham DV, Nguyen GL, Nguyen TN, Pham CV, Nguyen AV (2021) Multi-topic misinformation blocking with budget constraint on online social networks. IEEE Access 8:78879–78889

Le NT, Wang J, Le DH, Wang C, Nguyen TN (2021) Fingerprint enhancement based on tensor of wavelet subbands for classification. IEEE Access 8:6602–6615

Le NT, Wang J, Wang C, Nguyen TN (2019) Novel framework based on HOSVD for Ski goggles defect detection and classification. Sensors 19:5538

Le NT, Wang J, Wang C, Nguyen TN (2019) Automatic defect inspection for coated eyeglass based on symmetrized energy analysis of color channels. Symmetry 11:1518

Duc-Ly V, Trong-Kha N, Nguyen Tam V, Nguyen TN, Fabio M, PhuH P (2020) HIT4Mal: Hybrid image transformation for malware classification. Trans Emerg Telecommun Technol 31:e3789

Vu D, Nguyen T, Nguyen TV, Nguyen TN, Massacci F, Phung PH (2019) A convolutional transformation network for malware classification. In: 2019 6th NAFOSTED conference on information and computer science (NICS), pp 234–239

Zhang GP (2003) Time series forecasting using a hybrid ARIMA and neural network model. Neurocomputing 50(1):159–175. https://doi.org/10.1016/S0925-2312(01)00702-0

Hamzaebi C, Akay D, Kutay F (2009) Comparison of direct and iterative artificial neural network forecast approaches in multi-periodic time series forecasting. Expert Syst Appl 36(2):3839–3844. https://doi.org/10.1016/j.eswa.2008.02.042

Guresen E, Kayakutlu G, Daim TU (2011) Using artificial neural network models in stock market index prediction. Expert Syst Appl 38(8):10389–10397. https://doi.org/10.1016/j.eswa.2011.02.068

Wang JZ, Wang JJ, Zhang ZG, Guo SP (2011) Forecasting stock indices with back propagation neural network. Expert Syst Appl 38(11):14346–14355. https://doi.org/10.1016/j.eswa.2011.04.222

Chang P, Wang D, Zhou CA (2012) Novel model by evolving partially connected neural network for stock price trend forecasting. Expert Syst Appl 39(1):611–620. https://doi.org/10.1016/j.eswa.2011.07.051

Jo RDA, Ferrira TAE (2013) A morphological rank linear evolutionary method for stock market prediction. Inf Sci 237(1):3–17. https://doi.org/10.1016/j.ins.2009.07.007

Hegazy O, Soliman OS, Salam MA (2014) A Machine Learning Model for Stock Market Prediction. arXiv preprint arXiv:1402.7351

Bagheri A, Peyhani HM, Akbari M (2014) Financial forecasting using ANFIS network with quantum behaved particle swarm optimization. Expert Syst Appl 41(14):6235–6250. https://doi.org/10.1016/j.eswa.2014.04.003

Rather AM, Agarwal A, Sastry VN (2015) Recurrent neural network and a hybrid model for prediction of stock returns. Expert Syst Appl 42(6):3234–3241. https://doi.org/10.1016/j.eswa.2014.12.003

Majhi B, Anish CM (2015) Multi objective optimization based adaptive models with fuzzy making for stock market forecasting. Neuro Comput 167(2015):502–511. https://doi.org/10.1016/j.neucom.2015.04.044

Rout AK, Dash PK, Dash R, Bisoi R (2015) Forecasting financial time series using a low complexity recurrent neural network and evolutionary learning approach. J King Saud Univ Comput Inf Sci 29(4):536–552. https://doi.org/10.1016/j.jksuci.2015.06.002

Chen MY, Chen BT (2015) A hybrid fuzzy time series model based on granular computing for stock price forecasting. Inf Sci 294:227–241. https://doi.org/10.1016/j.ins.2014.09.038

Nayak RK, Mishra D, Rath AK (2015) A Naive SVM-KNN based stock market trend reversal analysis for Indian benchmark indices. Appl Soft Comput 35(1):670–680. https://doi.org/10.1016/j.asoc.2015.06.040

Jia H Investigation into the effectiveness of long short term memory networks for stock price prediction. arXiv preprint arXiv:1603.07893

Qu H, Zhang Y (2016) A new kernel of support vector regression for forecasting high-frequency stock returns. Math Probl Eng 1:1–9. https://doi.org/10.1155/2016/4907654

Kumar D, Meghwani SS, Thakur M (2016) Proximal support vector machine based hybrid prediction models for trend forecasting in financial markets. J Comput Sci 17(1):1–13. https://doi.org/10.1016/j.jocs.2016.07.006

Moghaddam AH, Moghaddam MH, Esfandyari M (2016) Stock market index prediction using artificial neural network. J Econ Finance Adm Sci 21(41):89–93. https://doi.org/10.1016/j.jefas.2016.07.002

Kumar DP, Ravi V (2017) Forecasting financial time series volatility using particle swarm optimization trained quantile regression neural network. Appl Soft Comput 58(1):35–52. https://doi.org/10.1016/j.asoc.2017.04.014

Mehdi K, Zahra H (2017) Performance evaluation of series and parallel strategies for financial time series forecasting. Financ Innov 3(24):1–15. https://doi.org/10.1186/s40854-017-0074-9

Lei L (2018) Wavelet neural network prediction method of stock price trend based on rough set attribute reduction. Appl Soft Comput 62:923–932. https://doi.org/10.1016/j.asoc.2017.09.029

Senapati MR, Das S, Mishra S (2018) A novel model for stock prediction using hybrid neural network. J Inst Eng India Ser B 99:555–563. https://doi.org/10.1007/s40031-018-0343-7

Selvamuthu D, Kumar V, Mishra A (2019) Indian stock market prediction using artificial neural networks on tick data. Financ Innov. https://doi.org/10.1186/s40854-019-0131-7

Syarif I, Prugel-Bennett A, Wills G (2012) Data mining approaches for network intrusion detection: from dimensionality reduction to misuse and anomaly detection. J Inf Technol Rev 3(2):70–83

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Dash, R.K., Nguyen, T.N., Cengiz, K. et al. Fine-tuned support vector regression model for stock predictions. Neural Comput & Applic 35, 23295–23309 (2023). https://doi.org/10.1007/s00521-021-05842-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-021-05842-w