Abstract

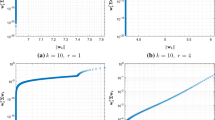

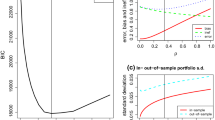

The covariance matrix, which should be estimated from the data, plays an important role in many multivariate procedures, and its positive definiteness (PDness) is essential for the validity of the procedures. Recently, many regularized estimators have been proposed and shown to be consistent in estimating the true matrix and its support under various structural assumptions on the true covariance matrix. However, they are often not PD. In this paper, we propose a simple modification to make a regularized covariance matrix be PD while preserving its support and the convergence rate. We focus on the matrix \(\ell_{\infty }\) norm error in covariance matrix estimation because it could allow us to bound the error in the downstream multivariate procedure relying on it. Our proposal in this paper is an extension of the fixed support positive-definite (FSPD) modification by Choi et al. (2019) from spectral and Frobenius norms to the matrix \(\ell_{\infty }\) norm. Like the original FSPD, we consider a convex combination between the initial estimator (the regularized covariance matrix without PDness) and a given form of the diagonal matrix minimize the \(\ell_{\infty }\) distance between the initial estimator and the convex combination, and find a closed-form expression for the modification. We apply the procedure to the minimum variance portfolio (MVP) optimization problem and show that the vector \(\ell_{\infty }\) error in the estimation of the optimal portfolio weight is bounded by the matrix \(\ell _{\infty }\) error of the plug-in covariance matrix estimator. We illustrate the MVP results with S&P 500 daily returns data from January 1978 to December 2014.

Similar content being viewed by others

References

Bickel, P., Levina, E.: Covariance regularization by thresholding. Ann. Stat. 36(6), 2577–2604 (2008a)

Bickel, P., Levina, E.: Regularized estimation of large covariance matrices. Ann. Stat. 36(1), 199–227 (2008b)

Cai, T.T., Liu, W.: Adaptive thresholding for sparse covariance matrix estimation. J. Am. Stat. Assoc. 106(494), 672–684 (2011)

Cai, T.T., Zhang, C.-H., Zhou, H.H.: Optimal rates of convergence for covariance matrix estimation. Ann. Stat. 38(4), 2118–2144 (2010)

Cai, T.T., Zhou, H.H.: Minimax estimation of large covariance matrices under \(\ell _1\)-norm. Stat. Sin. 22(4), 1319–1349 (2012a)

Cai, T.T., Zhou, H.H.: Optimal rates of convergence for sparse covariance matrix estimation. Ann. Stat. 40(5), 2389–2420 (2012b)

Chan, L.K.C., Karceski, J., Lakonishok, J.: On portfolio optimization: forecasting covariances and choosing the risk model. Rev. Financ. Stud. 12(5), 937–974 (2015)

Choi, Y.-G., Lim, J., Choi, S.: High-dimensional Markowitz portfolio optimization problem: empirical comparison of covariance matrix estimators. J. Stat. Comput. Simul. 89(7), 1278–1300 (2019a)

Choi, Y.-G., Lim, J., Roy, A., Park, J.: Fixed support positive-definite modification of covariance matrix estimators via linear shrinkage. J. Multivar. Anal. 171, 234–249 (2019b)

Dai, Z., Dong, X., Kang, J., Hong, L.: Forecasting stock market returns: new technical indicators and two-step economic constraint method. N. Am. J. Econ. Finance 53, 101216 (2020)

Dai, Z., Wen, F.: Some improved sparse and stable portfolio optimization problems. Finance Res. Lett. 27, 46–52 (2018)

DeMiguel, V., Garlappi, L., Nogales, F.J., Uppal, R.: A generalized approach to portfolio optimization: improving performance by constraining portfolio norms. Manag.Sci. 55(5), 798–812 (2009)

Fan, J., Liao, Y., Mincheva, M.: Large covariance estimation by thresholding principal orthogonal complements. J. R. Stat. Soc. Ser. B (Stat. Methodol.) 75(4), 603–680 (2013)

Glasserman, P., Kang, W.: OR forum-design of risk weights. Oper. Res. 62(6), 1204–1220 (2014)

Khare, K., Oh, S.-Y., Rajaratnam, B.: A convex pseudo-likelihood framework for high dimensional partial correlation estimation with convergence guarantees. J. R. Stat. Soc. Ser. B (Stat. Methodol.) 77(4), 803–825 (2015)

Ledoit, O., Wolf, M.: Improved estimation of the covariance matrix of stock returns with an application to portfolio selection. J. Empir. Finance 10(5), 603–621 (2003)

Ledoit, O., Wolf, M.: Honey, I shrunk the sample covariance matrix. J. Portfolio Manag. 30(4), 110–119 (2004)

Ledoit, O., Wolf, M.: Nonlinear shrinkage of the covariance matrix for portfolio selection: Markowitz meets Goldilocks. Rev. Financ. Stud. 30(12), 4349–4388 (2017a)

Ledoit, O., Wolf, M.: Numerical implementation of the QuEST function. Comput. Stat. Data Anal. 115, 199–223 (2017b)

Liu, H., Wang, L., Zhao, T.: Sparse covariance matrix estimation with Eigenvalue constraints. J. Comput. Gr. Stat. 23(2), 439–459 (2014)

Rothman, A.J.: Positive definite estimators of large covariance matrices. Biometrika 99(3), 733–740 (2012)

Won, J.-H., Lim, J., Kim, S.-J., Rajaratnam, B.: Condition-number-regularized covariance estimation. J. R. Stat. Soc. Ser. B (Stat. Methodol.) 75(3), 427–450 (2013)

Xue, L., Ma, S., Zou, H.: Positive-definite \(\ell _{1}\)-penalized estimation of large covariance matrices. J. Am. Stat. Assoc. 107(500), 1480–1491 (2012)

Acknowledgements

We are grateful to the associate editor and two reviewers for many valuable comments. S. Katayama’s research is supported by JSPS KAKENHI Grant No. 18K18009, and J. Lim and Y-G. Choi’s research is supported by the National Research Foundation of Korea (NRF-2017R1A2B2012264 and NRF-2020R1G1A1A01006229).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Cho, S., Katayama, S., Lim, J. et al. Positive-definite modification of a covariance matrix by minimizing the matrix \(\ell_{\infty}\) norm with applications to portfolio optimization. AStA Adv Stat Anal 105, 601–627 (2021). https://doi.org/10.1007/s10182-021-00396-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10182-021-00396-7