Abstract

Classic mean–variance optimization is very sensitive to expected returns. An alternative and more robust approach is to calculate the implied returns given the current portfolio allocation and risk profile. Portfolio managers can then do a reality check on the implied returns and find opportunities for better allocations. The most common implied return calculation assumes normal distribution and unlimited leverage, and use volatility as risk measure and covariance matrix as model input. However, practitioners usually have leverage constraints, often use non-parametric risk models, and care about portfolio tail risk. This paper presents a new approach to calculate expected returns with leverage constraints. This approach is flexible enough to alleviate normal distribution assumption, connect with non-parametric risk models, and use tail risk measures, such as conditional VaR.

Similar content being viewed by others

Notes

See Fabozzi, F. J., Kolm, P. N., Pachamanova, D. A., and Focardi, S. M. “Robust Portfolio Optimization and Management”. (John Wiley & Sons. 2007) p. 4, Black, Fischer, and Robert Litterman. 1992. Global portfolio optimization. Financial Analysts Journal 48(5): 28–43, and Litterman, Robert B. “Modern Investment Management: An Equilibrium Approach” (Hoboken, N.J.: John Wiley, 2003) p. 76, for detailed discussions.

CVaR is a better risk measure than VaR for optimization, because VaR is not coherent (Krokhmal et al. 2002; Artzner et al. 1999). However, VaR is coherent where all portfolios can be modeled as linear combinations of elliptically distributed risk factors (McNeil et al. (2015), so optimization using VaR is reasonable for portfolios without derivatives or strategies with discrete return distributions.

Incremental VaR does not always exist, as VaR is non-convex and non-smooth as a function of positions in some special cases, but it exists for most investment portfolios or strategies, so is calculated by many commercial risk systems. See Rockafellar et al. (2000), Artzner et al. (1999) and RiskMetrics (2009).

Morningstar, “Morningstar Global Allocation Index Fact Sheet,” accessed October 20, 2016, https://corporate.morningstar.com/US/documents/Indexes/MorningstarGlobalAllocationIndexFactSheet.pdf I replaced the Morningstar Emerging Market Index with MSCI Emerging Market index, as the history of the Morningstar index is incomplete on Bloomberg.

To avoid too many decimal points and for illustration purpose, I rounded the weights calculated by Eq. (16) in sample portfolio earlier.

References

Artzner, Philippe, Freddy Delbaen, Jean-Marc Eber, and David Heath. 1999. Coherent measures of risk. Mathematical Finance 9(3): 203–228.

Barra. United States Equity Version 3 (E3). 1998. —Risk Model Handbook. https://www.alacra.com/alacra/help/barra_handbook_US.pdf.

Black, Fischer, and Robert Litterman. 1992. Global portfolio optimization. Financial Analysts Journal 48(5): 28–43.

Damodaran, Aswath, Equity Risk Premiums (ERP). 2017. Determinants, estimation and implications—the 2017 Edition March 27, 2017. Available at SSRN: https://ssrn.com/abstract=2947861.

Fabozzi, F.J., P.N. Kolm, D.A. Pachamanova, and S.M. Focardi. 2007. Robust Portfolio Optimization and Management. New York: Wiley.

Fisher, Lawrence. 1975. Using modern portfolio theory to maintain an efficiently diversified portfolio. Financial Analysts Journal 31(3): 73–85.

Harlow, W.Van. 1991. Asset allocation in a downside-risk framework. Financial Analysts Journal 47 (5): 28–40.

He, Guangliang, and Litterman, Robert. 2002. The Intuition behind Black-Litterman model portfolios. Available at SSRN https://ssrn.com/abstract=334304.

Herold, Ulf. 2005. Computing Implied Returns in a Meaningful Way. Journal of Asset Management 6: 53–64.

Idzorek, Thomas. 2007. A step-by-step guide to the Black-Litterman model: Incorporating user-specified confidence levels. In Forecasting expected returns in the financial markets, pp. 17–38. Academic Press.

JP Morgan Asset Management. 2020. Long-term capital market assumptions. Retrieved Feburary 10, 2020, from https://am.jpmorgan.com/us/en/asset-management/institutional/insights/portfolio-insights/ltcma/.

Krokhmal, Pavlo, Jonas Palmquist, and Stanislav Uryasev. 2002. Portfolio optimization with conditional value-at-risk objective and constraints. Journal of Risk 4: 43–68.

Litterman, Bob. 2004. Modern investment management: An equilibrium approach, vol. 246. New York: Wiley.

Lucas, Andre, and Pieter Klaassen. 1998. Extreme returns, downside risk, and optimal asset allocation. Journal of Portfolio Management 25(1): 71.

McNeil, Alexander J., Rüdiger Frey, and Paul Embrechts. 2015. Quantitative risk management: concepts, techniques and tools-revised edition. Princeton: Princeton University Press.

Mina, Jorge, Jerry Yi Xiao. 2001. Return to riskmetrics: The evolution of a standard. RiskMetrics Group 1, pp. 1–11.

RiskMetrics Research Department. 2009. Incremental Market Risk Statistics. RiskMetrics Group Research Technical Note, www.msci.com.

Rockafellar, R. Tyrrell, and Stanislav Uryasev. 2000. Optimization of conditional value-at-risk. Journal of Risk 2, 21–42.

Satchell, Stephen, and Alan Scowcroft. 2000. A demystification of the Black-Litterman model: Managing quantitative and traditional portfolio construction. Journal of Asset Management 1(2): 138–150.

Sharpe, William F. 1974. Imputing expected security returns from portfolio composition. Journal of Financial and Quantitative Analysis pp. 463–472.

Pang, Tao, and Cagatay Karan. 2018. A closed-form solution of the Black-Litterman model with conditional value at risk. Operations Research Letters 46(1): 103–108.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Proofs of Propositions

Proof of Proposition 1

Under the definition (7), the utility function (1) becomes

To maximize (17), consider

Then, we have

Since \(\frac{{\partial \sigma_{p} }}{\partial W} = \frac{\varSigma W}{{\varsigma_{p} }},\) then \(\varSigma W = \sigma_{p} \left( {\frac{{IVol_{1} }}{{w_{1} }},\frac{{IVol_{2} }}{{w_{2} }}, \ldots ,\frac{{IVol_{N} }}{{w_{N} }}} \right)^{'} ,\) and thus \(\left( {r_{1} - r_{f} , \ldots , r_{N} - r_{f} } \right)^{'} = \lambda \sigma_{p} \left( {\frac{{IVol_{1} }}{{w_{1} }}, \ldots ,\frac{{IVol_{N} }}{{w_{N} }}} \right)^{'}\). Correspondingly,

for any \(i \in \left[ {1,2, \ldots , N} \right]\). Now from (18), it is easy to see that \(W^{\prime}R - W^{\prime}1_{N} r_{f}\) = \(r_{p} - r_{f} = \lambda \sigma_{p}^{2}\) and thus \(\frac{{r_{p} - r_{f} }}{{\sigma_{p} }} = \lambda \sigma_{p} .\) Consequently, \(r_{i} - r_{f} = \frac{{r_{p} - r_{f} }}{{\sigma_{p} }}\left( {IVol_{i} /w_{i} } \right),\) for any \(i \in \left[ {1,2, \ldots , N} \right].\) This completes the proof. From the proof, we see that \(\lambda =\) \(\frac{{r_{p} - r_{f} }}{{\sigma_{p}^{2} }}\).

Proof of Proposition 2

When the leverage constraint (\(\mathop \sum \nolimits_{i = 1}^{N} w_{i} = 1)\) exists for portfolios, we have \(r_{p} = \mathop \sum \nolimits_{i} w_{i} r_{i} = W^{\prime}R\) with \(\mathop \sum \nolimits_{i = 1}^{N} w_{i} = 1,\) according to (7). To maximize the utility function (1) under the leverage constraint, we consider the utility function incorporating the constraint as:

By setting\(\frac{{\partial U_{1} }}{\partial W} = R + 1_{N} \theta - \lambda\varSigma W = 0\), we have \(R = - 1_{N} \theta + \lambda \varSigma W\). Then, following the proof of Proposition 1 with \(r_{f}\) replaced by \(- \theta\), we can obtain

for any \(j \in \left[ {1,2, \ldots , N} \right]\).

Let \(\varphi = \frac{{r_{p} + \theta }}{{\sigma_{p} }} .\) Then, we have \((r_{j} + \theta )w_{j} = \varphi IVol_{j}\), for \(j \in \left[ {1,2, \ldots , N} \right]\), and \(r_{p} + \theta = \varphi \sigma_{p}\). Therefore, \(r_{p} + \theta - (r_{j} + \theta )w_{j} = \varphi (\sigma_{p} - IVol_{j} )\). Correspondingly, \(r_{p} - w_{j} r_{j} + \theta \left( {1 - w_{j} } \right) = \varphi (\sigma_{p} - IVol_{j} )\). Under the leverage constraint \(\mathop \sum \nolimits_{i = 1}^{N} w_{i} = 1\), it follows that \(\mathop \sum \nolimits_{i}^{i \ne j} w_{i} r_{i} + \theta \left( {1 - w_{j} } \right) = \varphi (\sigma_{p} - IVol_{j} )\), and thus

Subtracting (22) from (21), we have

\(r_{j} - \frac{{\mathop \sum \nolimits_{i}^{i \ne j} w_{i} *r_{i} }}{{1 - w_{j} }} = \varphi \left( {\frac{{IVol_{j} }}{{w_{j} }} - \frac{{\sigma_{p} - IVol_{j} }}{{1 - w_{j} }}} \right)\), for any \(j \in \left[ {1,2, \ldots , N} \right]\). This completes the proof. From the proof, we see the relationship \(\theta = \varphi \sigma_{p} - r_{p}\). With this new ratio \(\varphi ,\) the proposed model has more economic meanings and is more interpretable.

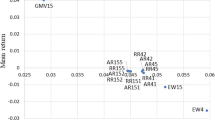

Appendix 2: Statistics for the sample portfolio

For the risk calculation of the sample portfolio, we use the daily returns from January 1st, 2011 to September 30th, 2016. Following are some statistics of the sample portfolio (Exhibits 5, 6).

Rights and permissions

About this article

Cite this article

Xin, L., Ding, S. Expected returns with leverage constraints and target returns. J Asset Manag 22, 200–208 (2021). https://doi.org/10.1057/s41260-020-00199-6

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-020-00199-6