Abstract

Persistent homology is the workhorse of modern topological data analysis, which in recent years becomes increasingly powerful due to methodological and computing power advances. In this paper, after equipping the reader with the relevant background on persistent homology, we show how this tool can be harnessed for investment purposes. Specifically, we propose a persistent homology-based turbulence index for the detection of adverse market regimes. With the help of an out-of-sample study, we demonstrate that investment strategies relying on a persistent homology-based turbulence detection outperform investment strategies based on other popular turbulence indices. Additionally, we conduct a stability analysis of our findings. This analysis confirms the results from the previous out-of-sample study, as the outperformance prevails for most configurations of the respective investment strategy and thereby mitigating possible data mining concerns.

Similar content being viewed by others

Notes

The trade-off between outperformance in turbulent times and underperformance in tranquil times can be controlled by the (indirect) weighting of negative/worst-case estimates of portfolio optimization inputs in the respective objective function.

See Scherer (2007).

Both methodologies can also be combined by estimating market regimes with the help of a risk indicator as shown in Kritzman et al. (2012).

Admittedly, even though it is a rule-based mathematical exercise, a PH-based analysis of very high-dimensional data still requires a lot of computing power.

As will be described more in detail below, we use a rolling window of daily data for the calculation of PH leading only to little changes in the underlying data.

See also Kritzman and Li (2010).

To be precise, the daily VIX data are constructed from three time series. The first time series contains the VIX calculated in real-time. It spans from the 22nd of September 2003 to the last trading day of December 2019. The second time series contains the reconstructed VIX (via back-calculation). It spans from the first trading day of January 1990 to the 19th of September 2003. Lastly, the third block contains the reconstruction of the S&P 100 Volatility Index (VXO). It spans from the first trading day of January 1986 to the last trading day of December 1989. Since the VXO and the VIX are very tightly correlated, this workaround should not affect the findings of our paper.

All methodologies and studies are implemented with the R programming language.

Furthermore, since our paper predominately targets finance practitioners, we do not always stick to a concise mathematical language throughout the paper.

Further applications are: breast cancer identification (Nicolau et al. 2011), semantic pattern recognition in political speeches (Gurciullo et al. 2015), critical transitions in genetic regulatory systems (Berwald and Gidea 2014) and spectroscopy (Offroy and Duponchel 2016). This list makes no claims to completeness.

Precisely, the dashed circle represents \(\delta /2\). We omit this fact in the main body of the text, as it leads to unnecessary complexity of the discussion.

To be precise, the hole emerges approximately at \(\delta =0.76537\). At \(\delta =0.76537\), all nearby points are connected by simple one-dimensional lines in such a way, that a “big hole” emerges.

To be precise, the hole disappears approximately at \(\delta =1.84776\). At \(\delta =1.84776\), all points in the cloud are connected by simple one-dimensional lines, leading to the disappearance of the “big hole”.

The selected period is characterized by the lowest return variance for a 60-trading-day window for the years 2006–2008. The variance was measured in monthly (month-end) intervals.

Analogous, this period exhibits the highest return variance for a 60-trading-day window for the years 2006–2008, whereby the variance was measured in monthly (month-end) intervals.

Using more concise mathematical terms, W is a so-called earth mover’s distance. If we consider two distributions as two piles of earth, W quantifies the minimum cost of turning one pile into the other.

The interested reader is referred to the “Appendix” for a detailed and mathematical discussion of the Wasserstein-Distance. We calculated W up to the first dimension. Calculating W for higher dimension gets increasingly time consuming and, in our experience, does not meaningfully improve the performance of the PHTI.

We downloaded monthly Treasury Bills return data from the homepage of Amit Goyal (http://www.hec.unil.ch/agoyal/).

The original Mahalanobis distance is the square root of the distance indicator \(d_{t}\)

The complete results are available upon request.

The complete results are available upon request. As expected, the control variable is highly significant.

References

Ang, A., Bekaert, G.: How regimes affect asset allocation. Financ. Anal. J. 60(2), 86–99 (2004)

Ang, A., Bekaert, G.: International asset allocation with regime shifts. Rev. Financ. Stud. 15(4), 1137–1187 (2015)

Asness, C.S., Israelov, R., Liew, J.M.: International diversification works (eventually). Financ. Anal. J. 67(3), 24–38 (2011)

Banerjee, P.S., Doran, J.S., Peterson, D.R.: Implied volatility and future portfolio returns. J. Bank. Finance 31(10), 3183–3199 (2007)

Bauer, R., Haerden, R., Molenaar, R.: Asset allocation in stable and unstable times. J. Invest. 13(3), 72–80 (2004)

Berwald, J., Gidea, M.: Critical transitions in a model of a genetic regulatory system. Math. Biosci. Eng. 11(4), 723–740 (2014)

Carlsson, G.: Topology and data. Bull. Am. Math. Soc. 46(2), 255–308 (2009)

Carlsson, G.: Topological pattern recognition for point cloud data. Acta Numer. 23, 289–368 (2014)

Cenesizoglu, T., Timmermann, A.: Do return prediction models add economic value? J. Bank. Finance 36(11), 2974–2987 (2012)

Chen, S.-S.: Predicting the bear stock market: macroeconomic variables as leading indicators. J. Bank. Finance 33(2), 211–223 (2009)

Chow, G., Jacquier, E., Kritzman, M., Lowry, K.: Optimal portfolios in good times and bad. Financ. Anal. J. 55(3), 65–73 (1999)

Chua, D.B., Kritzman, M., Page, S.: The myth of diversification. J. Portf. Manag. 36(1), 26–35 (2009)

Coudert, V., Gex, M.: Does risk aversion drive financial crises? testing the predictive power of empirical indicators. J. Empir. Finance 15(2), 167–184 (2008)

Delfinado, C.J.A., Edelsbrunner, H.: An incremental algorithm for Betti numbers of simplicial complexes on the 3-sphere. Comput. Aided Geom. Des. 12(7), 771–784 (1995)

DeMiguel, V., Plyakha, Y., Uppal, R., Vilkov, G.: Improving portfolio selection using option-implied volatility and skewness. J. Financ. Quant. Anal. 48(6), 1813–1845 (2013)

Edelsbrunner, H., Kirkpatrick, D., Seidel, R.: On the shape of a set of points in the plane. IEEE Trans. Inf. Theory 29(4), 551–559 (1983)

Edelsbrunner, H., Letscher, D., Zomorodian, A.: Topological persistence and simplification. In: Proceedings 41st Annual Symposium on Foundations of Computer Science, pp. 454–463. IEEE (2000)

Edelsbrunner, H., Letscher, D., Zomorodian, A.: Topological persistence and simplification. Discrete Comput. Geom. 28, 511–533 (2002)

Edelsbrunner, H., Mücke, E.P.: Three-dimensional alpha shapes. ACM Trans. Graph. (TOG) 13(1), 43–72 (1994)

Frosini, P.: A distance for similarity classes of submanifolds of a Euclidean space. Bull. Aust. Math. Soc. 42(3), 407–415 (1990)

Gidea, M.: Topological data analysis of critical transitions in financial networks. In: International Conference and School on Network Science, pp. 47–59. Springer (2017)

Gidea, M., Goldsmith, D., Katz, Y.A., Roldan, P., Shmalo, Y.: Topological recognition of critical transitions in time series of cryptocurrencies. Available at SSRN 3202721 (2018)

Gidea, M., Katz, Y.: Topological data analysis of financial time series: landscapes of crashes. Physica A Stat. Mech. Appl. 491, 820–834 (2018)

Giot, P.: Relationships between implied volatility indexes and stock index returns. J. Portf. Manag. 31(3), 92–100 (2005)

Gurciullo, S., Smallegan, M., Pereda, M., Battiston, F., Patania, A., Poledna, S., Hedblom, D., Öztan, B.T., Herzog, A., John, P., Mikhaylov, S.J.: Complex politics: a quantitative semantic and topological analysis of UK house of commons debates (2015). arXiv:abs/1510.03797

Kritzman, M., Li, Y.: Skulls, financial turbulence, and risk management. Financ. Anal. J. 66(5), 30–41 (2010)

Kritzman, M., Li, Y., Page, S., Rigobon, R.: Principal components as a measure of systemic risk. J. Portf. Manag. 37(4), 112–126 (2011)

Kritzman, M., Page, S., Turkington, D.: Regime shifts: implications for dynamic strategies (corrected). Financ. Anal. J. 68(3), 22–39 (2012)

Leibowitz, M.L., Bova, A.: Diversification performance and stress-betas. J. Portf. Manag. 35(3), 41–47 (2009)

Mahalanobis, P.C.: Analysis of race-mixture in Bengal. J. Asiatic Soc. Bengal 23, 301–333 (1925)

Mahalanobis, P.C.: On the generalized distance in statistics. Proc. Natl. Inst. Sci. India 2(1), 49–55 (1936)

Mayhew, S.: Implied volatility. Financ. Anal. J. 51(4), 8–20 (1995)

Nicolau, M., Levine, A.J., Carlsson, G.: Topology based data analysis identifies a subgroup of breast cancers with a unique mutational profile and excellent survival. Proc. Natl. Acad. Sci. 108(17), 7265–7270 (2011)

Offroy, M., Duponchel, L.: Topological data analysis: a promising big data exploration tool in biology, analytical chemistry and physical chemistry. Anal. Chim. Acta 910, 1–11 (2016)

Perea, J.A., Carlsson, G.: A klein-bottle-based dictionary for texture representation. Int. J. Comput. Vis. 107(1), 75–97 (2014)

Perea, J.A., Harer, J.: Sliding windows and persistence: an application of topological methods to signal analysis. Found. Comput. Math. 15(3), 799–838 (2015)

Poon, S.-H., Granger, C.W.: Forecasting volatility in financial markets: a review. J. Econ. Lit. 41(2), 478–539 (2003)

Robins, V.: Towards computing homology from finite approximations. Topol. Proc. 24, 503–532 (1999)

Scherer, B.: Can robust portfolio optimisation help to build better portfolios? J. Asset Manag. 7(6), 374–387 (2007)

Tütüncü, R., Koenig, M.: Robust asset allocation. Ann. Oper. Res. 132(1), 157–187 (2004)

Xia, K., Wei, G.-W.: Persistent homology analysis of protein structure, flexibility, and folding. Int. J. Numer. Methods Biomed. Eng. 30(8), 814–844 (2014)

Yang, L., Rea, W., Rea, A.: Impending doom: the loss of diversification before a crisis. Int. J. Financ. Stud. 5(4), 29 (2017)

Zomorodian, A., Carlsson, G.: Computing persistent homology. Discrete Comput. Geom. 33(2), 249–274 (2005)

Acknowledgements

We would like to thank the anonymous referees for valuable suggestions and comments. In addition, Eduard Baitinger would like to thank Dr. Marc Rohloff. Already back in 2017, Dr. Marc Rohloff introduced him to the concept of persistent homology and suggested a possible application to financial markets analysis. Unfortunately, due to a lack of time and different company affiliation, he was not able to work on this project.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The stated e-mail address is used by the corresponding author for no purpose other than to indicate his professional affiliation as is customary in publications. Furthermore, the contents of this paper are not intended as an investment, legal, tax or any other such advice and must not necessarily represent views of FERI Trust GmbH, the website www.feri.de or any of their other affiliates.

Appendices

Appendix

Further results and time series descriptions

See Fig. 7 and Tables 6, 7, 8, 9 and 10.

Methodology with mathematical notation

A simplicial complex S is a set of simplices \(\{ \sigma \}\) of arbitrary dimensions, satisfying:

-

1.

for any face \( \sigma ' \subseteq \sigma \) of a simplex \( \sigma \in S \), \( \sigma ' \in S \) is true.

-

2.

for all simplices \(\sigma _1, \sigma _2 \in S\) the intersection \(\sigma _1 \cap \sigma _2\) is either \(\emptyset \) or a face of both \(\sigma _1, \sigma _2\).

Regarding its properties, a topological space can be associated to a simplicial complex and therefore to a dataset, from which a simplicial complex is constructed. Given a dataset \(X = \{x_1, \ldots ,x_n \}\) arranged as a point cloud in an Euclidian space \(\mathbb {R}^d\) and a real number \(\delta > 0\), as our threshold parameter, we construct a simplicial complex \(VR(X, \delta )\), in this context called Vietoris–Rips complex, by defining that any subset of X is a simplex of \(VR(X,\delta )\) if and only if

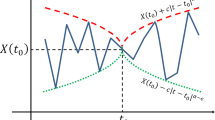

We note that \(VR(X,\delta ) \subset VR(X,\delta ')\), whenever \(\delta \le \delta '\). By satisfying this condition, the family of VR complexes \(\{VR(X,\delta )\}_{\delta >0}\) are called a filtration. To this filtration, we can apply the i-dimensional homology, obtaining a family \(\{H_i(VR(X,\delta ))\}_{\delta >0}\) of vector spaces, also having the filtration property \(H_i(VR(X,\delta )) \subset H_i(VR(X,\delta '))\), whenever \(\delta \le \delta '\).

The dimension of each such a vector space \(H_i(VR(X,\delta ))\) corresponds to the i-th Betti number of the topological space constructed from the dataset X at a given \(\delta \) and therefore to connected components, holes, cavities and so forth.

Corresponding to the inclusions of the filtration, canonical homomorphisms \(H_i(VR(X,\delta )) \hookrightarrow H_i(VR(X,\delta '))\), whenever \(\delta \le \delta '\), can be defined. Therefore, for each nonzero i-dimensional homology class h, there exists an interval [a, b] such that \(\forall \delta \in [a,b]: h \in H_i(VR(X, \delta ))\) and \(\forall \delta \notin [a,b]: h \notin H_i(VR(X, \delta ))\). Here, a and b correspond to the birth and death point of h.

This information can be illustrated by a persistence diagram \(P_i\), which contains every nonzero i-dimensional homology class h represented by a point with coordinates (a, b) in \(\mathbb {R}^2\) and all trivial homology generators being born and dying at the same \(\delta \), represented as the positive diagonal of \(\mathbb {R}^2\). A metric for measuring the distance of two persistence diagrams is the p-th Wasserstein distance:

where \(\phi \) are all bijections between \(P^1_i\) and \(P^2_i\).

Rights and permissions

About this article

Cite this article

Baitinger, E., Flegel, S. The better turbulence index? Forecasting adverse financial markets regimes with persistent homology. Financ Mark Portf Manag 35, 277–308 (2021). https://doi.org/10.1007/s11408-020-00377-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-020-00377-x